Market analysis from BlackBull Markets

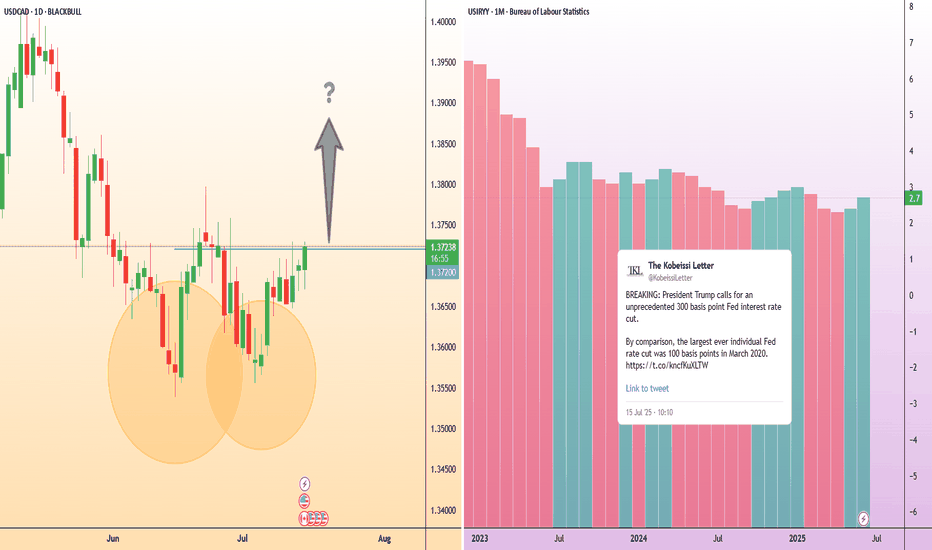

In the U.S., inflation accelerated for a second straight month, with headline CPI reaching 2.7% year-on-year in June as President Trump’s tariffs begin to push up the cost of a range of goods. Increasing inflation could likely heighten the Federal Reserve’s reluctance to cut its interest rate, in defiance of Trump’s public demand. This could provide upward...

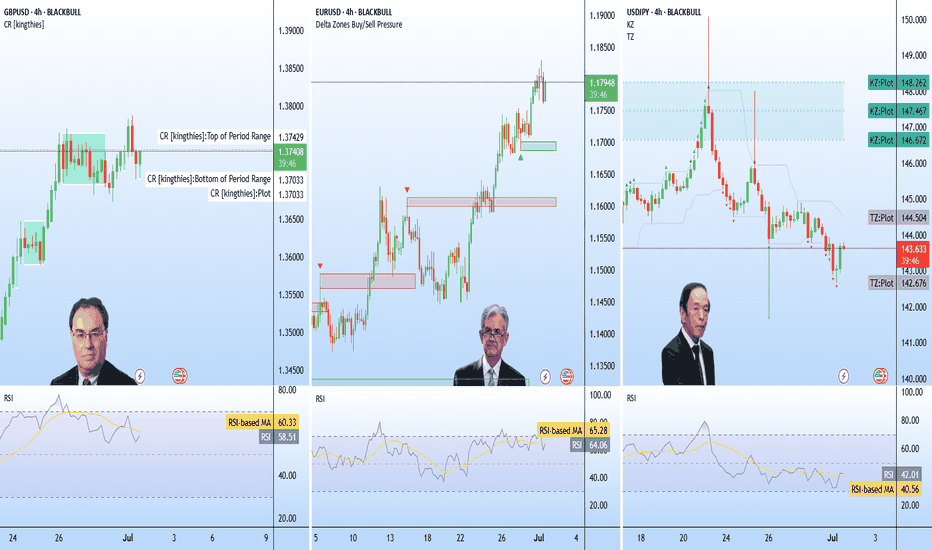

A sudden exit by Fed Chair Jerome Powell would create both a political and monetary shock. While the Chair is technically protected from arbitrary removal. Recent reports confirm that President Trump and his allies are scrutinising the Fed’s $2.5 billion renovation project—potentially laying the groundwork for a “for cause” dismissal. A surprise departure...

