Alert Price: $0.8450

Technical Analysis

Company Website | Recent News

This has been quite the profitable week of trading, with one of our past alerts already running up for triple-digits gains.

Earlier we promised you a fresh profile with triple-digit gain potential.

So without further ado, we'd like you to turn your full attention to Walcott Resources Ltd. (WALRF).

This junior mining company appears to be picking up some serious bullish momentum, and we are anticipating a huge move from it this upcoming trading session.

Over the last three sessions, shares of WALRF are up over +33%, with volume increasing steadily.

At this pace we could see WALRF trading above a $1.00 by the end of the week.

This is one potential bull run that you do not want to be watching from the sidelines.

Make sure you read our full profile below, start your research, and add WALRF to the top of your watchlist.

About Walcott Resources Ltd.

Walcott is a British Columbia based Company involved in the acquisition and exploration of mineral properties in Canada and Australia. The Company holds an option to acquire a 100% undivided interest, subject to a 1.5% NSR on all base, rare earth elements and precious metals, in the Cobalt Hill copper-gold-cobalt property (the "Property"), consisting of eight mineral claims covering an area of approximately 1,727.43 hectares located in the Trail Creek Mining Division in the Province of British Columbia, Canada.

In addition, the Company has acquired 60% of two silver assets in Australia - the Tyr Silver Project in northern New South Wales and Century South Silver-Zinc Project in north-west Queensland.

Walcott also trades on the Canadian Securities Exchange under the symbol (WAL) and on the Frankfurt Stock Exchange under the symbol (WR2).

Goldman Sachs Doubles Down On Bullish Gold Price Forecast

Goldman Sachs remains upbeat about gold in 2021.

In a report published Friday, the investment bank said that it is maintaining its 2021 gold price target of $US2,300 an ounce as the global economy returns to balance between positive news of potential vaccines for the COVID-19 virus and the still prevalent risks of further economic damage from more waves of the virus.

Gold prices ended Friday on Comex up around 0.7% at

Gold investors ignored the rise in US bond yields over the week – although they eased to 0.895% on Friday after touching a high of 0.97% earlier in the wake in the wake of the switch in investing triggered by news about the Pfizer COVID-19 vaccine.

Although Goldman Sachs economists see a strong economic recovery in the US and worldwide next year, commodity analysts Jeffrey Currie and Mikhail Sprogis, the authors of the gold report, said that there is still a “strong strategic case for gold.”

“In our view, the structural bull market for gold is not over and will resume next year as inflation expectations move higher, the U.S. dollar weakens and E.M. (Emerging Markets) retail demand continues to recover,” the analysts said.

Gold “should benefit from continued strong investment demand.”

Silver seems to be still more attractive to smaller investors because it is perceived as being cheaper (which it is) and prices around $US24 an ounce seem easier for investors to grasp than gold above

Source: sharecafe.com.au/2020/11/16/goldman-sachs-doubles-down-on-bullish-gold-price-forecast/

Silver price forecast for 2021 and beyond: more gains ahead

In a report published at the end of October, analysts at Metals Focus said they see silver prices going "well above" $30 per ounce.

They anticipate silver to get an upward momentum after the results of the US election are known: "Almost irrespective of the outcome of the US election, fresh large-scale fiscal and monetary stimuli seems inevitable, given an uncertain economic recovery and still high Covid-19 cases. The same may apply to Europe where record infections and new lockdown measures have also cast doubts about the solidity of the anticipated economic recovery. The case for silver (and gold investment) will therefore remain strong."

"This is the main assumption behind our forecast that the silver price will break through the $30 mark during 2021."

WALRF's Cobalt Hill Project

The Cobalt Hill Property is located 5 kilometres east of Castlegar, BC, and consists of 8 mineral tenures totaling 1727.43 hectares. The Property is owned by Jack Denny of Salmo, BC and is under option to Walcott Resources (“Walcott”) Ltd. of Vancouver, BC, who has the right to earn a 100% interest in the Property, subject to a retained Net Smelter Return.

The Cobalt Hill Property covers a portion of the multi-phase Bonnington pluton, which has intruded sedimentary, volcanic and sub-volcanic rocks of the Jurassic Rossland Group. These older rocks occur as embayments, pendants, and possible fault slices within the pluton, and are typically metamorphosed with relic textures preserved only locally (Caron, 2010).

The property exhibits widespread gold mineralization generally associated with narrow, often wide-spaced quartz veins. This high grade gold mineralization has been found in numerous locations throughout the property and is well described in historic assessment reports filed with the BC Ministry of Energy and Mines.

Numerous old prospect pits, shafts and adits on the Cobalt Hill Property are evidence of the early exploration history in the area, and there is anecdotal evidence of early placer gold mining on McPhee and Champion creeks. The presence of free gold in quartz veins at the Maud S showing has been known since the late 1890s.

