ILU @ 17 SEP 2021Text me if you have any questions/comments for me.

-----

ILU

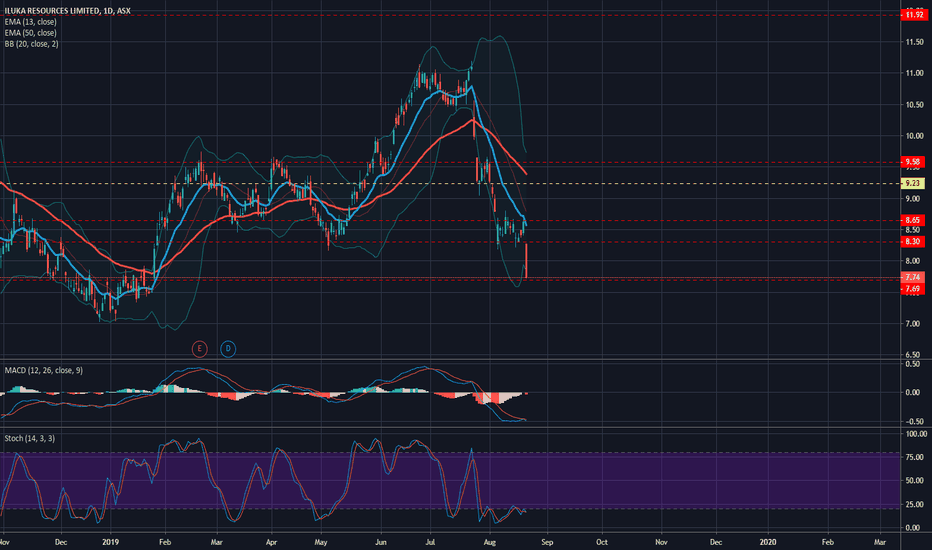

- Previous analysis was done on 14 Sep - Suggested half entry at 10.40 levels (to manage risk) or wait for a retracement and successful rebound

- Since then, the stock has dropped more than 9% to rest at the mid-term support

- As mention

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.304 CHF

129.96 M CHF

657.56 M CHF

399.08 M

About ILUKA RESOURCES LIMITED

Sector

Industry

CEO

Thomas O’Leary

Website

Headquarters

Perth

Founded

1954

ISIN

AU000000ILU1

FIGI

BBG006TLQNV5

Iluka Resources Ltd. engages in the exploration, development, mining, processing, marketing, and rehabilitation of mineral sands products. It operates through the following segments: Jacinth-Ambrosia/Mid West (JA/MW), Cataby/South West (C/SW), Rare Earths (RE), and United States/Murray Basin (US/MB). The JA/MW segment deals with mining operations at Jacinth-Ambrosia located in South Australia, and associated processing operations at the Narngulu mineral separation plant in mid-west Western Australia. The C/SW segment represents mining activities at Cataby and processing of ilmenite at Synthetic Rutile Kilns 1 and 2, located in Western Australia. The RE segment refers to the Eneabba Rare Earths Refinery, which is currently being constructed in Western Australia and associated feasibility studies alongside Phase 1 and 2 of the Eneabba development, and the Group's investment in Northern Minerals Limited. The US/MB segment focuses on rehabilitation obligations in Florida and Virginia, and certain idle assets located in Australia. The company was founded on July 24, 1954 and is headquartered in Perth, Australia.

