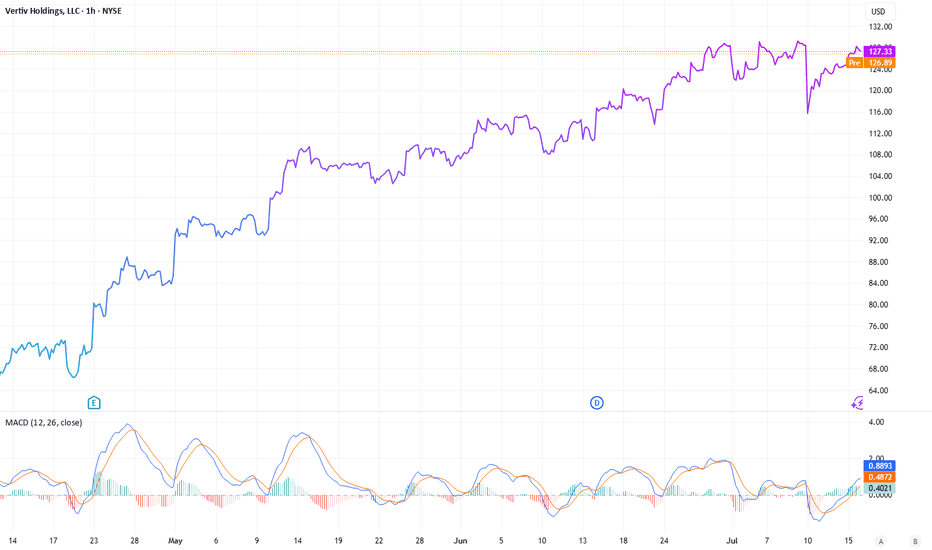

The Picks and Shovels of The AI Boom1. Six-Month Price Trend

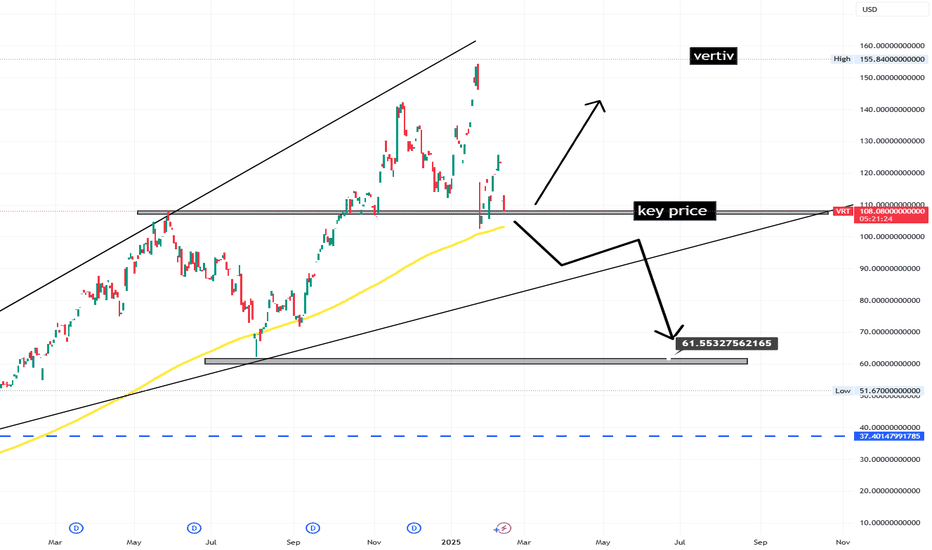

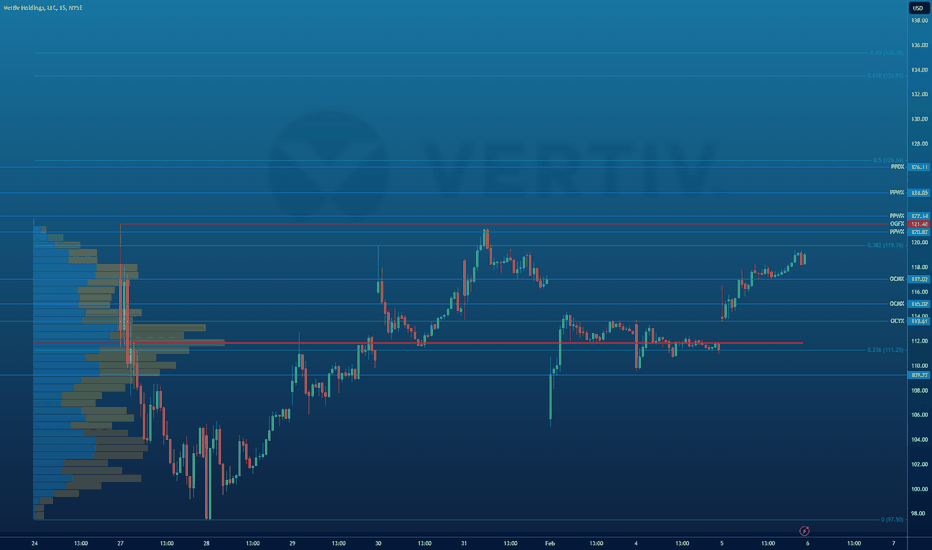

Long-term uptrend: Over the past 6 months, VRT has climbed from ~ $54 to a recent high around $155—deep into a clear bullish channel

Pullbacks vs higher lows: Corrections have consistently bounced off rising trend-lines and key moving averages (50 & 200-day), reinforcing t

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.104 BRL

3.07 B BRL

49.67 B BRL

373.31 M

About Vertiv Holdings, LLC

Sector

Industry

CEO

Giordano Albertazzi

Website

Headquarters

Westerville

Founded

1946

ISIN

BRV1RTBDR002

FIGI

BBG01TCJ1FS5

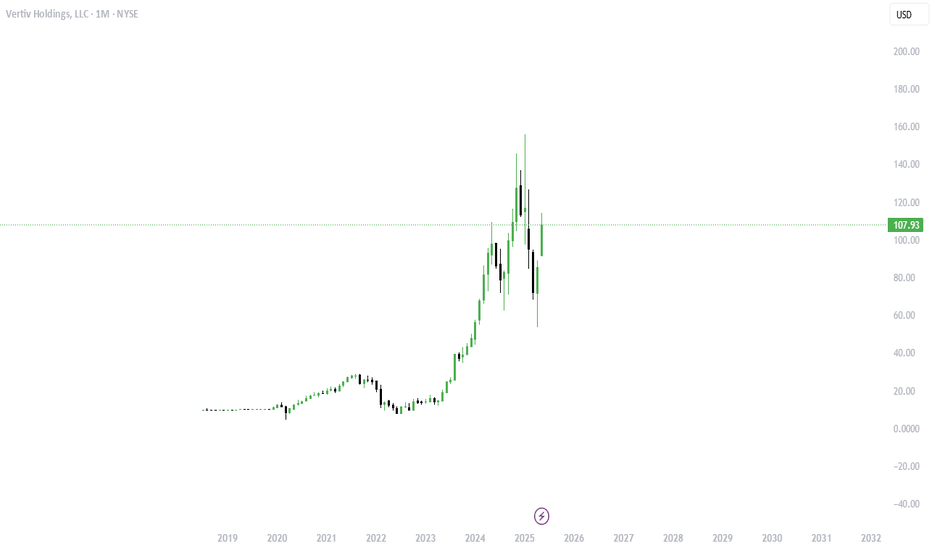

Vertiv Holdings Co. engages in the design, manufacture, and service of critical digital infrastructure technology for data centers, communication networks, and commercial and industrial environments. It also offers power management products, switchgear and busbar products, thermal management products, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure. It operates through the following geographical segments: Americas, Asia Pacific, and Europe, Middle East, and Africa (EMEA). The Americas segment offers products and services sold for applications within the data center, communication networks, and commercial and industrial markets in North America and Latin America. The Asia Pacific segment includes products and services sold for applications within the data center, communication networks, and commercial or industrial markets throughout Greater China, Australia and New Zealand, Southeast Asia, and India. The EMEA segment focuses on products and services sold for applications within the data center, communication networks, and commercial and industrial markets in Europe, Middle East, and Africa. The company was founded in 1946 and is headquartered in Columbus, OH.

Related stocks

Vertiv Holdings: Powering the AI ProgressionNYSE:VRT NASDAQ:NVDA NASDAQ:META NYSE:ETN NASDAQ:CEG

While investors are engaged in a race “identify the next major microchip manufacturer”, a quieter opportunity is emerging at the crossroads of artificial intelligence (AI), infrastructure, and long-term demand. Vertiv Holdings (VRT), a c

