Market analysis from ActivTrades

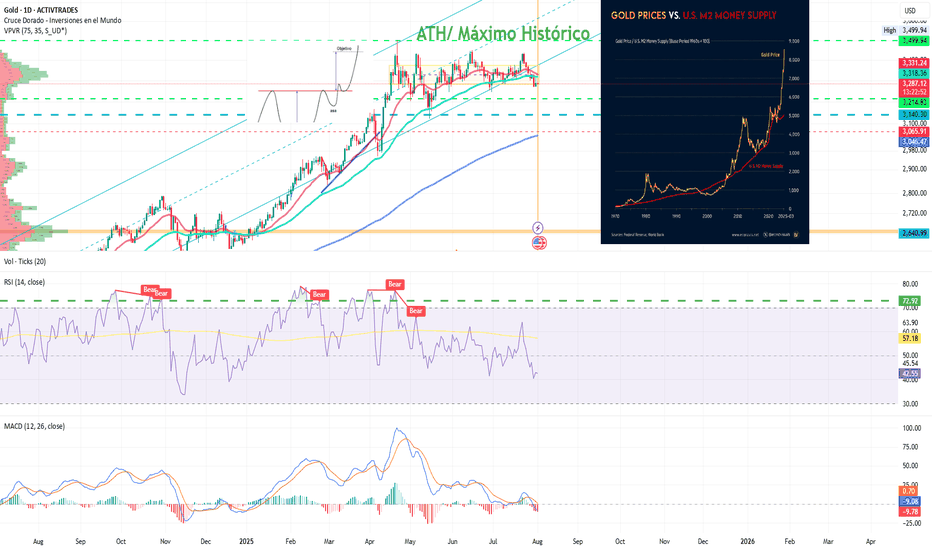

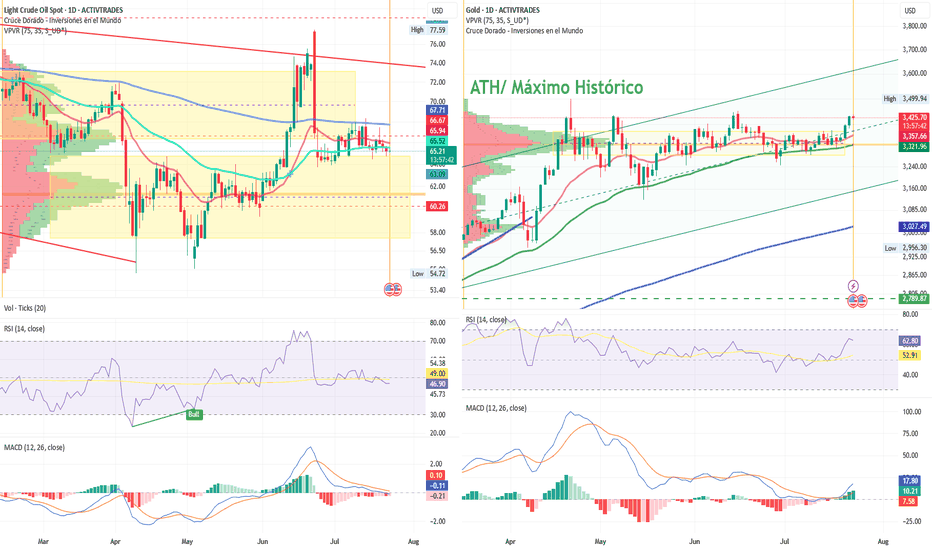

Ion Jauregui – Analyst at ActivTrades Fundamental Analysis In 2025, gold has appreciated around 27% year-to-date, reaching a peak of 33.37% at the end of April, driven by structural factors. Its strength is based on global de-dollarization, central bank purchases, persistent inflation, and expectations of real rate cuts in the U.S. Since real interest rates...

