Market analysis from OANDA

US30USD - Intraday Price action continues to be mixed and volatile for 4 days in succession resulting in spikes in both directions. RSI (relative strength indicator) is flat and reading close to 50 (mid-point) highlighting the fact that we are non- trending. There is no clear indication that the upward move is coming to an end. Economic figures could adversley...

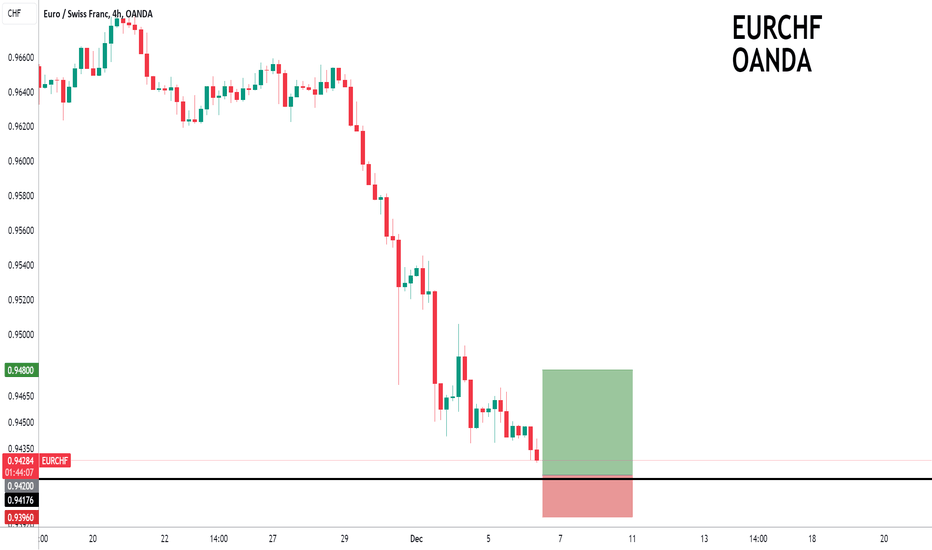

EURCHF - Intraday Buying posted close to the previous low of 0.9417. The bullish engulfing candle on the 4 hour chart the positive for sentiment. Yesterday's Marabuzo is located at 0.9431. We look to buy dips. Although the bears are in control, the stalling negative momentum indicates a turnaround is possible. We look to Buy at 0.9431 (stop at 0.9407)...

The Australian dollar is trading quietly on Friday. In the European session, AUD/USD is trading at 0.6611, up 0.14%. It has been a roller-coaster week for the Australian dollar. After declining 1.88% early in the week, the Aussie rebounded on Thursday and gained 0.80%. Today's US nonfarm payrolls report could result in further volatility from the Australian...

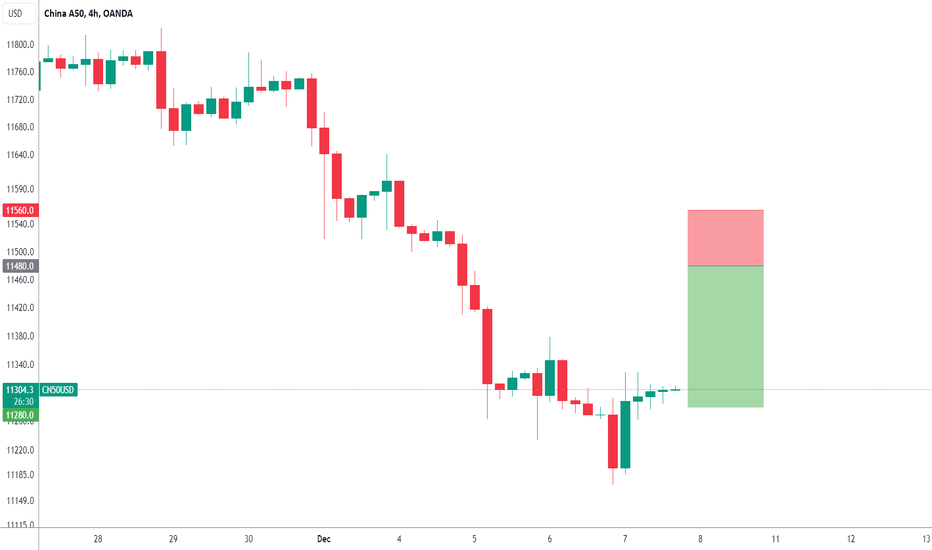

CHN50 - 24h expiry Buying pressure from 11171 resulted in prices rejecting the dip. The current move higher is expected to continue. The bias is still for lower levels and we look for any gains to be limited. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower. Further downside is expected although we prefer to...

The Japanese yen has surged on Thursday. In the North American session, USD/JPY is trading at 144.00, down a massive 2.25%. Earlier, the yen dropped as low as 143.79 per dollar, which marked the yen's highest level since August 10. The yen has posted its biggest one-day jump of the year against the dollar on Thursday after Bank of Japan policy makers provided...

