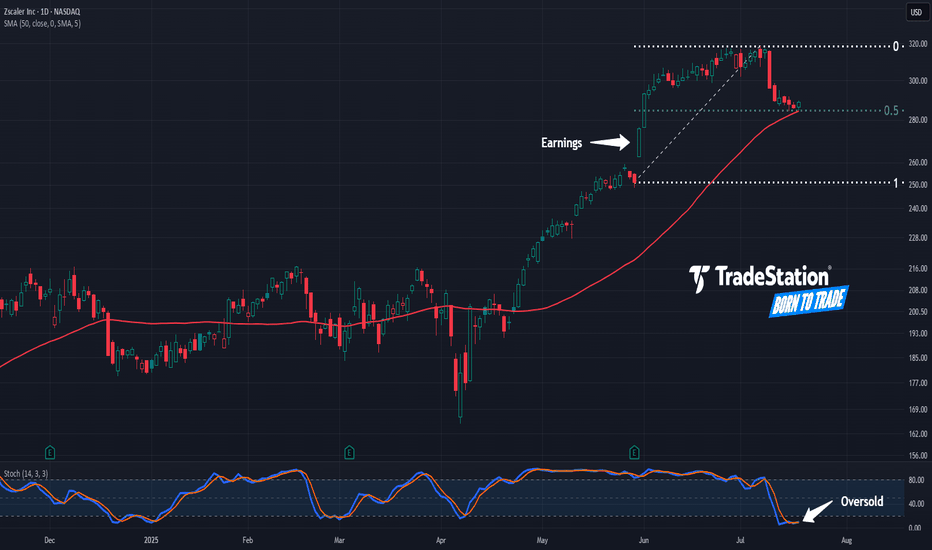

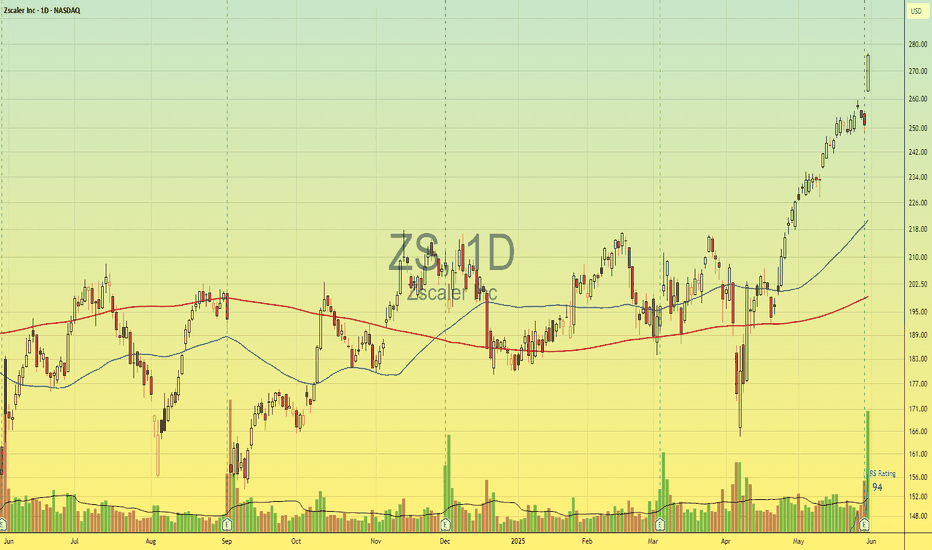

Zscaler May Be OversoldZscaler recently climbed to a three-year high, and now it’s pulled back.

The first pattern on today’s chart is the May 30 gap after earnings and revenue beat estimates. That may reflect positive fundamentals.

Second, the cybersecurity stock has retraced half the move following results. Stabilizing

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.210 CHF

−50.72 M CHF

1.91 B CHF

97.04 M

About Zscaler Inc

Sector

Industry

CEO

Jagtar Singh Chaudhry

Website

Headquarters

San Jose

Founded

2007

FIGI

BBG0156DM7R3

Zscaler, Inc. engages in the provision of a cloud-based internet security platform. It offers Zero Trust Exchange, Zscaler Client Connector, Zscaler Internet Access, Zscaler Private Access, Zscaler B2B, Zscaler Cloud Protection, and Zscaler Digital Experience. The company was founded by Jagtar Singh Chaudhry and K. Kailash in September 2007 and is headquartered in San Jose, CA.