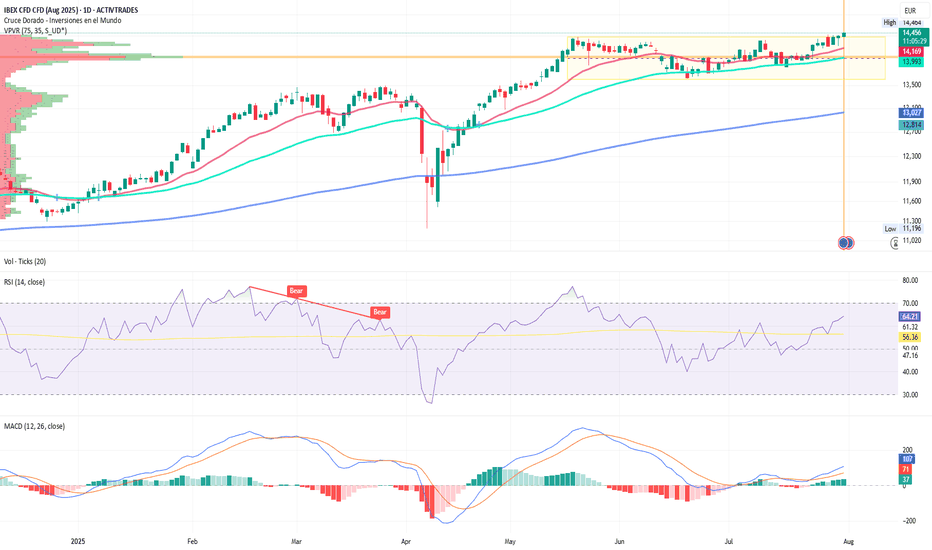

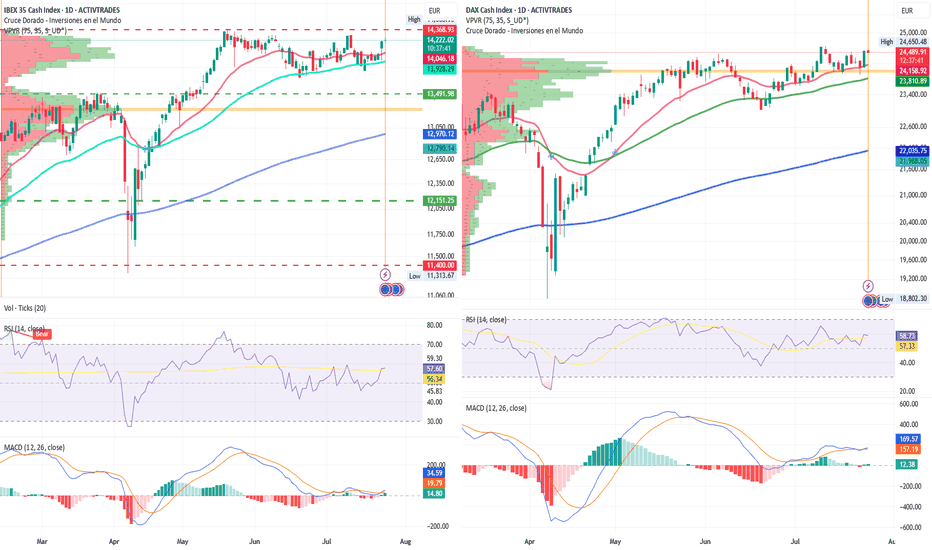

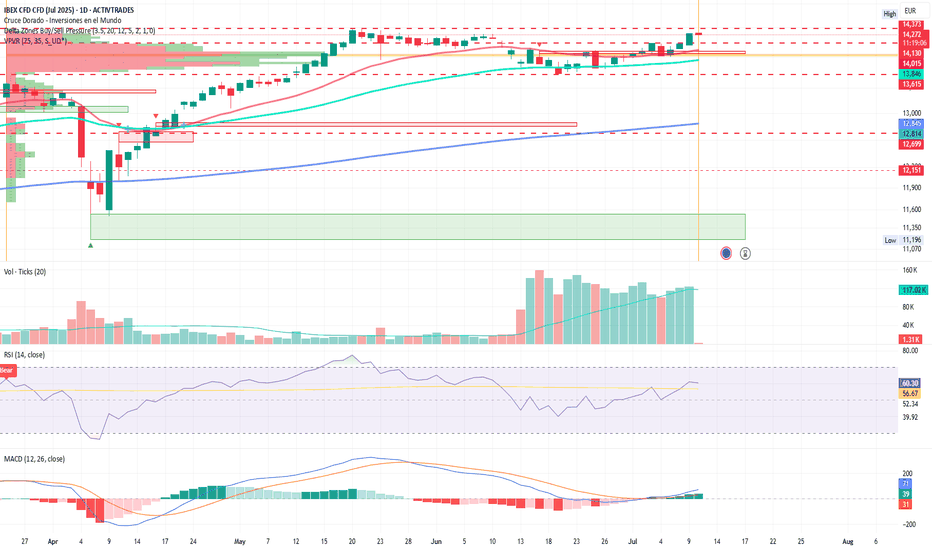

Will the IBEX 35 End July at New Highs? Futures Point Up Despite Tariff Threat By Ion Jauregui – Analyst at ActivTrades The IBEX 35 could end July near record highs following a strong opening across European markets. At 08:10 CET, futures on the Spanish benchmark were up 0.54% to 14,445 points, showing more strength than their peers: Euro Stoxx 50 futures rose...

