MP trade ideas

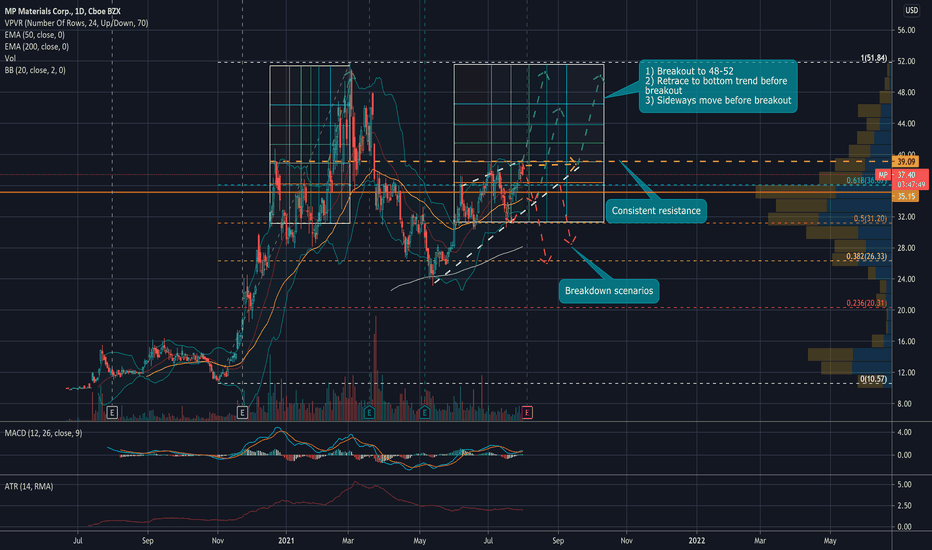

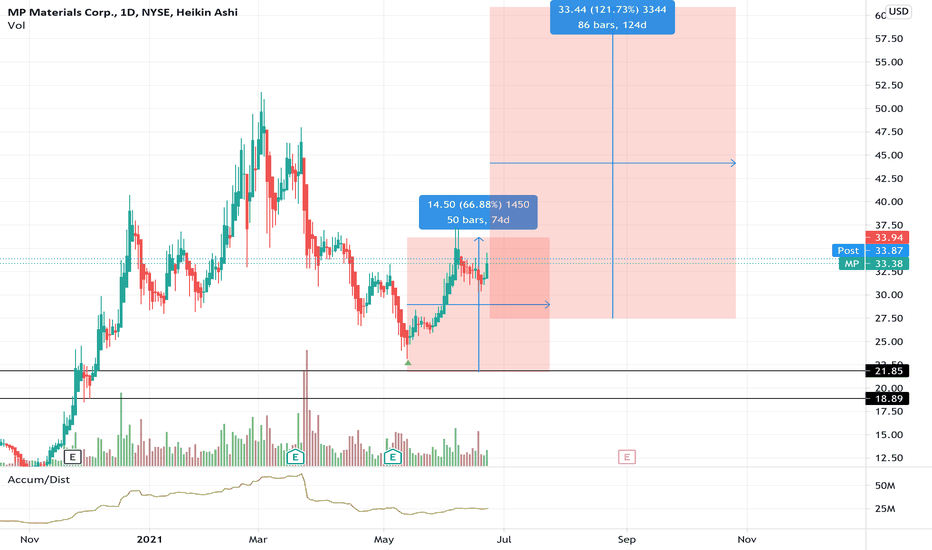

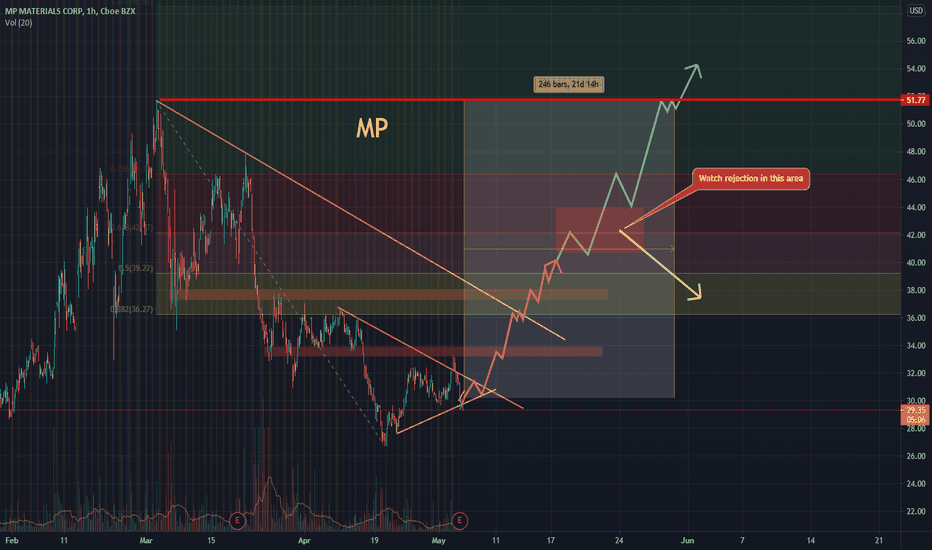

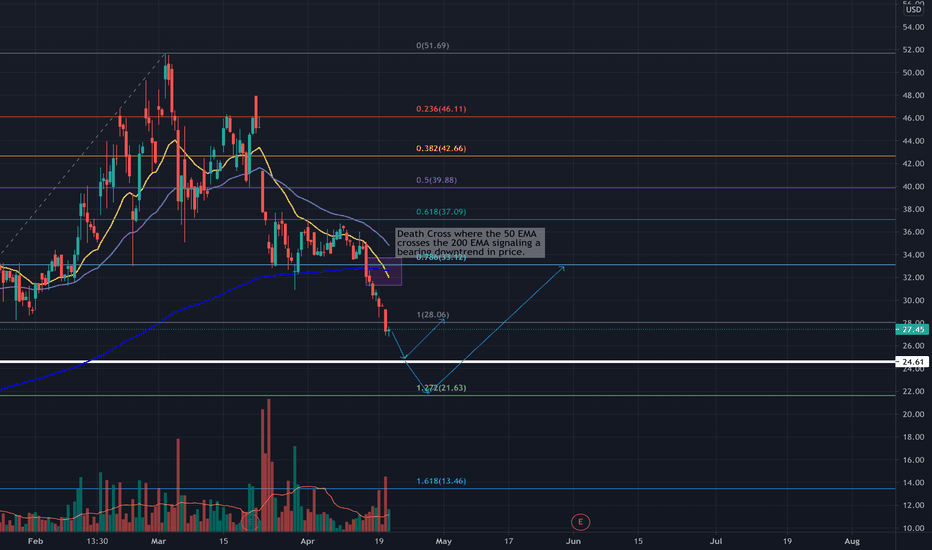

QE2 results a catalyst to higher pricesMP has been doing well in the past weeks while the small-cap stocks market notably SPACs were beaten down to disappointing prices. Now that there is less than a week to the QE2 results the price is at a pivotal level. There are resistance levels around $39 and $41, which can be broken if $MP reports impressive results as they have done it after their SPAC merger in 2020. Chamath Palihapitiya was the PIPE investor of this stock and it seems it is one of his best so far. The other ones such as $OPEN $CLOV are not doing well. Even, $SOFI did not have a good performance as many of its holders expected. A market rotation to small/medium cap stocks can send many of these stocks to the sky again, but that is a big question for right now as the mega-cap stocks are the safe haven for the big dogs.

