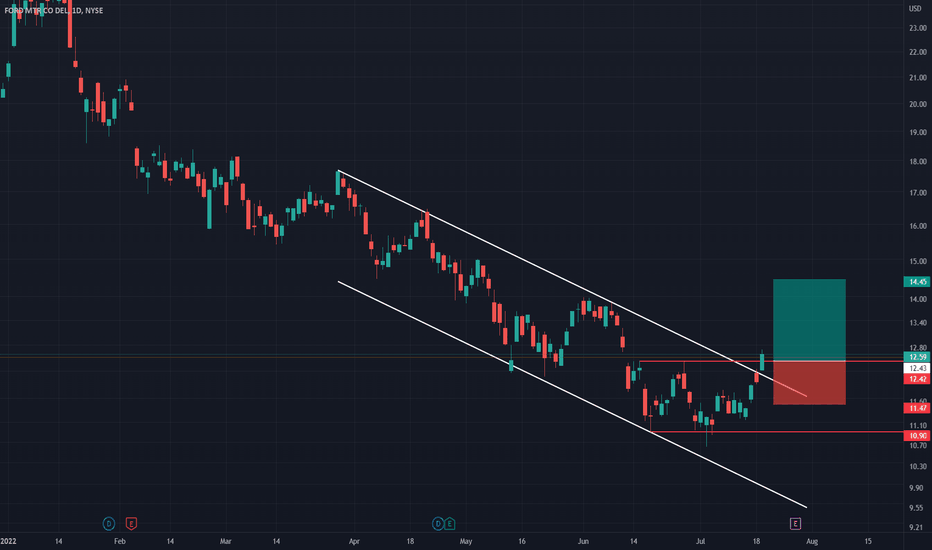

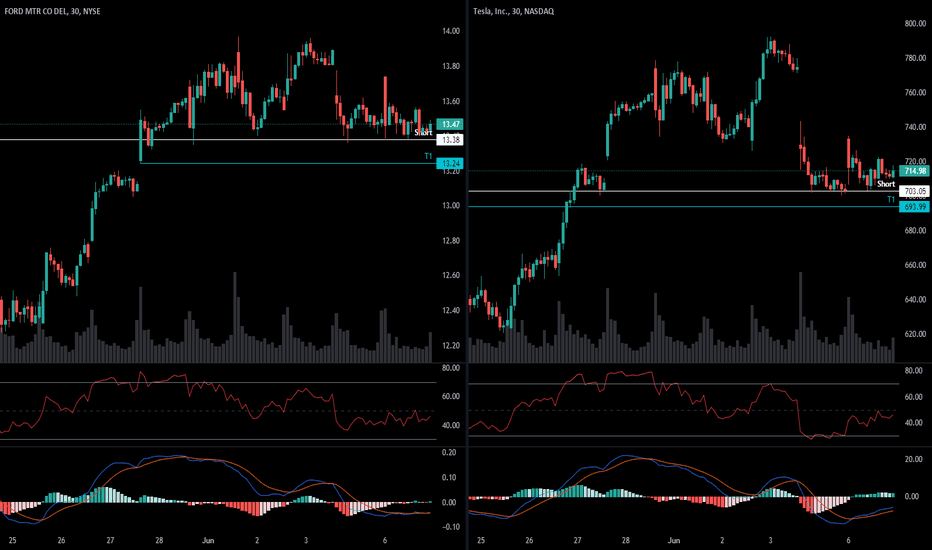

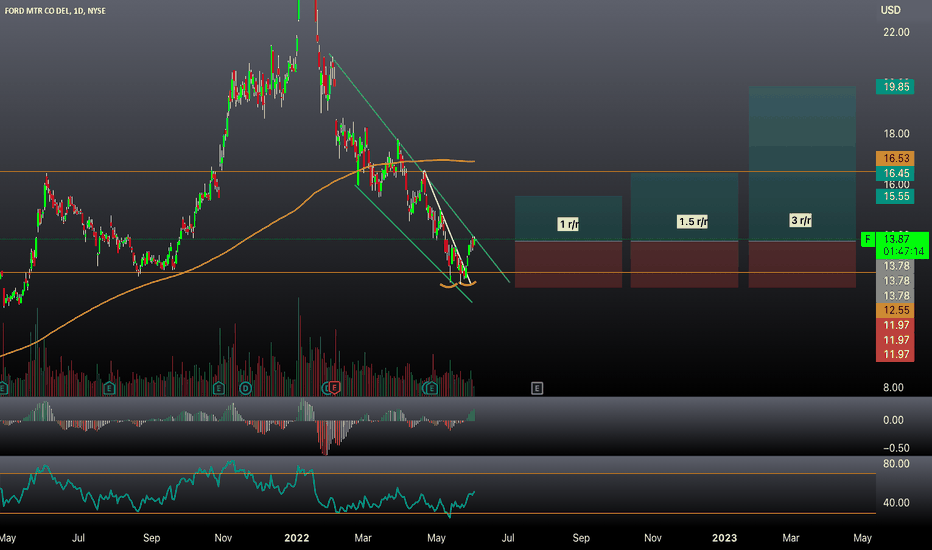

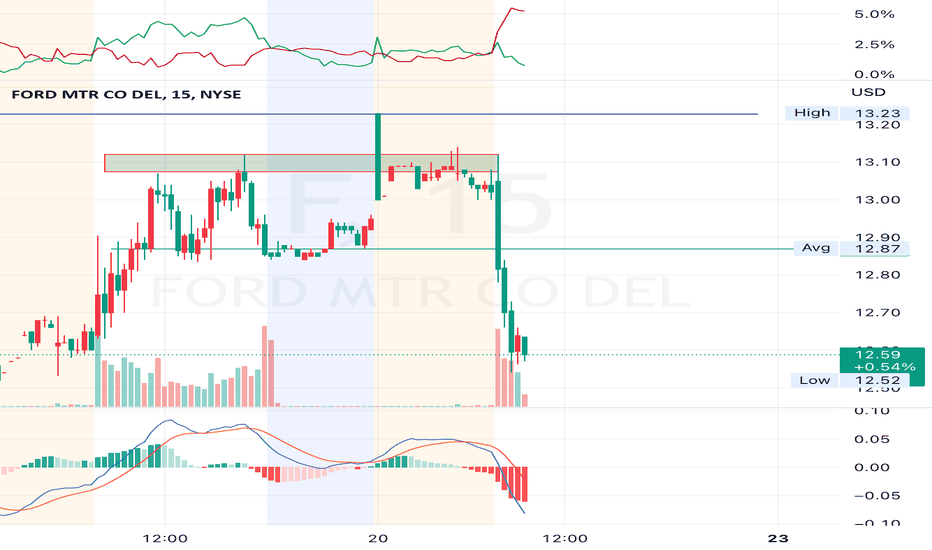

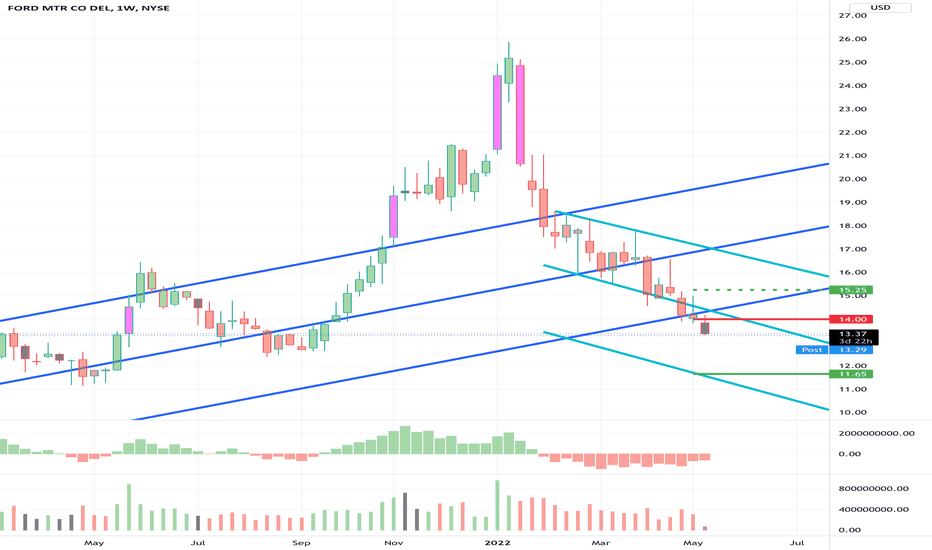

More af-FORD-able?Ford - Short Term - We look to Buy at 12.42 (stop at 11.47)

Broken out of the channel formation to the upside. Price action looks to be forming a bottom. A higher correction is expected. Expect trading to remain mixed and volatile.

