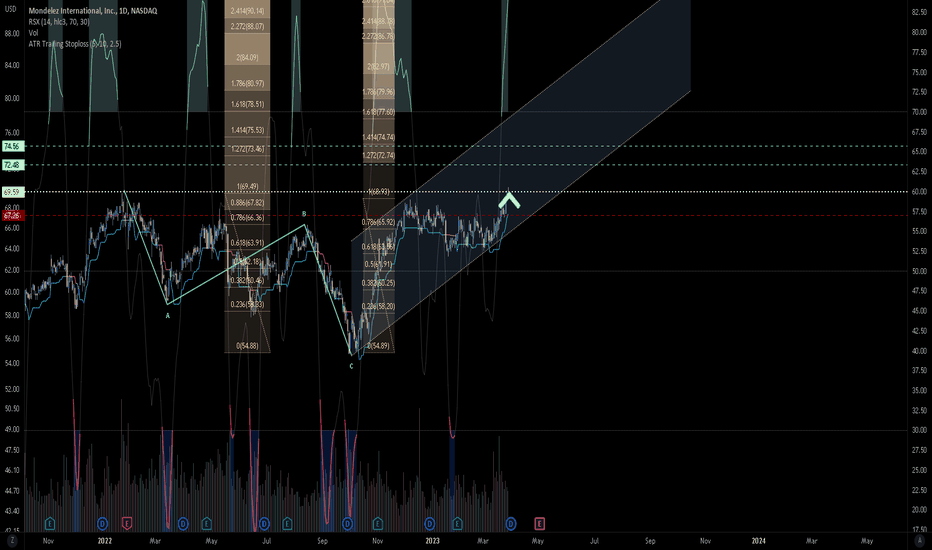

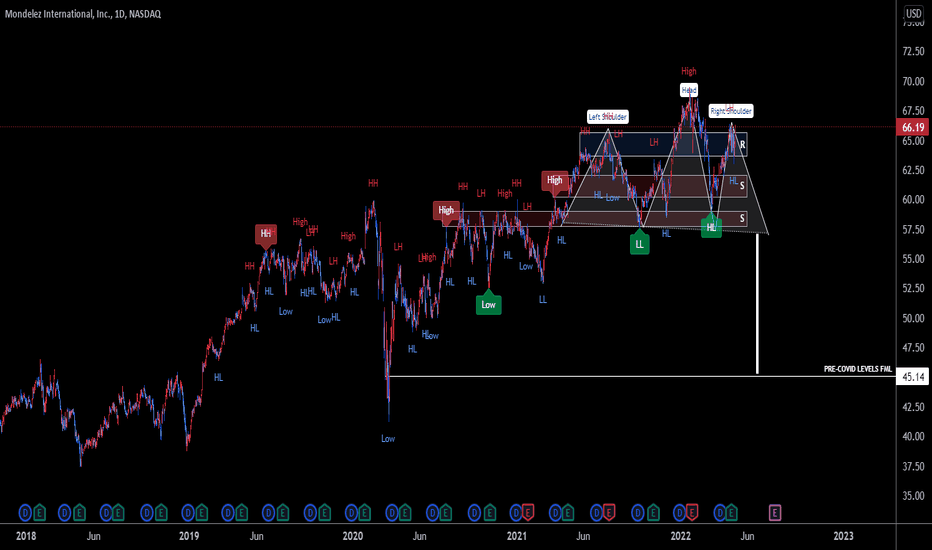

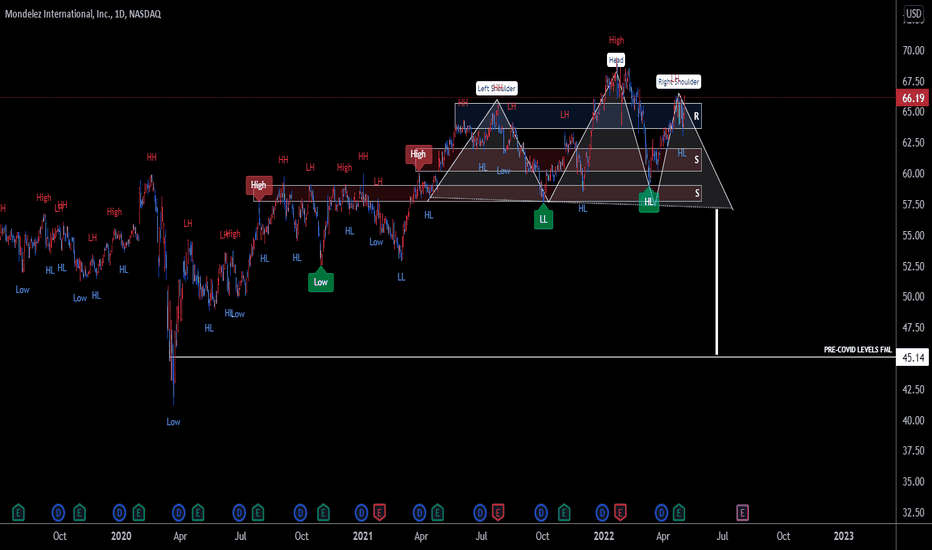

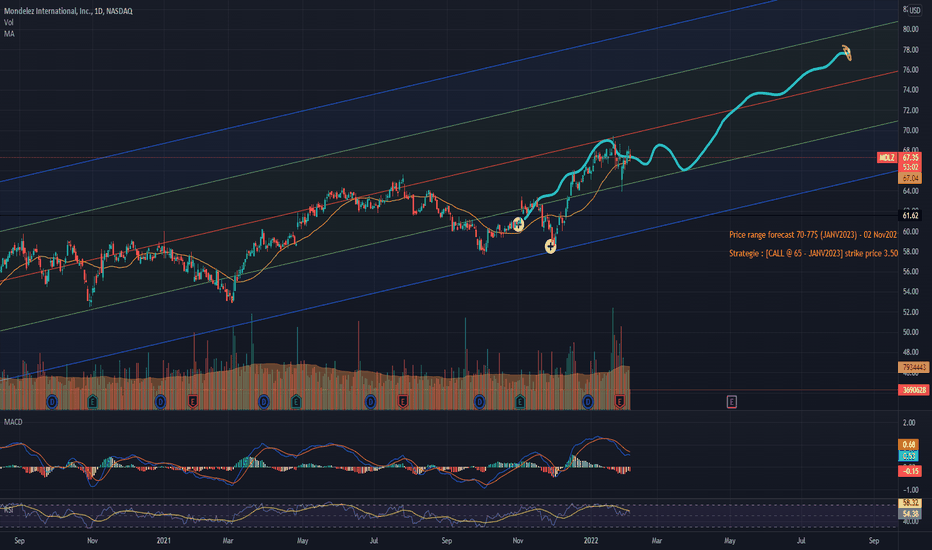

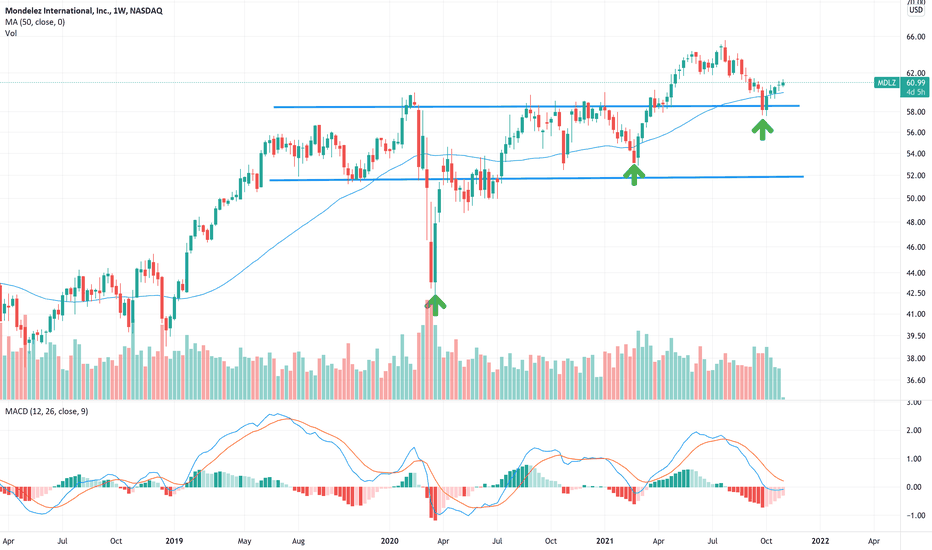

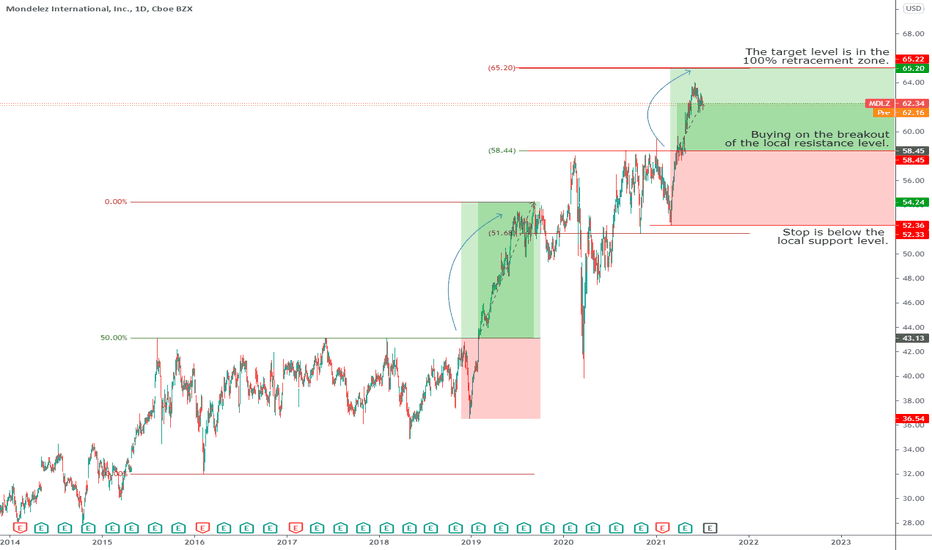

Seeing a possible blow off on Mondelez. MDLZMondelez is in an upgoing zigzag. Just confirmed through passing the most recent high. I like to draw channels to guide my Fib projections and other things, never mind in this case that we are overbought - every single is situational. That is why trading is more than a science, but an artform.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

