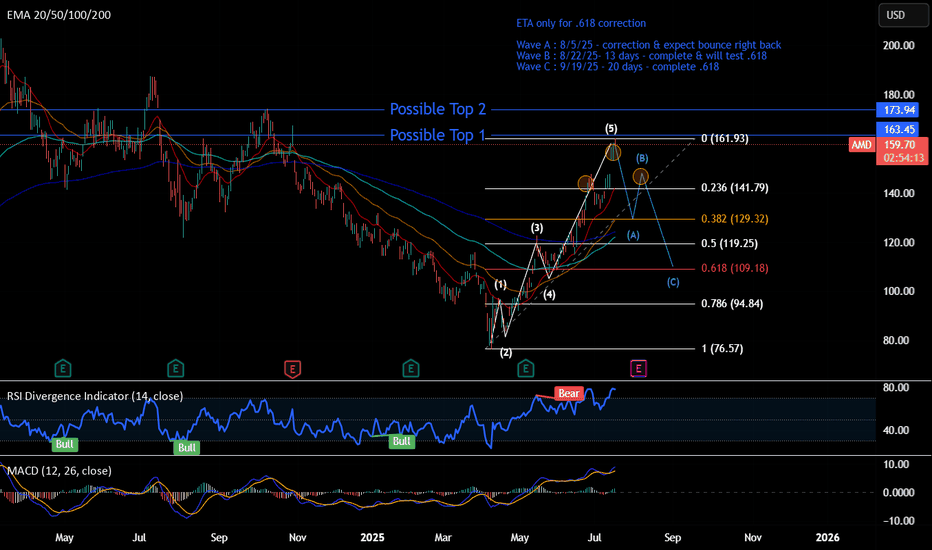

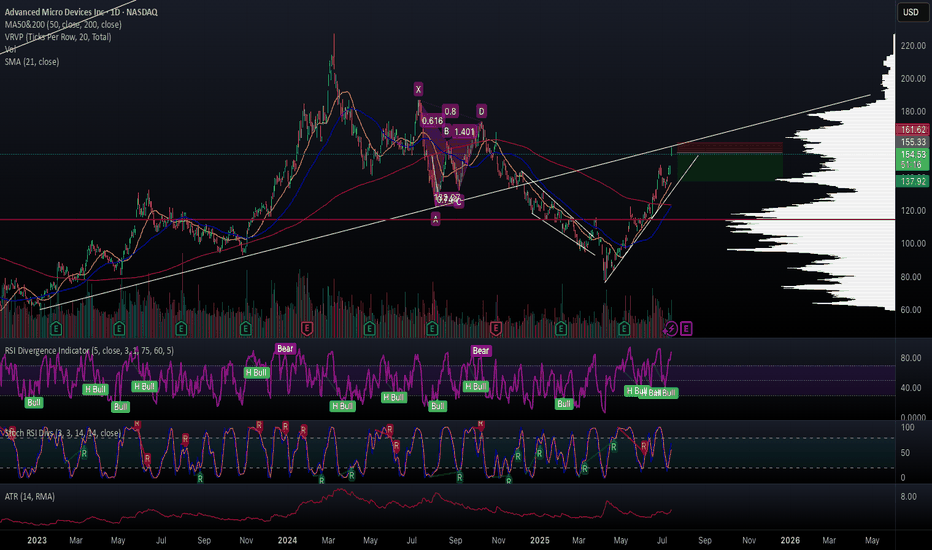

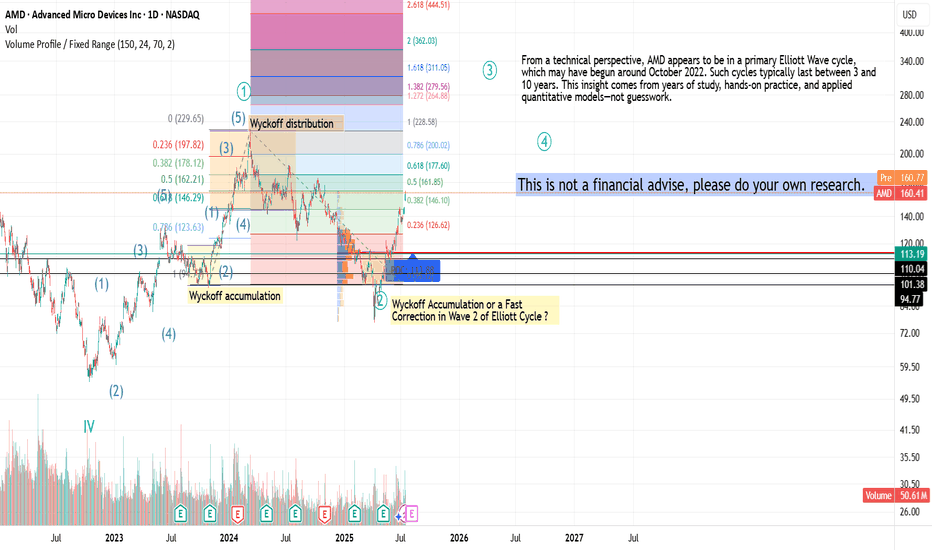

Short - AMDTime period for this play : week to months

Analysis : Elliot wave 12345 ABC. Expect hitting .618 and bounce back up to go higher.

Pattern if wave B completed : Head & Shoulder

Price Target: Wave ABC

ETA Timeline for correction. Please refer to the chart.

Upcoming events:

Tariff active on 8/1/25 -

Key facts today

Advanced Micro Devices (AMD) saw gains as chip sales to China are set to resume, contributing to a 2% increase in the technology sector.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.28 EUR

1.59 B EUR

24.91 B EUR

1.61 B

About Advanced Micro Devices Inc

Sector

Industry

CEO

Lisa T. Su

Website

Headquarters

Santa Clara

Founded

1969

FIGI

BBG000QFT7G3

Advanced Micro Devices, Inc. engages in the provision of semiconductor businesses. It operates through the following segments: Data Center, Client, Gaming, and Embedded. The Data Center segment includes server-class CPUs, GPUs, AI accelerators, DPUs, FPGAs, SmartNICs, and Adaptive SoC products. The Client segment refers to the computing platforms, which are a collection of technologies that are designed to work together to provide a more complete computing solution. The Gaming segment is a fundamental component across many products and can be found in APU, GPU, SoC or a combination of a discrete GPU with another product working in tandem. The Embedded segment focuses on the embedded CPUs, GPUs, APUs, FPGAs, and Adaptive SoC products. The company was founded by W. J. Sanders III on May 1, 1969 and is headquartered in Santa Clara, CA.

