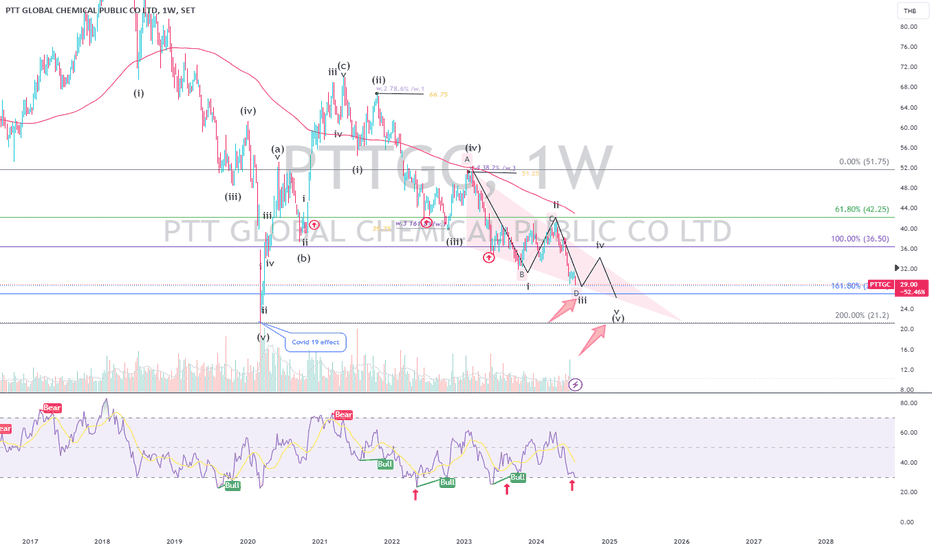

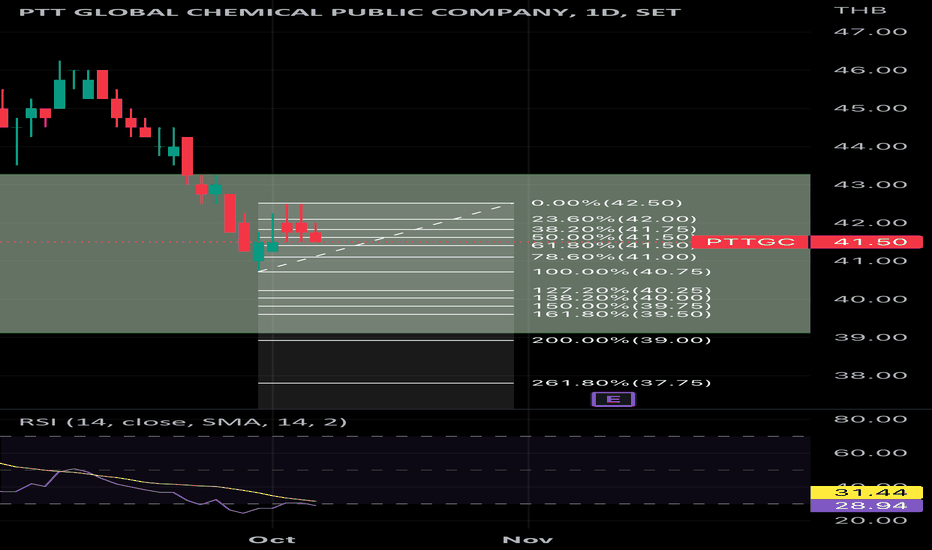

PTTGC| Wave Analysis - Ending Diagonal Pattern - Doubled BULL DIA possible ending diagonal pattern scenario - final 5-wave extension confirmation - 161.8% - 200% of 1-wave downtrend target at 27 and 22 baht zone

RSI weekly doubled bullish divergence indicator supporting 5-wave downtrend status

Long Entry: breakout falling wedge/ending diagonal pattern 33-36 ba

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−7.1 THB

−29.81 B THB

608.55 B THB

About PTT GLOBAL CHEMICAL PUBLIC CO LTD

Sector

Industry

CEO

Narongsak Jivakanun

Website

Headquarters

Bangkok

Founded

2011

ISIN

TH1074010R12

FIGI

BBG0025BQ3G3

PTT Global Chemical Plc engages in the production and distribution of ethylene, propylene polyethylene, and biochemical products. It operates through the following segments: Refinery and Shared Facilities, Aromatics, Olefins and Derivatives, Green Chemicals, Performance Materials and Chemicals, Service and Others, and Investment in Other Joint Ventures and Associates. The Refinery and Shared Facilities segment owns and operates a modern refinery complex and distributes petroleum products. The Aromatics segment includes production and sale of paraxylene, benzene, orthoxylene, mixed xylenes, toluene, and cyclohexane. The Olefins and Derivatives segment manufactures ethylene and propylene. The Green Chemicals comprises products created from natural feedstock such as palm oil, palm kernel oil, vegetable oil, animal fat, corn, sugar from sugarcane, and cassava. The Performance Materials and Chemicals segment offers hexamethylene diisocyanate, acrylonitrile, and methyl methacrylate products. The Services & Others segment comprises jetty and chemical tank farm; utility business; plant management and engineering design; safety, occupational health, environmental and securities; pipeline infrastructure; information technology; outsourcing; marketing and sales of methyl amine derivatives, plastic compound products, specialty products, and health and nutrition products; polymer sale and marketing; logistics; liquidity management and financing vehicle; social enterprise; manufacture, procure, sell products, and provide services that contributes to society; and development support on plastic packaging products. The company was founded on October 19, 2011 and is headquartered in Bangkok, Thailand.