Related stocks

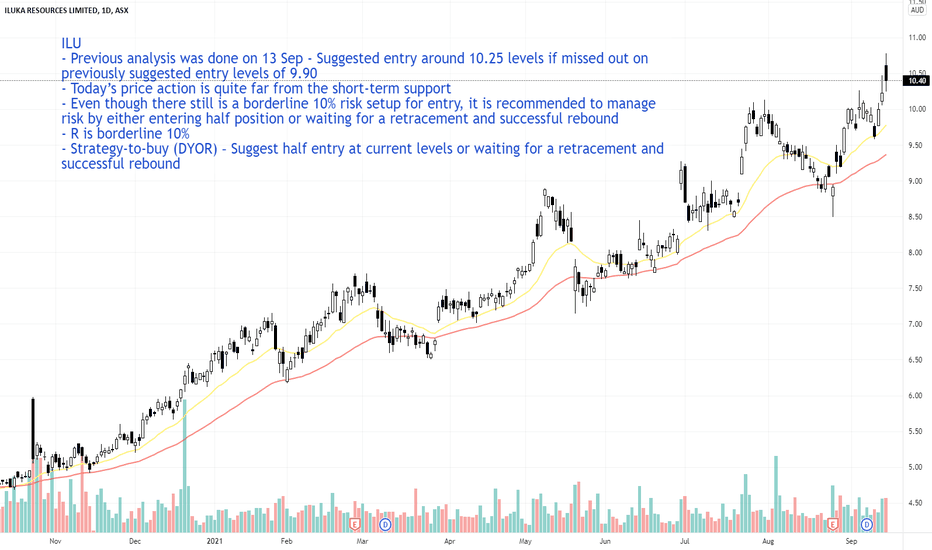

ILU @ 14 SEP 2021ILU

- Previous analysis was done on 13 Sep - Suggested entry around 10.25 levels if missed out on previously suggested entry levels of 9.90

- Today’s price action is quite far from the short-term support

- Even though there still is a borderline 10% risk setup for entry, it is recommended to manage

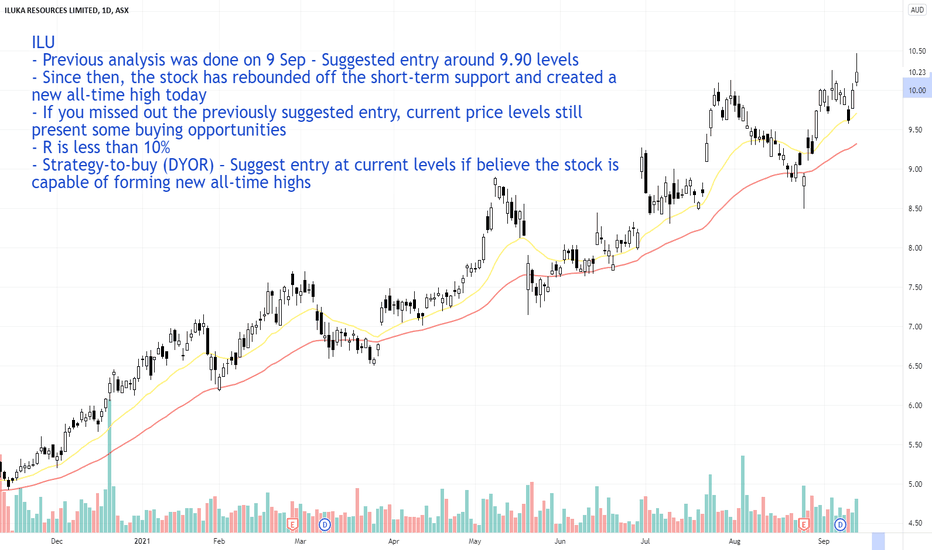

ILU @ 13 SEP 2021ILU

- Previous analysis was done on 9 Sep - Suggested entry around 9.90 levels

- Since then, the stock has rebounded off the short-term support and created a new all-time high today

- If you missed out the previously suggested entry, current price levels still present some buying opportunities