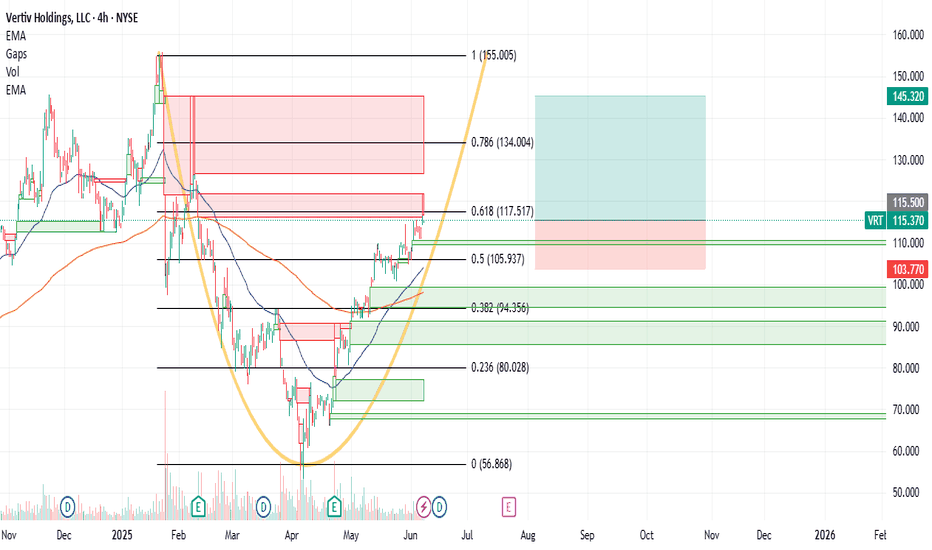

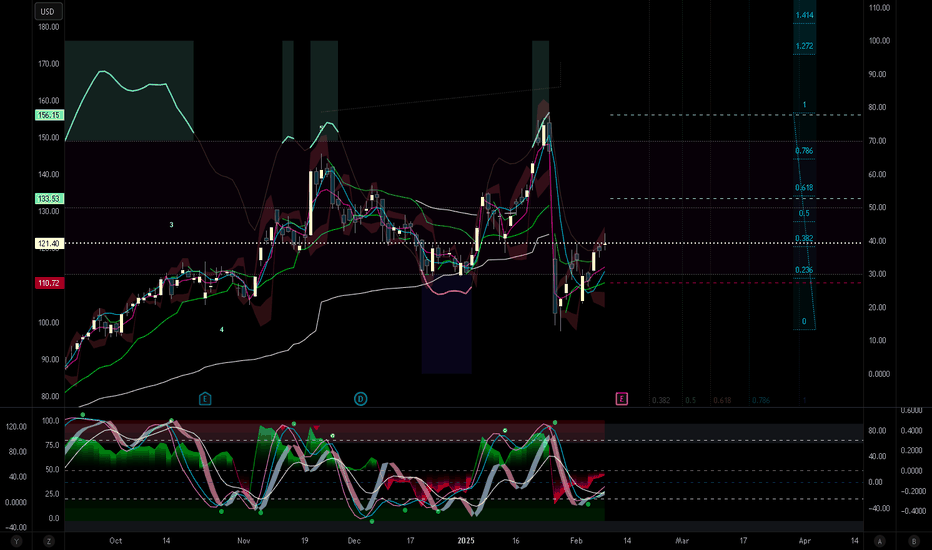

VRT : Long Position Vertiv Holdings is trading above the 50 and 200-period moving averages.

It has overcome the resistances one by one without being exposed to a very high IV.

It has started to draw a cup.

However, it is much better to focus on the big gap rather than the cup formation because with good chances it c

Is VRT (they make cooling systems for data centers) a buy ?Vertiv Holdings Co. (NYSE: VRT) is a leading provider of critical digital infrastructure and continuity solutions, particularly for data centers. Here's an overview of its recent performance, valuation, and potential challenges:

Financial Performance

Q1 2025 Highlights:

-Revenue: $2.04 billion

$NYSE:VRT (Vertiv Holdings, LLC) Bullish Outlook NYSE:VRT

Company Overview:

Cooling for Data Centers. One of the very few.

Vertiv Holdings Co. engages in the design, manufacture, and service of critical digital infrastructure technology that powers, cools, deploys, secures and maintains electronics that process, store and transmit data. It