1MDLZ trade ideas

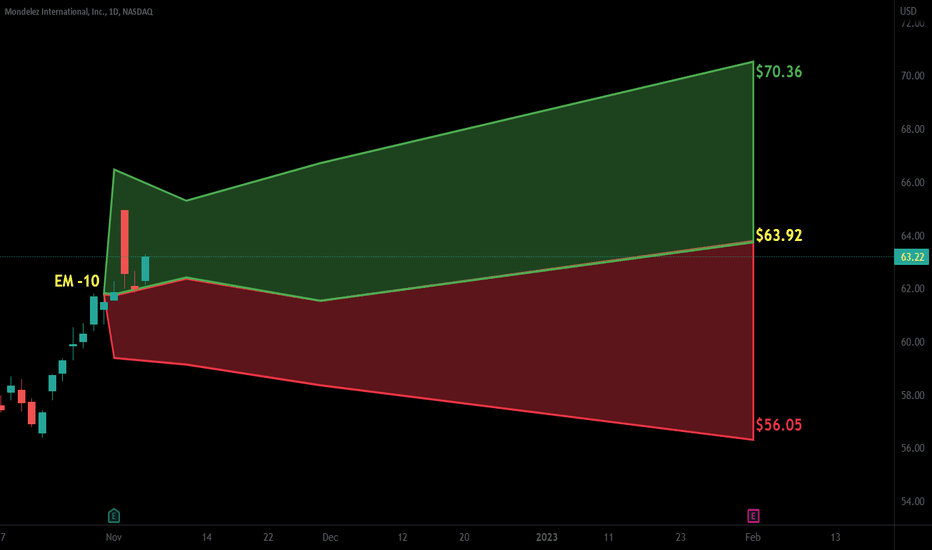

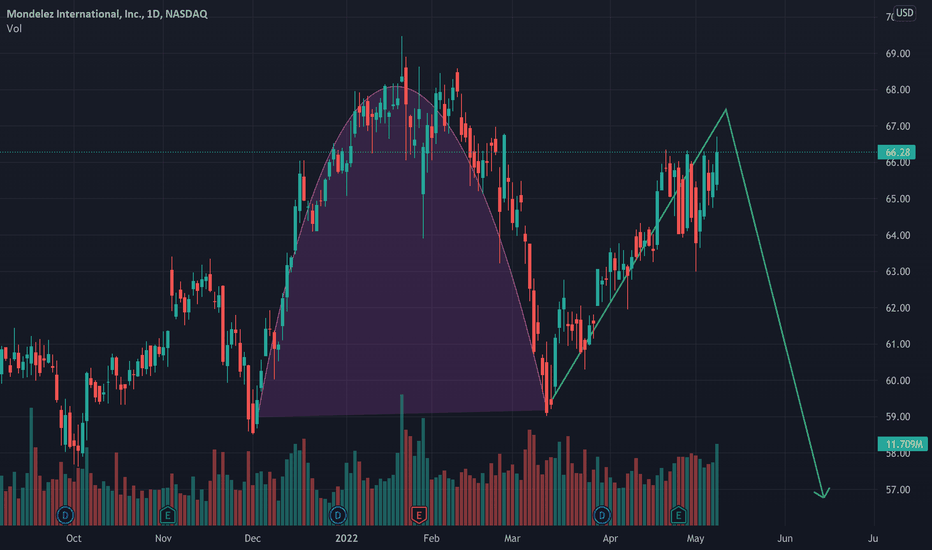

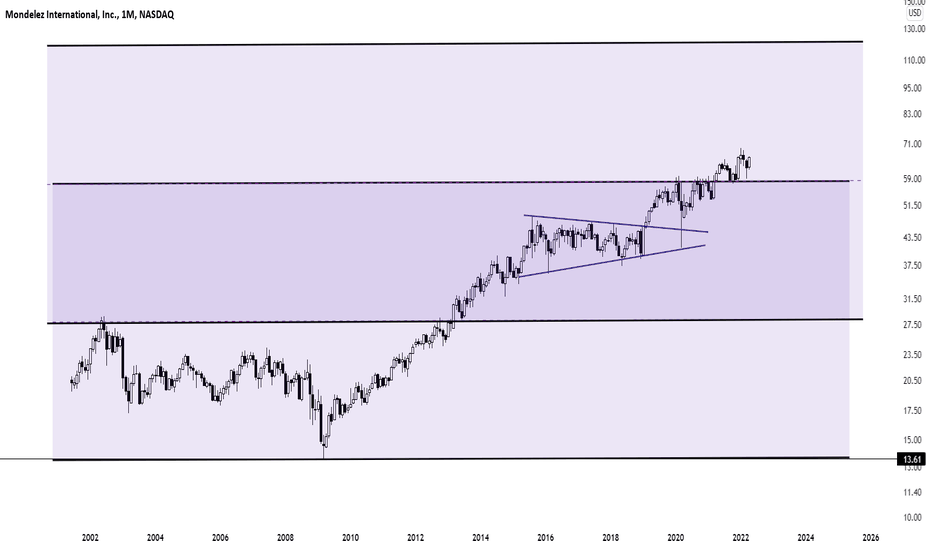

Long term hold, MDLZDuring time of uncertain, upheaval, plus global inflationary situation,

Staple sector always thrive without fail.

Simply because human need food to survive.

After a quick screen of the confectioners stocks,

Mondelez stands out amongst other stocks.

Extremely stable without much fluctuation and correction for the 1Q of March.

Future target is 120, unfortunately this could take 5 years.

Please do take note this is only my research and SHOULD NOT BE considered as a solicitation to buy or sell this stock.