Related stocks

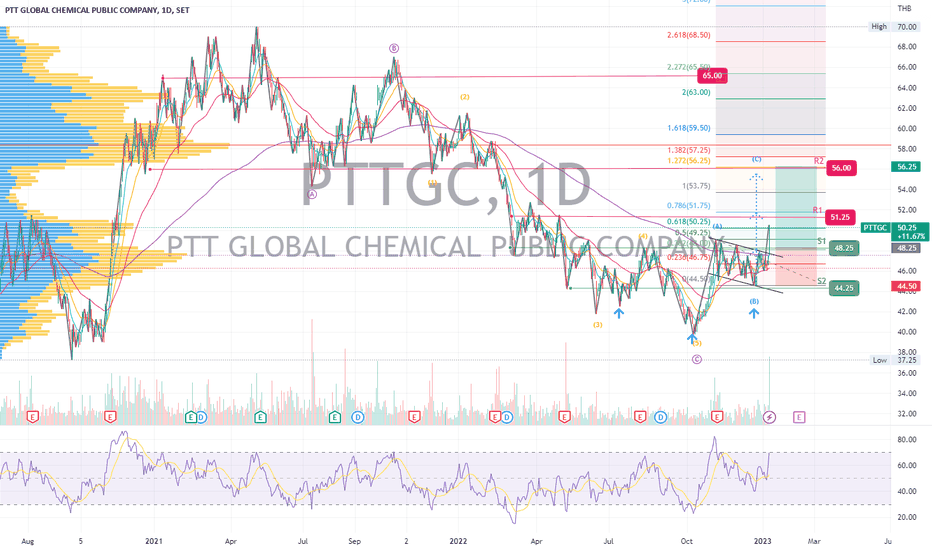

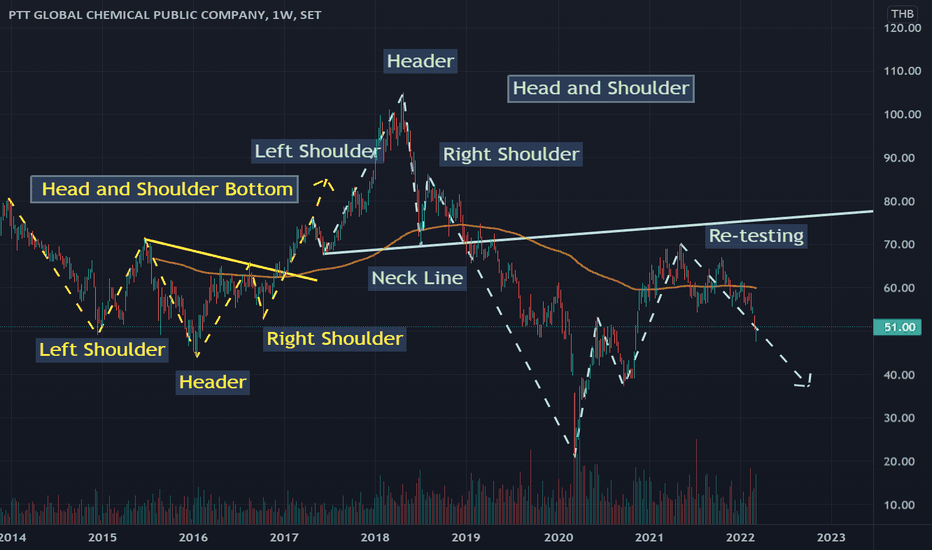

PTTGC | Wave Projection | Complex Inversed Head&ShouldersPrice action and chart pattern trading setup

> Global pattern bullish complex inversed head & shoulders pattern breakout

> Local bull flag breakout EMA200 dynamic resistance with strong bullish candle - a possible ABC bullish wave targeting new wave 1