Our profit targets will be 14.45 and 16.00

Resistance: 13.28 / 13.96 / 14.46

Support: 12.42 / 11.78 / 10.61

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

F trade ideas

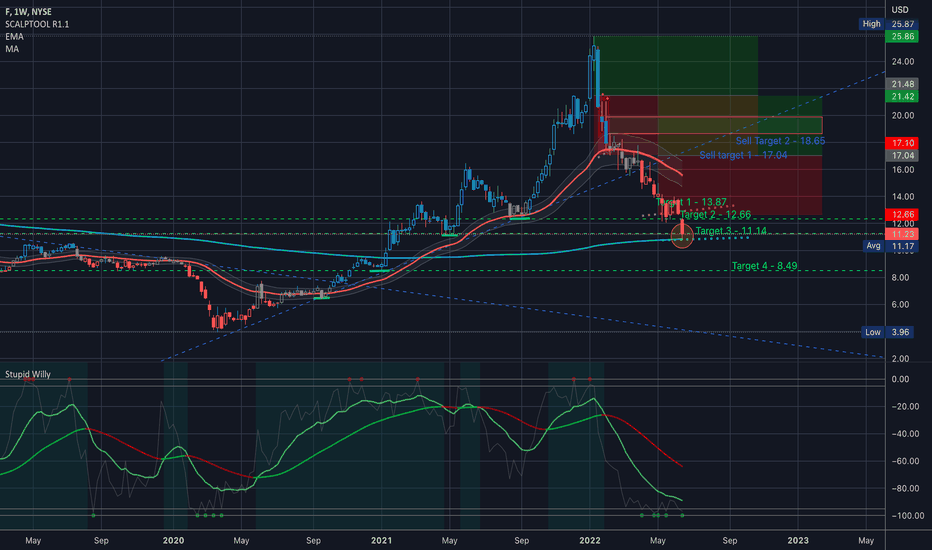

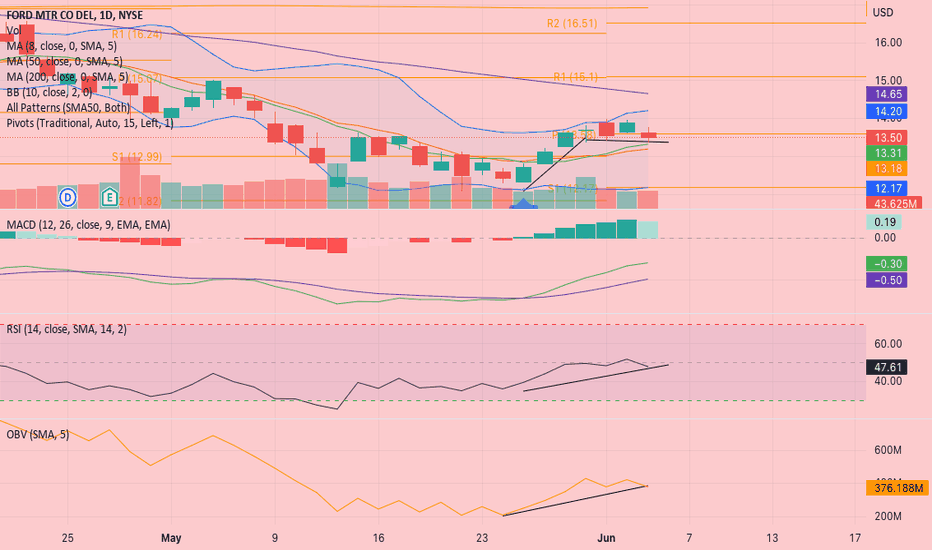

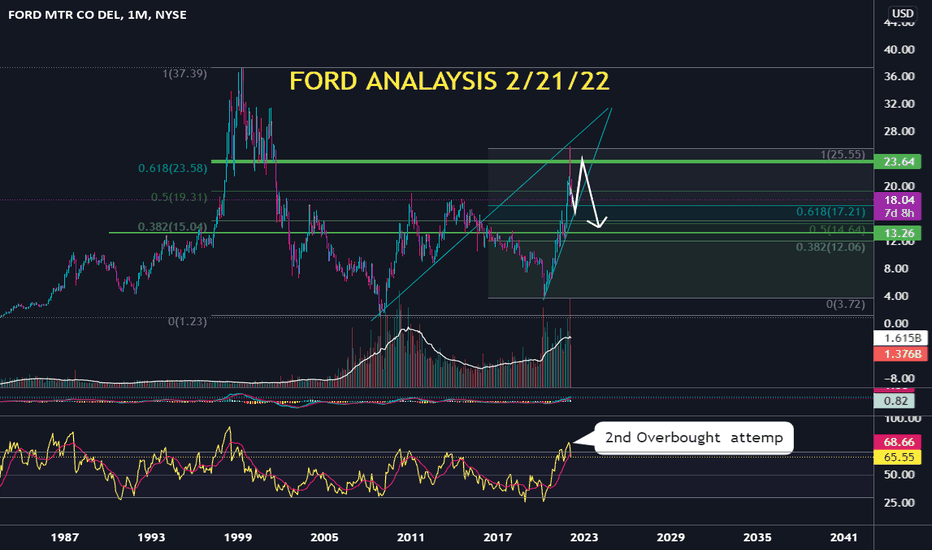

$F Analysis, Key Levels, and Targets$F Analysis, Key Levels, and Targets

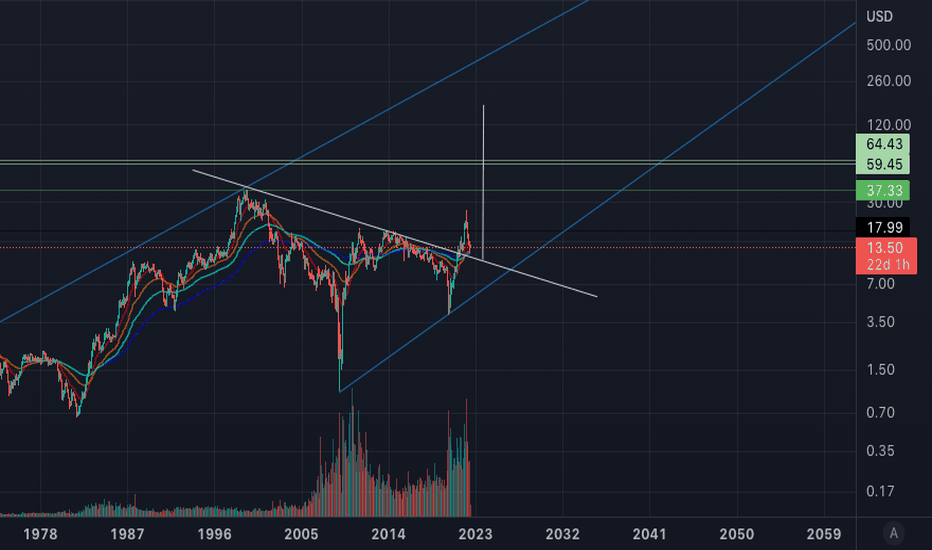

