7/8/25 - $qs - Pass. No thanks.7/8/25 :: VROCKSTAR :: NYSE:QS

Pass. No thanks.

- Great story bro, company

- Does this thing continue to ape higher a la meme market? idk idc

- I think pre-revenue stuff can be interesting if there's clear visibility toward scaling revenue or the costs are contained, but let's be real... 4 years

−0.002 BRL

−2.58 B BRL

0.00 BRL

About QuantumScape Corporation

Sector

Industry

CEO

Srinivasan Sivaram

Website

Headquarters

San Jose

Founded

2010

ISIN

BRQ2SCBDR001

FIGI

BBG014XK2WN1

QuantumScape Corp. engages in the provision of energy storage solutions. The company was founded by Jagdeep Singh, Tim Holme, and Fritz B. Prinz in May 2010 and is headquartered in San Jose, CA.

Related stocks

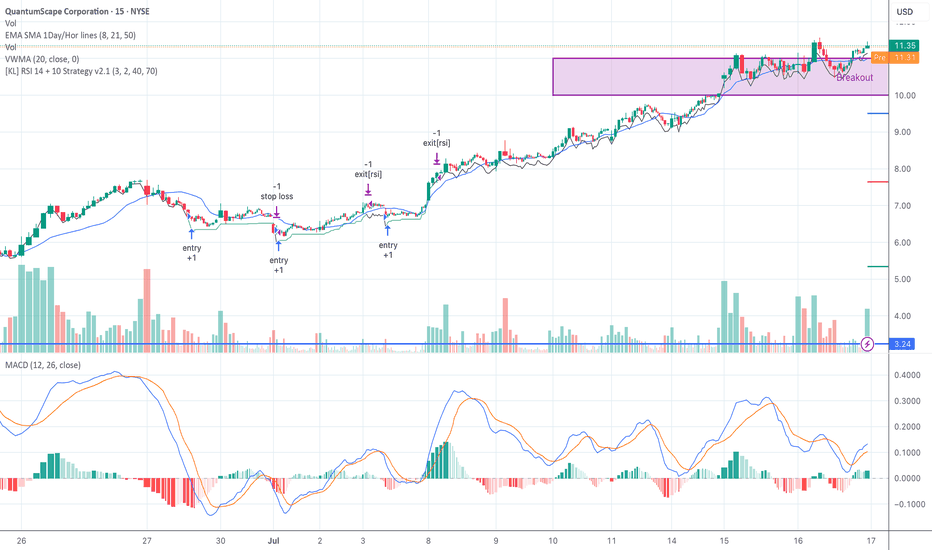

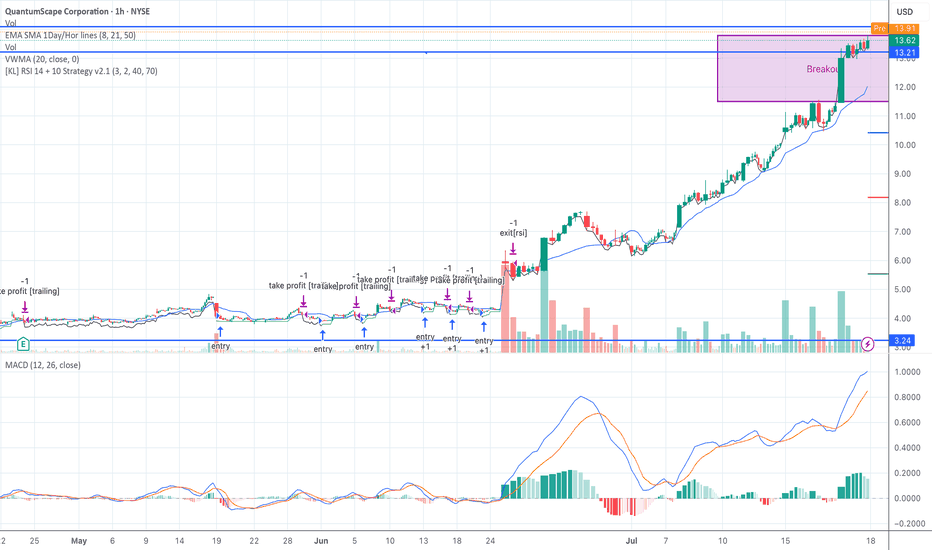

QS Breakout Setting Up — Entries Triggered, Waiting for ConfirmSeed System entries are printing on QS with trailing profit zones holding firm.

