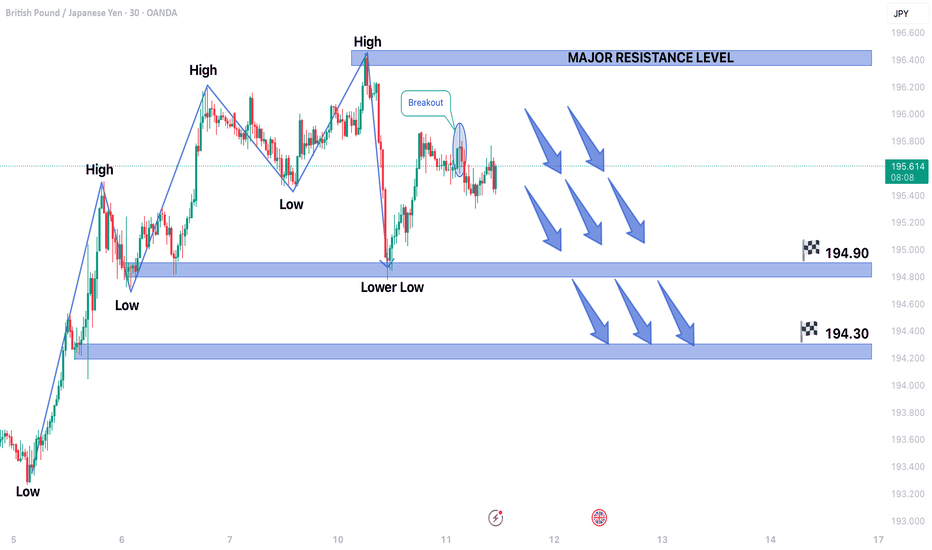

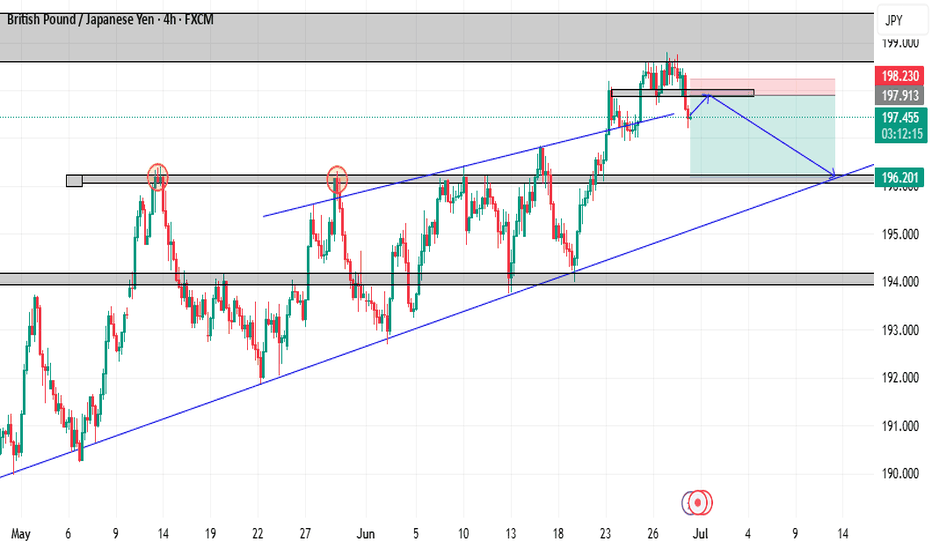

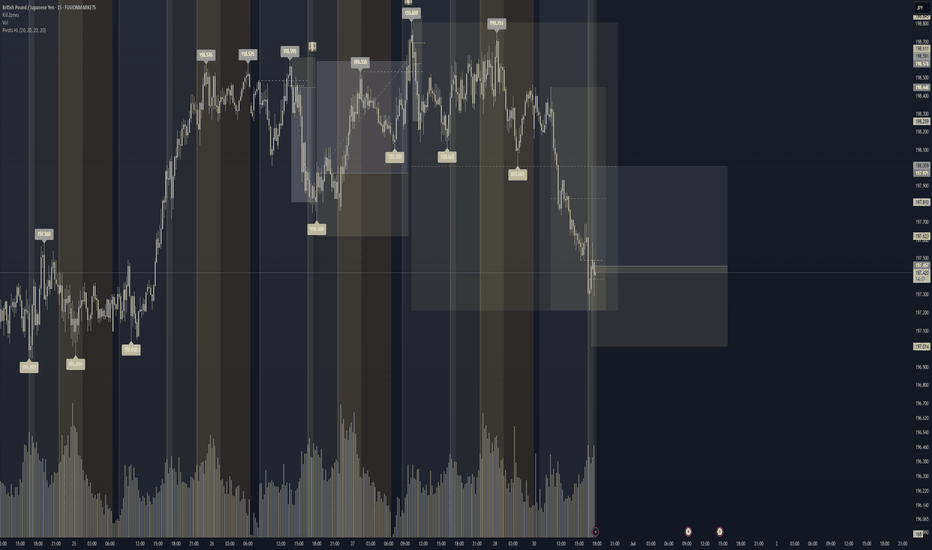

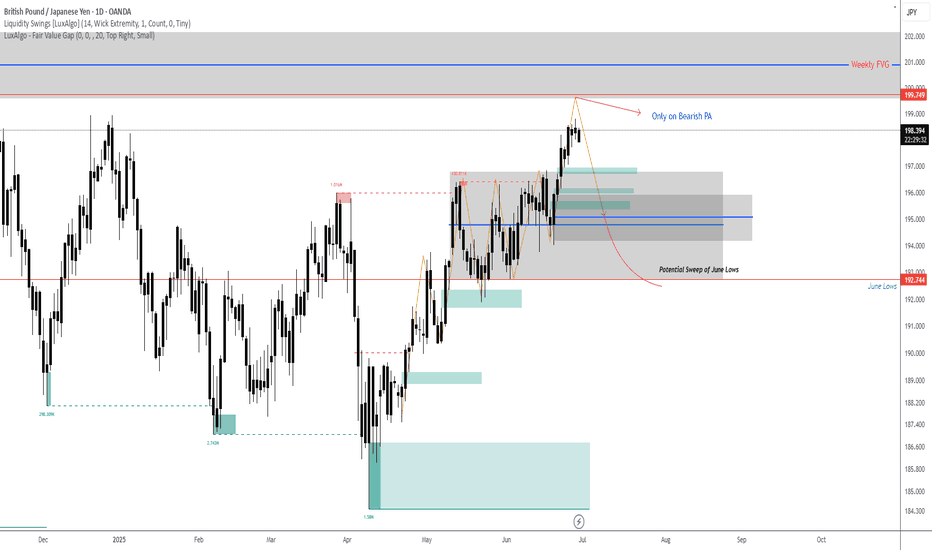

GBPJPY STARTED FORMING BEARISH TREND STRUCTUREGBPJPY STARTED FORMING BEARISH TREND STRUCTURE.

Market is forming lower low, which indicates downtrend in 30 minutes time frame charts.

Market was trading in secondary trend from lest few sessions.

Candlestick reversal pattern can be shown at the top of secondary trend.

market is expected to remain bearish for upcoming sessions.

On lower side market may hit the targets of 194.90 and 194.30.

On higher side 196.45 can be major resistance level.

