Hello Friends,

Welcome to RK_Chaarts,

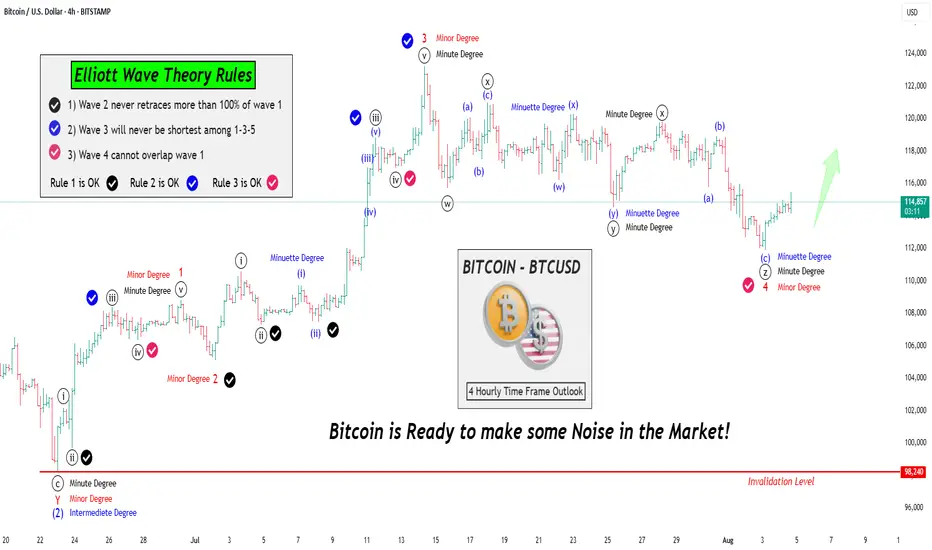

Friends, Today we are going to learn 3 Rules of the Elliott Wave theory, there are three principles and some patterns. Impulses move in a 1-2-3-4-5 pattern, either as an impulse or a motive wave. However, within impulses, there are three rules:

Rule No 1:

Wave 2 will never retrace more than 100% of Wave 1.

Rule No 2:

Wave 3 will never be the shortest among Waves 1, 3, and 5; it can be the largest, but never the smallest.

Rule No 3:

Wave 4 cannot overlap Wave 1, except in diagonals or triangles; in impulses, it cannot overlap.

We've checked these three rules and marked them with separate tick marks on the chart with different colors, making them clearly visible. You can review the chart and verify these rules yourself, learning how wave principles are applied and checked.

We've explained all this through a drawing on the chart, so we won't elaborate further here. Moving forward, let's analyze what the wave theory suggests about the current market trend. This entire analysis is shared for Educational purposes only.

I hope you'll consider this educational post as a learning resource, Definitely, I encourage you to review the chart as an image or picture to better understand the concepts we've worked hard to explain.

Our effort will be successful if you gain a deeper understanding and learn something new from this post. If you find this helpful and informative, our hard work will have paid off. Please keep this in mind as you review the material.

Now let's explore how wave counts within wave counts, or lower degrees within higher degrees, unfold through complete wave theory patterns and following theory Rules all the times.

Let's take a closer look at the Bitcoin chart we've analyzed using Elliott Waves. From this perspective, it's clear that the Intermediate Degree Wave (2) concluded around June 23rd.

After this, we observe that the internal wave counts of the lower degree, specifically Wave 1-2-3 (in red) have completed their cycle of Minor degree. Furthermore, Red Wave 4 of same Minor degree has been moving sideways, characterized by a downward trend.

Notably, the fall of Red Wave 4 is classified as a Minor Degree movement. Interestingly, this downward movement appears to have terminated in an even lower degree, namely the Minute Degree, which we've marked in black as ((w))-((x))-((y))-((xx))-((z)) that means Wave 4 of Minor degree (in Red) is complete.

Given that Red Wave 4 Minor has reached its conclusion, it's highly plausible that Wave 5 has initiated. This development suggests that Bitcoin is poised to make a significant move.