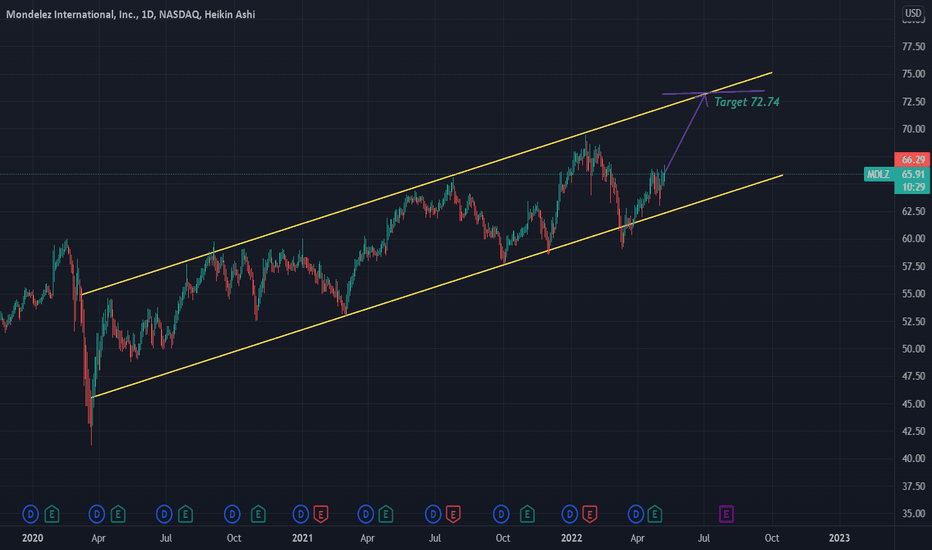

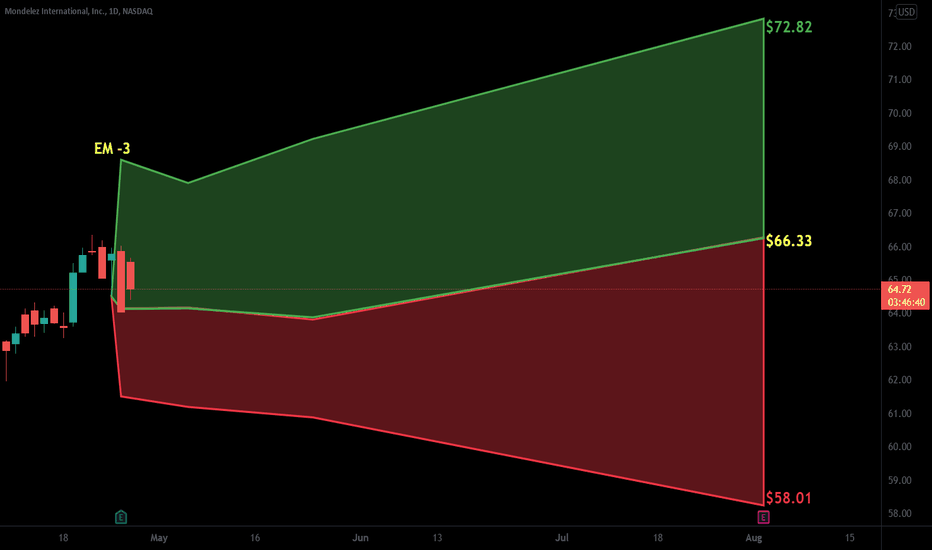

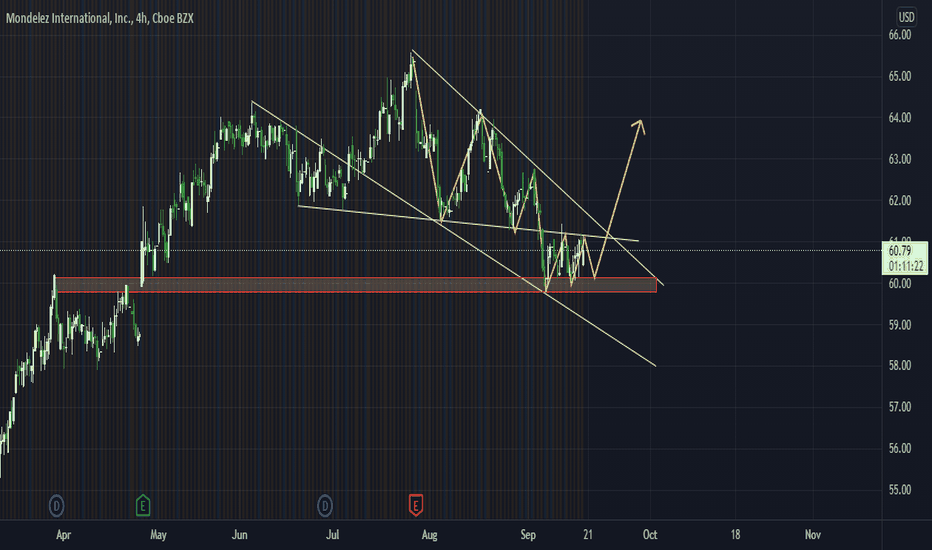

MDLZ might break resistance and go up soonMDLZ has been trading in an upwards channel for quite a while now. It looks like it's currently in a resistance zone leading to a potential breakout. I personally think it would be too early to enter right now but it could be interesting to watch for a potential breakout movement happening soon. Feel free to let me know what you think about this idea!

