__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

__________________________________________________________________________________

Technical & Fundamental Synthesis

__________________________________________________________________________________

__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

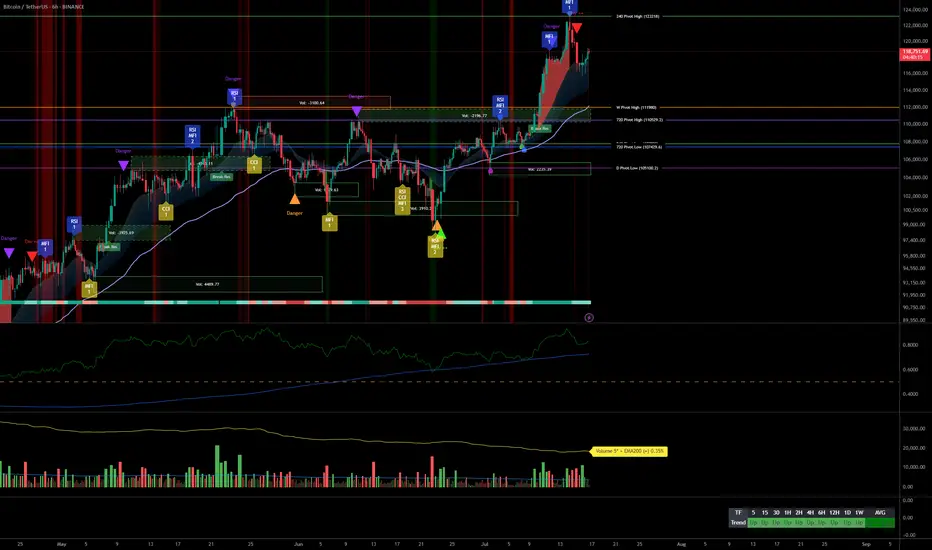

- Momentum: Very bullish across all timeframes; healthy compression above previous range.

- Key Supports: 115731–110481 USDT (structural, 1D to 1H).

- Major Resistances: 123240 USDT (multi-frame pivot).

- Volume: Normal, no climax or distribution — flows support the dominant bias.

- Risk On / Risk Off Indicator: Strong bullish HLTF signal; short-term neutral intraday.

- ISPD DIV: Neutral on all timeframes.

- Multi-TF Behavior: Bull rally, no excess, no euphoria or capitulation; market holds above key levels.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

- Global Bias: Strong bullish – MT/LT “buy on dips” confirmed.

- Opportunities: Progressive buying (117800, 115731 USDT), continuation on breakout >123240.

- Risk Zones: Possible pullback if clear rejection below 123240, swing invalidation if close <115731-111949.

- Macro Catalysts: Awaiting FOMC late July, short-term volatility limited. Watch geopolitics, extreme compression.

- Action Plan: Swing entry: 118300–119000. Stop: 115500. Target: 123200 then 126000+. R/R ≥2.5. Adjust risk management before FOMC.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

- 1D: Bullish momentum, supports at 105054/107939–110483. Risk On / Risk Off Indicator strong buy, healthy volume, ISPD neutral.

- 12H: Consolidation below 123240, aligned supports 110481/115731, healthy structure.

- 6H: Confirmed momentum, continuous compression, no major sell signals.

- 4H: Rally structure robust, corrections limited and on support.

- 2H: Key support band 115731–110481, volume supports rebound, possible rotation below 123240.

- 1H: Rally confirmed, no panic selling detected.

- 30min/15min: Intraday consolidation, micro-range below resistance, stable volume, Risk On / Risk Off Indicator short-term neutral.

- Cross-TF summary: CLEAR momentum across all frames, no significant divergence, high-quality HTF supports. Next >123240 breakout likely fast and dynamic.

__________________________________________________________________________________

Technical & Fundamental Synthesis

__________________________________________________________________________________

- Technical Synthesis: Broad bullish confirmation; buy-the-dip valid on 117800/115731, no aggressive downside signal. Swing positions above 118200 to be favored, expect acceleration after clear break of 123240.

- Stops & Invalidation: Swing stops below 115731/111949. Closing below = increased risk, “off” bias.

- Fundamentals: Optimal pre-FOMC swing window, US market in wait-and-see mode short term. Neutral/volatile geopolitics, no immediate shocks.

- On-chain: Heavy accumulation, historic compression, ETF flows strong (but on short pause). Imminent volatility squeeze possible either way.

Recommendation: Actively monitor 123240 (breakout above), 115731 (below = increased caution). Adjust stops and sizing, remain highly responsive, especially as FOMC approaches.

__________________________________________________________________________________

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.