Market analysis from OANDA

US500 - Intraday Price action has formed an expanding wedge formation. The formation has a measured move target of 4540. The trend of lower highs is located at 4323. Bespoke resistance is located at 4331. A break of 4340 is needed to confirm follow through bullish momentum. Economic figures could adversley affect the short term technical picture. We look...

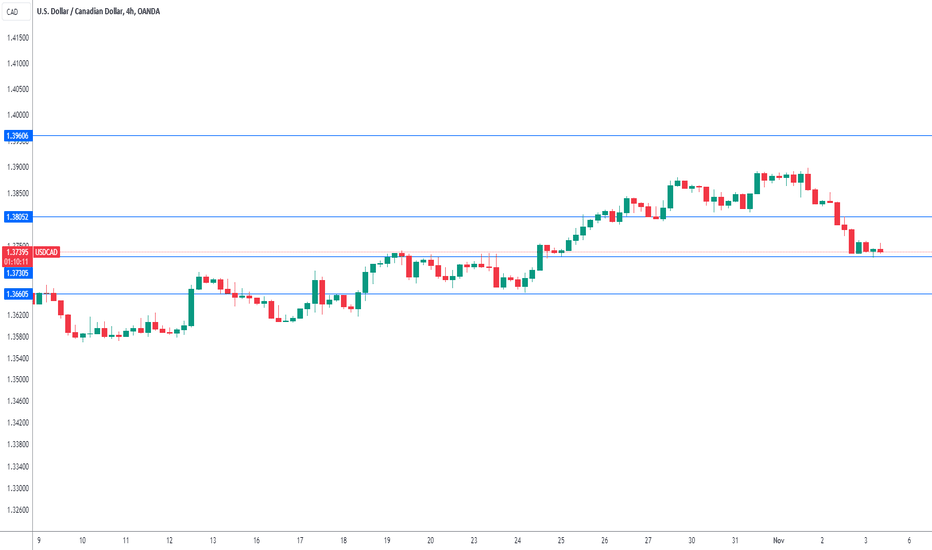

The Canadian dollar is showing little movement on Friday. In the European session, USD/CAD is trading at 1.3740, up 0.03%. The week wraps up with US and Canadian employment reports, which could mean volatility from the Canadian dollar during the North American session. The US releases nonfarm payrolls, which had a massive September and crushed expectations with...

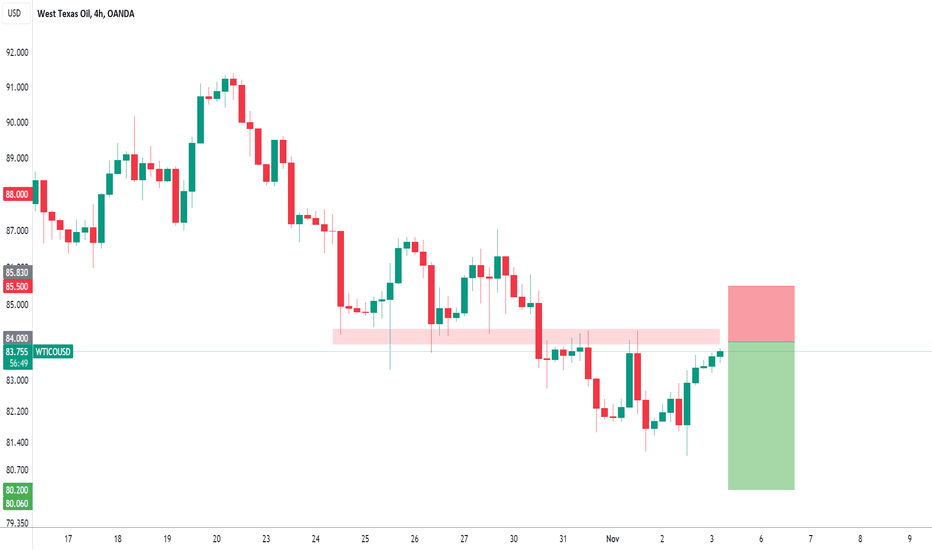

WTI - Intraday The AB=CD formation target is located at 70.19. Reverse trend line resistance comes in at 83.91. Bespoke resistance is located at 84.06. Preferred trade is to sell into rallies. The medium term bias remains bearish. We look to Sell at 84.00 (stop at 85.50) Our profit targets will be 80.20 and 79.60 Resistance: 83.91 / 84.06 /...