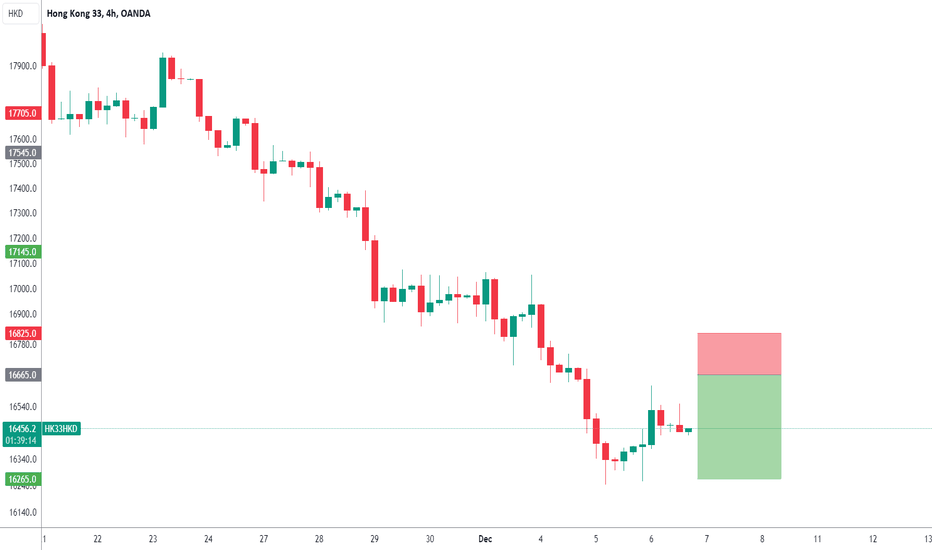

HS50 - 24h expiry Buying pressure from 16228 resulted in prices rejecting the dip. The current move higher is expected to continue. The bias is still for lower levels and we look for any gains to be limited. We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower. Further downside is expected although we prefer to...

The British pound is showing limited movement on Wednesday. GBP/USD is trading at 1.2582 in the North American session, down 0.10%. The UK Construction PMI ticked lower to 45.5 in November, compared to 45.6 in October and shy of the consensus estimate of 46.3. The construction sector has been in contraction for most of the year and the November print marked a...

EURCHF - 24h expiry Buying posted close to the previous low of 0.9417. Bullish divergence is expected to support prices. Early pessimism is likely to lead to losses although extended attempts lower are expected to fail. We look for a temporary move higher. We look to buy dips. We look to Buy at 0.9420 (stop at 0.9396) Our profit targets will be 0.9480...

The euro has extended its losses on Tuesday. In the North American session, EUR/USD is trading at 1.0792, down 0.41%. The euro has fallen for a fifth straight day, declining 1.9% during that time. Germany and eurozone services PMIs were revised upwards in November but that wasn't enough to stem the euro's nasty slide. The German PMI was revised sharply to 49.6,...

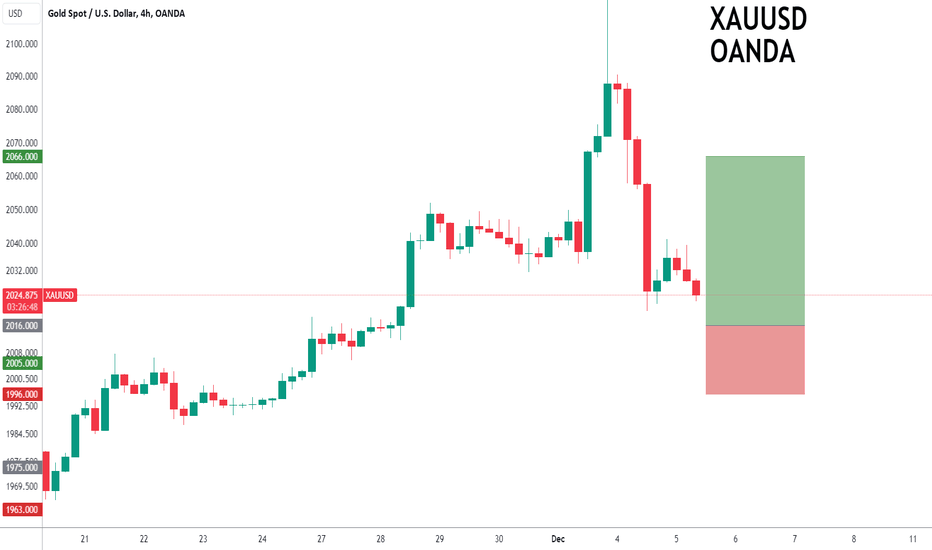

XAUUSD - 24h expiry Price action resulted in a new all-time high at 2145. Selling pressure from 2145 resulted in all the initial daily gains being overturned. Posted a Bearish Outside candle on the Daily chart. Bespoke support is located at 2016. Previous resistance, now becomes support at 2010. There is scope for mild upward pressure at the open but we look...