- R i

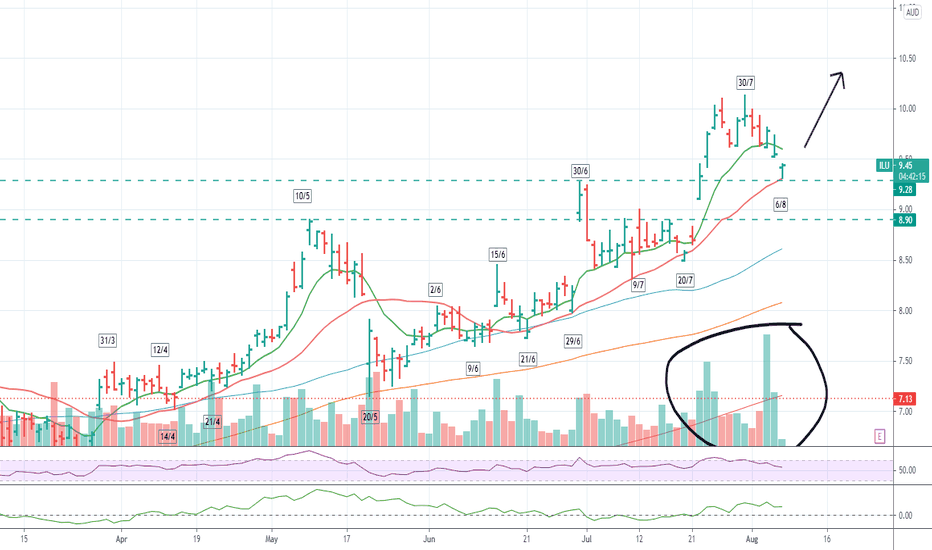

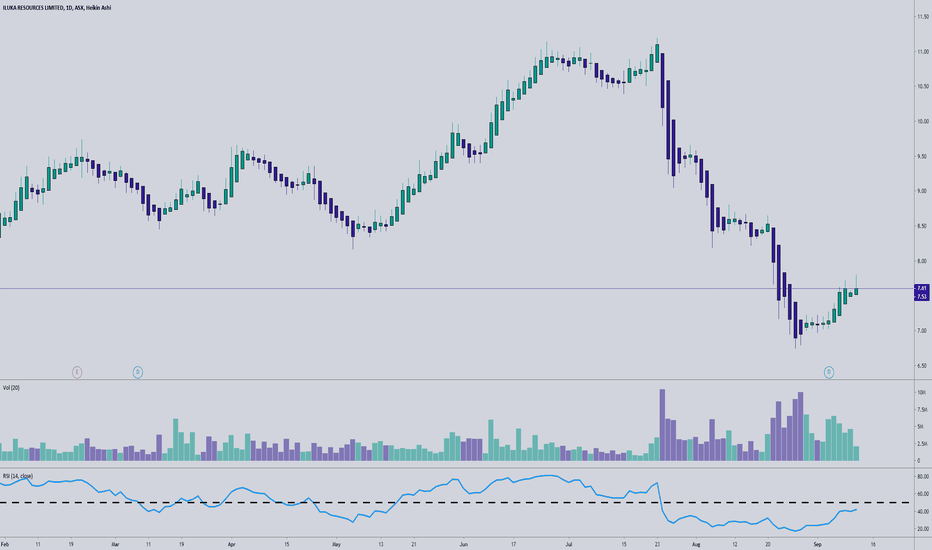

GO LONG ILUKA I have been watching Iluka for a while and i got it at 8.85 previously and it's been going well.

It reached a high on July 30 and has been retracing and today (Aug 6) it is sitting on a support line (previously the top on June 30.

Watch the volume where i have circled. Very good volume coming in

Iluka ResourcesBusiness profile:

Iluka Resources Limited engages in the exploration, project development, mining, processing, marketing, and rehabilitation of mineral sands. The company operates through Jacinth-Ambrosia/Mid West, Cataby/South West, Sierra Rutile, Mining Area C, and United States/Murray Basin segme

