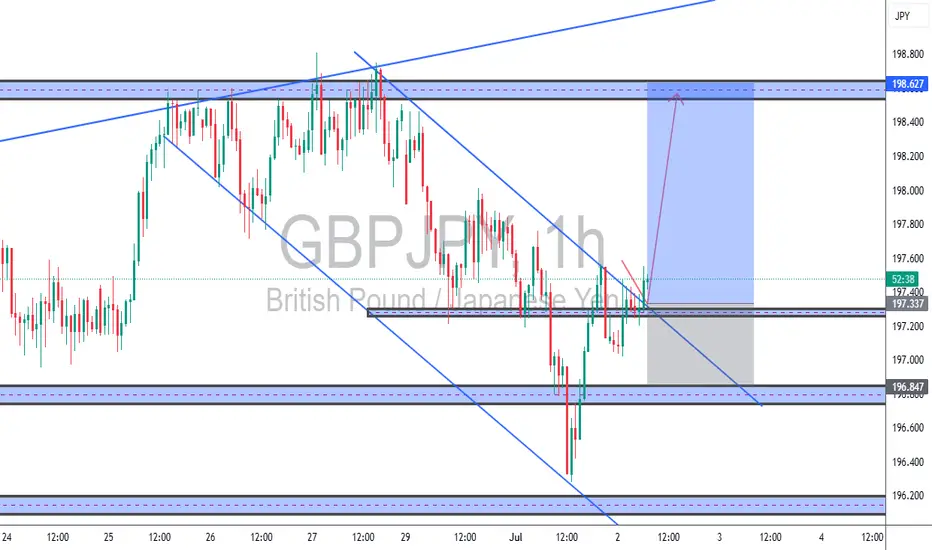

🧠 TCB Strategy Breakdown:

This is a textbook example of a TCB Flow setup:

🔹 Trend Phase

The market had been in a strong bullish trend leading into the end of June, topping near 198.800. That bullish impulse set the directional context — the market is overall bullish on the higher timeframe.

Even though price pulled back from those highs, no structural break to the downside occurred. So we still treat the overall flow as bullish.

🔹 Countertrend Phase

From the highs, price began a clean descending channel — the typical correction we look for. It wasn’t random chop — it had defined boundaries, touchpoints, and aligned with the psychology of a cooling market before the next push.

The countertrend ended with a false breakdown below 197.00, quickly rejecting off the 196.850 support zone. That created the final “spring” setup to trap early sellers.

🔹 Breakout Phase

We then get the breakout — price slices through the countertrend channel and closes strongly above it, just above 197.350–197.500 — which also acted as an earlier support–turned–resistance zone. That dual confluence makes this breakout high probability.

The best part? After the breakout, price dipped back into the zone, gave a clean retest wick, and showed bullish rejection — our TCB-style entry trigger.

🧭 Why This Trade Stands Out:

✅ Structure is clear — trend, pullback, breakout all line up visually

✅ No conflicting zones — clean path to TP (198.627)

✅ Risk–Reward solid — SL below last reaction low, TP back to major resistance

✅ Session timing — breakout happening around NY session, ideal for momentum

Clean TCB structure unfolding:

🔹 Trend Phase: Bullish move into 198.800 zone

🔹 Countertrend: Descending channel formed from highs

🔹 Breakout: Price broke above the countertrend channel with confluence at 197.35–197.50 support

✅ TCB Checklist Score: 95%

🎯 Entry: 197.50

🛡️ SL: 196.95

🏁 TP: 198.627

📈 R-Multiple: Projected 2.25R

NY session momentum could push this clean breakout toward target.

Trade the Flow. Master the Market – #TCBFlow

This is a textbook example of a TCB Flow setup:

🔹 Trend Phase

The market had been in a strong bullish trend leading into the end of June, topping near 198.800. That bullish impulse set the directional context — the market is overall bullish on the higher timeframe.

Even though price pulled back from those highs, no structural break to the downside occurred. So we still treat the overall flow as bullish.

🔹 Countertrend Phase

From the highs, price began a clean descending channel — the typical correction we look for. It wasn’t random chop — it had defined boundaries, touchpoints, and aligned with the psychology of a cooling market before the next push.

The countertrend ended with a false breakdown below 197.00, quickly rejecting off the 196.850 support zone. That created the final “spring” setup to trap early sellers.

🔹 Breakout Phase

We then get the breakout — price slices through the countertrend channel and closes strongly above it, just above 197.350–197.500 — which also acted as an earlier support–turned–resistance zone. That dual confluence makes this breakout high probability.

The best part? After the breakout, price dipped back into the zone, gave a clean retest wick, and showed bullish rejection — our TCB-style entry trigger.

🧭 Why This Trade Stands Out:

✅ Structure is clear — trend, pullback, breakout all line up visually

✅ No conflicting zones — clean path to TP (198.627)

✅ Risk–Reward solid — SL below last reaction low, TP back to major resistance

✅ Session timing — breakout happening around NY session, ideal for momentum

Clean TCB structure unfolding:

🔹 Trend Phase: Bullish move into 198.800 zone

🔹 Countertrend: Descending channel formed from highs

🔹 Breakout: Price broke above the countertrend channel with confluence at 197.35–197.50 support

✅ TCB Checklist Score: 95%

🎯 Entry: 197.50

🛡️ SL: 196.95

🏁 TP: 198.627

📈 R-Multiple: Projected 2.25R

NY session momentum could push this clean breakout toward target.

Trade the Flow. Master the Market – #TCBFlow

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.