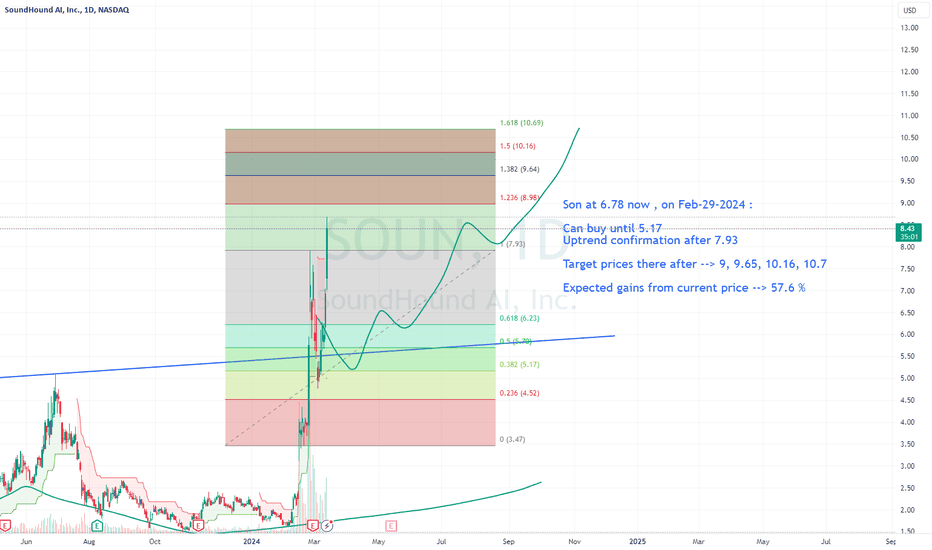

How to Trade $SOUNSurpassing the trendline at around 5.5, SOUN has created a trend, from 3.47 and started retracing from 7.93.

So, it was a goodbuy on dips of few quantity at 6.23, 5.7, 5.17 and then to hold for this to cross 7.93 as the confirmation level towards 10.69.

FYI, i have invested and holding for seeing full targets achieved.

SOUN trade ideas

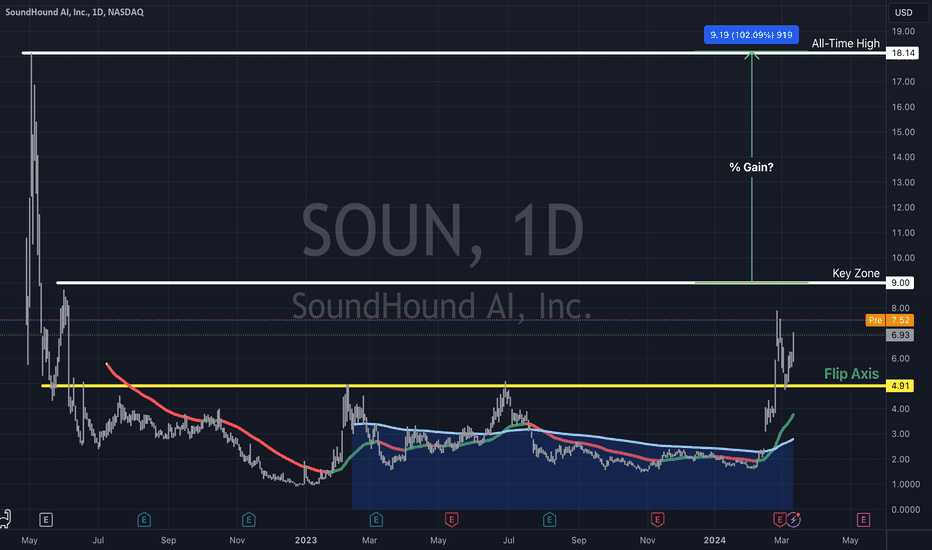

SoundHound AI $SOUN - Artificial Intelligence is on the rise!SoundHound AI - Everybody is talking about Artificial Intelligence (AI). The social media buzz is all about AI. The world is asking questions like: What are the possibilities? How far will AI go in its reach into day-to-day society? Meanwhile, AI stocks like NASDAQ:SOUN are becoming more and more popular. If SoundHound's stock price makes it to the $9.00 key zone, it will be 100% away from the all-time high. Can the media buzz propel SoundHound AI to new heights?

(NASDAQ:NVDA) Invest in (NASDAQ:SOUN),SOUN stock witnessed a notable increase after Nvidia (NASDAQ:NVDA) disclosed a stake in the company.

