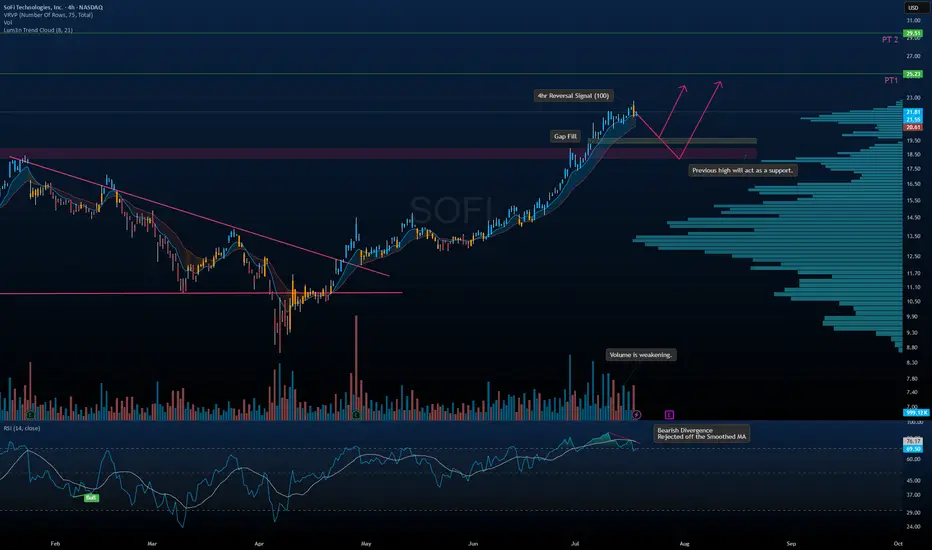

I’m extremely bullish on SoFi long-term, but the chart is signaling a potential pullback opportunity before the next leg up.

🔹 Technical Breakdown:

• Bearish Divergence on RSI with rejection off the smoothed MA

• Volume weakening as price moves higher – classic sign of exhaustion

• 4hr Reversal Signal flashing near local highs

• Gap Fill zone near $19.50 + previous highs = strong support zone

• Lum3n Trend Cloud still bullish — trend intact unless breakdown occurs

🎯 Targets:

• PT1 → $23.25

• PT2 → $29.50 (longer-term structure extension)

🧠 Thesis:

Letting price come to us is the smarter move here. I’m watching the $19.50–$20.00 zone closely for potential accumulation. That level has strong confluence with volume shelf, support, and fib structure.

🔹 Technical Breakdown:

• Bearish Divergence on RSI with rejection off the smoothed MA

• Volume weakening as price moves higher – classic sign of exhaustion

• 4hr Reversal Signal flashing near local highs

• Gap Fill zone near $19.50 + previous highs = strong support zone

• Lum3n Trend Cloud still bullish — trend intact unless breakdown occurs

🎯 Targets:

• PT1 → $23.25

• PT2 → $29.50 (longer-term structure extension)

🧠 Thesis:

Letting price come to us is the smarter move here. I’m watching the $19.50–$20.00 zone closely for potential accumulation. That level has strong confluence with volume shelf, support, and fib structure.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.