Key facts today

Boeing has secured an order for up to 18 787 Dreamliner jets from Bahrain's Gulf Air, comprising a firm purchase of 12 jets and options for an additional six aircraft.

A U.S. judge will hear a non-prosecution deal on August 28, allowing Boeing to avoid charges linked to the 737 MAX crashes that killed 346 people.

NTSB Chair Jennifer Homendy called media reports on the Air India Boeing crash, which killed 260, speculative and premature, affirming support for the ongoing investigation by India's authorities.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−16.58 EUR

−11.41 B EUR

64.25 B EUR

753.01 M

About Boeing Company (The)

Sector

Industry

CEO

Robert Kelly Ortberg

Website

Headquarters

Arlington

Founded

1916

FIGI

BBG000QFTG73

The Boeing Co. is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space, and security systems. It operates through the following segments: Commercial Airplanes (BCA), Defense, Space and Security (BDS), Global Services (BGS), and Boeing Capital (BCC). The Commercial Airplanes segment includes the development, production, and market of commercial jet aircraft and provides fleet support services, principally to the commercial airline industry worldwide. The Defense, Space and Security segment refers to the research, development, production and modification of manned and unmanned military aircraft and weapons systems for global strike, including fighter and combat rotorcraft aircraft and missile systems, global mobility, including tanker, rotorcraft and tilt-rotor aircraft, and airborne surveillance and reconnaissance, including command and control, battle management and airborne anti-submarine aircraft. The Global Services segment provides services to commercial and defense customers. The Boeing Capital segment seeks to ensure that Boeing customers have the financing they need to buy and take delivery of their Boeing product and manages overall financing exposure. The company was founded by William Edward Boeing on July 15, 1916 and is headquartered in Arlington, VA.

Related stocks

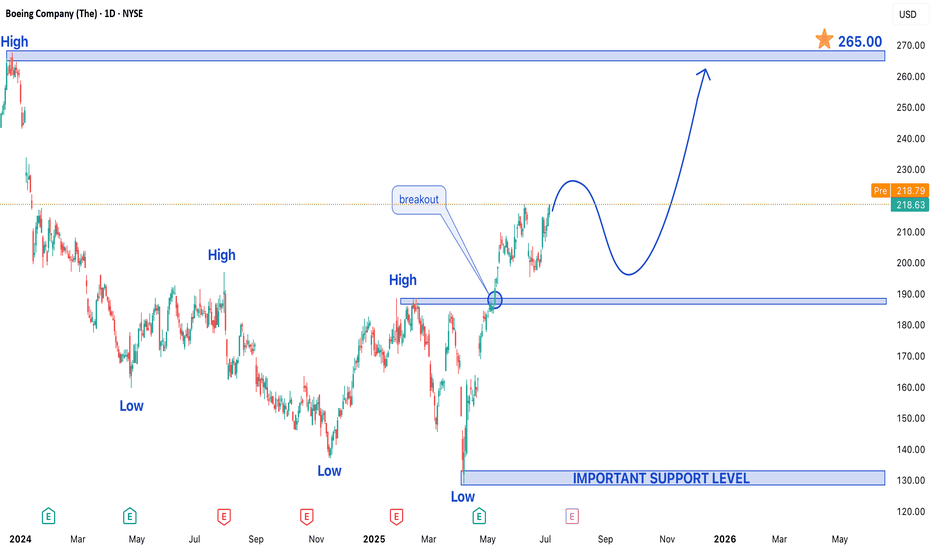

Long Opportunity: Boeing Could Take Flight Next WeekCurrent Price: $226.84

Direction: LONG

Targets:

- T1 = $233.00

- T2 = $238.00

Stop Levels:

- S1 = $223.00

- S2 = $218.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to i

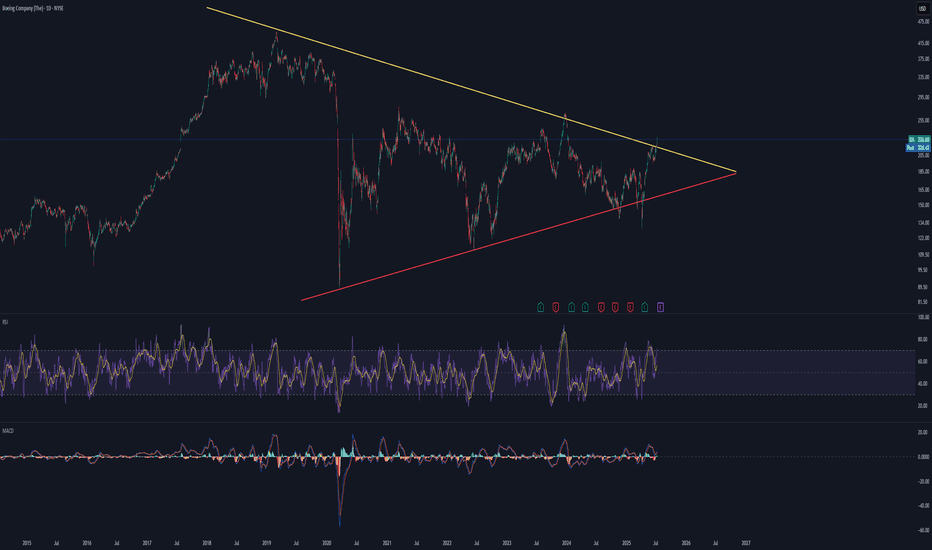

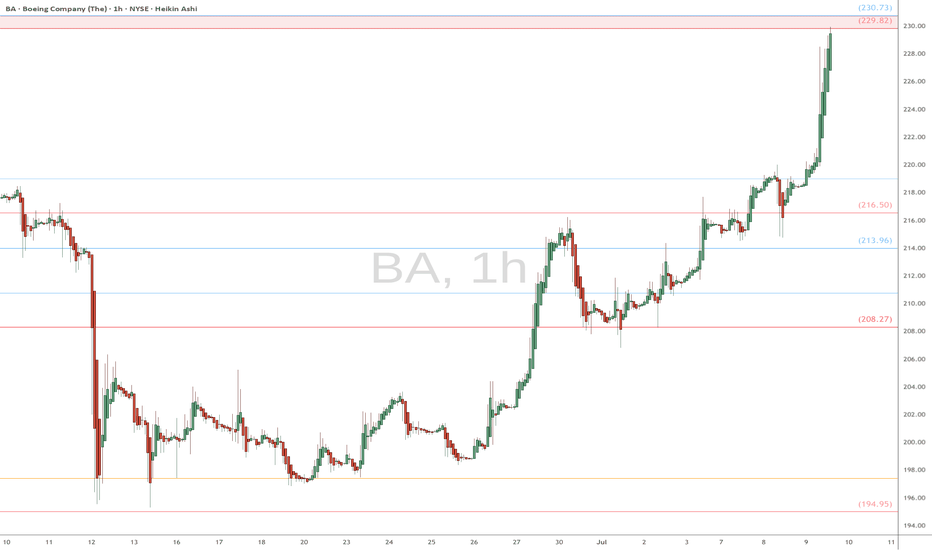

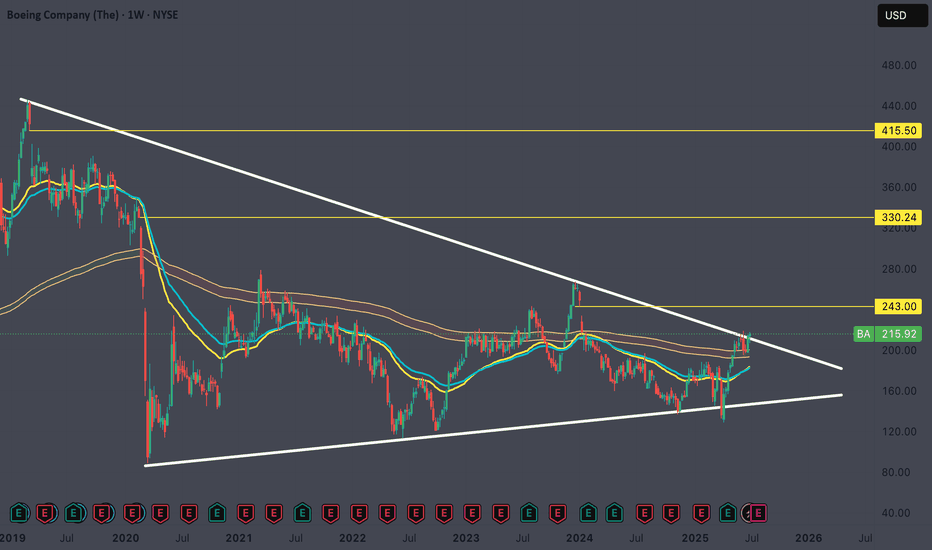

BA heads up into $230: Strong fib zone might cause a serious dipBA has been flying (lol) from its last crash caused crash.