Related stocks

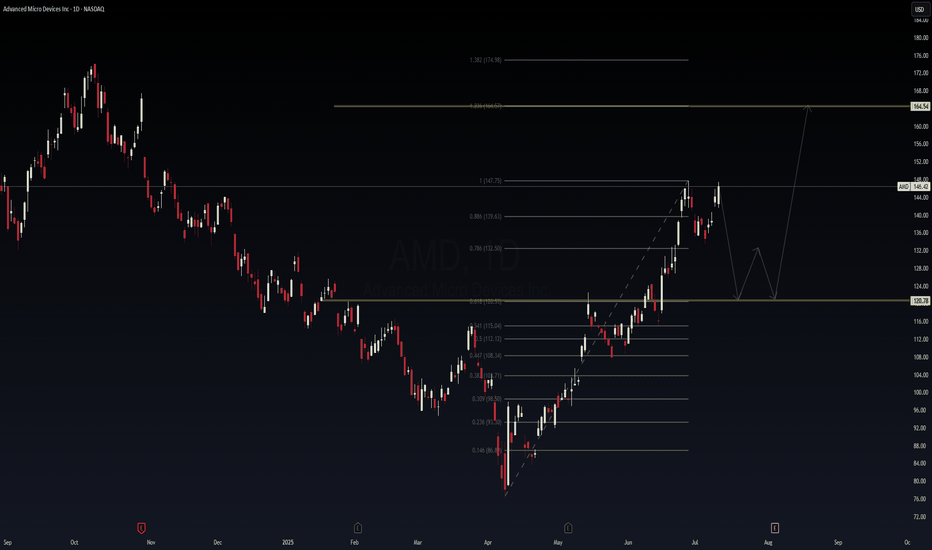

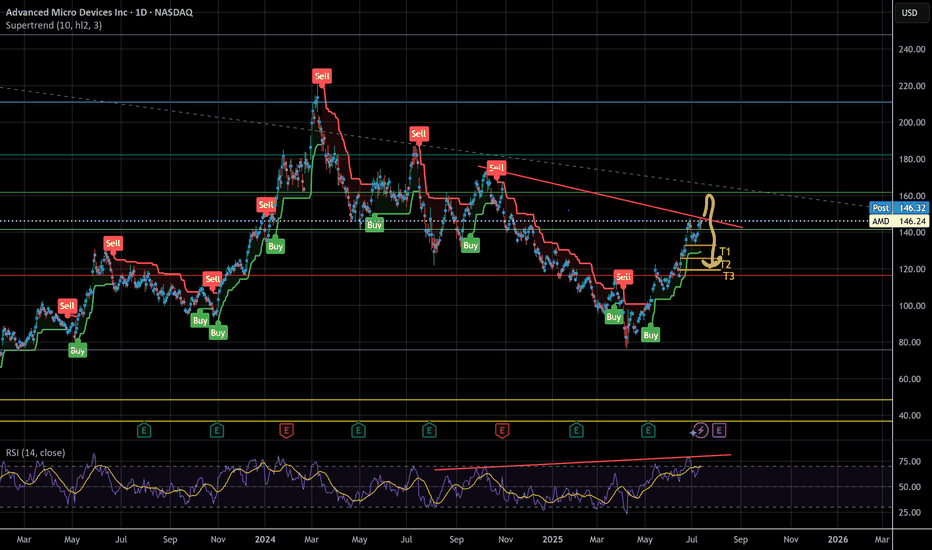

Trading Thesis: Silicon Whiplash – AMD Coiling for a Re-Launch🧠 Trading Thesis: “Silicon Whiplash – AMD Coiling for a Re-Launch to $164+?”

📉 Ticker: NASDAQ:AMD

🗓️ Timeframe: Daily (1D)

📍 Current Price: $144.42

📈 Fibonacci Expansion Target: $164.54 (1.236 extension), $174.98 (1.382 extension)

📉 Support Zone: $120.78

🔭 Play Duration: 2–4 weeks (event-based str

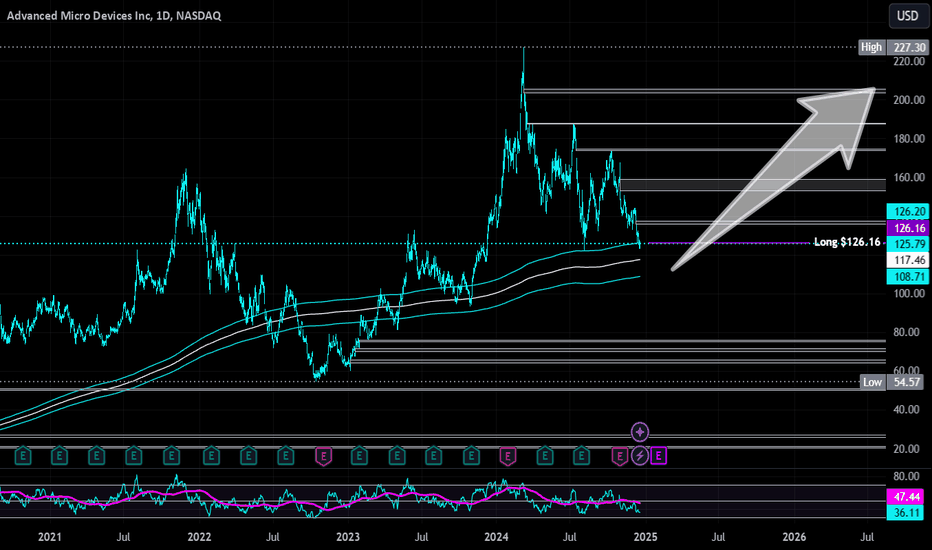

Advanced Micro Devices | AMD | Long at $126.00Advanced Micro Devices NASDAQ:AMD may be the sleeping giant in the semiconductor / AI space. While all eyes on NVidia NASDAQ:NVDA , earnings for NASDAQ:AMD grew by 800% over the past year... and are now forecast to grow 40% per year. Any other company would be soaring right now (like NVidia),