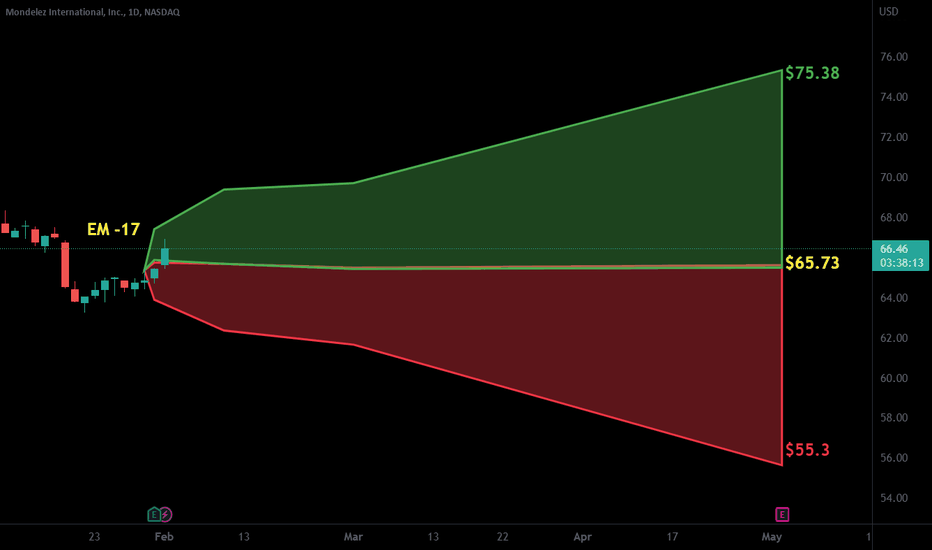

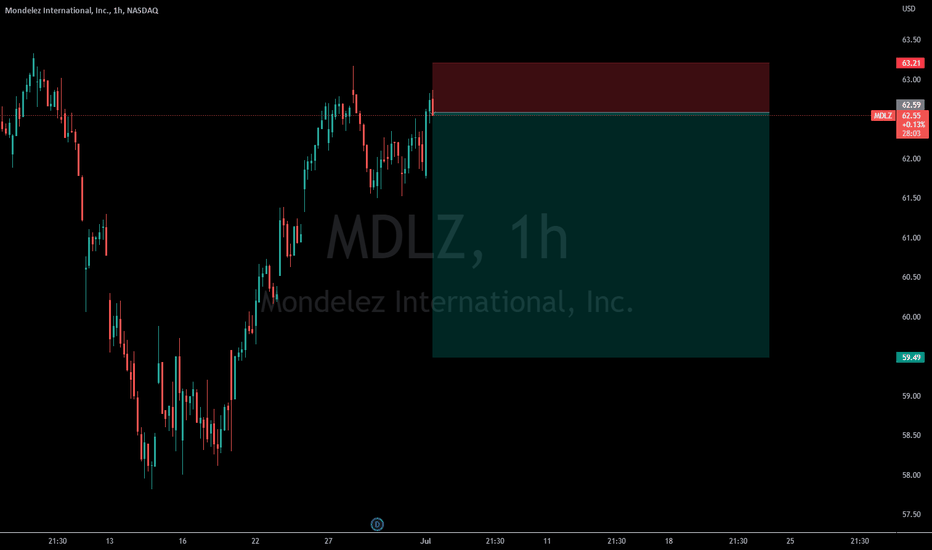

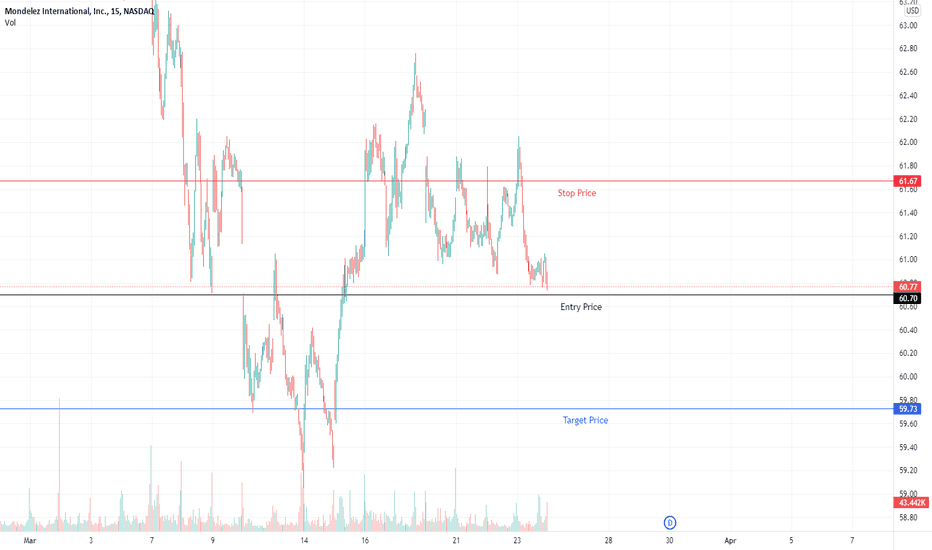

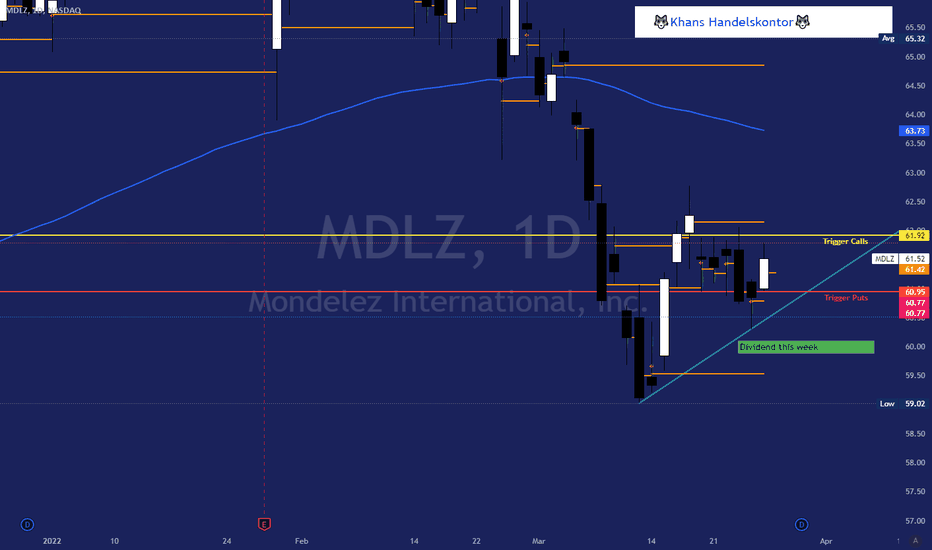

$MDLZ with a Bullish outlook following its earnings #Stocks The PEAD projected a Bullish outlook for $MDLZ after a Positive over reaction following its earnings release placing the stock in drift B with an expected accuracy of 81.82%.

