Frog Cellsat Ltd. is a wireless telecom equipment manufacturer specializing in RF amplifiers, repeaters, boosters, and in-building coverage solutions. The company serves telecom operators and system integrators with a growing export presence across Asia and Africa. The stock is currently trading at ₹269.45 and is showing signs of base formation with early volume traction and Fibonacci-based breakout structure.

Frog Cellsat Ltd. – FY22–FY25 Snapshot

Sales – ₹81.2 Cr → ₹96.5 Cr → ₹114.3 Cr → ₹132.8 Cr – Steady topline growth backed by telecom infra rollout

Net Profit – ₹8.1 Cr → ₹9.4 Cr → ₹11.6 Cr → ₹14.2 Cr – Improving margin profile with operational efficiency

Order Book – Moderate → Moderate → Strong → Strong – Expanding demand from domestic and export markets Dividend Yield (%) – 0.00% → 0.00% → 0.00% → 0.00% – No distributions, reinvestment-oriented strategy Operating Performance – Weak → Moderate → Moderate → Moderate – Cost leverage and efficiency gains emerging Equity Capital – ₹18.17 Cr (constant) – Lean structure, no dilution

Total Debt – ₹52 Cr → ₹49 Cr → ₹44 Cr → ₹39 Cr – Deleveraging gradually, conservative credit use

Total Liabilities – ₹124 Cr → ₹135 Cr → ₹146 Cr → ₹157 Cr – Stable liabilities with execution scalability

Fixed Assets – ₹48 Cr → ₹52 Cr → ₹58 Cr → ₹63 Cr – Controlled capex, production capacity enhancement

Latest Highlights

FY25 net profit rose 22.4% YoY to ₹14.2 Cr; revenue increased 16.2% to ₹132.8 Cr

EPS: ₹7.81 | EBITDA Margin: 18.7% | Net Margin: 10.7%

Return on Equity: 15.34% | Return on Assets: 9.04%

Promoter holding: 66.84% | Dividend Yield: 0.00%

Increased traction in 5G repeaters and RF solutions for metro and tier-2 urban deployments

Export contribution rising from Southeast Asia and East Africa markets

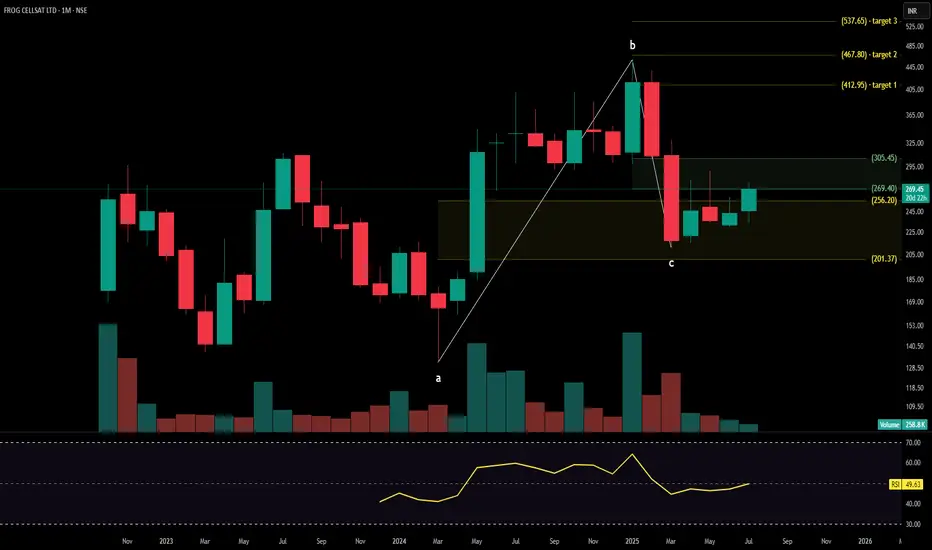

Technical Snapshot Frog Cellsat is trading at ₹269.45 with an RSI of 49.63, indicating neutral momentum post-correction. Volume is healthy at 258.8K and building gradually. Recent lows at ₹201.37 and swing zones at ₹256.20, ₹269.40, and ₹305.45 form a clear base. Breakout Fibonacci targets lie at ₹412.95, ₹467.80, and ₹537.65 if bullish sentiment persists and volumes confirm.