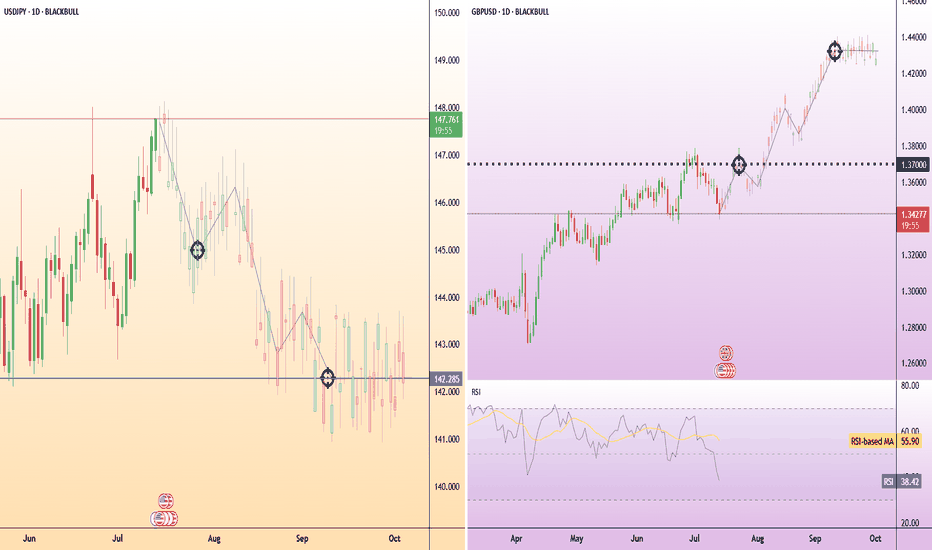

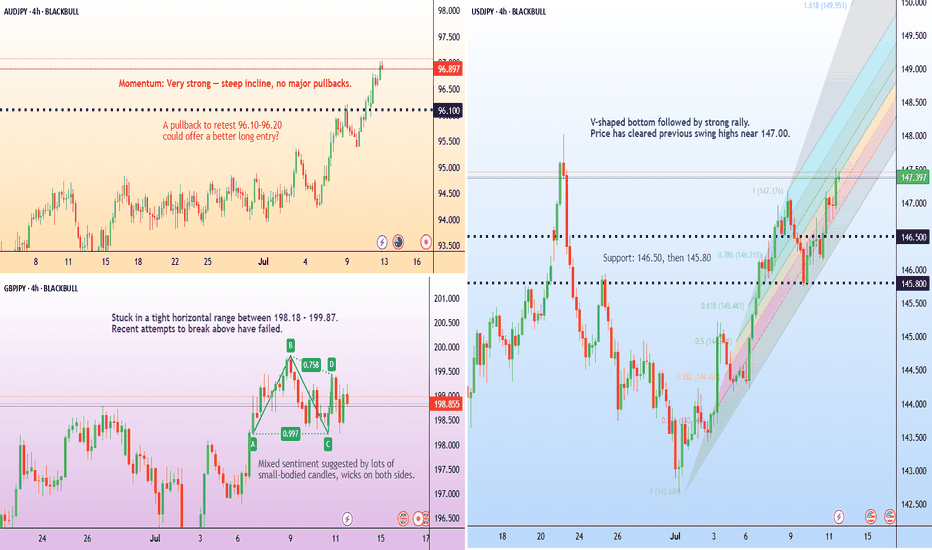

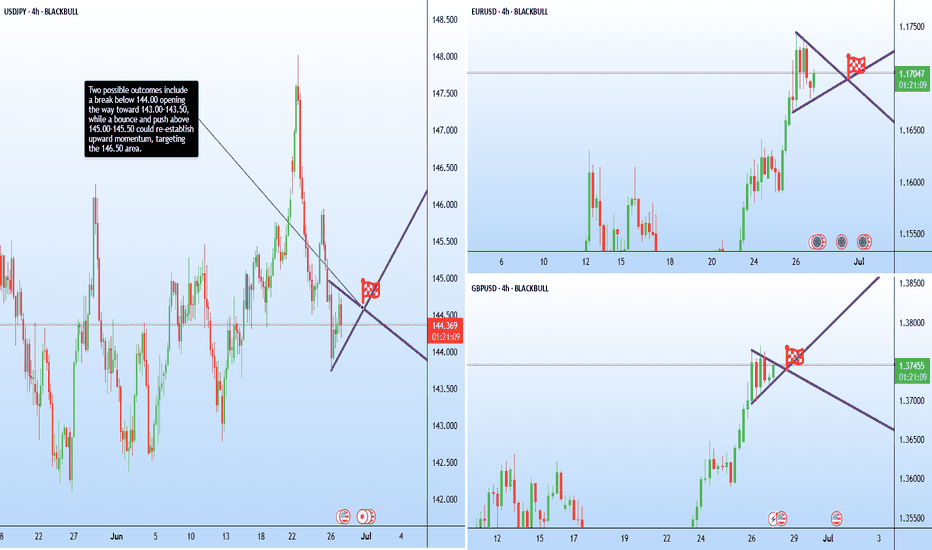

The Japanese yen remains vulnerable ahead of Japan’s Upper House election on July 20. Polls suggest the ruling LDP-Komeito coalition may lose its Upper House majority. Such an outcome would further weaken Prime Minister Shigeru Ishiba’s position, with his government already operating as a minority in the Lower House. Adding to the pressure, the U.S. is set to...

