Options Trading Series (LEAPS – BABA + JD) BABA and JD are two of China's largest and fastest growing e-commerce companies. Due to trade war fears, Chinese stocks have been under heavy selling pressure lately. BABA is down ~20% from its ATH and JD is down ~40%.

On the other hand, both companies are producing outstanding financial results and investing in the future (i.e. Google + WMT announced partnerships with JD; and SBUX + KO announced partnerships with BABA).

In terms of growth, just as an example, BABA's revenue in the March quarter grew 61% YoY; cloud computing revenue grew 103%. JD’s revenue grew by 33% YoY; active customer accounts were up 28% YoY, etc. It's not easy to find companies of this size growing at such an impressive speed. Obviously BABA is a standout, but JD is actually differentiated in many ways – most importantly are the quality of products on the website and the buildout of the logistic network; I think JD wins there (JD, over BABA, is often compared to AMZN in the early days – I think JD is far ahead than where AMZN was at this stage of being a public company).

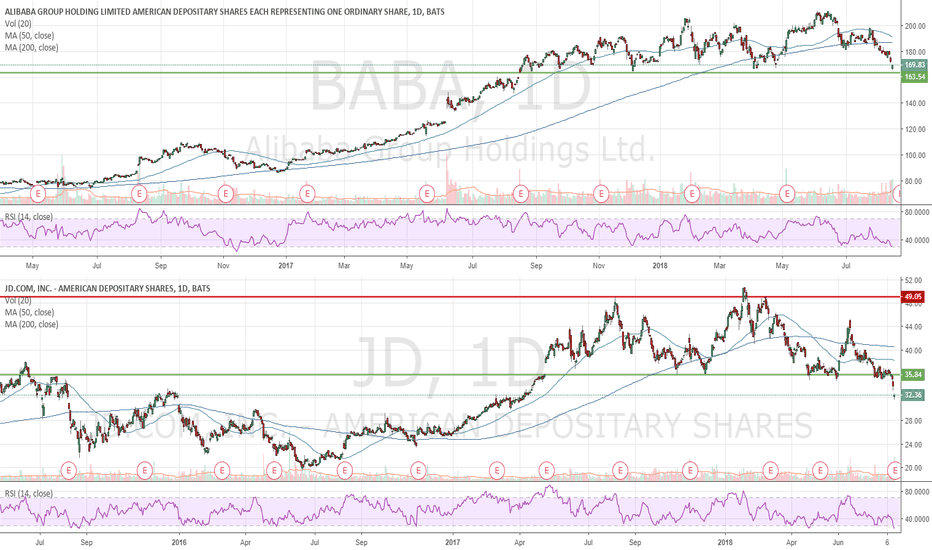

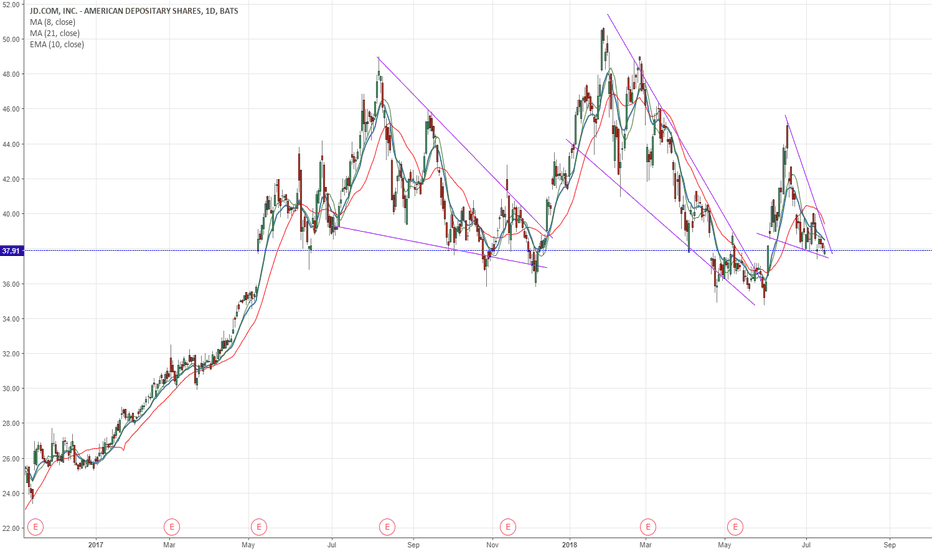

Technical perspective: both names are very oversold.