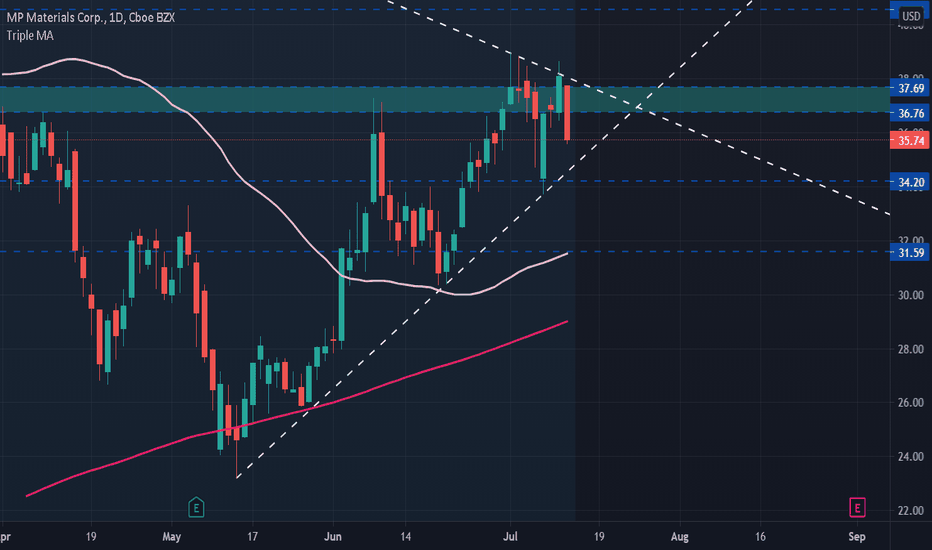

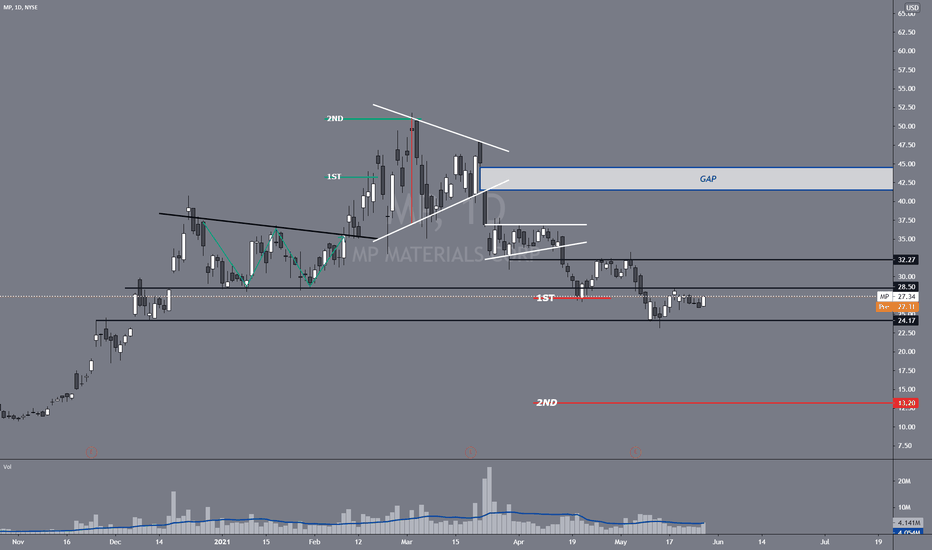

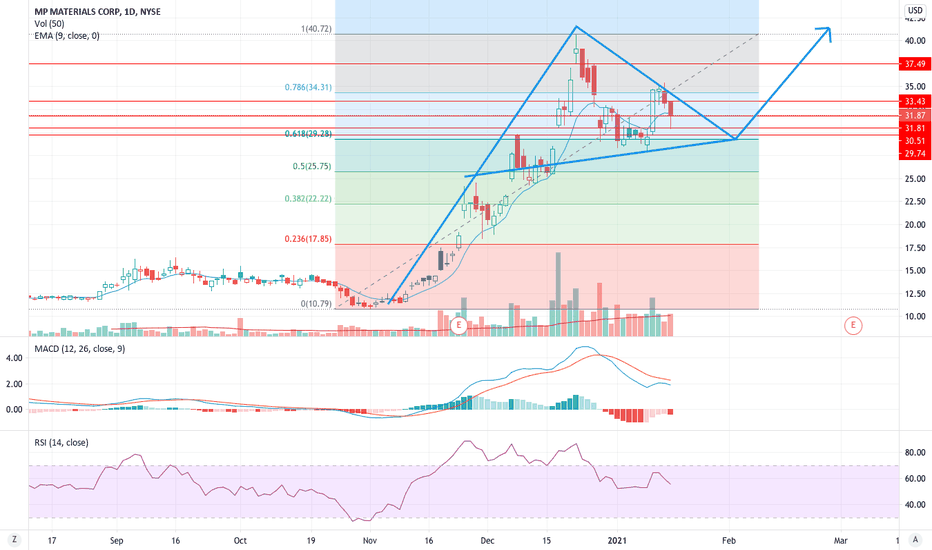

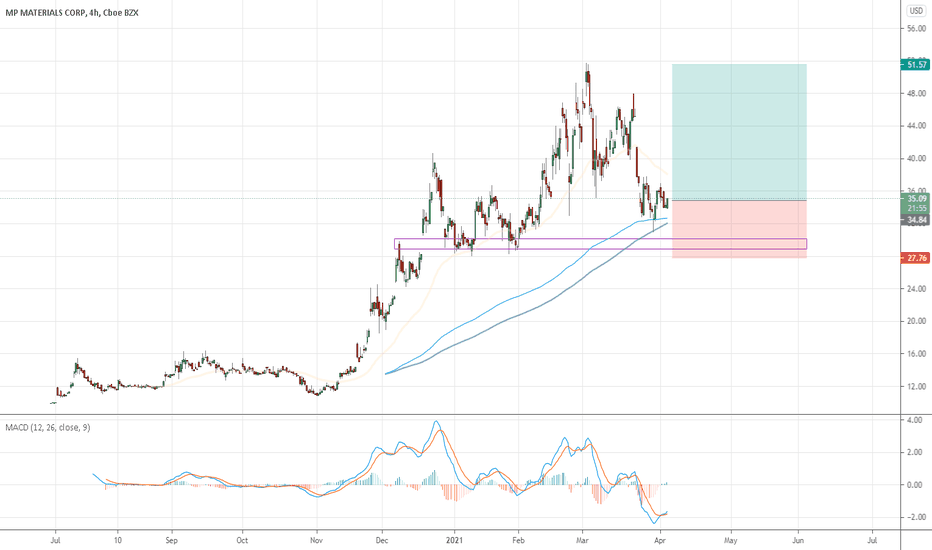

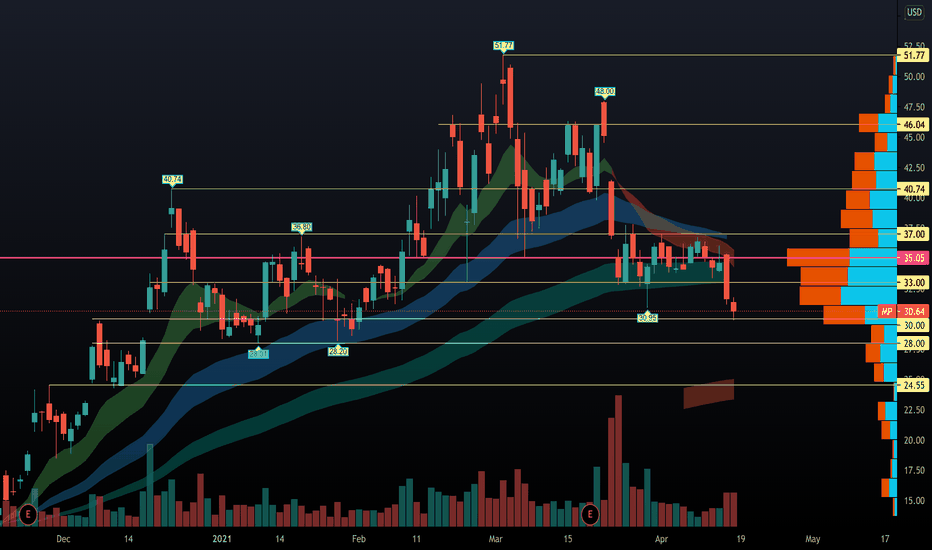

Mp MaterialsIn this chart you can clearly see the trading range MP is oscillating in. Once we are breaking above the Fib 0.5 with a closed daily candle above it's a confirmation of the completion of the C&H and a clear break out. And from there I would scale in more for a long position. If earnings are okay, we stay within the pink line and oscillate as this is the new channel.