MACD crossovers confirming the move. Watching RSI cooling just under breakout resistance at $11.35.

A push through $11.50 with volume and I’m adding — slowly.

Support at $10.03, cut fast if price shows weakness.

Let

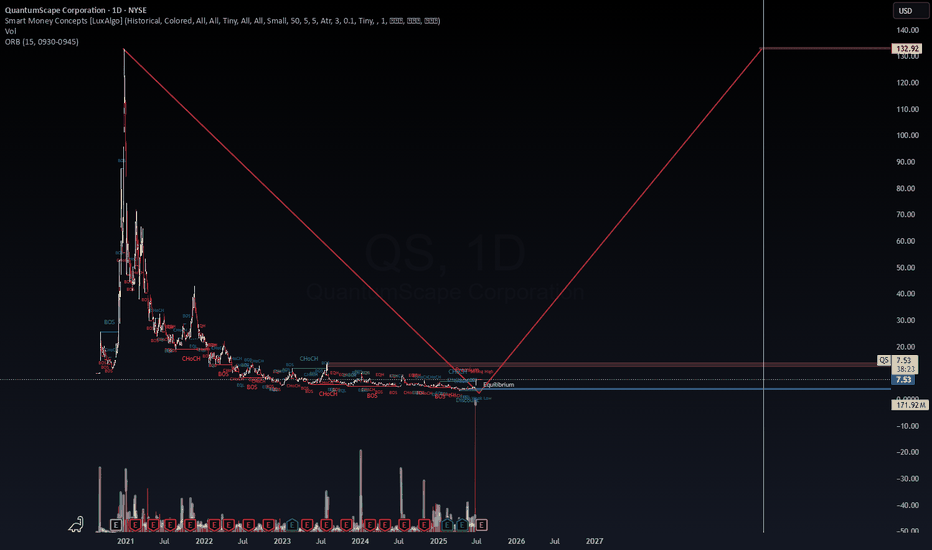

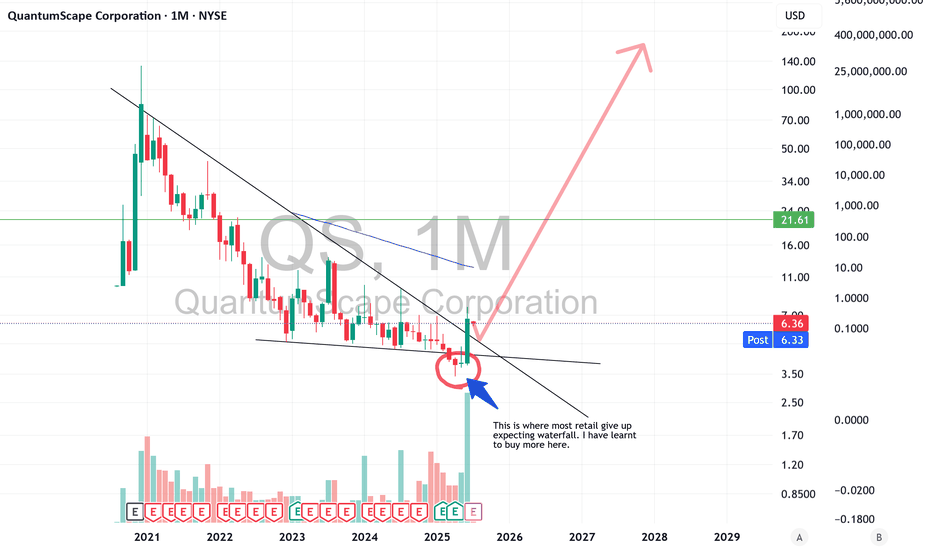

QuantumScape ($QS) | Long-Term Bet on Solid-State Battery RevoluQuantumScape has officially re-entered our radar after today's +32.72% move—driven by their “Cobra” separator scaling breakthrough. Volume surged to 171M+ confirming a major displacement event.