Related stocks

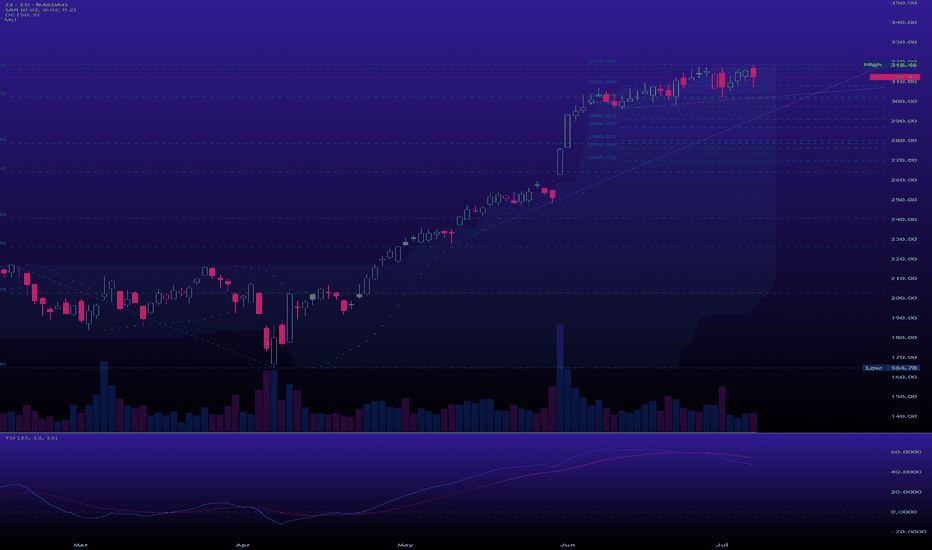

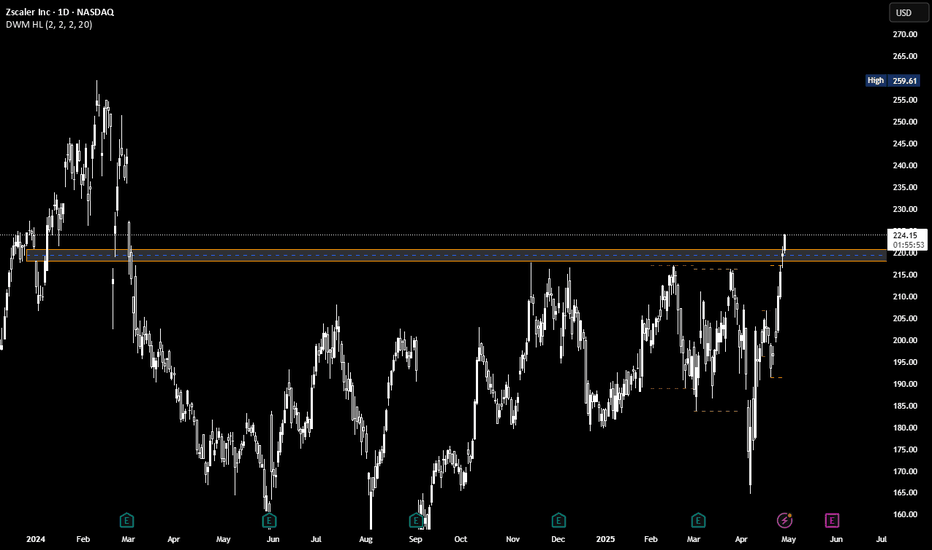

ZS is starting the early sign of the Wyckoff distribution phaseMarkup (Phase E) that has been going on for months. But look closer. The momentum is getting tired. The daily chart is where the truth comes out. After that magnificent run, the price has stalled and started moving sideways for a month.