About to test a signrificant resistance at $229.82-230.73

Expect at least some "orbits" or a pullback from this zone.

.

Previous analysis that caught THE BOTTOM:

==================================================

.

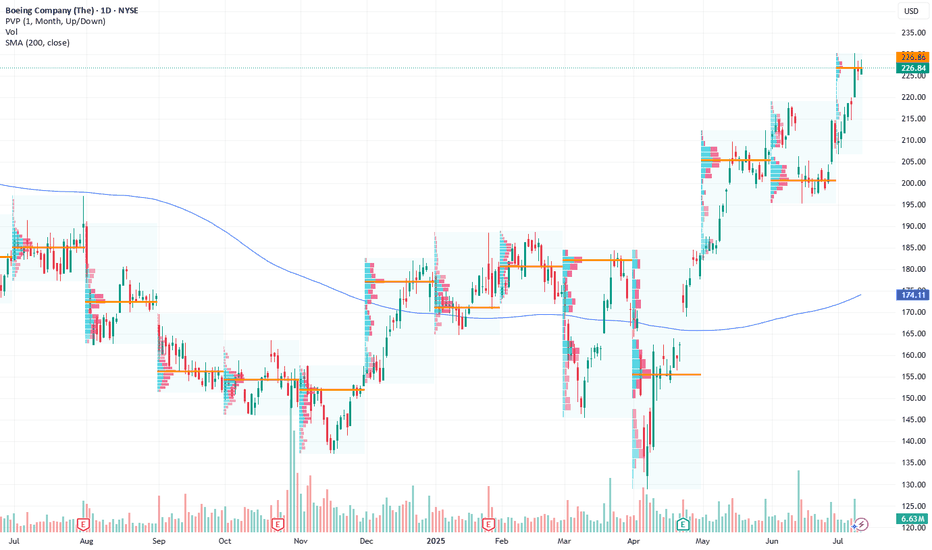

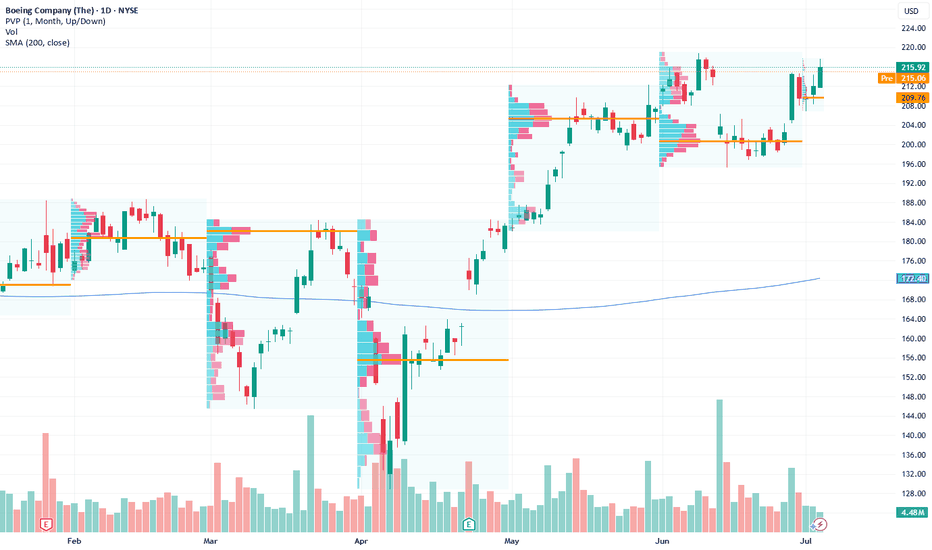

BOEING COMPANY STOCK ENTER INTO BULLISH TREND Boeing Company Stock Enters Bullish Trend on 1-Day Time Frame

