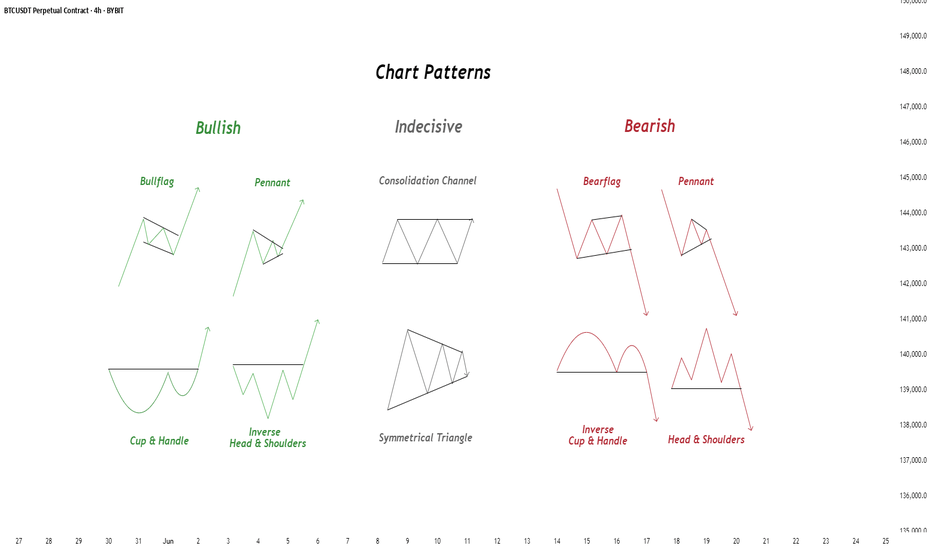

Chart Patterns - How to read them like a ProChart patterns are visual formations on price charts that help traders anticipate potential market movements.

These patterns fall into three main categories: bullish , bearish , and indecisive .

---

1. Bullish Chart Patterns

Bullish patterns often signal that price is likely to move upward.

1.1 Bull Flag

* What it looks like: A sharp upward move followed by a small downward-sloping rectangle (the flag).

* Meaning: After a strong rally, the price consolidates briefly before continuing higher.

* Key insight: A breakout above the flag typically signals a continuation of the trend.

1.2 Pennant (Bullish)

* What it looks like: A strong upward move followed by a small symmetrical triangle.

* Meaning: Similar to the bull flag, but the consolidation takes a triangular form.

* Key insight: Once price breaks above the pennant, the uptrend often resumes.

1.3 Cup & Handle

* What it looks like: A “U”-shaped curve (the cup) followed by a small downward drift (the handle).

* Meaning: This pattern suggests a period of accumulation before price breaks higher.

* Key insight: A breakout above the handle signals the beginning of a new bullish leg.

1.4 Inverse Head & Shoulders

* What it looks like: Three low points, with the middle low being the deepest.

* Meaning: This reversal pattern appears after a downtrend and signals a potential change to an uptrend.

* Key insight: A breakout above the “neckline” confirms the reversal.

---

2. Indecisive Chart Patterns

These patterns show market hesitation, where neither bulls nor bears are clearly in control.

2.1 Consolidation Channel

* What it looks like: Price moves within a horizontal channel.

* Meaning: Market is moving sideways with no strong trend.

* Key insight: A breakout in either direction often leads to a significant move.

2.2 Symmetrical Triangle

* What it looks like: Two converging trend lines forming a triangle.

* Meaning: This is a neutral pattern that can break out in either direction.

* Key insight: Traders wait for a breakout before taking a position.

---

3. Bearish Chart Patterns

Bearish patterns signal a high probability of downward price movement.

3.1 Bear Flag

* What it looks like: A sharp decline followed by a small upward-sloping rectangle.

* Meaning: After a strong drop, price consolidates before continuing lower.

* Key insight: A breakout below the flag suggests a continuation of the downtrend.

3.2 Pennant (Bearish)

* What it looks like: A sharp downward move followed by a small symmetrical triangle.

* Meaning: Similar to the bear flag, but the consolidation takes a triangular form.

* Key insight: A breakout downward typically resumes the bearish trend.

3.3 Inverse Cup & Handle

* What it looks like: An upside-down cup with a small upward drift forming the handle.

* Meaning: Indicates weakness after an uptrend, often followed by a drop.

* Key insight: A break below the handle usually signals a strong bearish move.

3.4 Head & Shoulders

* What it looks like: Three peaks, with the middle one being the highest.

* Meaning: A classic reversal pattern that indicates a potential shift from an uptrend to a downtrend.

* Key insight: A break below the “neckline” confirms the bearish reversal.

---

How to Use These Patterns

* Combine pattern recognition with support/resistance, volume, and indicators for stronger confirmation.

* Always wait for breakouts and avoid acting too early.

* Manage risk with stop-loss orders.

Community ideas

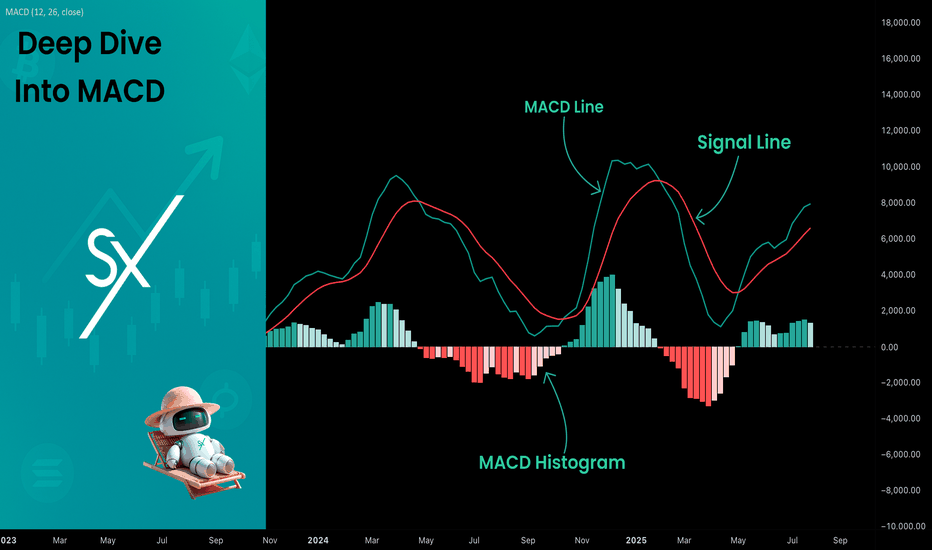

Deep Dive Into Moving Average Convergence Divergence (MACD)🗓 The Moving Average Convergence Divergence (MACD) is one of the most popular momentum indicators in technical analysis. Whether you're a beginner or an experienced trader, understanding how the MACD works can significantly enhance your trading decisions.

📚 Introduction: What Is MACD and Why It Matters

The MACD (Moving Average Convergence Divergence) is one of the most powerful and widely used momentum indicators in technical analysis. It was developed by Gerald Appel in the late 1970s and has since become a staple in the toolkit of traders and investors across markets — from stocks and forex to cryptocurrencies.

At its core, MACD helps traders understand the relationship between two moving averages of an asset’s price, providing insight into both trend direction and momentum strength. By analyzing how these averages converge and diverge, the indicator offers valuable signals for entries, exits, and trend reversals.

What makes MACD especially popular is its versatility — it works well in trending markets, can be used across all timeframes, and combines both leading and lagging components. Whether you're a day trader or a long-term investor, understanding how MACD works gives you an edge in making timely and informed trading decisions.

📚 How the MACD Is Calculated: The Components Explained

The MACD is built from three core components: MACD line, Signal line and MACD histogram.

🔹 Calculating the MACD Line:

The MACD line is the difference between two Exponential Moving Averages (EMAs), typically 12-period EMA (fast) and 26-period EMA (slow). The formula is:

MACD Line = EMA(12) − EMA(26)

This line captures momentum by tracking how the shorter-term average diverges from the longer-term average. When the MACD line rises, the short-term momentum is increasing faster than the longer-term trend — a sign of bullish acceleration. The reverse implies bearish momentum.

🔹 Calculating the Signal Line:

To reduce noise and provide clearer signals, a 9-period EMA of the MACD line is plotted on top. This is the Signal Line, and it acts as a trigger:

When the MACD line crosses above the signal line → bullish signal (buy)

When the MACD line crosses below the signal line → bearish signal (sell)

Signal Line = EMA(9)(MACD Line)

🔹 Calculating the MACD Histogram:

The Histogram shows the difference between the MACD Line and the Signal Line:

Histogram = MACD Line − Signal Line

It provides a visual representation of momentum strength. The histogram bars expand when momentum strengthens and contract as it fades. It helps you spot shifts in momentum earlier than a basic crossover.

📚 How to Use MACD in Trading Strategies

⚡️MACD Signal Line Crossover

Buy Signal:

MACD Line crosses above the Signal Line from below (bullish crossover)

Preferably when both lines are below the zero line (early in the trend)

Price closes above the long-term trend approximation, in our case we use 200-period EMA

Sell Signal:

MACD Line crosses below the Signal Line from above (bearish crossover)

Preferably when both lines are above the zero line (early in the trend)

Price closes below the long-term trend approximation, in our case we use 200-period EMA

📈Long Trading Strategy Example

1. Wait until MACD line crosses over the Signal line from down to up. In our example we use 1D time frame for BITMART:BTCUSDT.P . Open long trade if point 2 will be completed.

2. Price candle shall be closed above the 200-period EMA. This is long-term trend filter to increase the probability that trades will be open only in the direction of the main trend.

3. Close the long trade when the MACD line crosses under the Signal line. This is an approximation that short-term impulse is over and correction is about to start.

In our case we have +20% return on this long trade, but, please, notice that we have not used initial stop-loss in this strategy. Trade was closed according to the technical condition, this approach can violate the risk management rules, but also can be applicable if you trade the amount ready to lose using this strategy. We will talk about stop-loss later.

📉Short trading strategy example

1. Wait until MACD line crosses under the Signal line from up to down. In our example we use 1D time frame for BITMART:ETHUSDT . Open short trade if point 2 will be completed.

2. Price candle shall be closed below the 200-period EMA. This is long-term trend filter to increase the probability that trades will be open only in the direction of the main trend.

3. Close the short trade when the MACD line crosses over the Signal line. This is an approximation that short-term impulse is over and correction is about to start.

In this case we have +15% return on the short trade. Again, strategy used the technical condition to close the trade and now let's cover how to place the stop-loss. There is no right answer how to use stop-losses. The first and the most obvious way to place stop-loss is using recent swing low/high, but the problem is that all traders are seeing them and do the same. Price tends to reach such levels to collect liquidity.

Another one way to place stop-loss is using the signal candle's high/low. This is so-called 1 candle stop-loss. Usually it's very tight and can allow to have the fantastic risk to reward ratio, but we are now recommend to use it if you are not a professional trader because win rate of such strategy decreases.

