Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.81 EUR

1.46 B EUR

12.05 B EUR

429.81 M

About Citizens Financial Group, Inc.

Sector

Industry

CEO

Bruce Winfield van Saun

Website

Headquarters

Providence

Founded

1828

Citizens Financial Group, Inc. engages in the provision of commercial banking services. It operates through the Consumer Banking and Commercial Banking segments. The Consumer Banking segment includes deposit products, mortgage and home equity lending, student loans, auto financing, credit cards, business loans, and wealth management and investment services. The Commercial Banking segment offers lending and leasing, trade financing, deposit and treasury management, foreign exchange and interest rate risk management, corporate finance and debt, and equity capital markets. The company was founded in 1828 and is headquartered in Providence, RI.

Related stocks

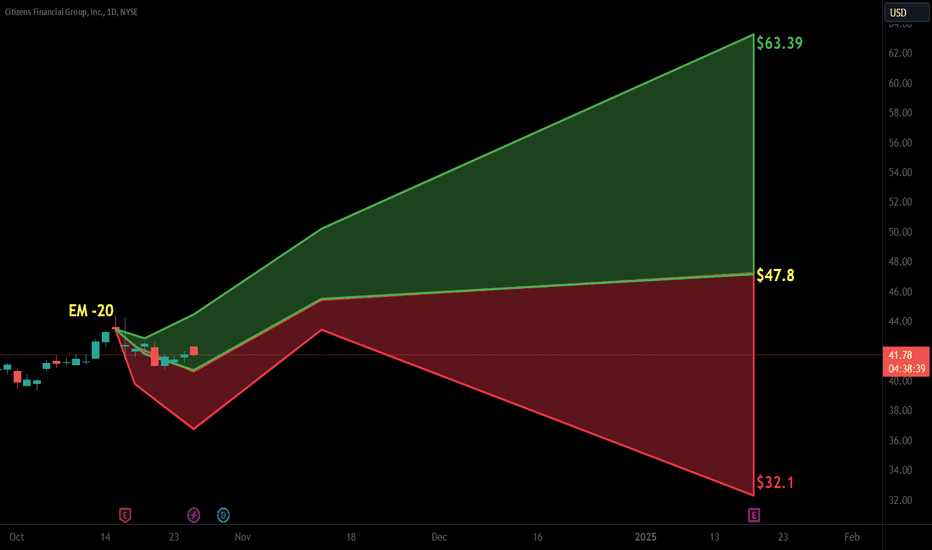

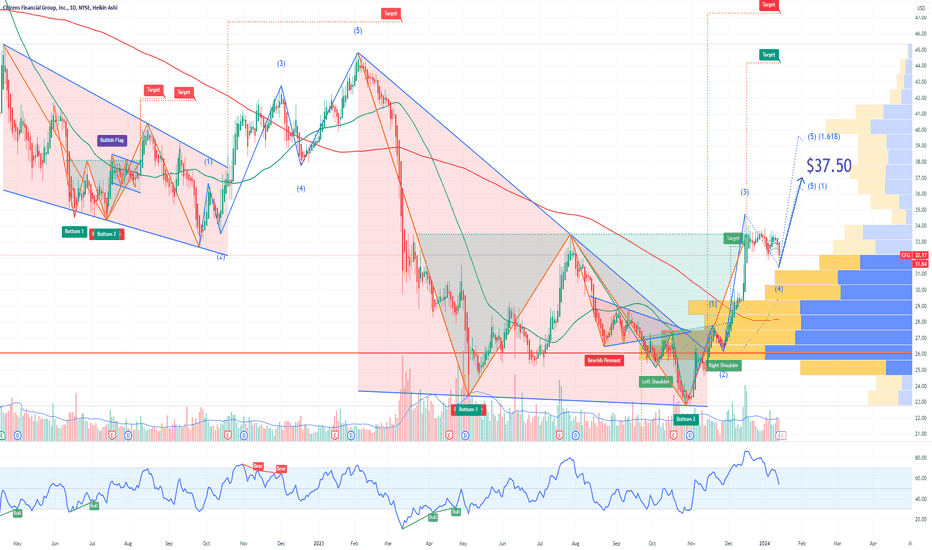

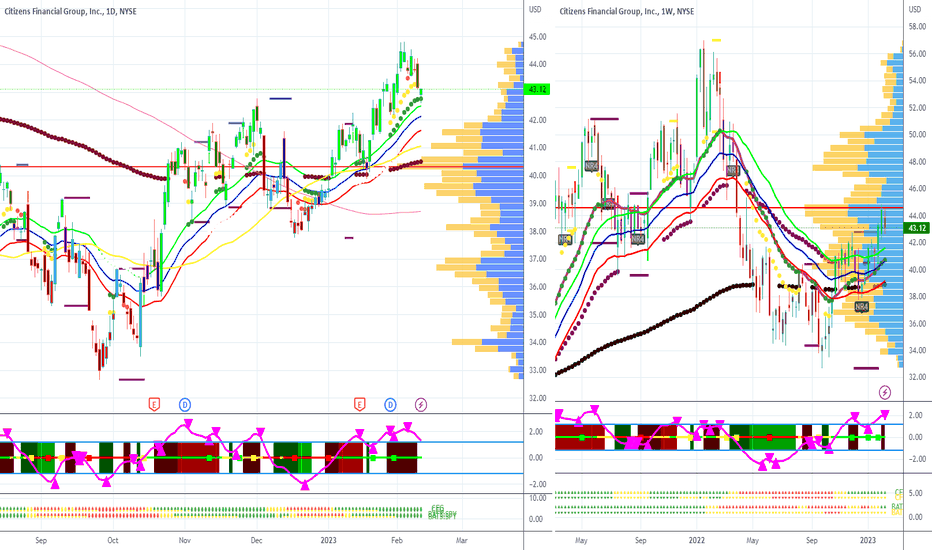

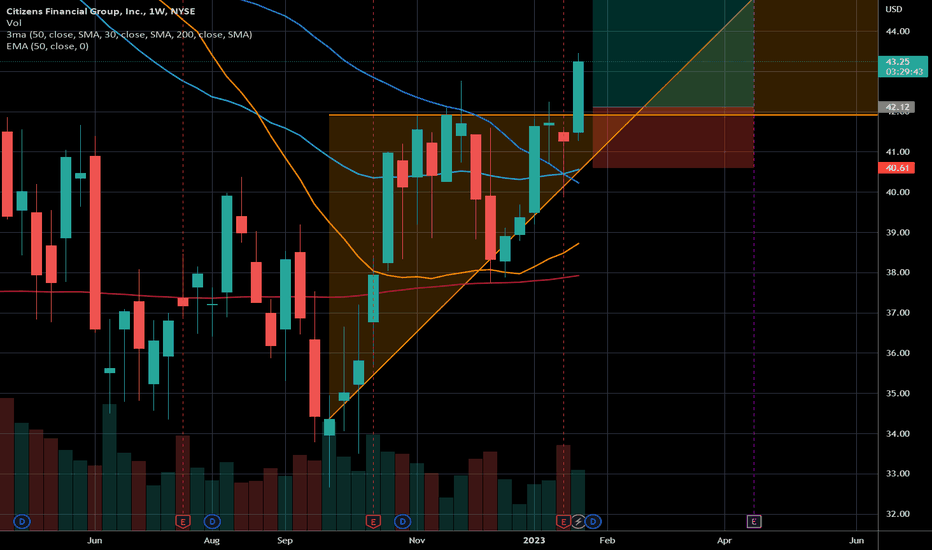

CFG Citizens Financial Group Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CFG Citizens Financial Group prior to the earnings report this week,

I would consider purchasing the $37.50usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately 1.20.