Business Growth Verdict Yes, Frog Cellsat is building scale with measured execution

Margin profile and return metrics are improving steadily

Debt and liabilities remain well-managed

Asset base expansion is conservative and tied to operating needs

Final Investment Verdict Frog Cellsat Ltd. presents a high-potential small-cap play in India’s telecom infrastructure ecosystem. The company’s operational discipline, rising export orders, and embedded tailwinds from 5G rollout place it on a strong long-term trajectory. While dividend payouts are absent and topline scale is modest, the margin strength, technical setup, and conservative financial profile make this stock worth tracking for gradual accumulation as the telecom cycle evolves.

Frog Cellsat Ltd. – FY22–FY25 Snapshot

Sales – ₹81.2 Cr → ₹96.5 Cr → ₹114.3 Cr → ₹132.8 Cr – Steady topline growth backed by telecom infra rollout

Net Profit – ₹8.1 Cr → ₹9.4 Cr → ₹11.6 Cr → ₹14.2 Cr – Improving margin profile with operational efficiency

Order Book – Moderate → Moderate → Strong → Strong – Expanding demand from domestic and export markets Dividend Yield (%) – 0.00% → 0.00% → 0.00% → 0.00% – No distributions, reinvestment-oriented strategy Operating Performance – Weak → Moderate → Moderate → Moderate – Cost leverage and efficiency gains emerging Equity Capital – ₹18.17 Cr (constant) – Lean structure, no dilution

Total Debt – ₹52 Cr → ₹49 Cr → ₹44 Cr → ₹39 Cr – Deleveraging gradually, conservative credit use

Total Liabilities – ₹124 Cr → ₹135 Cr → ₹146 Cr → ₹157 Cr – Stable liabilities with execution scalability

Fixed Assets – ₹48 Cr → ₹52 Cr → ₹58 Cr → ₹63 Cr – Controlled capex, production capacity enhancement

Latest Highlights

FY25 net profit rose 22.4% YoY to ₹14.2 Cr; revenue increased 16.2% to ₹132.8 Cr

EPS: ₹7.81 | EBITDA Margin: 18.7% | Net Margin: 10.7%

Return on Equity: 15.34% | Return on Assets: 9.04%

Promoter holding: 66.84% | Dividend Yield: 0.00%

Increased traction in 5G repeaters and RF solutions for metro and tier-2 urban deployments

Export contribution rising from Southeast Asia and East Africa markets

Technical Snapshot Frog Cellsat is trading at ₹269.45 with an RSI of 49.63, indicating neutral momentum post-correction. Volume is healthy at 258.8K and building gradually. Recent lows at ₹201.37 and swing zones at ₹256.20, ₹269.40, and ₹305.45 form a clear base. Breakout Fibonacci targets lie at ₹412.95, ₹467.80, and ₹537.65 if bullish sentiment persists and volumes confirm.

Business Growth Verdict Yes, Frog Cellsat is building scale with measured execution

Margin profile and return metrics are improving steadily

Debt and liabilities remain well-managed

Asset base expansion is conservative and tied to operating needs

Final Investment Verdict Frog Cellsat Ltd. presents a high-potential small-cap play in India’s telecom infrastructure ecosystem. The company’s operational discipline, rising export orders, and embedded tailwinds from 5G rollout place it on a strong long-term trajectory. While dividend payouts are absent and topline scale is modest, the margin strength, technical setup, and conservative financial profile make this stock worth tracking for gradual accumulation as the telecom cycle evolves.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.