Third approach in placing stop-loss which we often use in our algorithmic strategies is the Average True Range (ATR). ATR is the volatility measurement, it allows to take into account the current volatility. Sometimes it helps to avoid the stop-loss hit when trade finally goes in your direction. You can just simply subtract (in case of long trade) or add (in case of short trade) ATR value to the entry price and obtain the dynamic stop loss based on current market condition. Also multiplier can be used for ATR. You shall choose the approach which is more comfortable for you, backtest all these approached to make your choice.

🧪Important: we used the long signals only below the zero-line and short signals above it in the attempt to catch the beginning of a trend and have large potential move. On the picture below you can see the same BITMART:BTCUSDT.P , but what will happen if we open long on the lines crossover above zero line? This trade will not be profitable because of restricted potential.

⚡️MACD Zero Line Crossover

Buy Signal:

MACD Histogram crosses above the zero line (momentum shifts from bearish to bullish)

Price closes above the long-term trend approximation, in our case we use 200-period EMA

Sell Signal:

MACD Histogram crosses below the zero line (momentum shifts from bullish to bearish)

Price closes below the long-term trend approximation, in our case we use 200-period EMA

📈Long Trading Strategy Example

1. Wait until MACD Histogram crosses over zero line. Open long trade if point 2 will be completed.

2. Price candle shall be closed above 200-period EMA. This is long-term trend filter to increase the probability that trades will be open only in the direction of the main trend.

3. Take profit when price reaches 3:1 risk to reward ratio according to the stop-loss from point 4.

4. Stop-loss shall be placed below recent swing low. This point can be discussed, you can use any stop-loss technique described earlier in this article. We demonstrate the simplest one, the key here is using at least 3:1 RR.

📉Short trading strategy example

1. Wait until MACD Histogram crosses under zero line. Open short trade if point 2 will be completed.

2. Price candle shall be closed below 200-period EMA. This is long-term trend filter to increase the probability that trades will be open only in the direction of the main trend.

3. Take profit when price reaches 3:1 risk to reward ratio according to the stop-loss from point 4.

4. Stop-loss shall be placed above recent swing high. This point can be discussed, you can use any stop-loss technique described earlier in this article. We demonstrate the simplest one, the key here is using at least 3:1 RR.

⚡️MACD Divergence Strategy

MACD Divergence is a strategy that helps traders identify potential reversals in market direction before they become obvious on the price chart. This makes it a favorite tool among swing traders and crypto enthusiasts looking to catch major moves early.

But what exactly is a divergence? In simple terms, divergence occurs when price and momentum (MACD) are moving in opposite directions — signaling that the current trend may be losing strength and preparing for a reversal. There are two main types of divergence.

🐂 Bullish Divergence

Price makes a lower low

MACD Histogram makes a higher low

This suggests that while price is still falling, downward momentum is weakening. The bears are losing control, and a bullish reversal may be near. Trading signal is very simple, when bullish divergence happens wait for the first increasing column on MACD histogram and open long trade. Place stop-loss under recent swing low and take profit at 3:1 RR.

🐻Bearish Divergence

Price makes a higher high

MACD makes a lower high

This suggests that while price is still falling, downward momentum is weakening. The bears are losing control, and a bullish reversal may be near. Trading signal is very simple, when bearish divergence happens wait for the first decreasing column on MACD histogram and open short trade. Place stop-loss above recent swing high and take profit at 3:1 RR.

🧪 Important hint: MACD histogram shall cross the zero line between two lows/high to create the most reliable divergence signals. We are not recommend to use it without zero-line crossover to decrease number of false signals.

📈Long Trading Strategy Example

1. MACD Histogram shall create higher low.

2. Price shall create lower low.

3. MACD Histogram shall cross the zero line between lows.

4. MACD Histogram shall show the first increasing column.

5. Put stop-loss under the recent swing low.

6. Put take profit at 3:1.

🧪 You can enhance the long signal with the MACD Line divergence. In our case we have both divergences: with MACD Histogram and MACD Line.

📉Short trading strategy example

1. MACD Histogram shall create lower high.

2. Price shall create higher high.

3. MACD Histogram shall cross the zero line between lows.

4. MACD Histogram shall show the first decreasing column.

5. Put stop-loss above the recent swing high.

6. Put take profit at 3:1.

🧪Divergence is extremely strong signal, but when price continue it's move in the direction of a trend and it's not reversing it can also be the signal for the trend continuation. This situation is called "Baskerville Hound" signal, this name was given by famous trader Alexander Elder. We don't recommend to use it for novice traders, but it's useful to know about it.

📚 Conclusion

The Moving Average Convergence Divergence (MACD) is more than just a crossover tool — it's a powerful momentum indicator that offers deep insight into the strength, direction, and timing of market trends. By understanding how the MACD line, Signal line, and Histogram interact, traders can uncover early trend shifts, spot momentum divergences, and time entries and exits with greater confidence.

Whether you're a short-term trader using fast crossovers for scalping or a long-term investor watching for weekly divergences, MACD can adapt to your style when used thoughtfully. Like all indicators, it works best when combined with price action, support/resistance levels, and other indicators — not in isolation.

Ultimately, mastering MACD is not about memorizing patterns, but about learning to read the story of momentum that unfolds beneath the surface of price. With disciplined application and practice, MACD can become a reliable compass in your trading strategy.

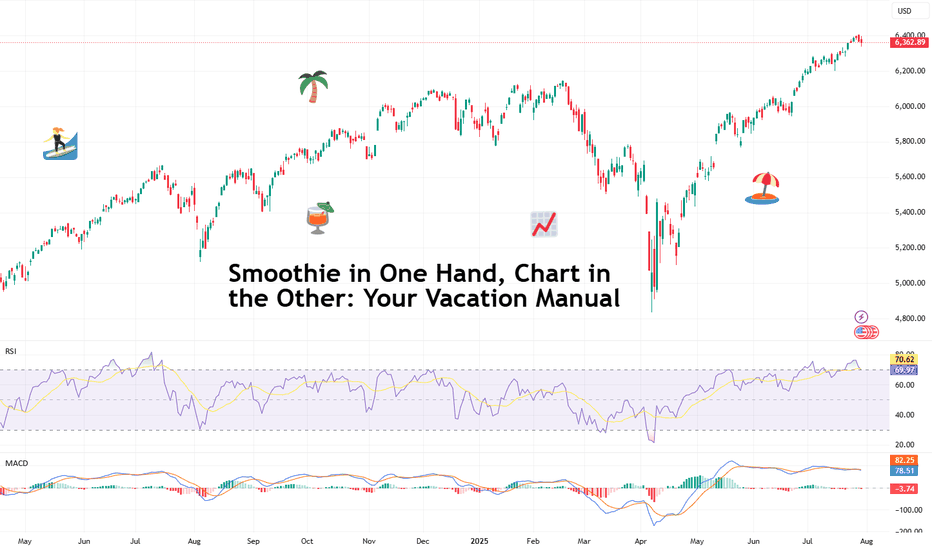

Smoothie in One Hand, Chart in the Other: Your Vacation ManualSome traders bring a beach read. Others bring their TradingView charts.

It’s the heat of the summer and we figured, why not take it easy with a breeze of lightweight lines to pair with your mezcal espresso martini? Let’s talk about how to relax while still watching the markets.

🏄♂️ Market Never Sleeps… But You Should

Vacations are supposed to be about unplugging, but for traders, that’s just code for “I’ll switch to the app instead.”

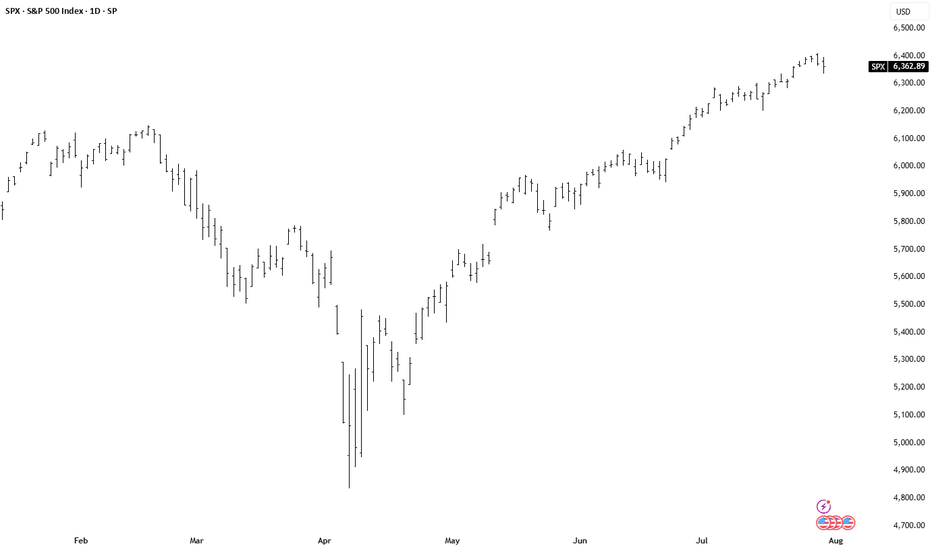

And we don’t blame you. With all that’s going on — US-EU tariff deal, stocks at record highs, and Ethereum BITSTAMP:ETHUSD outperforming Bitcoin BITSTAMP:BTCUSD in a monster July run — it’s only natural for market participants to be hooked at this time.

But watch for those signs of getting overly attached. Studies show performance suffers when you're overcooked — like your last scalp trade on Powell Day. So yes, that mojito matters. Just don’t place a leveraged position on a pool float.

📅 Timing the Market… and Your Booking

Let’s talk timing. The pros know not to schedule getaways during Nonfarm Payrolls week or FOMC decision day. (Unless your idea of relaxing is explaining yield curves to your kids on a ferry across lake Como.)

Instead, try planning your time off during historically low-volatility periods. Summer often sees volume dry up like your skin without sunscreen. Think August’s fairly dry weeks — when even the algorithms seem to be on holiday. As always, consult with the Economic Calendar to know when these are.

Bonus tip: if you’re flying and you wanna stay wired in, go for premarket or after-hours shifts. Nothing says “seasoned trader” like placing an order while the flight attendant gathers everyone’s attention for the safety demo.

🧴 SPF 50 and the S&P 500: Know Your Risk Exposure

In these scorchers outside, you wouldn’t step out without sunscreen, right? But would you let your positions roast unsupervised?

Use stop losses like you use sunblock: generously and repeatedly. Even better — scale back. Summer’s thin liquidity (and other summer trading traps ) can turn minor market moves into full-on tidal waves. No one wants to explain to their friends why they lost 40% of their portfolio during a snorkeling trip.

Adequate position sizing is your beach umbrella. It doesn’t stop the storm, but it’ll stop the burn.

🧭 Wi-Fi, but Make It Secure

Public Wi-Fi is great for scrolling memes, not executing trades. One accidental login from a beachside café in Mykonos and boom — your brokerage account may become a group project.

