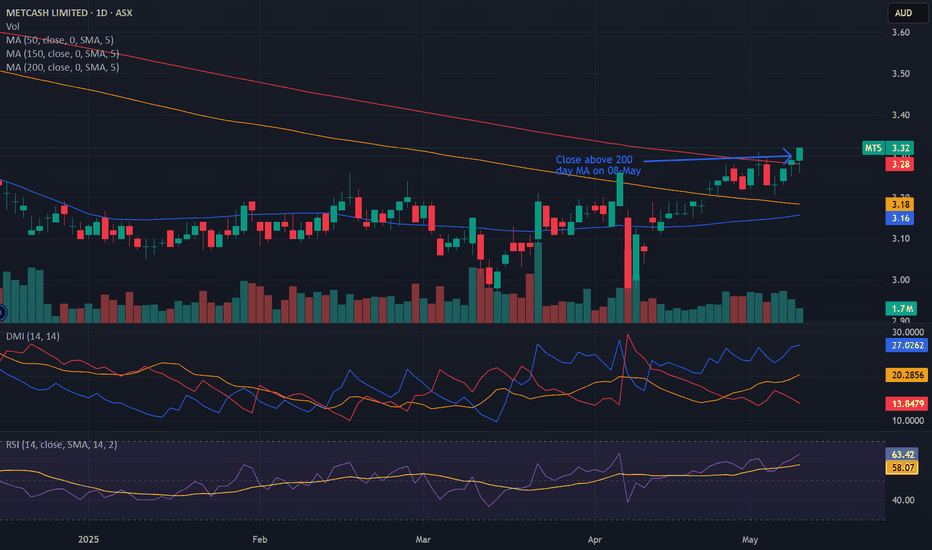

Bullish potential detected for MTSEntry conditions:

(i) higher share price for ASX:MTS along with swing up of indicators such as DMI/RSI.

Stop loss for the trade would be:

(i) below the recent swing low of 6th May (i.e.: below $3.21), or

(ii) a close below the 50 day moving average (currently $3.16), or

(ii) below the support lev

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.26 AUD

283.30 M AUD

17.32 B AUD

1.04 B

About METCASH LIMITED

Sector

Industry

CEO

Doug Jones

Website

Headquarters

Sydney

Founded

1927

ISIN

AU000000MTS0

FIGI

BBG000BT7W32

Metcash Ltd. engages in wholesaling, distributing, supplying, and supporting independent retailers and several other businesses networks. It operates through the following segments: Food, Liquor, and Hardware. The Food segment includes the distribution of a range of products and services to independent supermarket and convenience retail outlets. The Liquor segment offers liquor products to independent retail outlets and hotels. The Hardware segment consists of hardware products distributed to independent retail outlets and the operation of company owned retail stores. The company was founded by Joe David in 1927 and is headquartered in Sydney, Australia.