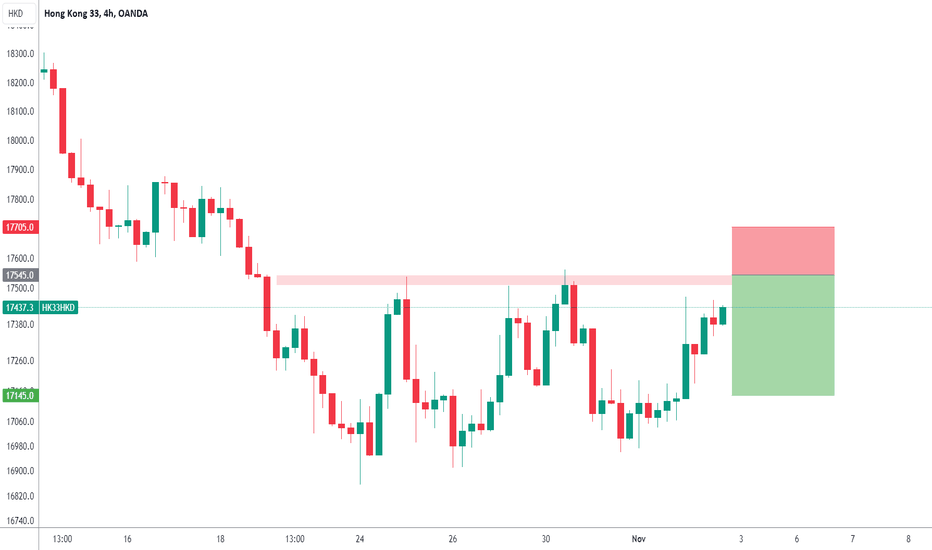

HS50 - 24h expiry Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible. The 200 day moving average should provide resistance at 17520. This is negative for sentiment and the downtrend has potential to return. The hourly chart technicals suggests further upside before the downtrend returns. We therefore, prefer...

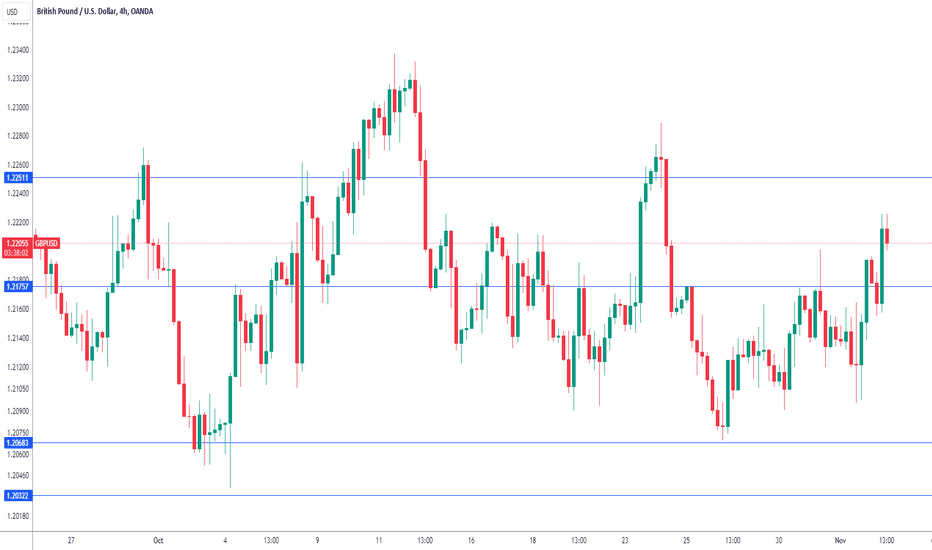

The British pound has posted strong gains on Thursday. In the European session, GBP/USD is trading at 1.2216, up 0.54%. Bank of England pauses The Bank of England voted to maintain interest rates at 5.25% at today's meeting. The pauses follow 14 straight rate increases in the current tightening cycle which began in December 2021. The move indicates that the MPC...