Trading from your vacation spot shouldn’t be a flex (no matter how much you want to look cool to the bunch of people around you). Focus on your game, trade in silence, and bask in sunlight and success.

☀️ Pack Light, Trade Lighter

The golden rule? If you’re not at your desk, don’t trade like you are.

Scale back positions, minimize leverage, and don’t try to outperform the market while someone’s kid is throwing a beach ball at your head. This is a maintenance phase, not a moonshot month.

Think: protect capital, avoid drawdowns, maybe sneak in a swing trade between sunscreen applications.

📲 Must-Have Apps for Sand-and-Screen Trading

You’re not bringing a full setup, but your phone can still do the heavy lifting. Load it with TradingView (obviously), your broker, ideally paired with TradingView, and a solid news feed . Bonus points for noise-canceling headphones that can drown out both market panic and crying toddlers.

Set up push notifications smartly — only the alerts you actually need. You don’t want your wrist buzzing every time Nvidia NASDAQ:NVDA moves 0.1%.

Question for the road : What’s your best summer trade… and was it worth checking your phone at dinner to place it?

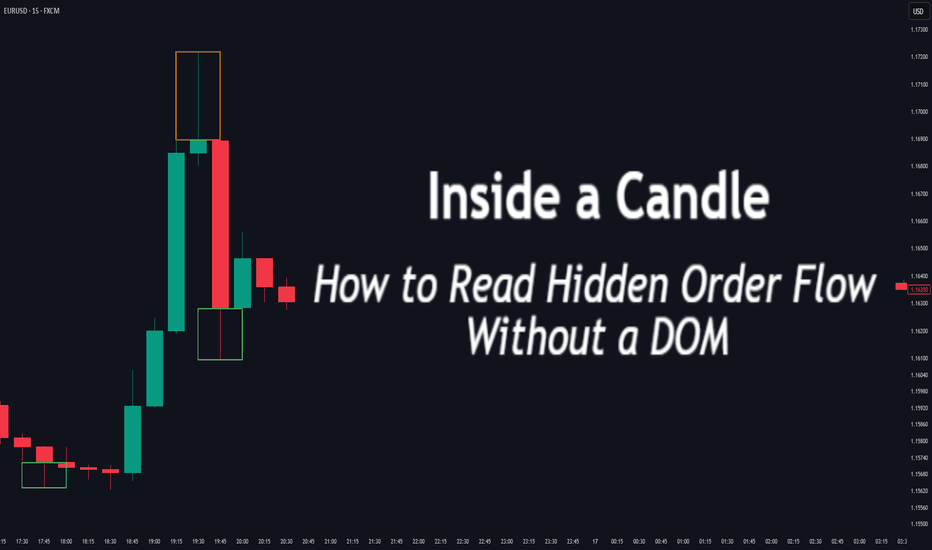

Inside a Candle: How to Read Hidden Order Flow Without a DOM

Difficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is for traders who want to understand the “story” behind a candle’s shape — and learn to spot aggressive buying/selling, absorption, and traps without needing footprint or order book tools.

🔵 INTRODUCTION

Most traders see candles as static shapes — green or red, big or small. But each candle is a battlefield of orders . Even without access to a DOM or volume footprint, you can still extract valuable information from just the candle's body, wick, and context .

🔵 ORIGINS: WHERE CANDLESTICKS COME FROM

Candlestick charts trace back to 18th-century Japan, where rice traders needed a way to visualize price movements over time. A legendary trader named Munehisa Homma , who traded rice futures in Osaka, is credited with developing the earliest form of candlestick analysis.

Homma discovered that price wasn’t just driven by supply and demand — but also by trader psychology . He created visual representations of market sentiment by tracking:

The opening and closing price of rice

The highest and lowest price reached during the session

This system became known as the “Sakata rules,” and it laid the foundation for many patterns still used today — such as Doji, Engulfing, and Marubozu.

Western traders only began using candlesticks widely in the 1990s, when analyst Steve Nison introduced them to the broader financial world through his book Japanese Candlestick Charting Techniques.

Today, candlesticks remain one of the most powerful and intuitive ways to visualize order flow, momentum, and market psychology — even without a Depth of Market (DOM) or depth of book.

In this article, you’ll learn how to read hidden order flow by analyzing:

Wick length and positioning

Body-to-range ratios

Candle clustering and sequences

🔵 HOW A CANDLE FORMS

Before you can read a candle, you need to understand how it comes to life . A single candle represents the full auction process during its time window.

Here’s how it builds, step by step:

Candle opens — this is the open price .

As price moves up during the session → the high] updates.

As price moves down → the low] updates.

The final traded price when the time closes → this becomes the close price .

The wick = price areas that were tested but rejected

The body = where the majority of aggressive trades occurred

If buyers push price up quickly but sellers slam it down before the close — the candle will have a long upper wick and close near the open, revealing seller absorption.

Understanding this flow helps you recognize traps, fakeouts, and reversals in real time.

🔵 CANDLE BODY: WHO'S IN CONTROL

The body of the candle reflects the result of the battle between buyers and sellers. A wide body with minimal wicks means dominance and commitment.

Big body, small wick → clear conviction

In an uptrend: buyer aggression

In a downtrend: panic or aggressive selling

Small body, long wicks → indecision, absorption, or trap

Often appears near tops/bottoms

Indicates both sides were active but neither won clearly

tradingview.sweetlogin.com

🔵 WICKS: THE SHADOWS OF REJECTION

Wicks are not just “leftovers” — they show where price was rejected after being tested.

Long upper wick = seller presence or absorption at highs

Long lower wick = buyer defense or trap spring

Double wick = liquidity sweep / false breakout

Use wick direction to spot:

Failed breakouts

Smart money traps

Exhaustion candles

🔵 HIDDEN ORDER FLOW PATTERNS

1️⃣ Absorption Candle

A large wick with little movement afterward — shows that big orders absorbed market pressure.

2️⃣ Trap Candle

A candle that sweeps above/below a key high/low and closes opposite — classic smart money fakeout.

3️⃣ Imbalance Candle

Large-bodied candle that closes near the high/low with no wick on the other end — implies one-sided aggression (and often leaves an imbalance).

🔵 CLUSTERING & SEQUENCES MATTER

Never read a candle alone. The sequence of candles tells the full story:

3+ rejection wicks near resistance? Liquidity building before breakout or trap

Bearish engulfing after long upper wick = smart money selling into retail buying

Tight-range dojis + volume spike = compression before expansion

Context + volume + structure = hidden flow decoded.

🔵 PUTTING IT TOGETHER: A REAL EXAMPLE

Price breaks above previous high

Candle closes with long upper wick and smaller body

Next candle opens, dumps fast, leaving imbalance behind

Buyers trapped — move likely to continue down

This is how you read order flow from candle anatomy .

🔵 TIPS FOR MASTERY

Use a lower timeframe (1M–5M) to see microstructure

Watch how wicks behave near S/R or OBs

Confirm with volume spikes or delta-style indicators

Use replay mode to slow down the story and study cause/effect

🔵 CONCLUSION

Every candle is a message. You don’t need expensive tools to read order flow — just your eyes, context, and curiosity.

Learn to see candles not as symbols, but as evidence of behavior . Absorption, imbalance, and traps are all visible if you look closely.

Take profit is more important than a stop lossAre you actually in profit, or just delaying your next loss?

How many times have you watched your gains vanish because you wanted more?

Maybe it's time to stop fearing losses and start planning exits.

Hello✌️

Spend 3 minutes ⏰ reading this educational material.

💸 Why Most Traders Lose Profits They Already Had

Most traders obsess over stop losses but never define where they'll take profits. Imagine entering a great trade, watching the price go up, then suddenly it pulls back and you're out with nothing. That happens because you didn’t define your win.

A well-placed take profit acts like a contract with your future self. It secures your gain before the market decides otherwise.

📉 No Take Profit? Say Hello to Unnecessary Losses

Failing to set a take profit is basically handing the market a free ticket to reverse your gains. Especially in the highly volatile crypto space, a missed exit often turns into a regretful stop out. So while everyone is talking about stop losses, you should focus on where the money is actually made.

🧮 A Clear Profit Target Creates a Clear Mind

Having a defined profit target gives your mind a place to rest. It brings structure and removes hesitation. This peace of mind is something new traders lack, which often leads them to close early or hold too long.

🧠 Greed Is the Real Enemy of Your Gains

Greed whispers "Wait, it might go higher"

But when you don't have a take profit plan, that whisper becomes your worst advisor. Pro traders map their exits before entering, while amateurs dream of riding forever.

🛡 True Capital Protection Begins with Profit Protection

If you're aiming for safe capital in crypto, it's not just about minimizing losses. It's about securing wins. Beginners often build their whole plan around stop loss. But advanced traders fear losing profits more than they fear taking a hit.

🎯 Take Profit Is Your Emergency Exit Plan

Setting a profit target is like having an escape route during a fire. Without it, you’ll panic when things turn. Crypto markets are full of pump traps. Your profit is only real when you actually take it.

🚪 Exit Strategy Matters More Than Entry

Everyone talks about entries, but it's your exit that defines whether your trade ends in green or red. Many traders nail the perfect entry but without a clear exit plan, they hand back their profits. Prioritizing your take profit is not optional. It’s essential.

🔁 Managing Gains Is Managing Emotions

Without a defined exit, every candle can shake your decision-making. But when your take profit is set in advance, emotions can’t hijack your strategy. You’re following a plan, not a feeling.

📊 TradingView Tools to Manage Take Profits Effectively

In the world of trading, the right tool means the right decision. TradingView offers powerful tools that help you manage not just your stop loss but more importantly, your take profit targets. With tools like Price Range and Long/Short Position, you can easily visualize where you entered and where you need to exit before greed pulls you deeper.

The Fibonacci Extension tool is especially valuable during bullish runs. It allows you to map out realistic and strategic profit levels like TP1, TP2, and TP3. These targets can then be paired with horizontal lines or alerts within TradingView’s chart system.

Even if you're using a free TradingView account, a simple custom Pine Script can help set alerts when your percentage targets are hit so you can scale out or lock in profits instead of emotionally reacting to price movement.

Using these tools practically empowers traders to build real-world strategies and take control of their exits, not just their entries. That’s the real edge.

📌 Final Takeaway

A clear, well-placed take profit protects both your money and your mind. Don’t let your wins dissolve into losses. With the right tools and the right mindset, you don’t just survive the market, you beat it. Start managing your profits today, not just your losses.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

Simple Psychology Tips Using Volume for Better TradingMany newer traders assume that when someone says "psychology" in trading, they are referring to mindset.

It is also widely believed that trading is about the BEST entries.

Now, think of it this way. It is not about winning trades, it is actually about managing losses well to allow you to take the winners over and over again. You might think that a 3 to 1 risk-to-reward strategy is boring, you might have gone all in on your favourite crypto project. But what makes the difference between gambling and trading is actually very, very simple. So simple, in fact, many overlook it or simply ignore it.