I

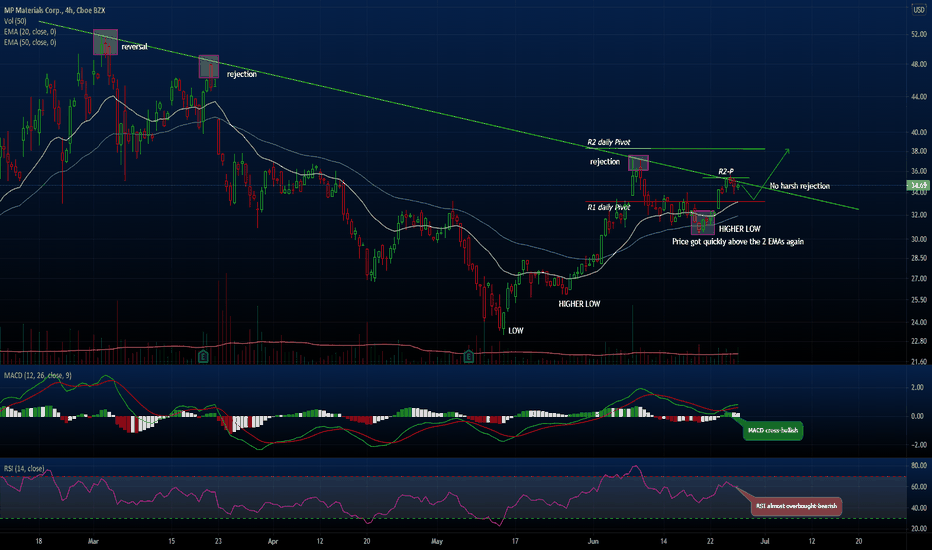

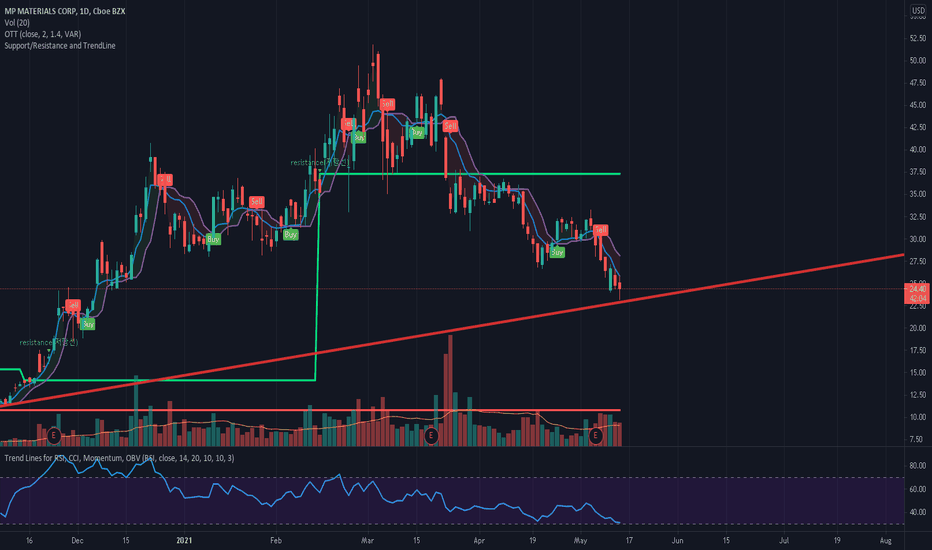

Are we going to break-out?!Well, it seems like...

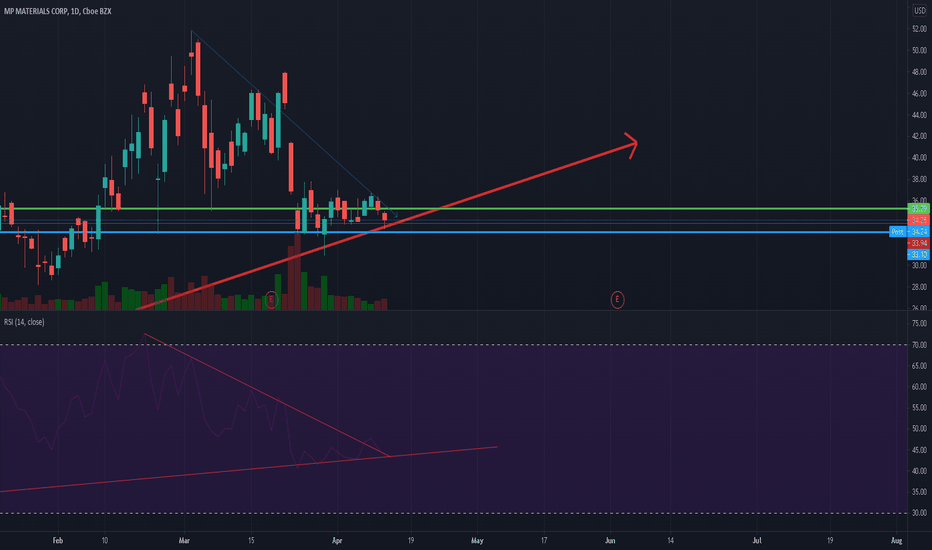

Multiple signs suggest that we are going to break-out soon.