JPYGBP trade ideas

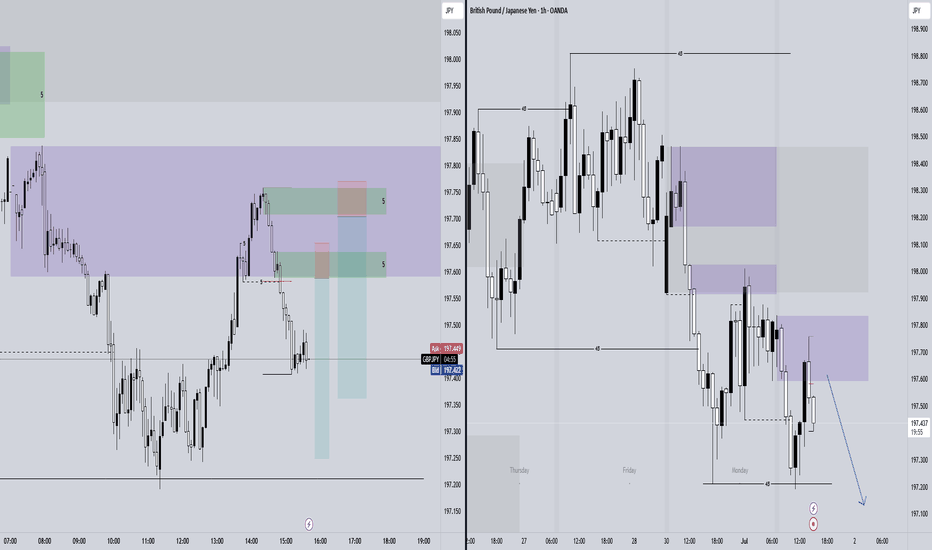

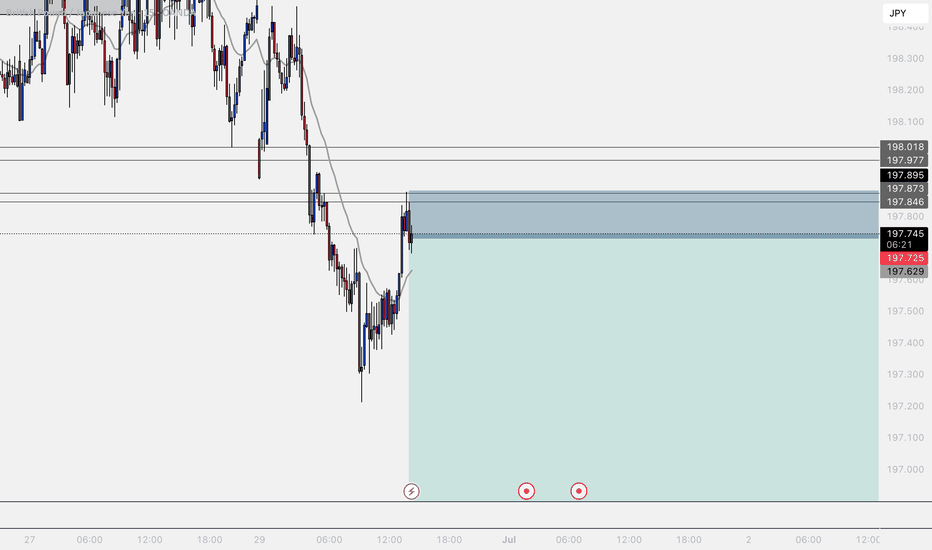

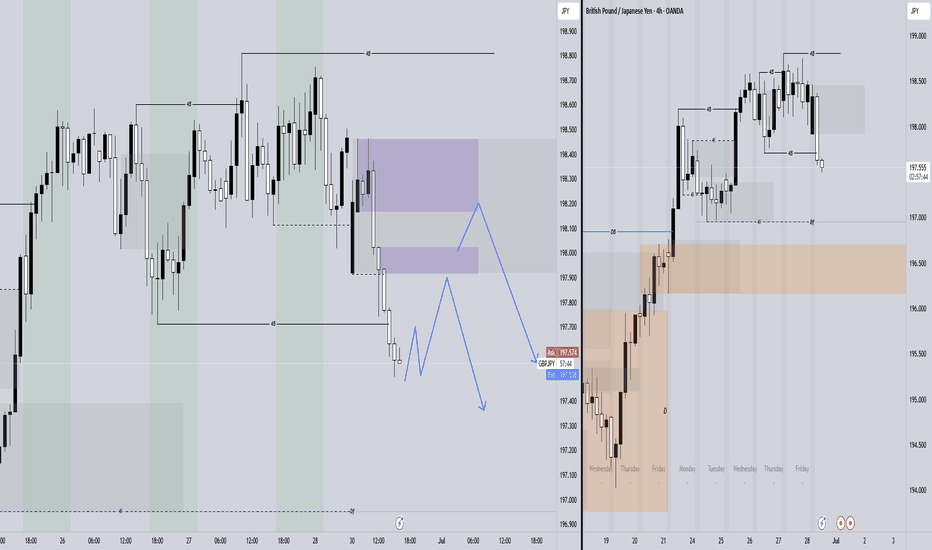

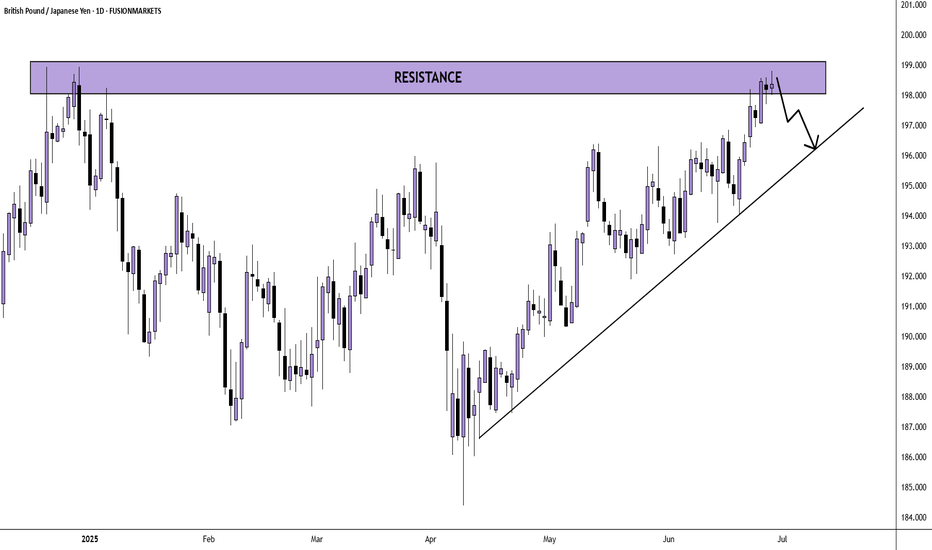

GBPJPY SELL IDEAPrice reached a daily resistance last week and respected it. The price was consolidating and finally broke the previous low (support) on the H4 chart, forming a lower low and signaling the beginning of a downtrend/fall.

I'm on the lookout for a retest of the broken support on H1 for entry for a sell to the next low.

Risk - 30 pips

Reward - 172 pips