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

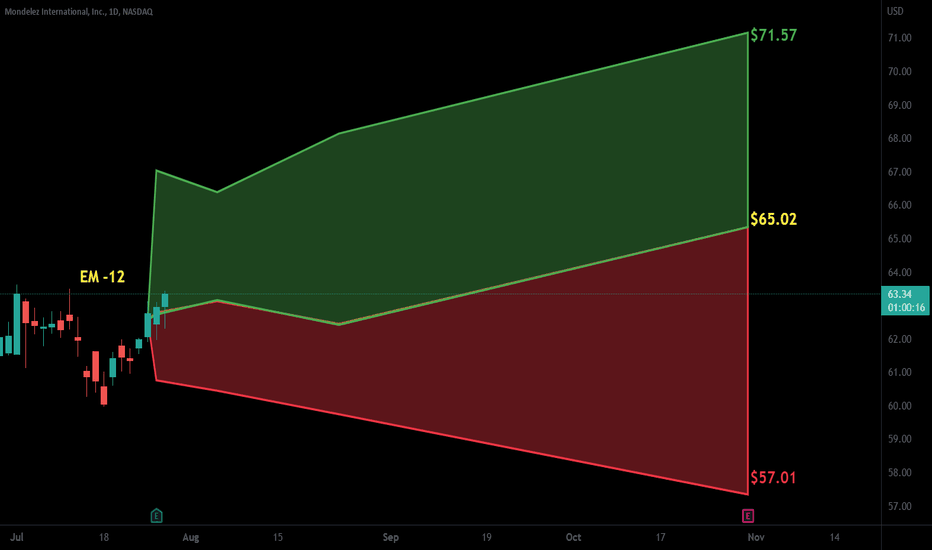

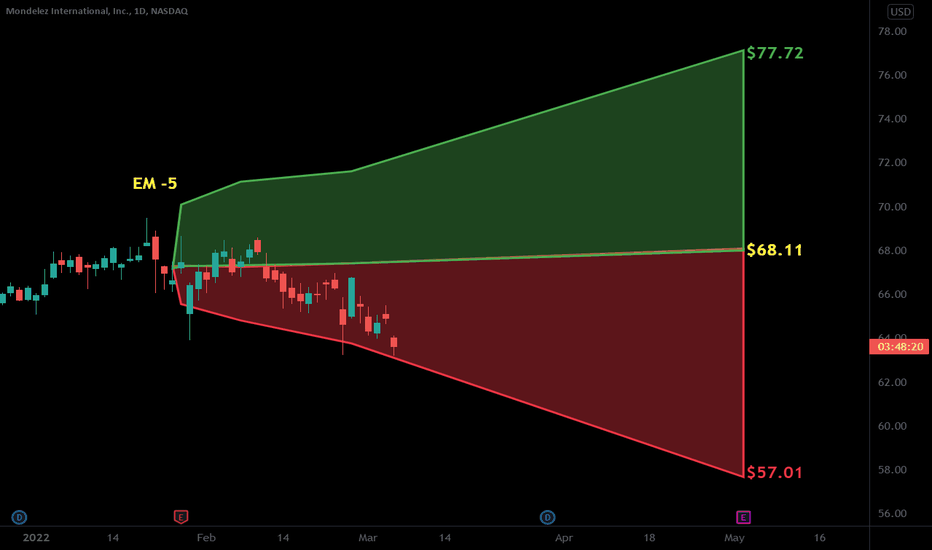

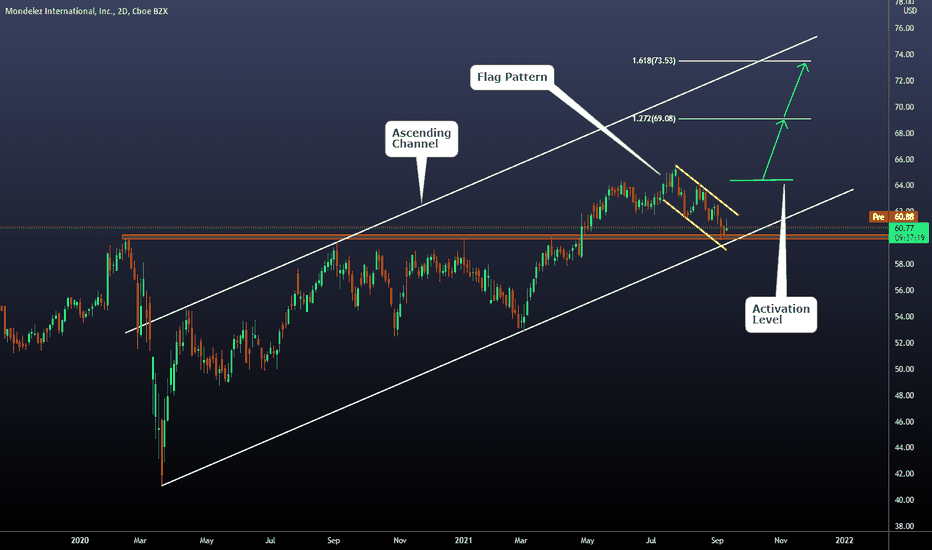

The Flag Pattern is 100% ready on MDLZ Today, we will speak about Mondelez International. Let's check what we can see on the chart:

a) The major structure is an ascending channel, where the price is about to make content with. There we expect a bullish reaction

b) Currently, we can observe a flat pattern that is 100% ready. From a technical perspective, flat patterns are continuation structures which means that after the confirmation breakout, we tend to observe movements in the same direction as the previous impulse.

c) Based on this context, we have defined an activation level (green horizontal line). The idea here is: IF the price reaches the activation level, we will expect a bullish movement towards the Fibo Targets. The maximum target is the higher trendline of the expanding channel

d) If the price keeps falling and breaks the ascending channel, we will cancel our view. Also, if the price reaches the activation level, we will define an invalidation level below the flag pattern.

e) The expected duration of the bullish movement is between 150 and 200 days

f) Another important element is the confluence between the ascending channel and the support/resistance level where we expect the Flag Pattern to be finished and not surpass that area (otherwise, we will consider that the pattern has failed)

Thanks for reading!

