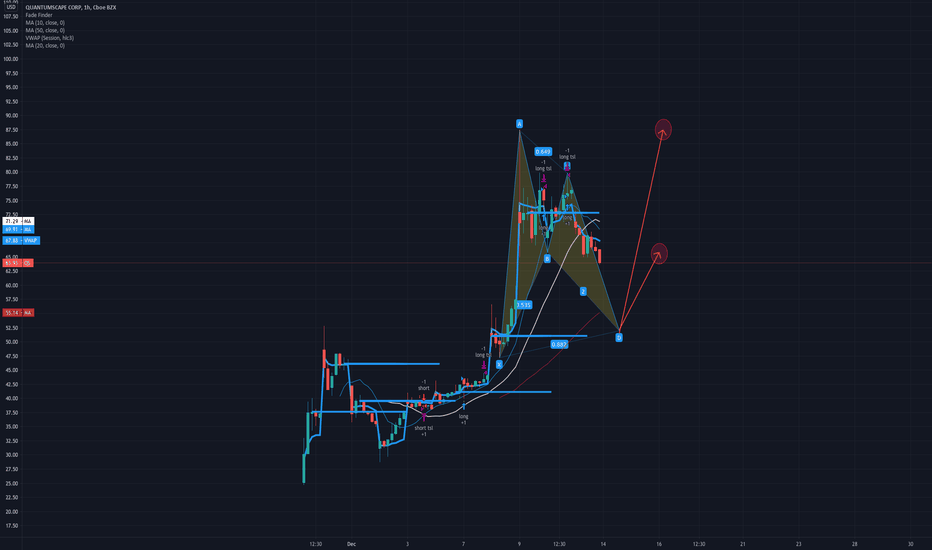

QS trade ideas

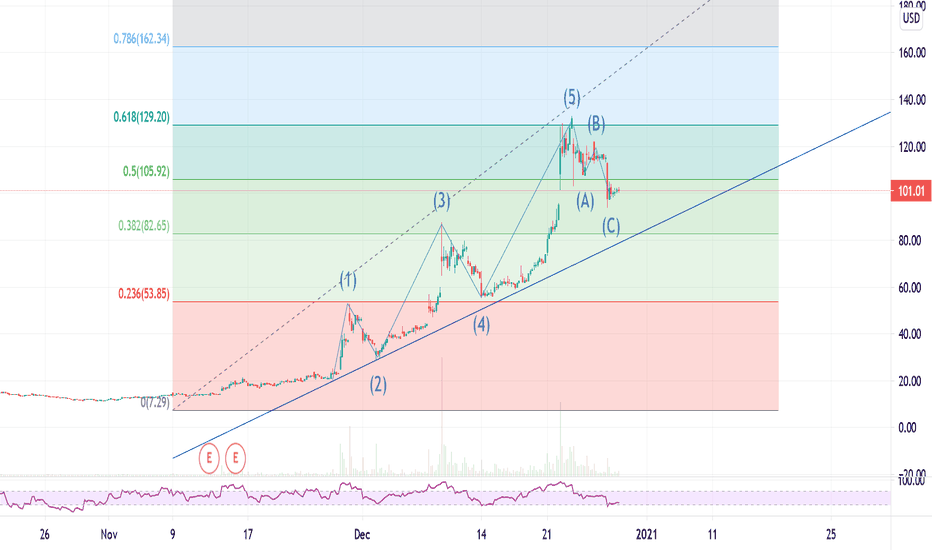

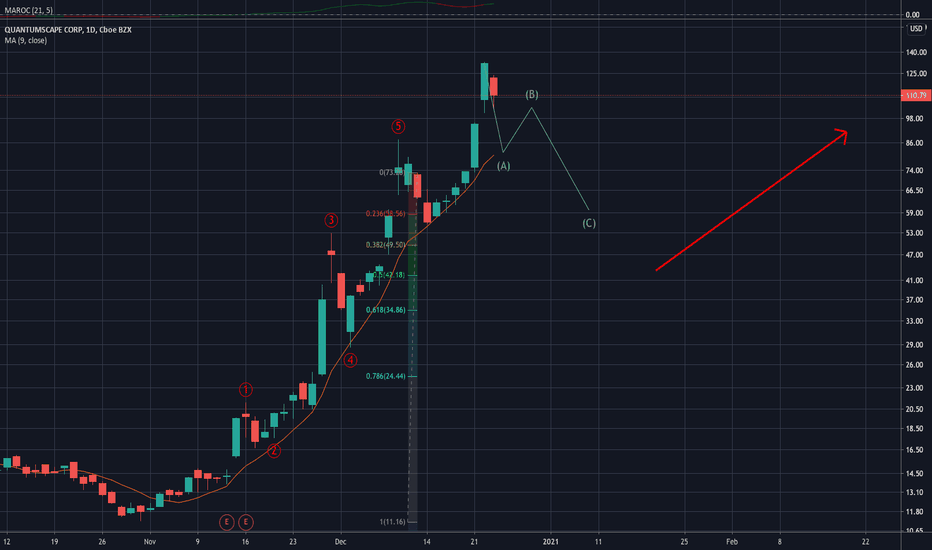

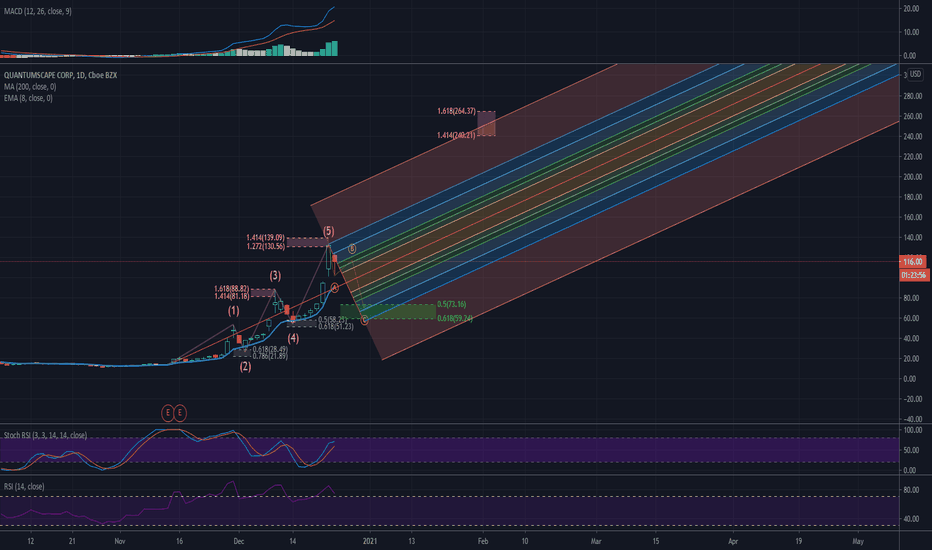

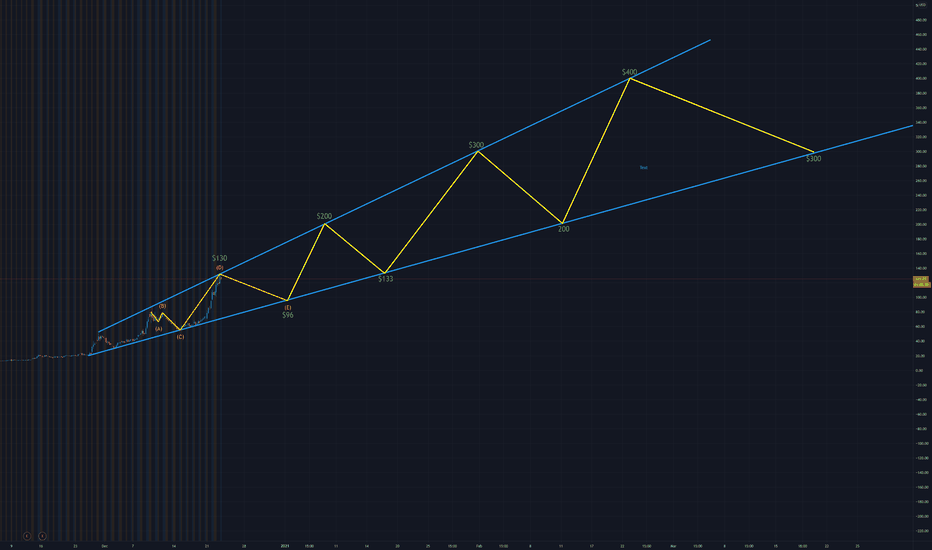

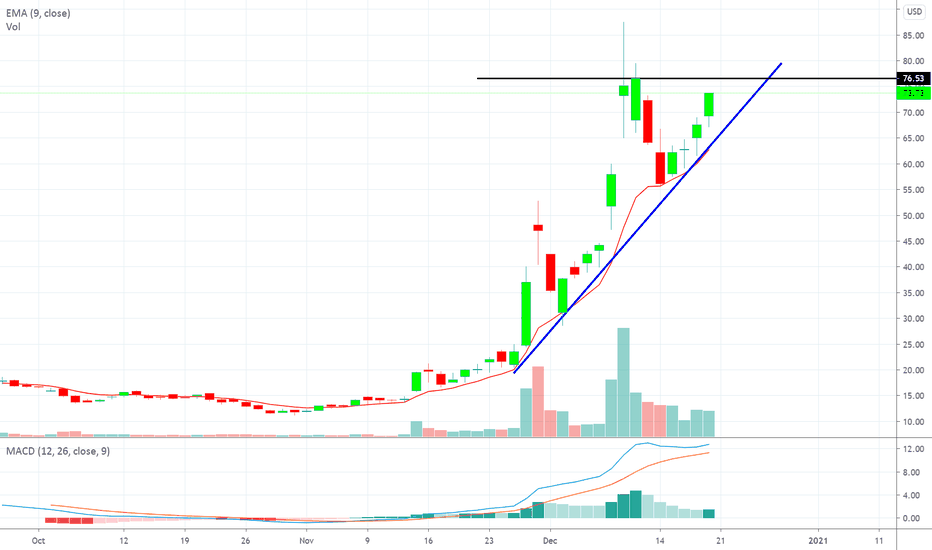

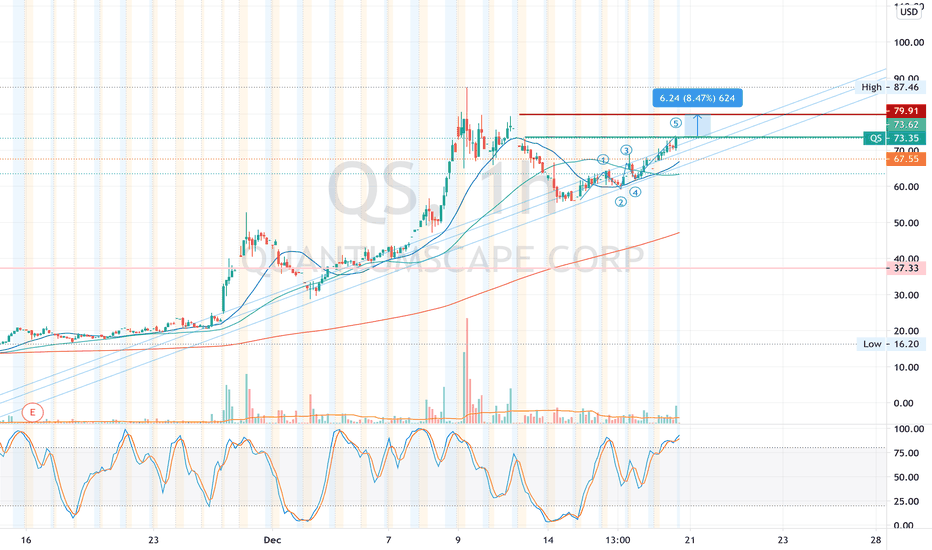