Most seek a silver bullet - high win rates and perfectly timed entries, then they overleverage and move stops on the one "good trade" they are seeking to make.

Whilst doing this, they tend to overload the 6 monitors they have purchased to trade with a thousand indicators, which they don't really need.

The candlesticks tell a story, volume supports that story. When you learn any technique from Elliott Waves to Wyckoff, they all have a dependence on volume - even if the correlation is not apparent.

Look at this first image.

Price had moved down since the vertical line, the AD line also moved down - sell-off, in full swing. But then volume starts to shift before the AD line starts to increase.

Now, look at what happens next...

As we move forward and the new vertical line shows where volume spiked, the AD line starts to decrease as the price continues to rise.

This is enough of a story to start your analysis.

We then get a move with a lower high formed.

As this plays out, the sell-side volume rises, creating momentum for the short position.

Look a little closer and you will see, that the volume on the move up just before the drop was also decreasing. Making a divergence to price.

You might feel that the market is against you, or that the big players are single-handedly seeking your stops. But the truth is, the psychology in moves such as this one shown is where most retail traders either have greed that markets will only go up for ever or the fear that they are missing out on a market that only goes up forever.

It is that herd mentality that generates the liquidity for the professionals.

Losing 1% on a trade, is part of the process, risking 80%> on a single move will make you paper rich for about 10 minutes before the real losses set in.

This is where the psychology and the basic techniques such as risk management and understanding what candlesticks and volume bars are telling you, will make a world of difference to your results.

A/D line and volume are free on @TradingView and to be fair you don't need to overcomplicate it more than that!

Stay safe, have a great weekend all!!!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

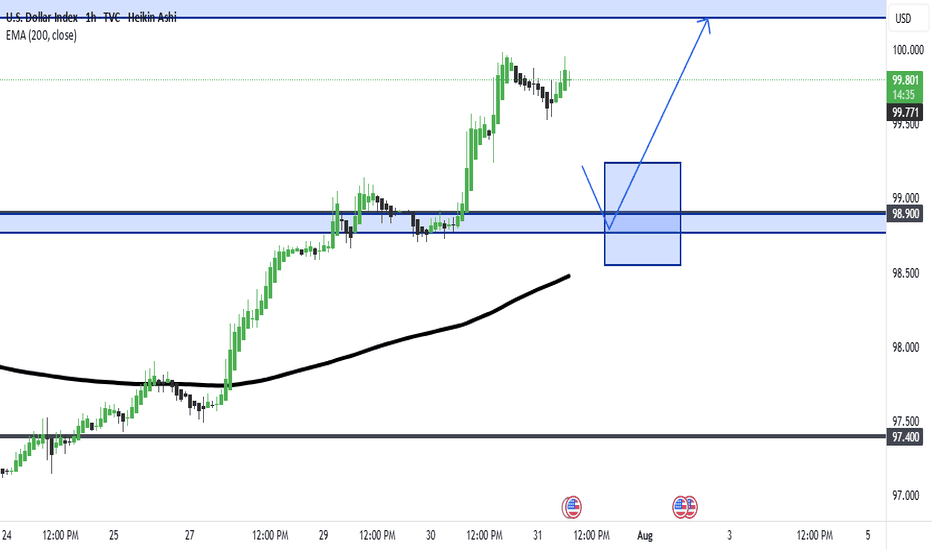

DXY Top-Down Analysis: Market Structure & Directional Bias This video demonstrates a top-down analysis of DXY. I'll show you how to identify market structure, value areas, directional bias, and key support and resistance levels. You'll learn to analyze the market from weekly to hourly timeframes using Heikin-Ashi candles and the 200 EMA.

14-Day Mindset Challenge: Become a Top Trader — Day 114 Days. Challenge: How to Become a Mindset-Strong Trader

Day 1: The Power of Physical Exercise in Enhancing Trading Performance

Embarking on a trading journey demands more than just technical knowledge and market analysis; it requires a resilient and focused mindset. One often overlooked but incredibly powerful tool to develop this mental strength is physical exercise. Regular movement not only benefits your body but also profoundly influences your mental clarity, emotional stability, and overall performance as a trader.

When you engage in physical activity, your brain releases a cascade of chemicals that improve mood, focus, and resilience—crucial qualities for navigating the volatile world of trading. Think of your body and mind as interconnected systems: by strengthening your physical health, you lay a solid foundation for a sharper, more disciplined trading mindset. Over the next 14 days, committing to a simple, consistent exercise routine can transform how you approach your trading sessions, helping you stay calm under pressure, make better decisions, and recover quickly from setbacks.

Let's start!

How Physical Exercise Improves Your Trading Results

1. Boosts Endorphin Production for Positive Feelings

One of the most immediate benefits of exercise is the release of endorphins—natural chemicals that promote feelings of happiness and reduce stress and pain. This positive mood boost helps traders maintain a calm and focused mindset, even amidst market volatility. Scientific studies have shown that regular physical activity increases endorphin levels, which can combat anxiety and improve overall emotional resilience.

2. Enhances Insulin Activity and Energy Levels

Exercise improves insulin sensitivity, enabling your body to more efficiently process glucose for energy. This increased metabolic efficiency helps combat fatigue and sustains mental alertness during prolonged trading sessions. Research indicates that physically active individuals experience higher energy levels and better stamina, which are vital for maintaining attention and decision-making capacity.

3. Reduces Disease Risk and Promotes Long-Term Health

Regular physical activity reduces the risk of cardiovascular disease, diabetes, and other chronic health issues. By maintaining good health, traders are less likely to experience unexpected absences due to illness and can trade consistently over time. Scientific evidence supports that healthier individuals have better cognitive function and emotional stability, both crucial for trading success.

4. Boosts Brain Health and Cognitive Function

Exercise increases heart rate and blood flow, delivering more oxygen and nutrients to the brain. Numerous studies have demonstrated that physical activity stimulates the growth of new neural connections and enhances neuroplasticity—the brain’s ability to adapt and learn. This leads to improved memory, concentration, and problem-solving skills, all essential for analyzing markets and executing trades efficiently.

5. Enhances Stress Regulation and Emotional Control

Research shows that regular exercise helps regulate the hypothalamic-pituitary-adrenal (HPA) axis, which controls stress responses. By improving your body’s ability to handle stress, exercise reduces the likelihood of emotional reactions such as impulsivity or panic during trading. This emotional regulation is key to maintaining discipline and sticking to your trading plan under pressure.

6. Improves Sleep Quality

Quality sleep is fundamental for cognitive performance and emotional regulation. Scientific studies have consistently shown that physical activity, especially aerobic exercise, improves sleep quality and duration. Better sleep enhances focus, decision-making, and emotional resilience—traits that directly impact trading performance.

7. Promotes Neurotransmitter Balance

Exercise influences the production and regulation of neurotransmitters such as dopamine, serotonin, and norepinephrine. These chemicals play a vital role in mood, motivation, and alertness. Balanced neurotransmitter levels support a positive mindset, resilience to setbacks, and sustained motivation—key ingredients for consistent trading.

8. Increases Resilience to Market Stressors

Finally, regular physical activity builds overall resilience—both physically and mentally. This resilience helps traders recover quickly from losses, handle unexpected market shocks, and stay committed to their strategies without succumbing to frustration or panic.

Incorporating these scientifically-backed points emphasizes how exercise not only benefits physical health but also fundamentally enhances the mental and emotional capacities critical for successful trading.

Taking Action: Your 14-Day Exercise Implementation Plan

1. Decide Your Exercise Routine

Choose activities that you enjoy and can commit to every day for the next two weeks. Whether it’s walking, jogging, weightlifting, yoga, Pilates, push-ups, mountain climbers, or any other physical activity—what matters is consistency. Pick something that makes you feel energized and motivated.

2. Set a Daily Time Commitment

Determine how much time you can dedicate each day—start with 30 minutes to 1 hour. Make it a non-negotiable part of your daily schedule. For example, you might decide to go for a brisk walk in the morning, do bodyweight exercises at home, or hit the gym. The goal is to establish a routine that becomes a natural part of your day.

3. Use Reminders and Push Through Initial Discomfort

Especially during the first two weeks, it’s normal to feel some resistance or emotional stress about starting new habits. Set reminders on your phone or calendar to prompt you. Be patient and persistent—initial discomfort will fade as your body adapts. Once exercise becomes a habit, it will feel less like a chore and more like a source of strength.

Final Tips for Success

Start Small, Progress Gradually: Don’t overcommit at the beginning; build gradually to avoid burnout.

Stay Consistent: Consistency beats intensity—daily effort compounds over time.

Track Your Progress: Keep a journal or use an app to monitor your activity and observe how you feel over the days.

Enjoy the Process: Find joy in the movement itself. As it becomes part of your routine, you'll notice improvements not only physically but also in your trading mindset.

Conclusion

A 14-day commitment to physical exercise can be a game-changer for your trading mindset. By boosting endorphins, increasing energy, enhancing brain function, and reducing health risks, you set the stage for more disciplined, confident, and resilient trading. Embrace this challenge—your mind and your portfolio will thank you.

✅ Follow me and save this educational post: "14-Day Mindset Challenge: Become a Top Trader — Day 1". Tomorrow, I'll be releasing Day 2 of the transformation... Stay tuned!

✅ Please share your thoughts about this article in the comments section below and HIT LIKE if you appreciate my post. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Fibonacci Arcs in Stock TradingFibonacci Arcs in Stock Trading

Fibonacci arcs, derived from the renowned Fibonacci sequence, offer a compelling blend of technical analysis and market psychology for traders. By mapping potential support and resistance areas through arcs drawn on stock charts, these tools provide insights into future price movements. This article delves into the practical applications of Fibonacci arcs in trading, their interplay with market psychology, and best practices for effective use.

Understanding Fibonacci Arcs

The Fibonacci arc indicator is a unique tool in technical analysis derived from the famed Fibonacci sequence. It’s crafted by drawing arcs at the key Fibonacci retracement levels - 38.2%, 50%, and 61.8% - from a high to a low point on a stock chart. Each curve represents potential support or resistance areas, offering insights into the stock’s future movements.

The art of arc reading, meaning interpreting these curves, is crucial for traders. When a stock approaches or intersects with an arc, it reflects a significant reaction level. For instance, if a stock price touches or nears an arc, it could face arc resistance, indicating a potential halt or reversal in its trend.

Applying Fibonacci Arcs in Trading

In the stock market, these arcs serve as a guide for traders seeking to anticipate future price movements. When applied correctly, they can provide critical insights into potential support and resistance levels. Here's a step-by-step look at how you may use them effectively:

- Identifying High and Low Points: Begin by selecting a significant high and low point on the stock's chart. In an uptrend, it’s the most recent swing high to a previous swing low, and vice versa. These are the anchor points.

- Drawing the Arcs: Once the points are selected, draw the arcs at the Fibonacci retracement levels of 38.2%, 50%, and 61.8%. They radiate from the chosen low point to the high point (or vice versa), cutting across the chart.

