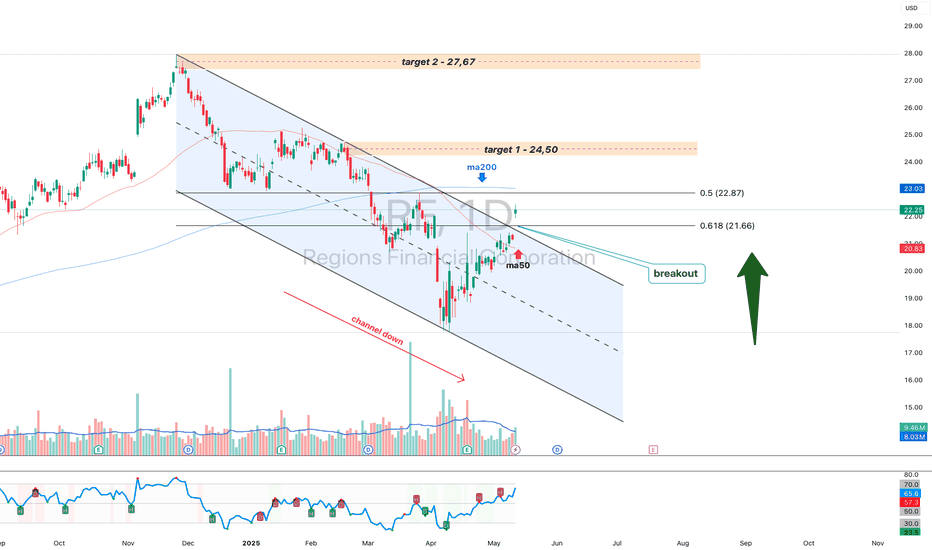

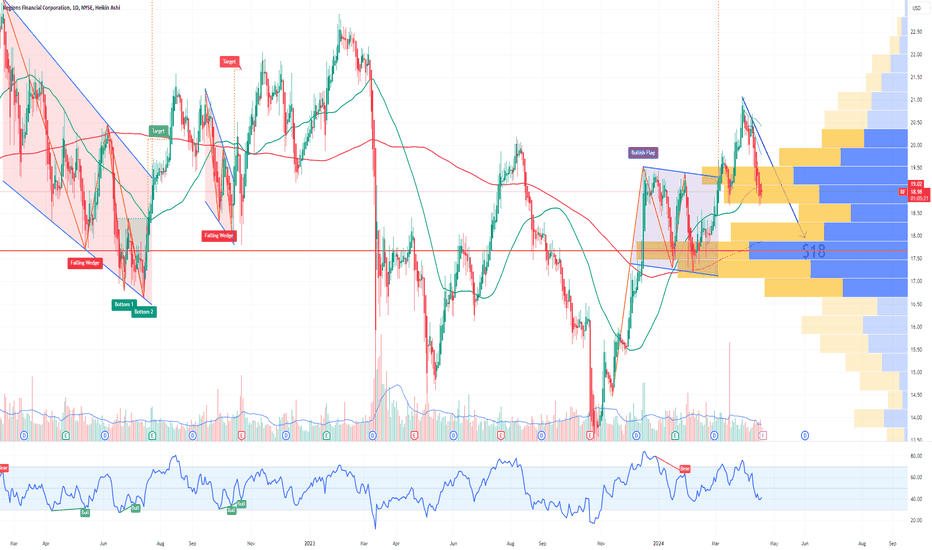

RF 1D: Breakout or Just a Bullish Pause?Regions Financial (ticker: RF) finally escaped the descending channel it had been stuck in for nearly 8 months — like someone who missed their stop and woke up in a different state. The breakout came with volume and a hold above the 50-day MA, which technically gives the bulls a reason to stretch th