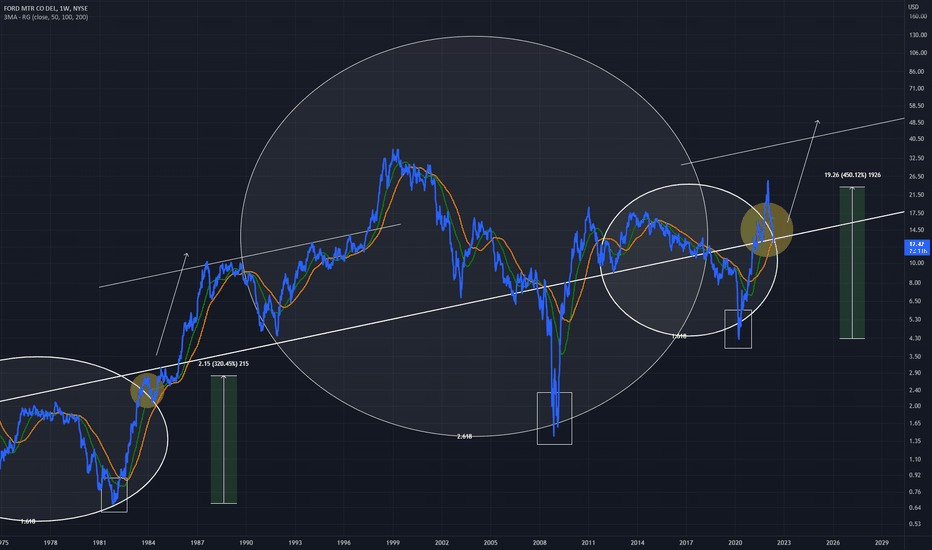

200 Weekly MA… what do y’all think? Buy… or wish you bought 😬

I know... it's cheap, and that doesn't mean it cant get cheaper.... but I like this level... I'm buying on tuesday... 💃🏻

I smoke way too much weed on 3 day weekends...

—-

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

IF you need anything analyzed Technically just comment with the Ticker and I’ll do it as soon as possible…