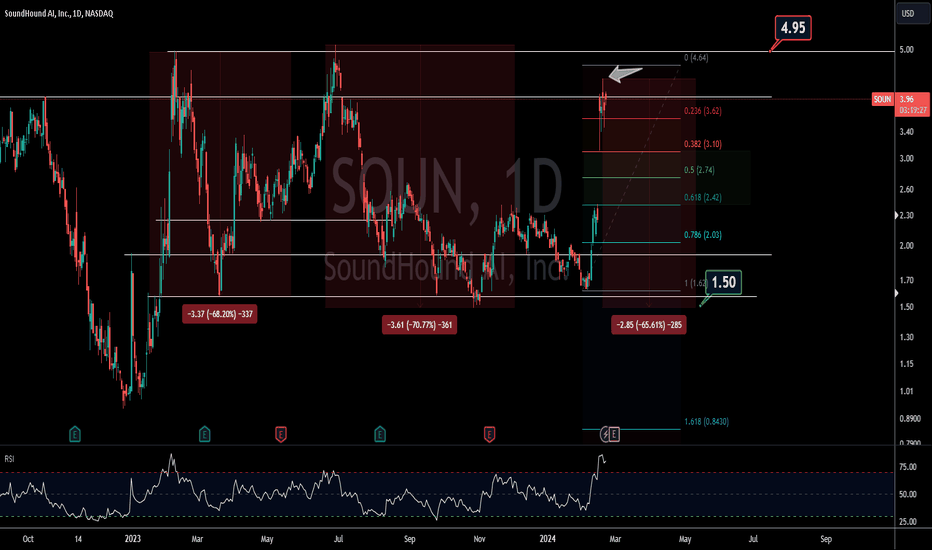

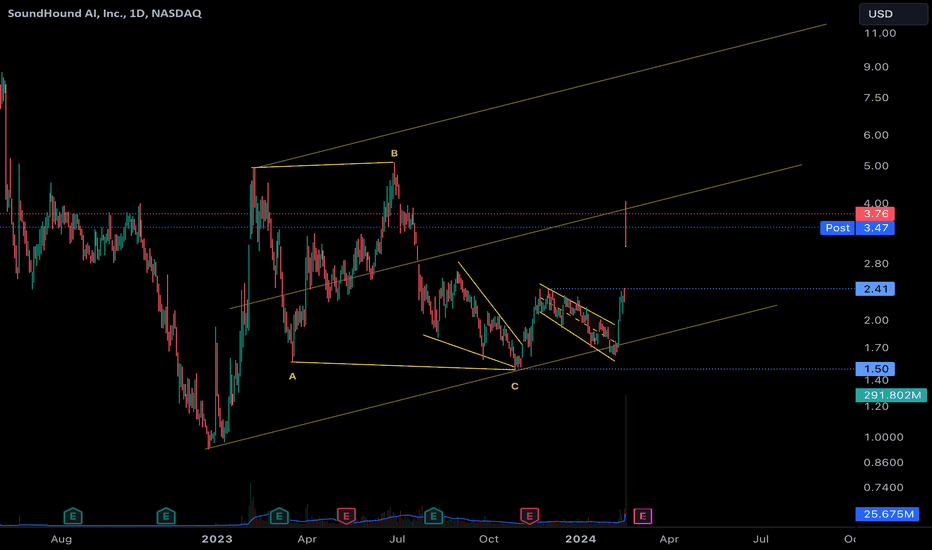

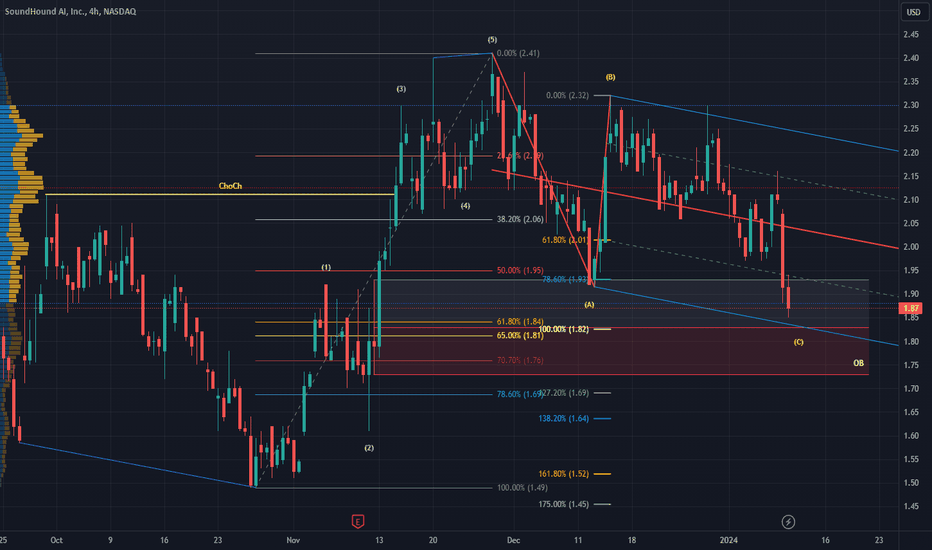

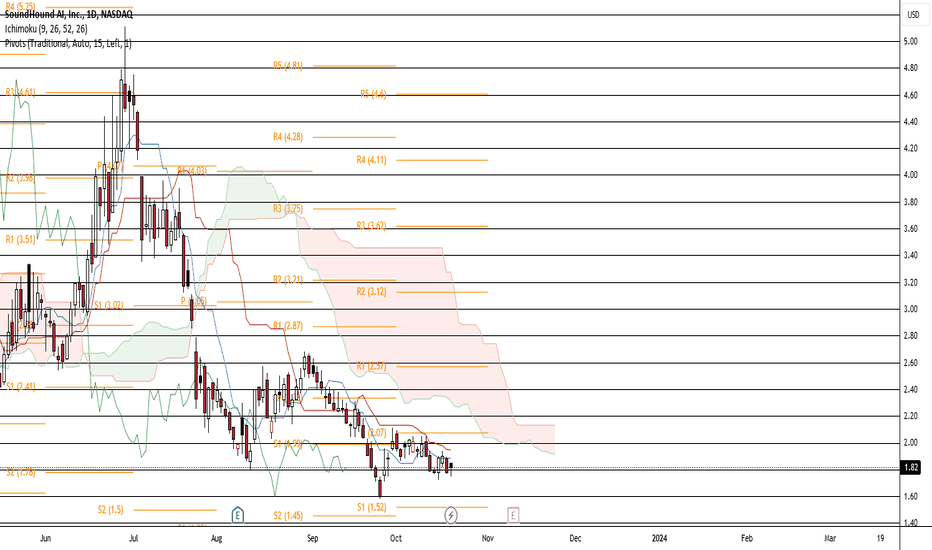

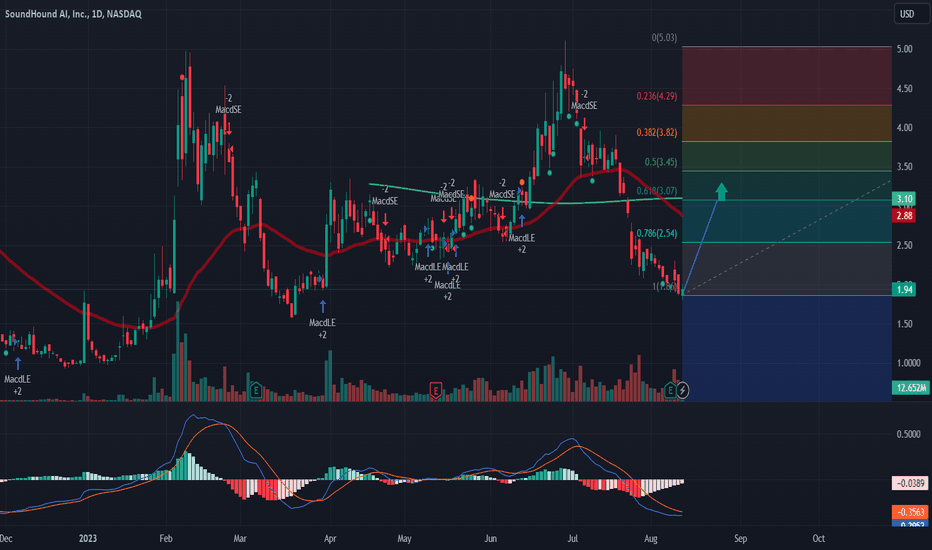

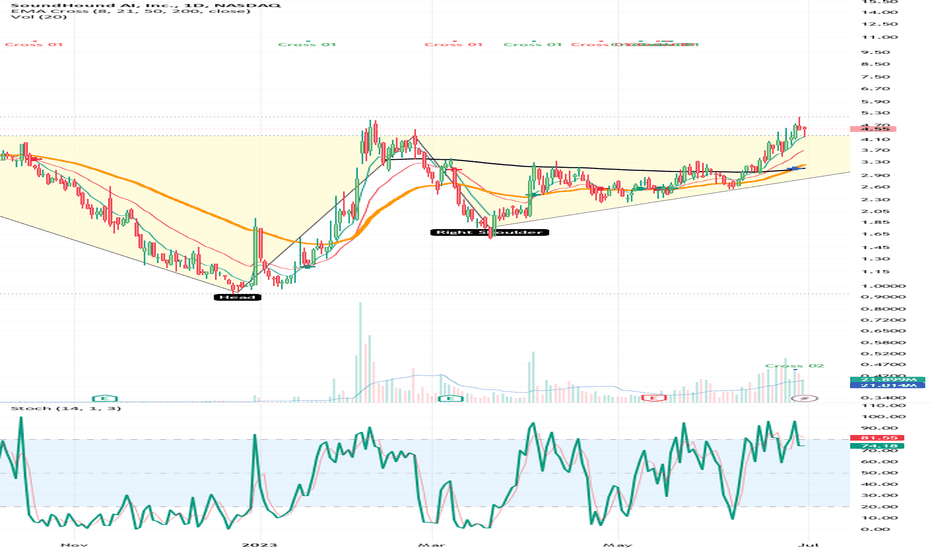

if the price acts in the same way as the previous two times as shown by the red graph with two falls,

the first of -68.20%

the second of -70.77%.

waiting for confirmation that the price of $4.35 was the highest in the short term.

there are chances that the price will reach $4.64, if it does,

the chances of the price will fall

to the levels of $3.10 (Orange) and $2.42 (Green) will increase,

filling the price gap shown in the green box. If everything I mentioned happens, the chance of it continues falling would increase with an average of up to -65.61% and it will require one more analysis to see the possibility of it reaching $1.50.

NFA

PLEASE, DYOR/MYOD!!

Hope to See your Likes 👍 to Support My Work

To Follow All My Ideas, Go to My Profile and Select the Follow Green button 😁

Please Re-Evaluate Before Make Your Last Decisions

Check my Profile for more.