If these options prove to be profitable p

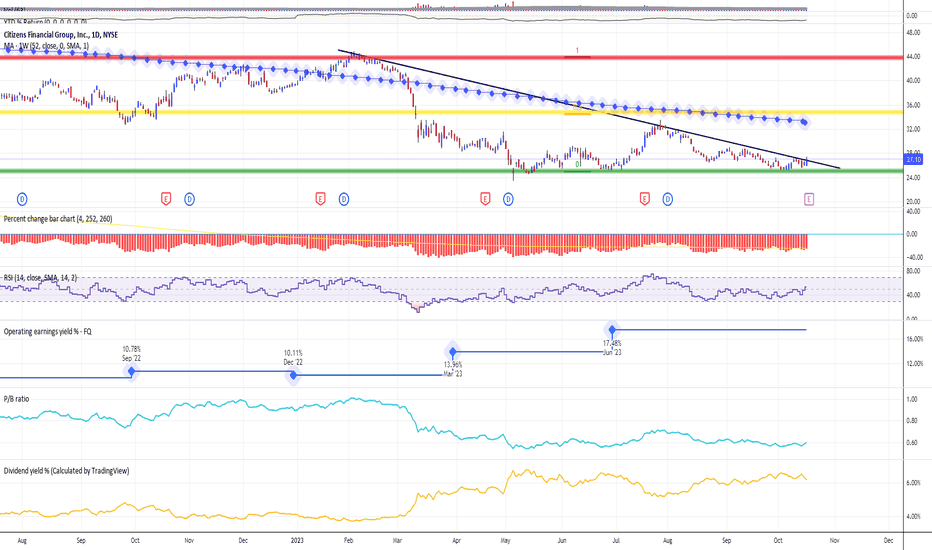

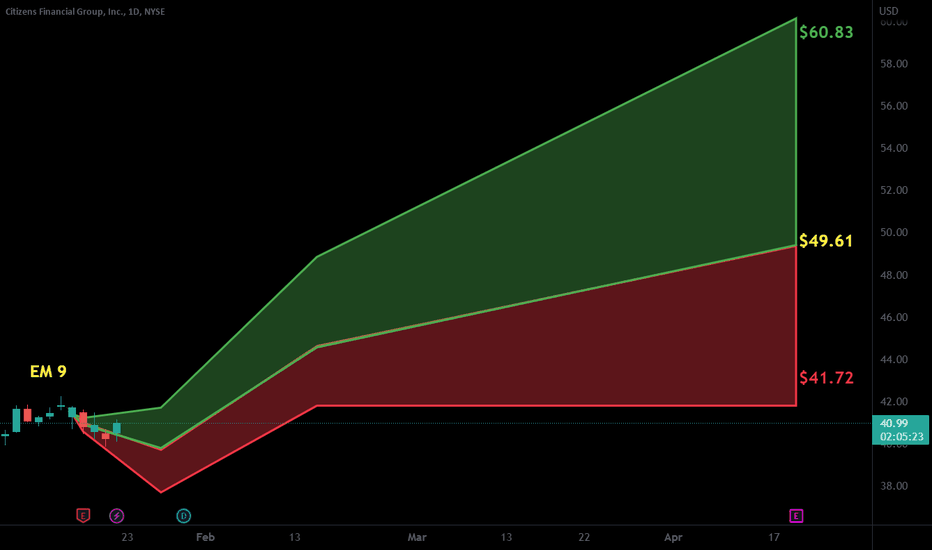

Citizens Financial Group. Possible Upside on Q3'23 Earnings CallBond pressure...

Pushing' down on me,

Pressing' down on you,

No man ask for...

Technical graph says that possible upside with NYSE:CFG stocks could be possible, with projected/ targeted line at 52W SMA.

With 6.20% dividends yield, double-digit operating yield and P/B just at 0.6, NYSE:CFG s