- Interpretation: Watch how the stock interacts with these lines. When the price approaches an arc, it might encounter resistance or support, signalling a potential change in trend or continuation.

- Timing Entries and Exits: Traders can use the arcs in the stock market as a tool to time their trading decisions. For instance, a bounce could be a signal to enter a trade, whereas the price breaking through might suggest it's time to exit.

Fibonacci Arcs and Market Psychology

The effectiveness of Fibonacci arcs in trading is deeply intertwined with market psychology. They tap into the collective mindset of traders, who often react predictably to certain price levels. The Fibonacci sequence, underlying this tool, is not just a mathematical concept but also a representation of natural patterns and human behaviour.

When a stock nears a curve, traders anticipate a reaction, often leading to a self-fulfilling prophecy. If many traders make an arc stock forecast, they might sell as the price approaches a certain point, causing the anticipated resistance to materialise. Similarly, seeing support at an arc can trigger buying, reinforcing the tool’s power.

This psychological aspect makes Fibonacci arcs more than just technical tools. They are reflections of the collective expectations and actions of market participants, turning abstract mathematical concepts into practical indicators of market sentiment and potential movements.

Best Practices

Incorporating Fibonacci arcs into trading strategies involves nuanced techniques for better accuracy and efficacy. Here are some best practices typically followed:

- Complementary Tools: Traders often pair this tool with other indicators like moving averages or RSI for a more robust analysis.

- Accurate Highs and Lows: It's best to carefully select the significant high and low points, as the effectiveness of the curves largely depends on these choices.

- Context Consideration: Understanding the broader market context is crucial. Traders usually use Fibonacci arcs in conjunction with fundamental factors to validate their analysis.

- Watch for Confluence: Identifying areas where Fibonacci levels converge with other technical signals can provide stronger trade setups.

- Practice Patience: Traders typically avoid making hasty decisions based solely on Fibonacci levels. It's usually better to wait to see additional confirmation from the price action.

Advantages and Limitations of Fibonacci Arcs

Fibonacci arcs are a popular tool in technical analysis, offering distinct advantages and some limitations in analysing stock movements. Understanding these can help traders leverage the tool more effectively.

Advantages

- Intuitive Nature: The Fibonacci sequence is a natural pattern, making the tool intuitive for traders to understand and apply.

- Dynamic Support and Resistance Levels: They provide dynamic levels of support and resistance, unlike static lines, adapting to changing market conditions.

- Versatility: Effective in various market conditions, the arcs can be used in both trending and sideways markets.

Limitations

- Subjectivity in Selection: The effectiveness largely depends on correctly identifying the significant high and low points, which can be subjective.

- Potential False Signals: Like all technical tools, they can generate false signals, especially in highly volatile markets.

- Requires Complementary Analysis: To maximise effectiveness, these curves are usually used alongside other technical indicators, as they are not infallible on their own.

The Bottom Line

Fibonacci arcs are invaluable tools in stock analysis, providing insights into market trends and potential price movements.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

HOW TO TRADE THE TREND WITH THE 8-STAGE "MARKET TREND MODEL"How to TRADE THE TREND ,

and decide WHEN TO GO LONG OR SHORT ,

using 8-STAGE MARKET LIFECYCLE ROADMAP

This way you will INCREASE YOUR WIN RATE ,

avoid getting stopped out by BEING COMPLETELY AGAINST THE MARKET ,

while seeing BIG MISSED MARKET OPPORTUNITIES

The Methodology is:

1. Simple & Systematic - so it is easy to learn

2. Works across all Markets

3. Works across all Timeframes

4. Can be combined with existing methodologies..

Trailing Stops:Let trades developTrailing stops are one of the most underused tools in a trader’s playbook. Most traders spend hours obsessing over entries, but then wing the exit or bail too early the moment a red candle appears. That’s where trailing stops come in. They give your trades room to breathe, while gradually reducing risk as price moves in your favour.

If you’ve ever caught a good move and felt unsure about how long to hold it, this one’s for you.

Here are three practical ways to trail your stop, stay in the trade, and help manage profitable trades objectively.

1. Trail Behind Structure

This is the simplest and most intuitive method. As the trade moves in your favour, you move your stop just behind the most recent swing high or low. In a long trade, that means raising your stop to sit just below the latest higher low. In a short, you drop it just above the most recent lower high.

This approach works best in clean, trending conditions. It gives the trade room to develop naturally without forcing you to guess the top. You won’t capture the absolute high, but you’ll often stay in the move longer than most.

It also keeps you in rhythm with the market. If the structure is broken, it’s a pretty good sign that the trend is changing or stalling and that’s a logical place to step aside.

Example:

Here’s a clean example of using structure to trail stops on a momentum trade. The entry came on a break and retest of resistance, with the initial stop placed just below the retest level. As the trade moved higher, a series of higher swing lows developed, providing clear reference points to adjust the stop.

It’s not designed to catch the exact top and that’s fine. The goal is to follow price action with minimal lag, using objective structure rather than guesswork.

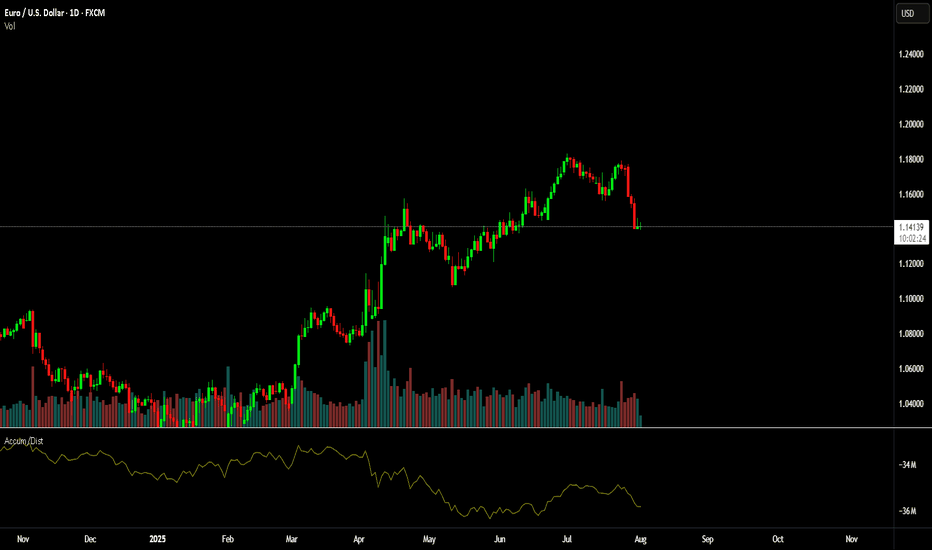

EUR/USD Hourly Candle Chart

Past performance is not a reliable indicator of future results

2. Use Moving Averages

Trailing stops don’t have to follow every single swing. Sometimes, a smoother option is better, especially if you want to stay in a move that’s trending hard. That’s where moving averages come in.

A short-term exponential moving average like the 9 or 21 EMA can act as a dynamic trailing stop. As long as price remains above the average, the trend is intact and you stay in. If price closes below the EMA in a long trade, or you get a crossover in the opposite direction, that can signal an exit or at least a scale-down.

This method works best in fast, directional markets. It won’t suit every condition, but when the move is strong, letting a trade run along the moving average keeps things simple and stress-free.

Example:

In this short-term 5-minute chart example, the 21 EMA acts as a dynamic trailing stop. There are two common approaches. You can wait for a candle to close below the 21 EMA, or use a crossover trigger where the 9 EMA crosses under the 21 EMA. The choice depends on how tightly you want to manage the trade and how much room you are willing to give it.

S&P 500 5min Candle Chart

Past performance is not a reliable indicator of future results

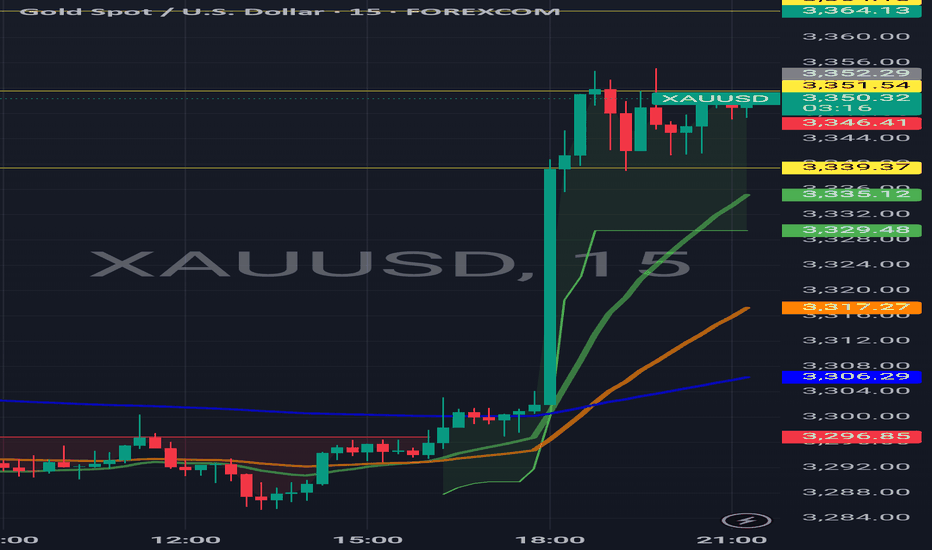

3. Volatility-Based Stops (ATR)

When the market gets fast and messy, a fixed stop can either get hit too easily or feel too far away. That’s where volatility-based stops come in. The most common tool for this is the Average True Range (ATR).

Instead of using swing points, you trail your stop a set number of ATRs behind the current price. If ATR is rising, your stop gives the trade more room. If volatility shrinks, the stop tightens naturally. It’s an adaptive approach that works well in conditions where price is expanding or moving fast.

A popular setting is to use two times the current ATR value, but you can adjust it to suit your timeframe or risk tolerance.

Example:

This is a classic wedge breakout setup in gold. A trailing stop set at two times the ATR helps manage risk while giving the trade enough room to breathe. As price moves in your favour, the stop tightens automatically based on volatility. It’s worth remembering that trailing stops are only adjusted in one direction. Once set, they follow the move but are never loosened, which means the stop will eventually take you out as momentum fades or the market turns.

Gold Daily Candle Chart

Past performance is not a reliable indicator of future results

Decide on Your Technique BEFORE You Place the Trade

There’s no perfect way to trail a stop. Each method has its strengths. Structure-based stops keep you aligned with price action. EMAs are smooth and simple. ATR lets volatility do the work for you.

The most important thing is to make a decision before you place the trade. Know whether you’re using a manual swing method or a dynamic indicator. Know what would trigger a move in your stop, and what would keep it steady. Avoid changing the plan just because the trade gets emotional.