The Boeing Company (BA) stock has entered a bullish trend on the 1-day timeframe, signaling potential upward momentum. A key development in this trend is the recent breakout above the critical resistance level of $189.00, which now acts

Boeing: Potential Pullback Ahead, But Long-Term Growth IntactCurrent Price: $215.92

Direction: LONG

Targets:

- T1 = $222.00

- T2 = $227.00

Stop Levels:

- S1 = $209.00

- S2 = $193.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

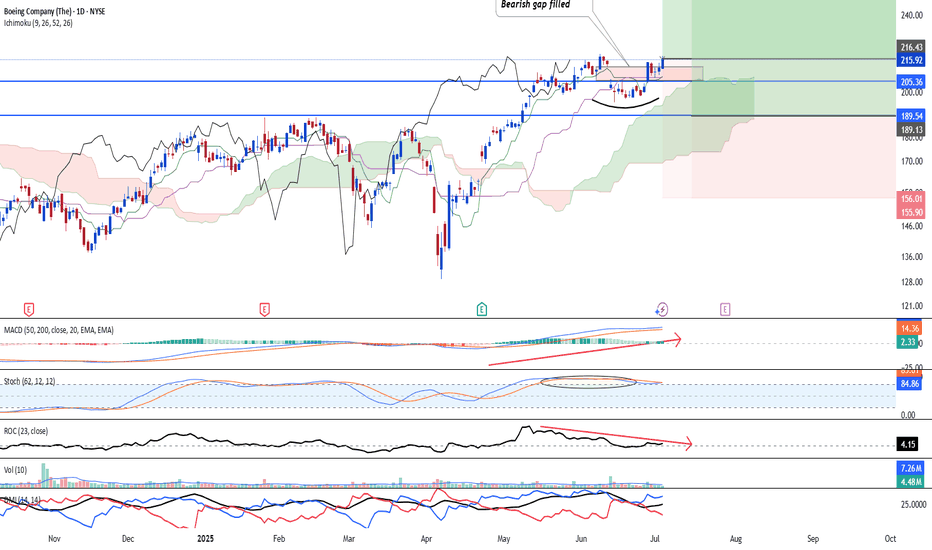

Boeing - Eyeing a recovery soon?NYSE:BA is back to the upside and has been trending upwards since early April 2025. Price action saw the stock is back into action after filling up the bearish breakaway gap. Now it is waiting to break the key resistance above 220.00 to further confirmed the upside.

Meanwhile, Ichimoku is showing

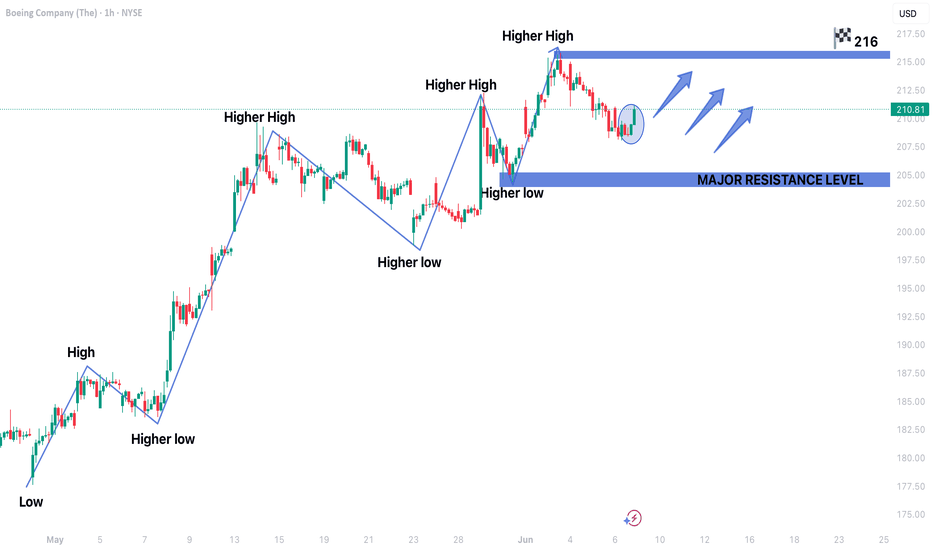

BOEING STOCK PRICE CONTINUING IN BULLISH TREND BOEING STOCK PRICE CONTINUING IN BULLISH TREND.