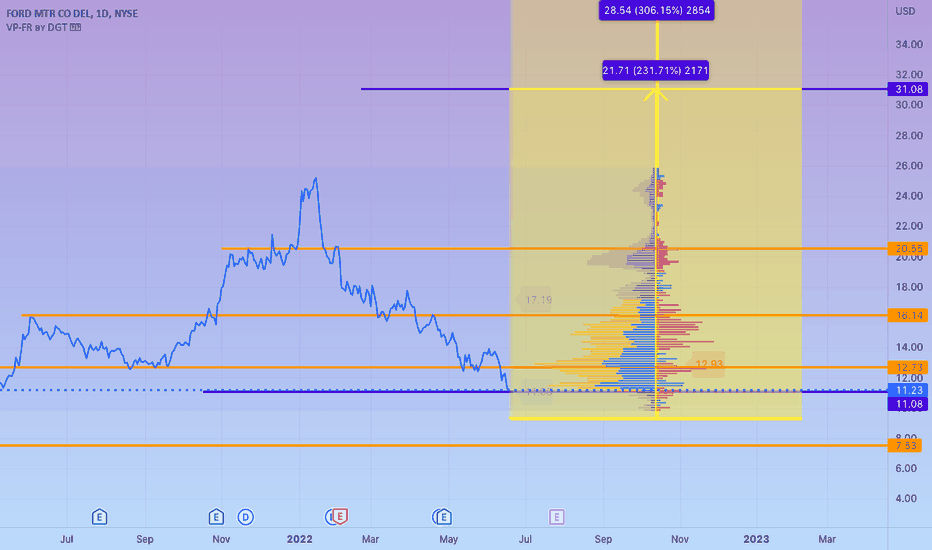

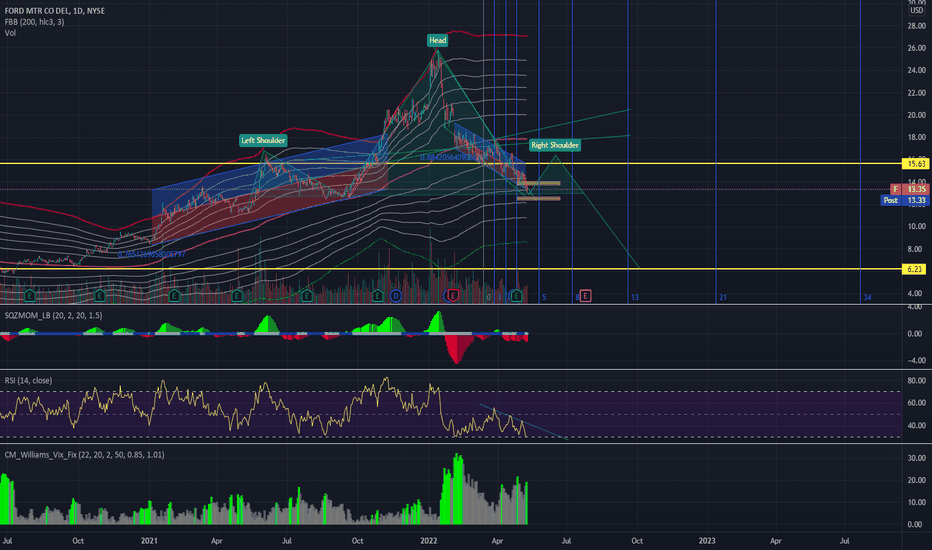

FORD FORECASTFord Motor Co. engages in the manufacture, distribution, and sale of automobiles. It operates through the following segments: Automotive, Mobility, Ford Credit, Corporate Other, Interest on Debt, and Special Items. The Automotive segment develops, manufactures, markets, and services Ford and Lincoln vehicles, service parts, and accessories. The Mobility segment includes the development of autonomous vehicles, equity ownership in Argo AI which is a developer of autonomous driving systems, and related businesses. The Ford Credit segment consists of vehicle-related financing and leasing activities. The Corporate Other segment covers corporate governance expenses, interest income, gains and losses from cash, cash equivalents, and marketable securities, and losses associated with intercompany lending. The Interest on Debt segment is composed of interest expense on company debt excluding Ford Credit. The Special Items segment deals with pension and employment benefit remeasurement gains and losses, gains and losses on investments in equity securities, significant personnel expenses, and other items that are not considered to be indicative of earnings from ongoing operating activities. The company was founded by Henry Ford on June 16, 1903, and is headquartered in Dearborn, MI.

