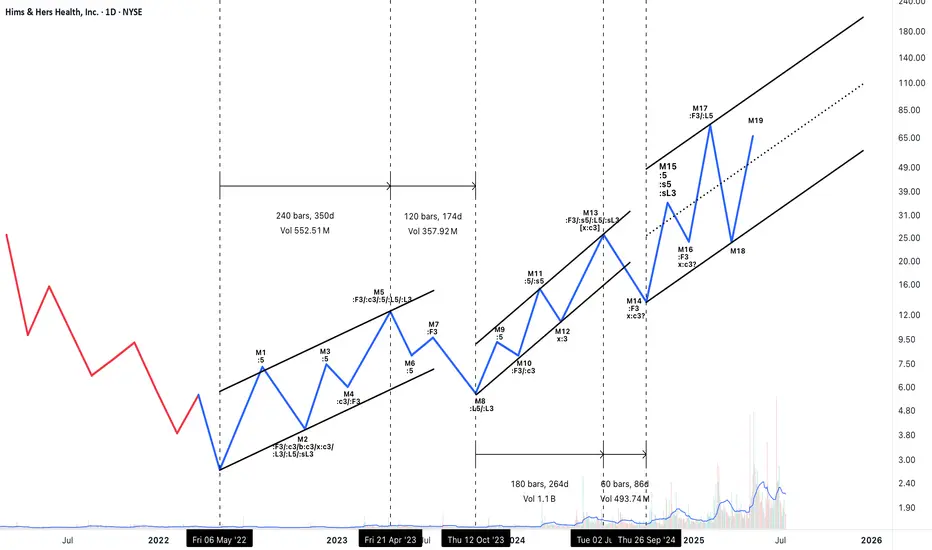

This analysis interprets the ongoing structure as a Complex Correction in the form of a W–X–Y–X–Z pattern. Here's a breakdown of the logic behind the wave labeling and key observations:

Overall Structural Summary:

W wave (M1–M5): Though M1 is labeled as ":5", a closer examination of its internal structure reveals corrective characteristics. Therefore, the entire M1–M5 segment is best interpreted as a complex corrective structure, possibly a double three or flat.

X wave 1 (M6–M8): A clear Zigzag, fulfilling the requirements for a valid X. All relevant time and price criteria are met, forming a neat connector after W.

Y wave (M9–M13):

M9–M10: A Zigzag formation.

M11–M12–M13: M12 serves as an x-wave, and M13 unfolds as a simple corrective move in three waves, completing the Y wave. Though M13 is a single-leg visually, the internal structure confirms a three-part move.

The Y wave is longer in both time and complexity, appropriate for its position in the sequence.

X wave 2 (M14): Despite appearing as a short single move, it satisfies the X criteria in the context of the ongoing correction. The small size is acceptable as per rule allowances for connectors in Z formations.

Z wave (M15–ongoing):

M15–M17: Another Zigzag, forming the first leg of Z.

M18: Likely the X connector within Z.

M19: Assumed to be the beginning of the final leg of Z. The structure from here forward will determine whether Z completes as a triangle, zigzag, or another combination.

Supporting Rule Applications:

Several Neowave rules were cross-verified:

- Rule 2a and 5a were referenced to validate corrections that exceed the 61.8% retracement and duration benchmarks.

- Rule 7c and 4 supported impulse invalidations and corrections involving running structures.

Time symmetry across connectors and leg duration was considered to maintain wave consistency.

Visual Channels:

All W, Y, and Z legs are progressing within clearly defined channels.

The Z leg is currently within a steep rising channel. If Z completes as a non-triangular formation, a reversal might follow.

Conclusion & Risk Notes:

This structure, though corrective in nature, contains strong upward segments — especially within Z — making it tradable for bullish swings.

Given that Z is the final leg, caution is warranted. Once Z completes (especially if M19 develops into a three-wave structure), the larger correction may terminate, potentially leading to a larger trend reversal.

Position management (e.g., scaling out or using stop-losses) is advised as the structure evolves.

Overall Structural Summary:

W wave (M1–M5): Though M1 is labeled as ":5", a closer examination of its internal structure reveals corrective characteristics. Therefore, the entire M1–M5 segment is best interpreted as a complex corrective structure, possibly a double three or flat.

X wave 1 (M6–M8): A clear Zigzag, fulfilling the requirements for a valid X. All relevant time and price criteria are met, forming a neat connector after W.

Y wave (M9–M13):

M9–M10: A Zigzag formation.

M11–M12–M13: M12 serves as an x-wave, and M13 unfolds as a simple corrective move in three waves, completing the Y wave. Though M13 is a single-leg visually, the internal structure confirms a three-part move.

The Y wave is longer in both time and complexity, appropriate for its position in the sequence.

X wave 2 (M14): Despite appearing as a short single move, it satisfies the X criteria in the context of the ongoing correction. The small size is acceptable as per rule allowances for connectors in Z formations.

Z wave (M15–ongoing):

M15–M17: Another Zigzag, forming the first leg of Z.

M18: Likely the X connector within Z.

M19: Assumed to be the beginning of the final leg of Z. The structure from here forward will determine whether Z completes as a triangle, zigzag, or another combination.

Supporting Rule Applications:

Several Neowave rules were cross-verified:

- Rule 2a and 5a were referenced to validate corrections that exceed the 61.8% retracement and duration benchmarks.

- Rule 7c and 4 supported impulse invalidations and corrections involving running structures.

Time symmetry across connectors and leg duration was considered to maintain wave consistency.

Visual Channels:

All W, Y, and Z legs are progressing within clearly defined channels.

The Z leg is currently within a steep rising channel. If Z completes as a non-triangular formation, a reversal might follow.

Conclusion & Risk Notes:

This structure, though corrective in nature, contains strong upward segments — especially within Z — making it tradable for bullish swings.

Given that Z is the final leg, caution is warranted. Once Z completes (especially if M19 develops into a three-wave structure), the larger correction may terminate, potentially leading to a larger trend reversal.

Position management (e.g., scaling out or using stop-losses) is advised as the structure evolves.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.