Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.37 EUR

1.10 B EUR

51.31 B EUR

165.63 M

About Bunge Limited

Sector

Industry

CEO

Gregory A. Heckman

Website

Headquarters

Chesterfield

Founded

2023

ISIN

CH1300646267

FIGI

BBG01K03XKB4

Bunge Global SA engages in agribusiness including food and ingredients. It operates through the following segments: Agribusiness, Refined & Specialty Oils, Milling, Sugar & Bioenergy, and Corporate & Other. The Agribusiness segment is an integrated, global business principally involved in the purchase, storage, transportation, processing and sale of agricultural commodities and commodity products. The Refined & Specialty Oils segment includes businesses that sell vegetable oils and fats, including cooking oils, shortenings, specialty ingredients, and renewable diesel feedstocks. The Milling segment refers to the businesses that sell wheat flours, bakery mixes, and corn-based products. The Sugar & Bioenergy segment consists of results from the company’s previously owned 50% ownership interest in BP Bunge Bioenergia. The Corporate & Other segment focuses on the salaries and overhead for corporate functions that are not allocated to individual reporting segments because the operating performance of such reporting segments is evaluated. It connects farmers to consumers to deliver essential and sustainable food, feed and fuel. The company was founded on February 14, 2023 and is headquartered in Chesterfield, MO.