Trailing stops give you freedom. They let you step back, protect your capital and give your best trades a real chance to develop. Used properly, they enhance trade management consistency.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85.24% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

HOW TO TRADE 'BIG CANDLE"This is an educational video showing a trade set up based on big candles.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

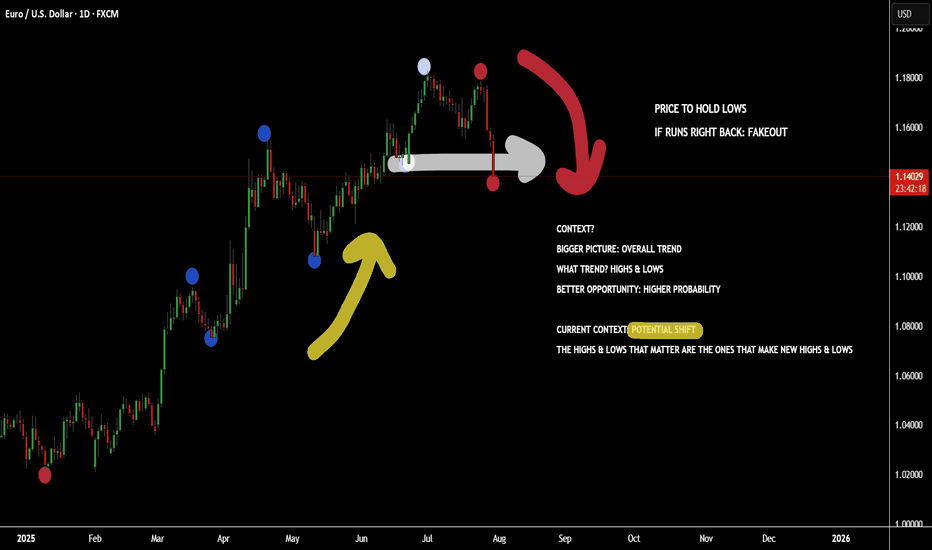

MARKET CONTEXT...#1 TOOL FOR PROFITABLE TRADING...EURUSD EXAMPLEHey hey TradingView family! Hope you are all doing amazing! I just wanted to come on and make a video speaking on market context, the #1 tool/idea that helped me go from struggling to profitable trader.

Understanding the bigger picture in trading, like TRULY understanding the higher timeframe perspective will work wonders in your analysis & trading whether you are a scalper or a position trader. It gives you the context for what market and the stage of market you are in whether in short term or longer term positions, which will IMMEDIATELY give you an edge.

Understanding=profitability in the markets. So does simplicity.

So watch this video as many times as you guys need, keep it simple, and watch this change your trading starting TODAY for the GOOD!

Cheers!

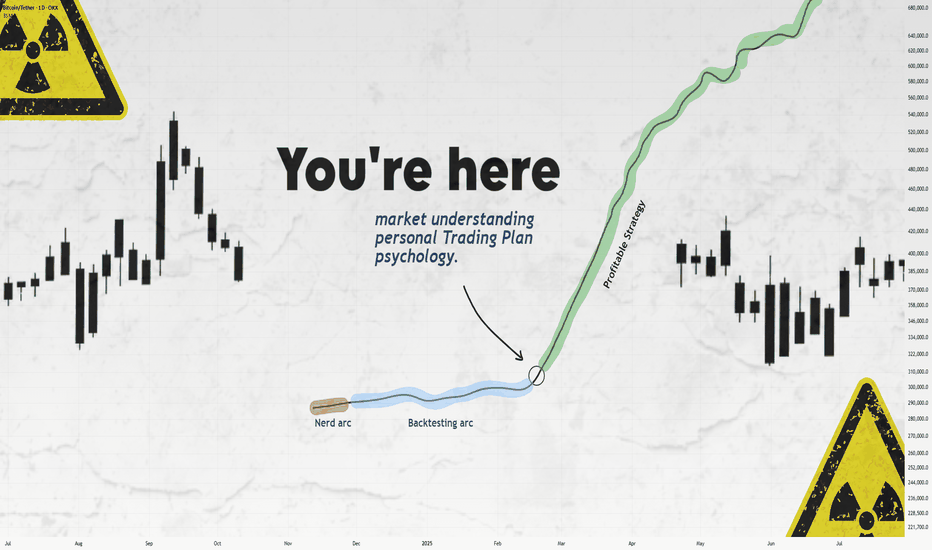

Still Losing After Backtesting? This Fixed It.Let’s get straight to it.

If you’ve gone through the "nerd arc" and the "backtesting arc" but still aren’t profitable...

What’s the fix?

In this short write-up, I’ll walk you through 3 brutal truths that made me finally see green.

Is it hard?

UH—Damn right.

But let’s go 👇

1. Market Understanding

This isn’t something you "learn" from a course.

It’s something that clicks after dozens of stop losses and live trades.

Here are a few ways I got more comfortable with it:

1. Don’t fear opening trades or hitting stop loss.

Each trade gives you data. More trades = more experience = better market feel.

What’s the requirement? Capital and risk management. Without that, you won’t even survive long enough to "get" it.

2. Journaling every single trade.

Write everything: your thoughts, screenshots, feelings — before and after.

Too lazy to do it? Left trading. Simple.

3. Be the detective.

Read the chart like a story. No, seriously.

Think of Bitcoin as a character with real moods.

Every candle tells you something.

That 5% pump? Buyers pushing up. Then bears smacked it down — candle closed red.

Now price is bleeding again.

Why?

🔍 Be the detective.

4. Analyze the market every day — even without trading.

The more you observe, the more you see. Structures. Patterns. Behavior.

Easy? Nah.

It takes discipline — like posting one story text to Insta for 1,000 days straight. Still wanna try?

2. Personal Trading Plan

Remember how I said "don’t fear opening trades"?

Well — after you’ve opened a bunch, you can start tailoring your own trading plan based on you.

This isn’t a PDF you can steal off Google.

Only after seeing how you behave in trades, you’ll know what rules make sense.

Maybe:

"I don’t trade when I’m emotionally off."

"This setup gave me the best results over 100 trades."

Just don’t copy-paste someone else’s rules.

Make a flexible structure, then let the details emerge from the market and your own experience.

Now —

Take a deep breath.

When was the last time you enjoyed your coffee?

More than a day ago?

Go make one now.

Might not get to taste it tomorrow.

Not everything in life is trading :)

3. Psychology

Ah, the final boss.

Still my weakest area, honestly.

But here are a few real things that helped:

Tip 1: WRITE.

Just write whatever you feel.

Telegram saved messages? Notebook?

Or if you're like me (🧠nerd), Notion.

Do it for 60 days straight — then feed that journal to ChatGPT and analyze yourself.

Takes time, but the patterns you'll see are... magical.

Tip 2: Money & Risk Management.

When you know your stop loss means only -0.25% of your capital…

why should you panic?

For me:

I place the SL, set a TP alert, and leave the screen.

No emotions, no fear.

Why? Because when capital is protected, so is my psychology.

Truth is, trading emotions aren’t just during the trade — they live in your head all day.

When your mental energy’s drained?

You’ll miss A+ setups.

Fall for BS ones.

Lose focus.

It’s complicated.

Because humans are complicated.

Our brains are the most tangled system known.

And somehow, out of all that noise, consciousness emerges.

A miracle.

So don’t expect to always feel calm.

Just aim to get better.

That’s it.

Thanks for sticking around.

These are just my thoughts, from one tired trader to another 🧠

I’m no expert—just sharing what’s worked (and what hasn’t).

If it helped, a boost would mean a lot.

🚫 Don’t FOMO

✅ Manage your capital

Until tomorrow —

Peace out. ✌️

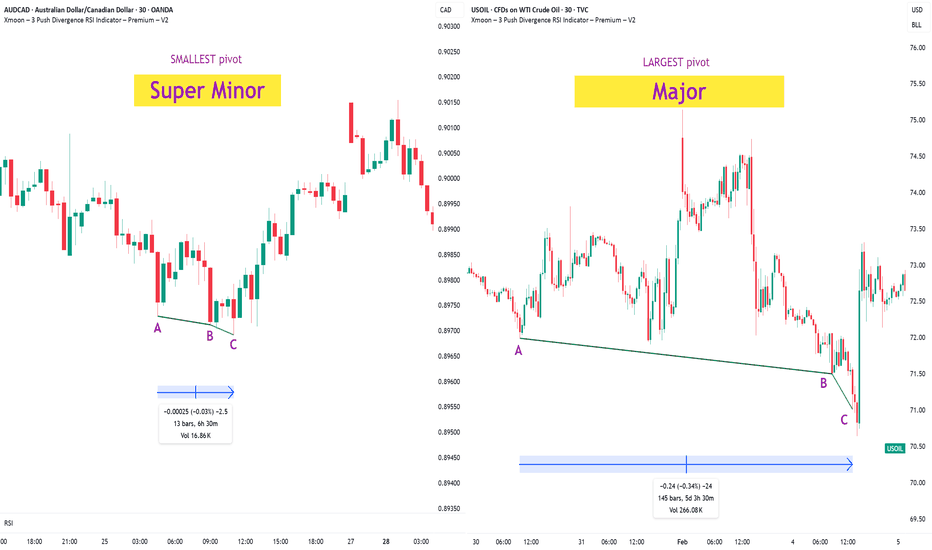

Xmoon Indicator Tutorial – Part 2 – Pivots🔻🔻🔻+ Persian translation below 🔻🔻🔻

🔹 What Is a Pivot?

In the Xmoon strategy, every high or low that forms on the chart is considered a pivot.

The number of candles between two highs or two lows defines the size of the pivot.

The more candles there are between them, the larger and more reliable the pivot becomes.

🔸 Types of Pivots in the Xmoon Indicator Settings

In the settings panel, you can choose which types of pivots the patterns should be based on.

There are 4 pivot types :

• Super Minor → the smallest pivot

• Minor

• Mid Major

• Major → the largest pivot

⏫ As you move from Super Minor to Major, the strength of the pivot increases — but the number of signals decreases.

⚖️ Choosing the Right Pivot = Your Trading Style

• Want more signals? → Use smaller pivots like Minor or Super Minor

• Prefer higher accuracy and lower risk? → Use larger pivots like Major or Mid Major

💡 Pro Tip: On higher timeframes, pivots perform better and help reduce risk.

✍️ Summary

If you're looking for frequent signals, trade on lower timeframes, and can handle higher volatility and pressure, then smaller pivots like Super Minor and Minor are a better choice.

But if you prefer quality over quantity, work on higher timeframes, and value clarity, peace of mind, and higher success rates, then larger pivots like Mid Major and Major are the way to go.

📣 If you have any questions or need guidance, feel free to ask us. We’d be happy to help.