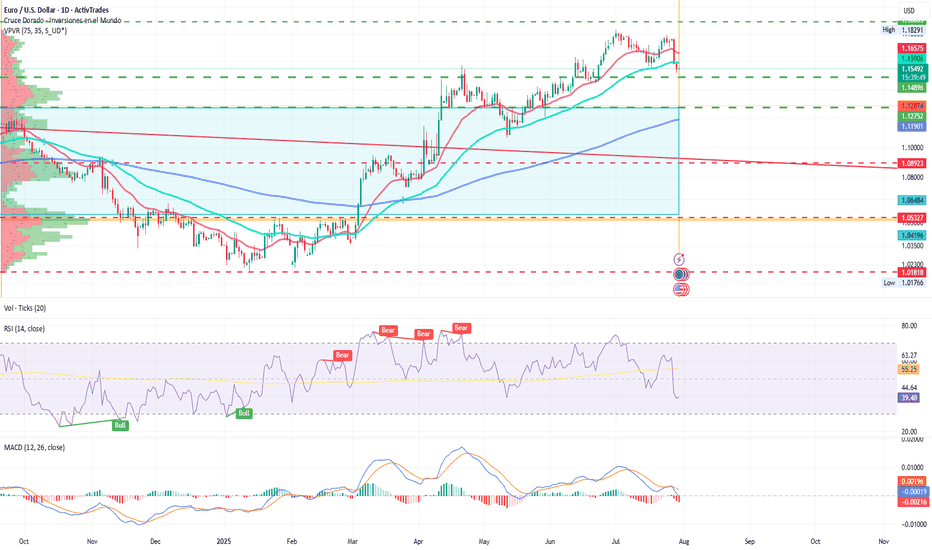

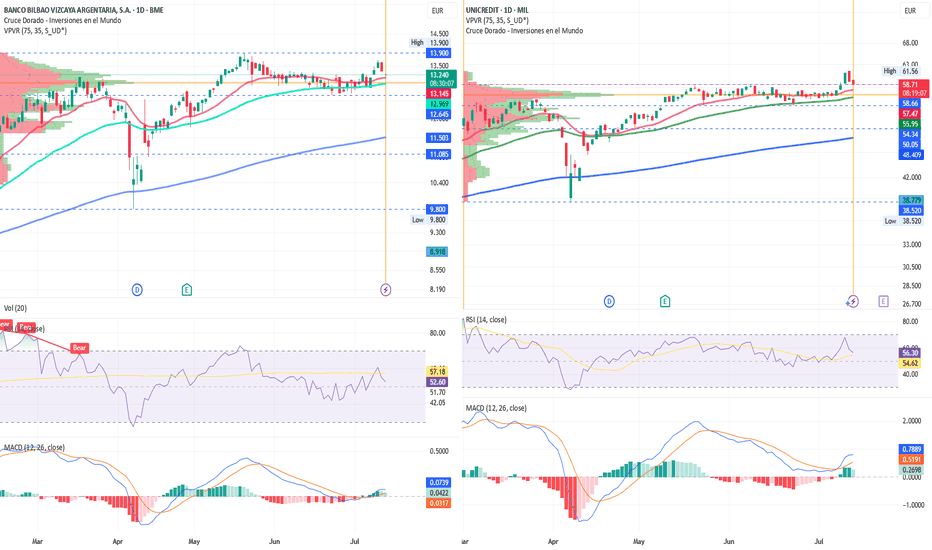

By Ion Jauregui – Analyst at ActivTrades The European Central Bank has decided to pause its rate-cutting cycle after seven consecutive reductions over the past twelve months, leaving the deposit rate at 2%, the refinancing rate at 2.15%, and the marginal lending facility at 2.4%. This move, largely priced in by the markets, reflects the ECB’s growing caution in...