From a Smart Money Concepts (SMC) lens, the market structure shows repeated Change of Character (ChoCH) a

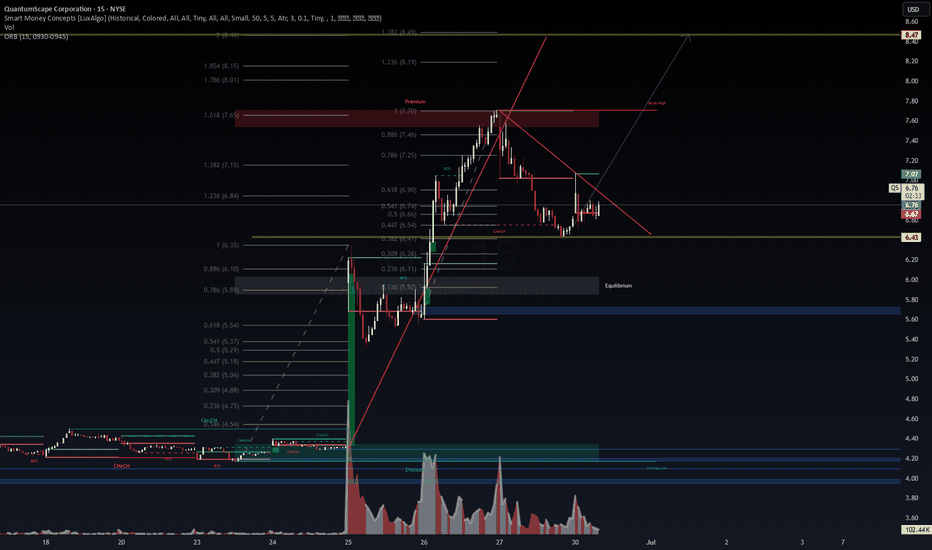

QuantumScape ($QS) – VolanX SMC Activation Zone🔍 Technical Context

QuantumScape is setting up for a potential bullish breakout after consolidating within a descending wedge and maintaining structure above the golden Fibonacci pocket (0.5–0.618 zone). Smart Money Concepts (CHoCH + BOS) have been triggered, indicating the start of institutional po