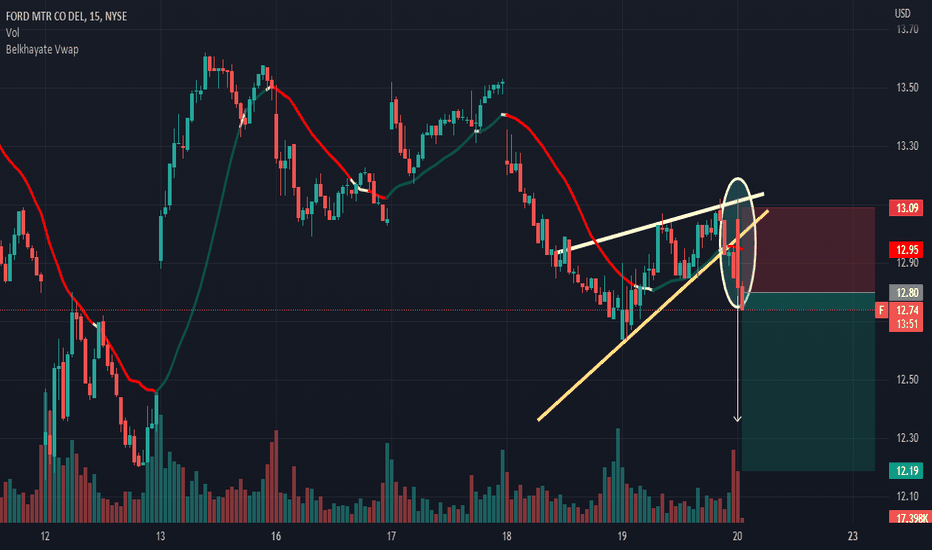

donno bout u but Its looking sunny with me from this end might just catch this

falling knife imma be flexible though so if u want the updates public

u can like so i know im helpin someone

however if it does break $8-7.50 ITS DEF GOING TO 4

SENNA SEASON

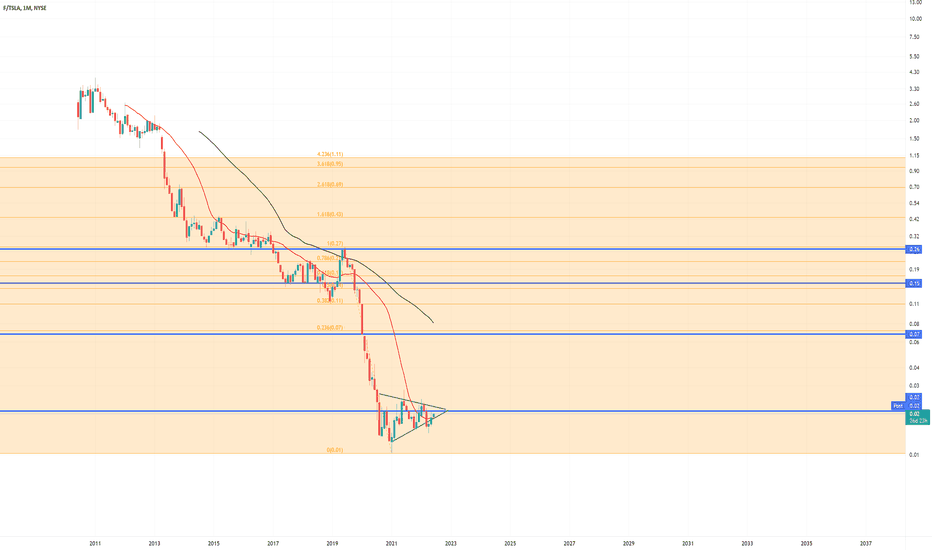

LONG $F , SHORT $TSLAAlthough I am a huge fan of Tesla and believe they are way ahead of the competition, I think they are in for a pretty major correction. Best case $540, more realistically around $350 IMO. Especially if we head into a recession, which it looks like we might. In the meantime, I think Ford looks pretty cheap around here and will gain some significant market share.

-TSLA currently at 95 P/E ratio

-Ford at ~4.7 P/E

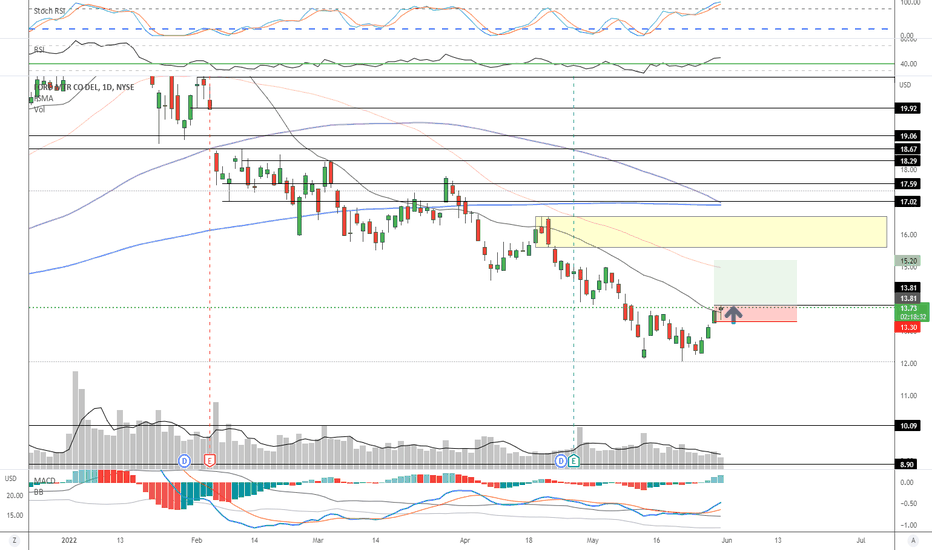

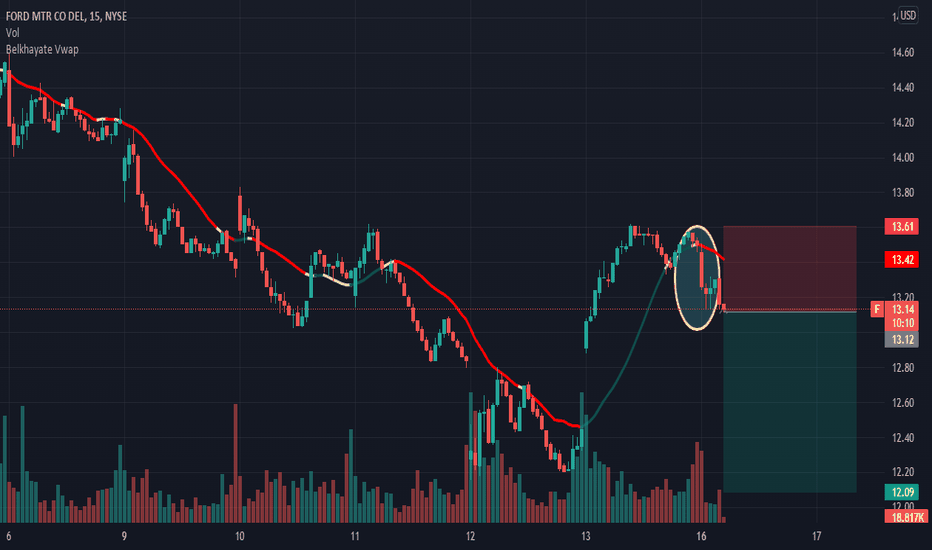

3 White Soldiers Advance3 white soldiers is one of the most textbook bullish patterns in Japanese Candlestick Charting Techniques (Nison, S., 1991)

We see 3 consecutive bullish candles with small or no wicks on the daily timeframe, accompanied by growing volume each day.