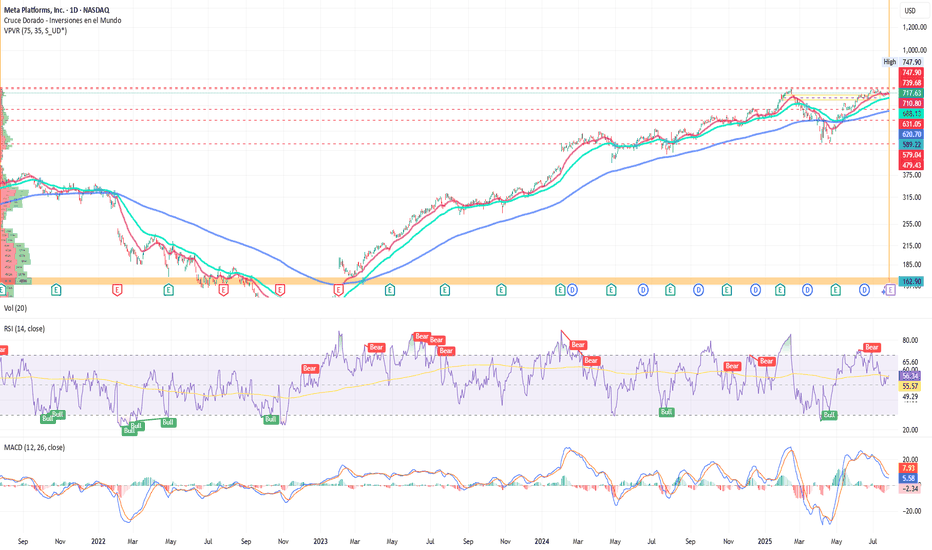

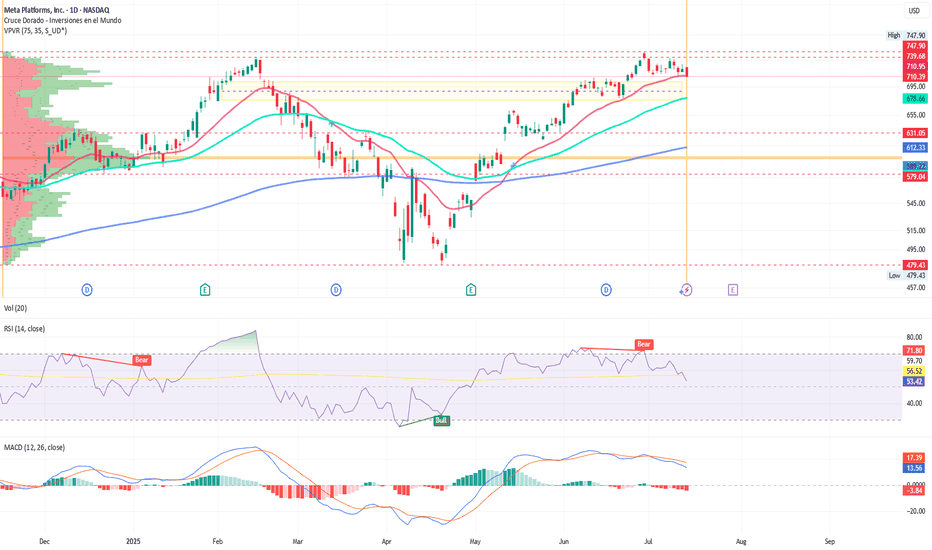

By Ion Jauregui – Analyst at ActivTrades Meta Platforms (TICKER AT: META.US) has posted strong quarterly results that significantly exceeded market expectations, driven by its solid positioning in artificial intelligence, advertising monetization, and the resilience of its digital ecosystem. Key Financial Highlights In the second quarter of 2025, Meta...

