ADL | Direction: Neutral to Bullish | Key Reason: Valuation Re-rating Potential | (June 23, 2025)

1️⃣ Insight Summary

ADL is trading near its book value and showing modest sales growth. Although profits are very low, there's speculative potential if margins improve or the sector attracts investor attention.

2️⃣ Trade Parameters

Bias: Neutral to Long (speculative)

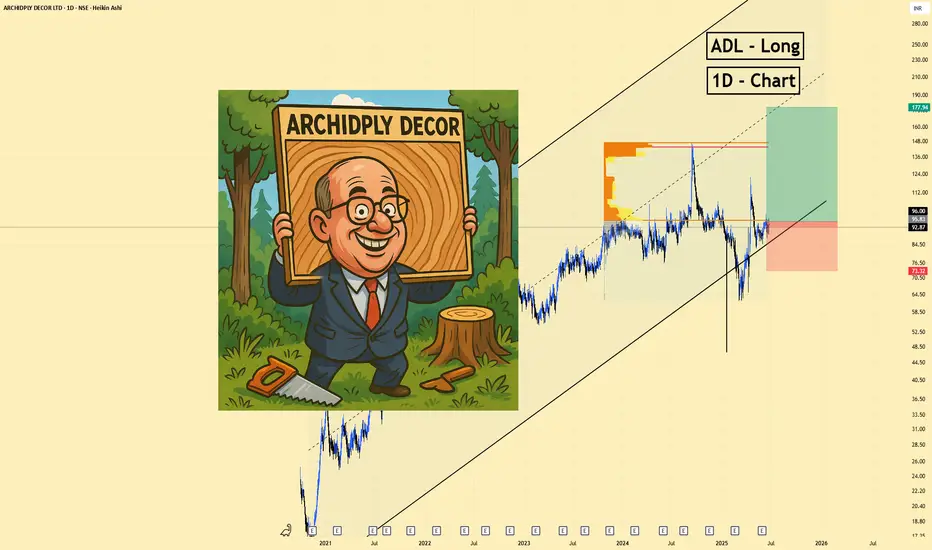

Check out the chart.

3️⃣ Key Notes

✅ Valuation – Trades close to book value, offering some downside cushion if fundamentals improve.

❌ Weak profitability – Earnings are almost flat; valuation appears stretched without consistent profits.

✅ Stable ownership – High promoter holding, no signs of aggressive leverage.

❌ Low liquidity – Very limited average trading volume may impact order execution and price volatility.

✅ Sector catalyst potential – If building materials or housing themes gain traction, small-cap names like ADL could benefit.

4️⃣ Follow-up Note

I’ll reassess this trade setup after upcoming earnings or on a confirmed break above current resistance with volume support.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

1️⃣ Insight Summary

ADL is trading near its book value and showing modest sales growth. Although profits are very low, there's speculative potential if margins improve or the sector attracts investor attention.

2️⃣ Trade Parameters

Bias: Neutral to Long (speculative)

Check out the chart.

3️⃣ Key Notes

✅ Valuation – Trades close to book value, offering some downside cushion if fundamentals improve.

❌ Weak profitability – Earnings are almost flat; valuation appears stretched without consistent profits.

✅ Stable ownership – High promoter holding, no signs of aggressive leverage.

❌ Low liquidity – Very limited average trading volume may impact order execution and price volatility.

✅ Sector catalyst potential – If building materials or housing themes gain traction, small-cap names like ADL could benefit.

4️⃣ Follow-up Note

I’ll reassess this trade setup after upcoming earnings or on a confirmed break above current resistance with volume support.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.