Viking Holdings (VIK) – Sailing Ahead in Luxury TravelCompany Snapshot:

Viking NYSE:VIK is a premium cruise operator targeting affluent retirees and “active agers”, offering adult-only ships and experiential itineraries designed for high-value travelers seeking enrichment and comfort.

Key Catalysts:

Premium Brand with Pricing Power 💰

Unlike many peers, Viking has avoided deep discounting, maintaining premium pricing—a testament to brand equity and customer loyalty, protecting margins amid inflationary pressures.

Exceptional Demand & Occupancy 📈

Occupancy rates consistently above 90% reflect both high demand and strong operational execution, boosting revenue per cruise and signaling long-term customer retention.

Tailwinds from Demographic Trends 👴🏻👵🏻

Viking is uniquely positioned to benefit from the global growth in affluent aging populations, who prioritize experience-driven travel over material consumption.

Investment Outlook:

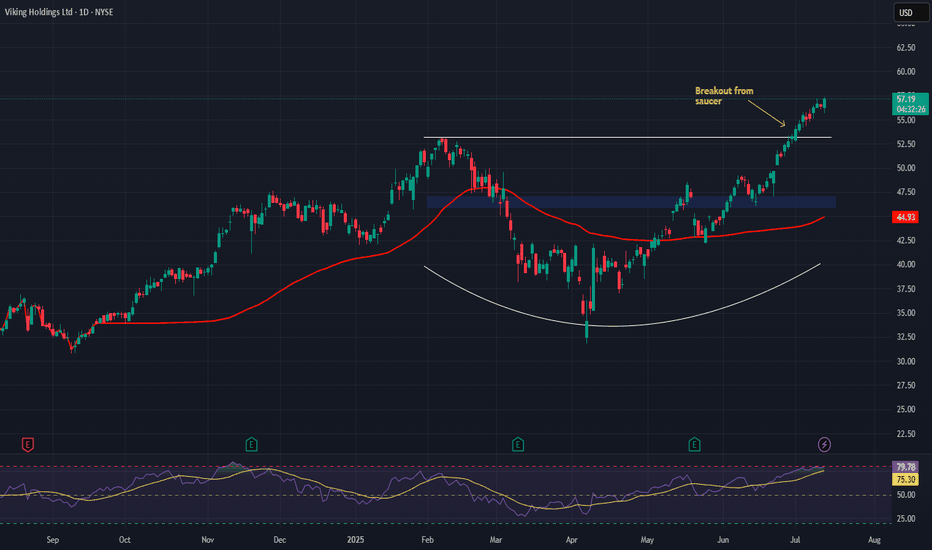

Bullish Entry Zone: Above $46.00–$47.00

Upside Target: $75.00–$76.00, powered by brand strength, margin durability, and demographic-driven demand.

🛳️ As a leader in luxury cruising, Viking is charting a long-term growth course anchored in loyalty, premium experiences, and generational travel trends.

#VikingCruises #VIK #LuxuryTravel #ExperientialTourism #CruiseStocks #ActiveAgers #RetirementBoom #TravelDemand #PremiumBrand #ConsumerDiscretionary