Bitcoin started the correction from $13774.7 on 25th, June 2019, and now it seems to have bottomed at $6617.9 area on 25th November 2019.

The retracement lasted for five months and seemed to end on the exact day in November, "25th." So crazy how market work.

The corrective wave which unfolded has double three zigzag seemed to have found a bottom at $6617.9 critical support circa. The zone was comprising the low of the previous fourth wave at one & two lesser degree, 61.8 Fibonacci retracement of the advance from $3220.8, and fourth bounce of descending wedge support.

Today's also mark the first day we see a strong bullish rejection candle coming off the critical demand zone. So it's highly probable time to get in if you're considering investing or trade Bitcoin or other cryptos since Bitcoin is their primary price driver.

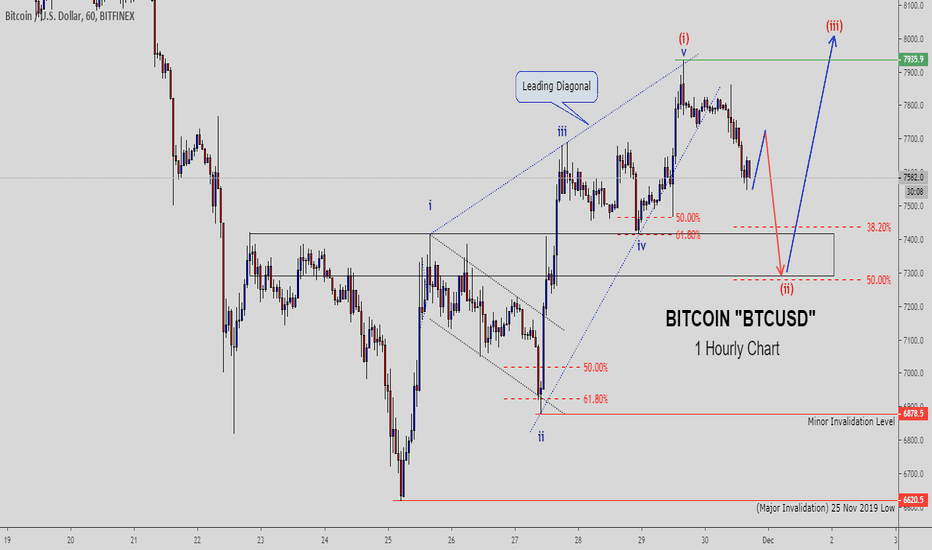

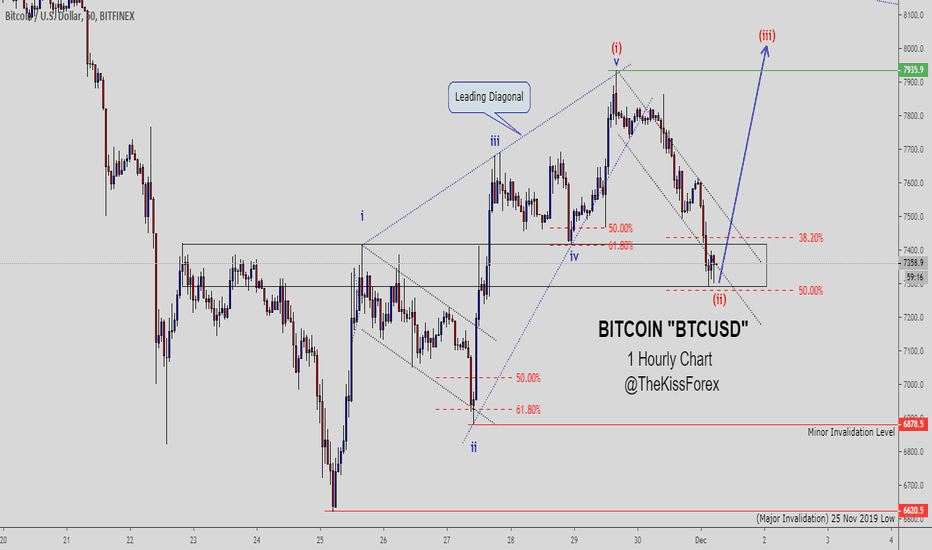

Checking to see if we see impulse move on lower timeframe:

So from yesterday's low, bitcoin rose in five-wave impulse, and according to EW theory, impulse determines the direction of the market and follows by three-wave correction. The retracement which seems not completed yet due to the shallow structure, I'm expecting the correction to reach 50% Fib area before the rally resumes. Yesterday's low must be held to believe we had a bottomed indeed.

If this wave count is correct, we should anticipate a rally from or near the current level and advance towards the resistance with 0.786 and 1.0 Fibonacci extension, as indicated on the chart.

Best of luck on the chart!

Veejahbee.

The retracement lasted for five months and seemed to end on the exact day in November, "25th." So crazy how market work.

The corrective wave which unfolded has double three zigzag seemed to have found a bottom at $6617.9 critical support circa. The zone was comprising the low of the previous fourth wave at one & two lesser degree, 61.8 Fibonacci retracement of the advance from $3220.8, and fourth bounce of descending wedge support.

Today's also mark the first day we see a strong bullish rejection candle coming off the critical demand zone. So it's highly probable time to get in if you're considering investing or trade Bitcoin or other cryptos since Bitcoin is their primary price driver.

Checking to see if we see impulse move on lower timeframe:

So from yesterday's low, bitcoin rose in five-wave impulse, and according to EW theory, impulse determines the direction of the market and follows by three-wave correction. The retracement which seems not completed yet due to the shallow structure, I'm expecting the correction to reach 50% Fib area before the rally resumes. Yesterday's low must be held to believe we had a bottomed indeed.

If this wave count is correct, we should anticipate a rally from or near the current level and advance towards the resistance with 0.786 and 1.0 Fibonacci extension, as indicated on the chart.

Best of luck on the chart!

Veejahbee.

Note

Here is what's happening on BTC. The corrective wave 2 is becoming more complex, and It's unfolding as an EW regular FLAT pattern. Guess what will happen after the completion? It will send BITCOIN price higher sharply, at least to $8300 area. The KEY LEVEL for the bulls/buyers to hold remains 7241.7

Note

The price of bitcoin is making a series of 1-2, (1)-(2) pattern and as well it's broken and retesting a significant supply and demand zone. This is an indication of an extremely bullish market. Buyers/Investors to look for buy from subsequent Higher Lows. Our current Key Level that must hold buyers is $7461 and potential buying area is now or a dip to $7700 will give another cheap entry.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.