Aegean: The cheapest airline in Europe?Aegean is flying high, but the stock remains grounded at -71.5% – The market values it at just 28.5% of its real worth: The cheapest airline in Europe?

Aegean: Time for the Market to Wake Up

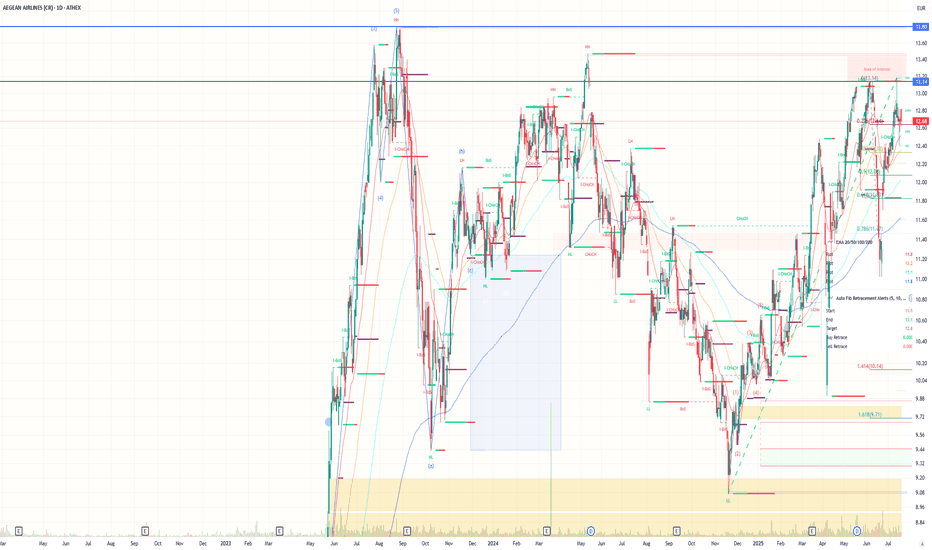

We’ve said a lot about Aegean. About its stock going nowhere, about how it's been ignored by the market, about how it just refuses to move. Sure, some of that skepticism is understandable—geopolitical risk, a volatile global landscape, travel disruptions. But at some point, we need to look at the numbers.

Because this isn’t just another airline stock. Aegean is sitting on assets worth over €4 billion. And its current market cap? Just €1.14 billion.

Do the math: that's a 71.5% discount — the stock is trading at only 28.5% of what the company is worth on paper.

If that’s not undervalued, what is?

60 Aircraft, €4 Billion in Investment

This isn’t hype — it's hard investment. Aegean has committed to 60 Airbus A320/321neo aircraft by 2031, with a total fleet investment reaching $4 billion. The two newest additions, the A321neo XLRs, have a flight range of over 10 hours. That opens the door to long-haul destinations far beyond Europe — like India, the Maldives, Nairobi, and more.

In fact, direct flights to India are already scheduled to start in March 2026, ahead of the original plan. This isn’t about just growing the fleet — it’s a shift in scale, reach, and ambition.

Meanwhile, Aegean has already received 36 of the 60 aircraft. The buildout is real. And it’s happening now.

An Airline Investing in Itself

Aegean isn't just growing in the air — it’s building on the ground. It has launched maintenance and training facilities, is servicing third-party aircraft, and is investing heavily in talent and education.

From 1,878 employees in 2013 to nearly 4,000 today. Dozens of scholarships. A full ecosystem of aviation infrastructure is taking shape — one that positions Aegean not just as an airline, but as a regional aviation hub.

How is all of that still being missed on the board?

The Market Is Rallying – Aegean Is Not

While the Athens Stock Exchange hits 15-year highs, and large caps are breaking records, Aegean’s stock is standing still.

It’s one of the few big names that hasn’t made a move — and that makes it a prime candidate for a snap revaluation.

All it needs is a spark — a catalyst. A major deal. A re-rating. A surprise quarter. Something to jolt the market awake. And when that happens, it won’t be slow or gradual. It’ll be violent and vertical.