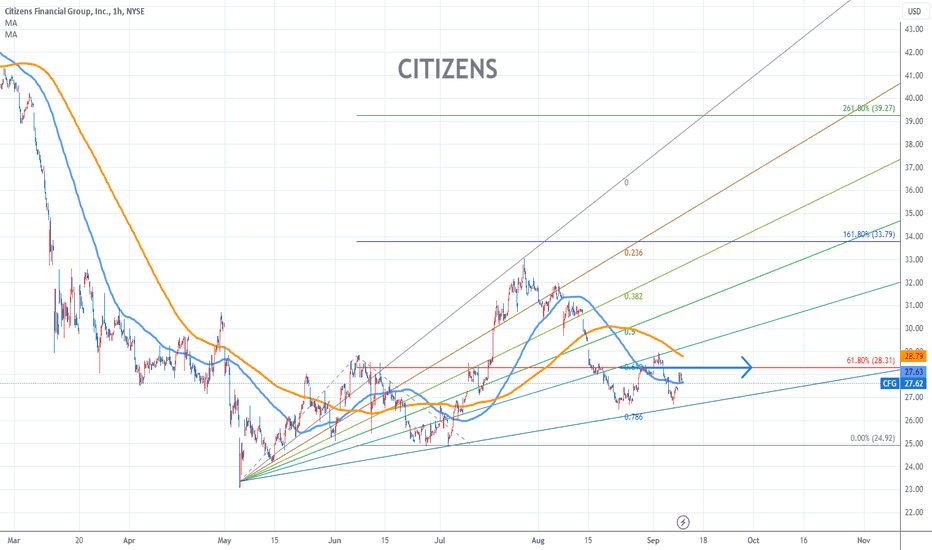

CITIZENS Stock Chart Fibonacci Analysis 091123 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 28.3/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