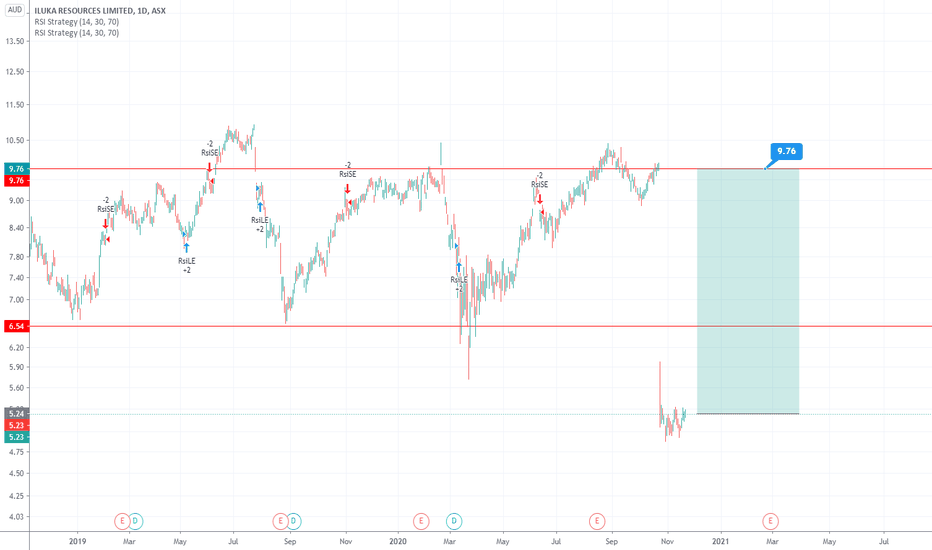

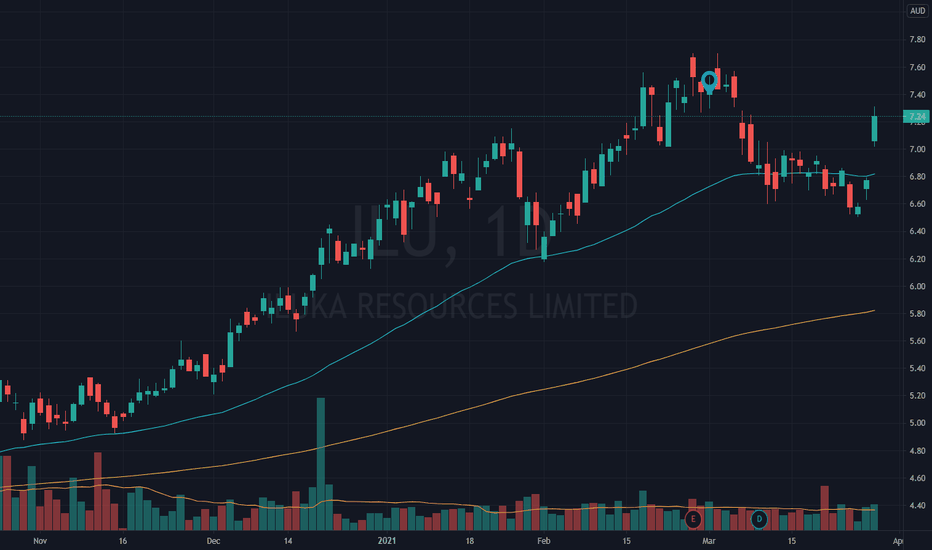

ILU gaps up on good volume. Recent director buys.Iluka gapped up today on good volume after some recent direct buying in March at a higher level around $7.40. This was a good 7% bounce from lows around $7. Mineral sands continues to play a big part in construction and infrastructure building, and no doubt producers will continue to be in demand in