🔻🔻🔻 Persian Section – بخش فارسی 🔻🔻🔻

🔹 پیوت چیست؟

در استراتژی ایکسمون، هر قله یا درهای که روی چارت شکل میگیرد، یک پیوت محسوب می شود

فاصله زمانی بین دو قله یا دو دره (یعنی تعداد کندلهایی که بینشان قرار دارد) اندازهی پیوت را مشخص میکند

هرچه تعداد کندل بین دو سقف یا کف بیشتر باشد، آن پیوت بزرگتر و معتبرتر است

🔸 انواع پیوت در تنظیمات اندیکاتور ایکسمون

در بخش تنظیمات، میتوانید مشخص کنید که الگوها بر اساس چه نوع پیوتهایی شناسایی شوند

ما ۴ نوع پیوت داریم

• سوپر مینور ← کوچکترین پیوت

• مینور

• میدماژور

• ماژور ← بزرگترین پیوت

⏫ هرچه از سوپرمینور به سمت ماژور برویم، قدرت پیوت بیشتر میشود، ولی تعداد سیگنالها کمتر می شود

⚖️ انتخاب پیوت مناسب = سبک معاملاتی شما

• به دنبال سیگنال زیاد هستید ← پیوت کوچک تر = مینور و سوپرمینور

• به دنبال دقت بیشتر و ریسک کمتر هستید← پیوت بزرگتر = ماژور و میدماژور

💡 نکته حرفهای: در تایمفریمهای بالا، پیوتها عملکرد بهتری دارند و به کنترل ریسک کمک میکنند

✍️ جمعبندی

اگر دنبال سیگنالهای زیاد هستید، در تایمفریمهای کوچکتر کار میکنید و میتونید نوسانات و فشار روانی بالاتر رو تحمل کنید، پیوتهای کوچکتر مثل سوپرمینور و مینور انتخاب مناسبتری هستند

اما اگر در تایم فریم های بزرگتر کار می کنید و کیفیت سیگنال، آرامش ذهنی و احتمال موفقیت برایتان مهمتر است، پیوتهای بزرگتر مثل میدماژور و ماژور انتخاب بهتری هستند

📣 اگر سوالی دارید یا نیاز به راهنمایی دارید، خوشحال میشویم از ما بپرسید

با کمال میل در خدمتتان هستیم

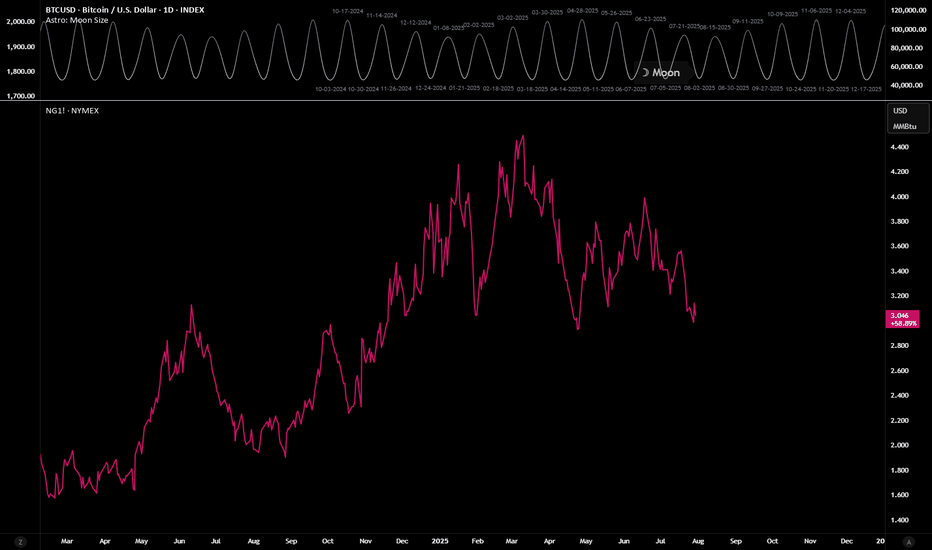

Using Astro: indicators on non-24/7 chartsWhen loading AstroLib powered Astro: indicators on non-24/7 assets like NatGas, you may notice the indicator has gaps and the plots are not smooth. A simple workaround is to pull up a BTC chart, load the indicator, merge the two panes, hide the BTC plots, and then compare the non-24/7 asset in another pane. The chart for this TradingView Idea is a template that can be used for this workaround. Just click "Grab this chart" above to make your own working copy.

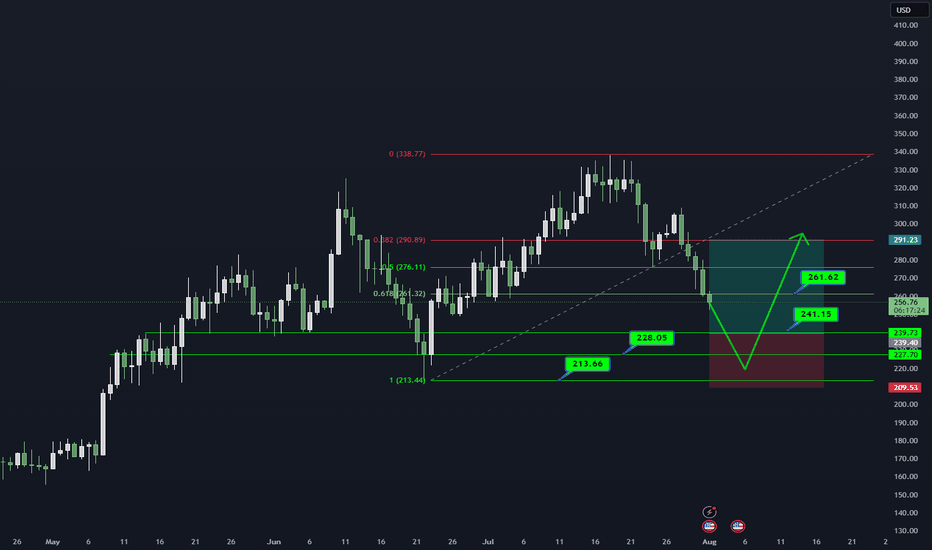

AAVE/USDT DAILY OUTLOOK📊 AAVE/USDT – DAILY TECHNICAL OUTLOOK

🔍 MARKET STRUCTURE

AAVE critical demand zone (241–228) par trade kar raha hai.

Higher timeframe trend bullish jab tak 213 strong base hold karta hai.

📌 KEY LEVELS TO WATCH

Support Zones: 241.15 → 228.05 → 213.66 (Major Base)

Resistance Zones: 261.62 → 291.23

Breakout Confirmation: Daily close above 261 could open path to 291.

🎯 TRADING PLAN (25% SCALING STRATEGY)

Entries ko 25% ke 4 parts me divide karein:

241.15

228.05

220–213 support range

Targets: 261.62 → 291.23

Stop Loss: Daily close below 213

⚠️ RISK MANAGEMENT NOTE

Spot trades safer. Leverage trading = technical gambling.

Capital preservation = long-term survival.

📖 QUOTE

"The big money is made by sitting, not trading." – Reminiscences of a Stock Operator

💬 WHAT’S YOUR VIEW ON AAVE?

Bullish bounce from demand zone or deeper retest ahead?

Share your thoughts in the comments!

#AAVE #CryptoTrading #Altcoins #TradingView #TechnicalAnalysis #CryptoCommunity #RiskManagement #SpotTrading

How to Use Engulfing Candles in TradingViewEngulfing patterns are among the most powerful candlestick formations because they signal strong momentum shifts and can help you spot dramatic trend reversal opportunities.

What You'll Learn:

• How to identify valid engulfing formations where one candle completely covers another's body

• The two types: bullish engulfing (green candle engulfs red) and bearish engulfing (red candle engulfs green)

• Psychology behind engulfing patterns: when one side completely overwhelms the other

• Using volume analysis to confirm engulfing pattern validity

• Finding meaningful engulfing patterns at trend highs and lows for reversal setups

• Timeframe considerations for engulfing analysis on any chart period

• Step-by-step trading strategy for engulfing reversal setups

• Setting proper stop losses above engulfing candle highs

• Determining profit targets below engulfing candle lows

• Managing wide-range drawdowns common with strong momentum shifts

• Advanced entry technique: waiting for retracements to improve risk-reward ratios

This tutorial may help futures traders and technical analysts who want to use powerful candlestick patterns to identify significant momentum changes.

The strategies covered could assist you in creating effective reversal setups when strong buying or selling pressure appears at key price levels.

Learn more about futures trading with Tradingview: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

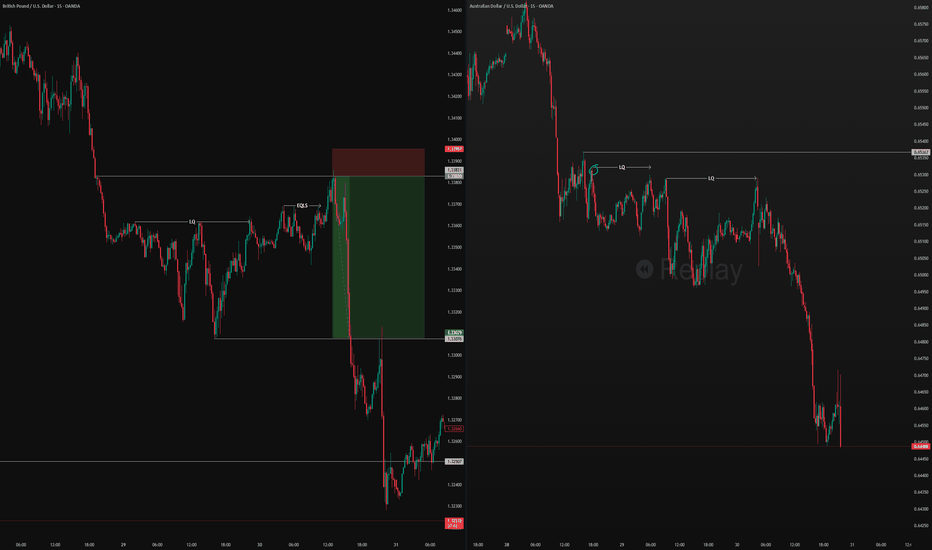

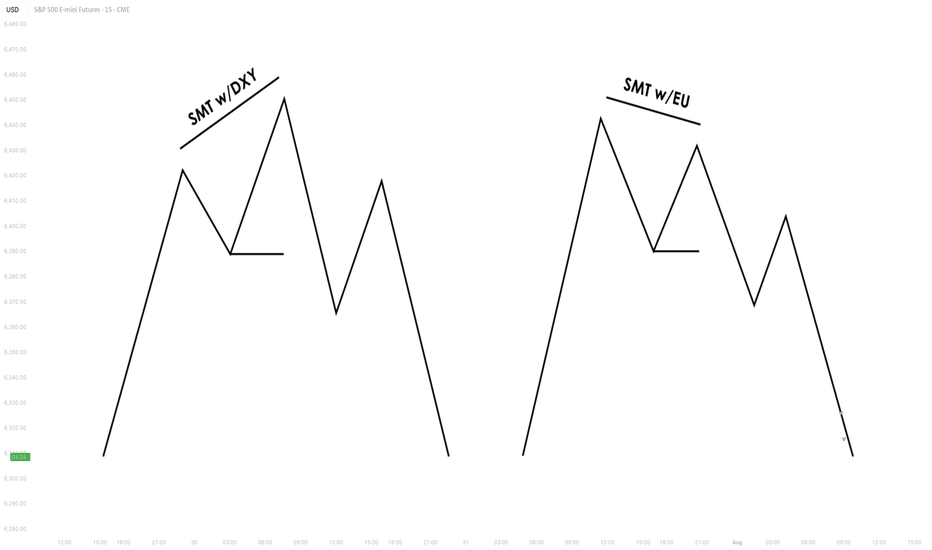

Understanding SMT Divergence In Trading1. Definition and Importance

SMT (Smart Money Technique) Divergence refers to a trading concept that involves identifying discrepancies between the price movement of correlated markets or instruments.