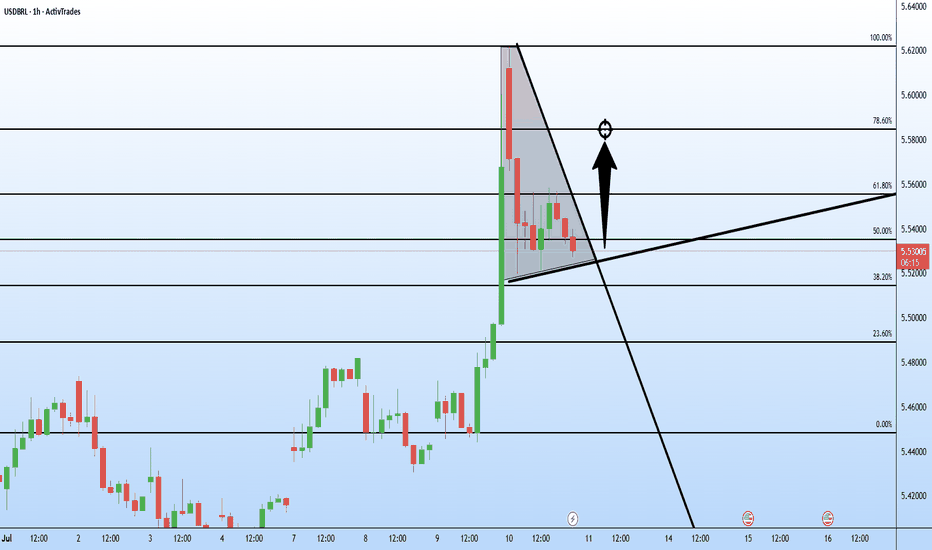

The Brazilian real weakened sharply against the U.S. dollar after US President Trump announced 50% tariffs on Brazilian exports, effective 1 August. In response, Brazilian President Luiz Inacio Lula da Silva announced Brazil would retaliate with the same rate on U.S. imports. Trump has already pledged to retaliate if Brazil retaliates. USD/BRL rallied from...