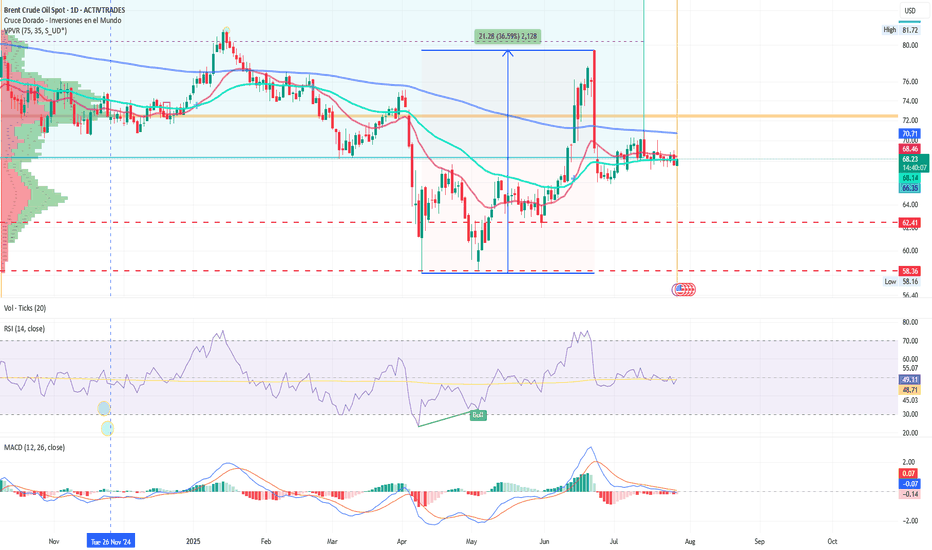

By Ion Jauregui – Analyst at ActivTrades Bearish pressure is intensifying in the oil market, with Brent crude leading the liquidation among major investment funds. The expiration of U.S. tariff exemptions on August 1st, combined with a global economic slowdown, has triggered a wave of risk aversion across energy commodities. Funds Exit Oil: Alarming Figures ...

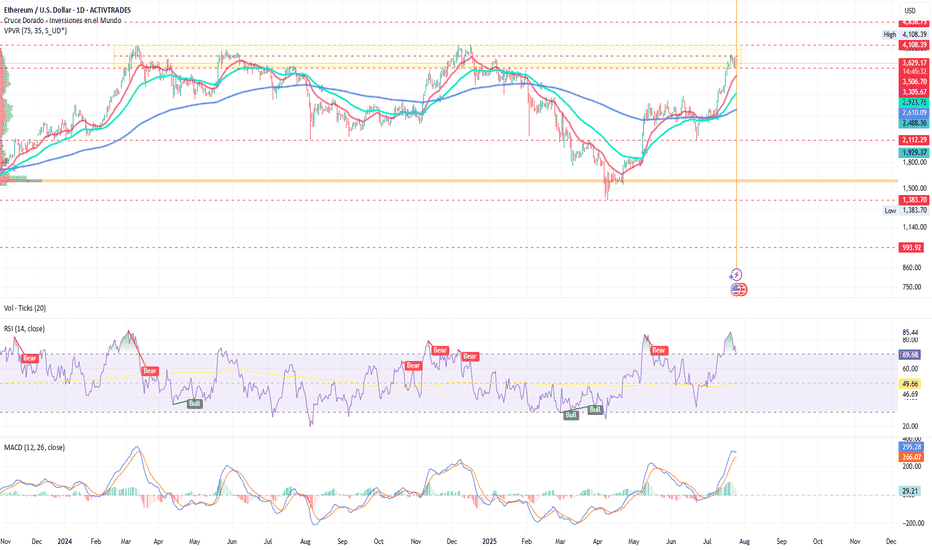

Ethereum gains momentum: SEC green light and JPMorgan’s historic shift By Ion Jauregui – Analyst at ActivTrades Ethereum once again takes center stage in financial markets after a week full of positive signals: on one hand, the long-awaited clarification of its regulatory status by the SEC; on the other, the unexpected opening of JPMorgan to cryptocurrencies....

IBEX 35 lider of european bullish advances in the tariff agreements By Ion Jauregui – Analyst at ActivTrades European markets kick off the day with strong gains, driven by renewed optimism over trade negotiations between the United States and China. In this context, IBEX 35 futures surge by 1.52% to 14,273 points, positioning the index as one of the top...

Canadian Crude and Gold Under Pressure as Trump Threatens New Tariffs Unless Market Access Improves By Ion Jauregui – Analyst at ActivTrades Trade tensions between the United States and Canada are once again on the rise following Donald Trump's return to office. The president has set August 1st as the deadline to impose a 35% tariff on Canadian products unless...

