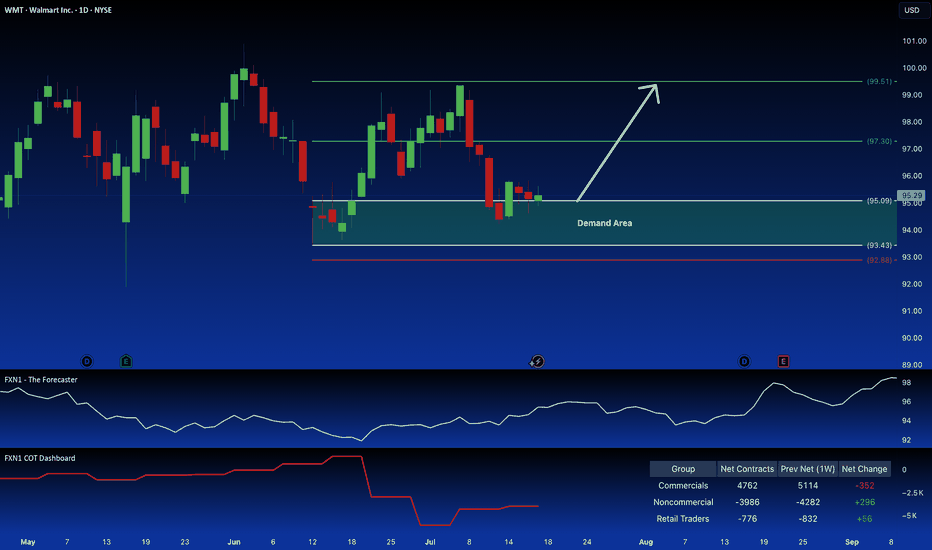

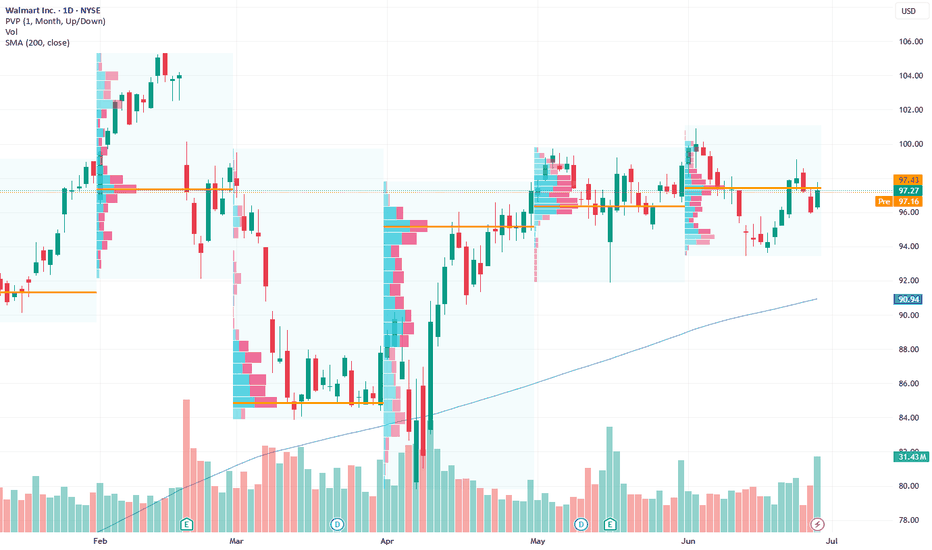

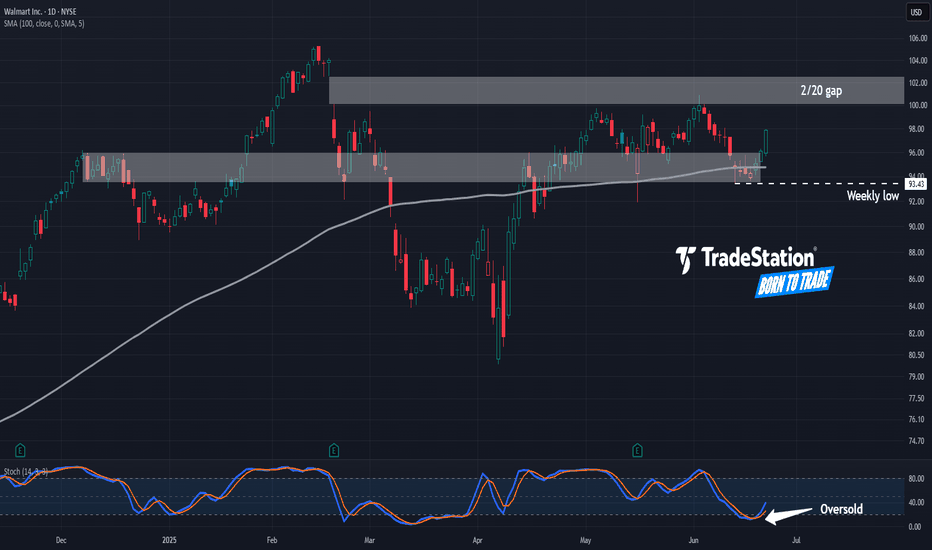

Walmart: Long Position Attractive on Demand ZoneWalmart Inc. presents a compelling long opportunity. The price action is reclaiming a key demand zone, suggesting a continuation of the current uptrend, a pattern reinforced by seasonal factors. Further bolstering the bullish case is the observed increase in large speculator positions.

✅ Please

0.83 BRL

106.59 B BRL

3.73 T BRL

About Walmart Inc.

Sector

Industry

CEO

C. Douglas McMillon

Website

Headquarters

Bentonville

Founded

1962

ISIN

BRWALMBDR005

FIGI

BBG001721TS0

Walmart, Inc. engages in the retail and wholesale business. The company offers an assortment of merchandise and services at everyday low prices. It operates through the following business segments: Walmart U.S., Walmart International, and Sam's Club. The Walmart U.S. segment