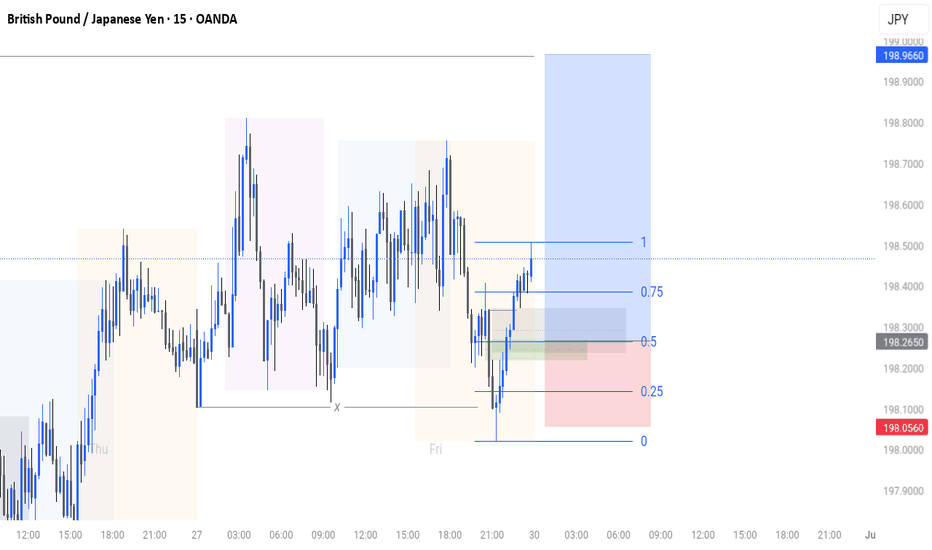

GBPJPY Long – Liquidity Sweep & Bullish Shift from Discount Pric

Price swept key sellside liquidity at 197.489, forming a clean external W pattern in deep discount territory. A bullish engulfing candle followed, closing above the internal shift point and reclaiming structure just beneath 198.012 (yesterday’s low). Entered long on confirmed shift with TP set at box equilibrium (EQ) and stop loss placed below the pattern base. Setup aligns with liquidity theory, structure reclaim, and smart money accumulation.