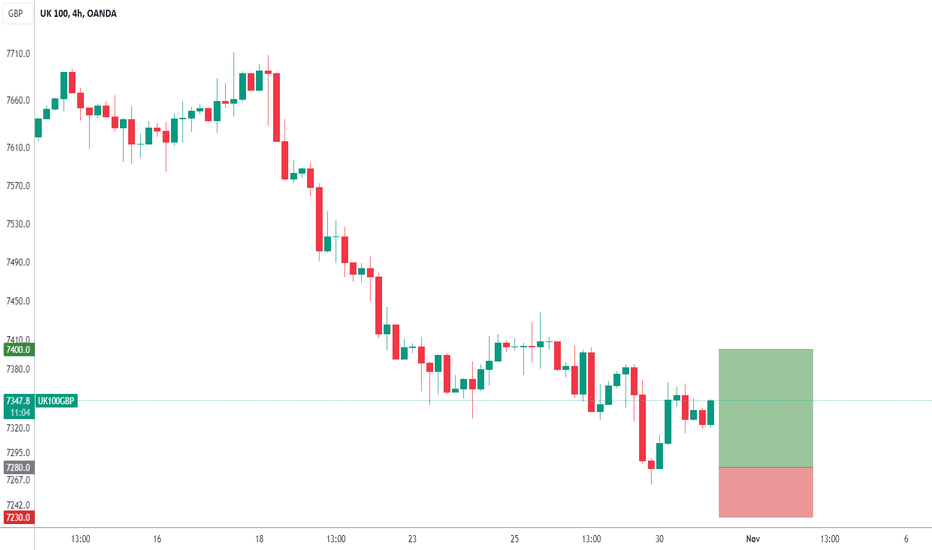

UK100GB - 24h expiry Price action looks to be forming a bottom. Short term RSI is moving higher. Risk/Reward would be poor to call a buy from current levels. A move through 7400 will confirm the bullish momentum. The measured move target is 7500. We look to Buy at 7350 (stop at 7300) Our profit targets will be 7470 and 7500 Resistance: 7400 / 7450 /...

NZDJPY - 24h expiry Price action looks to be forming a bottom. We expect a reversal in this move. Short term RSI is moving higher. Risk/Reward would be poor to call a buy from current levels. A move through 88.25 will confirm the bullish momentum. We look to Buy at 87.80 (stop at 87.40) Our profit targets will be 88.80 and 89.00 Resistance: 88.25 /...

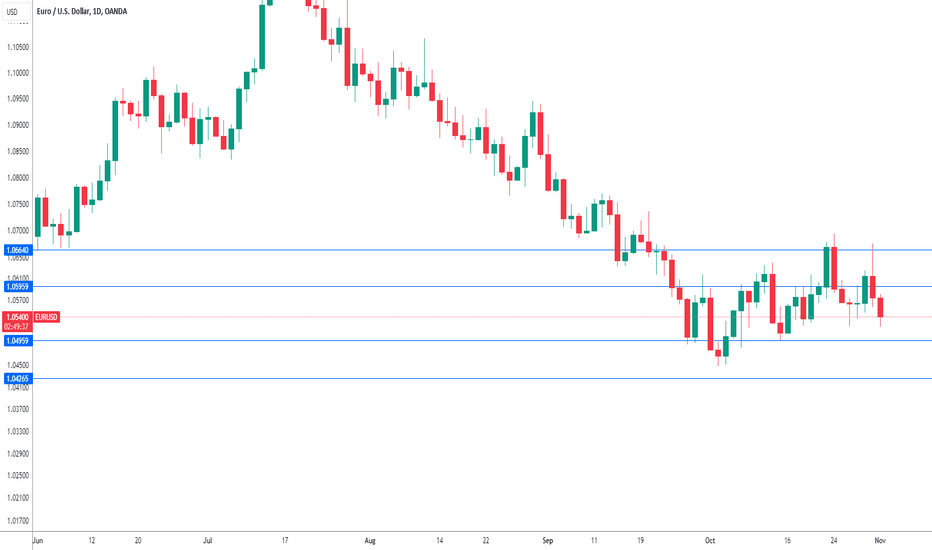

The euro is in negative territory on Wednesday after posting a losing session a day earlier. In the North American session, EUR/USD is trading at 1.0532, down 0.40%. The Federal Reserve makes its interest rate announcement later today and the markets have fully priced in rate pause, which would keep the benchmark rate at 5.25%-5.50%. Although the decision is...