Ford has just begun shipping their electric F150. The Ford 150 is America's best selling vehicle for 40 years running (as of 2021).

While we may see some pullback to the $12-13 level, I expect this is the start of a significant bullish trend for Ford Motor Company.

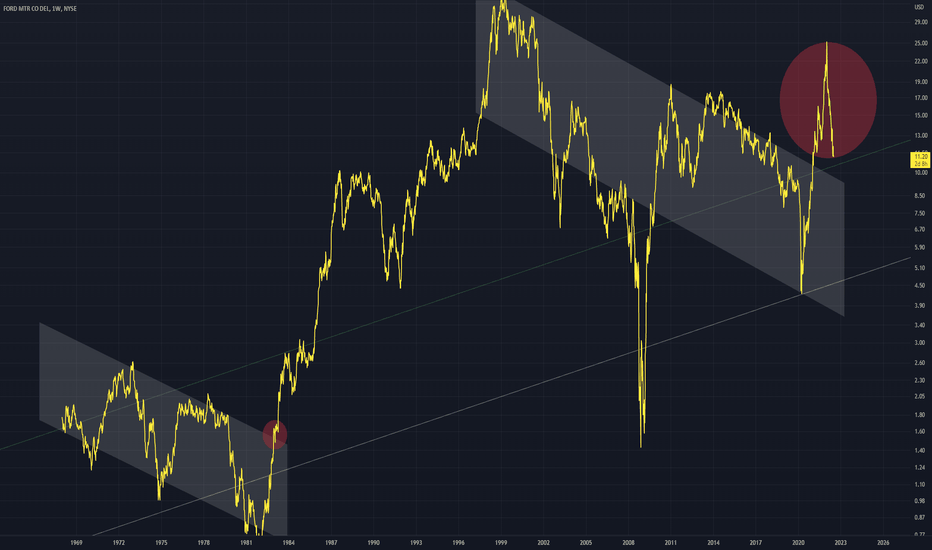

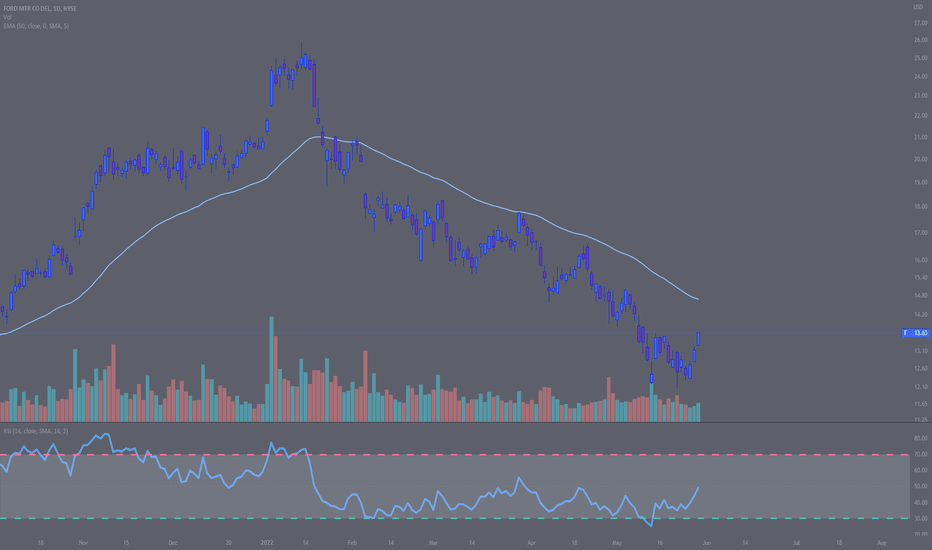

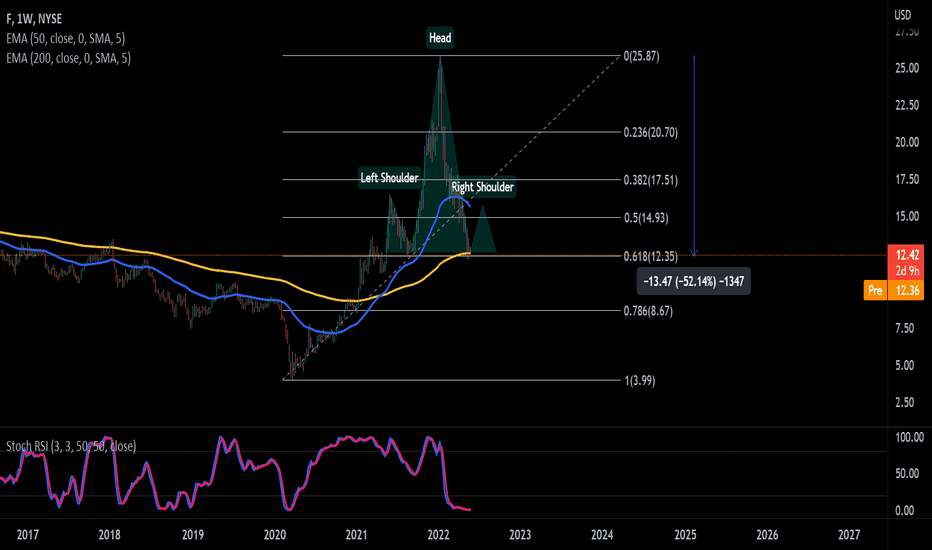

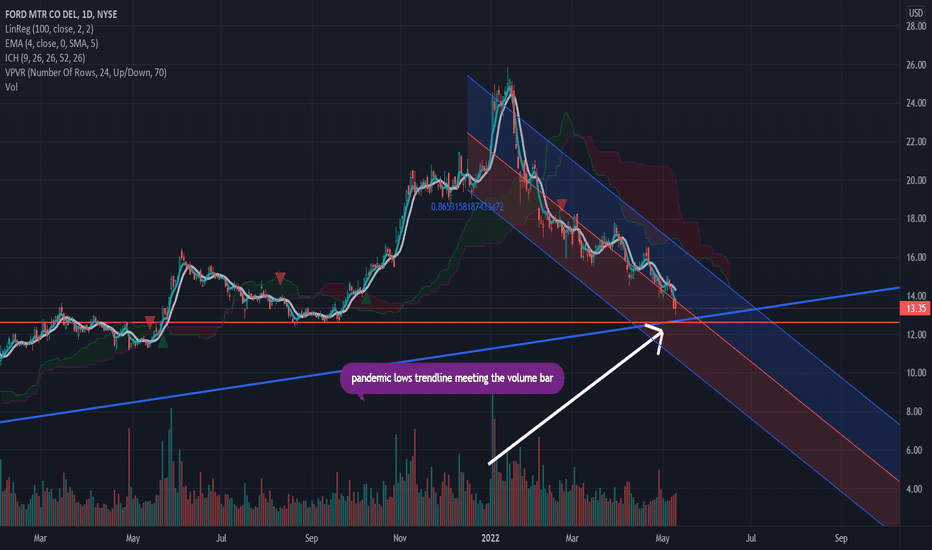

Ford - A good spot for a swing trade Long?Looking at the Ford weekly chart, share price has fallen hard since Jan. of this year with no relief pull-back. Well over 50% from the low in March 2020. Is it at a good level now for that pull-back to happen?

Notice a possible head and shoulder formation brewing in the works. Price is at the 200ema on the weekly and at the .618 fib level. The .618 fib level is at a point of support also. Stoch RSI has been under 20 since early Feb. Maybe a good time to pick up a few shares for the longer term investor. Or possibly a nice swing trade long.