GBPJPY SHORT DAILY FORECAST Q3 D30 W27 Y25GBPJPY SHORT DAILY FORECAST Q3 D30 W27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBP/CAD (Two Trade Recaps) EUR/NZD Long and GBP/JPY LongEUR/NZD Long

Minimum entry requirements:

- If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

- If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

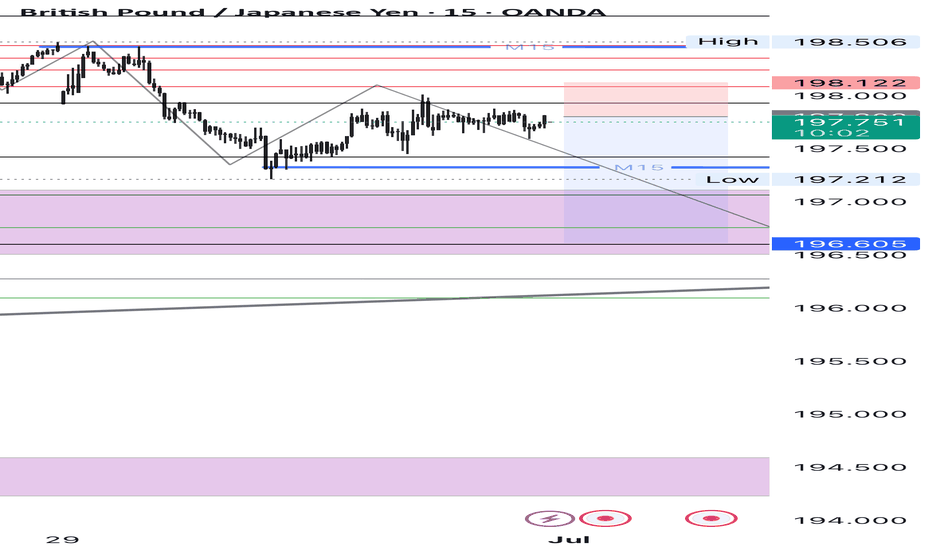

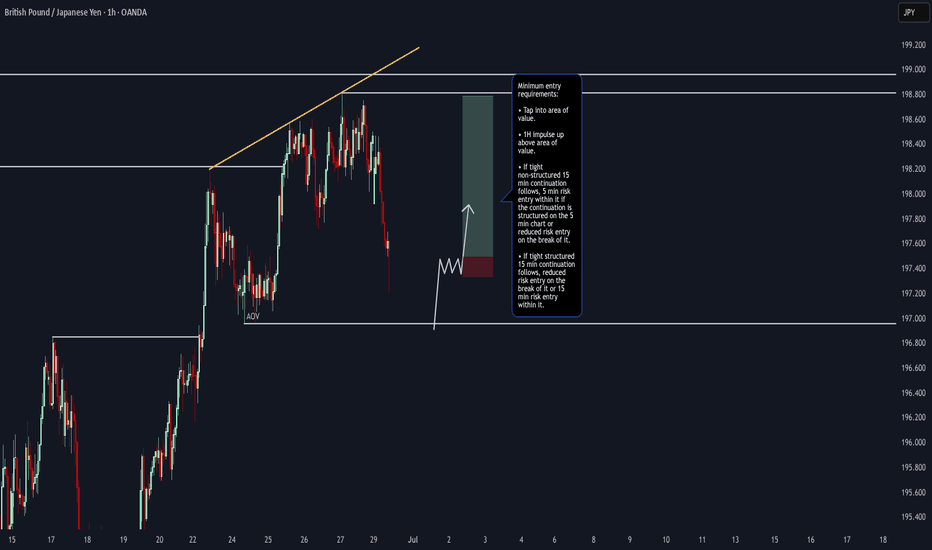

GBP/JPY Long

Minimum entry requirements:

- Tap into area of value.

- 1H impulse up above area of value.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