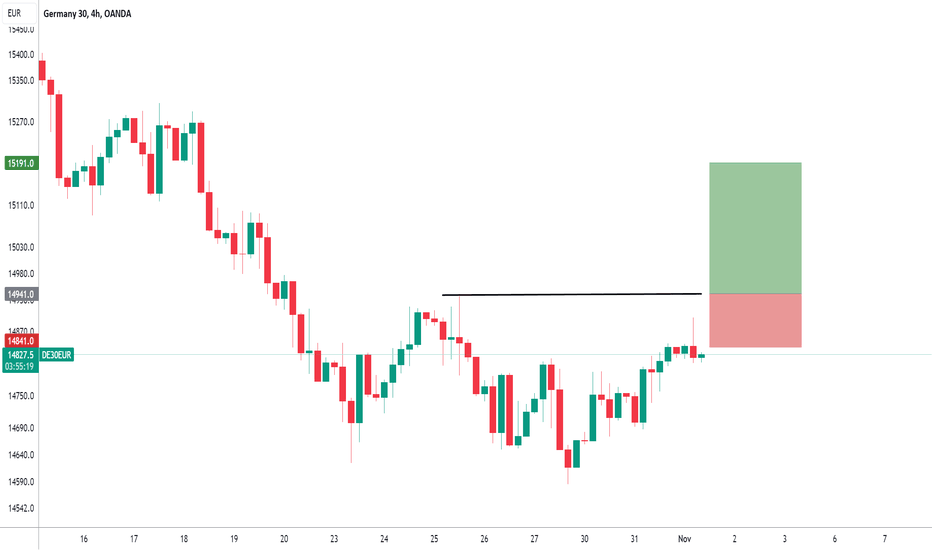

GER40 - 24h expiry The previous day's bullish engulfing candle led to further buying yesterday. 3 positive daily performances in succession. Short term momentum is bullish. Price action looks to be forming a bottom. Bullish divergence is expected to support prices. 14936 has been pivotal. A break of the recent high at 14936 should result in a further move...

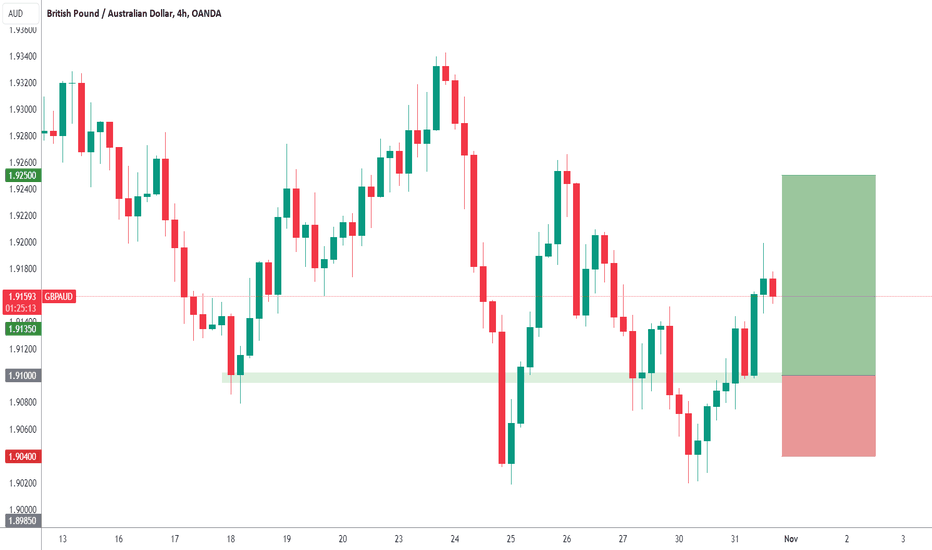

GBPAUD - 24h expiry Indecisive price action has resulted in sideways congestion on the intraday chart. RSI (relative strength indicator) is flat and reading close to 50 (mid-point) highlighting the fact that we are non- trending. Risk/Reward would be poor to call a buy from current levels. A move through 1.9175 will confirm the bullish momentum. The measured...