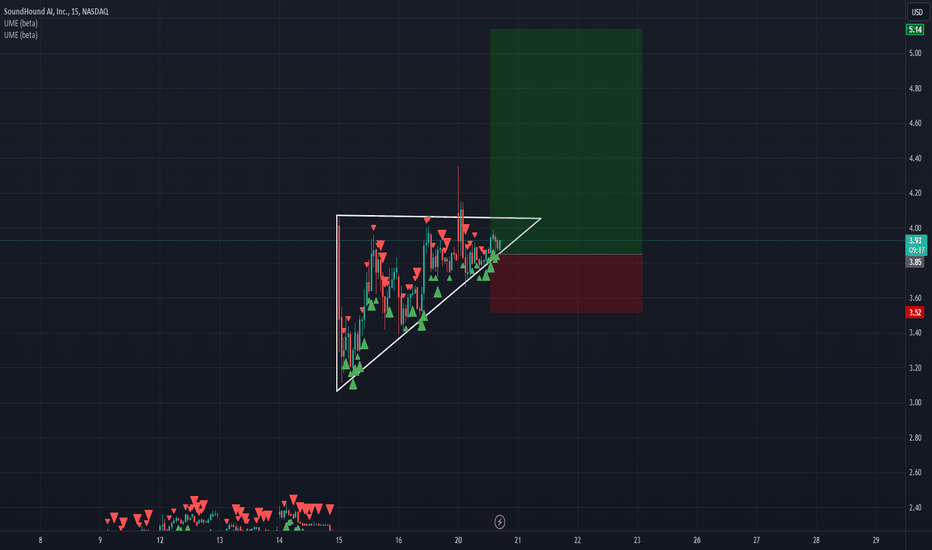

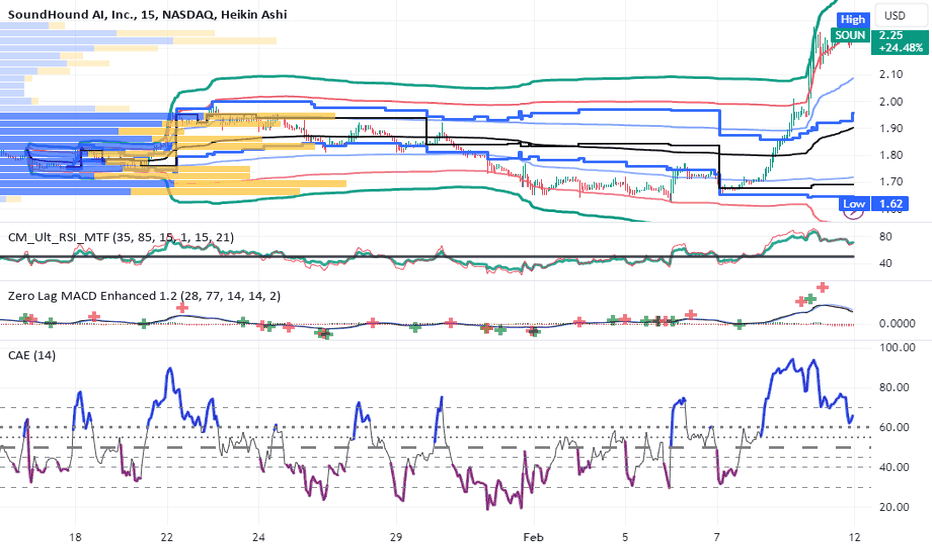

SOUN Breakout 15m Chart!I've been watching NASDAQ:SOUN charts since last week as well as noticing the unusual option volume on barchart on Friday before close. I will be buying (5) contracts - March 15th exp. $4.00c with a hedge of (1) contract of $3.50p incase of a sharp fall. After watching both the 15m and 5m charts, there will be a breakout to the upside pushing this stock into the mid-high $4 range

SOUN might be overbought and overvalued for a reversalSOUNDHound AI on the 15 minute on Wednesday 60 hours ago, broke out after a trend down to

begin the year. The tailwinds of the technology stock earnings and their tailwinds pushed hard.

SOUN broke out through the entire high volume area and then rose above it. Pretty much the

same from the lower aVWAP bands into the uppers after crossing over the mean line.

On the three indicators, RSI , MACD and the Chop index bearish diveragence is seen. This may

be an early reversal in progress but then again it might just be prudent traders liquidating to

take full or partial profits to close out the week. I am running full on this, I will watch the

price action early next week to determine a continuation vs a reversal. Relative volume

and relative volatility may show long traders closing with targets reached and shorts taking

their positions causing a pivot high of even a " long squeeze". Alerts and their notifications are

set on a 5-minute time frame to allow for some early warning. On the other hand it SOUN

can put out some higher decibels I may decide to look at the 2/16 options chain and chart

for an OTM call in the $2.5 or $3 range.

SoundHound AI's Stock Soar by Over 50%.Nvidia ( NASDAQ:NVDA ), a powerhouse in the realm of AI technology, recently unveiled its ambitious foray into smaller AI firms, with a particular focus on revolutionizing industries ranging from healthcare to autonomous driving. Among its notable investments stands SoundHound AI ( NASDAQ:SOUN ), a voice AI platform poised for a groundbreaking trajectory. Let's delve into how Nvidia's strategic maneuvers are reshaping the future of AI and propelling companies like SoundHound AI to unprecedented heights.