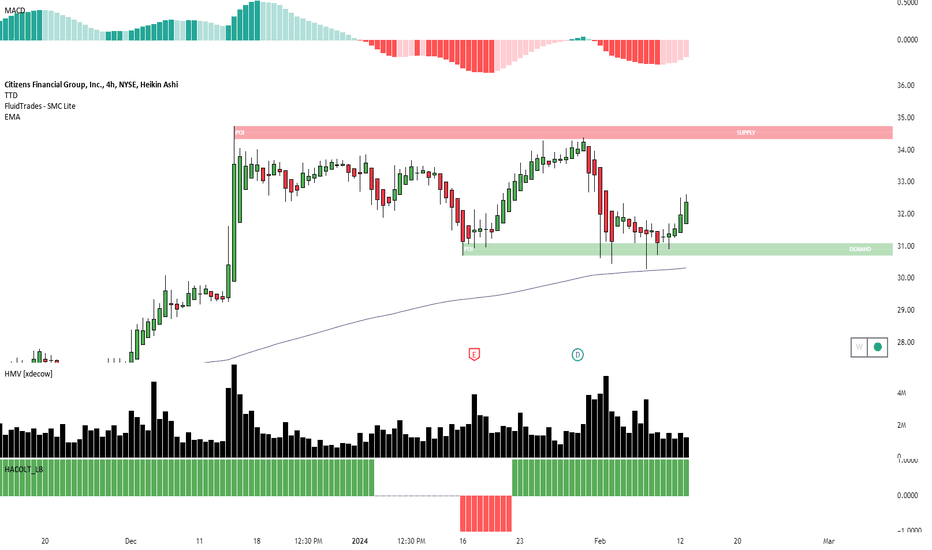

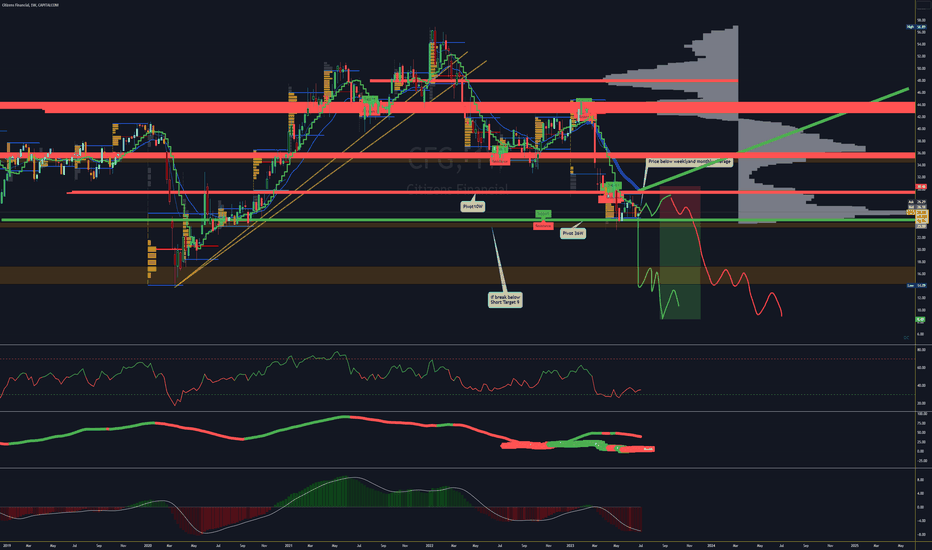

CFG Citizens Financial Bearish ShortTrend Bearish

Lower Highs

Lower Lows

POC falling

RSI below 50

Stochastic Bearish

MACD Bearish

A break below Pivot(See Chart) would reach quickly next Target at 13,80

Citizens Financial Group, Inc. Announces Preliminary Stress Capital Buffer

This document contains forward-looking statements within

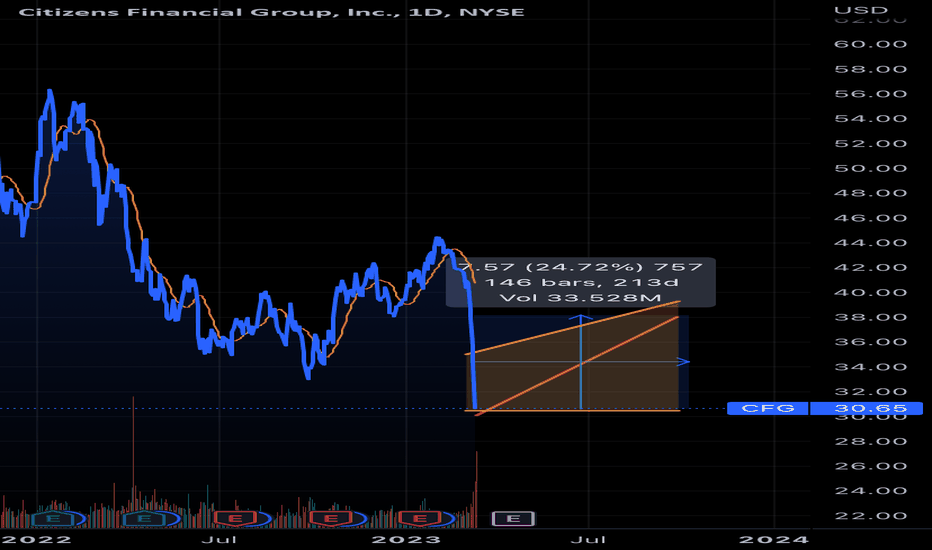

Citizens Bank OversoldCitizens bank appears to be unfairly sold off amongst the SVB banking crisis. It has a solid balance sheet and a low P/E, with a high dividend yield. This gives lots of upsides to potential investors looking for a discount. I predict this will ride back up 25-30% in to the high 30’s within the comin

CFG - Minor Low BreakCFG is following a reinvigorated banking sector with a strong uptrend.

A recent pullback has left prices within my buy band.

G/G trend with 13/21 propulsion dots. RAF > Extreme and Vscore =1 has proven to be support.

Darvas 3.0 signal is further confirmation of strength.

