Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.96 EUR

188.33 M EUR

568.35 M EUR

193.75 M

About PEYTO EXPLORATION & DEVELOP CORP

Sector

Industry

CEO

Jean-Paul H. Lachance

Website

Headquarters

Calgary

Founded

1998

FIGI

BBG000GZ93F2

Peyto Exploration & Development Corp. engages in the exploration, development, and production of oil and natural gas. Its operations include deep basin, marketing, and reserves. The company was founded by Richard F. Braund and Donald T. Gray in 1998 and is headquartered in Calgary, Canada.

Related stocks

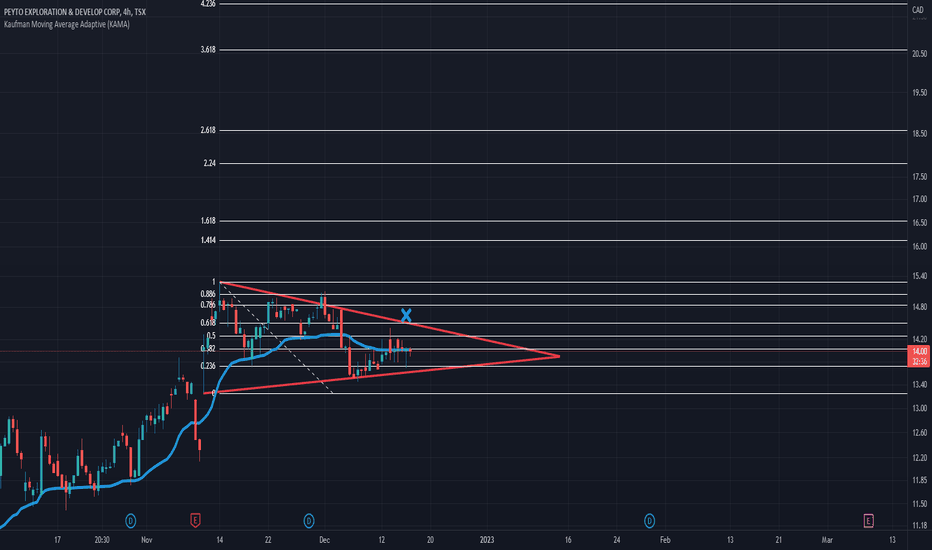

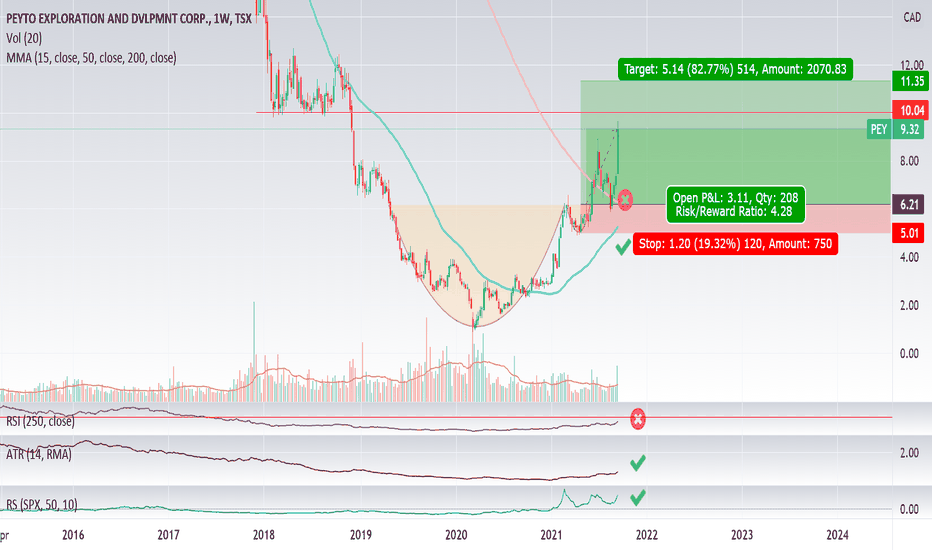

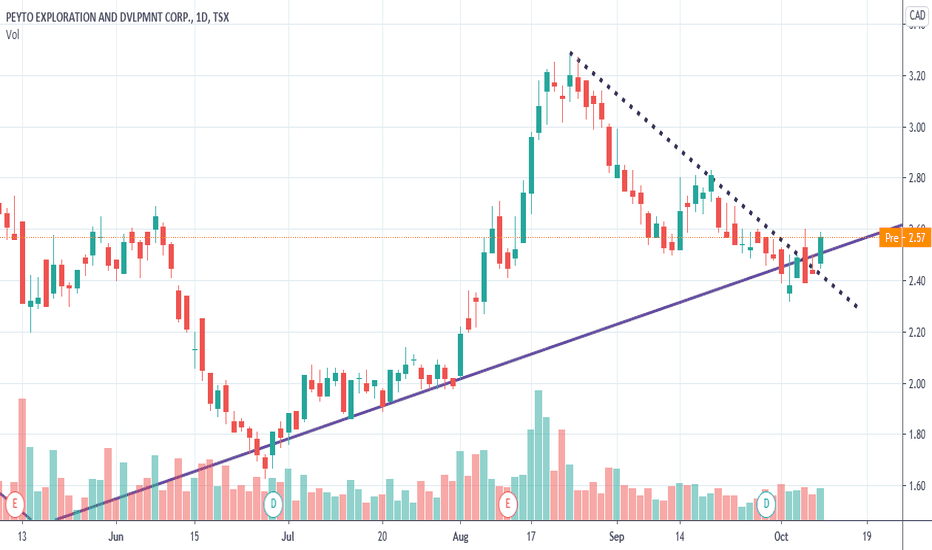

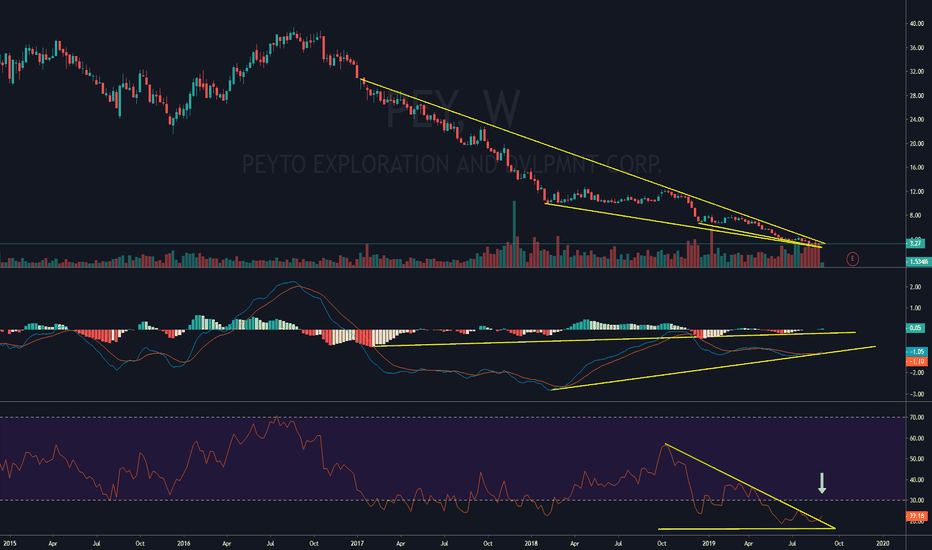

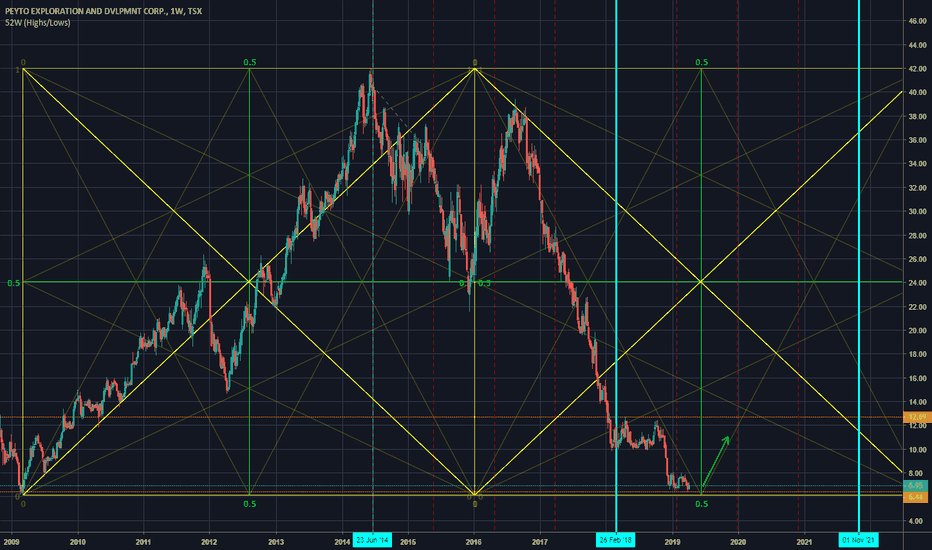

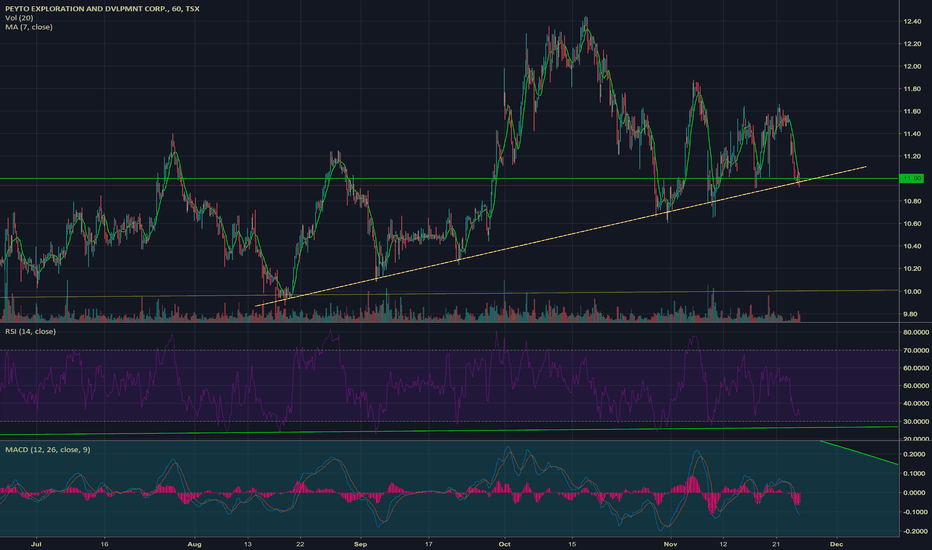

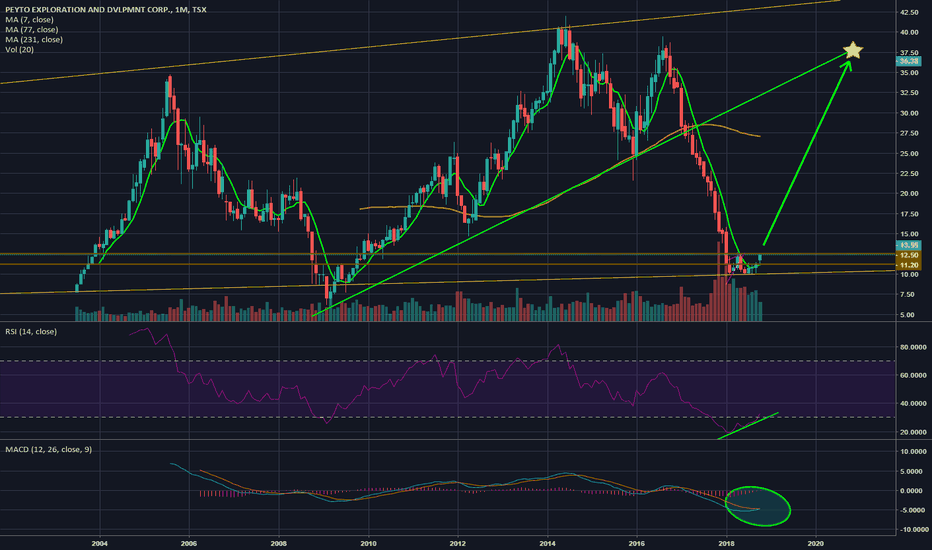

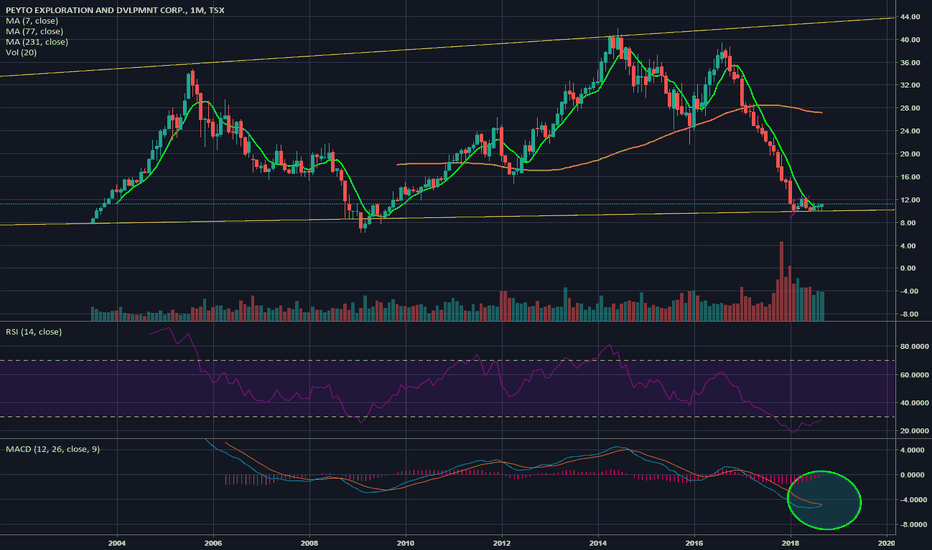

Gann Box and MACD AnalysisTSX:PEY appeared on my screener for a MACD crossover play. I applied Gann box and it looks like we are coming up on a critical point with the potential for the move upwards.

