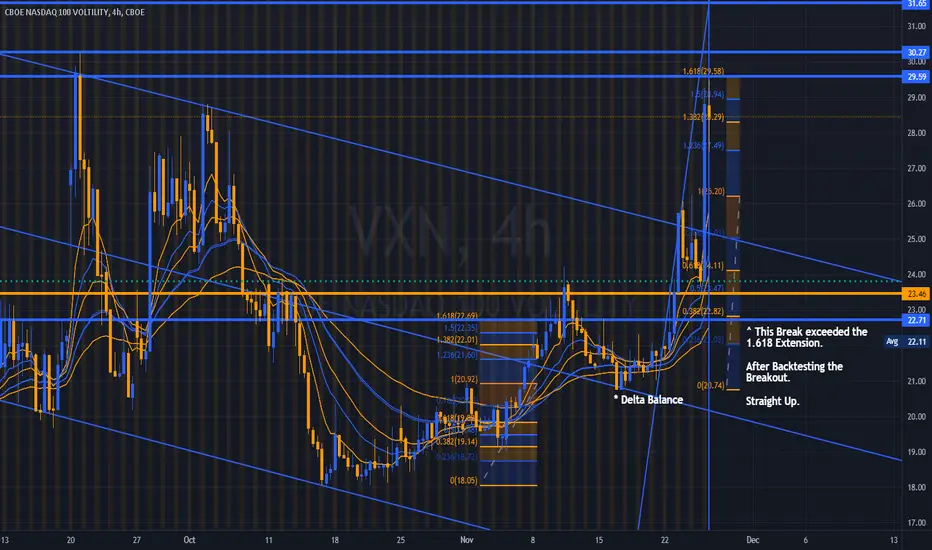

The Apex is refreshed from a 1-hour Chart showing its Zenith in the lower 31s.

What is fascinating about the VXN - imminent change in the index occurs when

a Prior Range is broken and a Price Objective is Exceeded.

This is followed by a rapid rise in the Index when it moves through after Backtesting.

The Delta HEdge needed the lowest possible FILL for the VX COMPLEX.

The VXN volatility index is now at a fairly high level, where it will provide - 1 of 3 outcomes

1. Continue an exponential move higher

2. Complete APEx and retracement to Support.

3. Reverse on the Secondary High

____________________________________________________________________________________

Given the outright Fraud in the Q3 Reporting and repeated Gamma Squeeze since September,

Collapsing Confidence - UMICH @ 500 Sample Size / Upcoming CCI 3000 Sample Size and

reduced Liquidity.

Any Panic will have a cascading effect.

_____________________________________________________________________________________

There are a great many very Disturbing possibilities.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.