Related stocks

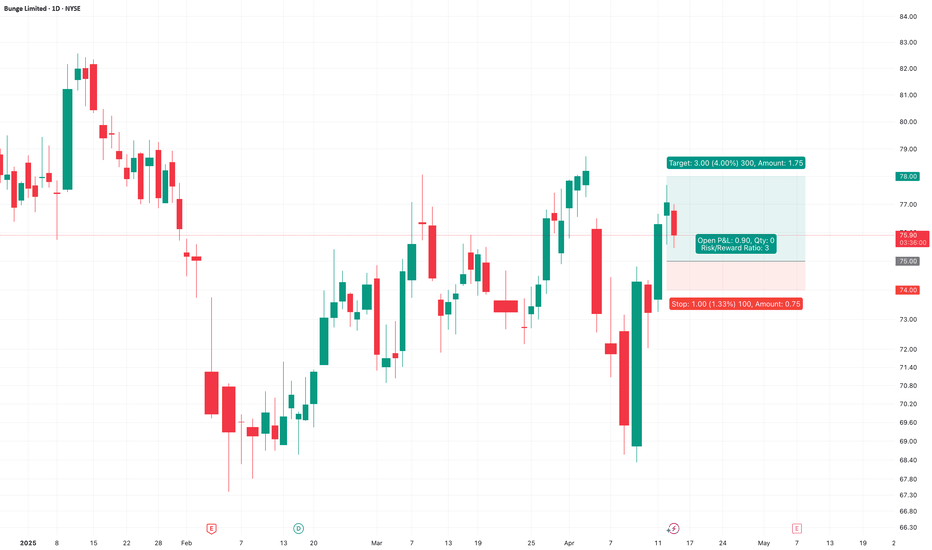

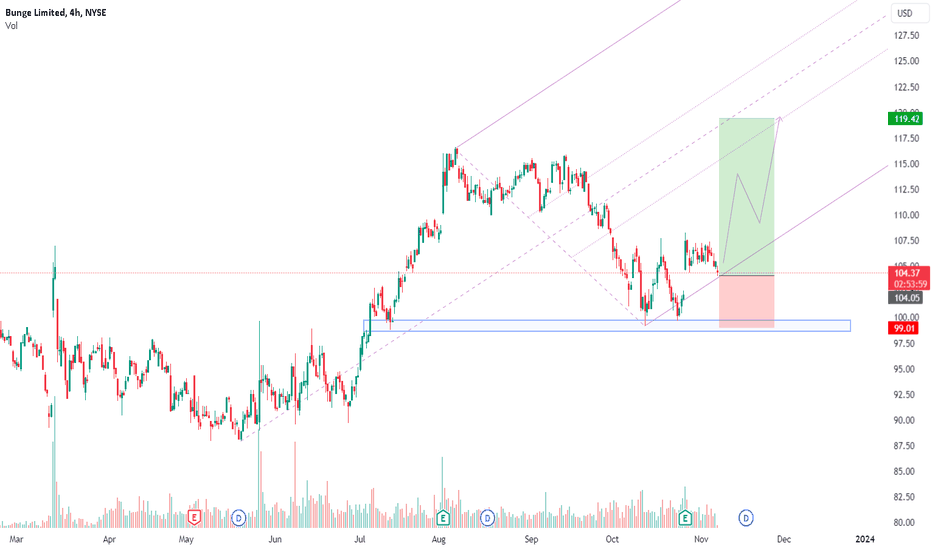

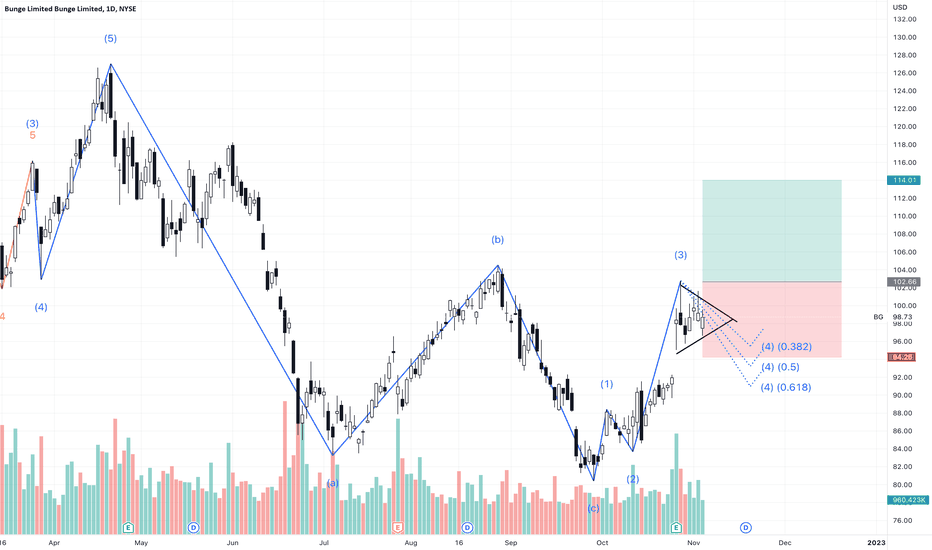

BG - Bunge Limited (Daily chart, NYSE) - Long PositionBG - Bunge Limited (Daily chart, NYSE) - Long Position; short-term research idea.

Risk assessment: Medium {support structure integrity risk}

Risk/Reward ratio ~ 3

Current Market Price (CMP) ~ 75.80

Entry limit ~ 75.50 to 74.50 (Avg. - 75) on April 15, 2025

Target limit ~ 78 (+4%; +3 points)

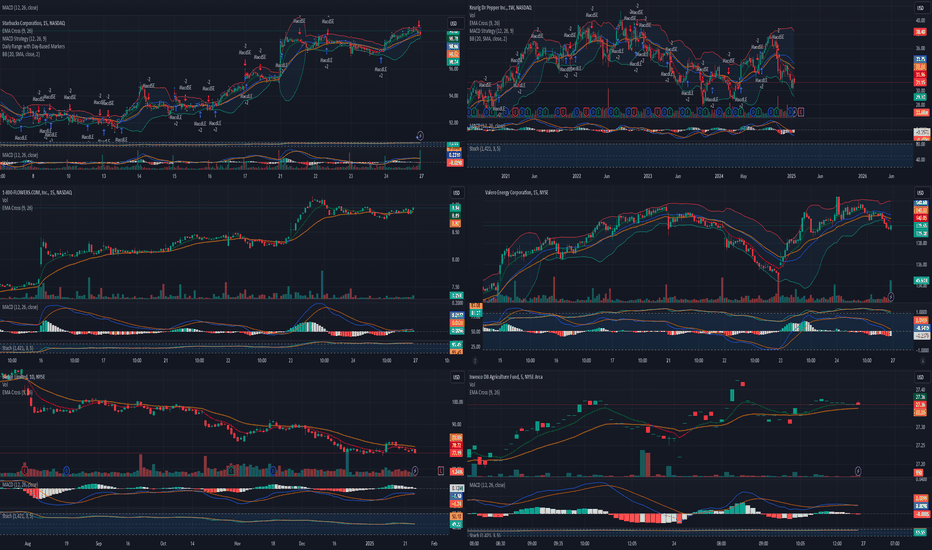

Trade wars begin.The trade war with Colombia will have a ripple effect across several industries, particularly those heavily reliant on imports and exports. Here’s a breakdown of how this could impact sectors and stocks:

1. Coffee Companies (Starbucks, Green Mountain Coffee)

Impact: Coffee prices are likely to rise

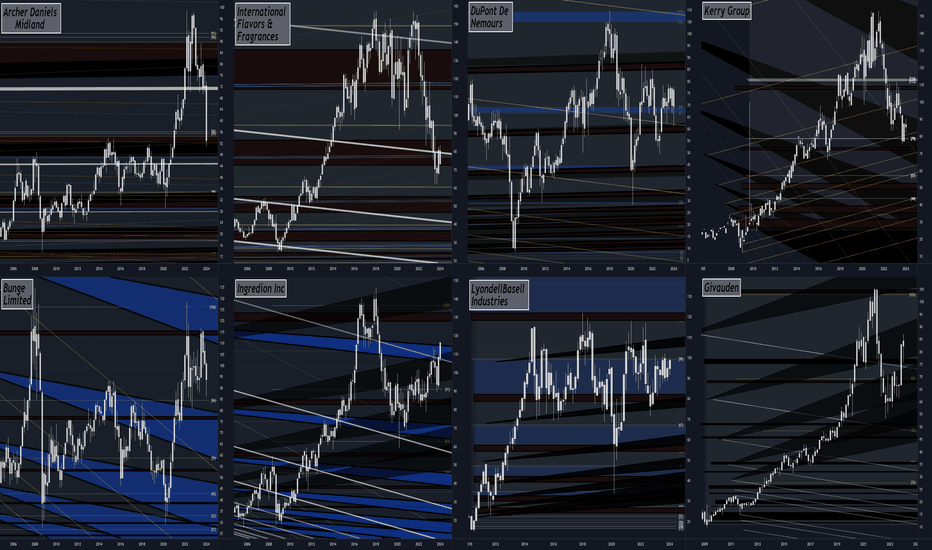

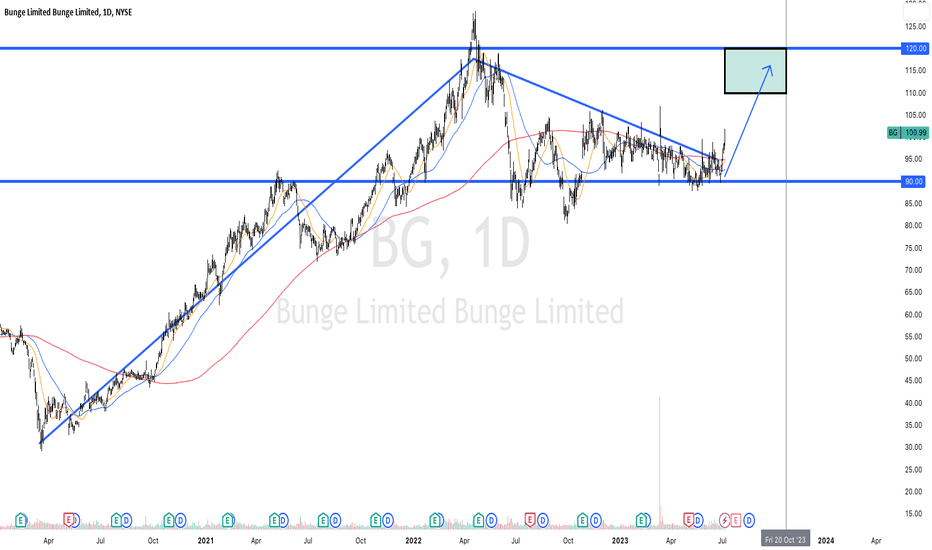

Food Additive Giants: Macro Fib SchematicsThese food additive companies manufacture agricultural ingrediants and additives that nakes its way to prodcust in grocery stores. Archer Daniels Midlands Co, Bunge Limited, International Flavors & Fragrances, Ingredion Inc, DuPont De Nemours, LyondellBasell Industries, Kerry Group, and Givauden are