Related stocks

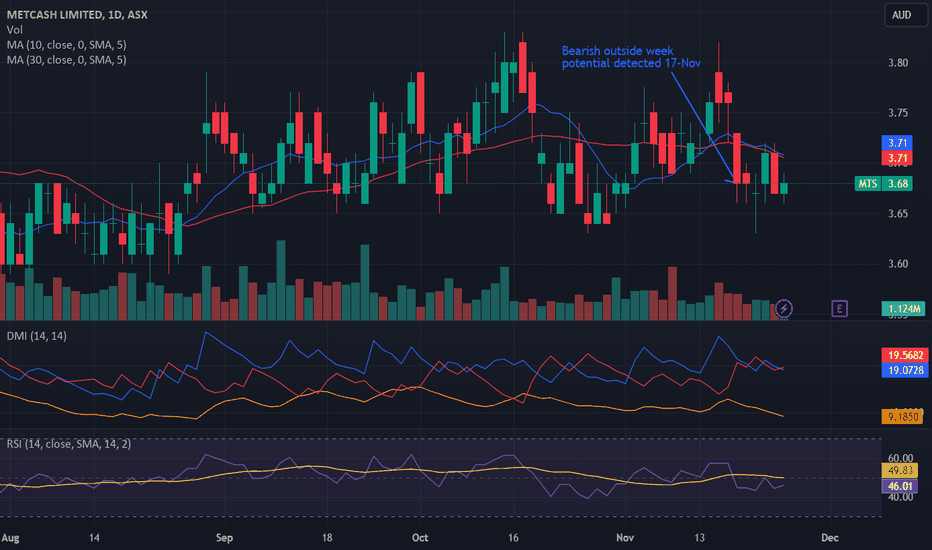

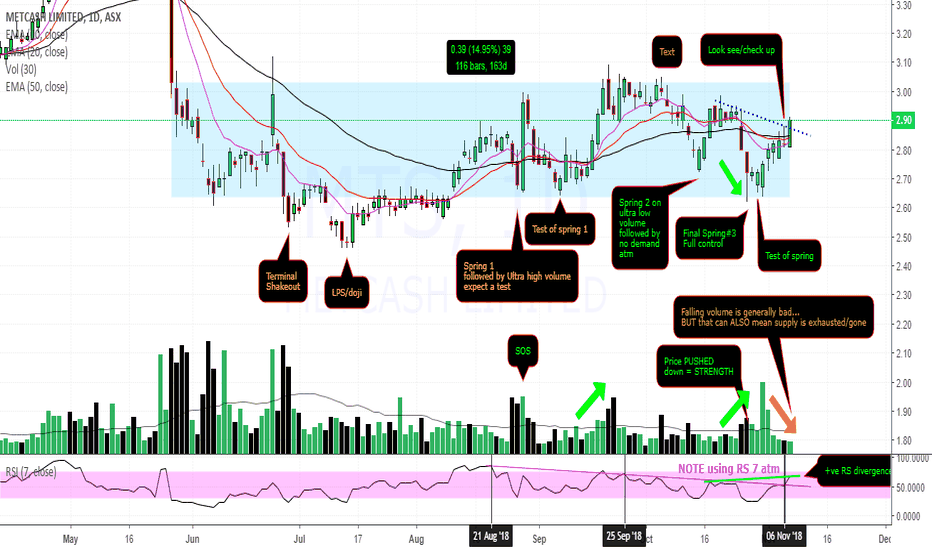

Potential outside week and potential bearish breakout for MTSAs noted in the latest video update for week ended 17-Nov (apologies for the delayed publishing of these details - another hectic week), MTS represents a potential bearish opportunity should momentum continue and lower lows be made to confirm the outside week. Stop loss for the trade would be above

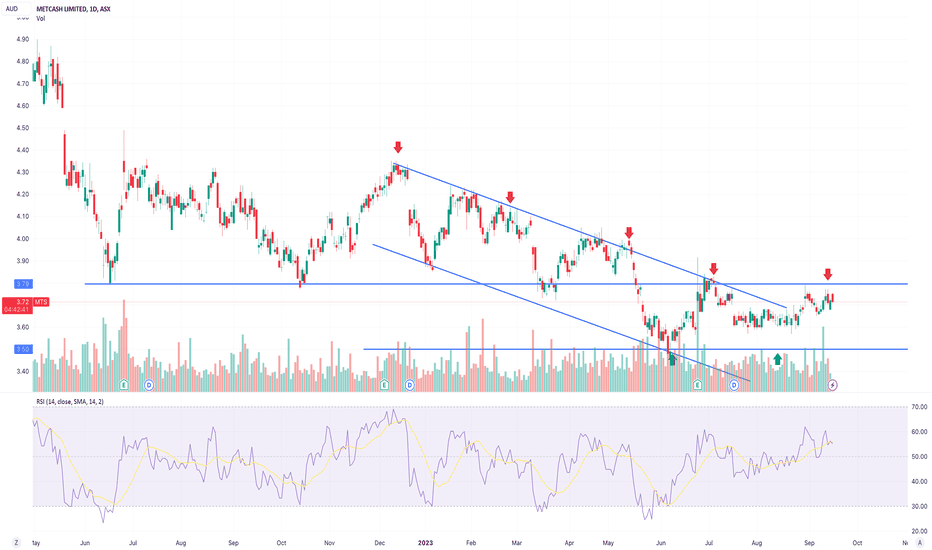

ASX: MTS: Take Profit < $3.50Metcash (ASX: MTS) has been trading within a narrow range of $3.48 – $4.33 for the past 52 weeks and is currently trading at $3.62, at the time of writing. However, over the last 90 days, MTS has experienced a decline of -7.42%, indicating a negative trend in the market. Unfortunately, this trend ha

