__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

__________________________________________________________________________________

Strategic Synthesis – Recommended Actions

__________________________________________________________________________________

__________________________________________________________________________________

Macro Calendar Watchlist

• 08/07/2025: RBA & RBNZ rate decisions (limited BTC impact)

• 29–30/07: FOMC (US Fed, key BTC/risk catalyst)

• Anticipate rising volatility ahead of FOMC. Monitor volume, possible institutional profit-taking.

__________________________________________________________________________________

On-Chain & Institutional Flow Analysis

__________________________________________________________________________________

Conclusion

Market structure remains bullish and sound. Setup: buy on pullback, take profit under resistance, monitor macro events (esp. FOMC). Plan only invalidated by break below 105054.7 or negative macro catalyst.

__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

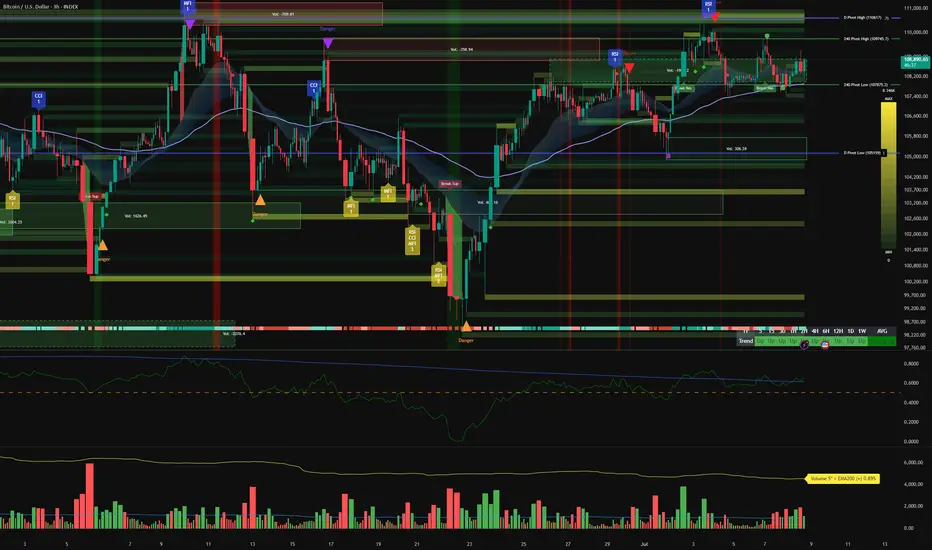

- Momentum: Strong bullish consensus across all timeframes, confirmed by the Risk On / Risk Off Indicator (STRONG BUY).

- Key Supports: 107761 (240min Pivot), 105054.7 (D Pivot Low, swing invalidation zone), 102019.9 (240min Pivot), 74485 (W Pivot Low, macro invalidation).

- Key Resistances: 109676.5 – 110630.1 (240min & 1D cluster), 111949 (W Pivot High).

- Volume: Normal to very high, no selling climax detected.

- Multi-TF Behaviours: No behavioral excess indicated by ISPD DIV, healthy market structure.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

- Overall Bias: Confirmed bullish. Any pullback towards 107761/105054.7 = buy-the-dip opportunity.

- Risk Zones: Below 105054.7 = multi-TF invalidation, risk of bearish acceleration to 102019.9.

- Macro Catalysts: Focus on FOMC (29–30/07). Until then, controlled volatility, bullish bias sustained.

- Action Plan: Buy on support, partial profit near 110630–111949 cluster. Reduce exposure/partial exit before FOMC.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

- Daily (1D): Steady bullish momentum, resistances at 110630–111949 being watched.

- 12H – 6H – 4H – 2H: Bias remains strong, intermediate supports defended (107761). No behavioral or breakout alerts.

- 1H – 30min: Continued bullish dominance, increased volatility and volume but no distribution signs.

- 15min: Local technical correction, no key pivot broken. Overall trend still absorbed by buyers.

- Risk On / Risk Off Indicator: Strong Buy signal (slight neutral on 15min).

- Summary: Bullish confirmation across all timeframes. Only a break below 107761 would weaken the setup.

__________________________________________________________________________________

Strategic Synthesis – Recommended Actions

__________________________________________________________________________________

• Remain net long while 105054.7 holds.

• Buy zone: retest at 107761/105054.7.

• Take profits gradually below 110630/111949; manage risk if key support breaks.

• Only major macro shocks or break of 105054.7 invalidate current plan.

• Solid on-chain positioning, no major capitulation risk detected.

__________________________________________________________________________________

Macro Calendar Watchlist

• 08/07/2025: RBA & RBNZ rate decisions (limited BTC impact)

• 29–30/07: FOMC (US Fed, key BTC/risk catalyst)

• Anticipate rising volatility ahead of FOMC. Monitor volume, possible institutional profit-taking.

__________________________________________________________________________________

On-Chain & Institutional Flow Analysis

- Majority of investors in profit, holding dominates, new ATH for long-term holders.

- Robust ETF/institutional flows.

- No liquidity stress or stablecoin squeeze seen.

__________________________________________________________________________________

Conclusion

Market structure remains bullish and sound. Setup: buy on pullback, take profit under resistance, monitor macro events (esp. FOMC). Plan only invalidated by break below 105054.7 or negative macro catalyst.

__________________________________________________________________________________

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.