Soil sample results from previous soil surveys show significant gold, copper and cobalt anomalies trending through the Property, expanding outward from the areas with known workings. Gold and copper-cobalt associations seen in the soil geochemistry anomalies are also present in rock sample results.

WALRF Closes Big Time Acquisition Of Silver Mines

WALRF Acquires Two Australian Projects With Historic Mines

The Company announce that it has closed the acquisition (the "Transaction") of 60% of the issued and outstanding shares of 1256714 B.C. Ltd. ("TargetCo") pursuant to a share exchange agreement dated effective August 13, 2020 among the Company, TargetCo and the shareholders of TargetCo (the "Definitive Agreement"). Targetco owns a 100% interest (subject to a 2% NSR) in two prospective silver-zinc projects in Australia, being the Tyr Silver Project and the Century South Silver-Zinc Project.

The Silver Projects

Tyr Silver Project in northern New South Wales has two historic silver mines - Burra and Torny - with potential for high-grade silver zinc-lead-tin mineralization.

The Tyr Silver Project covers an area of approximately 300 km2 in Northern New South Wales comprised of minimal use, hilly pastoral land, mostly cleared and lightly forested.

The tenement was granted in March 2018 and is due for renewal in March 2024.

The Tyr Silver Project delivers upside potential with mineral occurrences apparent along a north-west trend with numerous old workings both along this trend and possibly others.

Notably, the north-west trend is part of a large-scale mineralized system that includes the historic silver mines, which materially boosts exploration upside.

Century South Silver-Zinc Project in the Mt Isa Basin, north-west Queensland, which is under-explored but in a highly prospective region and is along strike from one of the world's largest silver-zinc mines.

Century South lies approximately 8 km south east of the New Century Zinc Mine and is around 250 km2 in size, comprised of hilly, open savannah country.

The tenement was granted in October 2018 and is due for renewal in October 2023.

Both projects are located near established mining infrastructure & accessible port, whilst Australia is a stable, well-regulated, mining jurisdiction.

Read the full article here.

Recently, the company followed up with major updates from the Tyr Silver Project and the Century South Silver-Zinc Project ("CSSZP").

Tyr Silver Project Update

Highlights

Subsequent to the August 13, 2020 news release announcing the acquisition of two Australian silver projects, Walcott has commissioned its Australian technical team to expedite exploration work on the prospective Tyr Silver Project.

Building on previous work, the technical team is fast-tracking plans for a site visit to review previously determined prospective silver targets in order to formulate an inaugural drilling campaign.

Within the Tyr Silver Project are the two historic silver mines (Burra and Torny) which both produced silver, zinc and lead between 1920-35: Adjacent to both historic mines are priority areas earmarked for extensive surface sampling and geophysical surveys to reconcile historic data sets and geological reports.

A distinctive quality of the Tyr Silver Project is numerous mineral occurrences along a north-west trend that is 20 km in length and 4 km wide.

The proximity, geology and mineralization patterns indicate that the north-west trend could potentially be part of a mineralized system - including the historic silver mines.

CEO David Thornley-Hall remarked: "The fact there are two historic silver mines and numerous reported mineral occurrences, potentially within a 20 km by 4 km potentially mineralized system, suggests that a considerable future pipeline of work is warranted. Leveraging earlier work, we aim to rapidly deploy field teams to the Tyr Silver Project to commence reviewing preliminary targets and accelerate the formulation of our inaugural drilling campaign."

Century South Silver-Zinc Project ("CSSZP") Update

Highlights

Walcott's CSSZP consists of approximately 277 square kms and is located in a highly prospective region - the Mt Isa Basin which hosts several world-class silver-zinc-lead and copper deposits, yet much of the region remains under-explored.

The CSSZP is approximately 8km along strike from New Century Resources' (ASX: NCZ) world-class Century Mine that recommenced mining operations in 2018:

The two projects are on the same regional fault line which is known to control and constrain silver-zinc mineralization in the district;

Both CSSZP and Century Mine are hosted in the same Lawn Hill Platform which is within the Western Fold Belt; and

There are similarities between the magnetic / density geophysical characteristics apparent at CSSZP and Century Mine, indicating that the underlying geology might be comparable.

CSSZP is located in a well-established mining district with reliable infrastructure and access to nearby ports. In terms of power infrastructure; 90% the tenement lies within the 10km transmission network corridor as powerlines run through the centre of the EPM26713. The remaining 10% on the easternmost perimeter lies within the 30km transmission network corridor.

Walcott's technical team plans to undertake a site visit and commence a wide-spread surface sampling campaign, focused along the prospective regional fault.

CEO David Thornley-Hall remarked: "We are excited by the strong fundamentals linked to our Century South Silver-Zinc Project, and we anticipate committing to a significant work program on this property. Accordingly, our Australian technical team have set an ambitious agenda to swiftly and effectively advance towards drillable targets within the tenure."