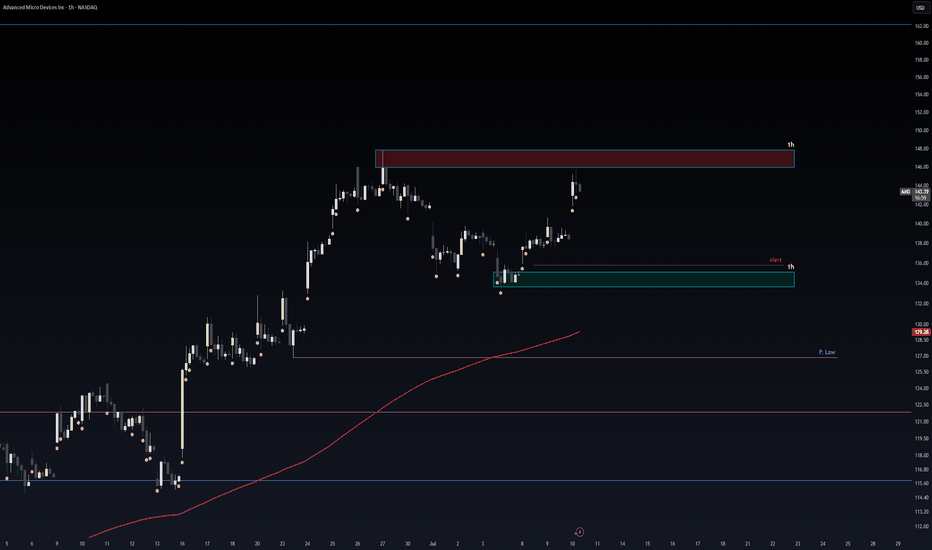

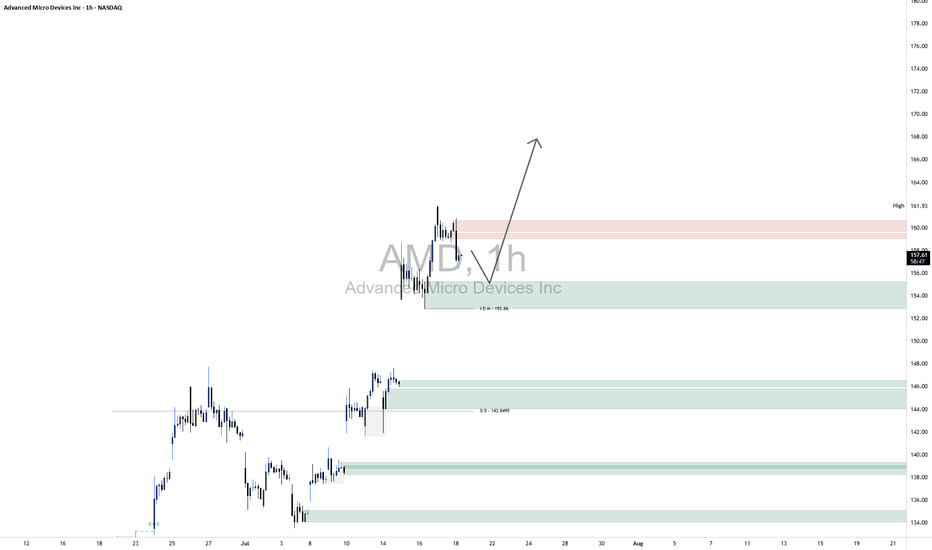

7/15 AMD short AMD just reached a major resistance level and is expected to pull back toward the $135 area. While it may not signal a full trend reversal, a retracement from today’s high is likely.

If the 7/15 candle forms a red shooting star, it would provide further confirmation.

May the trend be with you.