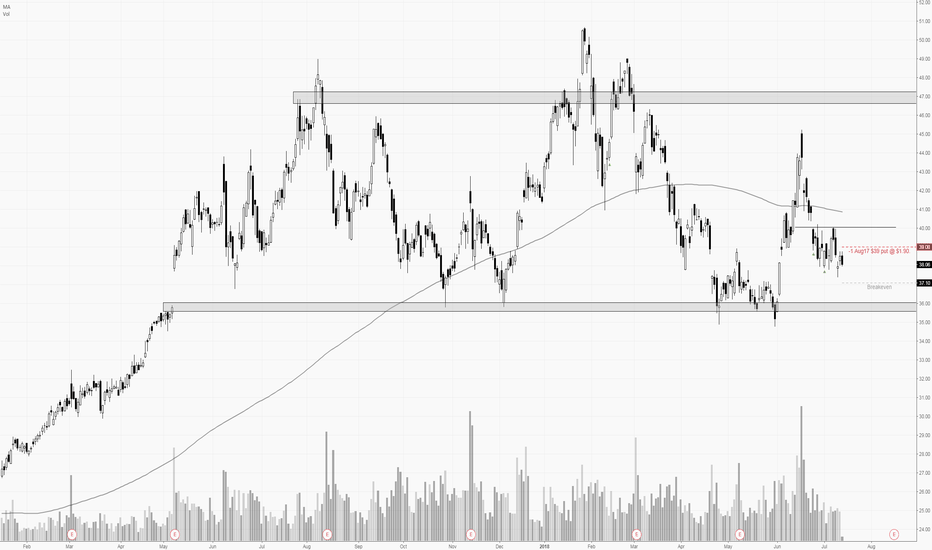

BABA – as you can see shares have traded sideways for about a year: ~$163-$165 has severed as a floor of support. The last time RSI touched 30 was in Dec-17. Shares ran up from $165 and hit $205 before selling off (24% move). I think the stock is set up nicely for another run-up.