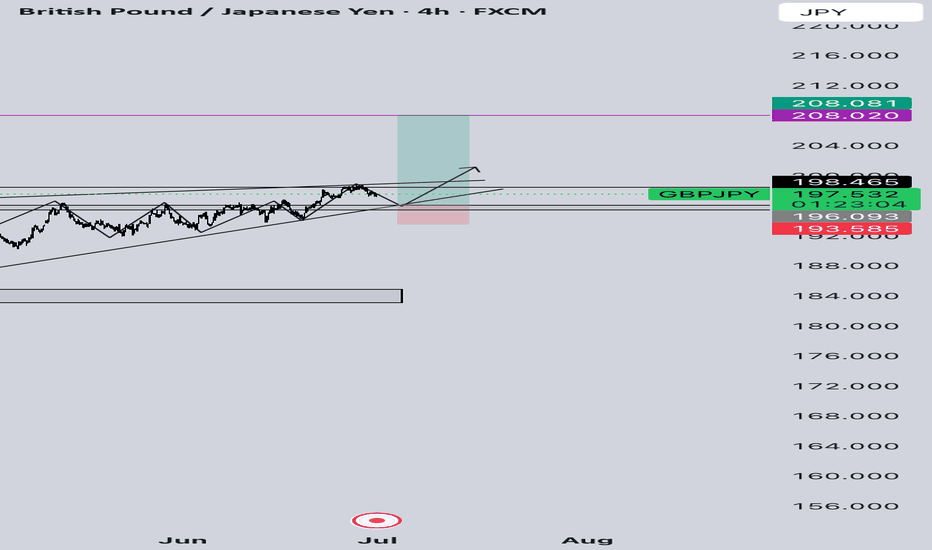

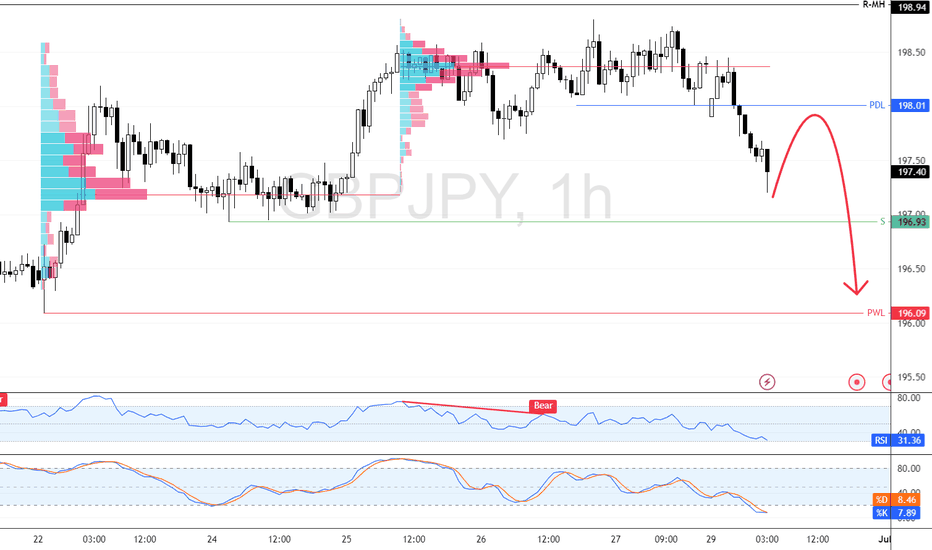

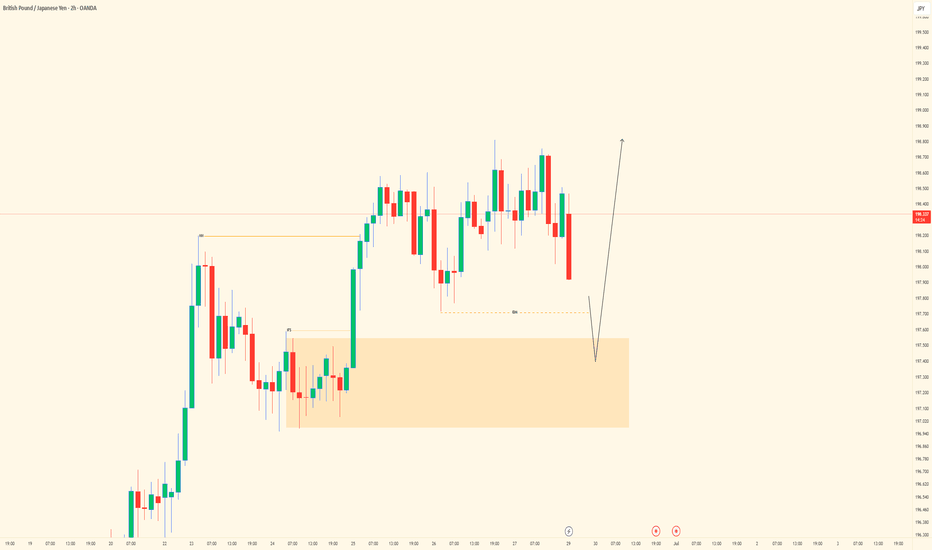

GBP/JPY Trades Lower After Breaching 198.0 SupportGBP/JPY declined from recent highs, currently trading around 197.3. The break below Friday’s 198.0 low intensified the downtrend, with the pair nearing a key support at 196.9.

A temporary rebound toward 198.0 is possible before the downtrend resumes toward 196.0. The bearish outlook is invalidated if GBP/JPY breaks above 198.9.

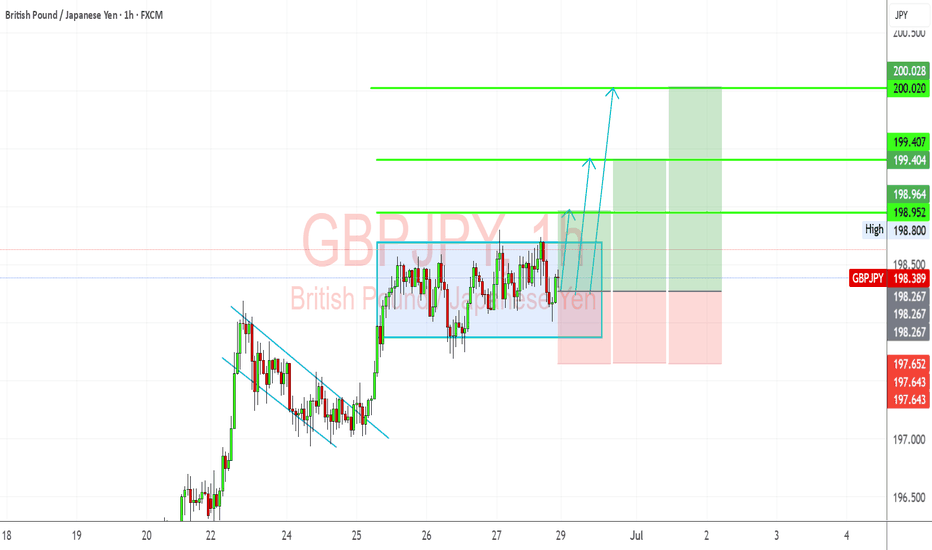

GBPJPY Eyes 200 BoJ Dovishness & Bullish UK SentimentGBPJPY pair has staged a decisive breakout from a multi-day consolidation zone, with technical momentum and macro fundamentals aligning in favor of further upside. Price action has respected a bullish continuation structure — a falling wedge followed by horizontal accumulation — and is now pressing toward the psychological 200.00 level. With the Bank of England holding firm on policy and the Bank of Japan maintaining its ultra-loose stance, GBPJPY presents one of the strongest carry trade setups in the market. Here's a breakdown of what’s driving this move and what to watch next:

📈 Current Bias: Bullish

The pair has confirmed a bullish breakout above the 198.80–198.95 resistance zone, targeting higher fib extensions at 199.40 and 200.00. Momentum is clearly on the bulls’ side as GBPJPY follows through on a textbook pattern breakout.