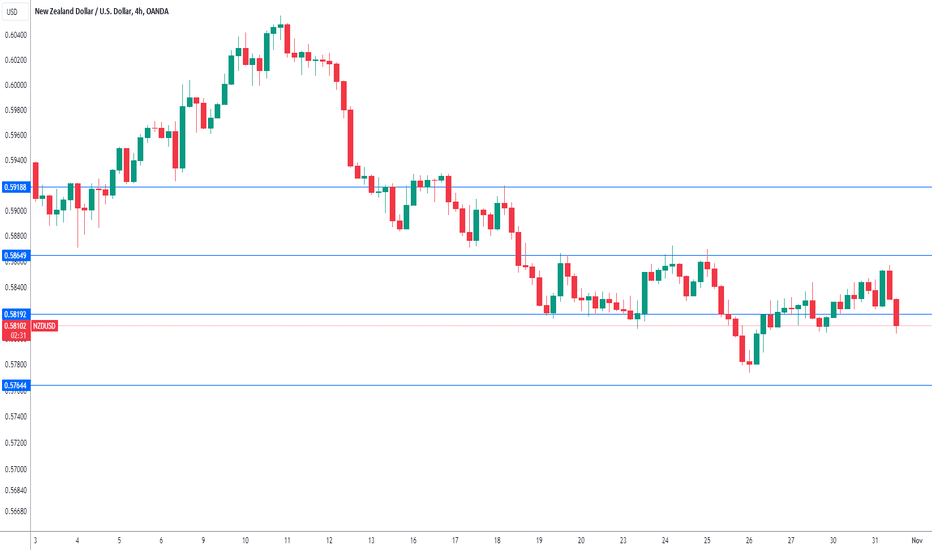

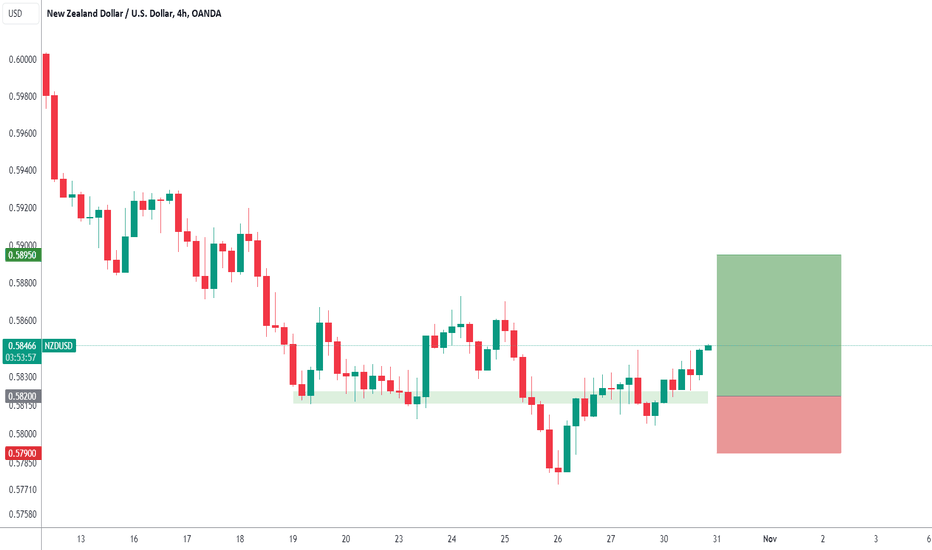

The New Zealand dollar has extended its losses on Tuesday. In the North American session, NZD/USD is trading at 0.5808, down 0.60%. October hasn't been kind to the New Zealand dollar, which has declined by 3%. Last week NZD/USD dropped as low as 0.5772, its lowest level in a year. New Zealand's labour market is expected to cool in the third quarter, as elevated...

UK100GB - 24h expiry Price action looks to be forming a bottom. Price action has continued to trend strongly lower and has stalled at the previous support near 7250. We expect a reversal in this move. Risk/Reward would be poor to call a buy from current levels. A move through 7350 will confirm the bullish momentum. We look to Buy at 7280 (stop at 7230)...

NZDUSD - 24h expiry Price action looks to be forming a bottom. Risk/Reward would be poor to call a buy from current levels. A move through 0.5850 will confirm the bullish momentum. Short term RSI has turned positive. The measured move target is 0.5900. We look to Buy at 0.5820 (stop at 0.5790) Our profit targets will be 0.5895 and 0.5900 Resistance:...