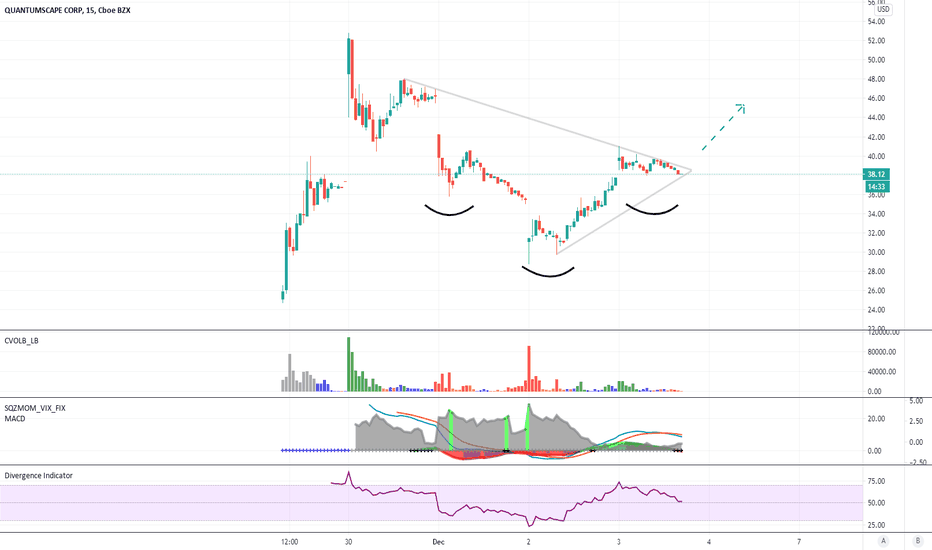

QS Long on Dips QS is on our watchlist as this solid-state battery company released data demonstrating that it’s single-layer batter cell could charge in 15 minutes. QS is also using an electrolyte gel, making it more of a hybrid solution than a pure solid-state battery, at least for the time being. That said investor interest for solid-state hold the promise of energy densities 50-100% higher than those of traditional Lithium Ion batteries. Our research suggest QS is targeting the Electric Vehicle market, look to buy Leaps on QS heading into 2021with dips into 66-58 range.