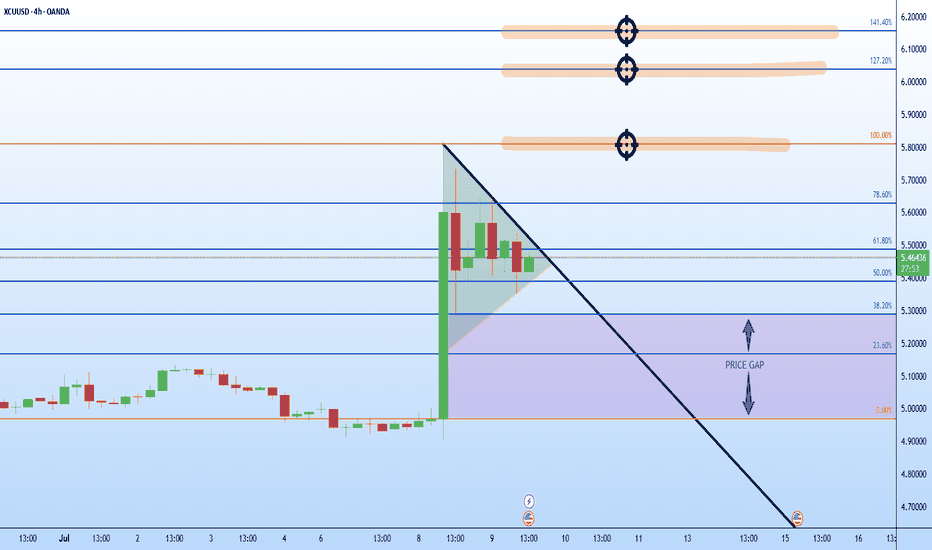

Copper markets erupted higher this week following President Trump's proposal to impose a 50% tariff on copper imports. The price ripped from just above $5.20 to nearly $5.80 in a single 4-hour candle. Now, copper could be forming a bullish flag or pennant on the 4-hour timeframe. After the vertical spike, price is consolidating in a tight, potentially...

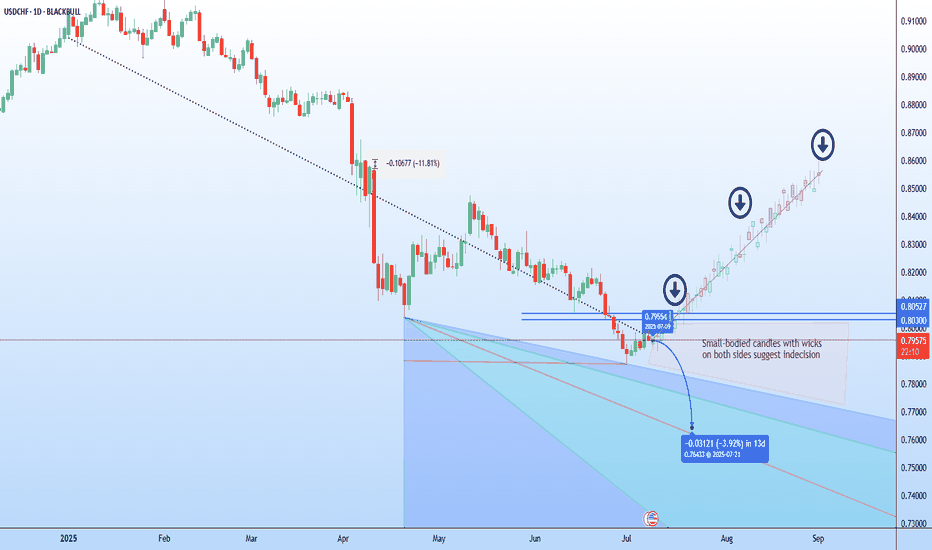

Bank of America argues that the Swiss franc has reasserted itself as the true safe-haven hedge. BofA says the trend of the CHF being used more like gold, and a hedge against problems like rising US debt, could continue. Unlike the yen, which has lost much of its appeal as a pure haven. Technically, recent candles might indicate buyers are attempting to build a...