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.9 EUR

1.83 B EUR

8.95 B EUR

895.82 M

About Regions Financial Corporation

Sector

Industry

CEO

John M. Turner

Website

Headquarters

Birmingham

Founded

1970

Regions Financial Corp. is a bank holding company, which engages in providing consumer and commercial banking, wealth management, and mortgage products and services. It operates through the following segments: Corporate Bank, Consumer Bank, Wealth Management, and Other. The Corporate Bank segment represents the commercial banking functions including commercial and industrial, commercial real estate, and investor real estate lending. The Consumer Bank segment holds the branch network, including consumer banking products and services related to residential first mortgages, home equity lines and loans, small business loans, indirect loans, consumer credit cards, and other consumer loans. The Wealth Management segment offers individuals, businesses, governmental institutions and non-profit entities a range of solutions to help protect, grow and transfer wealth. The Other segment includes its treasury function, the securities portfolio, wholesale funding activities, interest rate risk management activities, and other corporate functions that are not related to a strategic business unit. The company was founded on June 26, 1970 and is headquartered in Birmingham, AL.

Related stocks

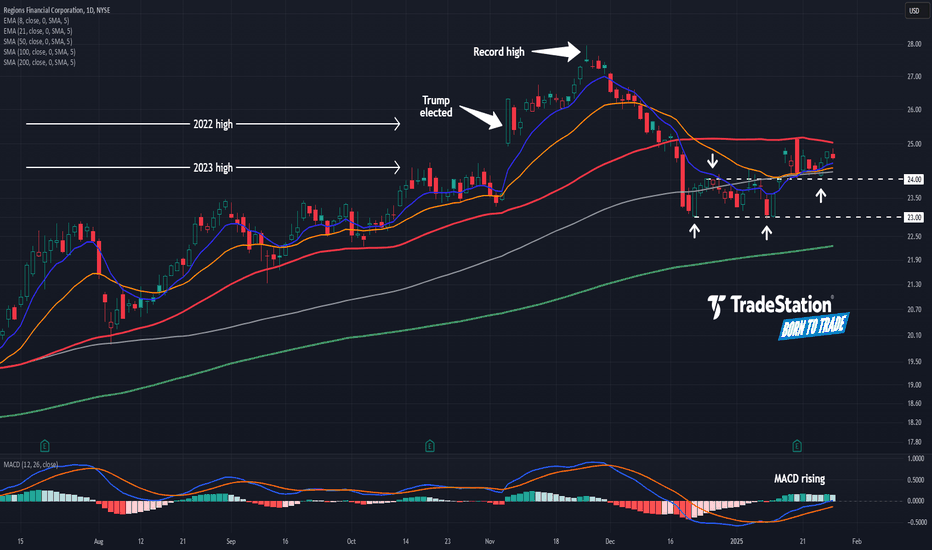

Uptrend in Regions Financial?Regions Financial leaped to new record highs after Donald Trump was reelected as U.S. President. Now, following a pullback, some traders may think its uptrend remains in effect.

The first pattern on today’s chart is the price range between $23 and $24. RF tested and held the bottom of this channel