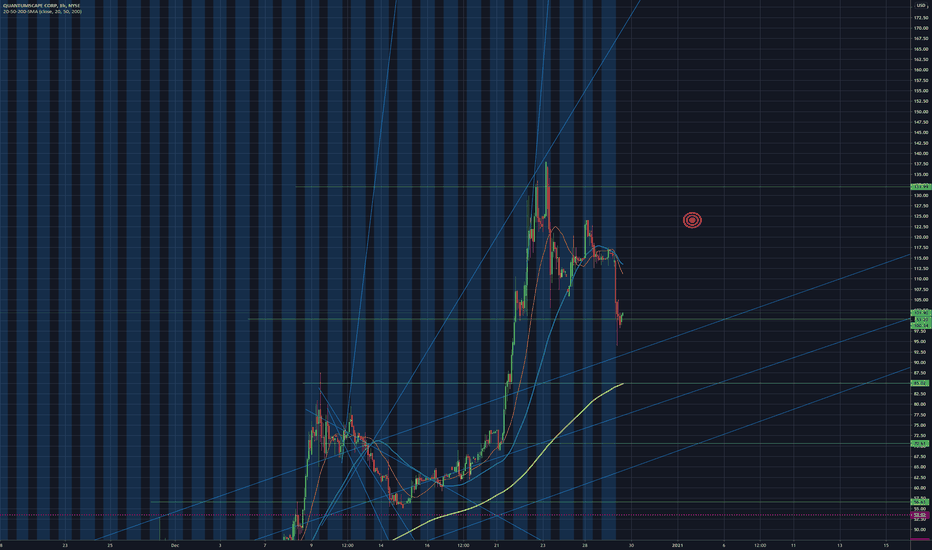

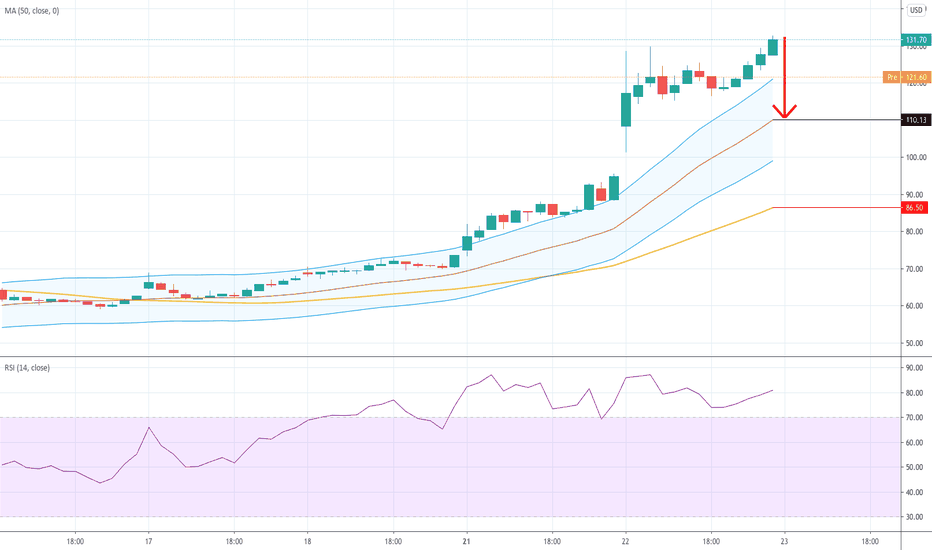

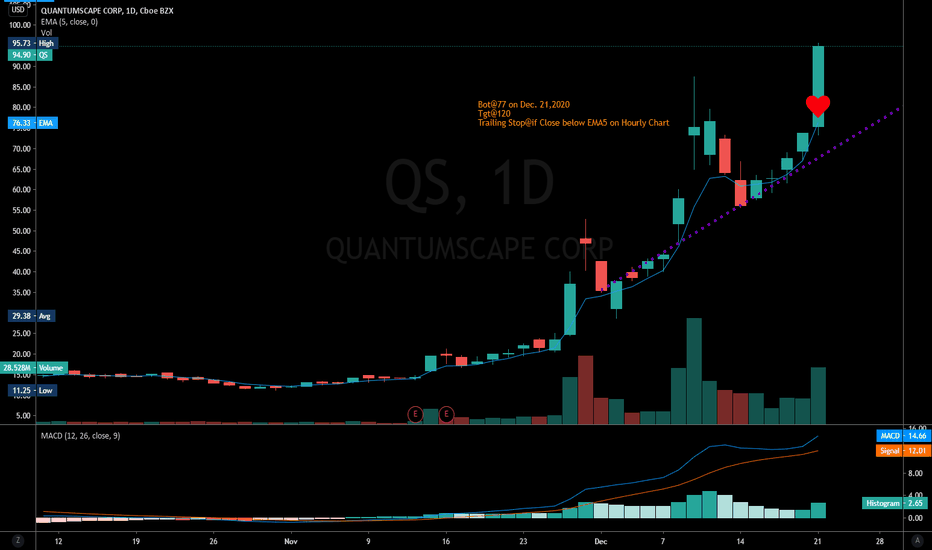

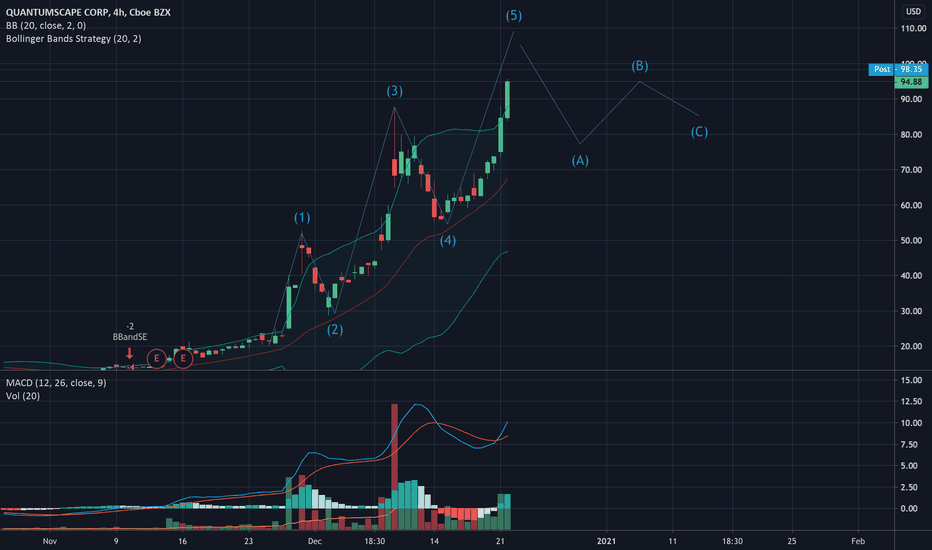

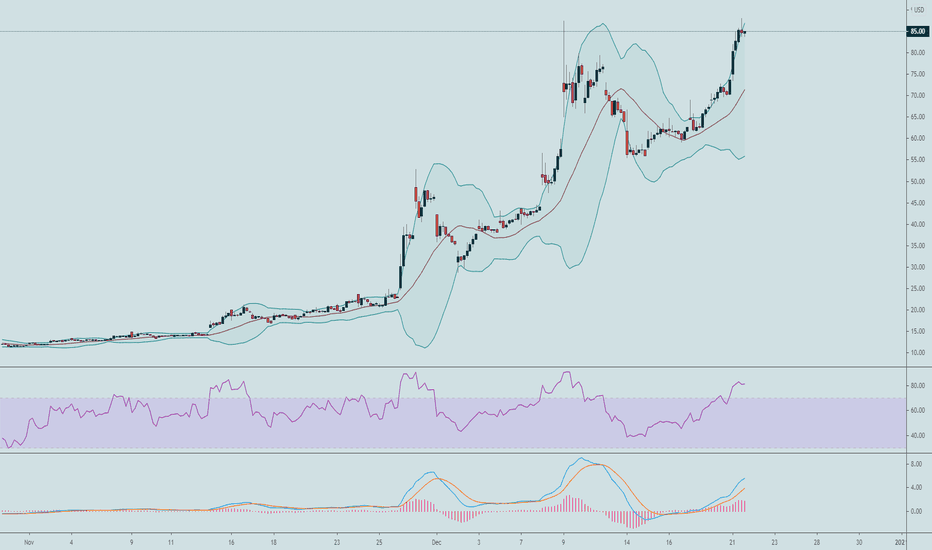