These discrepancies can signal potential market reversals or price manipulation. Specifically, it focuses on the divergence between price movements and indicators (like volume, momentum, or oscillators) in markets that typically move in sync.

In SMT Divergence, traders look for situations where two or more correlated instruments (like

Forex pairs, indices, or bonds) are moving in opposite directions. This "divergence" signals that

there may be a shift in market sentiment, liquidity manipulation, or an opportunity for price

correction.

The importance of SMT Divergence lies in its ability to detect hidden market dynamics that are

often manipulated by institutional players. By understanding these divergences, traders can

gain insights into potential market moves and position themselves accordingly.

2. The Relationship Between Correlated Markets

Understanding these relationships is crucial for identifying SMT Divergence:

Forex Pairs : Many Forex pairs have direct correlations. For example, EUR/USD and USD/JPY are often correlated in the sense that when the USD strengthens, both pairs may exhibit price movement in the same direction (EUR/USD decreases, USD/JPY increases). SMT

Divergence occurs when these pairs move in opposite directions, indicating that something

unusual is happening in the market (e.g., liquidity manipulation or market anticipation).

Indices : Stock market indices (like the S&P 500 or Dow Jones) and related instruments like futures or ETFs can show correlation. A divergence in these indices might indicate potential

trends or reversals, signaling that institutions are positioning themselves for a move in one

direction, and the market is showing resistance.

Bonds : The relationship between bond yields and currency pairs, for instance, can also show correlations. When bond yields move in one direction, certain currency pairs should

generally follow suit. Divergence in this relationship can reveal clues about market

intentions, such as shifts in interest rates or macroeconomic sentiment.

Commodities and Stocks : Commodities like oil and gold can often correlate with indices or specific stocks. For example, if oil prices rise and an energy sector index doesn’t move in the

same direction, this could be a sign of market inefficiencies or institutional positioning.

3. SMT Types

3.1. Bullish SMT Divergence

Bullish SMT (Smart Money Technique) Divergence occurs when one correlated asset forms a

higher low while another makes a lower low. This indicates that one market is showing hidden

strength, suggesting a potential reversal to the upside.

How to Spot Higher Lows in One Asset While the Other Makes Lower Lows:

1. Identify Two Correlated Markets – Choose two assets that typically move together, such as EUR/USD and GBP/USD or NASDAQ and S&P 500.

2. Look for Divergence – Observe when one asset makes a new lower low, while the other fails to do so, instead of forming a higher low.

3. Volume & Price Action Confirmation – Institutions may absorb liquidity in the weaker asset while the stronger one holds its ground.

4. Validate with Market Context – Look at macroeconomic conditions, liquidity pools, and institutional activity to confirm the setup.

3.2. Bearish SMT Divergence

Bearish SMT Divergence occurs when one correlated asset forms a lower high while another

makes a higher high. This signals hidden weakness, indicating that the market may be setting

up for a bearish reversal.

How to Spot Lower Highs in One Asset While the Other Makes Higher Highs:

1. Find Two Correlated Markets – Common pairs include NASDAQ vs. S&P 500 or EUR/USD vs. GBP/USD.

2. Identify the Divergence – One asset makes a higher high, while the other fails to follow and forms a lower high instead.

3. Liquidity & Volume Analysis – Smart money may be using the stronger asset to attract buyers before reversing.

4. Confirm with Institutional Order Flow – Watch for liquidity grabs and imbalance zones.

3.3. Intermarket SMT

Definition : Divergence between assets from different markets, such as Forex vs. Commodities, Stocks vs. Bonds, or Indices vs. the U.S. Dollar.

Examples :

EUR/USD vs. DXY (U.S. Dollar Index) – If EUR/USD forms a higher low while DXY makes a

higher high, this suggests USD weakness and potential EUR/USD strength.

NASDAQ vs. S&P 500 – If NASDAQ makes a higher high but S&P 500 doesn’t, it can indicate

a weakening stock market rally.

Strength & Validity :

High validity because institutions hedge positions across different markets.

3.4. Intramarket SMT

Definition : Divergence within the same market (e.g., multiple Forex pairs or stock indices).

Examples :

EUR/USD vs. GBP/USD – If EUR/USD makes a lower low but GBP/USD doesn’t, it could

indicate bullish strength.

Dow Jones vs. S&P 500 vs. NASDAQ – If NASDAQ is making new highs while the Dow lags, it

may signal weakness in the broader stock market.

Strength & Validity :

Still valid but needs additional confirmation (liquidity sweeps, volume analysis).

4. SMT Divergence vs. RSI Divergence

Why SMT Is Superior to Traditional RSI Divergences

1. RSI Measures Momentum, Not Liquidity – RSI divergence is based on momentum shifts,

which institutions can easily manipulate with fake breakouts or engineered price moves.

2. SMT Focuses on Market Structure & Liquidity – SMT divergence detects institutional

positioning by comparing correlated assets, making it harder to manipulate.

3. RSI Can Remain Overbought/Oversold for Long Periods – Markets can continue trending

despite RSI divergence, while SMT divergence often provides stronger reversal signals.

How Smart Money Manipulates Classic Divergence Traders

Liquidity Sweeps – Institutions use RSI divergence to lure retail traders into premature

reversals before executing stop hunts.

False RSI Signals – In trending markets, RSI divergences often fail, while SMT divergence

provides a more contextual view of smart money positioning.

5. Using TradingView for SMT Analysis

To effectively analyze SMT divergence, traders should monitor at least two correlated assets

simultaneously.

TradingView makes this easy by allowing multiple chart layouts. Steps to Set Up Multiple Charts in TradingView:

a. Open TradingView and click on the “Select Layout” button.

b. Choose a two-chart or four-chart layout to compare correlated assets.

c. Sync timeframes across all charts for consistency.

d. Adjust scaling to ensure price action is easily comparable.

Best Pairs to Compare for SMT Analysis:

Forex : EUR/USD vs. GBP/USD, USD/JPY vs. DXY

Indices : NASDAQ vs. S&P 500, Dow Jones vs. S&P 500

Commodities & FX : Gold (XAU/USD) vs. USD/JPY

Bonds & Equities : 10-Year Treasury Yield vs. S&P 500

6. Key Takeaways

SMT divergence reveals institutional intent by showing liquidity accumulation or

distribution through correlated assets.

Bullish SMT occurs when one asset makes a lower low while the other does not, signaling a

potential reversal up.

Bearish SMT occurs when one asset makes a higher high while the other does not, signaling

a potential reversal down.

Best markets for SMT analysis include Forex pairs, indices, commodities, and bonds, where

correlations are strongest.

SMT is most effective near key liquidity levels, such as session highs/lows, order blocks, and

fair value gaps.

SMT is more reliable during high-impact news events, London & New York sessions, and

quarterly shifts, where institutional activity is highest.

SMT is superior to RSI divergence because it reflects real liquidity dynamics, whereas RSI

can produce false signals.

Combining SMT with market structure shifts like BOS and CHoCH increases trade accuracy

and reliability.

Risk management in SMT trading requires stop-loss placement beyond liquidity grabs and a

minimum 2:1 risk-reward ratio.

Mastering SMT helps traders avoid liquidity traps, improve precision, and align with smart

money moves.

SMT divergence is the footprint of smart money—where one market whispers the truth while the other follows the herd.

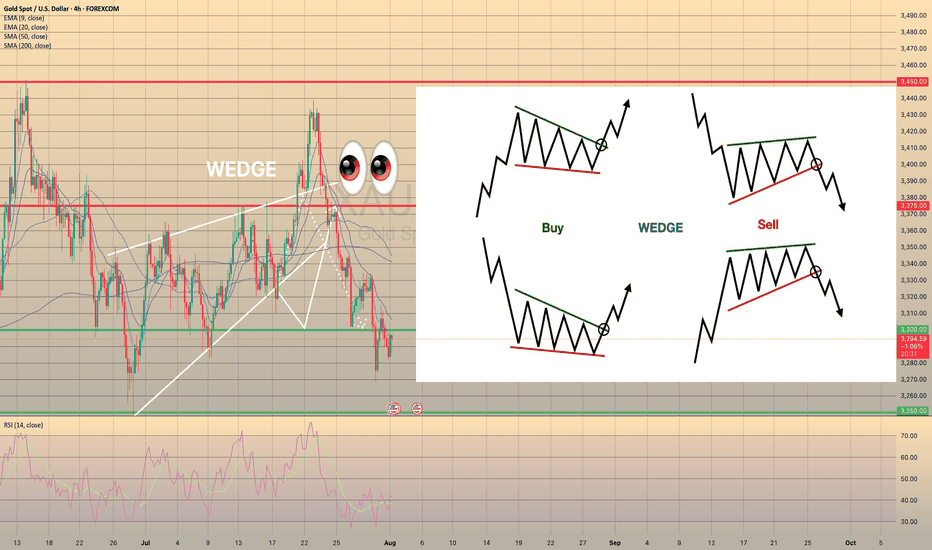

Wedge Pattern: A Key to Trend Reversals and Continuations📈 Wedge Pattern: A Key to Trend Reversals and Continuations

A wedge pattern is a technical chart formation that signals a potential reversal or continuation in the market. It’s formed when price moves between two converging trendlines — either sloping upward or downward — creating a narrowing range over time.

There are two main types of wedge patterns:

🔻 Falling Wedge (Bullish)

Formed during a downtrend or as a correction in an uptrend.

Characterized by lower highs and lower lows, with the slope of the support line steeper than the resistance line.

Typically signals a bullish reversal as momentum builds for a breakout to the upside.

✅ Confirmation: Break above the resistance line with volume surge.

🔺 Rising Wedge (Bearish)

Appears during an uptrend or as a correction in a downtrend.

Shows higher highs and higher lows, but the support line is steeper than the resistance line.

Often leads to a bearish reversal, especially when volume declines into the pattern.

⚠️ Confirmation: Break below the support line with increasing volume.

🧠 Key Characteristics

Volume tends to decrease as the pattern forms, indicating a pause in momentum.

The breakout direction (up or down) determines whether it’s a continuation or reversal signal.

Wedges can appear on any time frame and are useful for both day traders and long-term investors.

📊 Trading Tip

Always wait for confirmation of the breakout before entering a trade. False breakouts can be common, especially in low-volume environments