These signs are: MACD cross, no rejection at the resistance, price above the 2 EMAs.

The only concerning thing is the RSI, it is almost overbought. I think it needs to consolidate for awhile (2-3 days) before it start a new leg up.

Stop loss: below 30.07

Resistance: 35.45, 38.29

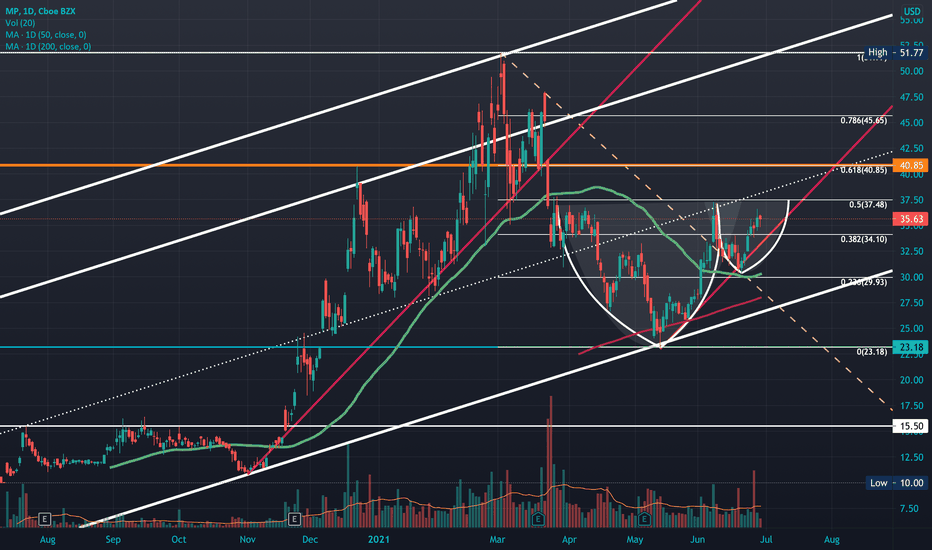

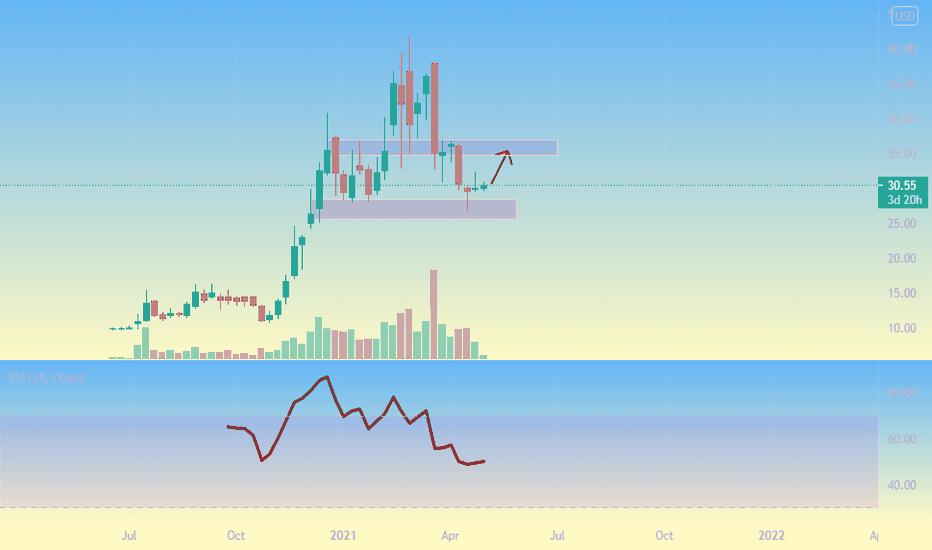

the hiatus is back offlooking for a strong rally in this name through the rest of 2021. Everyone and their grandmother wants to make an EV. You need a ton of rare earth minerals to build those induction motors. China & Biden administration even worse relations. Good luck getting your magnets from Shyna 🤙🏽