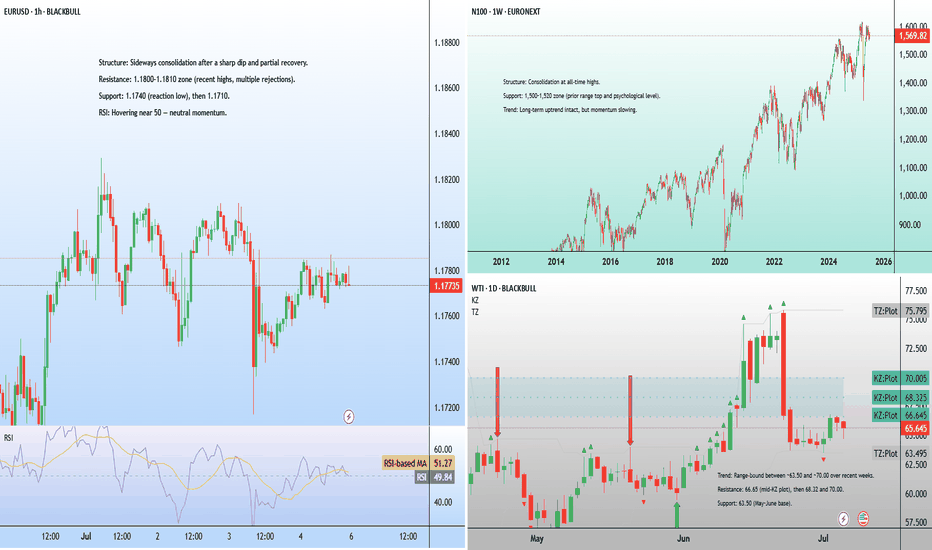

As US traders return from the Independence Day holiday, they'll find a stronger dollar supported by renewed trade tensions and geopolitical noise. Tariffs are back in focus ahead of Wednesday's deadline, with President Trump warning that countries aligning with BRICS policies contrary to US interests will face a 10% tariff. Markets remain frustrated by shifting...

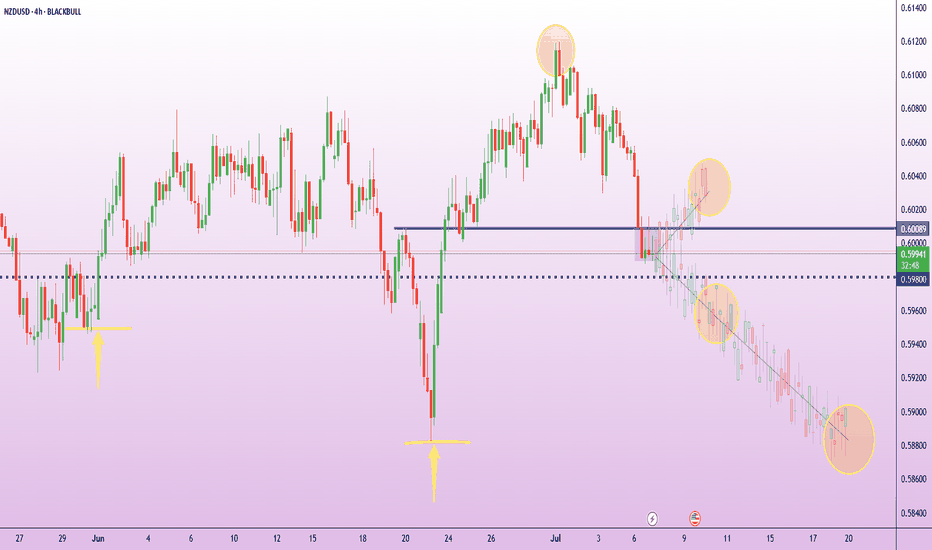

The RBNZ is widely expected to hold the Official Cash Rate at 3.25% this Wednesday. NZIER’s Shadow Board advises against a cut, noting the economy remains weak but inflation pressures are mixed. Markets see just a 10–15% chance of a cut this week but still price for further easing by October. NZD/USD has pulled back sharply from 0.6100, with price now possibly...