Geopolitics? Sure. But Everyone’s Facing It

Yes, global tensions are high. Wars, inflation, airspace closures, unpredictability. But every airline is in the same storm. What matters is how you build resilience. And Aegean has done that.

It emerged from the COVID crisis leaner, stronger, more focused. While others pulled back, Aegean doubled down. That’s not weakness — that’s conviction.

Why the Discount Still Exists

The short answer: the market hasn't connected the dots.

The new fleet hasn’t been fully priced in.

The strategic expansion hasn’t registered.

The infrastructure buildout hasn’t translated into market value.

Investors are still judging it on short-term P&Ls — not on what it’s quietly turning into.

Time for That to Change

It’s time for the market to take another look. To see the €4 billion in assets not as a future maybe — but as a real foundation for growth. To recognize the international pivot. To price in the hidden strength.

Aegean has the fundamentals. It has the vision. It has the operational edge.

What it doesn’t have — yet — is the recognition on the board.

But that’s coming. And when it comes, the move won’t be subtle.

Aegean is undervalued. Not just theoretically, but blatantly — with a 71.5% discount staring everyone in the face. The business is solid. The growth is real. The investments are in motion.

The market will catch up. The only question is: will you be in before it does?

Aegean

The Risky Strategy of Vassilakis: Aegean’s Profit Decline The Bold but Risky Strategy of Vassilakis: Aegean’s Profit Decline and the Volotea Acquisition

Aegean's nine-month financial results for 2024 confirmed a worrisome trend that had begun to surface on the stock market, revealing a significant deterioration in the company's financials. The 3% drop in revenue and a 23% decline in post-tax profits compared to the same period last year underscore the financial pressure facing the company.

This downward trend is also reflected in Aegean’s stock, which has plummeted by 26.22% over the past six months, showing losses of 13.14% since the start of the year. These developments intensify investor pessimism, with the stock nearing its 52-week low.

Despite these challenges, Aegean made a bold yet potentially risky move by acquiring a 13% stake in Volotea, one of Europe’s top low-cost carriers. This €100 million investment could be seen as Aegean’s attempt to strengthen its position in the European market and increase its international presence. However, given the current negative financial state, the investment appears risky, particularly considering the challenges the company is already facing.

Mr. Vassilakis, Aegean's chairman, continues to pursue investments despite the company’s financial difficulties, a strategy that could lead to further risks. Aegean is facing a decline in efficiency and a serious drop in key financial metrics. Especially concerning is the EBITDA, which dropped by 10%, indicating reduced operational profitability and raising doubts about the long-term viability of this strategy.

The decision to allocate such a large capital amount for an acquisition amid falling profits leaves room for questioning the appropriateness of this move in the current economic climate.

Looking ahead to the year’s end, prospects appear bleak, as the company’s financial trajectory suggests potentially greater losses. The negative growth rate in critical indicators suggests that challenges will persist, casting doubt on the profitability of the Volotea acquisition at this stage.

This acquisition could only be successful if Aegean manages to reverse its negative course and capitalize on its investment in Volotea, but current signs leave little room for optimism. The combination of financial challenges and high acquisition costs may confront Aegean's management with tough decisions.

Key financial results for Aegean for Q3 and the nine months of 2024:

Third Quarter 2024 compared to 2023:

Revenue: €630.8 million (down 3% from €653.6 million in 2023)

EBITDA: €182.3 million (down 20% from €227.9 million in 2023)

Earnings before interest and taxes: €136.1 million (down 27% from €186.2 million in 2023)

Earnings before taxes: €138.8 million (down 18% from €168.8 million in 2023)

Net profit after taxes: €108.3 million (down 19% from €133.6 million in 2023)

Nine Months 2024 compared to 2023:

Revenue: €1,379.9 million (up 4% from €1,331.7 million in 2023)

EBITDA: €329.9 million (down 10% from €367.4 million in 2023)

Earnings before interest and taxes: €199.5 million (down 21% from €253.7 million in 2023)

Earnings before taxes: €170.4 million (down 22% from €217.5 million in 2023)

Net profit after taxes: €132.0 million (down 23% from €170.7 million in 2023)