Looking for a minor

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CFG5416477

Citizens Financial Group, Inc. 5.641% 21-MAY-2037Yield to maturity

5.86%

Maturity date

May 21, 2037

CFG5053448

Citizens Financial Group, Inc. 2.638% 30-SEP-2032Yield to maturity

5.81%

Maturity date

Sep 30, 2032

CFG5796235

Citizens Financial Group, Inc. 6.645% 25-APR-2035Yield to maturity

5.48%

Maturity date

Apr 25, 2035

CFG5853910

Citizens Financial Group, Inc. 5.718% 23-JUL-2032Yield to maturity

5.09%

Maturity date

Jul 23, 2032

CFG4946486

Citizens Financial Group, Inc. 2.5% 06-FEB-2030Yield to maturity

5.03%

Maturity date

Feb 6, 2030

CFG4981697

Citizens Financial Group, Inc. 3.25% 30-APR-2030Yield to maturity

4.98%

Maturity date

Apr 30, 2030

CFG5736901

Citizens Financial Group, Inc. 5.841% 23-JAN-2030Yield to maturity

4.97%

Maturity date

Jan 23, 2030

CFG6014632

Citizens Financial Group, Inc. 5.253% 05-MAR-2031Yield to maturity

4.93%

Maturity date

Mar 5, 2031

CFG4316726

Citizens Financial Group, Inc. 4.3% 03-DEC-2025Yield to maturity

4.73%

Maturity date

Dec 3, 2025

C

CZTN5458274

Citizens Bank, National Association 4.575% 09-AUG-2028Yield to maturity

4.63%

Maturity date

Aug 9, 2028

CFG4862143

Citizens Financial Group, Inc. 2.85% 27-JUL-2026Yield to maturity

4.60%

Maturity date

Jul 27, 2026

See all 1C5 bonds

Frequently Asked Questions

The current price of 1C5 is 41.77 EUR — it has decreased by −1.07% in the past 24 hours. Watch CITIZENS FINANCIAL GROUP INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange CITIZENS FINANCIAL GROUP INC stocks are traded under the ticker 1C5.

1C5 stock has risen by 2.77% compared to the previous week, the month change is a 19.27% rise, over the last year CITIZENS FINANCIAL GROUP INC has showed a 11.37% increase.

We've gathered analysts' opinions on CITIZENS FINANCIAL GROUP INC future price: according to them, 1C5 price has a max estimate of 56.05 EUR and a min estimate of 41.82 EUR. Watch 1C5 chart and read a more detailed CITIZENS FINANCIAL GROUP INC stock forecast: see what analysts think of CITIZENS FINANCIAL GROUP INC and suggest that you do with its stocks.

1C5 stock is 1.19% volatile and has beta coefficient of 1.26. Track CITIZENS FINANCIAL GROUP INC stock price on the chart and check out the list of the most volatile stocks — is CITIZENS FINANCIAL GROUP INC there?

Today CITIZENS FINANCIAL GROUP INC has the market capitalization of 18.17 B, it has increased by 3.22% over the last week.

Yes, you can track CITIZENS FINANCIAL GROUP INC financials in yearly and quarterly reports right on TradingView.

CITIZENS FINANCIAL GROUP INC is going to release the next earnings report on Oct 16, 2025. Keep track of upcoming events with our Earnings Calendar.

1C5 earnings for the last quarter are 0.78 EUR per share, whereas the estimation was 0.75 EUR resulting in a 4.14% surprise. The estimated earnings for the next quarter are 0.88 EUR per share. See more details about CITIZENS FINANCIAL GROUP INC earnings.

CITIZENS FINANCIAL GROUP INC revenue for the last quarter amounts to 1.73 B EUR, despite the estimated figure of 1.71 B EUR. In the next quarter, revenue is expected to reach 1.81 B EUR.

1C5 net income for the last quarter is 370.12 M EUR, while the quarter before that showed 344.78 M EUR of net income which accounts for 7.35% change. Track more CITIZENS FINANCIAL GROUP INC financial stats to get the full picture.

Yes, 1C5 dividends are paid quarterly. The last dividend per share was 0.37 EUR. As of today, Dividend Yield (TTM)% is 3.46%. Tracking CITIZENS FINANCIAL GROUP INC dividends might help you take more informed decisions.

CITIZENS FINANCIAL GROUP INC dividend yield was 3.84% in 2024, and payout ratio reached 55.53%. The year before the numbers were 5.07% and 53.71% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 20, 2025, the company has 17.29 K employees. See our rating of the largest employees — is CITIZENS FINANCIAL GROUP INC on this list?

Like other stocks, 1C5 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CITIZENS FINANCIAL GROUP INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CITIZENS FINANCIAL GROUP INC technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CITIZENS FINANCIAL GROUP INC stock shows the strong buy signal. See more of CITIZENS FINANCIAL GROUP INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.