Lyft, Inc. Riding High on Subscription & Urban Mobility Growth Company Snapshot:

Lyft NASDAQ:LYFT is gaining ground with a subscription-led strategy, tech-driven cost efficiency, and a rebound in urban ride demand.

Key Catalysts:

Lyft Pink Momentum & High-Margin Revenue 🎯

The subscription model is paying off—Lyft Pink adoption is rising, improving rider retention and average revenue per user (ARPU), which boosts predictable, high-margin income.

Rebound in Active Riders 🚦

Active riders surged to 23.5M, marking the fastest growth in over two years—a sign of urban mobility normalization and broader consumer engagement.

Enterprise Partnerships & Diversified Income 🤝

New deals with Fortune 500 companies provide recurring revenue streams, diversify exposure, and expand Lyft’s footprint in corporate mobility.

Efficiency Gains & Margin Expansion 💡

Gross margin expanded 300+ bps YoY due to tech upgrades in dispatch and routing, cutting costs and lifting profitability.

Investment Outlook:

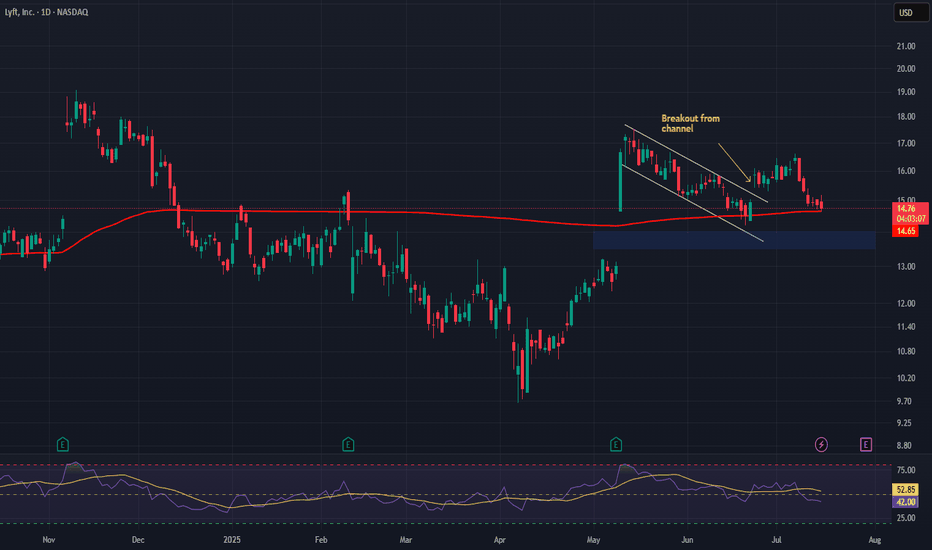

Bullish Entry Zone: Above $13.50–$14.00

Upside Target: $19.00–$20.00, fueled by rider growth, subscription traction, and operational leverage.

📊 Lyft is shifting gears from recovery to growth, with improving fundamentals and a clear path to profitability.

#Lyft #LYFT #MobilityStocks #RideSharing #SubscriptionModel #UrbanRecovery #TechEfficiency #GrowthStock #ARPU #TransportationInnovation