🔍 Key Fundamentals:

Bank of Japan’s Dovish Stance: The BoJ continues to resist any significant tightening, reaffirming yield curve control and negative real yields. This keeps the yen fundamentally weak, especially against higher-yielding currencies.

Bank of England’s Hawkish Hold: Despite global easing signals, the BoE remains cautious and data-dependent, with inflation still sticky in the UK. This underpins GBP strength relative to the yen.

Global Risk Appetite: Strong equity markets, especially the US500 rally, reduce demand for the safe-haven JPY and increase appetite for high-yielding cross pairs like GBPJPY.

⚠️ Risks to the Trend:

Safe-Haven Shocks: Any sudden geopolitical tension (e.g., Middle East, US-China trade rhetoric) may trigger JPY demand and reverse the bullish flow.

Unexpected BoE Dovish Pivot: A surprise in UK inflation or dovish commentary from the BoE could weaken GBP momentum.

JPY Intervention Risks: With the yen near historically weak levels, any threat or action from Japan’s Ministry of Finance or verbal intervention by BoJ officials could spark sudden volatility.

📅 Key News/Events Ahead:

Japan’s Tankan Survey (June 30): May influence BoJ tone.

UK Final Manufacturing PMI (July 3): A key gauge for growth momentum.

BoE Governor Bailey Speech (July 5): Any hints on policy trajectory will be market-moving.

US NFP & Global Risk Sentiment: Impacts broader carry trade appetite.

⚖️ Leader or Lagger?

GBPJPY is a leader — it often acts as the flagship pair for carry trade demand. Moves in GBPJPY frequently guide sentiment across other JPY pairs like CADJPY, AUDJPY, and NZDJPY, especially when driven by macro divergences. Its high beta to risk sentiment also makes it a prime barometer for global financial mood.

🎯 Conclusion:

GBPJPY has momentum, macro divergence, and a clean technical setup on its side. The breakout above consolidation favors a continued rally toward 199.40 and possibly 200.00. While geopolitical or policy shocks remain risks, the current backdrop supports staying bullish while above the 197.65 invalidation level.

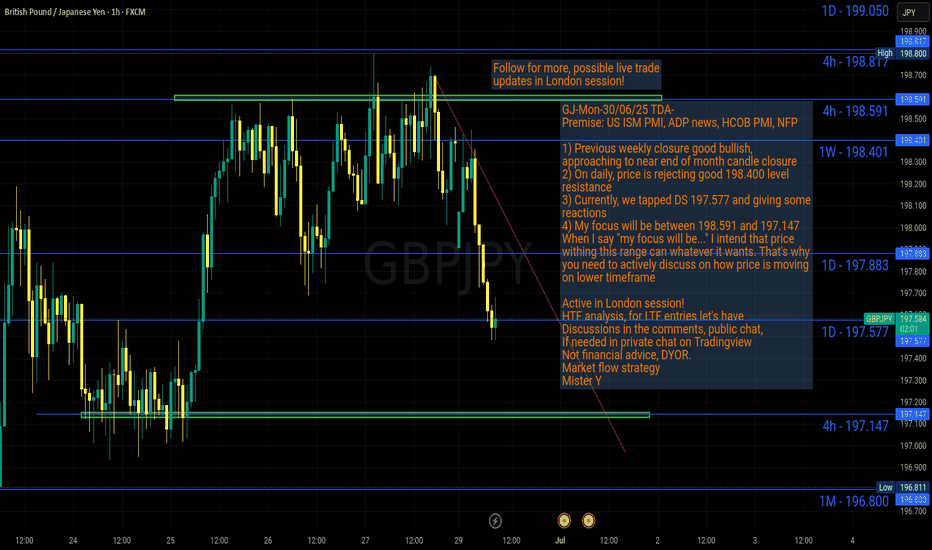

GJ-Mon-30/06/25 TDA-Near end of month candle closureAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Random daily reminder:

Keep pushing forward, learn, make mistake, improve.

Have patience, you are getting there day by day.

-How would you see yourself in 3 years?

-Are you willing to take sacrifices in order to

create for yourself opportunity to live the life you want to?

Journal down consistently, so you keep track of your progress

and see how far you have come.

Don't underestimate the power of little compounds over time.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