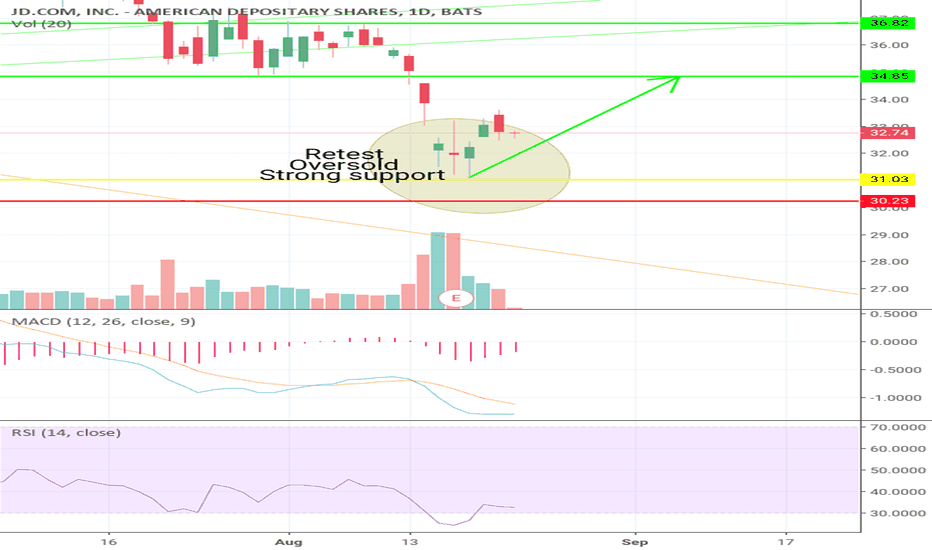

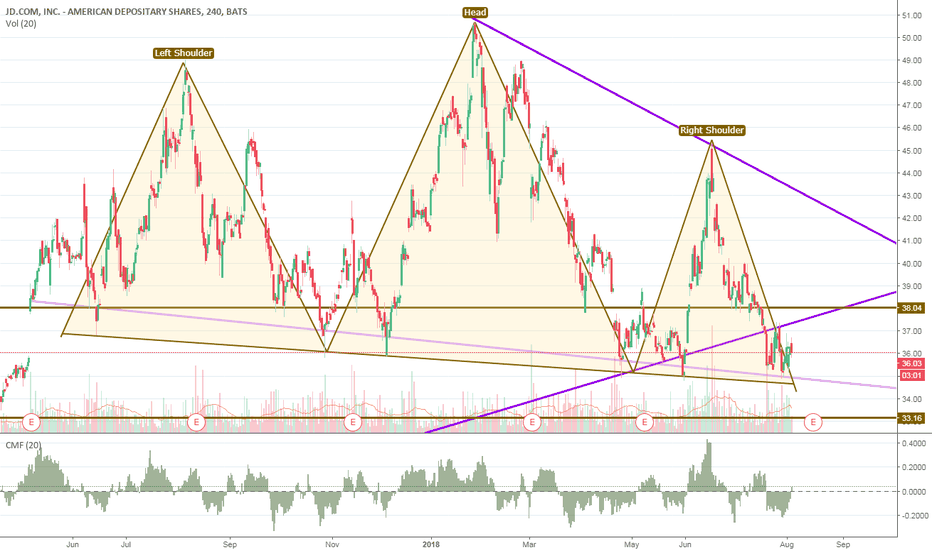

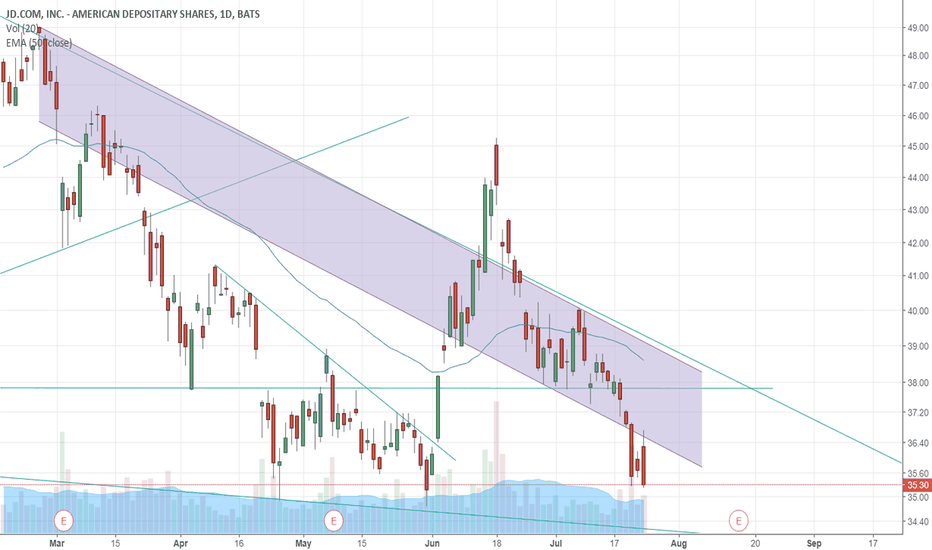

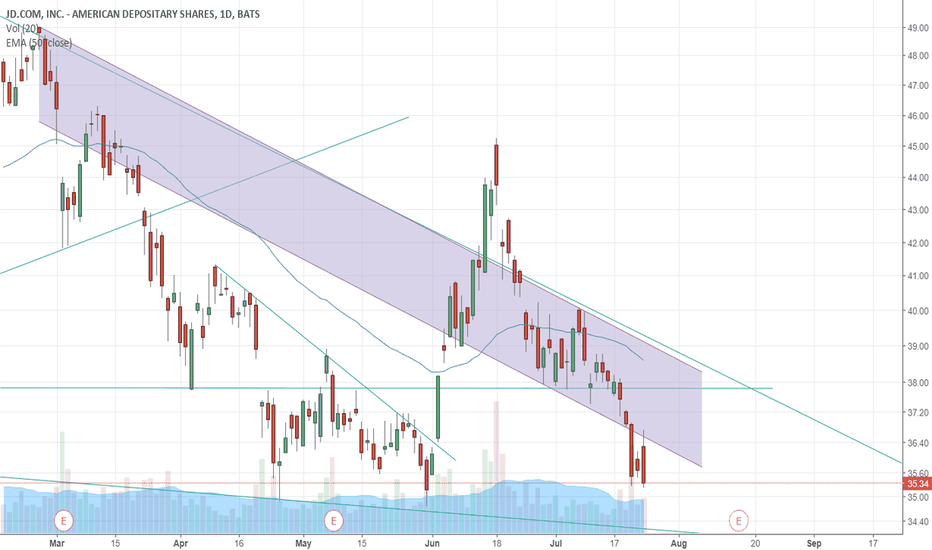

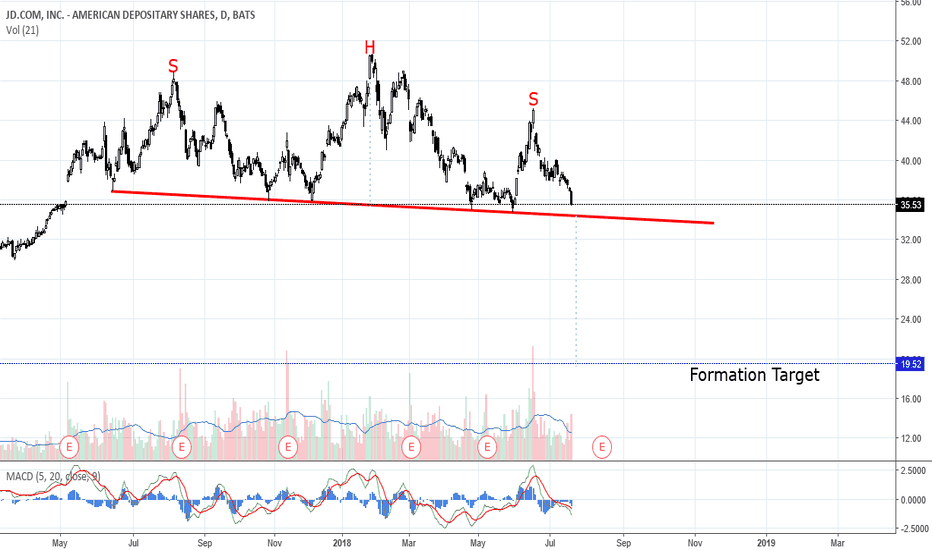

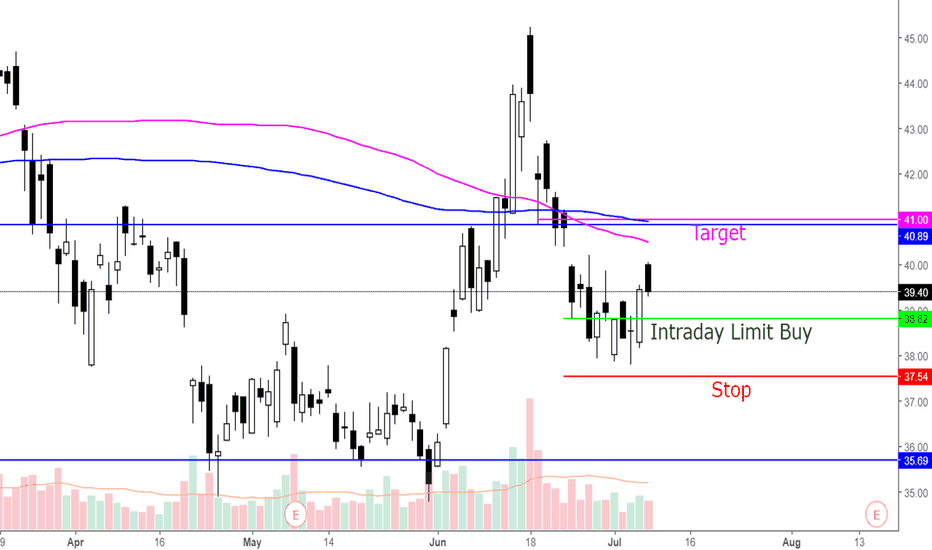

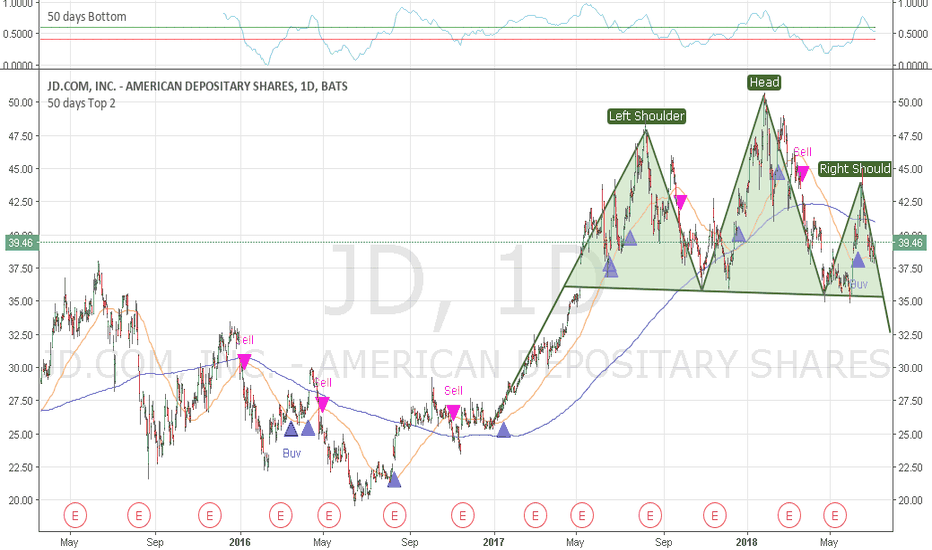

JD - this stock has been a bit of a rollercoaster, hitting at a high of $50 with $35 serving as a floor of support -- which has just broken. The last time RSI hit ~25 was back in April 2018 when shares went from ~$35 to $45 before reversing course (28% move). While I do think there's more risk to this name, I think this stock is also nicely set up for a rebound.

Given the level of risk I see with these China names and not knowing how long the trade war fears will play out / uncertain to the extent of the impact at this point, I decided to do LEAPs in both names. What I will do is trade shorter dated options (both calls/puts) around these “core” positions.

Action: This morning I open both trades:

JD - 1/17/2020 $37 Calls (JD reports tomorrow morning).

BABA – 6/21/19 $180 Calls. (reports next week).

I think trade war fears are overblown and these company very well-positioned for the future. I'd be a buyer here and on any future weakness.

I will post update periodically.

Cheers!

013A trade ideas

JD thoughtsI feel this company has a good future and agree with their focus on expanding their logistics to bring better services to their clients. Without a good logistics group the system will fall apart. I would be looking for a similar pattern of a double bottom it had from April to Early June. Could last a bit longer this time as earnings are set for sometime in November.