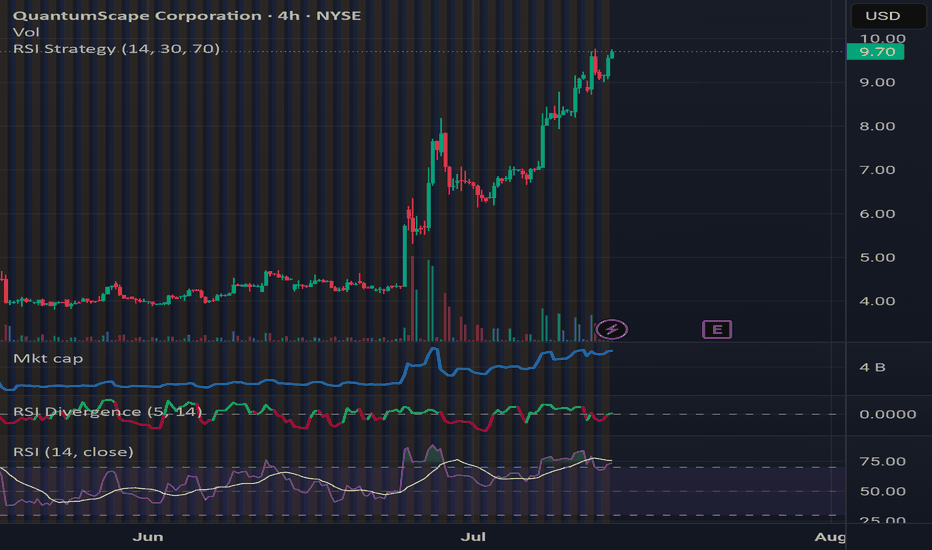

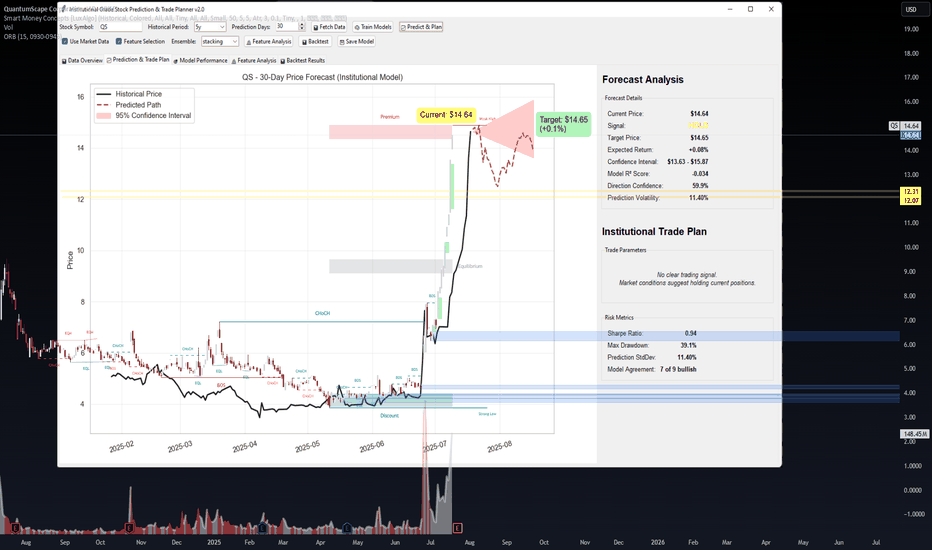

QS Forecast – Holding Premium Territory After Parabolic Move📊 QS Forecast – Holding Premium Territory After Parabolic Move

🔍 WaverVanir DSS Forecast (VolanX Protocol)

Our institutional AI model flags no fresh signal on NYSE:QS , suggesting a HOLD posture as the stock consolidates above the equilibrium band. Current price: $14.64, with a 30-day target of $1

QS Re-Tested Box Top – Waiting for $14.10 + VolumeQS is currently re-testing this morning’s high at $13.79 (box top).

VWMA and EMA alignment are bullish. MACD remains strong.

Plan: Buy above $14.10 on volume, stop at $13.20, trim at $15.00, extended target $16.50.

#QS #SeedSystem #DarvasBox #BreakoutWatch #VWMA #LiveUpdate

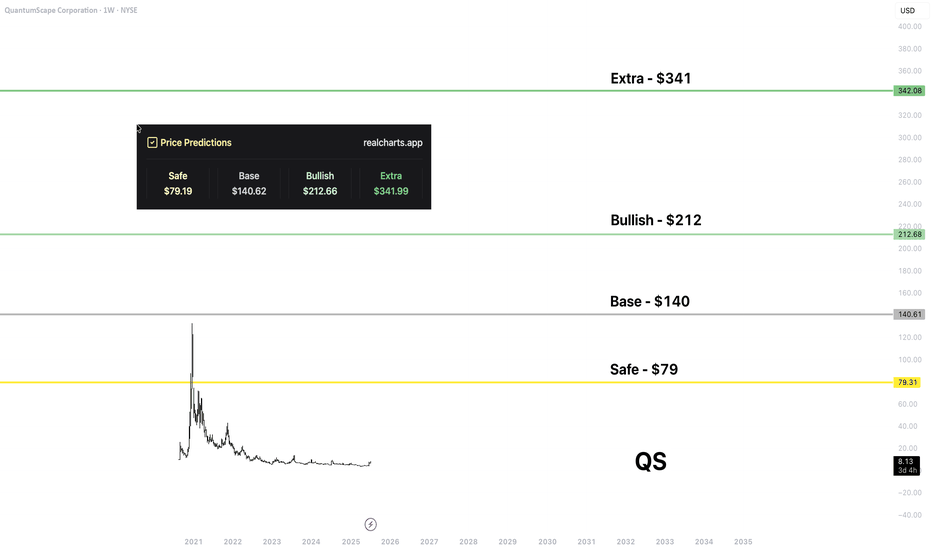

QS | Price PredictionNYSE:QS is one of the most promising assets in my stock portfolio. I expect massive upside and becoming revenue positive from 2026-27.

That level is from my platform. I think the "safe" is the most realistic in the first phase of the upside, and the "base" is quite realistic too. For the next lev

QS heading a lot higherFor those that have been following me for a while know I have been a long time holder of QS and have been accumulating even up until yesterday. Its been a long painful hold but I believe we are finally ready to begin the upward trajectory that many expected. I pointed out in the chart where most ret

QuantumScape Stock Chart Fibonacci Analysis 061125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 4.25/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.