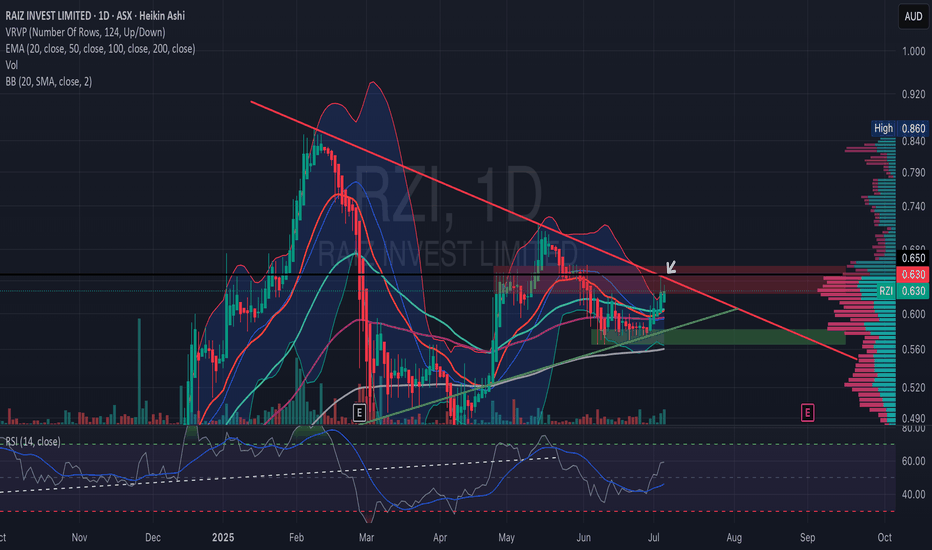

RZI Bullish BreakoutThe price is currently testing resistance around 0.63, after rising from 0.575. The volume profile indicates high activity around 0.58-0.62, showing strong interest.

The EMAs reflect a bullish shift, with the 20 EMA approaching a crossover above the 50 EMA.

After a period of squeeze inside the triangle, the bands are beginning to open.

The RSI is neutral to bullish, trending upward around 50. Overall, the chart suggests a potential breakout. No clear over-bought yet, there is room to run if bulls stay in control.

Key Scenarios

Bullish Breakout: A daily close above the red trendline + A$0.63–0.65 resistance zone would confirm.

First target: A$0.70–0.72 (next volume-profile “valley” and previous swing highs)

Secondary: A$0.80+ (upper Bollinger band confluence from the Feb top)

False Break / Rejection:

Look for a swift pullback into the green ascending line (~A$0.60) or the broader support box around A$0.57–0.58.

Watch EMAs for signs of rolling over (20 EMA crossing back below 50 EMA would turn neutral-to-bearish).

Raizinvest

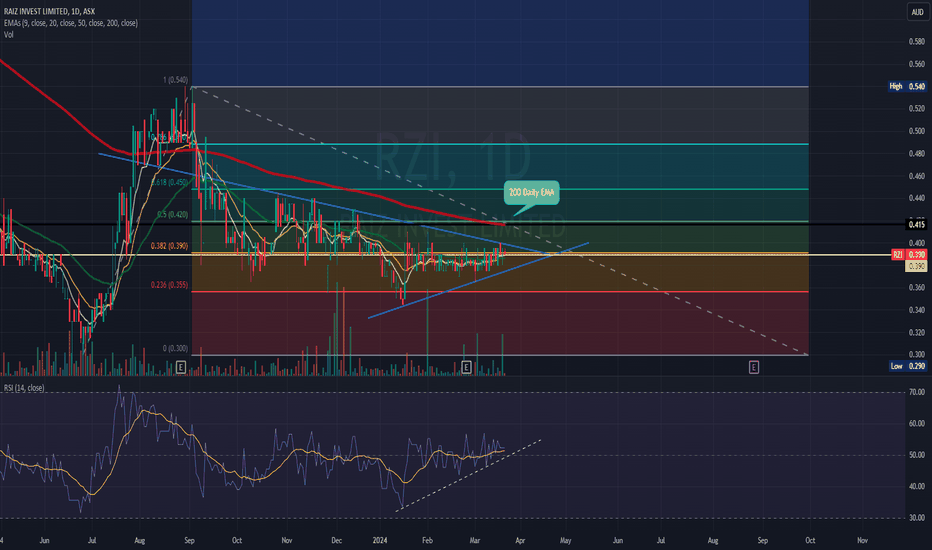

$RZI Approaching potential break outRaiz is heading towards a break out from the current downtrend with potential for a golden cross scenario if consistent buy pressure continues.

The SP is currently at support level of 0.39c and has been trading sideways within the range of 0.375 - 0.39c since February this year.

200 EMA is sitting right on the key resistance level of 0.415c, breaking this will signal a potential run back to around the ~0.50c level in line with fib extension levels.

Finally, RSI showing higher lows also indicating a bullish sentiment going forward.

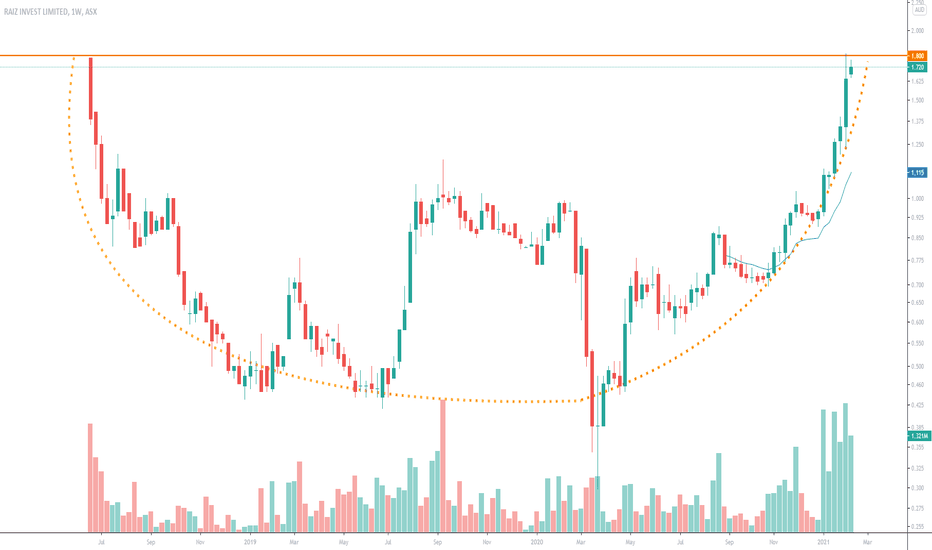

ASX: RZI - Ready to jump on SMSF Growth engine ? The Raiz app and financial engine is built to facilitate commission-free micro investing in a diversified portfolio of exchange traded funds (ETFs) offered by some of the world’s largest asset managers. This allows customers to purchase fractional ETFs and automatically save and invest small amounts of money frequently.

Raiz constructs and optimises 7 diversified portfolios with help from the Nobel Prize winning economist and father of Modern Portfolio Theory, Dr. Harry Markowitz.

Raiz has made micro investing possible through its proprietary investment platform. The asset allocation operates algorithmically while the proprietary back-end technologies aggregate order-processing and clearing functions, repopulating data via the cloud. Raiz has pioneered micro investing, enabling a new class of investors.

$0.60 - $0.63 is good entry pointI think, I will wait for good entry position between $0.60 - $0.63.

I think, It would be good to have in long term portfolio.

p.s: please note these are my personal notes, by no means trading advise to anyone. please do your own research before entering into any trade.