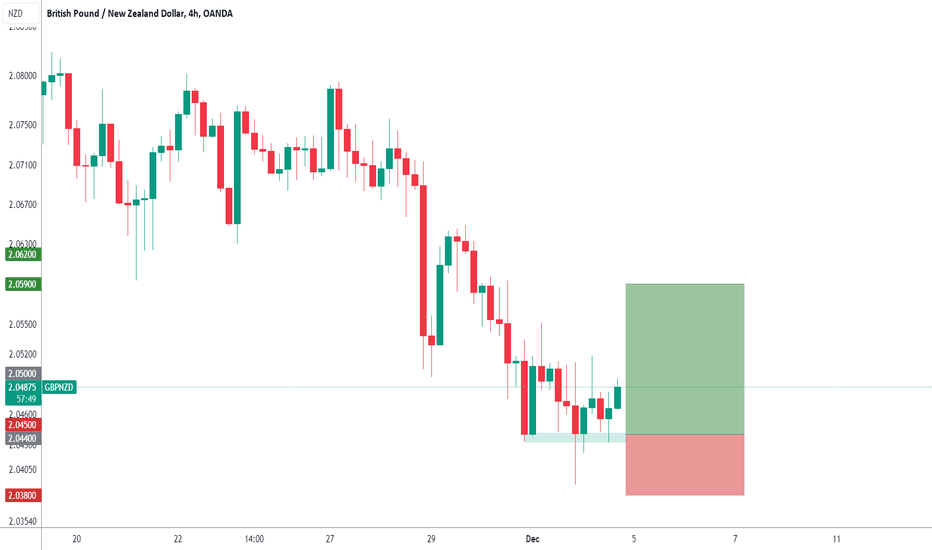

GBPNZD - 24h expiry Price action has continued to trend strongly lower and has stalled at the previous support near 2.0430. Price action looks to be forming a bottom. Momentum is flat, highlighting the lack of clear direction. Risk/Reward would be poor to call a buy from current levels. A move through 2.0500 will confirm the bullish momentum. We look to Buy...

The Australian dollar has started the week in negative territory. In the European session, AUD/USD is trading at 0.6648, down 0.40%. The Australian dollar is coming off a strong week, with gains of 1.38%. The Reserve Bank of Australia is expected to hold rates at 4.35% at its Tuesday rate meeting. The central bank has paused for four straight months and the...

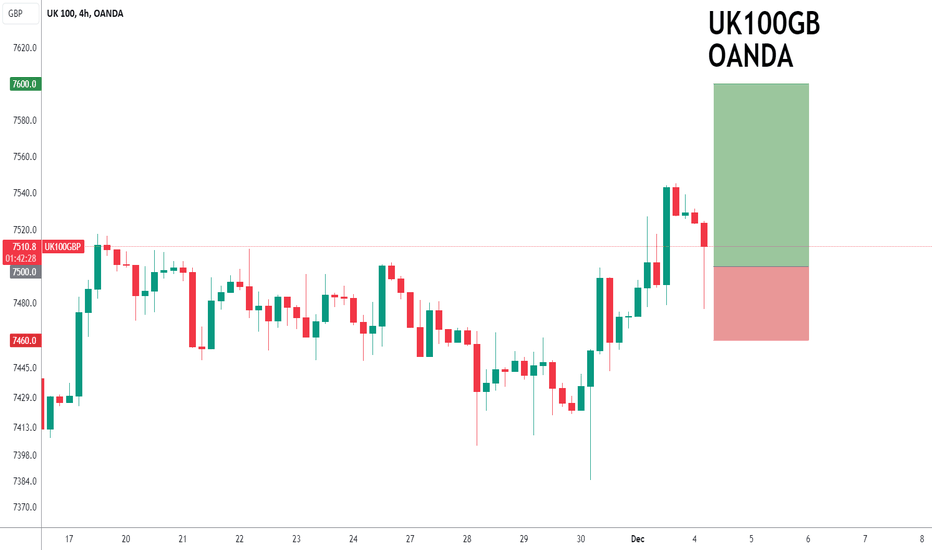

UK100GB - 24h expiry A lower correction is expected. There is no clear indication that the upward move is coming to an end. Risk/Reward would be poor to call a buy from current levels. A move through 7525 will confirm the bullish momentum. The measured move target is 7575. We look to Buy at 7500 (stop at 7460) Our profit targets will be 7600 and 7620...