Moving on to the analysis, we observe that:

- Rule 1: Wave 2 has not retraced more than 100% of Wave 1, so this rule is intact.

- Rule 2: Wave 3 is not the shortest among Waves 1, 3, and 5, so this rule is also valid.

- Rule 3: Wave 4 does not overlap Wave 1, so this rule is also satisfied.

Bitcoin is all set to shake things up! We eagerly anticipate further rallies in the market.

This post is shared purely for educational purpose & it’s Not a trading advice.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Chaarts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Welcome to RK_Chaarts,

Friends, Today we are going to learn 3 Rules of the Elliott Wave theory, there are three principles and some patterns. Impulses move in a 1-2-3-4-5 pattern, either as an impulse or a motive wave. However, within impulses, there are three rules:

Rule No 1:

Wave 2 will never retrace more than 100% of Wave 1.

Rule No 2:

Wave 3 will never be the shortest among Waves 1, 3, and 5; it can be the largest, but never the smallest.

Rule No 3:

Wave 4 cannot overlap Wave 1, except in diagonals or triangles; in impulses, it cannot overlap.

We've checked these three rules and marked them with separate tick marks on the chart with different colors, making them clearly visible. You can review the chart and verify these rules yourself, learning how wave principles are applied and checked.

We've explained all this through a drawing on the chart, so we won't elaborate further here. Moving forward, let's analyze what the wave theory suggests about the current market trend. This entire analysis is shared for Educational purposes only.

I hope you'll consider this educational post as a learning resource, Definitely, I encourage you to review the chart as an image or picture to better understand the concepts we've worked hard to explain.

Our effort will be successful if you gain a deeper understanding and learn something new from this post. If you find this helpful and informative, our hard work will have paid off. Please keep this in mind as you review the material.

Now let's explore how wave counts within wave counts, or lower degrees within higher degrees, unfold through complete wave theory patterns and following theory Rules all the times.

Let's take a closer look at the Bitcoin chart we've analyzed using Elliott Waves. From this perspective, it's clear that the Intermediate Degree Wave (2) concluded around June 23rd.

After this, we observe that the internal wave counts of the lower degree, specifically Wave 1-2-3 (in red) have completed their cycle of Minor degree. Furthermore, Red Wave 4 of same Minor degree has been moving sideways, characterized by a downward trend.

Notably, the fall of Red Wave 4 is classified as a Minor Degree movement. Interestingly, this downward movement appears to have terminated in an even lower degree, namely the Minute Degree, which we've marked in black as ((w))-((x))-((y))-((xx))-((z)) that means Wave 4 of Minor degree (in Red) is complete.

Given that Red Wave 4 Minor has reached its conclusion, it's highly plausible that Wave 5 has initiated. This development suggests that Bitcoin is poised to make a significant move.

Moving on to the analysis, we observe that:

- Rule 1: Wave 2 has not retraced more than 100% of Wave 1, so this rule is intact.

- Rule 2: Wave 3 is not the shortest among Waves 1, 3, and 5, so this rule is also valid.

- Rule 3: Wave 4 does not overlap Wave 1, so this rule is also satisfied.

Bitcoin is all set to shake things up! We eagerly anticipate further rallies in the market.

This post is shared purely for educational purpose & it’s Not a trading advice.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Chaarts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

YouTube: youtube.com/@rk_charts

Telegram : t.me/RK_Charts

Twitter : @charts_rk

Email : rkcharts@gmail. com

Disclaimer.

I am not sebi registered analyst.

My studies are for educational purpose only.

Telegram : t.me/RK_Charts

Twitter : @charts_rk

Email : rkcharts@gmail. com

Disclaimer.

I am not sebi registered analyst.

My studies are for educational purpose only.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

YouTube: youtube.com/@rk_charts

Telegram : t.me/RK_Charts

Twitter : @charts_rk

Email : rkcharts@gmail. com

Disclaimer.

I am not sebi registered analyst.

My studies are for educational purpose only.

Telegram : t.me/RK_Charts

Twitter : @charts_rk

Email : rkcharts@gmail. com

Disclaimer.

I am not sebi registered analyst.

My studies are for educational purpose only.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.