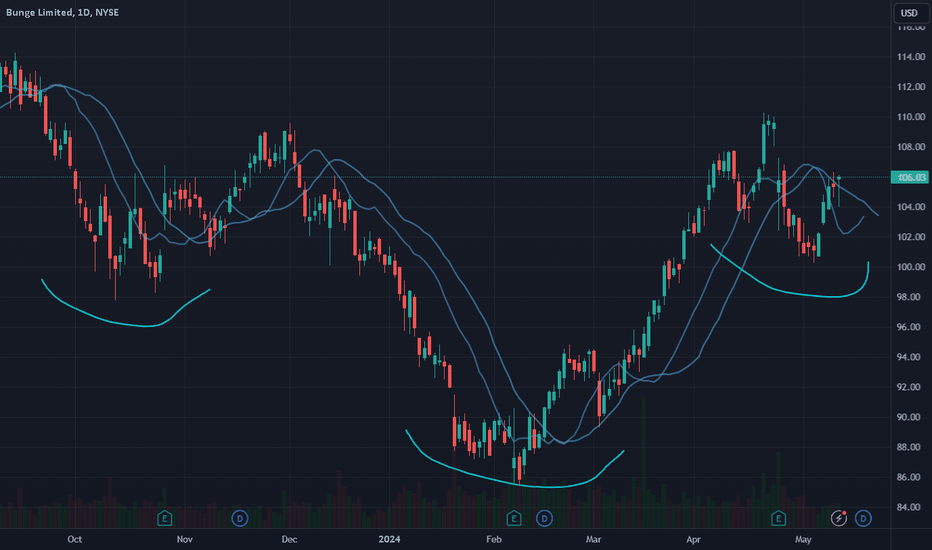

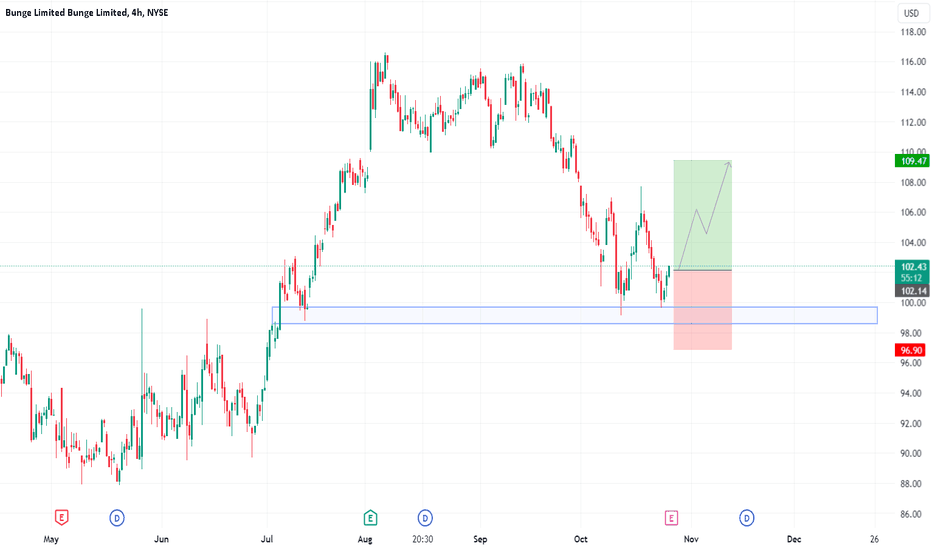

Bunge Limited ($BG) LongBunge Limited ( NYSE:BG ) is an American agribusiness and food company, incorporated in Bermuda, and headquartered in St. Louis, Missouri, United States. As well as being an international soybean exporter, it is also involved in food processing, grain trading, and fertilizer. The daily chart shows