Nvidia's Bold Moves:

Nvidia's latest disclosure in a 13-F filing with the U.S. SEC revealed its strategic bets on a diverse array of AI firms. Notably, the company's investment in SoundHound AI ( NASDAQ:SOUN ) sparked a seismic shift, catapulting its shares by a staggering 72%. This move underscores Nvidia's acute awareness of the transformative potential of voice AI technologies. With nearly $3.7 million injected into SoundHound AI ( NASDAQ:SOUN ), Nvidia solidifies its position as a key player in shaping the future of voice-driven AI applications.

Unveiling SoundHound AI's Potential:

SoundHound AI ( NASDAQ:SOUN ), renowned for its cutting-edge voice AI platform, emerges as a prime beneficiary of Nvidia's strategic investment. The substantial surge in its stock value underscores the market's recognition of SoundHound AI's disruptive capabilities. By leveraging advanced AI algorithms, SoundHound AI ( NASDAQ:SOUN ) is poised to revolutionize various sectors, including telecommunications, automotive, and consumer electronics. Nvidia's endorsement further validates SoundHound AI's technological prowess and sets the stage for its accelerated growth trajectory.

Navigating the Healthcare Landscape:

Nvidia's strategic investments extend beyond SoundHound AI ( NASDAQ:SOUN ), encompassing healthcare innovators like Nano-X Imaging and Recursion Pharmaceuticals. Nano-X Imaging, a medical device company harnessing AI software for diagnostic analysis, witnessed a notable uptick in its stock value following Nvidia's investment. This synergy between AI and healthcare underscores the transformative potential of technology in revolutionizing medical diagnostics and treatment modalities. With Nvidia's backing, Nano-X Imaging is well-positioned to redefine the future of medical imaging technologies.

Empowering Innovation in Autonomous Driving:

Moreover, Nvidia's strategic investments extend to autonomous driving technology, exemplified by its support for TuSimple Holdings. Despite its recent delisting from Nasdaq, TuSimple Holdings remains a formidable player in the autonomous driving space. Nvidia's infusion of capital reaffirms its commitment to driving innovation in the realm of self-driving vehicles. As the automotive industry undergoes a paradigm shift towards autonomy, strategic partnerships and investments are crucial in accelerating technological advancements.

Conclusion:

SoundHound AI's meteoric rise following Nvidia's endorsement underscores the transformative potential of voice AI technologies. As Nvidia continues to chart new frontiers in AI innovation, the collaborative synergy between industry leaders promises to redefine the future of technology across diverse sectors. With SoundHound AI ( NASDAQ:SOUN ) and other visionary firms at the forefront of this revolution, the stage is set for a future shaped by unprecedented technological advancement and societal transformation.