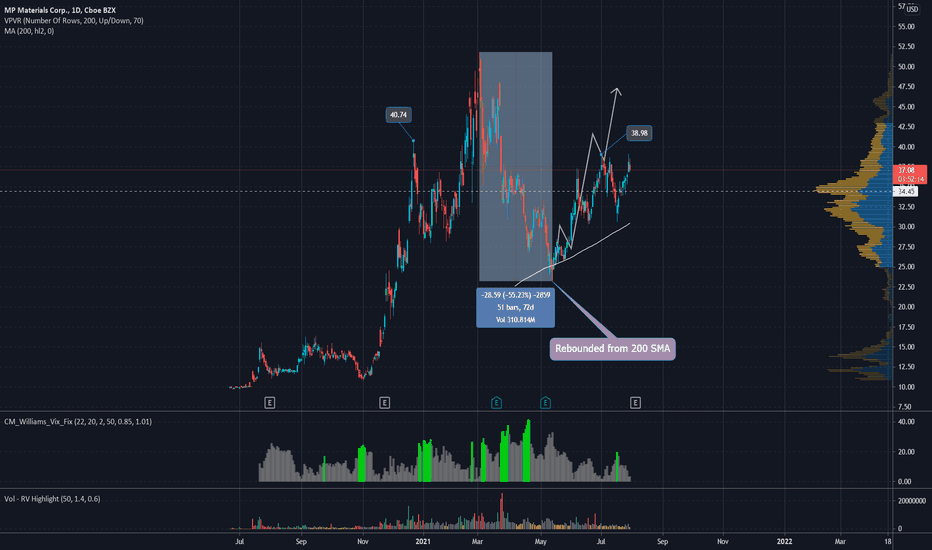

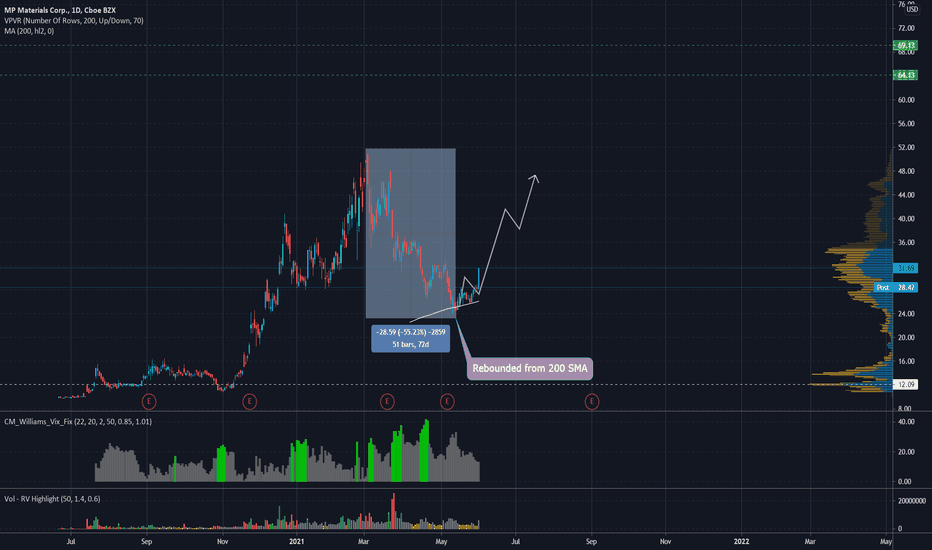

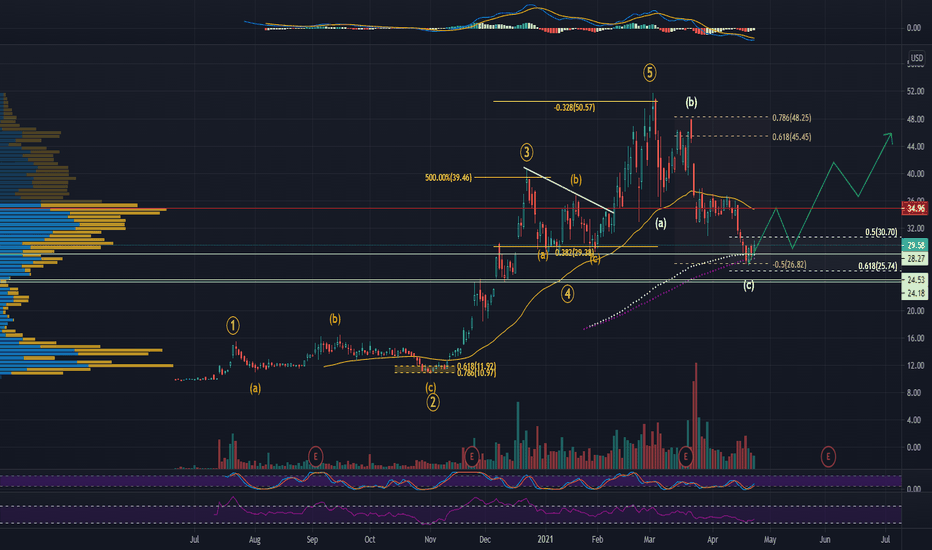

When both technicals and fundamentals confluence$MP, the rare earth materials company, has reported great quarterly reports in the past year, and this year that proves it is pacing firmly to become a very sound investment in the course of electrification and the global clean energy campaign. After a 55% decline, the price became ripe for a good entry if you missed the train in the first place or add to an existing position. Today, a bounce from the 200 SMA confirms that $MP is on its way to higher targets namely: 39, 48, 64, 69, 89, and 97 in the coming months and years. This is a promising and pretty much a safe bet for those who are patient and want to surf on the wave of electrification regardless of the sector or the companies that fight for it to get a good share of the billions of dollars spent in the next 5 to 10 years. My target for the next 12 months was around $40, but if we continue with the momentum that we have seen in the past few days in the growth stock, we should be there this year. This is not investment advice, DYODD!