I have shown the 48 Day periods which is part of Gann's 192-day cycle to see if there are any points of reversals and it li

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PXK is 12.14 EUR — it has increased by 0.37% in the past 24 hours. Watch PEYTO EXPLORATION & DEVELOPMENT CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange PEYTO EXPLORATION & DEVELOPMENT CORP stocks are traded under the ticker PXK.

PXK stock has risen by 3.36% compared to the previous week, the month change is a −6.76% fall, over the last year PEYTO EXPLORATION & DEVELOPMENT CORP has showed a 26.59% increase.

We've gathered analysts' opinions on PEYTO EXPLORATION & DEVELOPMENT CORP future price: according to them, PXK price has a max estimate of 15.08 EUR and a min estimate of 12.09 EUR. Watch PXK chart and read a more detailed PEYTO EXPLORATION & DEVELOPMENT CORP stock forecast: see what analysts think of PEYTO EXPLORATION & DEVELOPMENT CORP and suggest that you do with its stocks.

PXK stock is 1.88% volatile and has beta coefficient of 1.06. Track PEYTO EXPLORATION & DEVELOPMENT CORP stock price on the chart and check out the list of the most volatile stocks — is PEYTO EXPLORATION & DEVELOPMENT CORP there?

Today PEYTO EXPLORATION & DEVELOPMENT CORP has the market capitalization of 2.44 B, it has increased by 0.07% over the last week.

Yes, you can track PEYTO EXPLORATION & DEVELOPMENT CORP financials in yearly and quarterly reports right on TradingView.

PEYTO EXPLORATION & DEVELOPMENT CORP is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

PXK earnings for the last quarter are 0.37 EUR per share, whereas the estimation was 0.40 EUR resulting in a −9.52% surprise. The estimated earnings for the next quarter are 0.30 EUR per share. See more details about PEYTO EXPLORATION & DEVELOPMENT CORP earnings.

PEYTO EXPLORATION & DEVELOPMENT CORP revenue for the last quarter amounts to 227.54 M EUR, despite the estimated figure of 234.62 M EUR. In the next quarter, revenue is expected to reach 202.90 M EUR.

PXK net income for the last quarter is 73.29 M EUR, while the quarter before that showed 52.51 M EUR of net income which accounts for 39.58% change. Track more PEYTO EXPLORATION & DEVELOPMENT CORP financial stats to get the full picture.

Yes, PXK dividends are paid monthly. The last dividend per share was 0.07 EUR. As of today, Dividend Yield (TTM)% is 6.80%. Tracking PEYTO EXPLORATION & DEVELOPMENT CORP dividends might help you take more informed decisions.

PEYTO EXPLORATION & DEVELOPMENT CORP dividend yield was 7.70% in 2024, and payout ratio reached 92.09%. The year before the numbers were 10.96% and 80.69% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 20, 2025, the company has 140 employees. See our rating of the largest employees — is PEYTO EXPLORATION & DEVELOPMENT CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PEYTO EXPLORATION & DEVELOPMENT CORP EBITDA is 378.09 M EUR, and current EBITDA margin is 62.46%. See more stats in PEYTO EXPLORATION & DEVELOPMENT CORP financial statements.

Like other stocks, PXK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PEYTO EXPLORATION & DEVELOPMENT CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PEYTO EXPLORATION & DEVELOPMENT CORP technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PEYTO EXPLORATION & DEVELOPMENT CORP stock shows the buy signal. See more of PEYTO EXPLORATION & DEVELOPMENT CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.