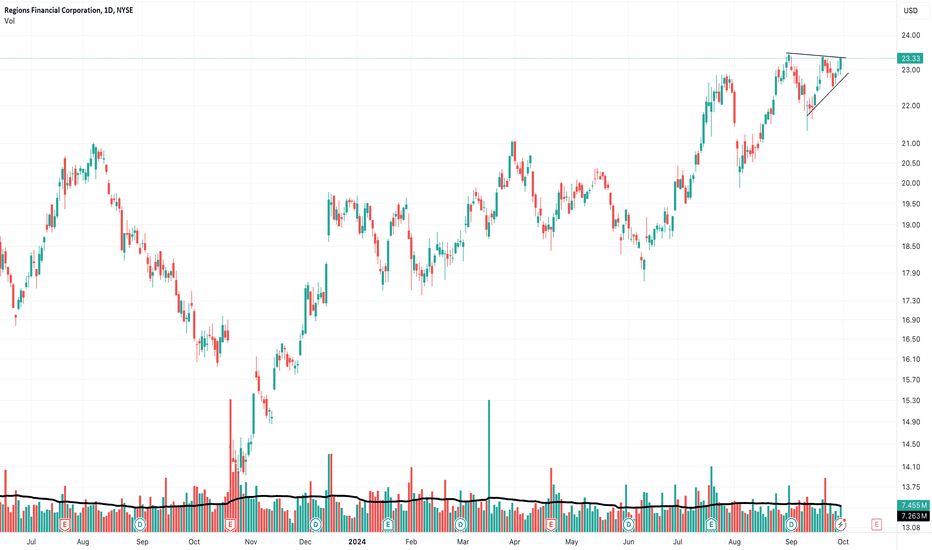

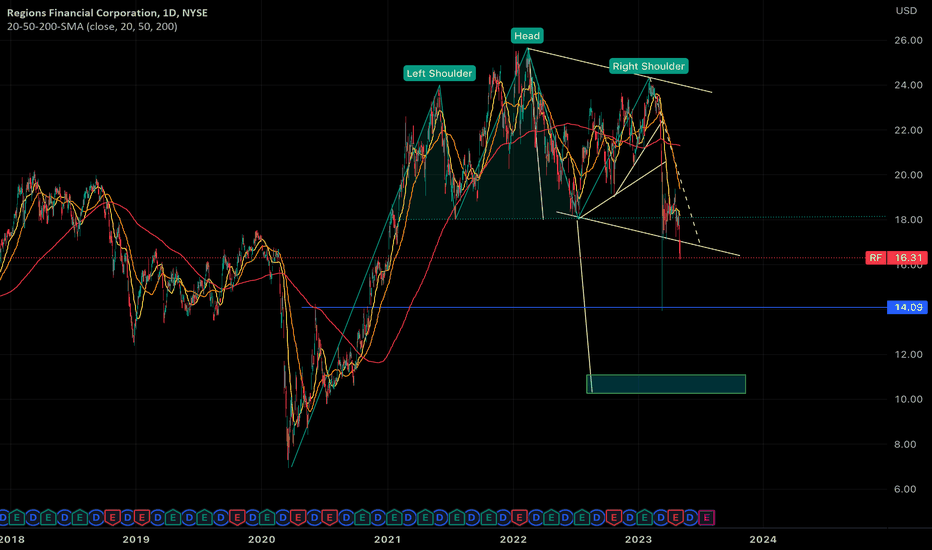

Neutral on Regions! A couple of scenarios.🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

RF Regions Financial Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RF Regions Financial Corporation prior to the earnings report this week,

I would consider purchasing the 18usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $1.65.

If these options prove to be profitable

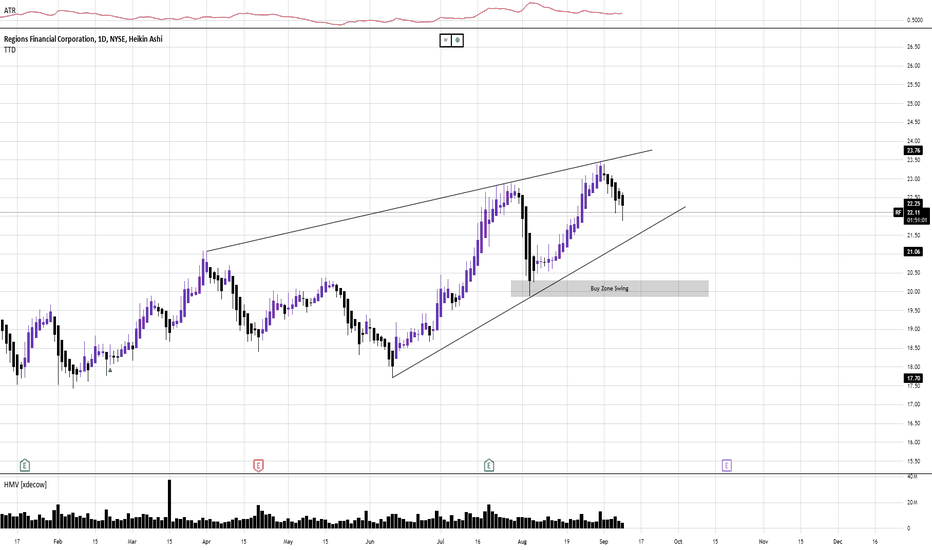

Regions Financial AnalysisThis is a fantastic company.