> Support pullback entry level : EMA200 zone

>

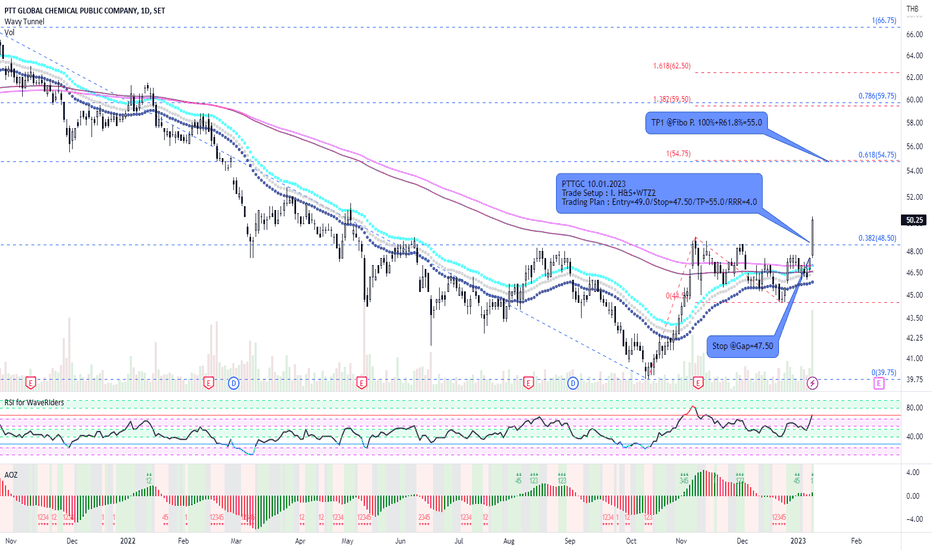

PTTGC upside*NO fundamental analysis*

My bias is on a long side for PTTGC, a stock in SET.

Technically, the LH and the main trend line is broken. It implies that bearishness has shifted out from the market. It is a better try to buy, but we need to be patient for the throw back to demand zone.

The RSI is g

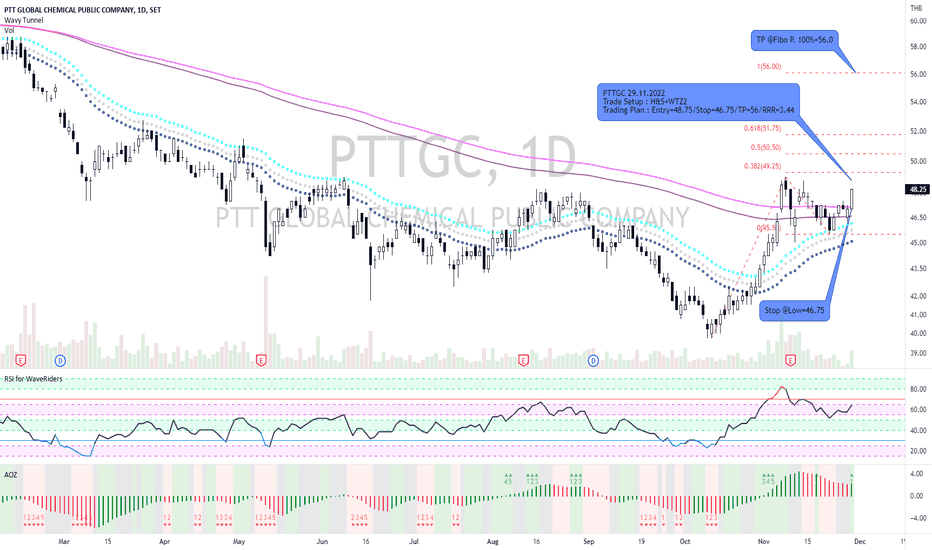

PTTGC with Inverted H&S Pattern and WTZ2I apply chart pattern (Inverted H&S) together with WTZ2, my favorite setup for trading strategy of this stock. In addition, if finding their financial statement, you will not doubt to entry. Once again, don't forget to calculate your risks well before trading. Good Luck!

PTTGC | Wave Analysis | Downtrend Target Wave II ProjectionPrice action and chart pattern trading

> ABC correction wave 2 is around the corner within the zone 0.5 retracement of wave I.

> The current wave C extended 1.213 of wave A

> Upcoming Elliott Channel breakout to confirm end of downtrend correction

> Long Entry @ Channel breakout near SMA50 zone

> Sh

PTTGC | Dragon Pattern | Double Bottom BreakoutPrice Action & Chart Pattern Trading - Short Term Setup

> Dragon Pattern - Rectangle with ENTRY @ doubled bottom breakout

Indicator:

> Smart Money and Banker Chip Volume Support

> Banker BBD positive uptrend above baseline

> Fund flow bottom signal and reversal from the oversold area

> KDJ Stocha

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PETFF5148220

GC Treasury Center Co. Ltd. 4.3% 18-MAR-2051Yield to maturity

7.41%

Maturity date

Mar 18, 2051

PETFF5387544

GC Treasury Center Co. Ltd. 5.2% 30-MAR-2052Yield to maturity

7.18%

Maturity date

Mar 30, 2052

PETFF5148221

GC Treasury Center Co. Ltd. 2.98% 18-MAR-2031Yield to maturity

5.91%

Maturity date

Mar 18, 2031

PETFF5387541

GC Treasury Center Co. Ltd. 4.4% 30-MAR-2032Yield to maturity

5.65%

Maturity date

Mar 30, 2032

See all PTTGC.R bonds