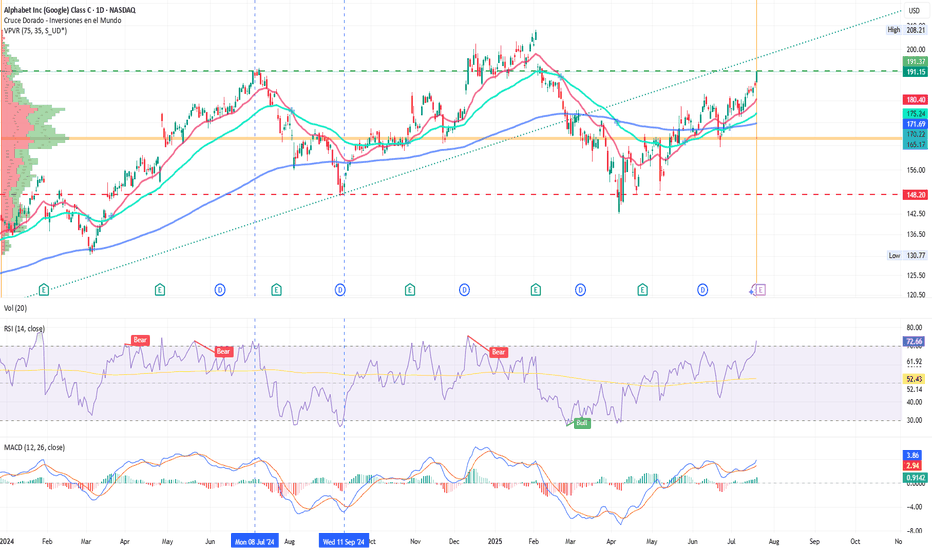

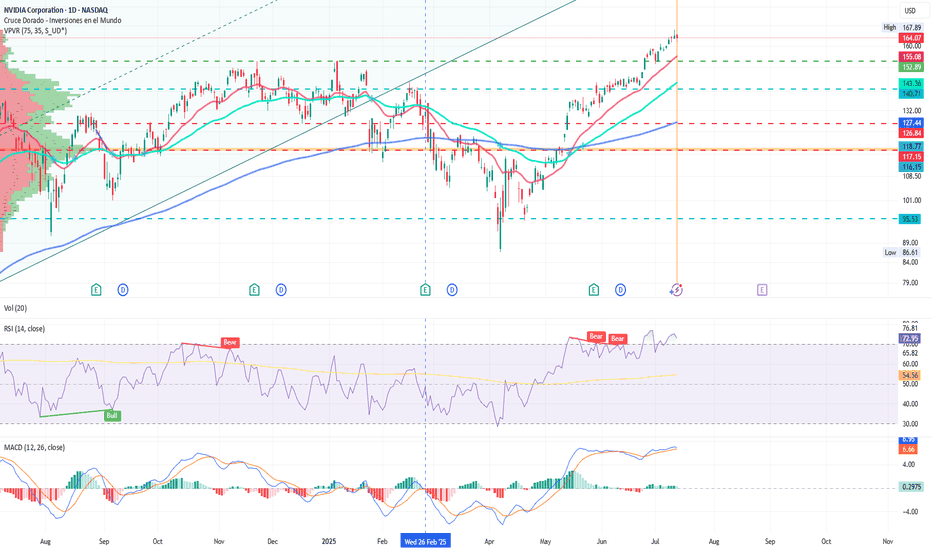

Silicon Valley Shaken by China’s Free AI Offensive By Ion Jauregui – Analyst at ActivTrades Artificial intelligence is undergoing its first major geopolitical fracture. While OpenAI strengthens its infrastructure by renting servers from Google Cloud, China’s advance with free generative models threatens to redefine the balance of power in the sector. Names like...