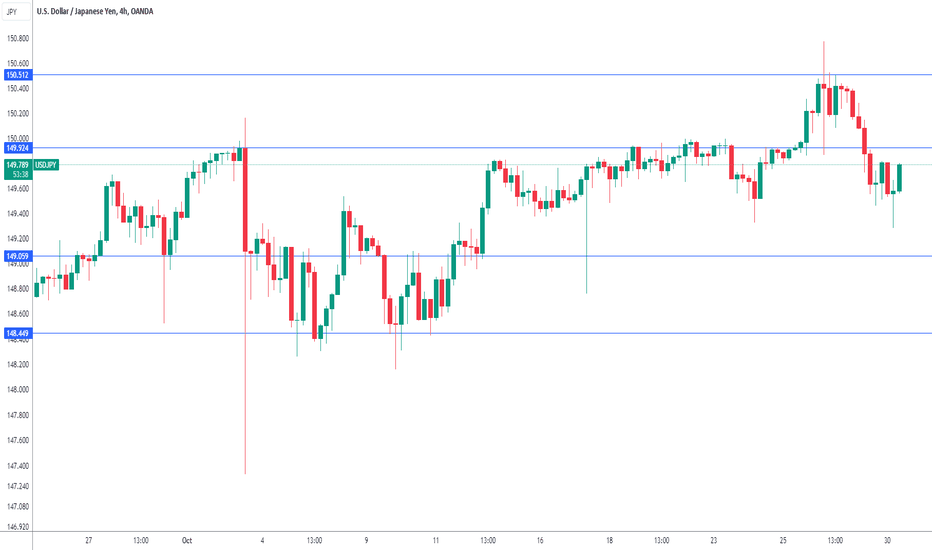

The Japanese yen is drifting on Monday after pushing the US dollar back below 150 on Friday. In the European session, USD/JPY is trading at 149.71, up 0.05%. The Bank of Japan holds its two-day meeting beginning on Monday and there's plenty of anticipation around the meeting. BoJ meetings were once dreary affairs that barely made the news, but that has changed in...

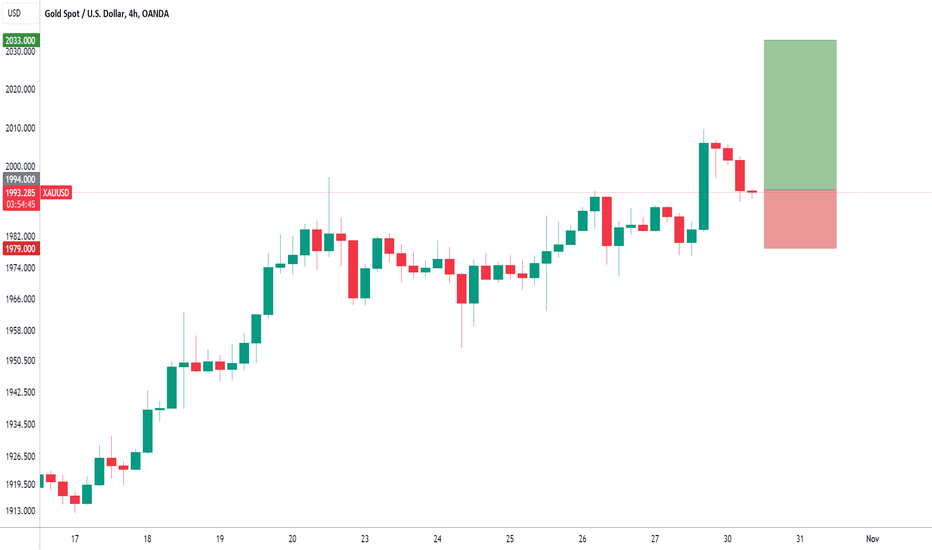

Gold - 24h expiry - We look to Buy at 1994 (stop at 1979) Previous resistance level of 1997 broken. A Fibonacci confluence area is located at 2033. Due to an Ending Wedge formation, we continue to treat extended gains with caution. The Marabuzo level from the 27.10 is located at 1995. The previous swing high is located at 1994. Preferred trade is to buy on...