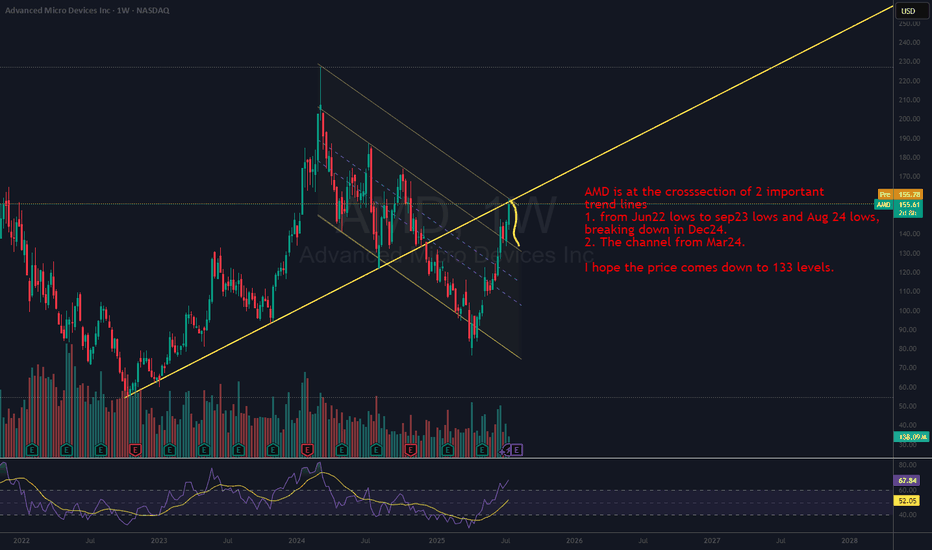

Must go down to go upI think AMD needs to cool off before it continues further, possibly tapping $160 first before a serious correction. Targets are listed at the strong support ending at $120. RSI printing bearish divergence on multiple time frames

Look at the red line, look at the direction of price. It's still a dow

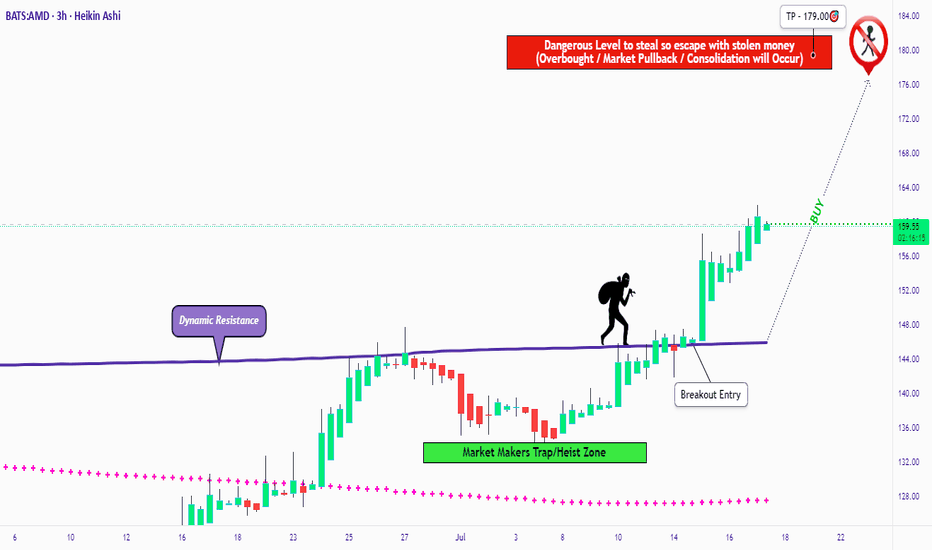

The AMD Long Heist – Ready to Rob the Bulls?!🚨 AMD Stock Vault Heist: Bullish Breakout Plan with Thief Trading Style! 📈💰

🌟 Greetings, Wealth Raiders & Market Mavericks! 🌟

Hello, Ciao, Salaam, Bonjour, and Hola to all you savvy traders! Ready to crack the AMD Stock Vault (Advanced Micro Devices Inc.) with our 🔥 Thief Trading Style 🔥? This high

Safe Entry Zone AMDPrice Rejected From Resistance.

Safe Entry Green Zone.