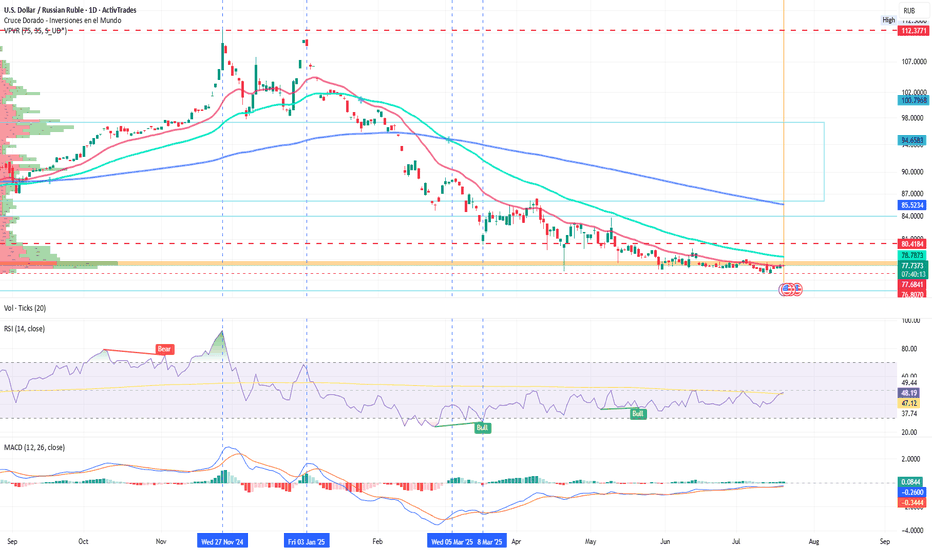

Ion Jauregui – Analyst at ActivTrades The ruble is under the spotlight as Russian banks prepare to request a bailout amid a growing wave of loan defaults. 1. Russian banks falter behind the scenes Although the Central Bank of Russia maintains a narrative of stability, the actual state of the financial system could be far more fragile. According to Bloomberg,...

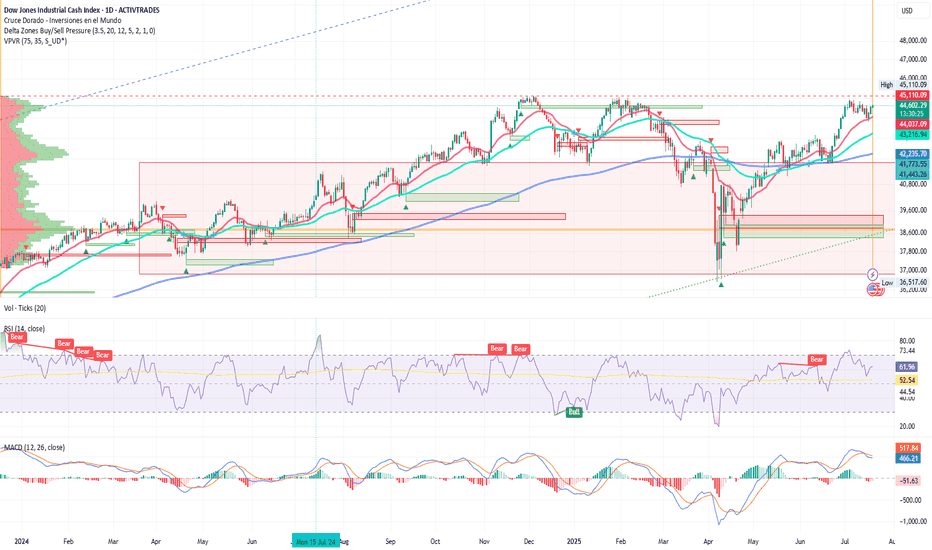

Ion Jauregui – Analyst at ActivTrades The main Wall Street indices closed Thursday’s session with mixed results. Comments from Trump stating he had no plans to fire Powell but “doesn’t rule anything out” except in cases of fraud, along with Powell’s declaration that he will serve his full term until mid-2026, pressured the market. The U.S. market has been...

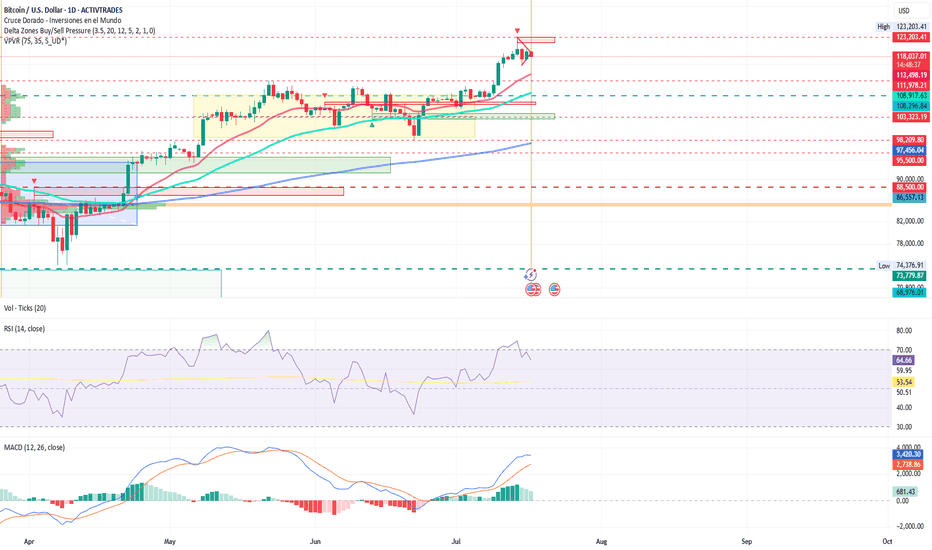

Congressional Crypto Week: Bitcoin Hits All-Time Highs in a Decisive Week for the U.S. Ion Jauregui – Analyst at ActivTrades Bitcoin (BTCUSD) is back in global headlines after breaking above $123,203 this Tuesday, setting a new all-time high in the same week. So far in July, the leading cryptocurrency has surged 17%, fueled by a combination of institutional...

