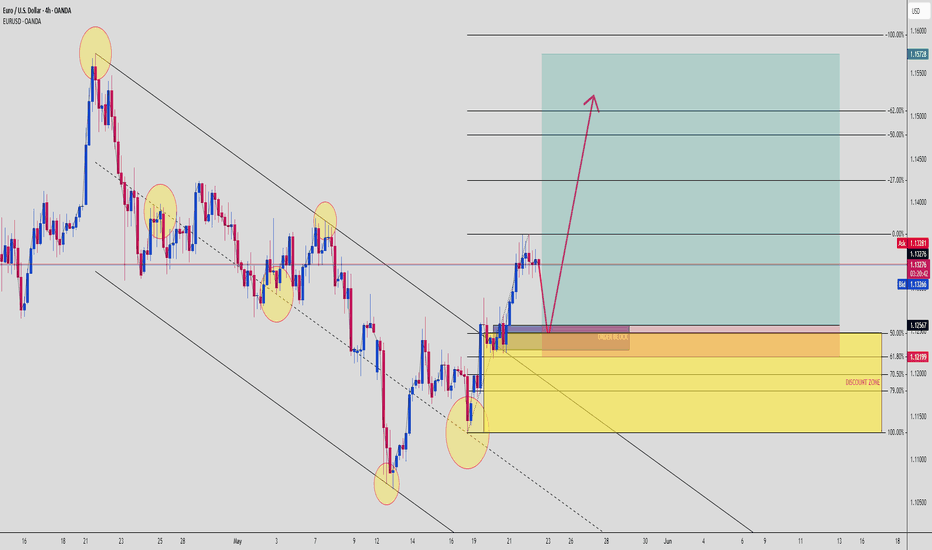

EURUSD Bounce Incoming? Smart Money Reversal BrewingThis EURUSD setup is a case study in smart money accumulation after a liquidity sweep + channel break. Price action is aligning like clockwork for a long setup, and the confluences are hard to ignore.

🧠 Breakdown:

🔻 Bearish Channel Structure: Market has respected this descending channel since early May — multiple taps, respected diagonals

🟡 Reversal Clues: Clean sweep of liquidity at the channel bottom with bullish engulfing candle

💰 Order Block + Discount Zone:

OB marked inside the 50%–79% retracement range

🔹 OB top: ~1.12567

🔹 Key entry: Between 1.12567 – 1.12199

🔹 SL: Below 1.1180 (clean under discount zone)

📈 TP zone: 1.15728 — previous market structure high and fib -100% level

✅ Risk-Reward: 1:5+ if played with precision

🔍 Why this setup is 🔥:

✅ Channel break = structure shift

✅ OB + Fib 61.8%–79% = strong demand confluence

✅ Liquidity below equal lows already taken

✅ Sharp bullish move after sweep = signs of big players entering

✅ Price likely to pull back to mitigate before exploding

🧠 Institutional Logic:

“Liquidity fuels price. Structure guides it. Confluence confirms it.”

The market swept lows, flipped structure, and now is likely returning to fill orders before the next leg up. This is a classic bullish mitigation play.

📊 If price taps into the OB and shows bullish confirmation — this is a sniper zone.

Set alerts. Wait for the wick. Enter on the flip. Let the market work for you, not the other way around.

Riskrewardsetup

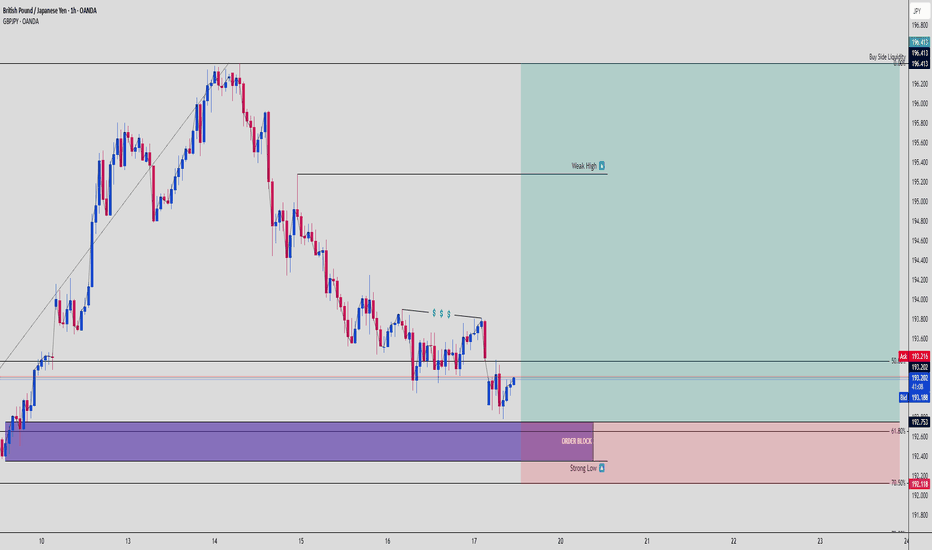

GBPJPY Trap & Reversal | Smart Money Loading from OB Zone!We’re analyzing a high-probability bullish reversal setup forming on GBPJPY 1H, built on clean SMC logic. Here’s how this trade is setting up:

🔄 Market Structure:

Prior bearish move into a reversal area

Equal highs (liquidity built up)

Clean sweep below short-term lows ➝ Liquidity grab ✅

Price now reacting from a defined Order Block zone

🧱 Order Block Zone:

Purple OB zone marked at 192.753–192.118

This zone is resting between 61.8% and 70.50% fib levels – high confluence 🔥

💸 Liquidity Levels in Play:

Sell-side liquidity already swept

Buy-side liquidity sitting above the recent highs @ 196.413 (target zone)

🚀 Entry Plan:

Entry Point: Reacting from OB near 192.753

Stop Loss: Below the strong low (192.118)

TP Zone: 196.413 = Buy side liquidity ➝ Weak High marked for potential sweep

🧮 RRR (Risk-to-Reward):

Massive potential ➝ Approx 1:8+ RRR

This is the kind of setup institutions dream of. 🚀

📈 Key Confluences:

Equal highs = liquidity magnet

OB sitting at golden zone

Strong low protecting entry

Institutional pattern: Sweep ➝ OB reaction ➝ expansion

📉 Watch for Pullback/Entry Reconfirmation:

Price may tap deeper into the OB before expanding

Wait for bullish momentum confirmation (CHoCH on 15M or 30M TF = better entry sniper style)

📢 Pro Tip (Trader Mindset):

This setup screams “liquidity engineering”. Retail traders shorted the lower high; Smart Money is about to flip the script. Be the shark, not the fish 🦈