🧨 GEX-Based Options Outlook:

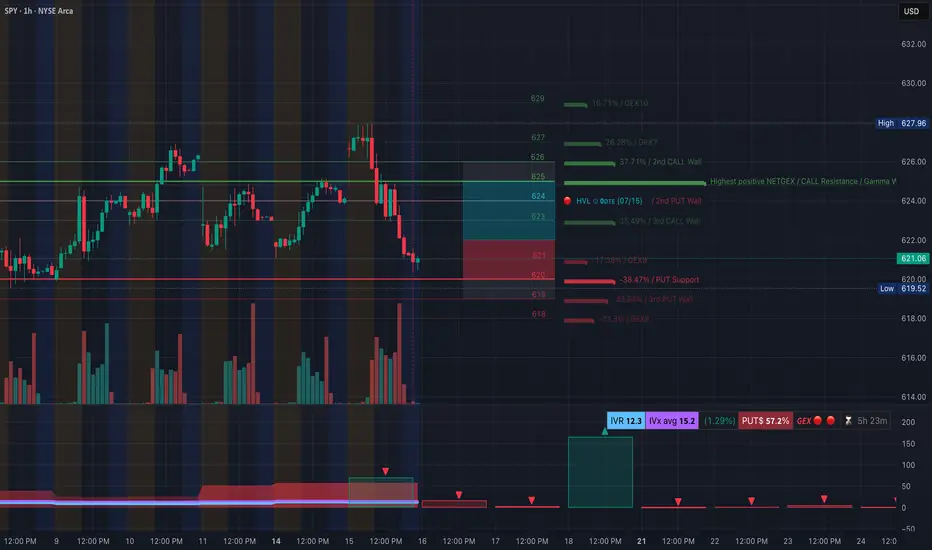

* GEX Sentiment: Negative gamma dominates (🟥 GEX 🔻), indicating elevated dealer hedging risk.

* Put Wall & Support:

* Major PUT Wall at 620 (⚠️ -38.47%) is being tested.

* Additional downside liquidity lies below 618.

* Call Resistance:

* Upside resistance around 625–627, where both the 2nd CALL Wall and GEX7/8 sit.

* IV/Flow Summary:

* IVR 12.3 (low), PUTs 57.2% – bearish skew.

* Option flow is protecting downside → less confidence in upside follow-through unless we reclaim 624.5+.

* Conclusion: SPY is pinned around major support. A breakdown under 620 could accelerate downside into 616/614 range.

📉 1H Price Action & Trade Setup:

* SPY formed a CHoCH breakdown and is retesting the wedge base.

* Strong rejection from the 624.81–627.96 supply zone.

* Price is now hugging trendline support and could trigger a bounce or further breakdown depending on liquidity sweep.

Bullish Scenario:

* ✅ Entry: Above 621.50 reclaim with confirmation.

* 🎯 Targets: 624.50 → 626.80.

* ⛔ Stop: 620 or below trendline.

* ⚠️ Note: Only valid if SPY holds the CHoCH base and sweeps under 620 to trap bears.

Bearish Scenario:

* ❌ Entry: Clean break below 620, especially if it fails a retest.

* 🎯 Targets: 618 → 615.50 → 612.

* ⛔ Stop: Back above 622 with volume.

🎯 My Thoughts & Recommendation:

SPY is balancing on a major PUT wall and SMC support trendline. If 620 fails, the path of least resistance is down toward 615 and potentially 612 due to the lack of supportive gamma levels below. A relief bounce is possible only if dealers regain control above 624. Keep stops tight, as this zone could snap quickly.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

* GEX Sentiment: Negative gamma dominates (🟥 GEX 🔻), indicating elevated dealer hedging risk.

* Put Wall & Support:

* Major PUT Wall at 620 (⚠️ -38.47%) is being tested.

* Additional downside liquidity lies below 618.

* Call Resistance:

* Upside resistance around 625–627, where both the 2nd CALL Wall and GEX7/8 sit.

* IV/Flow Summary:

* IVR 12.3 (low), PUTs 57.2% – bearish skew.

* Option flow is protecting downside → less confidence in upside follow-through unless we reclaim 624.5+.

* Conclusion: SPY is pinned around major support. A breakdown under 620 could accelerate downside into 616/614 range.

📉 1H Price Action & Trade Setup:

* SPY formed a CHoCH breakdown and is retesting the wedge base.

* Strong rejection from the 624.81–627.96 supply zone.

* Price is now hugging trendline support and could trigger a bounce or further breakdown depending on liquidity sweep.

Bullish Scenario:

* ✅ Entry: Above 621.50 reclaim with confirmation.

* 🎯 Targets: 624.50 → 626.80.

* ⛔ Stop: 620 or below trendline.

* ⚠️ Note: Only valid if SPY holds the CHoCH base and sweeps under 620 to trap bears.

Bearish Scenario:

* ❌ Entry: Clean break below 620, especially if it fails a retest.

* 🎯 Targets: 618 → 615.50 → 612.

* ⛔ Stop: Back above 622 with volume.

🎯 My Thoughts & Recommendation:

SPY is balancing on a major PUT wall and SMC support trendline. If 620 fails, the path of least resistance is down toward 615 and potentially 612 due to the lack of supportive gamma levels below. A relief bounce is possible only if dealers regain control above 624. Keep stops tight, as this zone could snap quickly.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.