Ion Jauregui – Analyst at ActivTrades Zuckerberg Takes the Stand This week, Mark Zuckerberg appears as a witness in a civil lawsuit worth $8 billion, in which the governance of Meta Platforms (NASDAQ: META) is under scrutiny following the well-known Cambridge Analytica scandal. The plaintiffs — shareholders of the company — argue that decisions were made...

Nvidia at a Crossroads: Unstoppable Growth, Geopolitical Tensions, and Fears of Talent Drain to China Ion Jauregui – Analyst at ActivTrades Nvidia’s rise as a central player in the artificial intelligence revolution has not been a solitary journey. The company, now valued at over $4 trillion, has built a complex network of suppliers, strategic clients, and...

Ion Jauregui – Analyst at ActivTrades Gold posted a slight gain during Monday's Asian session, driven by renewed safe-haven demand amid escalating trade tensions between the United States and several key economies, as well as rising geopolitical uncertainty surrounding Russia and Ukraine. The initial uptick in gold was supported by the announcement of 30%...

Bank Mergers in Check: Between Brussels and National Interests Ion Jauregui – Analyst at ActivTrades Banking consolidation plans in Europe have gained momentum in 2025, driven by the Draghi and Letta reports, which advocate for the creation of pan-European banks capable of competing globally with U.S. and Chinese giants. However, the recent BBVA-Sabadell and...

By Ion Jauregui – Analyst at ActivTrades Consolidation and Vertigo at Peak Levels In 2025, the IBEX 35 has staged a moderate yet consistent rally, reaching levels not seen since 2015, recently hitting 14,373 points. After a strong start to the year, fueled by the stabilization of interest rates in the eurozone and a recovery in the banking sector, the index...

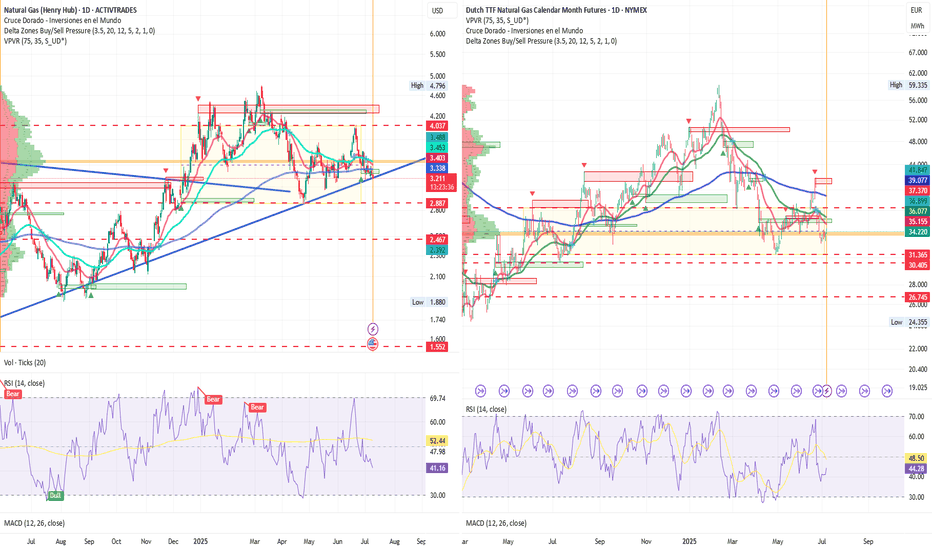

Europe Shudders over Winter Gas Fears: Germany Puts Market on Edge By Ion Jauregui – Analyst at ActivTrades Europe is once again sounding the alarm over a potential energy crunch this coming winter. The continent’s gas reserves—particularly Germany’s—are significantly below normal levels for this time of year, amid soaring energy demand, heatwaves, and weaker...