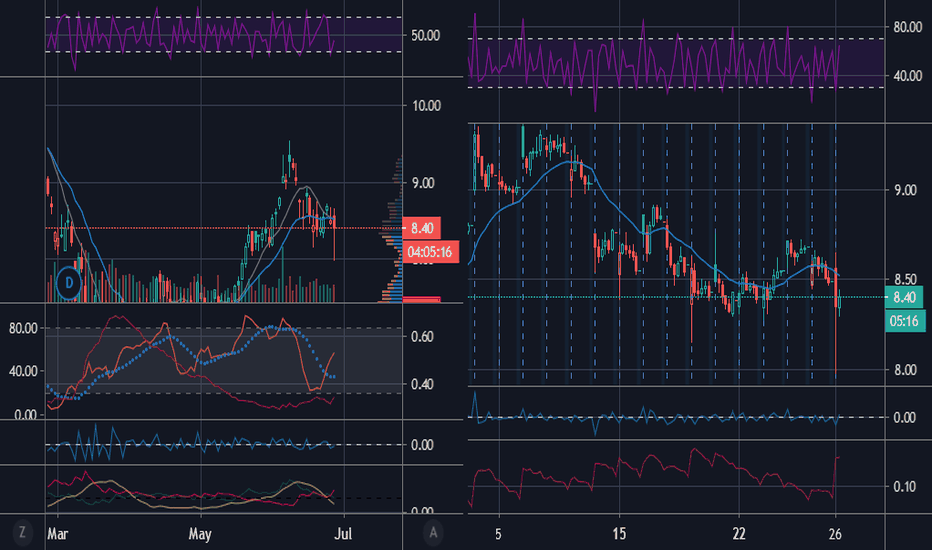

Short ILU Before the market I was looking at ILU for a short, reason is that it hit 13 ema confirming a downward trend. with the weekly chart confirming a bearish move as well. i enter this trade on the 5 min and might hold it for couple of days, but it might bounce back tomorrow. keep an eye on it.

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ILZ is 2.509 CHF — it has decreased by −64.38% in the past 24 hours. Watch ILUKA RESOURCES stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange ILUKA RESOURCES stocks are traded under the ticker ILZ.

ILZ stock has fallen by −64.38% compared to the previous week, the month change is a −64.38% fall, over the last year ILUKA RESOURCES has showed a −64.38% decrease.

We've gathered analysts' opinions on ILUKA RESOURCES future price: according to them, ILZ price has a max estimate of 3.40 CHF and a min estimate of 2.35 CHF. Watch ILZ chart and read a more detailed ILUKA RESOURCES stock forecast: see what analysts think of ILUKA RESOURCES and suggest that you do with its stocks.

ILZ stock is 180.71% volatile and has beta coefficient of 1.50. Track ILUKA RESOURCES stock price on the chart and check out the list of the most volatile stocks — is ILUKA RESOURCES there?

Today ILUKA RESOURCES has the market capitalization of 1.18 B, it has increased by 31.02% over the last week.

Yes, you can track ILUKA RESOURCES financials in yearly and quarterly reports right on TradingView.

ILUKA RESOURCES is going to release the next earnings report on Aug 26, 2025. Keep track of upcoming events with our Earnings Calendar.

ILZ earnings for the last half-year are 0.13 CHF per share, whereas the estimation was 0.11 CHF, resulting in a 19.30% surprise. The estimated earnings for the next half-year are 0.08 CHF per share. See more details about ILUKA RESOURCES earnings.

ILUKA RESOURCES revenue for the last half-year amounts to 293.47 M CHF, despite the estimated figure of 293.30 M CHF. In the next half-year revenue is expected to reach 306.66 M CHF.

ILZ net income for the last half-year is 54.84 M CHF, while the previous report showed 80.13 M CHF of net income which accounts for −31.56% change. Track more ILUKA RESOURCES financial stats to get the full picture.

ILUKA RESOURCES dividend yield was 1.58% in 2024, and payout ratio reached 14.78%. The year before the numbers were 1.06% and 8.70% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 20, 2025, the company has 971 employees. See our rating of the largest employees — is ILUKA RESOURCES on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ILUKA RESOURCES EBITDA is 283.58 M CHF, and current EBITDA margin is 43.13%. See more stats in ILUKA RESOURCES financial statements.

Like other stocks, ILZ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ILUKA RESOURCES stock right from TradingView charts — choose your broker and connect to your account.