operates as a mass merchandiser of consumer products, operating under the Walmart and Walmart Neighborhood Market brands, including walmart.com. The Walmart International segment includes operations of wholly-owned subsidiaries in Canada, Chile, China, and Africa, and majority-owned subsidiaries in India, as well as Mexico and Central America. The Sam's Club segment manages membership-only warehouse clubs and operates samsclub.com. The company was founded by Samuel Moore Walton and James Lawrence Walton on July 2, 1962 and is headquartered in Bentonville, AR.

Related stocks

WMT is ready for another phase of the price discoveryThis Week (July 8 - 12):

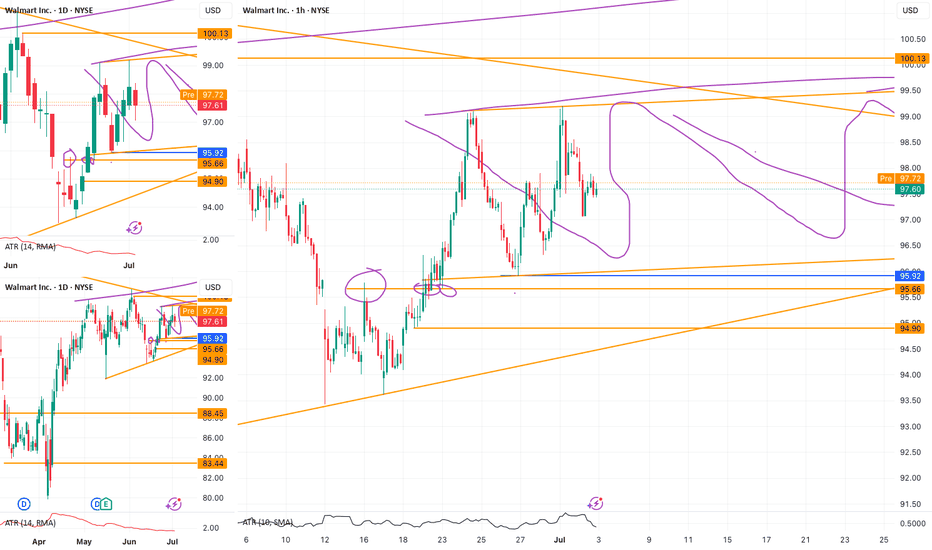

Support: The 20-day moving average around $96.70 is the first floor. Below that, the key range support is at $95.00.

Resistance: The top of the range and the all-time high around $101.50 is the ceiling that needs to break.