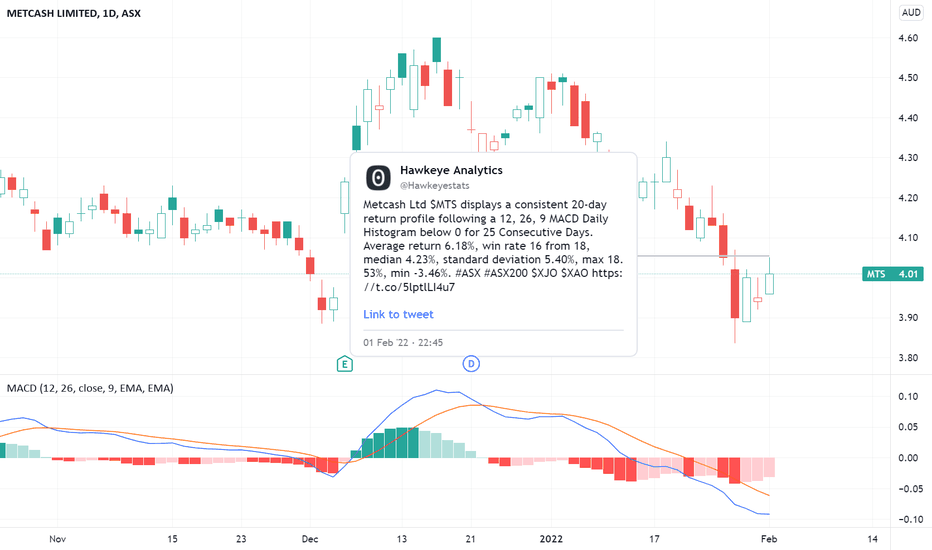

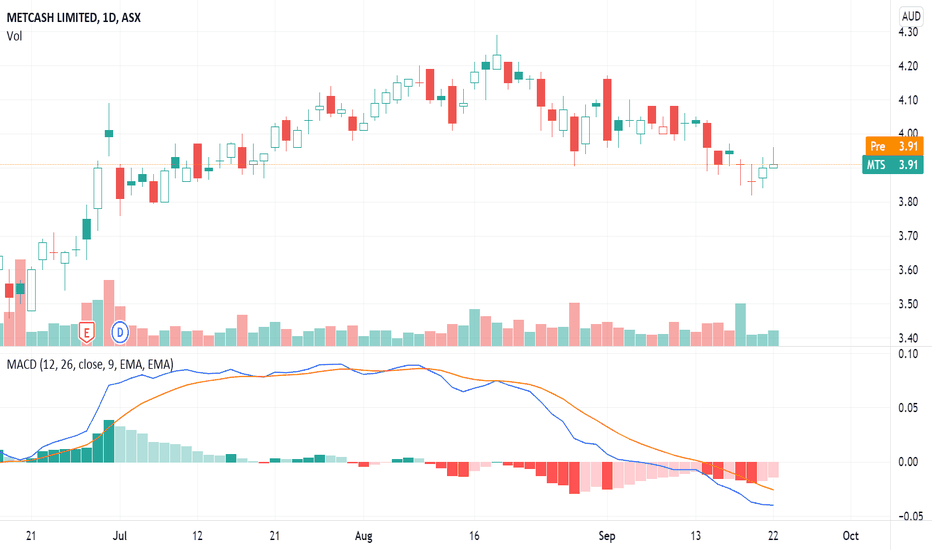

MTS - MACD Daily Histogram below 0 for 25 Consecutive DaysThe Metcash Ltd (ASX:MTS) MACD Histogram (12, 26, 9) has just recorded 25 consecutive days below 0. Since 2000, this type of indicator persistence below 0, was usually the forerunner to some short-term upside.

The 20-day average absolute return, following MTS's (12, 26, 9) MACD Daily Histogram belo

MTS - MACD Daily Histogram below 0 for 25 Consecutive DaysThe Metcash Ltd (ASX:MTS) MACD Histogram (12, 26, 9) has just recorded 25 consecutive days below 0. Since 2000, this type of indicator persistence below 0, was usually the forerunner to some short-term upside.