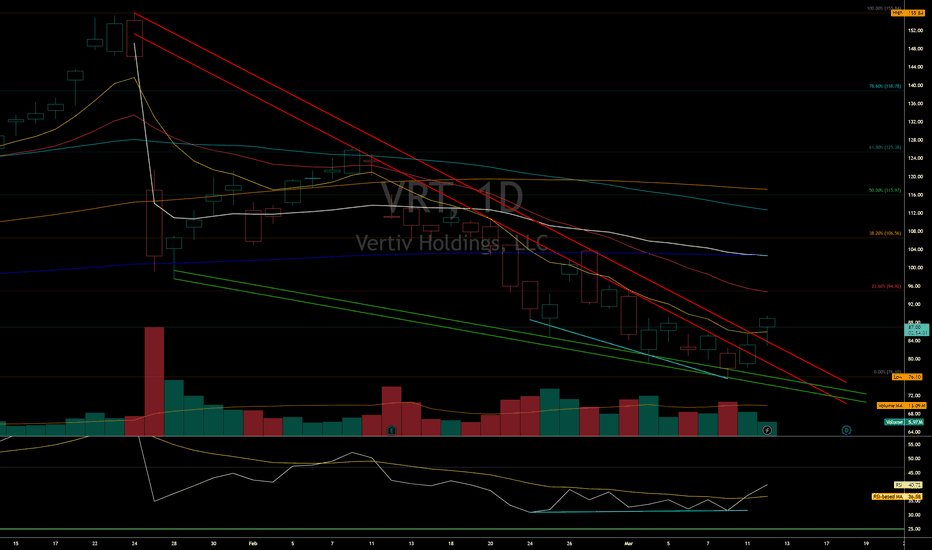

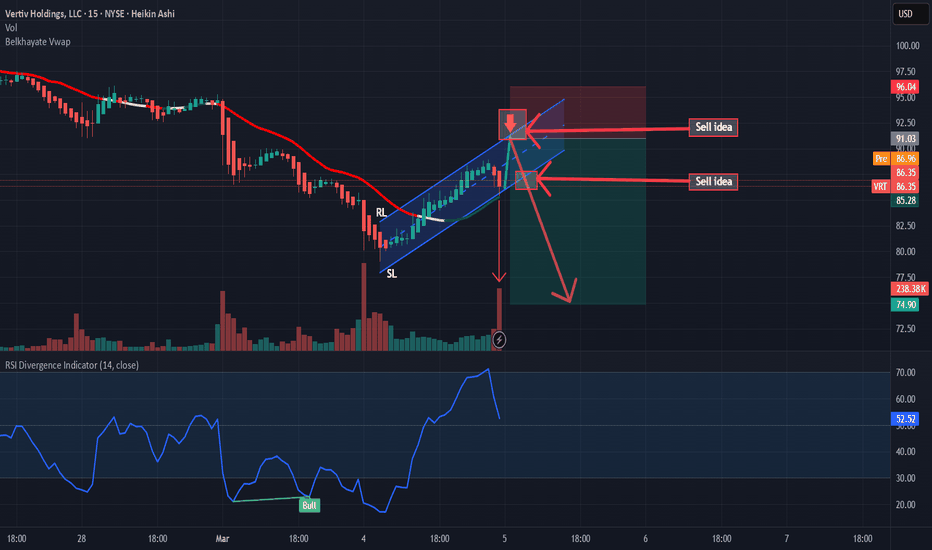

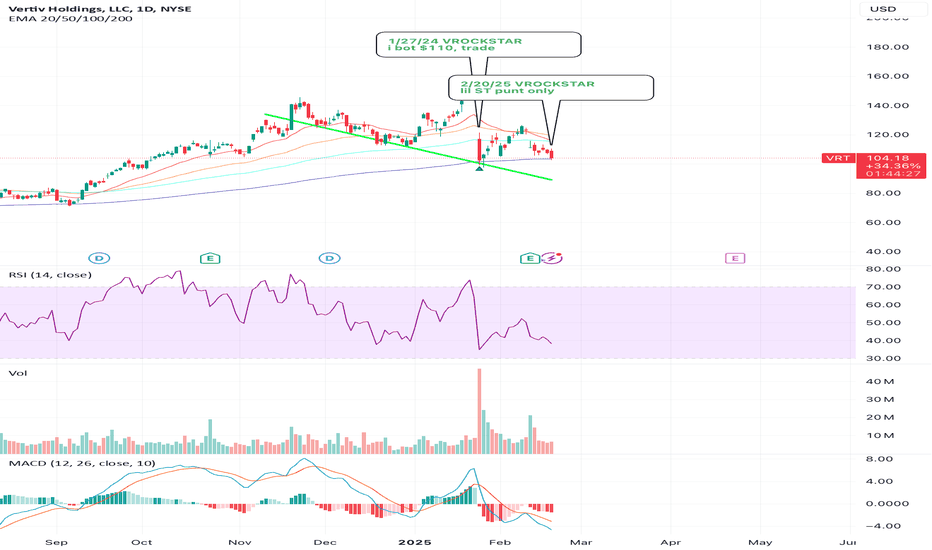

2/20/25 - $vrt - lil ST punt only2/20/25 :: VROCKSTAR :: NYSE:VRT

lil ST punt only

- not cheap, not expensive, but reasonable

- dr. warren says... better to pay reasonable px for great asset than great px for mediocre asset

- nvda results r on deck and mkt probably remains choppy until then, but my industry sources confirming th

See all ideas