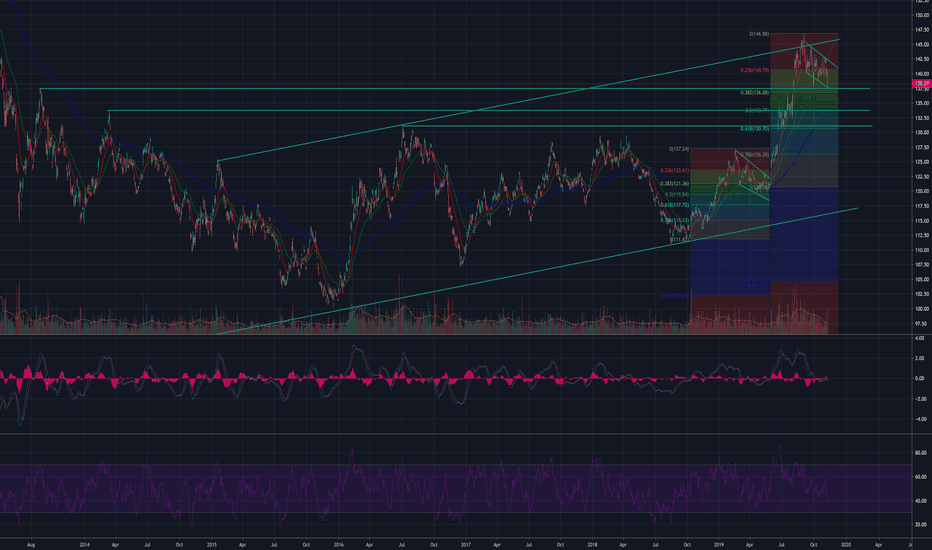

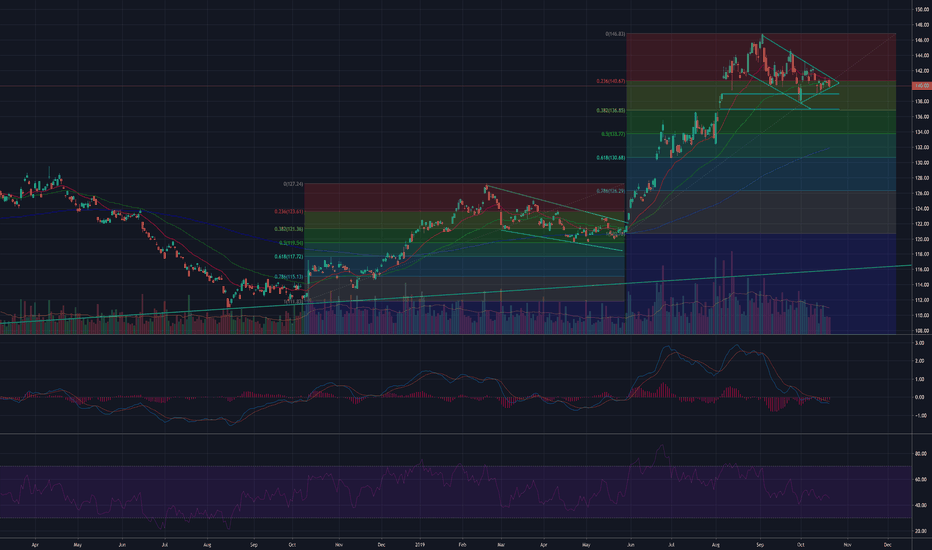

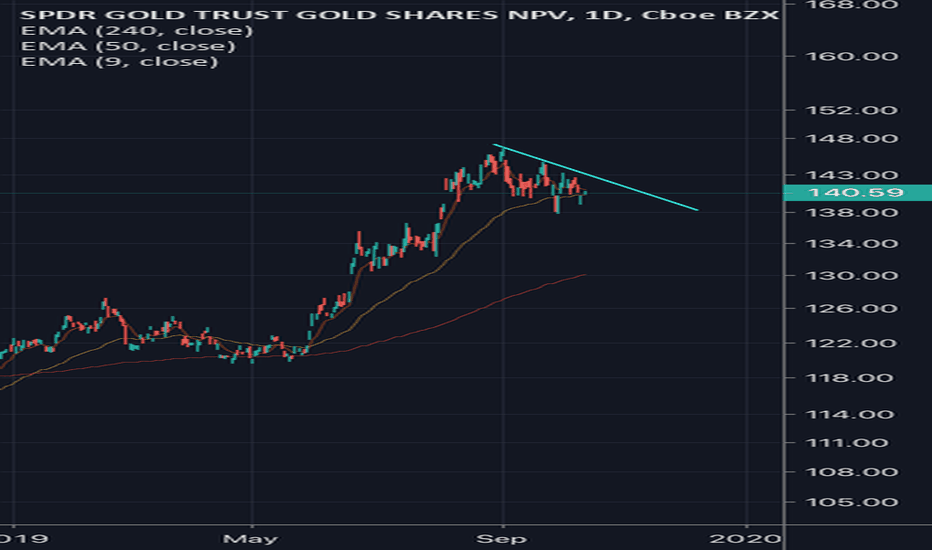

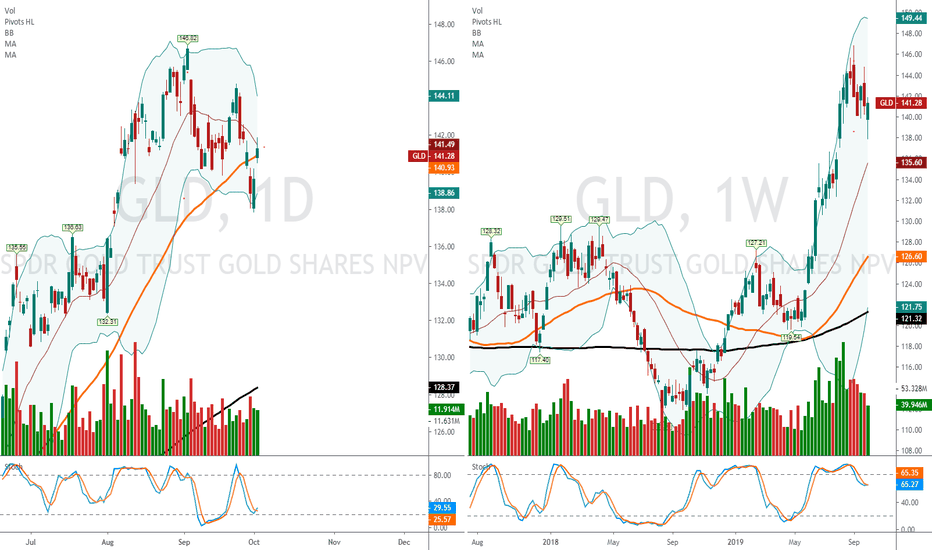

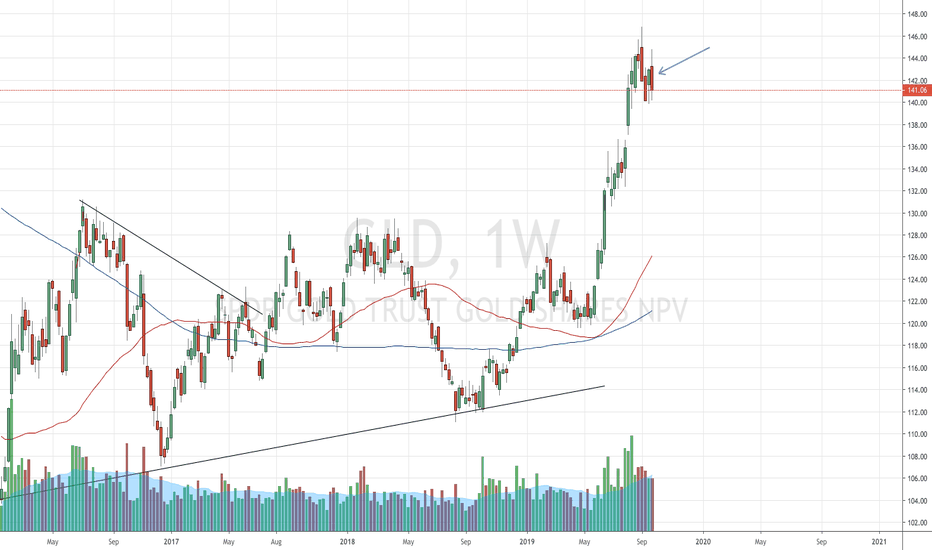

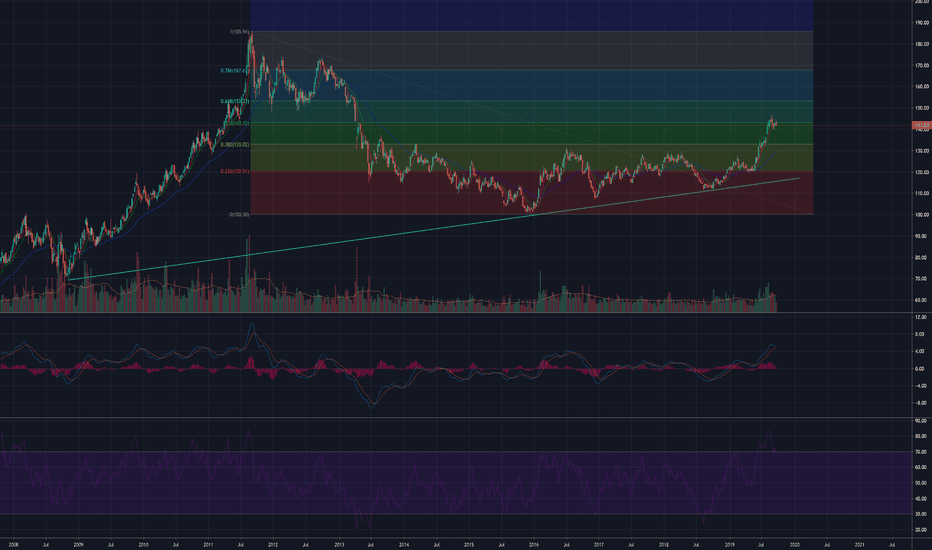

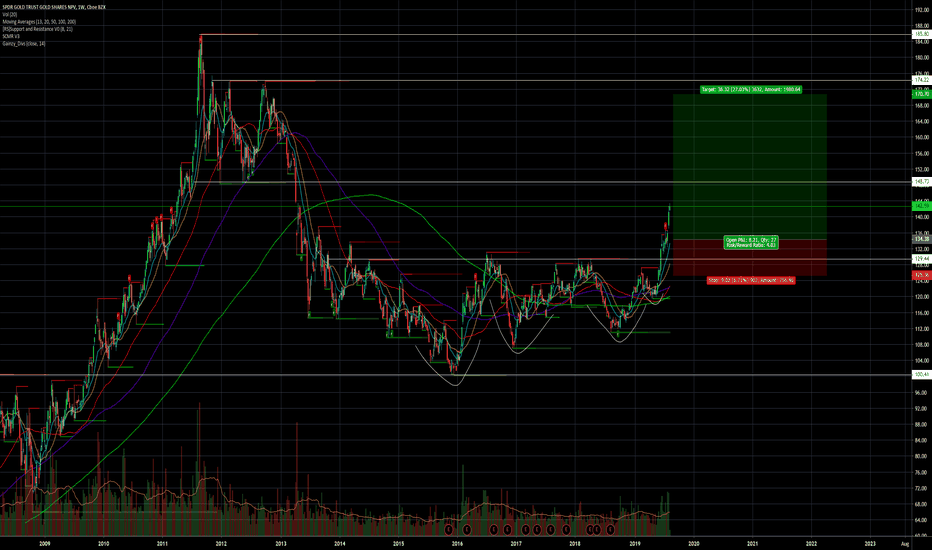

GLD - Big Picture!We are doing exactly what we should be doing. Consolidating a huge up move. This flag is ten weeks in the making and about five weeks less than the flag that began the most recent breakout. Going back to 2009 and the stair step up to 2011 you can see similar flags of similar duration. I'm not calling a bottom but just want to show that we are doing what we should be doing notwithstanding that we probably would have liked to see another move up. Macro economic conditions have favored equities that last couple months but gold's day to shine is coming. Maybe need a little more oversold and a touch of the 200 day before we head up again. We are at the bottom end of the range of the flag right here and may get a bounce before making another move down. Next week should be interesting. Market making new highs daily but lots of charts looking top and RSI at extreme overbought levels. We shall see. Have great weekend folks.