Stock is currently trading in bullish trend in 1 hour time frame.

Forming higher highs and higher lows.

Secondary trend is expected to end.

Bullish engulfing candles shows the strength of buyers in the market.

Price is expected to remain bullish for up

Short-term BA Short - Gap Fill OpportunityHey y’all —

Sharing this idea a bit late, but I believe there’s still more downside to capture.

Last Friday’s massive pump on BA closed the gap on the daily timeframe. Based on the current structure, the chart suggests a likely move to close the lower gap as well. I entered around the checkered fl

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US97023BS3

BOEING CO. 16/46Yield to maturity

7.72%

Maturity date

Jun 15, 2046

BCOC

BOEING CO. 15/45Yield to maturity

7.56%

Maturity date

Mar 1, 2045

US97023BV6

BOEING CO. 17/47Yield to maturity

7.55%

Maturity date

Mar 1, 2047

BA4602171

Boeing Company 3.625% 01-MAR-2048Yield to maturity

7.52%

Maturity date

Mar 1, 2048

BA4762315

Boeing Company 3.85% 01-NOV-2048Yield to maturity

7.35%

Maturity date

Nov 1, 2048

BA4866210

Boeing Company 3.95% 01-AUG-2059Yield to maturity

7.25%

Maturity date

Aug 1, 2059

BA4798350

Boeing Company 3.825% 01-MAR-2059Yield to maturity

7.24%

Maturity date

Mar 1, 2059

BA4829131

Boeing Company 3.9% 01-MAY-2049Yield to maturity

7.21%

Maturity date

May 1, 2049

BA4866209

Boeing Company 3.75% 01-FEB-2050Yield to maturity

7.17%

Maturity date

Feb 1, 2050

BA5803372

Boeing Company 7.008% 01-MAY-2064Yield to maturity

6.86%

Maturity date

May 1, 2064

BA4798349

Boeing Company 3.5% 01-MAR-2039Yield to maturity

6.66%

Maturity date

Mar 1, 2039

See all 4BA bonds

Curated watchlists where 4BA is featured.

Frequently Asked Questions

The current price of 4BA is 196.38 EUR — it has increased by 1.39% in the past 24 hours. Watch BOEING stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange BOEING stocks are traded under the ticker 4BA.

4BA stock has risen by 7.61% compared to the previous week, the month change is a 13.19% rise, over the last year BOEING has showed a 16.09% increase.

We've gathered analysts' opinions on BOEING future price: according to them, 4BA price has a max estimate of 245.77 EUR and a min estimate of 166.43 EUR. Watch 4BA chart and read a more detailed BOEING stock forecast: see what analysts think of BOEING and suggest that you do with its stocks.

4BA stock is 1.06% volatile and has beta coefficient of 1.52. Track BOEING stock price on the chart and check out the list of the most volatile stocks — is BOEING there?

Today BOEING has the market capitalization of 149.12 B, it has increased by 2.63% over the last week.

Yes, you can track BOEING financials in yearly and quarterly reports right on TradingView.

BOEING is going to release the next earnings report on Jul 29, 2025. Keep track of upcoming events with our Earnings Calendar.

4BA earnings for the last quarter are −0.45 EUR per share, whereas the estimation was −1.08 EUR resulting in a 58.18% surprise. The estimated earnings for the next quarter are −1.18 EUR per share. See more details about BOEING earnings.

BOEING revenue for the last quarter amounts to 18.02 B EUR, despite the estimated figure of 17.89 B EUR. In the next quarter, revenue is expected to reach 18.47 B EUR.

4BA net income for the last quarter is −34.20 M EUR, while the quarter before that showed −3.73 B EUR of net income which accounts for 99.08% change. Track more BOEING financial stats to get the full picture.

As of Jul 19, 2025, the company has 172 K employees. See our rating of the largest employees — is BOEING on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BOEING EBITDA is −7.67 B EUR, and current EBITDA margin is −13.46%. See more stats in BOEING financial statements.

Like other stocks, 4BA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BOEING stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BOEING technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BOEING stock shows the buy signal. See more of BOEING technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.