Strong Profits

The company makes solid money on what it sells. It keeps a high percentage of revenue as profit, with strong margins all around. It also generates good returns from the money it invests.

No Debt, Plenty of Cash

The company has almost no debt and a strong cash position. It has more than enough to cover short-term needs and stay financially stable.

Earnings Are Growing

Earnings more than doubled over the last year and are expected to grow again next year. Big investors like mutual funds and institutions are buying more of the stock, which is a good sign.

Business Has an Edge

The company has very high profit margins, which suggests it has pricing power or a business model that’s hard to compete with.

HIGH INSTITUTIONAL OWNERSHIP 66.15%

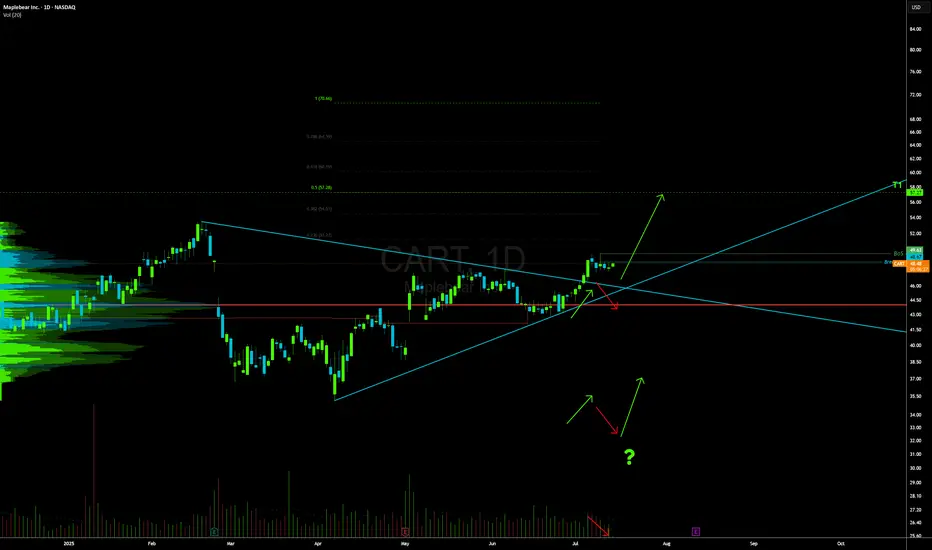

-Broke Out of a Wedge

The stock recently broke out of a wedge pattern, which often means it's ready to move higher.

-Pulling Back Gently

After the breakout, the stock is easing back on light trading volume INTO THE 8ema. That usually means sellers aren't too aggressive and a move higher could be coming.

Looking Toward the Mid-Fifties

Based on the current setup, the stock looks like it could climb to around 57 if momentum holds up.

-Momentum is Positive

The stock is trending above its key moving averages and has gained a lot over the past year. The trend is still strong.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.