The 20-day average absolute return, following MTS's (12, 26, 9) MACD Daily Histogram belo

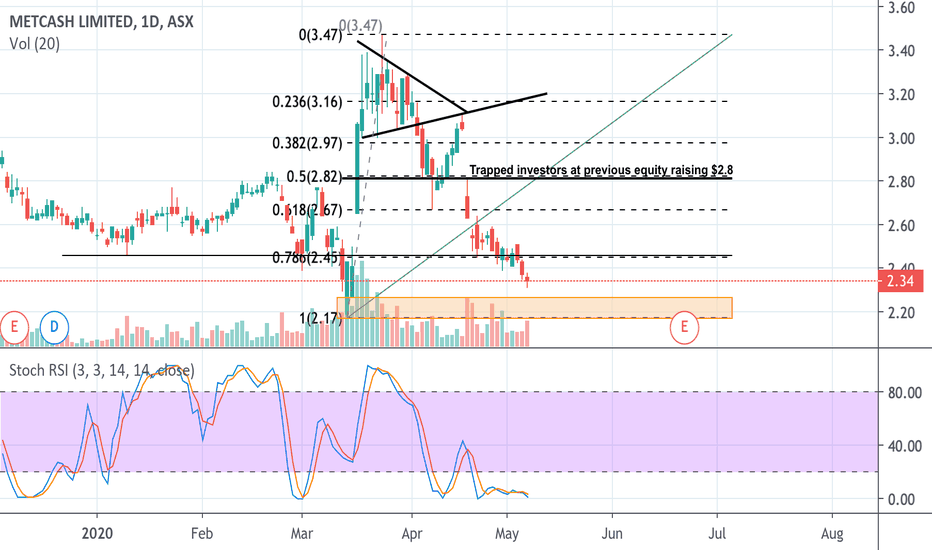

$MTS long trade setup on ASXTrade setup today long $MTS Metacash on the ASX. I like the dip, double bottom and higher high green candles trending bullish. Went in with 4251 units at 2.35. Targets and stop loss set. As always trading is risky and can go against us at any time no matter how good a chart looks. As such risk manag

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of MTSCD is 4.00 AUD — it has decreased by −11.11% in the past 24 hours. Watch METCASHLTD FPO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on ASX exchange METCASHLTD FPO stocks are traded under the ticker MTSCD.

MTSCD stock has fallen by −11.11% compared to the previous week, the month change is a −11.11% fall, over the last year METCASHLTD FPO has showed a −11.11% decrease.

We've gathered analysts' opinions on METCASHLTD FPO future price: according to them, MTSCD price has a max estimate of 5.00 AUD and a min estimate of 3.75 AUD. Watch MTSCD chart and read a more detailed METCASHLTD FPO stock forecast: see what analysts think of METCASHLTD FPO and suggest that you do with its stocks.

MTSCD stock is 12.50% volatile and has beta coefficient of 0.70. Track METCASHLTD FPO stock price on the chart and check out the list of the most volatile stocks — is METCASHLTD FPO there?

Today METCASHLTD FPO has the market capitalization of 4.34 B, it has decreased by −1.23% over the last week.

Yes, you can track METCASHLTD FPO financials in yearly and quarterly reports right on TradingView.

METCASHLTD FPO is going to release the next earnings report on Dec 1, 2025. Keep track of upcoming events with our Earnings Calendar.

MTSCD earnings for the last half-year are 0.13 AUD per share, whereas the estimation was 0.13 AUD, resulting in a −0.07% surprise. The estimated earnings for the next half-year are 0.13 AUD per share. See more details about METCASHLTD FPO earnings.

METCASHLTD FPO revenue for the last half-year amounts to 9.38 B AUD, despite the estimated figure of 9.18 B AUD. In the next half-year revenue is expected to reach 8.59 B AUD.

MTSCD net income for the last half-year is 141.50 M AUD, while the previous report showed 141.80 M AUD of net income which accounts for −0.21% change. Track more METCASHLTD FPO financial stats to get the full picture.

METCASHLTD FPO dividend yield was 5.59% in 2024, and payout ratio reached 69.63%. The year before the numbers were 4.95% and 75.61% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 19, 2025, the company has 11.5 K employees. See our rating of the largest employees — is METCASHLTD FPO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. METCASHLTD FPO EBITDA is 702.80 M AUD, and current EBITDA margin is 4.04%. See more stats in METCASHLTD FPO financial statements.

Like other stocks, MTSCD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade METCASHLTD FPO stock right from TradingView charts — choose your broker and connect to your account.