High, stable and consistent profit margin standing at 25%, on average, per year, for the past 7 years, seems to be the pillar of performance for this banking services provider.

Second stellar attribute is its ability to control debt and cash. Since 2018 to present, Reg

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

RF.GJ

Regions Financial Corporation 7.375% 10-DEC-2037Yield to maturity

5.79%

Maturity date

Dec 10, 2037

RF5885392

Regions Financial Corporation 5.502% 06-SEP-2035Yield to maturity

5.53%

Maturity date

Sep 6, 2035

RF5824702

Regions Financial Corporation 5.722% 06-JUN-2030Yield to maturity

4.92%

Maturity date

Jun 6, 2030

RF5237267

Regions Financial Corporation 1.8% 12-AUG-2028Yield to maturity

4.50%

Maturity date

Aug 12, 2028

See all RN70 bonds

Frequently Asked Questions

The current price of RN70 is 14.8 EUR — it has increased by 0.68% in the past 24 hours. Watch REGIONS FINANCIAL PFD E stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange REGIONS FINANCIAL PFD E stocks are traded under the ticker RN70.

RN70 stock has fallen by −0.67% compared to the previous week, the month change is a 1.37% rise, over the last year REGIONS FINANCIAL PFD E has showed a −10.84% decrease.

RN70 reached its all-time high on Aug 16, 2022 with the price of 19.9 EUR, and its all-time low was 13.2 EUR and was reached on May 12, 2023. View more price dynamics on RN70 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RN70 stock is 1.35% volatile and has beta coefficient of 1.16. Track REGIONS FINANCIAL PFD E stock price on the chart and check out the list of the most volatile stocks — is REGIONS FINANCIAL PFD E there?

Today REGIONS FINANCIAL PFD E has the market capitalization of 20.16 B, it has increased by 0.05% over the last week.

Yes, you can track REGIONS FINANCIAL PFD E financials in yearly and quarterly reports right on TradingView.

REGIONS FINANCIAL PFD E is going to release the next earnings report on Oct 17, 2025. Keep track of upcoming events with our Earnings Calendar.

RN70 earnings for the last quarter are 0.51 EUR per share, whereas the estimation was 0.47 EUR resulting in a 7.29% surprise. The estimated earnings for the next quarter are 0.50 EUR per share. See more details about REGIONS FINANCIAL PFD E earnings.

REGIONS FINANCIAL PFD E revenue for the last quarter amounts to 1.62 B EUR, despite the estimated figure of 1.58 B EUR. In the next quarter, revenue is expected to reach 1.64 B EUR.

RN70 net income for the last quarter is 477.93 M EUR, while the quarter before that showed 452.93 M EUR of net income which accounts for 5.52% change. Track more REGIONS FINANCIAL PFD E financial stats to get the full picture.

Yes, RN70 dividends are paid quarterly. The last dividend per share was 0.24 EUR. As of today, Dividend Yield (TTM)% is 3.84%. Tracking REGIONS FINANCIAL PFD E dividends might help you take more informed decisions.

REGIONS FINANCIAL PFD E dividend yield was 4.17% in 2024, and payout ratio reached 50.71%. The year before the numbers were 4.54% and 41.77% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 20, 2025, the company has 19.64 K employees. See our rating of the largest employees — is REGIONS FINANCIAL PFD E on this list?

Like other stocks, RN70 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade REGIONS FINANCIAL PFD E stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So REGIONS FINANCIAL PFD E technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating REGIONS FINANCIAL PFD E stock shows the sell signal. See more of REGIONS FINANCIAL PFD E technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.