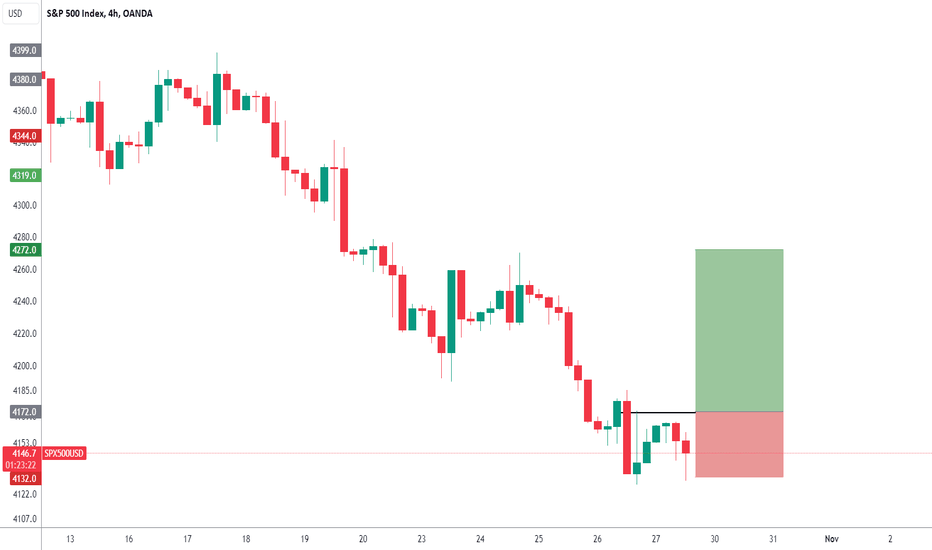

US500 - Intraday Price action has formed an expanding wedge formation. The medium term bias remains bullish. Trend line support is located at 4145. Trend line resistance is located at 4345. A break of 4172 is needed to confirm follow through bullish momentum. We look to Buy a break of 4172 (stop at 4132) Our profit targets will be 4272 and 4292...

The Japanese yen has steadied after three straight days of losses. In the European session, USD/JPY is trading at 150.11, down 0.19%. Tokyo Core CPI climbed 2.7% y/y in October, above 2.5% in September which was also the consensus estimate. The index, which excludes fresh food is a key indicator of inflation trends in Japan and is closely monitored by the Bank of...

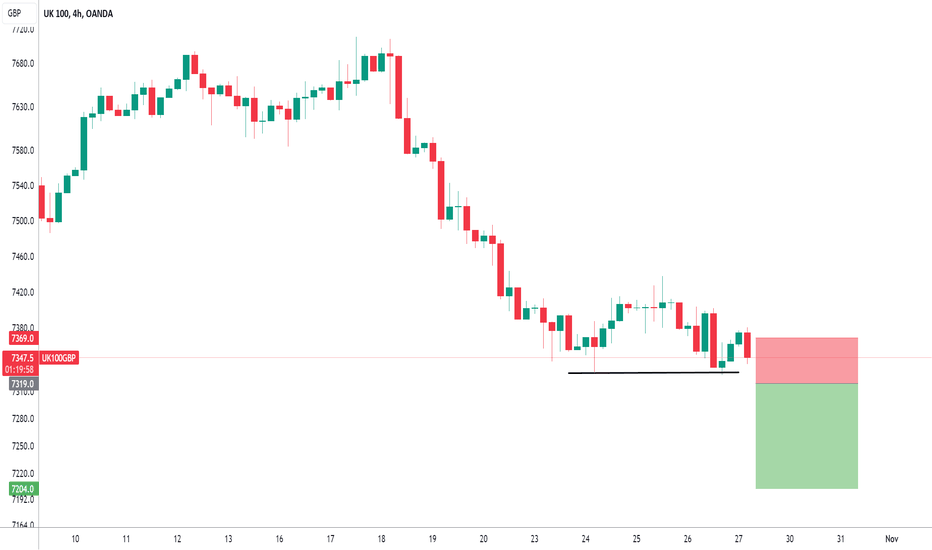

UK100GB - Intraday Posted a Double Bottom formation. A break of the recent low at 7328 should result in a further move lower. Short term bias is bearish. Trading within a Corrective Channel formation. The lack of interest is a concern for bulls. The bias is to break to the downside. We look to Sell a break of 7319 (stop at 7369) Our profit targets will...