WALRF Provides Update On Cobalt Hill Property

Vancouver, British Columbia--(Newsfile Corp. - September 11, 2020) - Walcott Resources Ltd. (CSE: WAL) (the "Company" or "Walcott") is pleased to provide and update on exploration activities on the Cobalt Hill Property located near Castlegar in Southern BC.

This 2020 exploration program has been designed to follow-up on zones of known high grade gold mineralization which occur at numerous locations on the property and are well described in historic assessment reports filed with the BC Ministry of Energy and Mines. It will also assess the potential for larger zones of lower grade gold mineralization on the property.

Activities will include compiling historic geochemical, geological and geophysical data along with ground truthing, mapping and sampling to follow-up areas of interest.

One high priority target which has been identified for work in 2020 is a 650 x 100-250 m coincident gold-in-soil geochemical anomaly and magnetic low anomaly located in an area of minimal rock exposure approximately 500 m west of the High Grade zone. Visible gold occurs in a narrow intrusive-hosted quartz vein at the High Grade zone. Numerous historic rock samples collected from the vein have returned high gold assays, including 14.4 ppm Au, 38.0 ppm Au, 88.4 ppm Au and 413.0 ppm Au1,2. The target area west of the High Grade zone which is slated for work in 2020 includes values to 622 ppb gold-in-soil and is untested by previous drilling3. Historic rock samples from within the target area have returned greater than 2 ppm gold from float samples.

A second target for this exploration program is the Meister/Marilyn zone, located 2 km to the west, where historic prospect pits and trenches expose strong sericite alteration with local silicification and quartz veining occurring within a 200 x 100 m area. This zone is located 350 m northeast of the Maud S occurrence, another narrow intrusive-hosted quartz vein on the property which has visible gold and has returned high gold values from historic rock sampling (including 6.4, 7.9, 38.0, 39.0 and 85.6 ppm Au) 1,2. Narrow quartz veins at the Meister/Marilyn zone have also returned elevated gold values from historic samples, including 8.0 and 37.3 ppm Au. A coincident gold-in-soil geochemical anomaly and magnetic low anomaly occurs 200 m to the northeast of the historic Meister pits, in an area of limited rock exposure. Neither the Meister/Marilyn zone nor the geochemical anomaly to the northeast have been tested by drilling.

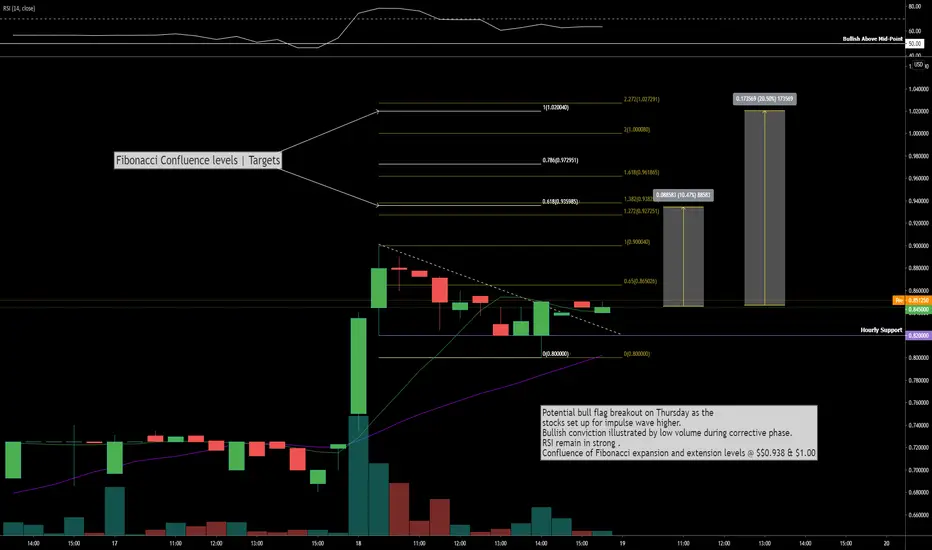

Technical Analysis

As we mentioned above, WALRF appears to be on the verge a long-term bull rally.

The Company has seen both a rise in share price and volume over the past few sessions.

We've done our very own chart analysis and see the potential for a move past a dollar and beyond from here!

Bullish Indicators:

Potential bull flag breakout this upcoming session as it sets up for impulse wave higher.

Bullish conviction illustrated by low volume during corrective phase.

RSI remain in strong.

Confluence of Fibonacci expansion and extension levels at $0.938 and $1.00

The Bottom Line

WALRF appears to be picking up some serious bullish momentum, and we are anticipating a huge move from it this upcoming trading session.

Over the last three sessions, shares of WALRF are up over +33%, with volume increasing steadily.

At this pace we could see WALRF trading above a $1.00 by the end of the week.

This is one potential bull run that you do not want to be watching from the sidelines!By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

Best regards,

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.