Next Month (July):

Support: The main support for

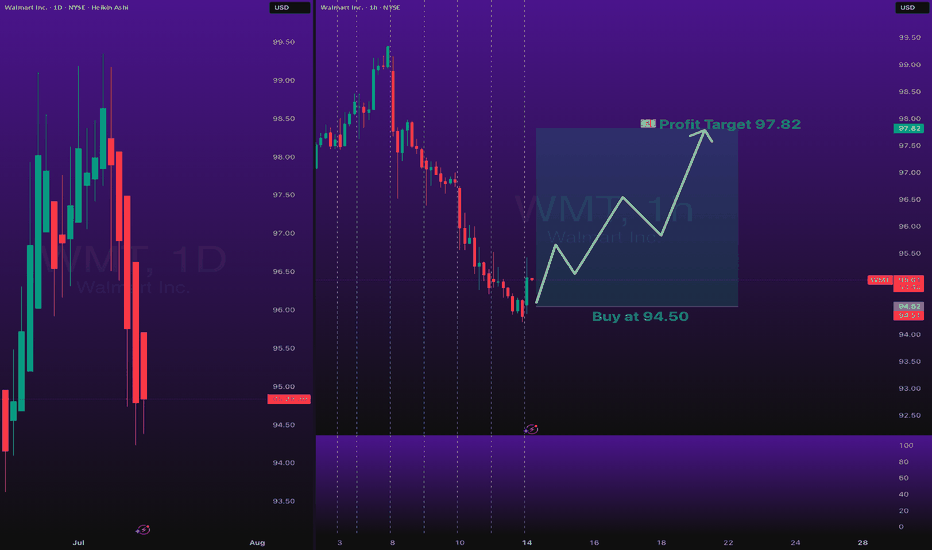

Stocks SPOT ACCOUNT: WMT stocks Buy Trade with Take ProfitStocks SPOT ACCOUNT: NYSE:WMT stocks my buy trade with take profit.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Looks good Trade.