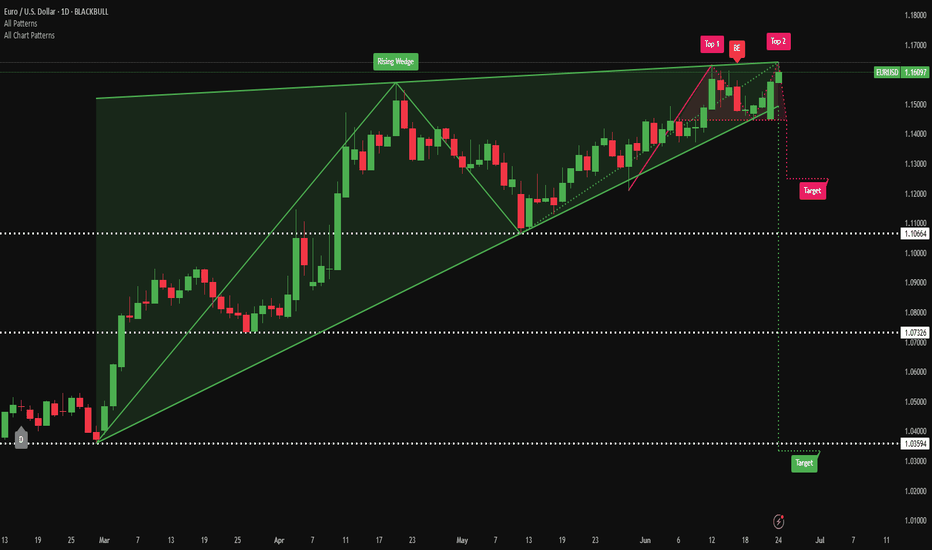

Tuesday, July 9 marks a key deadline for two major market-moving events. Tuesday is the official deadline for U.S.–EU trade negotiations. While a full deal is off the table, the EU hopes to secure a last-minute "agreement in principle" to avoid a threatened 50% U.S. tariff on some European exports. President Trump’s history of moving deadlines adds...

Markets ended a subdued session as attention turned to the upcoming US jobs report, with the dollar retreating after a surprising ADP jobs print far below what was expected. Focus is also on President Trump's fiscal bill, which faces resistance in the House, with Congressman Thomas Massie claiming enough votes to block its passage. Bond yields stay high, driven...

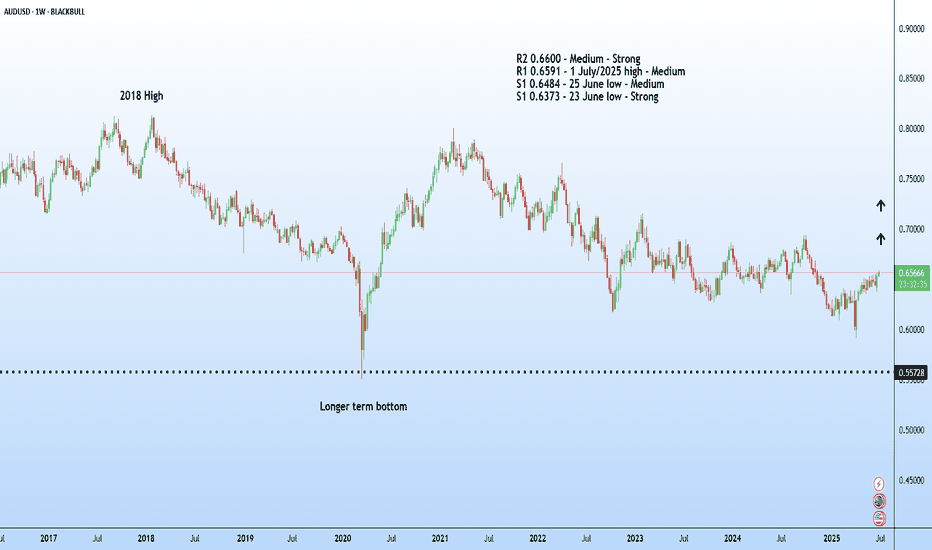

The Reserve Bank of Australia (RBA) will deliver its latest policy decision on Tuesday, 9 July. Markets are heavily positioned for a 25-basis point cut, which would bring the official cash rate down to 3.60%. Major Australian banks including CBA, Westpac, NAB and ANZ are aligned in expecting a cut this month, with some anticipating further easing in August and...