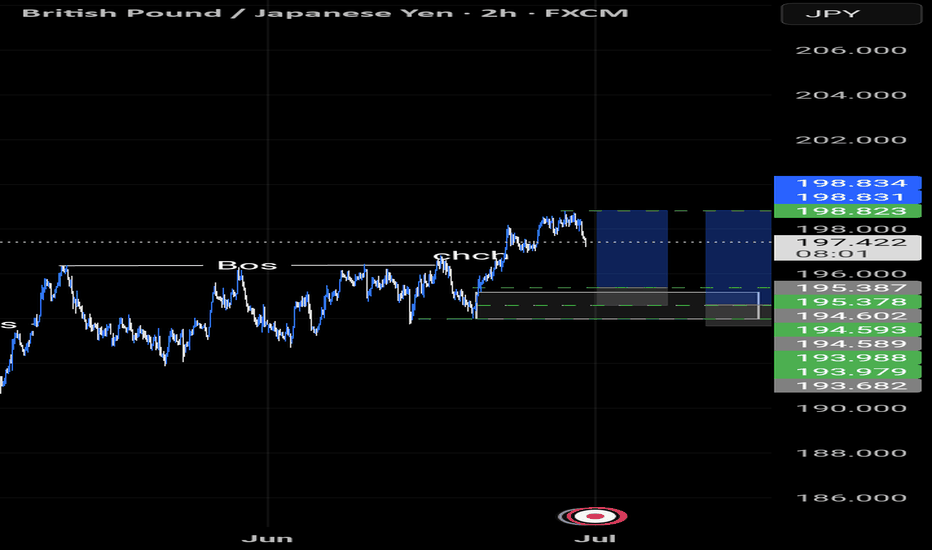

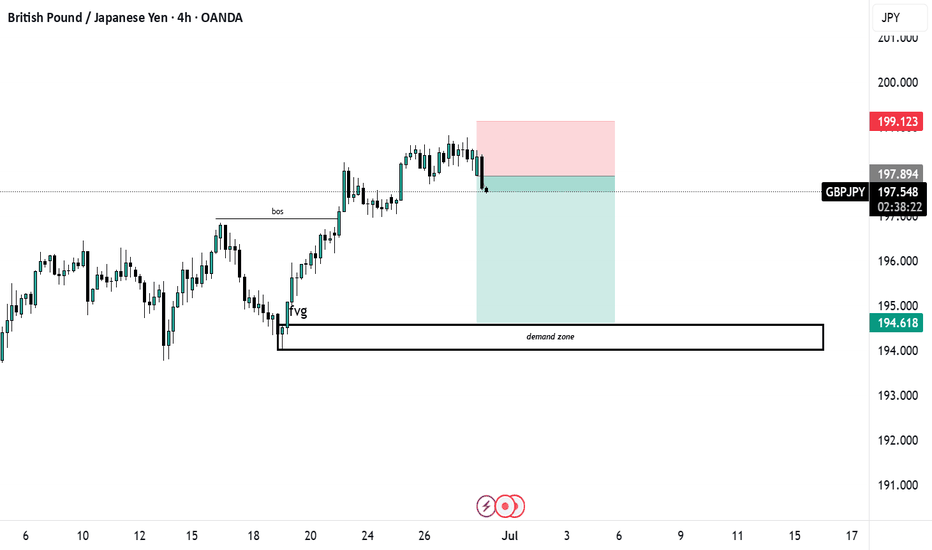

demand zone spotted short sell for long bullish continuation📉 GBP/JPY 4H Analysis – Liquidity Grab + Demand Zone Anticipation

Price action on GBP/JPY is currently in a corrective phase after a strong bullish move, and this pullback presents an interesting setup based on institutional footprints.

1. Structure Break (BOS) & Shift in Momentum

* A Break of Structure (BOS) occurred after price broke above the previous swing high, confirming a bullish trend direction.

* Following the BOS, price retraced into an imbalance (Fair Value Gap - FVG), and responded with aggressive bullish momentum — a classic SMC footprint suggesting institutional buy orders being filled.

2. Current Price Action – Short-Term Bearish Retracement

* Price is currently rejecting the 197.894 resistance zone, and showing signs of weakness with bearish candles.

* This correction is likely targeting liquidity beneath recent lows and a return into the demand zone for potential long opportunities.

3. Demand Zone & Buy Setup

* A well-defined **Demand Zone** sits between **194.000 – 194.600**, which aligns with the previous consolidation and origin of the last major push up.

* This area is also aligned with the unmitigated FVG area — making it a confluence zone where institutional orders are likely to rest.

📍 Trade Plan

Short-Term Bias: Bearish into Demand

Long-Term Bias: Bullish continuation

* Entry: 197.894 (already tapped)

* Stop Loss: 199.123 (above recent highs/supply)

* Take Profit: 194.618 (just above the demand zone to secure profits early)

* Risk-to-Reward: Approximately 1:3

If price enters the demand zone and forms bullish price action (engulfing, internal BOS, or FVG), I will be looking to **flip long** with a target back toward **197.800 – 198.900**.

✅ Conclusion

The current move looks like a healthy retracement to fill imbalances and grab liquidity before the next impulsive leg. This setup provides a high-probability trade opportunity using clean smart money principles.

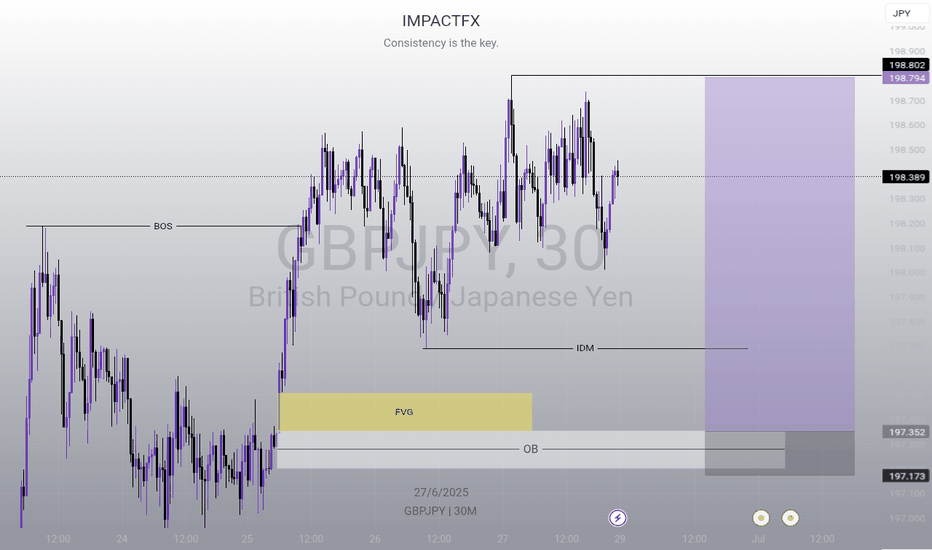

GBPJPY| - Bullish Play with Eyes on Deeper Liquidity📌 Pair: GBPJPY

📈 Bias: Bullish

🕰 HTF View (4H):

Major external structure has been broken to the upside, showing clear bullish intent. Price hasn’t aggressively swept sell-side liquidity yet, so we stay aware of the possibility—but structure favors a continuation north.

🧭 LTF View (30M):

Refined bullish structure forming. Waiting for liquidity sweep into the 30M OB for mitigation and signs of lower timeframe shift.