O87 trade ideas

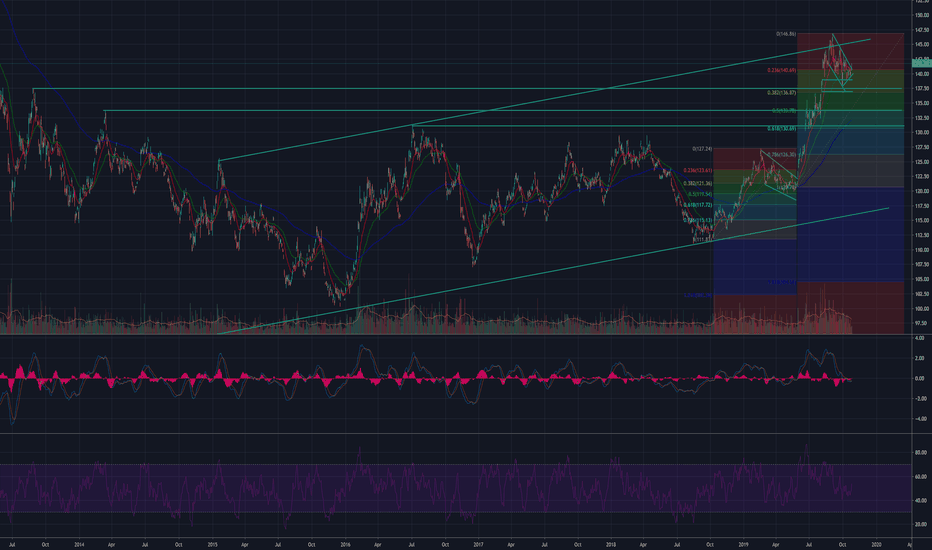

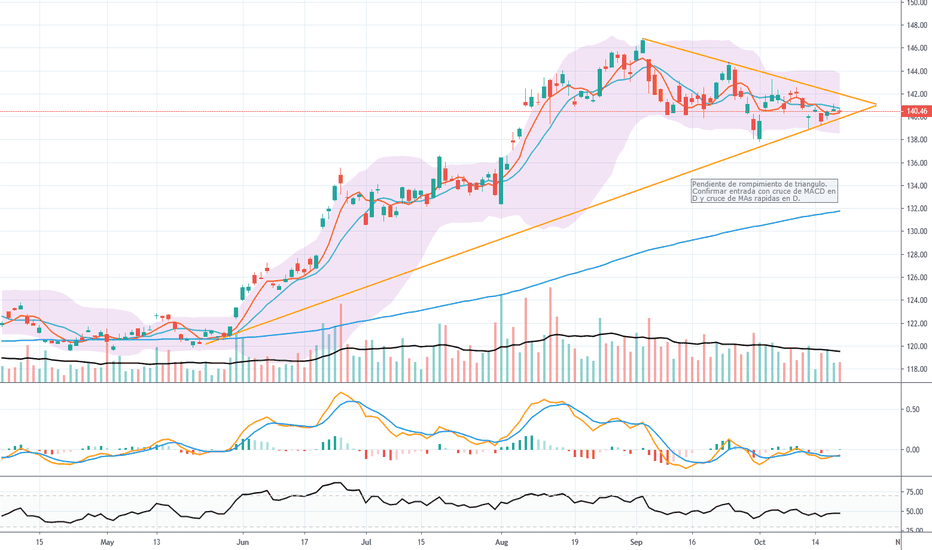

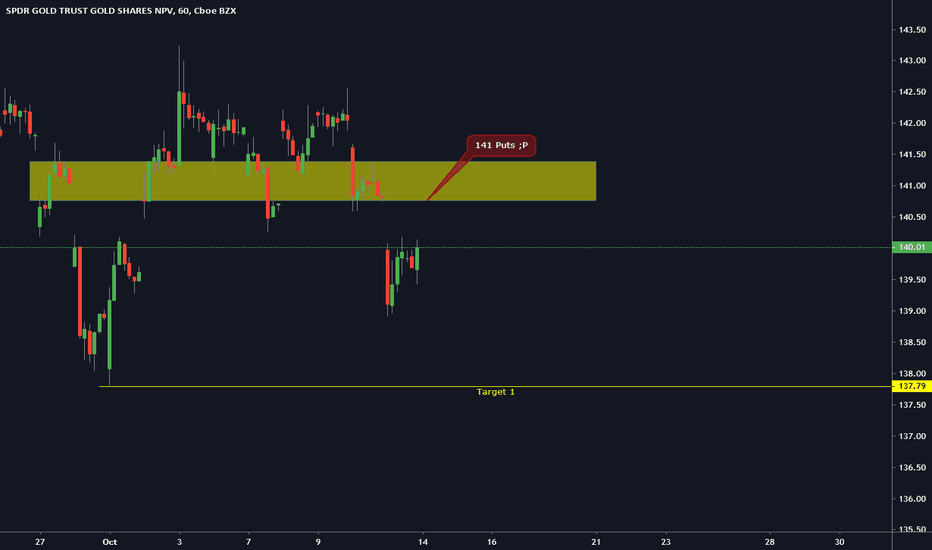

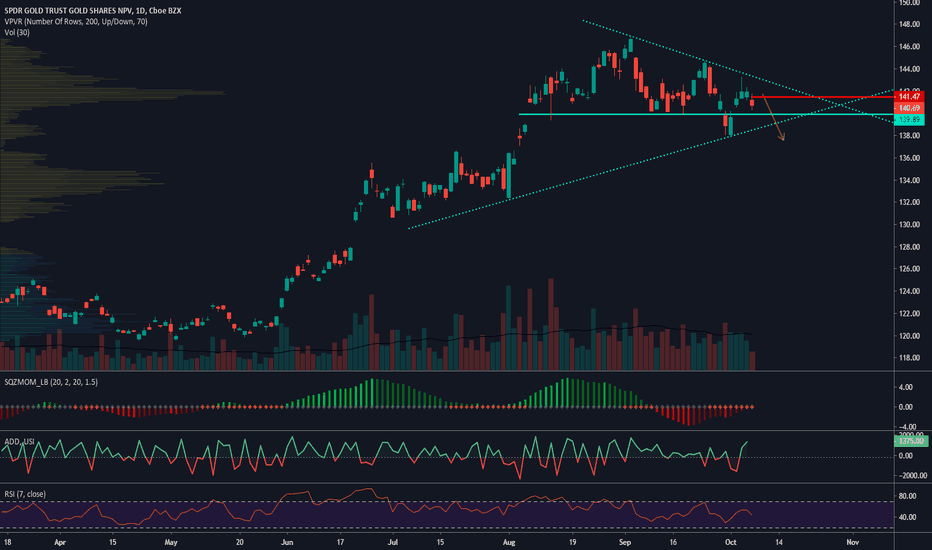

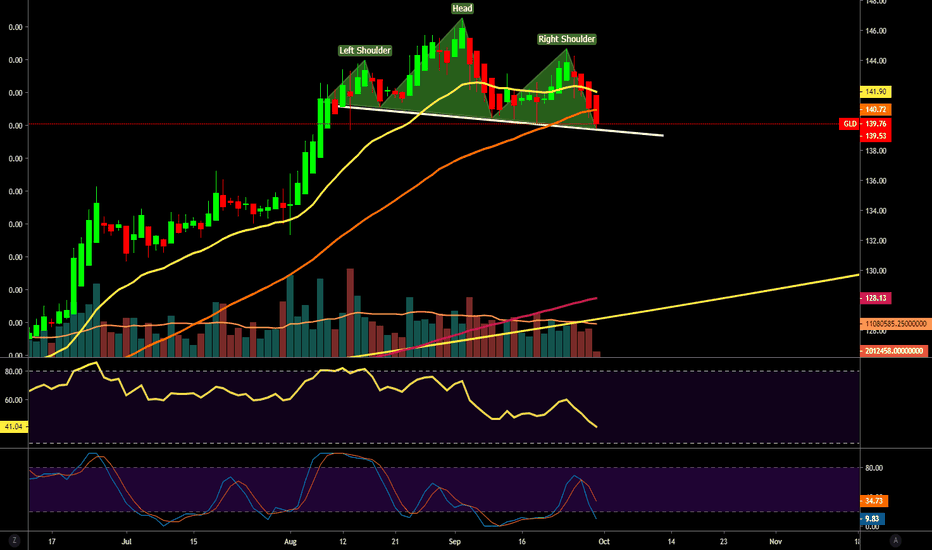

GLD - next move?I have this chart marked every which way to Sunday. Still believe that GLD and the precious metal space is due for some kind of rally. It is at an inflection point right now and a hold here would be a good sign. Could use some help from the market too. Everyday making new highs on the same trade story has become debilitating. In any event I do not believe we will see any trading below FIB .382. I follow Rick Ackerman who believes that $1448 on the December Gold contract would be a back up the truck scenario. We don't have to trade there which would be about another $20 or so. Lets see what happens. Last day of the week. Hang in there. Gold's day to shine again is coming.