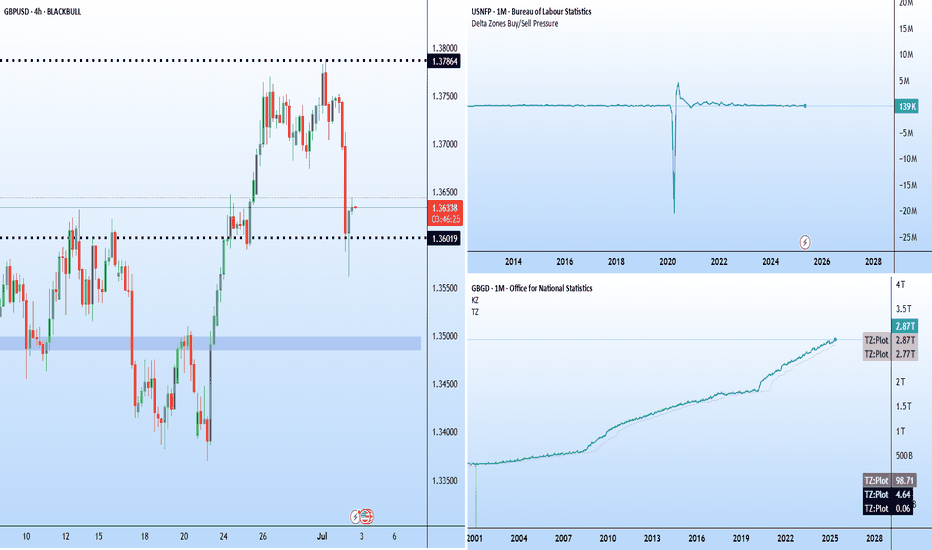

Two major stories are developing on either side of the Atlantic. ADP reported a 33 k fall in June private payrolls (consensus +95 k). It is the third straight miss and sets the tone for Thursday’s early Non-Farm Payroll (NFP) release, brought forward because of the 4 July holiday. In the UK, speculation is growing around the position of Chancellor Rachel...

