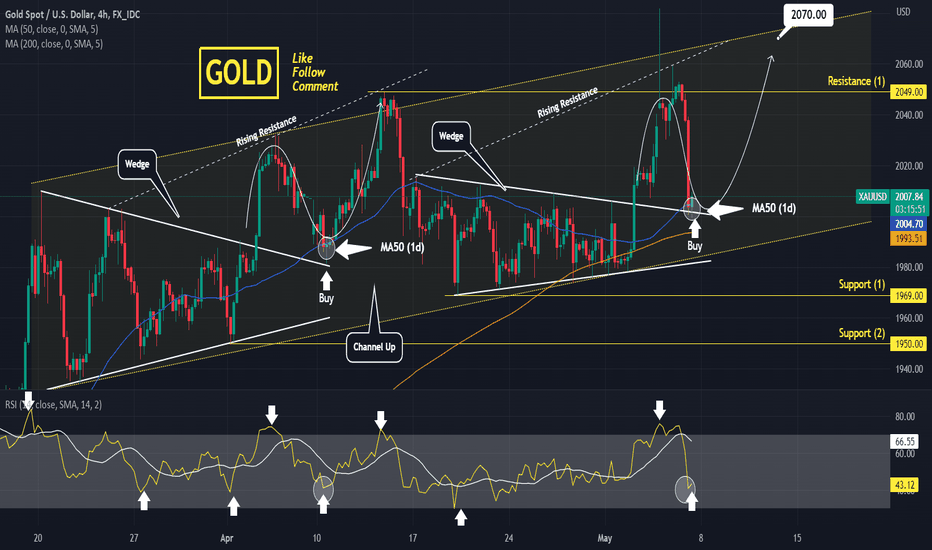

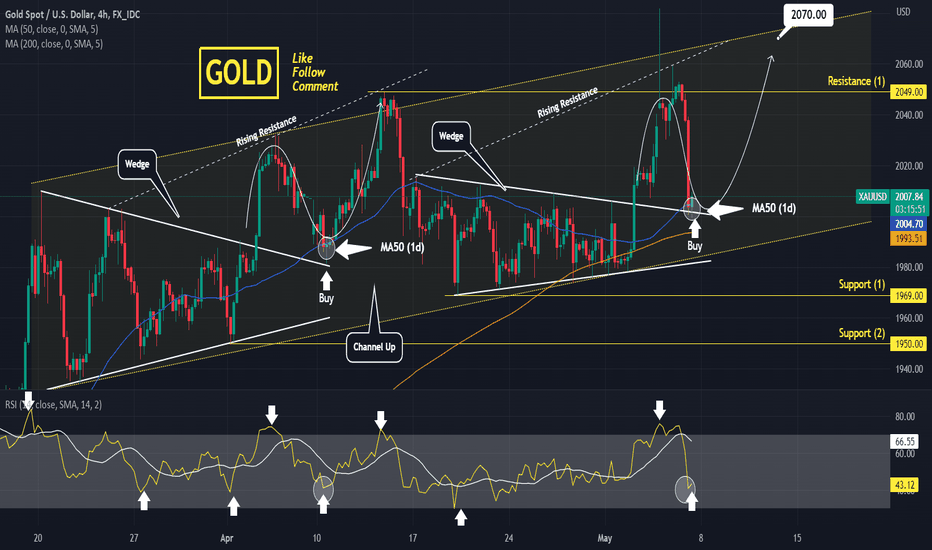

Gold hit today the MA50 (1d) for the first time since March 13th.

The last time it closed under it (Feb 13th), it declined more as low as the MA100 (1d).

If it closes under it, a potential low and rebound level can be within Support (2) and (3): 1935.50 - 1950.

Trading Plan:

1. Buy if a 1d candle closes over the MA50 (1d).

2. Sell if it closes under the MA50 (1d).

3. Buy at the bottom of the Channel Up and near the MA100 (1d).

4. Sell if the price closes under the MA100 (1d).

Targets:

1. 2080 (Resistance 3).

2. 1950 (Support 2).

3. 2080 (Resistance 3).

4. 1850 (potential contact with the MA200 1d).

Tips:

1. An RSI (1d) reading near 30.00 would be a great additional long term buy indicator.

Please like, follow and comment!!

Notes:

Past trading plan:

The last time it closed under it (Feb 13th), it declined more as low as the MA100 (1d).

If it closes under it, a potential low and rebound level can be within Support (2) and (3): 1935.50 - 1950.

Trading Plan:

1. Buy if a 1d candle closes over the MA50 (1d).

2. Sell if it closes under the MA50 (1d).

3. Buy at the bottom of the Channel Up and near the MA100 (1d).

4. Sell if the price closes under the MA100 (1d).

Targets:

1. 2080 (Resistance 3).

2. 1950 (Support 2).

3. 2080 (Resistance 3).

4. 1850 (potential contact with the MA200 1d).

Tips:

1. An RSI (1d) reading near 30.00 would be a great additional long term buy indicator.

Please like, follow and comment!!

Notes:

Past trading plan:

Join our private Telegram signals channel, with +70% accuracy for forex and crypto! 🎉

Also doing account management, earn +15% monthly profit!

👉CONTACT: t.me/tradingbrokersview

Stop gambling with your trades! 🎰

Start being profitable! 💰

Also doing account management, earn +15% monthly profit!

👉CONTACT: t.me/tradingbrokersview

Stop gambling with your trades! 🎰

Start being profitable! 💰

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join our private Telegram signals channel, with +70% accuracy for forex and crypto! 🎉

Also doing account management, earn +15% monthly profit!

👉CONTACT: t.me/tradingbrokersview

Stop gambling with your trades! 🎰

Start being profitable! 💰

Also doing account management, earn +15% monthly profit!

👉CONTACT: t.me/tradingbrokersview

Stop gambling with your trades! 🎰

Start being profitable! 💰

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.