Target after that 162$ price level.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Z

AMD Overview & Elliott Wave CycleAMD recently reported strong Q2 2025 results, with growth driven by Data Center and AI segments, notably thanks to the Instinct MI300 chip family. Revenue rose +15% YoY, with a significant boost from AI-related demand. Future projects include next-gen GPUs, AI platforms, deeper cloud integration, an

AMD LongKey Technical Insights:

Clean Rejection from Demand Zone:

Price recently tapped into a well-defined demand zone (highlighted green) around $152–$155.

The immediate bounce suggests that buyers stepped in with strength, likely absorbing sell-side liquidity.

Liquidity Grab Below Short-Term Lows:

Be

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMD5426832

Advanced Micro Devices, Inc. 4.393% 01-JUN-2052Yield to maturity

6.16%

Maturity date

Jun 1, 2052

AMD5426831

Advanced Micro Devices, Inc. 3.924% 01-JUN-2032Yield to maturity

4.67%

Maturity date

Jun 1, 2032

AMD6026360

Advanced Micro Devices, Inc. 4.319% 24-MAR-2028Yield to maturity

4.12%

Maturity date

Mar 24, 2028

AMD6026359

Advanced Micro Devices, Inc. 4.212% 24-SEP-2026Yield to maturity

3.99%

Maturity date

Sep 24, 2026

See all 4AMD bonds

Curated watchlists where 4AMD is featured.

Frequently Asked Questions

The current price of 4AMD is 135.14 EUR — it has decreased by −1.44% in the past 24 hours. Watch ADVANCED MICRO DEVICES stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange ADVANCED MICRO DEVICES stocks are traded under the ticker 4AMD.

4AMD stock has risen by 8.84% compared to the previous week, the month change is a 18.71% rise, over the last year ADVANCED MICRO DEVICES has showed a −12.43% decrease.

We've gathered analysts' opinions on ADVANCED MICRO DEVICES future price: according to them, 4AMD price has a max estimate of 172.47 EUR and a min estimate of 81.92 EUR. Watch 4AMD chart and read a more detailed ADVANCED MICRO DEVICES stock forecast: see what analysts think of ADVANCED MICRO DEVICES and suggest that you do with its stocks.

4AMD reached its all-time high on Mar 8, 2024 with the price of 207.40 EUR, and its all-time low was 1.48 EUR and was reached on Aug 26, 2015. View more price dynamics on 4AMD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4AMD stock is 3.49% volatile and has beta coefficient of 2.12. Track ADVANCED MICRO DEVICES stock price on the chart and check out the list of the most volatile stocks — is ADVANCED MICRO DEVICES there?

Today ADVANCED MICRO DEVICES has the market capitalization of 219.50 B, it has increased by 10.42% over the last week.

Yes, you can track ADVANCED MICRO DEVICES financials in yearly and quarterly reports right on TradingView.

ADVANCED MICRO DEVICES is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

4AMD earnings for the last quarter are 0.89 EUR per share, whereas the estimation was 0.87 EUR resulting in a 1.64% surprise. The estimated earnings for the next quarter are 0.41 EUR per share. See more details about ADVANCED MICRO DEVICES earnings.

ADVANCED MICRO DEVICES revenue for the last quarter amounts to 6.88 B EUR, despite the estimated figure of 6.59 B EUR. In the next quarter, revenue is expected to reach 6.29 B EUR.

4AMD net income for the last quarter is 655.36 M EUR, while the quarter before that showed 465.60 M EUR of net income which accounts for 40.76% change. Track more ADVANCED MICRO DEVICES financial stats to get the full picture.

No, 4AMD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 19, 2025, the company has 28 K employees. See our rating of the largest employees — is ADVANCED MICRO DEVICES on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ADVANCED MICRO DEVICES EBITDA is 5.52 B EUR, and current EBITDA margin is 20.11%. See more stats in ADVANCED MICRO DEVICES financial statements.

Like other stocks, 4AMD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ADVANCED MICRO DEVICES stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ADVANCED MICRO DEVICES technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ADVANCED MICRO DEVICES stock shows the buy signal. See more of ADVANCED MICRO DEVICES technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.