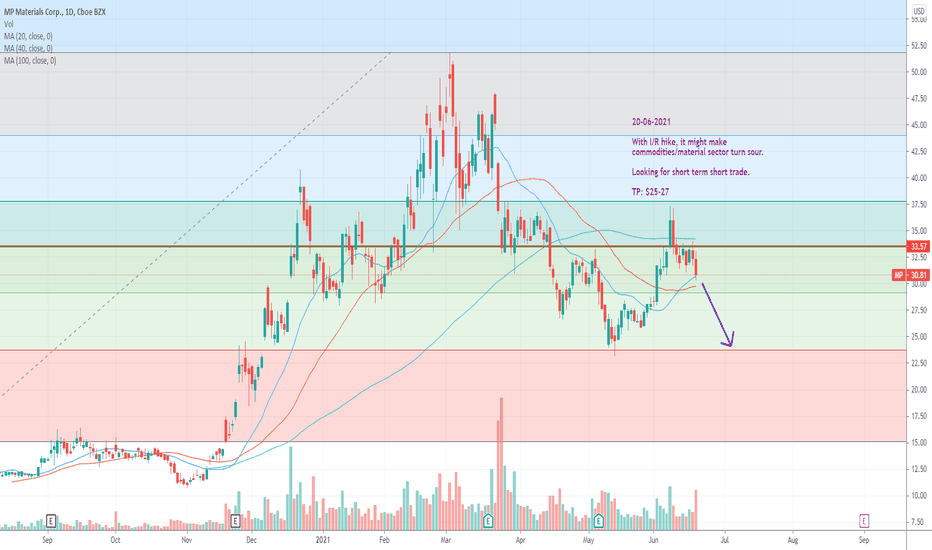

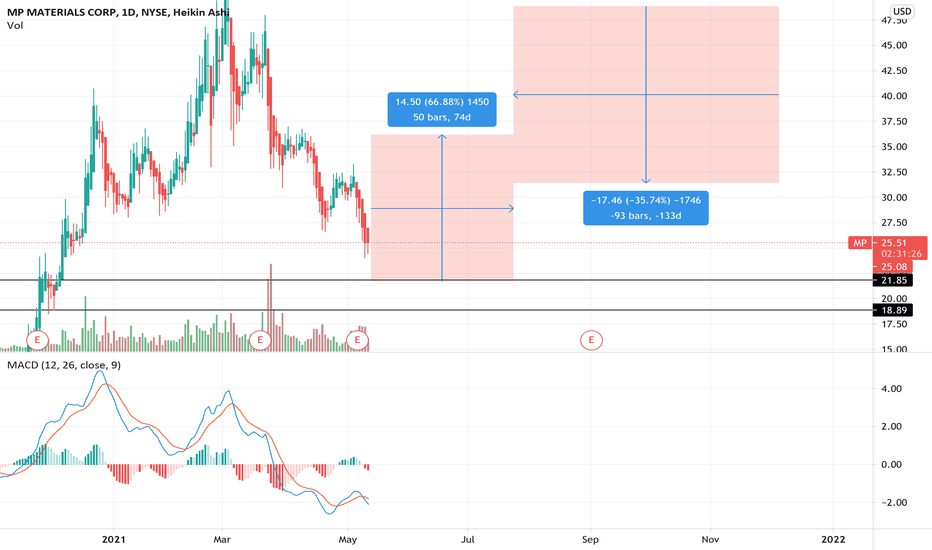

Stagflation Play #2American rare earth materials supplier. The stock's getting a buzzcut, too expensive vs. sentiment atm, but hey nothing's cheap today, and if you're driving an EV in the next couple years, you're rig needs hella strong magnets to efficiently propel that induction motor.

I think it ricochets somewhere off $18-20 then somewhere in the $40-$60 come September. Bull thesis is customers locking in orders in the here & now drive up pricing while they wait on semis to fit & finish.