Disclaimer: only idea, not advice

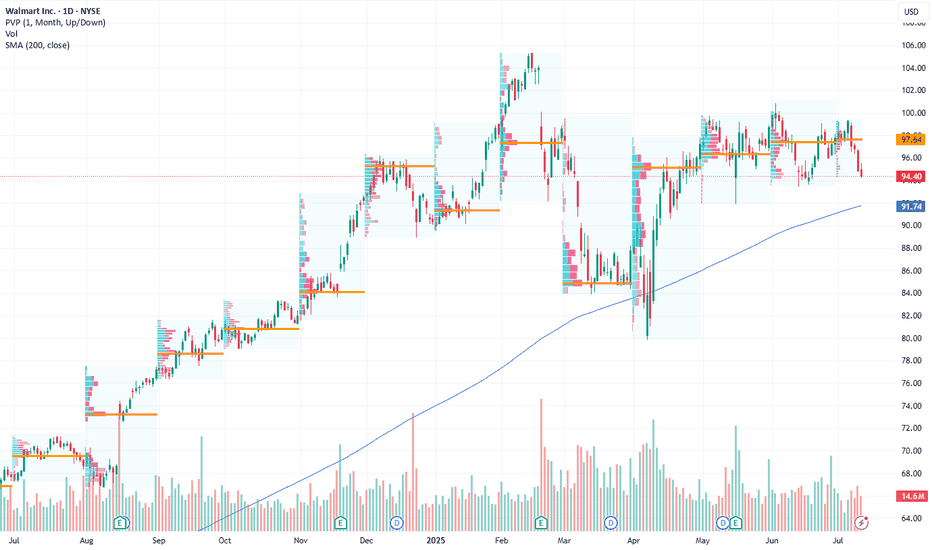

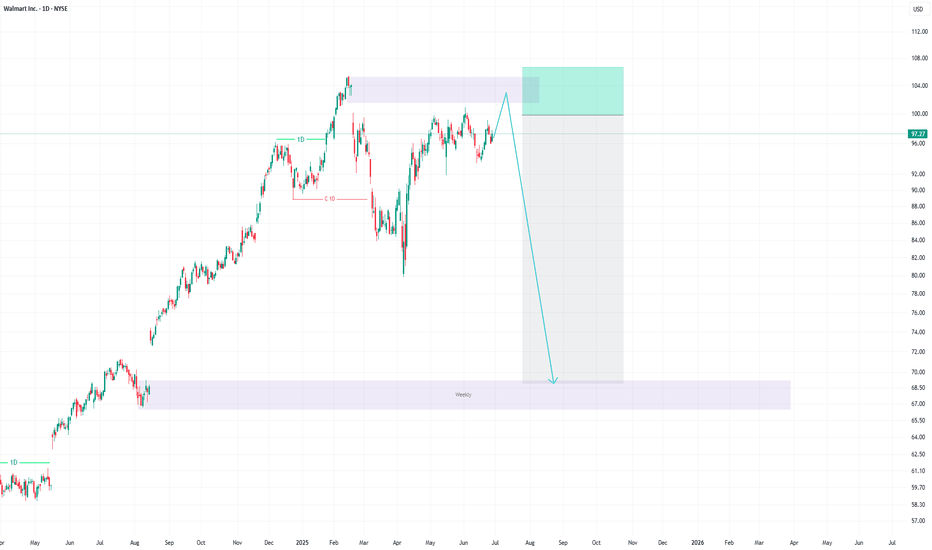

Walmart: Retail Giant Positioned for Growth Amid Bullish MomentuCurrent Price: $94.40

Direction: LONG

Targets:

- T1 = $98.20

- T2 = $101.80

Stop Levels:

- S1 = $92.10

- S2 = $90.40

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ident

Exact Entry Levels & Profit Potential (July 3, 2025)🎯 Market Structure Breakdown – Exact Entry Levels & Profit Potential (July 3, 2025)

📊 In today’s session, I revisit the market for the second time – and you’ll see why I’m ruling out some setups altogether. There’s value in looking twice. What did I miss earlier? It's all in the structure.

I break

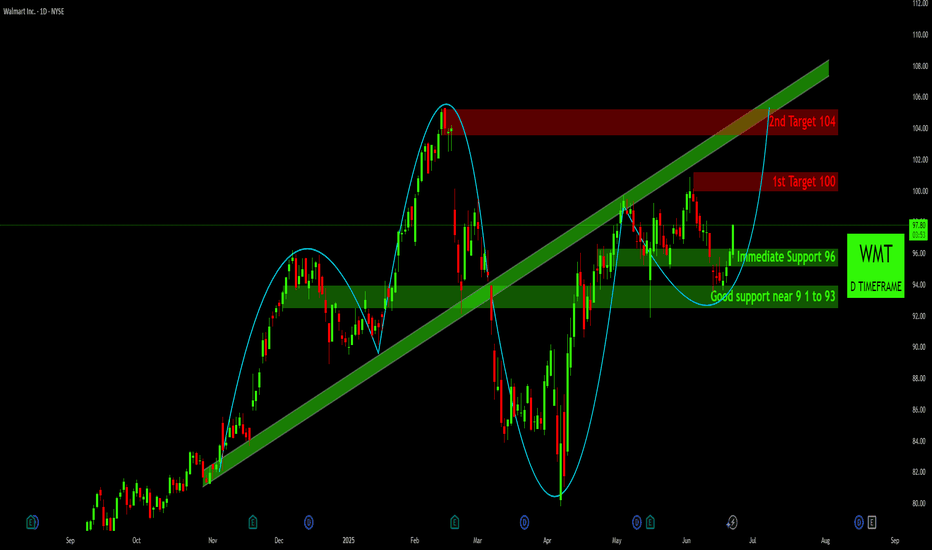

Long Position Targeting Key Resistance LevelsCurrent Price: $97.27

Direction: LONG

Targets:

- T1 = $100.25

- T2 = $102.50

Stop Levels:

- S1 = $95.50

- S2 = $94.25

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ident

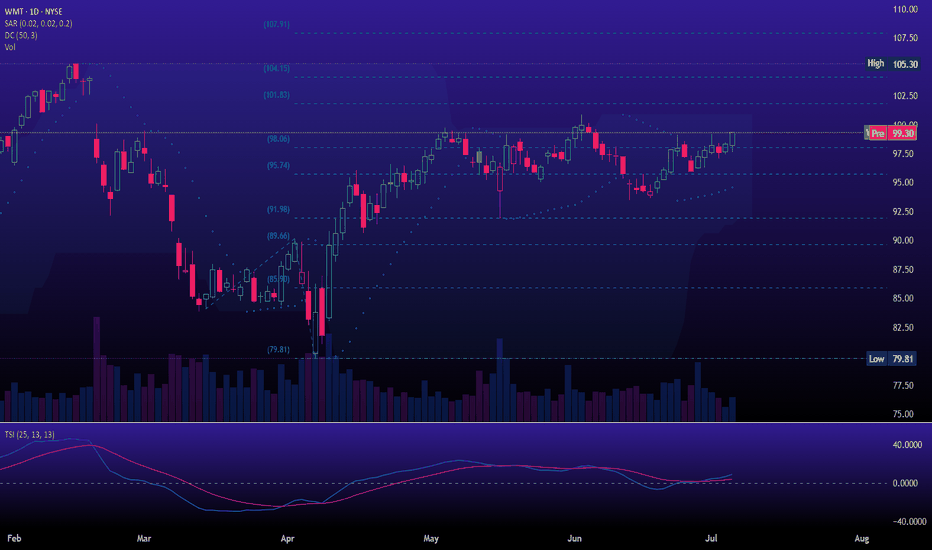

Wake-Up Time for Walmart?Walmart has snoozed for months, but some traders may think it’s waking up.

The first pattern on today’s chart is the price range on either side of roughly $95. The retail giant peaked at that level in early December and is back near the same location more than six months later. That indicates a per

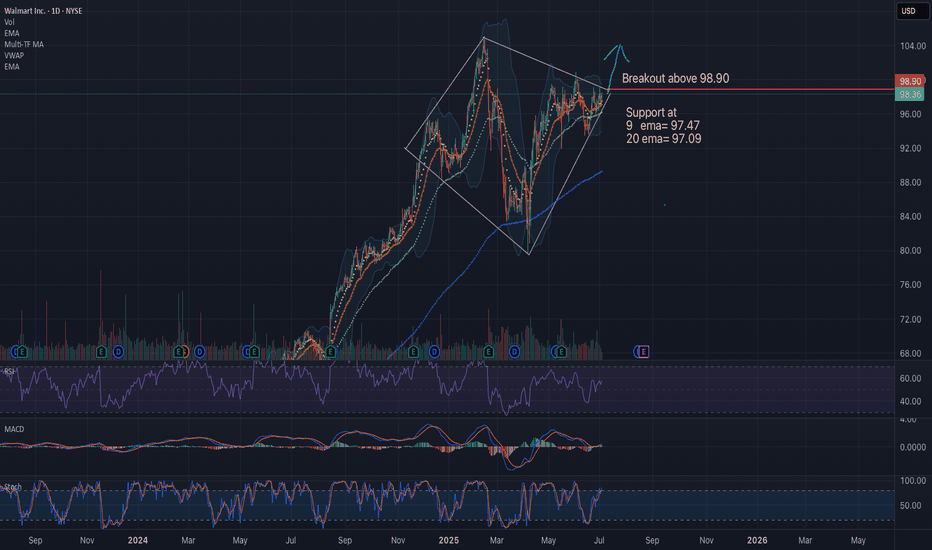

Walmart (WMT): Building Momentum, Targets in SightLong-Term Trend Break : Walmart (WMT) was in a strong, sustained uptrend until early 2025, indicated by the thick green channel, but then experienced a significant correction in March that broke this primary ascending channel.

Established Support Zones : Following the March decline, WMT has estab

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US931142EV1

WALMART 21/51Yield to maturity

6.89%

Maturity date

Sep 22, 2051

WMT4887055

Walmart Inc. 2.95% 24-SEP-2049Yield to maturity

6.61%

Maturity date

Sep 24, 2049

US931142EU3

WALMART 21/41Yield to maturity

6.43%

Maturity date

Sep 22, 2041

US931142DW0

WALMART 2047Yield to maturity

6.33%

Maturity date

Dec 15, 2047

US931142EC3

WALMART 18/48Yield to maturity

6.12%

Maturity date

Jun 29, 2048

WMT3991377

Walmart Inc. 4.0% 11-APR-2043Yield to maturity

5.92%

Maturity date

Apr 11, 2043

WMT5472137

Walmart Inc. 4.5% 09-SEP-2052Yield to maturity

5.88%

Maturity date

Sep 9, 2052

WMT5571329

Walmart Inc. 4.5% 15-APR-2053Yield to maturity

5.86%

Maturity date

Apr 15, 2053

US931142EW9

WALMART 22/25Yield to maturity

5.84%

Maturity date

Sep 9, 2025

WMT4117478

Walmart Inc. 4.3% 22-APR-2044Yield to maturity

5.65%

Maturity date

Apr 22, 2044

WMT4055720

Walmart Inc. 4.75% 02-OCT-2043Yield to maturity

5.62%

Maturity date

Oct 2, 2043

See all WALM34 bonds

Curated watchlists where WALM34 is featured.