NAS100USD - Intraday An Evening Doji Star formation has been posted at the high. A Fibonacci confluence area is located at 16029. Bespoke support is located at 15315. Selling spikes offers good risk/reward. There is scope for mild buying at the open but gains should be limited. We look to Sell at 16029 (stop at 16129) Our profit targets will be 15779 and...

The Canadian dollar continues to gain ground against a slumping US dollar. In the European session, USD/CAD is trading at 1.3529, down 0.23%. The Canadian currency is poised to post a third straight winning week against the greenback and soared 2.25% in November. It is a busy Friday, with Canada releasing the employment report, the US publishing the ISM...

XAUUSD - Intraday Broke the sequence of 5 positive daily performances. Buying posted in Asia. Price action has continued to range within a triangle formation. The trend of lower highs is located at 2045. Bespoke support is located at 2007. Selling spikes offers good risk/reward. We look to Sell at 2046 (stop at 2055) Our profit targets will be 2021 and...

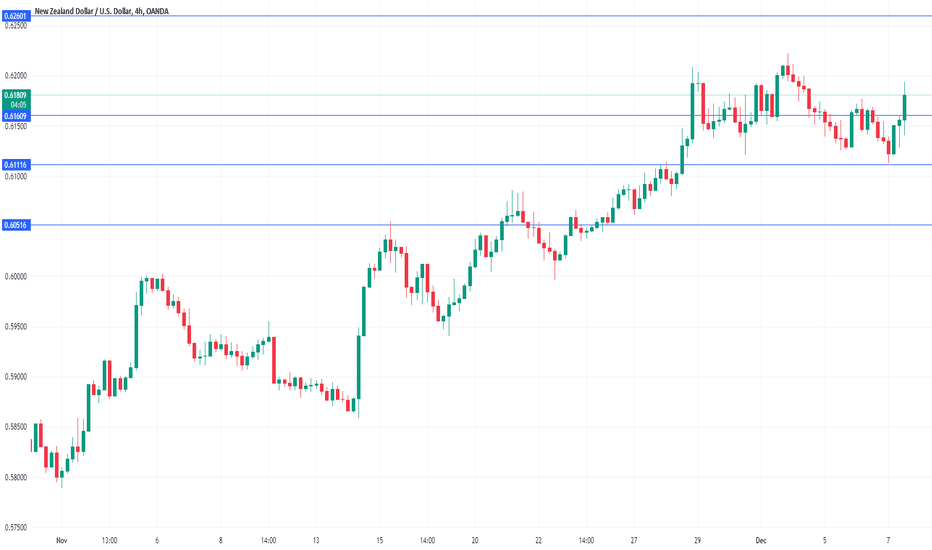

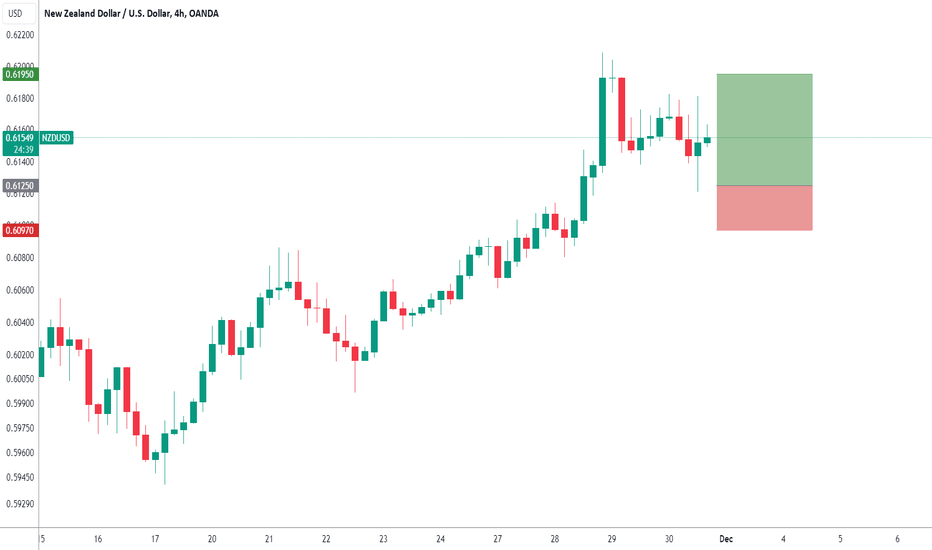

NZDUSD - 24h expiry The correction lower is assessed as being complete. We expect a reversal in this move. Risk/Reward would be poor to call a buy from current levels. A move through 0.6175 will confirm the bullish momentum. The measured move target is 0.6225. We look to Buy at 0.6125 (stop at 0.6097) Our profit targets will be 0.6195 and 0.6215 Resistance:...

GBPCHF - 24h expiry Although the bears are in control, the stalling negative momentum indicates a turnaround is possible. Short term bias is mildly bullish. Price action looks to be forming a bottom. This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher. Further upside is expected...