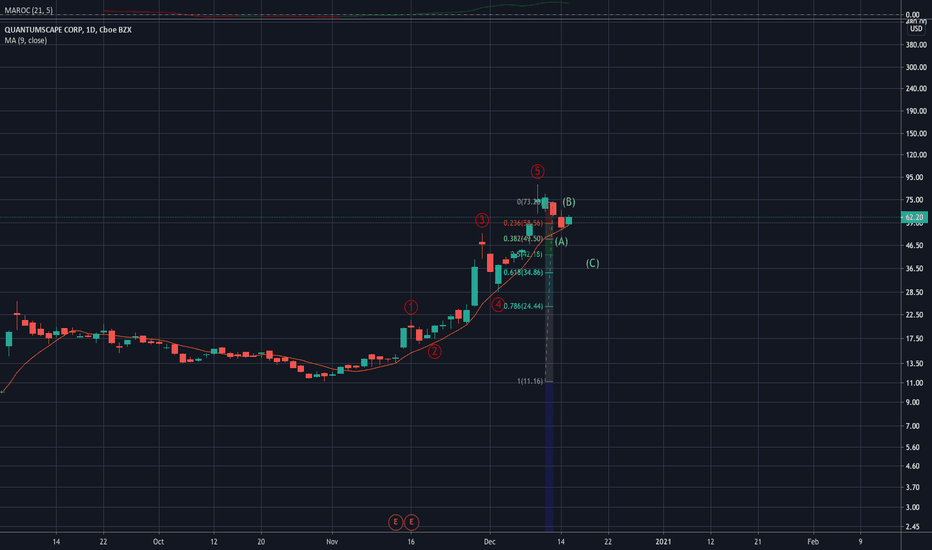

QS shortQS is way overcooked. They are not expecting significant sales until 2027 and they face competition from existing battery producers making their own solid state EV batteries. It could either drop to its 20-day moving average at about $110 or its 50-day moving average at about $86. Either way it will find some sort of support but it is due for a correction. It is trading way outside of a reasonable range.