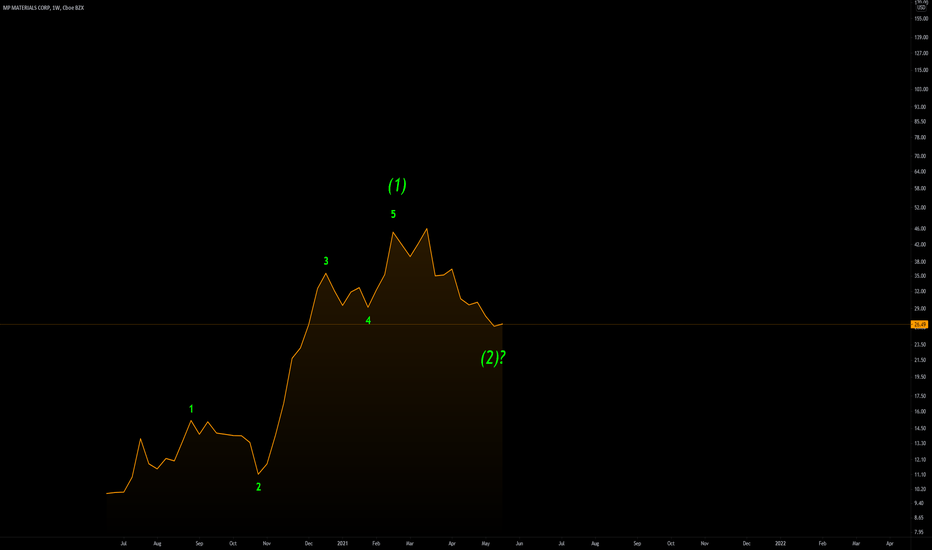

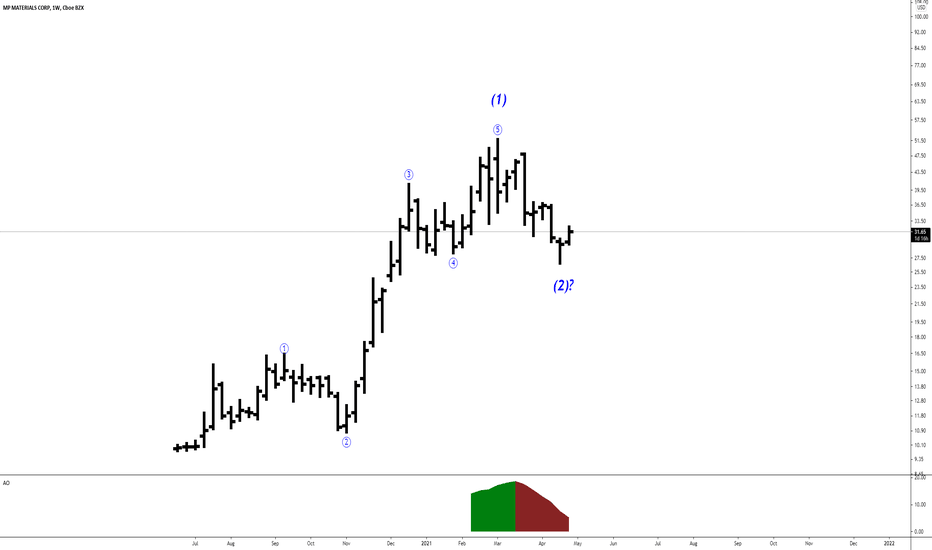

$MP - correction finished?On the technical side, the first 5 wave move from SPAC merger to march 2nd high has retraced more than 50% and bounced off the 150d SMA and EMA....the pattern off the high is a perfect 3 move correction hitting the 78.6% on wave b and the -0.5% on wave c.....on the financial side, they're the only fully integrated rare earth mining and processing facility the western hemisphere, and are looking to cut off north American dependency on Chinese rare earth metals.

Looking for 34 > 41 > 45 as wave 1/3/5 targets.

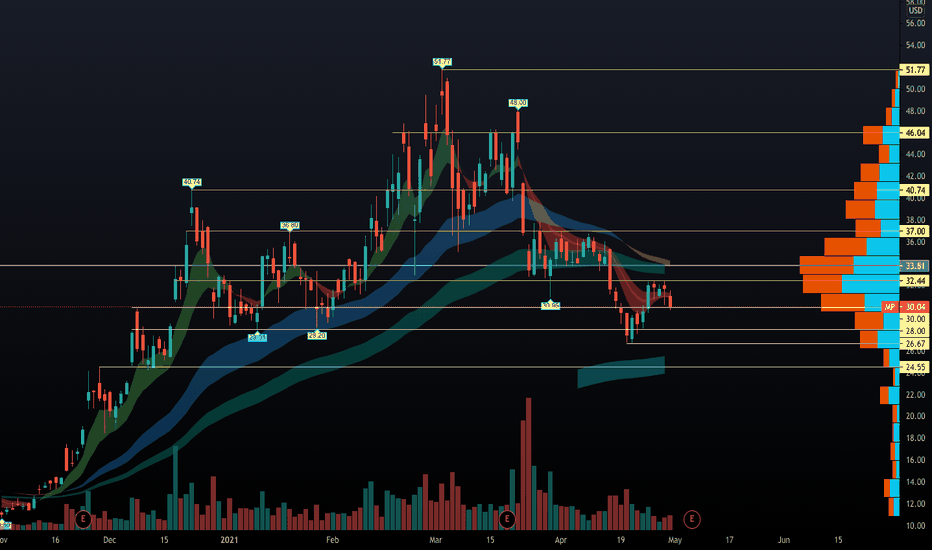

Took A Fresh LookAfter missing some nuances, I took a look at the weekly (Red arrow) along with daily RSI and daily downward trend and have an updated chart. From this perspective, it looks like tomorrow and Thursday are key points. The RSI came right back to the shorter term downward trend and is also bumping against the longer term trend. I am 100% rooting for the long term trends to be stronger than the shorter, on both RSI and the daily chart, but being a newb I just don't know what is going to happen without some news as a catalyst.

MP Interesting intersectionI am seeing a long term trend line being tested along with a long RSI trend being tested. Those two things and a decent support support line will converge this week. I think that could explain the low volume so far today. I would love to see a big move up tomorrow, but this one has been confusing at times so will wait for confirmation tomorrow or Wednesday. Within a couple months, I will believe we get back to $45-$50.