Entry Level: Initiate a trade if ZS rallies to the $325 - $32

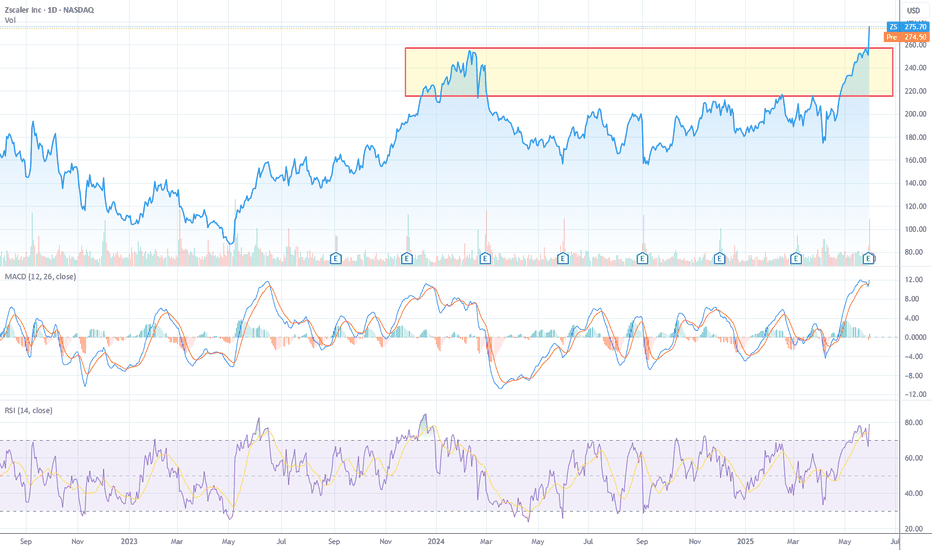

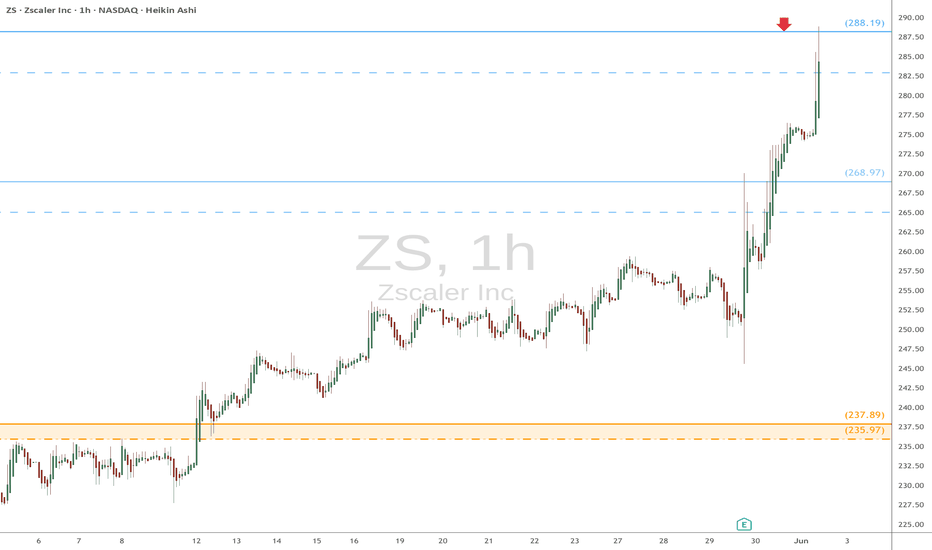

ZS - Breakout Confirmed — Now What?Zscaler has broken out of a year-long ceiling with volume and momentum — as long as it holds above $275, the trend has shifted bullish and targets $310+ are now in play.

1. Structural Breakout

That resistance zone capped price for over a year — multiple failed attempts, including the November–Dece