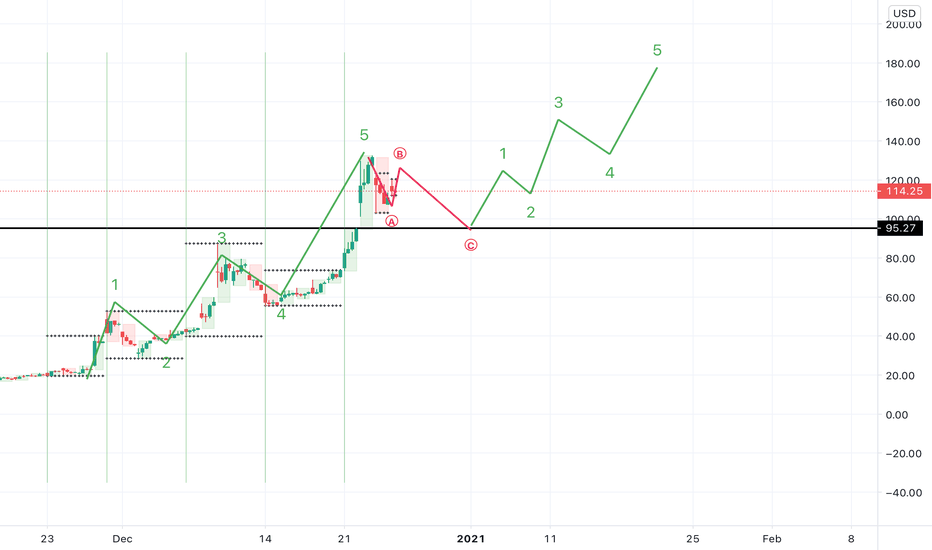

Does a speculator care to explain the 417% gain here?This battery startup is in the right space at the right time. Headlines showcasing an environment that will be opportunistic for powerful moves.

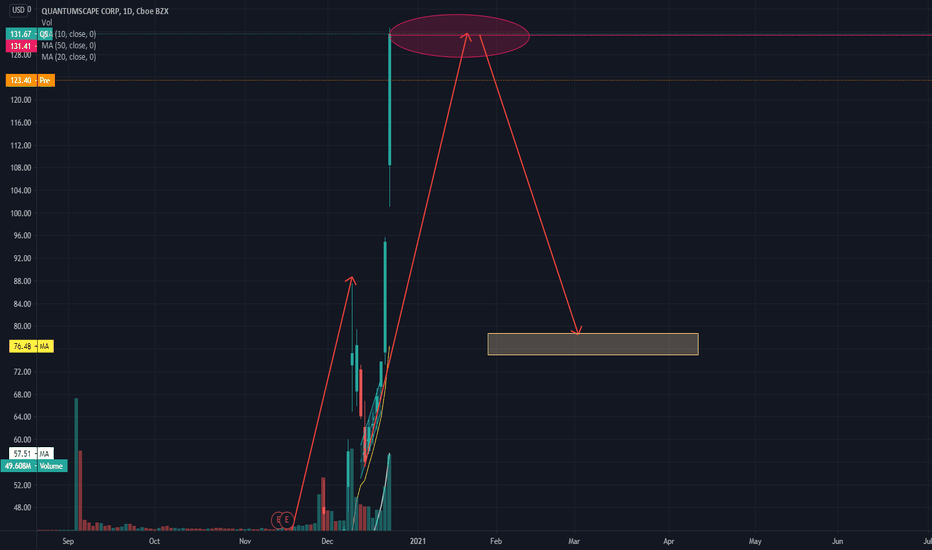

Think about what the market has priced this at? In three months a market cap almost the size of Ford? Seems like risky business to be long here at this staggering price, but who knows maybe they are sitting on some R&D treasure?

Link to Article finance.yahoo.com

Bubble or insane earnings growth potential? Wonder which of these picks will age better...