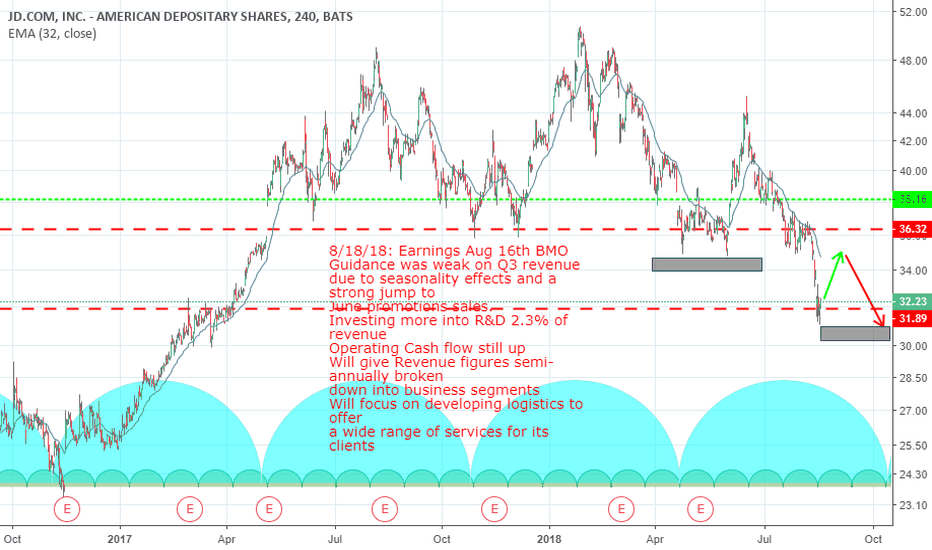

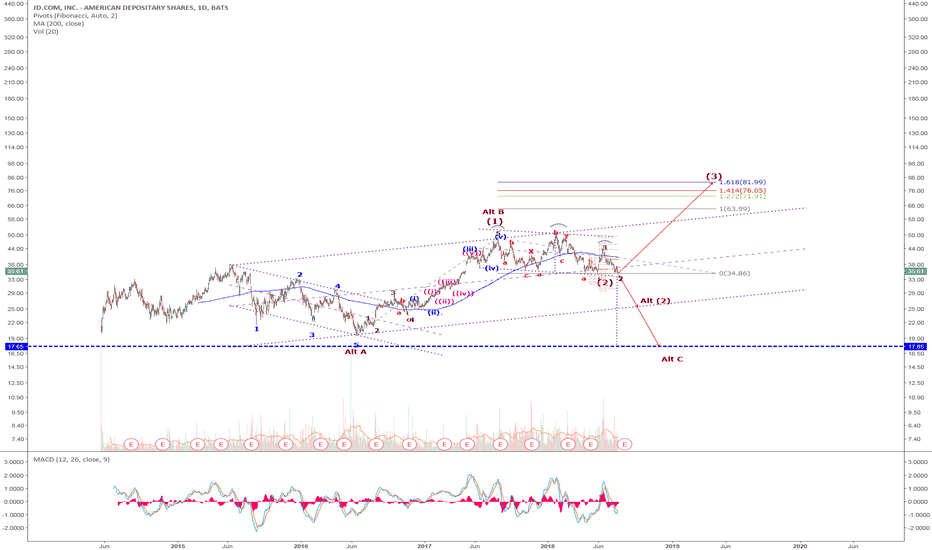

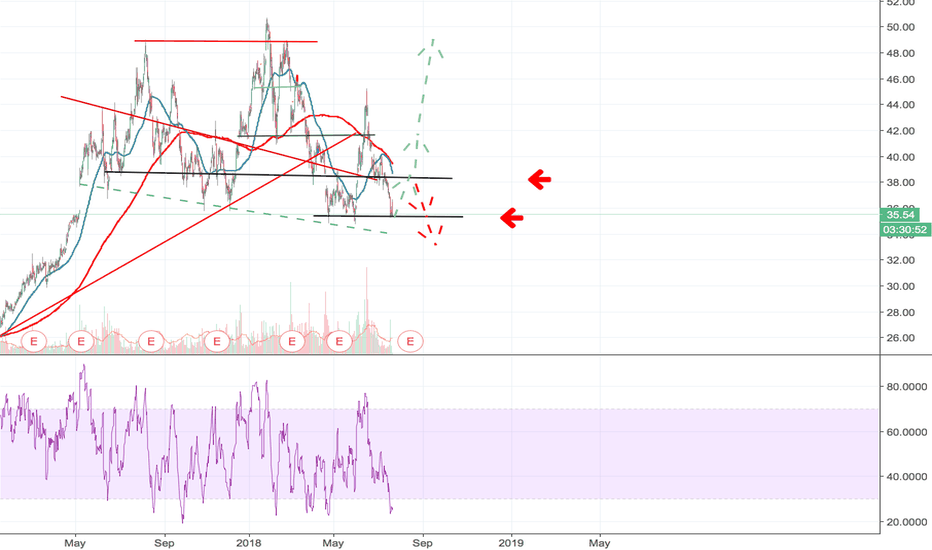

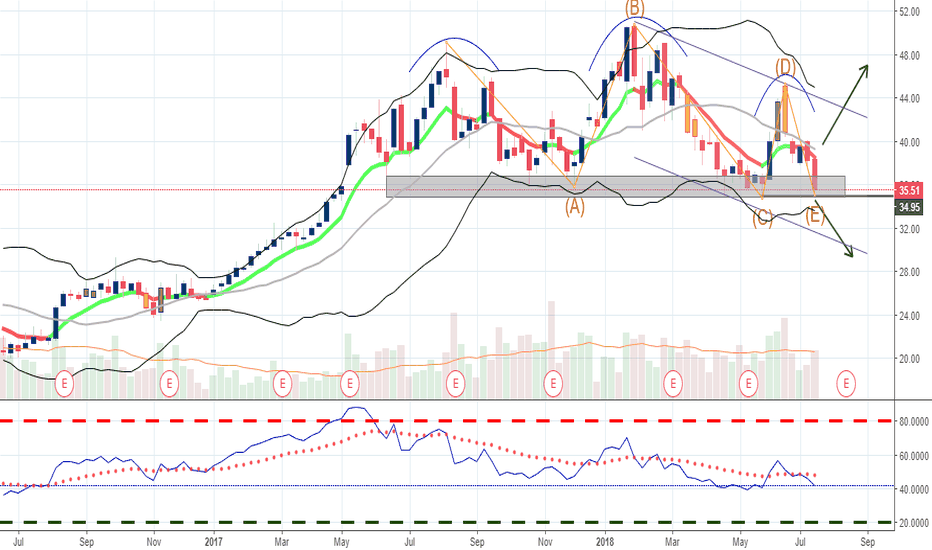

JD.com - The sky is not fallingThe image of several charts related to China's companies has turned quite ugly lately.

I was reading some articles concerning China, JD.com and looking also at Investors' comments as to several China stocks.

Although equity markets became cloudy lately, looking at JD.com I do not see the sky falling.