🎯 Entry Criteria:

After liquidity sweep → LTF CHoCH → Return into OB

Entry off optimal zone (refined precision based on PA)

🎯 Target: Near recent structure highs

🧠 Mindset Note:

Let price come to you. Don’t chase—anticipate. We’re playing the long game through structure and flow, not emotion.

Bless Trading!

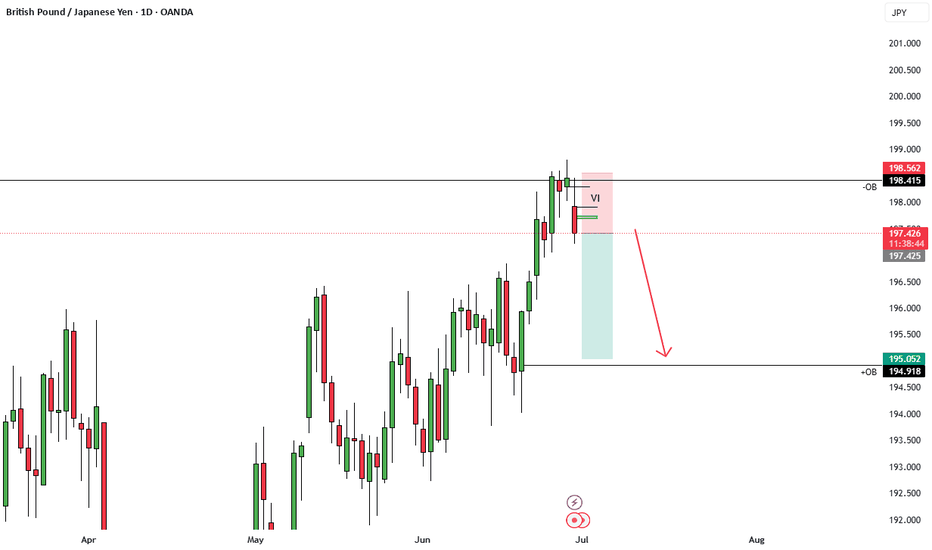

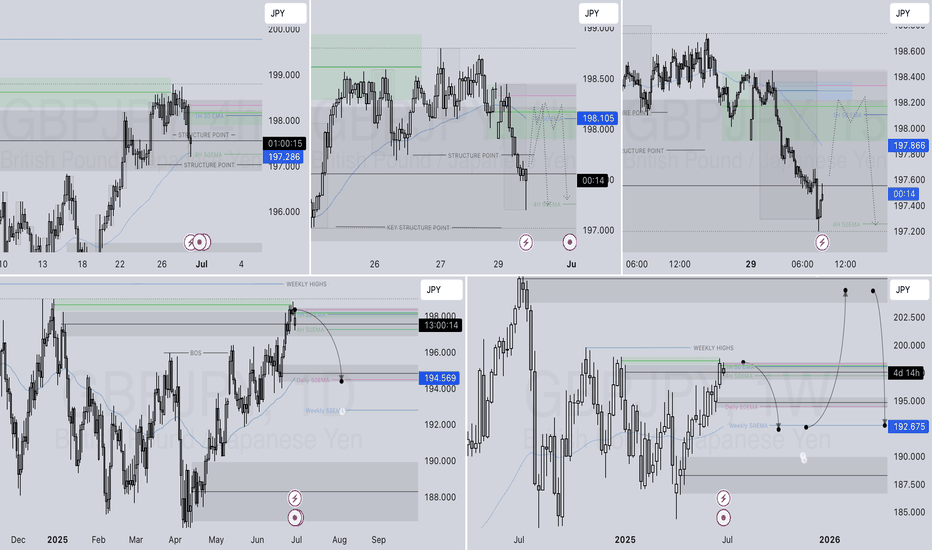

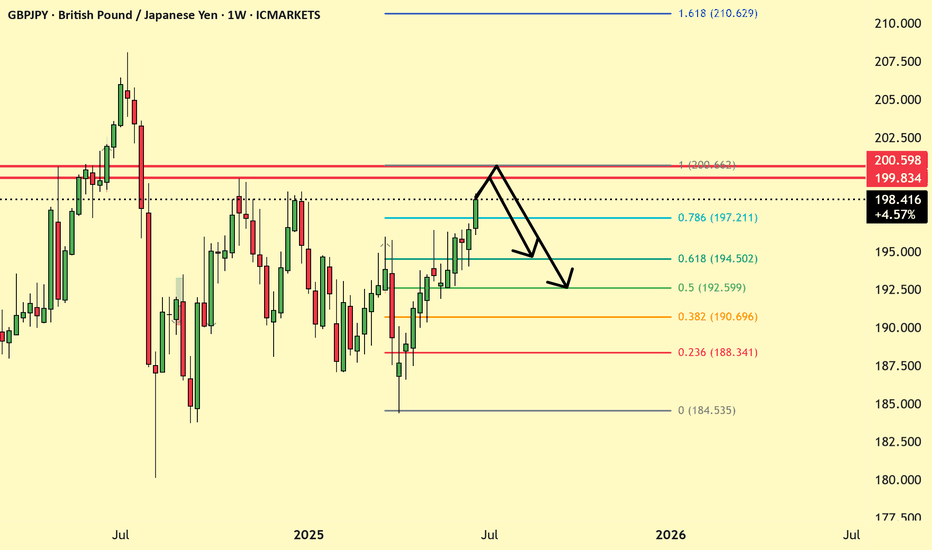

GBPJPY WEEKLY HIGHER TIME FRAME FORECAST Q3 W27 Y25GBPJPY WEEKLY HIGHER TIME FRAME FORECAST Q3 W27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅Daily Order block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X