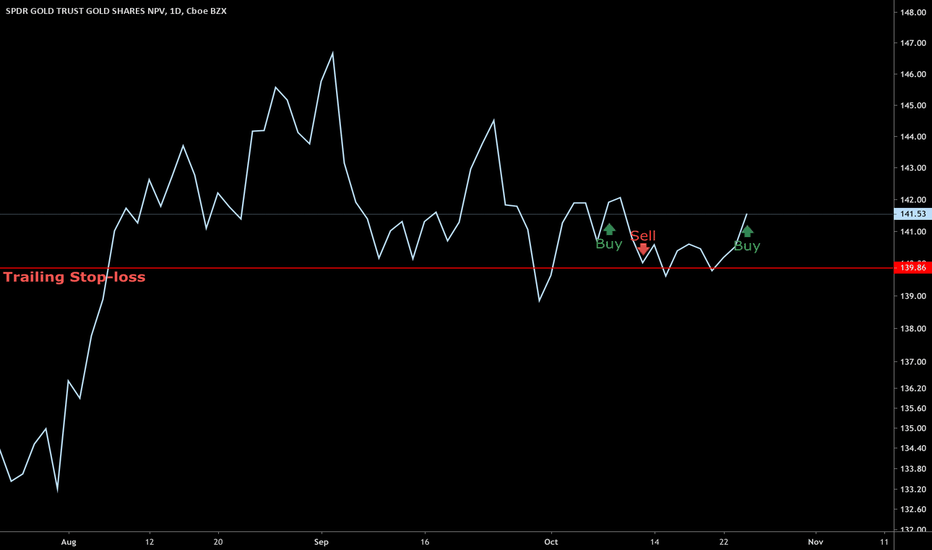

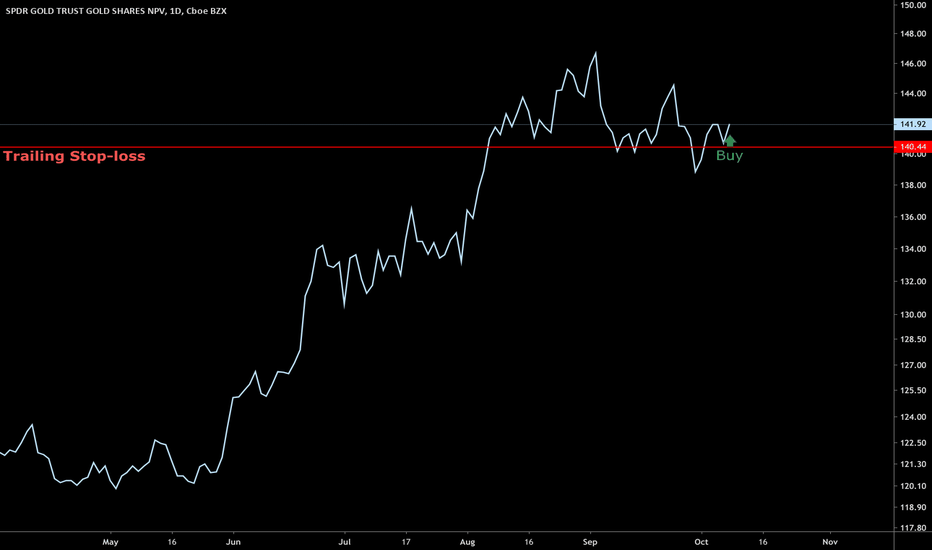

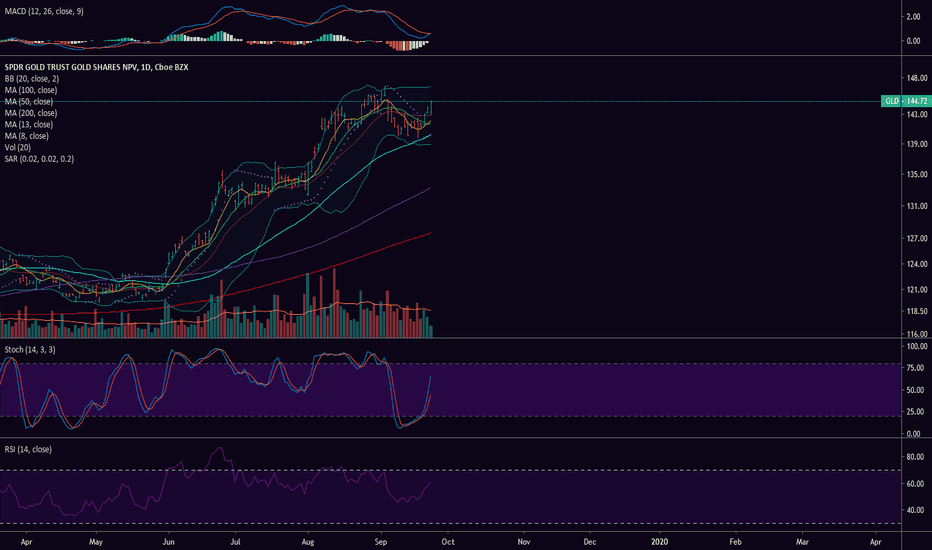

GLD - Contained Correction?A little surprised to see this weakness given the constructive price action and technicals over the past week. GLD is down at the bottom end of the channel it has been in for the last 6-8 weeks. For now the correction appears to be contained and the same goes for the miners. Expecting GLD to hold and continue its basing around these levels.