It'll be interesting if price just destroys this zone or reacts to it.

Ford - Similar Indicator Situations Similar scenario right now to the area first in yellow

Price has dipped similarly to the 100MA

This touch on the 100MA on this Weekly timeframe will be bullish and lead to continuation above the major trend line

Major point is the initial and latter scenario are very similar

Bullish

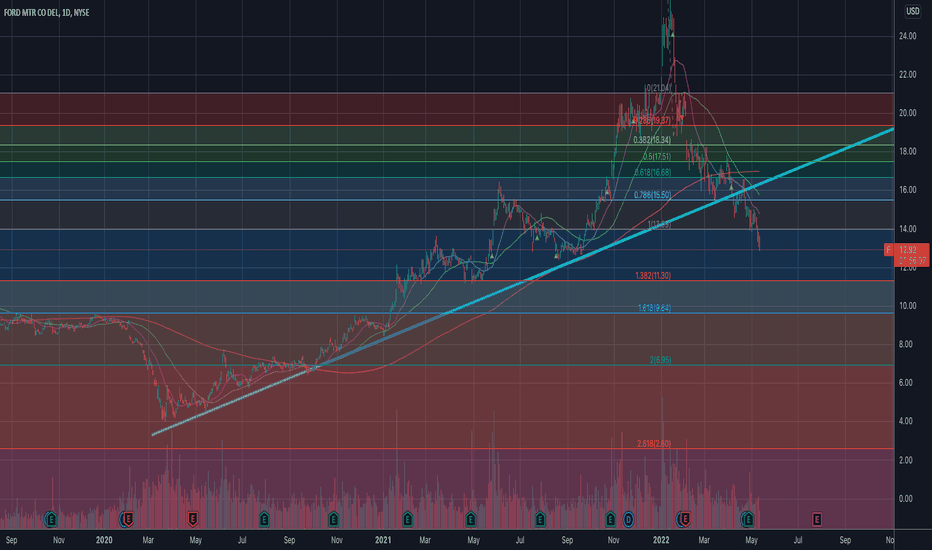

$F - Breaking down from multi-year trendlineFord broke below the multi-year trendline that started from March of 2020.

The price could further breakdown to $11.30 area before finding a support. However, if $11.30 breaks the next support area is $9.60 area which would be an attractive entry point.

I'd be interested to start a small position around 11.30 and load more at $9.60.

Not an investment advice.