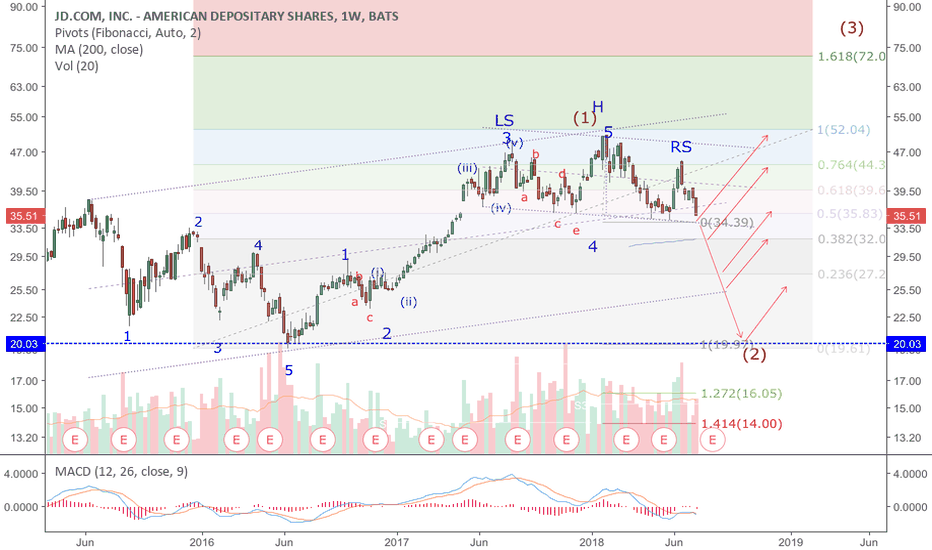

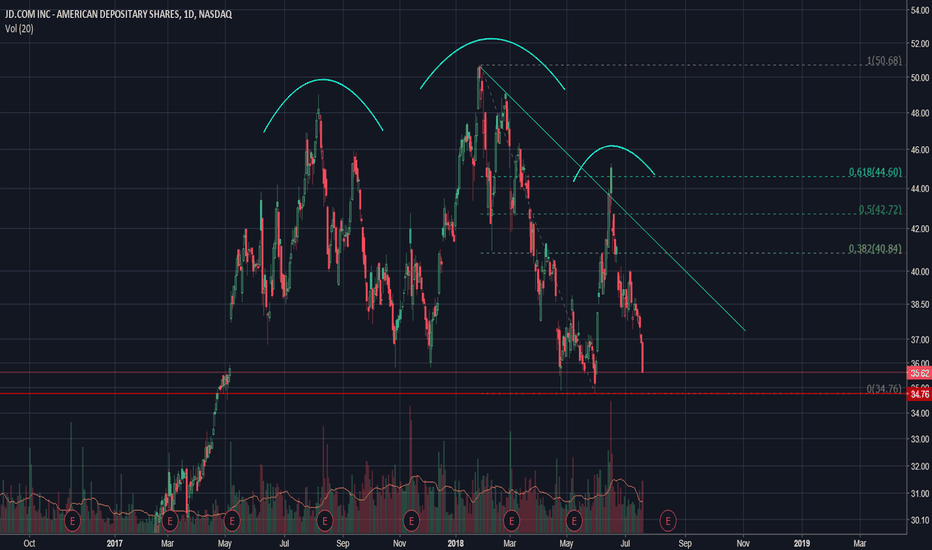

According to my calculations we had the first phase of uptrend (in 5 Waves) and we are now at the final stages of the move down (in 3 Waves).

As soon as C ends - we are not far away from that level - I believe that JD.com will start a new and very important phase of uptrend.

I have as target $60+ for this phase, then a 4th down and a 5th phase up which will be higher (I did not have enough space to place it).

But for now let's focus at the end of II with the C and then there will be time to discuss the $60+ target.

The C will most probably end just above or at the yellow rectangle.

Once there is confirmation of the new phase up, I will update the analysis.

What to do: the simple way is to gradually accumulate stocks of JD.com, a really excellent company.

Now that there is fear for China stocks, the period seems interesting.

Another possibility that I am thinking, is to start picking as of today some Call options Val. Dec 2018, Strike price $33 ($2.30 at this moment)

be “Fearful when others are greedy and greedy when others are fearful.” as the Great WB once said.

JD - JD.comEarnings coming up soon and I like JD overall. Low part of the range after a great 2017.

I went with a synthetic covered call, selling the Aug17 $39 put for $1.90 cr. This trade is around a 5% cash ROC within the next 35 days.

I'll go for 50% W or continue rolling this position out, collecting credit through time.

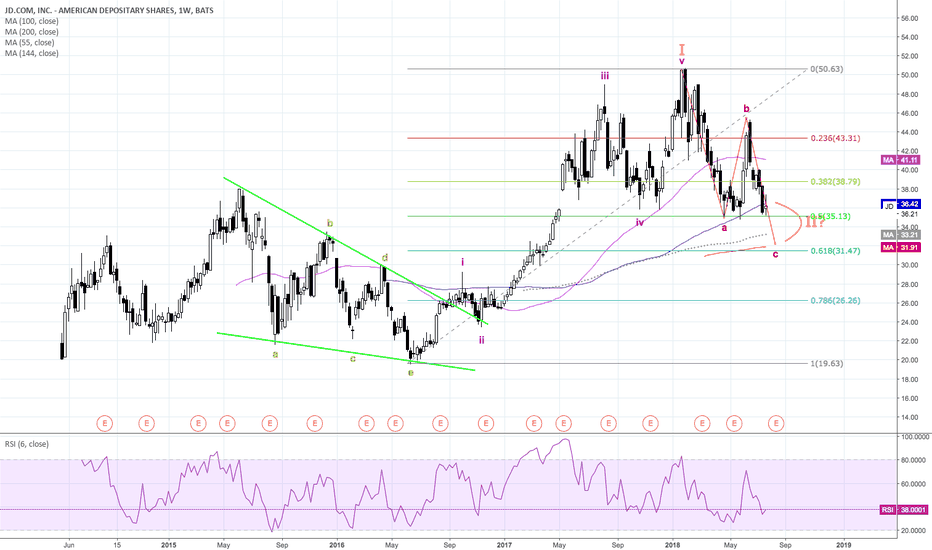

JD-5 possibilitiesJD- a rather long drawn out retracement. A closer analysis revealed a few more possibilities. The most positive and immediate target is a 50% retracement which is also the bottom rail support of the down channel.

Next is the 61.8%, followed by the 76.4%, and then the bottom rail support of the up channel. The final possibility is the target of the HnS which is at about 99% retracement which is still within the rules.