🔸 Market Snapshot

📉 Gold pulled back sharply on Friday after a surprisingly strong U.S. NFP report, which added 303,000 jobs — well above forecasts. This cooled immediate expectations for aggressive Fed rate cuts and pushed Treasury yields and the dollar higher, triggering a short-term correction in gold prices.

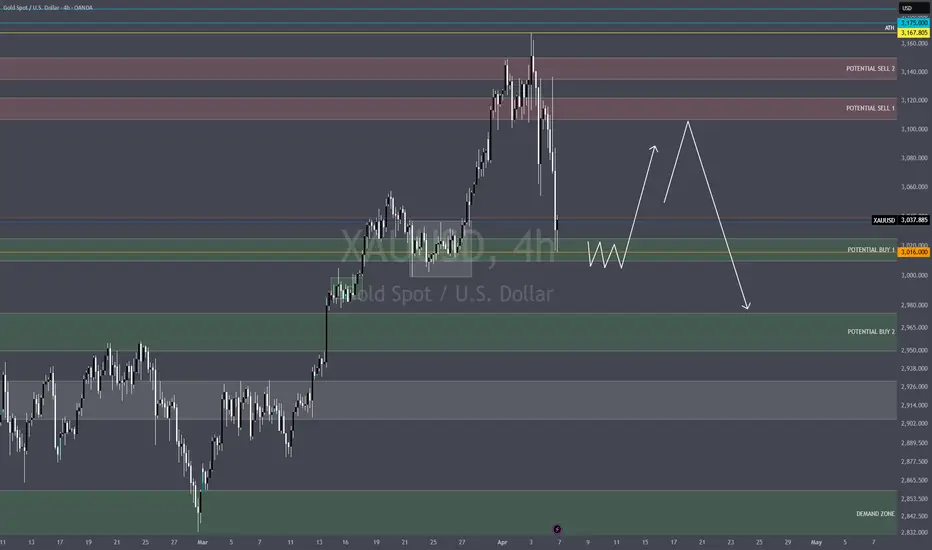

📊 After printing a fresh all-time high at $3168 last week, this drop is seen as a technical retracement, not a trend reversal. Powell’s speech echoed a cautious stance, reiterating a data-dependent path, which leaves room for renewed upside if inflation softens or geopolitical tensions escalate.

🌍 With Middle East tensions still brewing and demand for safe havens intact, many traders now eye 3015–2975 as a key demand zone for potential reaccumulation — setting the stage for the next leg toward 3200 and beyond.

🟩 BUY SCENARIO 1

📍 Entry: 3020–3015

🧠 Confluences: Bullish M15 FVG + Trendline Support + RSI Reversal

TP1: 3086

TP2: 3130

SL: 3008 (below swing low + OB invalidation)

📌 Look for bullish M5 CHoCH or strong reaction wick for sniper entry

🟩 BUY SCENARIO 2

📍 Entry: 2975–2965

🧠 Confluences: Untapped M30 OB + Imbalance Zone + D1 Demand

TP1: 3050

TP2: 3086

SL: 2958 (below OB + psychological 2960 level)

⚠️ Only valid if 3010 breaks and flushes into this zone. Let the price come to you.

🔻 SELL SCENARIO 1

📍 Entry: 3107–3115

🧠 Confluences: M15 OB + Unmitigated FVG + CHoCH after LH

TP1: 3030

TP2: 3010

SL: 3119 (above OB + intraday wick room)

📌 Look for M1–M5 bearish confirmation or rejection wick at OB

🔻 SELL SCENARIO 2

📍 Entry: 3135–3142

🧠 Confluences: Strong OB Zone + Premium Liquidity Grab + Equal Highs

TP1: 3086

TP2: 3020

SL: 3148 (above liquidity + OB invalidation)

⚠️ Still valid if price rallies fast – bonus confluence if RSI shows divergence

📌 Key Levels Recap:

🔹 3142 – Premium OB Zone

🔹 3115 – Intraday LH Rejection

🔹 3020 – Bullish FVG + Trendline Support

🔹 2965 – Deeper Demand Zone

🔹 2958 & 3148 – Final SL Protection Areas

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

If you find the ideas contribute to your views on the market be kind to press boost🚀/like button. Your support is appreciated.

📉 Gold pulled back sharply on Friday after a surprisingly strong U.S. NFP report, which added 303,000 jobs — well above forecasts. This cooled immediate expectations for aggressive Fed rate cuts and pushed Treasury yields and the dollar higher, triggering a short-term correction in gold prices.

📊 After printing a fresh all-time high at $3168 last week, this drop is seen as a technical retracement, not a trend reversal. Powell’s speech echoed a cautious stance, reiterating a data-dependent path, which leaves room for renewed upside if inflation softens or geopolitical tensions escalate.

🌍 With Middle East tensions still brewing and demand for safe havens intact, many traders now eye 3015–2975 as a key demand zone for potential reaccumulation — setting the stage for the next leg toward 3200 and beyond.

🟩 BUY SCENARIO 1

📍 Entry: 3020–3015

🧠 Confluences: Bullish M15 FVG + Trendline Support + RSI Reversal

TP1: 3086

TP2: 3130

SL: 3008 (below swing low + OB invalidation)

📌 Look for bullish M5 CHoCH or strong reaction wick for sniper entry

🟩 BUY SCENARIO 2

📍 Entry: 2975–2965

🧠 Confluences: Untapped M30 OB + Imbalance Zone + D1 Demand

TP1: 3050

TP2: 3086

SL: 2958 (below OB + psychological 2960 level)

⚠️ Only valid if 3010 breaks and flushes into this zone. Let the price come to you.

🔻 SELL SCENARIO 1

📍 Entry: 3107–3115

🧠 Confluences: M15 OB + Unmitigated FVG + CHoCH after LH

TP1: 3030

TP2: 3010

SL: 3119 (above OB + intraday wick room)

📌 Look for M1–M5 bearish confirmation or rejection wick at OB

🔻 SELL SCENARIO 2

📍 Entry: 3135–3142

🧠 Confluences: Strong OB Zone + Premium Liquidity Grab + Equal Highs

TP1: 3086

TP2: 3020

SL: 3148 (above liquidity + OB invalidation)

⚠️ Still valid if price rallies fast – bonus confluence if RSI shows divergence

📌 Key Levels Recap:

🔹 3142 – Premium OB Zone

🔹 3115 – Intraday LH Rejection

🔹 3020 – Bullish FVG + Trendline Support

🔹 2965 – Deeper Demand Zone

🔹 2958 & 3148 – Final SL Protection Areas

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

If you find the ideas contribute to your views on the market be kind to press boost🚀/like button. Your support is appreciated.

Trade active

🟩 BUY SCENARIO 2 - TP1 hit ✅ 850 pips📍 Entry: 2975–2965

🧠 Confluences: Untapped M30 OB + Imbalance Zone + D1 Demand

TP1: 3050

TP2: 3086

SL: 2958 (below OB + psychological 2960 level)

Note

🟩 BUY SCENARIO 1 - TRADE ACTIVE RUNNING AT 250+ PIPS IN PROFIT✅(part of the profit is locked in)

📍 Entry: 3020–3015

TP1: 3086

TP2: 3130

SL: 3008

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.