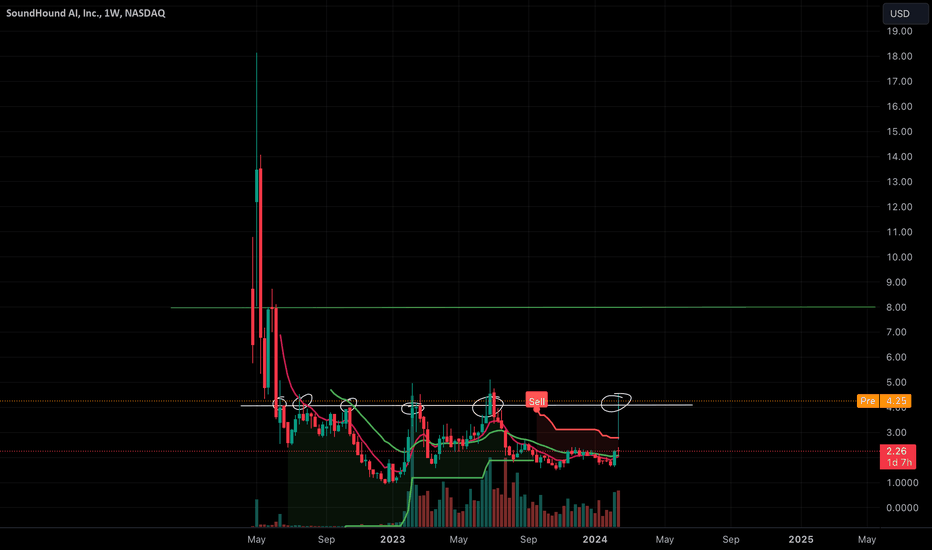

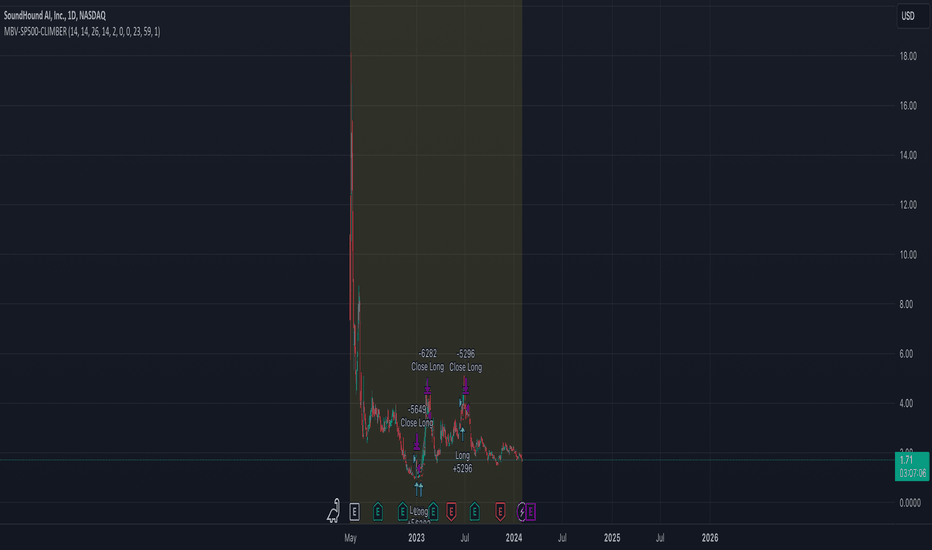

MBV-SP500-CLIMBER: SOUNIntroduction:

This trading idea is based on a Long-Only strategy that utilizes the Dynamic Movement Index (DMI), supplemented by the Average Directional Index (ADX) and an Average True Range (ATR)-based Trailing Stop-Loss.

Strategy Overview:

Main Indicators: DMI, ADX, ATR

Time Frame : Variable, based on the DMI length (Default: 14 days)

Objective: To take long-term positions in bullish market phases

Optional Trading Hours and Seasonality:

Yellow Background (Trading Days) : Positions are only opened on trading days highlighted with a yellow background on the chart.

Blue Background (S&P 500 Seasonality) : Positions are only opened during periods highlighted with a blue background on the chart.

Strategy Details:

ADX and DMI : A Long signal is generated, taking into account the optional trading hours and seasonality, when the ADX exceeds a defined threshold and the positive DMI is greater than the negative DMI. This indicates a strong upward movement.

ATR-based Trailing Stop-Loss : The Stop-Loss is dynamically set with a multiplier of the ATR value below the current price and updated to secure profits.

The strategy script is available for free on TradingView.

You can find it under the name: "MBV-SP500-CLIMBER"

Please share your optimizations with the TradingView community by leaving comments under the script.

Please provide feedback on the strategy, especially on the trading signals, in the comments.

---

Einleitung:

In dieser Handelsidee beruht auf einer Long-Only-Strategie, die auf dem Dynamic Movement Index (DMI) basiert, ergänzt durch den Average Directional Index (ADX) und einen Average True Range (ATR)-basierten Trailing Stop-Loss.

Strategie-Überblick:

Hauptindikatoren : DMI, ADX, ATR

Zeitfenster : Variable, basierend auf der DMI-Länge (Standard: 14 Tage)

Ziel : Langfristige Positionen in bullishen Marktphasen

Optionale Handelszeiten und Saisonalität:

Gelber Hintergrund (Handelstage): Positionen werden nur an den im Chart mit einem gelben Hintergrund hervorgehobenen Handelstagen eröffnet.

Blauer Hintergrund (S&P 500-Saisonalität): Positionen werden nur während der im Chart mit einem blauen Hintergrund hervorgehobenen Zeiträume eröffnet.

Strategie-Details:

ADX und DMI : Ein Long-Signal wird unter Berücksichtigung der optionalen Handelszeiten und Saisonalität generiert, wenn der ADX einen definierten Schwellenwert überschreitet und der positive DMI größer ist als der negative DMI. Dies signalisiert eine starke Aufwärtsbewegung.

ATR-basierter Trailing Stop-Loss : Der Stop-Loss wird dynamisch mit einem Multiplikator des ATR-Wertes unter dem aktuellen Preis gesetzt und aktualisiert, um Gewinne zu sichern.

Das Strategie-Skript ist auf TradingView kostenlos verfügbar .

Sie finden Sie unter dem Namen: "MBV-SP500-CLIMBER"

Bitte teilen Sie Ihre Optimierungen mit der TradingView-Community, indem Sie Kommentare unter dem Skript hinterlassen.

Bitte geben Sie Feedback zur Strategie, insbesondere zu den Handelssignalen, in den Kommentaren.

