Description:

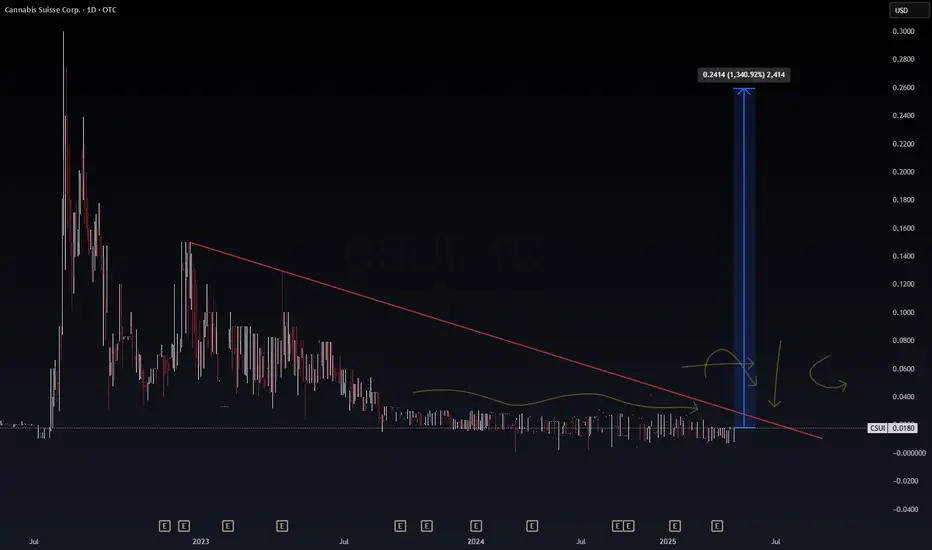

Cannabis Suisse Corp. (CSUI) has been consolidating near historical lows, forming a long-term descending triangle. After a prolonged period of illiquidity and price compression, the stock closed today at $0.0180—up 125%—on a bullish candle that tests the upper boundary of the multi-year downtrend line.

🔍 Key Technical Highlights:

Downtrend Resistance Breakout Setup: A clean break of the red descending trendline signals a potential reversal pattern forming, especially after over a year of flatlined price action.

Volume Analysis: Volume remains thin but recent bursts suggest possible accumulation. Watch for volume expansion confirming breakout.

Measured Move Projection: If the breakout confirms, the projected move aligns with historical retracement levels up to $0.24, suggesting a +1340% upside (see vertical blue projection).

Mean Reversion Play: Price is far below historical averages and may revert to long-term mean, backed by increasing speculative momentum across microcap cannabis names.

⚠️ Risk Management:

Entry Zone: $0.0170–$0.0190

Stop Loss: Below $0.0100 (recent base)

Profit Targets:

TP1: $0.045 (near-term resistance)

TP2: $0.11 (intermediate)

TP3: $0.24 (full measured move)

📌 Disclaimer: OTC penny stocks are highly speculative. Liquidity is low and volatility is extreme. Trade small, use limit orders, and never risk more than you're willing to lose.

Cannabis Suisse Corp. (CSUI) has been consolidating near historical lows, forming a long-term descending triangle. After a prolonged period of illiquidity and price compression, the stock closed today at $0.0180—up 125%—on a bullish candle that tests the upper boundary of the multi-year downtrend line.

🔍 Key Technical Highlights:

Downtrend Resistance Breakout Setup: A clean break of the red descending trendline signals a potential reversal pattern forming, especially after over a year of flatlined price action.

Volume Analysis: Volume remains thin but recent bursts suggest possible accumulation. Watch for volume expansion confirming breakout.

Measured Move Projection: If the breakout confirms, the projected move aligns with historical retracement levels up to $0.24, suggesting a +1340% upside (see vertical blue projection).

Mean Reversion Play: Price is far below historical averages and may revert to long-term mean, backed by increasing speculative momentum across microcap cannabis names.

⚠️ Risk Management:

Entry Zone: $0.0170–$0.0190

Stop Loss: Below $0.0100 (recent base)

Profit Targets:

TP1: $0.045 (near-term resistance)

TP2: $0.11 (intermediate)

TP3: $0.24 (full measured move)

📌 Disclaimer: OTC penny stocks are highly speculative. Liquidity is low and volatility is extreme. Trade small, use limit orders, and never risk more than you're willing to lose.

Note

We wanna know their earnings before investing. Rule 1. of "investing" from my playbook. Note

My Ai says that. I trust my AI so I will look elsewhere. Let's shop around. Note

youtube.com/watch?v=l6IcWZHico8&list=RDz74wvKTQtP4&index=26&ab_channel=NoCopyrightSounds random playlist playing while I am analyzing some assets... Distracting or good, idk. Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.