See all ideas

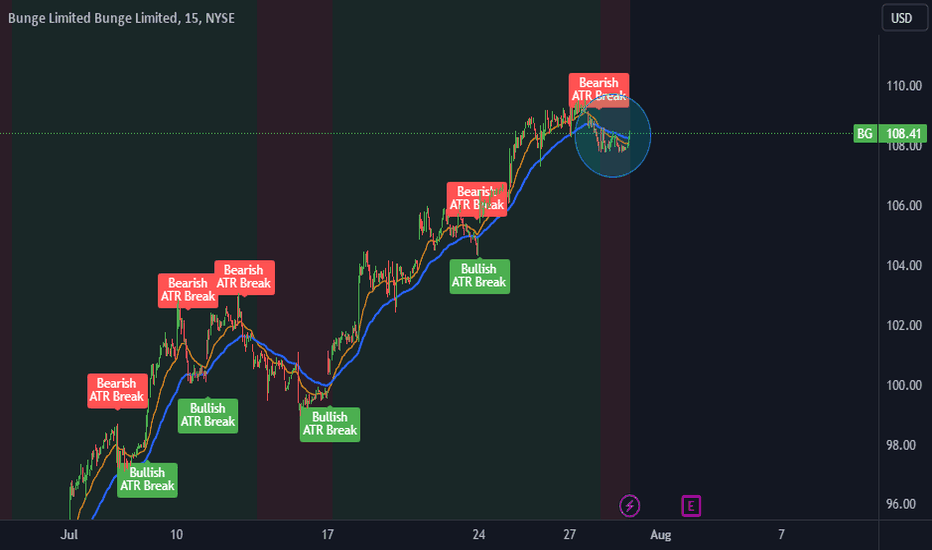

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where Q23 is featured.

Frequently Asked Questions

The current price of Q23 is 63.96 EUR — it has increased by 1.46% in the past 24 hours. Watch BUNGE GLOBAL LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange BUNGE GLOBAL LTD stocks are traded under the ticker Q23.

Q23 stock has risen by 0.03% compared to the previous week, the month change is a −13.94% fall, over the last year BUNGE GLOBAL LTD has showed a −37.99% decrease.

We've gathered analysts' opinions on BUNGE GLOBAL LTD future price: according to them, Q23 price has a max estimate of 88.97 EUR and a min estimate of 62.70 EUR. Watch Q23 chart and read a more detailed BUNGE GLOBAL LTD stock forecast: see what analysts think of BUNGE GLOBAL LTD and suggest that you do with its stocks.

Q23 stock is 1.91% volatile and has beta coefficient of 0.30. Track BUNGE GLOBAL LTD stock price on the chart and check out the list of the most volatile stocks — is BUNGE GLOBAL LTD there?

Today BUNGE GLOBAL LTD has the market capitalization of 12.84 B, it has decreased by −3.92% over the last week.

Yes, you can track BUNGE GLOBAL LTD financials in yearly and quarterly reports right on TradingView.

BUNGE GLOBAL LTD is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

Q23 earnings for the last quarter are 1.67 EUR per share, whereas the estimation was 1.18 EUR resulting in a 41.27% surprise. The estimated earnings for the next quarter are 0.95 EUR per share. See more details about BUNGE GLOBAL LTD earnings.

BUNGE GLOBAL LTD revenue for the last quarter amounts to 10.76 B EUR, despite the estimated figure of 12.03 B EUR. In the next quarter, revenue is expected to reach 10.39 B EUR.

Q23 net income for the last quarter is 185.79 M EUR, while the quarter before that showed 581.52 M EUR of net income which accounts for −68.05% change. Track more BUNGE GLOBAL LTD financial stats to get the full picture.

Yes, Q23 dividends are paid quarterly. The last dividend per share was 0.62 EUR. As of today, Dividend Yield (TTM)% is 3.68%. Tracking BUNGE GLOBAL LTD dividends might help you take more informed decisions.

BUNGE GLOBAL LTD dividend yield was 3.50% in 2024, and payout ratio reached 34.02%. The year before the numbers were 2.59% and 17.56% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 20, 2025, the company has 23 K employees. See our rating of the largest employees — is BUNGE GLOBAL LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BUNGE GLOBAL LTD EBITDA is 1.71 B EUR, and current EBITDA margin is 4.11%. See more stats in BUNGE GLOBAL LTD financial statements.

Like other stocks, Q23 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BUNGE GLOBAL LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BUNGE GLOBAL LTD technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BUNGE GLOBAL LTD stock shows the strong sell signal. See more of BUNGE GLOBAL LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.