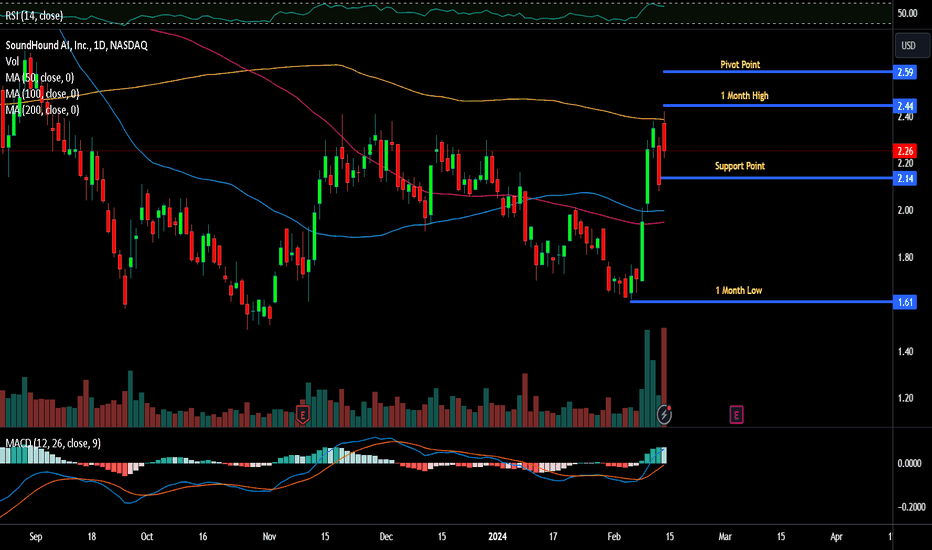

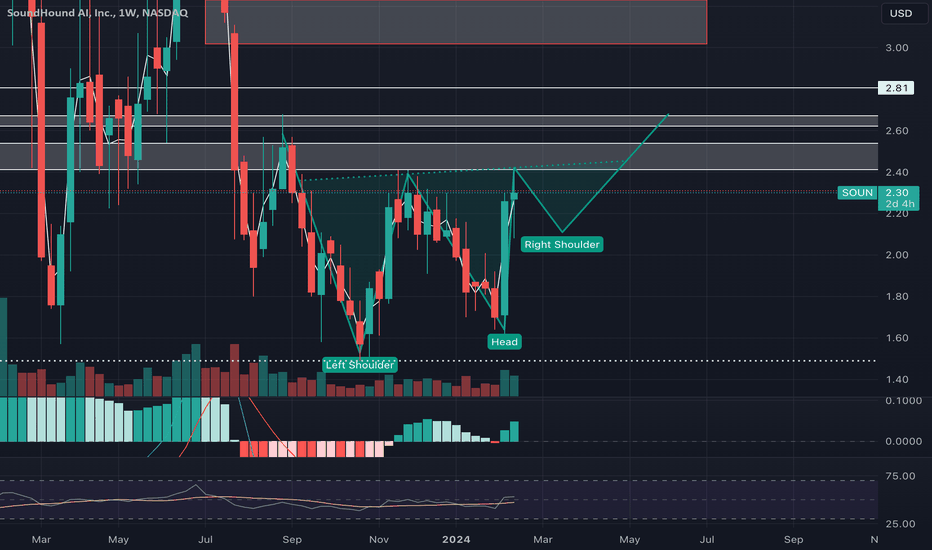

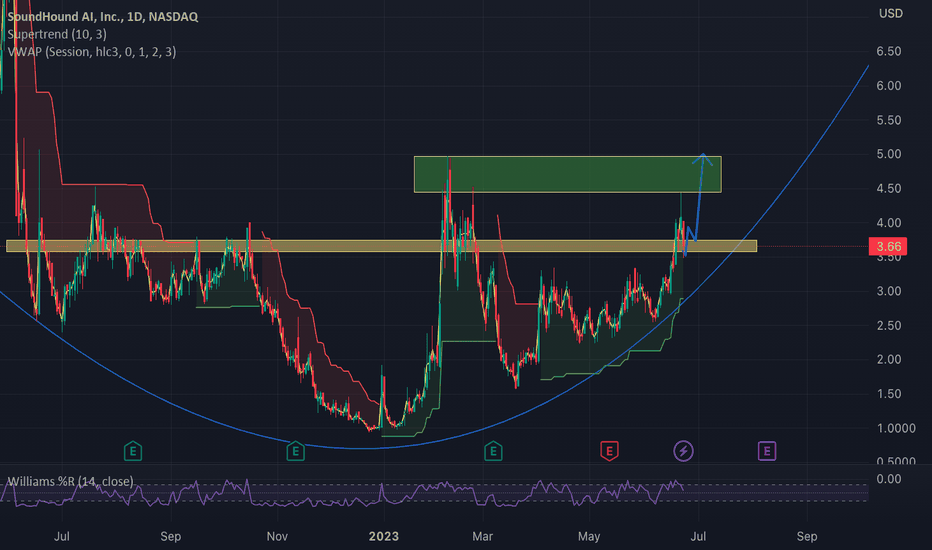

To the top it shall gohere anothers banger for the week after beating earnings SOUN has been hammered these last couple weeks, look for a reversal on this YTD chart it looks due for a reversal can easily see 15% profit

if it falls below 10% look to cut losses but if it can consilidate and hold the 3s within the next few weeks could be interesting for this stock

the last two times it hit the 1.94 level it went in the right direction which was up with good volume and price momentum see upside shortterm?