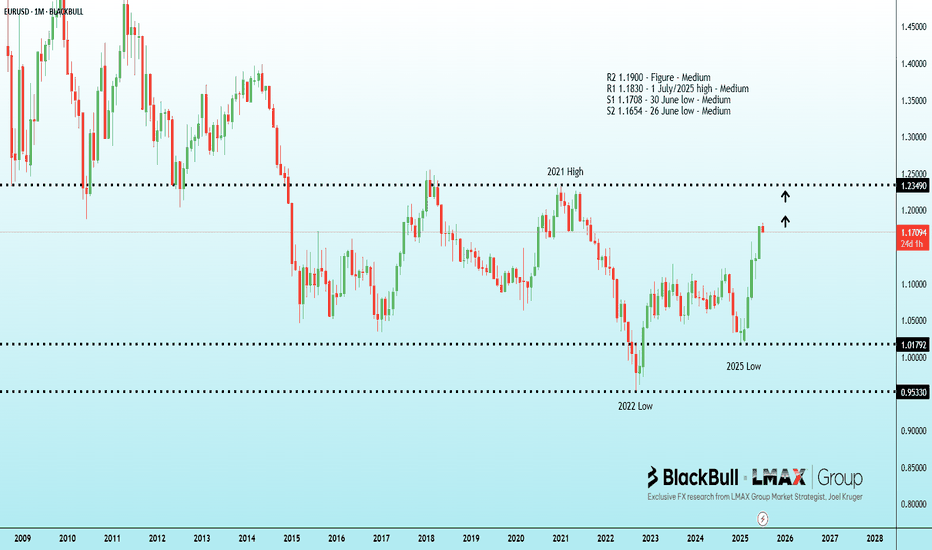

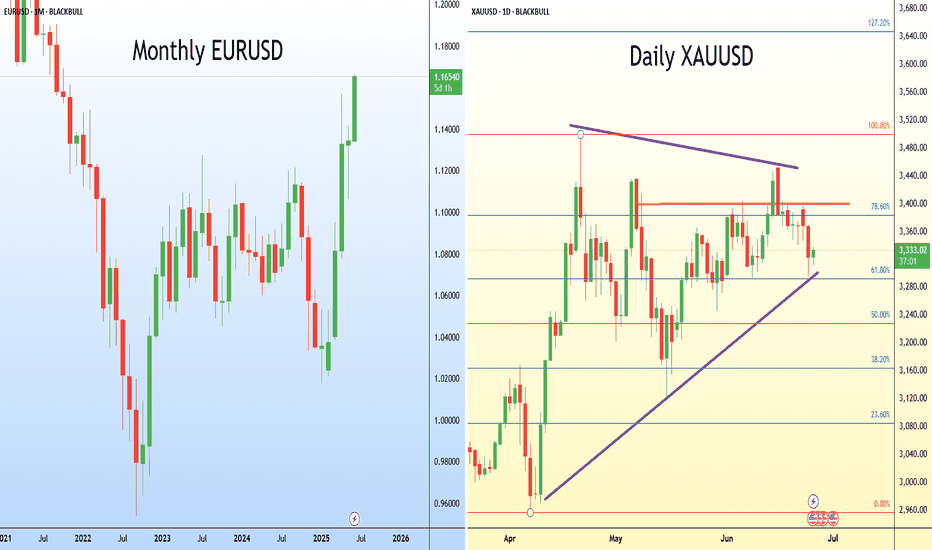

The US dollar faced renewed pressure at the start of July, with the dollar index dropping to its lowest since February of 2022, marking a 10.8% decline in the first half of 2025—the worst since 1973. Driven by geopolitical tensions and Trump trade policies, President Trump's ongoing criticism of Federal Reserve Chair Powell and the Fed's high interest rates,...

The ECB Forum in Sintra brought together the heads of the world’s most influential central banks—Lagarde (ECB), Powell (Fed), Bailey (BOE), Ueda (BOJ), and Rhee (BOK). Across the board, central banks are remaining cautious and data-driven, with no firm commitments on timing for rate changes. Fed Chair Powell said the U.S. economy is strong, with inflation...

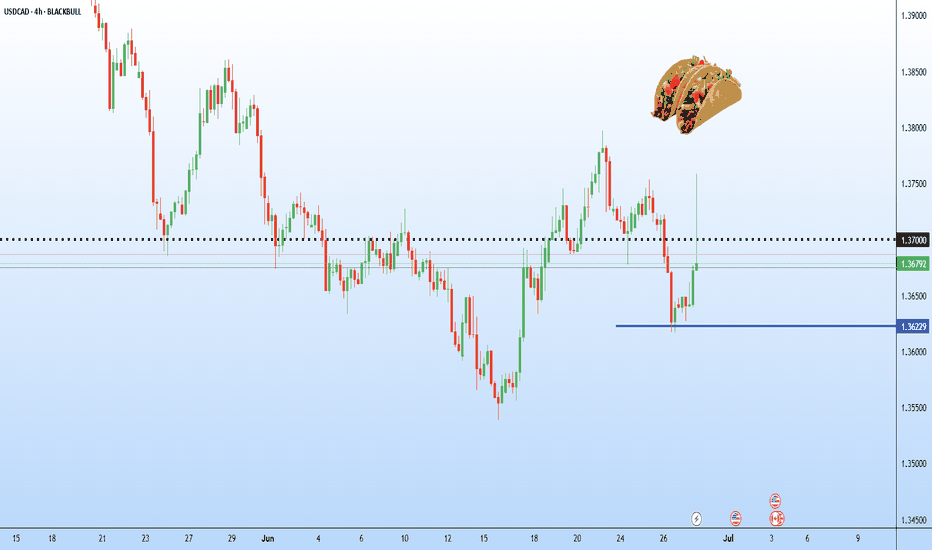

USD/CAD jumped nearly 900 pips on Monday after President Donald Trump announced he is “terminating” trade negotiations with Canada. But the surge didn’t stick. Within hours, the pair gave up most of its gains, slipping back below the 1.3700 breakout level. There’s been no reversal from Trump — not yet. But price action suggests the market might be front-running...

The latest U.S. PCE report is set for release at 8:30am EDT, with both headline and core inflation expected at 0.1% month-on-month. As the Fed’s preferred inflation measure, today’s figures could influence interest rate expectations. A stronger print may reduce the case for a July rate cut, while a softer result could add pressure on the U.S. dollar. The...

The euro has reached its highest level since October 2021, driven in part by commitments from European leaders to increase NATO defence spending. The swing factor for the euro dollar in the shorter term is the possibility of US rate cuts. Critical for this will be US inflation data, starting with tomorrow's PCE report. If tariffs fail to significantly lift...

“Don’t fix what isn’t broken” seems to be the Fed’s current stance. Two Fed officials made that clear over the last 24 hours. Vice Chair for Supervision Michael Barr warned that tariffs could fuel inflation by lifting short-term expectations, triggering second-round effects, and making inflation more persistent. New York Fed President John Williams echoed that...