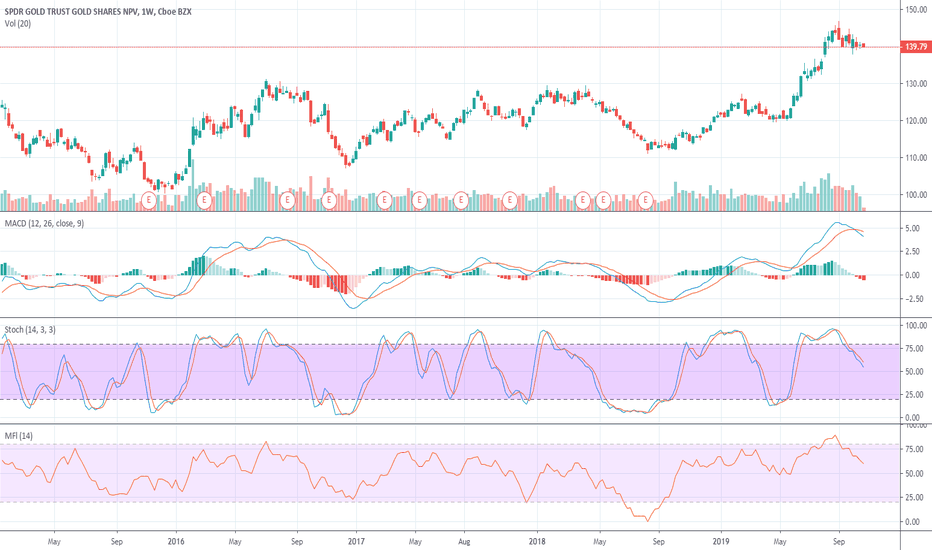

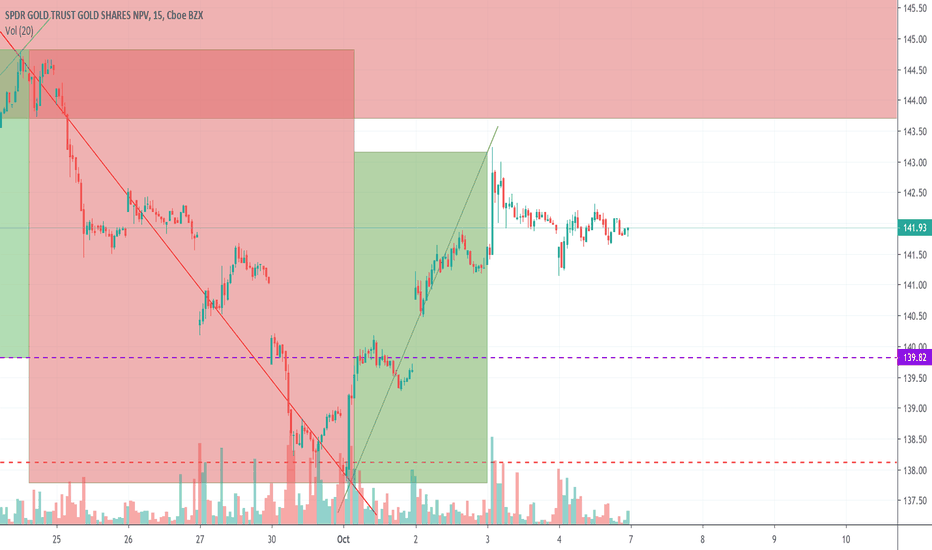

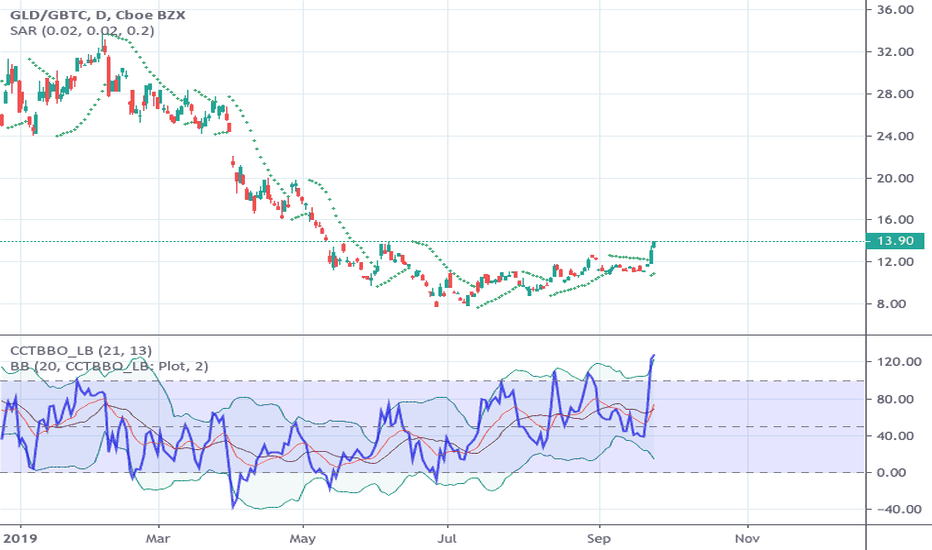

GLD - Encouraging!Precious metals perking up. GLD still has a little work to do but in the context of the big picture this looks like it is ready to test resistance. Technology holding up market today with AMZN earnings on tap after the bell. Like MSFT, AMZN shouldn't do anything surprising. One day delivery costs are real and an impact on profits. GLD RSI and MACD looking good. Let's go!

GLD - correction almost over?GLD looks to be coiling and ready for its next move which I believe is a continuation of the uptrend. GLD has been waffling above and below its 50 day line for some time now in a tight trading range just below $1,500. A decisive break above this level with volume and some follow through is what we are looking for. Miners chart also looks ready to break out. We know don'y buy bottoms but this is getting very very ripe for a trade and sustained up move. Don't forget SLV which has been very stingy giving anything back during the last few weeks of its corrective stage.