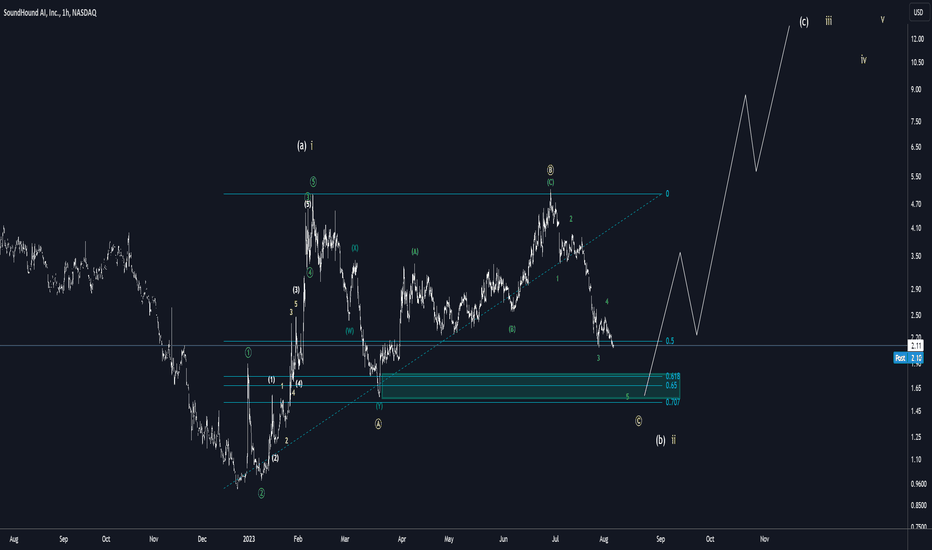

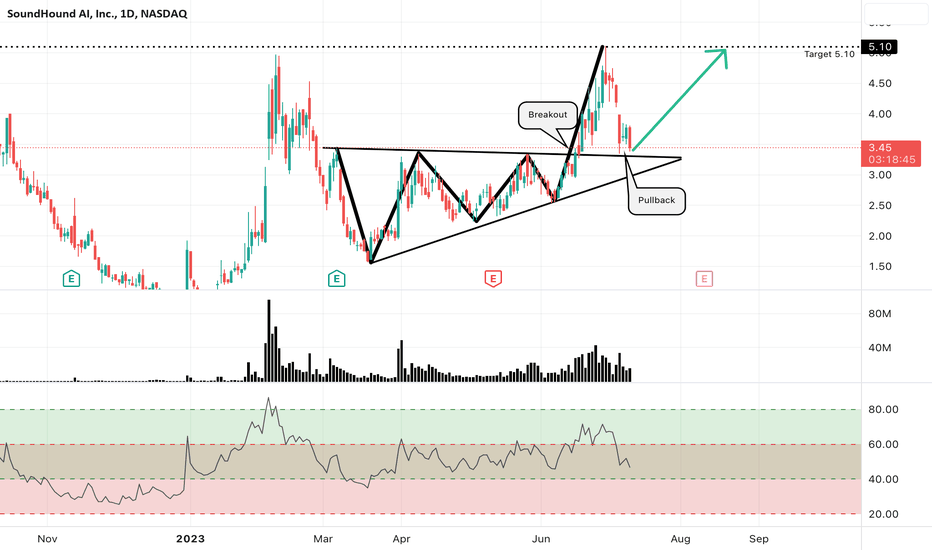

Pullback Buy in SOUNI started buying SOUN on a breakout above 3.35 two weeks ago. This was a classic breakout pattern with big volume on the advances and the stock was in the hottest group - AI. And shares surged 50% over the next 14 days.

I sold half my position at around 4.80. Since the stock topped just below the $5 mark back in February, this was likely to be a key resistance area and the SOUN pulled back as expected.

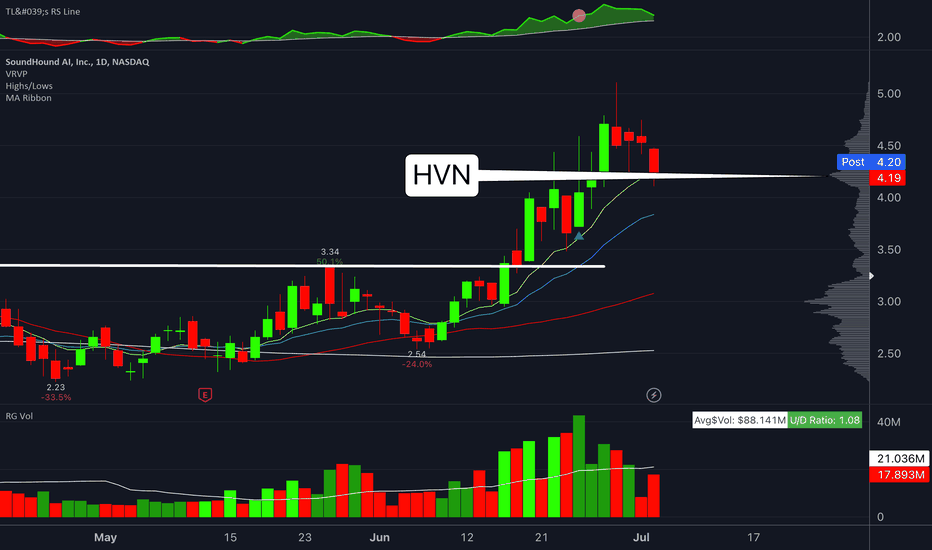

I added the rest of my position back on here at 4.15 on Wednesday.

If this rally is to continue, this seems like a likely bounce point. Not only is this a high volume node on the volume profile where the most trading has occurred since the breakout, it is also sitting on the 10-day EMA.

This represents a 20% pullback from last week's highs, and I would like to see buyers step in here if this stock is truly under accumulation. I do not expect to see SOUN go below 4.00. If shares break below 3.90, I will likely begin exiting my position.

If you do not own the stock, this is a decent place to buy in on a pullback. If you bought the breakout, however, this is a way to "press" the trade and risk some of your profits to see if this can be a monster win.