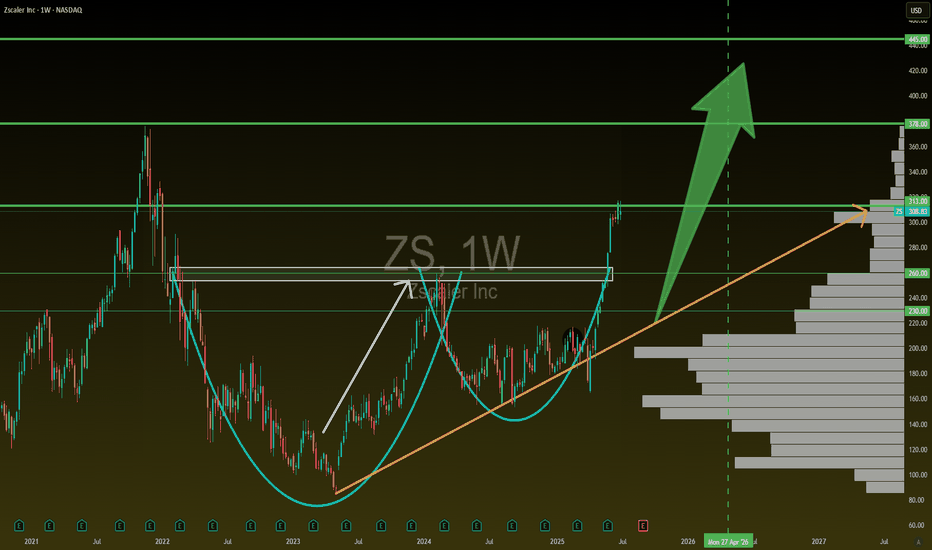

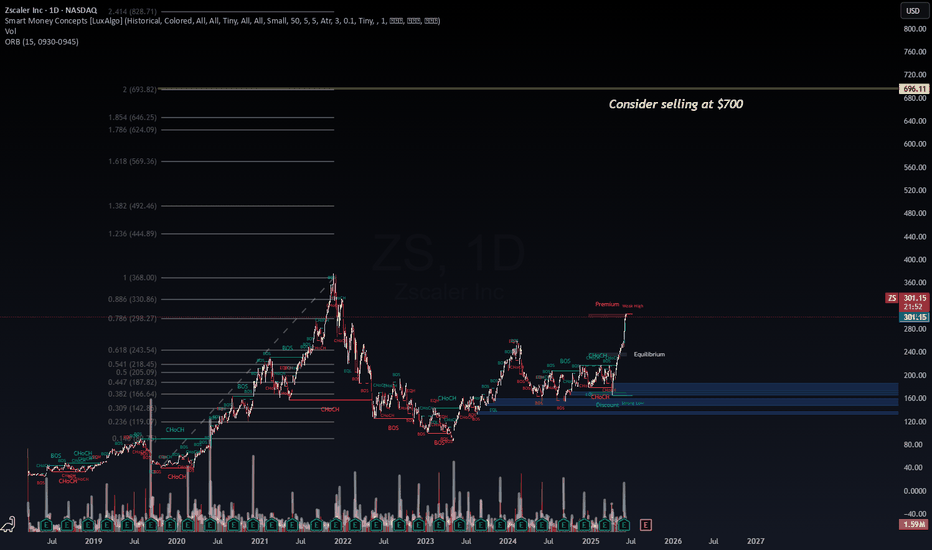

Zscaler Inc. (ZS) – Multi-Year Breakout with Target at $700📅 1D Chart | Smart Money Concepts | Fibonacci Extensions | Volume Profile

Price: $301.19 | Volume: 1.59M

ZS has officially broken through its prior consolidation structure and is now trading firmly in premium territory. With the 0.786 Fib level at $298.27 now reclaimed, momentum traders are eyeing

Attempting a break above the resistance NASDAQ:ZS is looking at a potential break to the upside after the stock has crossed above all ichimoku indicators. Additionally, long-term MACD is showing a constant steady flow of upside momentum. Beside that, mid-term stochastic has rebounded above the 20-oversold line with %K and %D crosses, ris

$270 Target by June 20thThe Cyber Security space is one I anticipate to gain a lot of traction this year due to current economic environment. NASDAQ:CRWD Is already trading at a premium even though the market has had a downturn recently. NASDAQ:ZS is the only ticker comparable to it in terms of fundamental strength. I

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 0ZC is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 0ZC is 249.229 CHF — it has increased by 1.31% in the past 24 hours. Watch ZSCALER INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange ZSCALER INC stocks are traded under the ticker 0ZC.

We've gathered analysts' opinions on ZSCALER INC future price: according to them, 0ZC price has a max estimate of 306.11 CHF and a min estimate of 170.94 CHF. Watch 0ZC chart and read a more detailed ZSCALER INC stock forecast: see what analysts think of ZSCALER INC and suggest that you do with its stocks.

0ZC stock is 1.29% volatile and has beta coefficient of 1.80. Track ZSCALER INC stock price on the chart and check out the list of the most volatile stocks — is ZSCALER INC there?

Today ZSCALER INC has the market capitalization of 36.21 B, it has increased by 0.35% over the last week.

Yes, you can track ZSCALER INC financials in yearly and quarterly reports right on TradingView.

ZSCALER INC is going to release the next earnings report on Sep 4, 2025. Keep track of upcoming events with our Earnings Calendar.

0ZC earnings for the last quarter are 0.70 CHF per share, whereas the estimation was 0.62 CHF resulting in a 11.64% surprise. The estimated earnings for the next quarter are 0.64 CHF per share. See more details about ZSCALER INC earnings.

ZSCALER INC revenue for the last quarter amounts to 561.24 M CHF, despite the estimated figure of 551.66 M CHF. In the next quarter, revenue is expected to reach 569.43 M CHF.

0ZC net income for the last quarter is −3.41 M CHF, while the quarter before that showed −7.04 M CHF of net income which accounts for 51.51% change. Track more ZSCALER INC financial stats to get the full picture.

No, 0ZC doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 19, 2025, the company has 7.35 K employees. See our rating of the largest employees — is ZSCALER INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ZSCALER INC EBITDA is −4.73 M CHF, and current EBITDA margin is −1.98%. See more stats in ZSCALER INC financial statements.

Like other stocks, 0ZC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ZSCALER INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ZSCALER INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ZSCALER INC stock shows the buy signal. See more of ZSCALER INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.