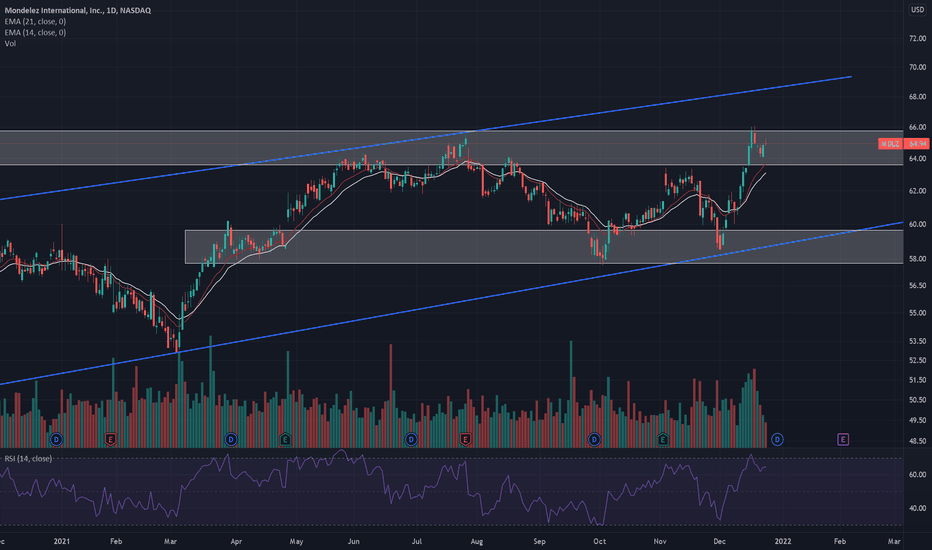

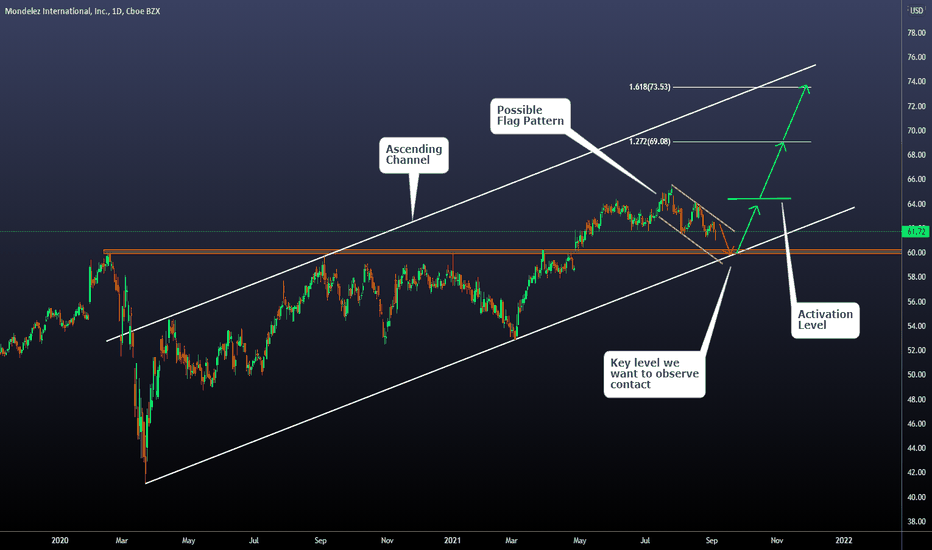

How we will trade MDLZ. Full explanationToday we will speak about Mondelez International.

Let´s see the conclusions we can make on the chart:

a) The price is inside an ascending channel

b) Currently, the price is close to a key support/resistance level which makes convergences with the ascending channel

c) That's a key level we want to observe contact. That would mean for us that the current Flag Pattern is perfect

d) If that happens, we want to observe a bounce. The green horizontal line represents our activation level, where we think it's a confirmation of the bullish movement. The main target we will use is the 2nd fibo extension level which is the same as the higher trendline of the expanding channel.

e) the First level of the fibo extension in our experience is a good place to move the stop to the entry-level if reached. (risk-free situation)

f) The risk we will take on this setup is 1% of our trading account on the stop loss area.

g) This movement can take between 150 - 200 days.