Market analysis from Blueberry

Tesla is a global innovator that is changing the world. As a general rule, many investors have a saying: Never bet against Elon. They're not wrong. Elon delivers. But the short term is messy. The stock is hovering around its 200-day moving average, a critical test. Break lower and we could see $290, maybe $260. That’s not panic, it's just price catching up to...

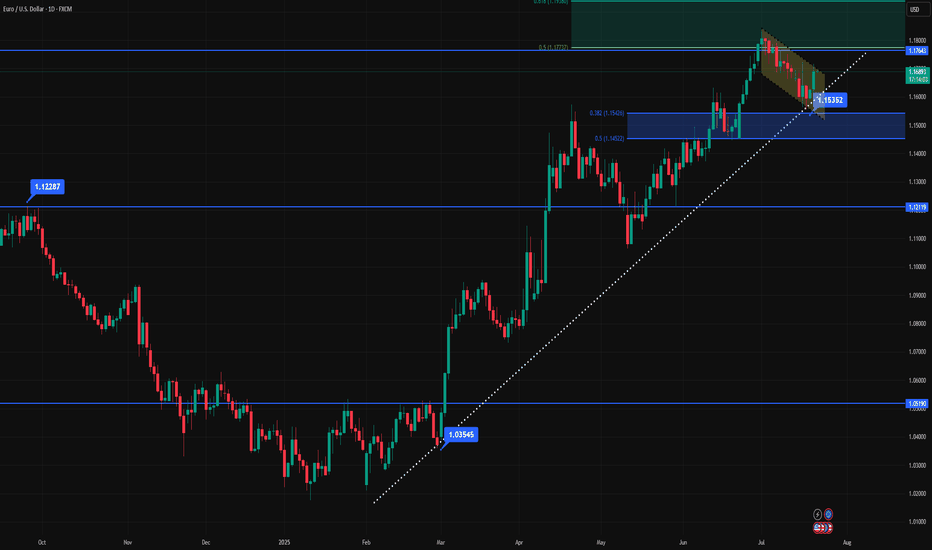

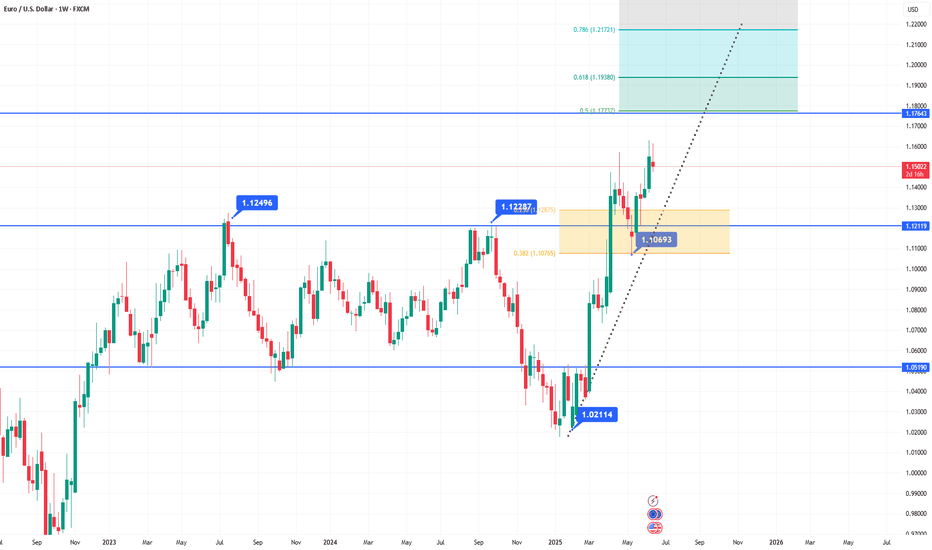

Fundamental analysis The EUR/USD pair remains buoyant near 1.1700 in todays Asian session, extending monday’s gains as the US Dollar weakens sharply amid renewed US-EU trade tensions. The US Dollar Index (DXY) is treading water around 97.88, down from its recent one month high of 99.00, as risk sentiment deteriorates following reports that President Trump is...

Chinese stocks are not for the faint-hearted. It's a market with a lot of volatility, swings, and roundabouts. Despite this, we've been keeping a close eye on the Shanghai Composite Index over the past few weeks and like the pattern we are seeing emerge. As of the time of writing, the Shanghai Composite Index trades in the 3,500 range. A clear double bottom...

The Japanese Yen slipped to its lowest level since April during the Asian session on Wednesday, weighed down by fading expectations of a near term rate hike from the Bank of Japan (BoJ). The market reaction reflects growing concerns over the potential economic fallout from recently imposed higher US tariffs, which has dampened hawkish bets on the BoJ and...

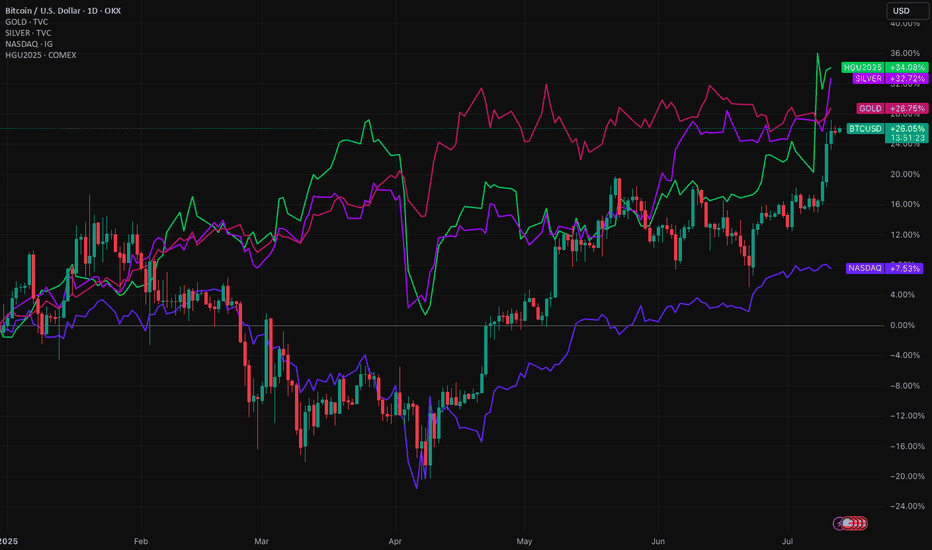

Bitcoin is up around 26% this year. A strong gain. But it’s not alone. The higher Bitcoin rises, the less the gains become in percentage terms. It's now in a different league, so a $1,000 or $10,000 move its necessarily what it used to be. Meanwhile, Gold, silver and copper have also pushed higher in 2025. The Nasdaq 100 is up too. All signs point to a weakening...

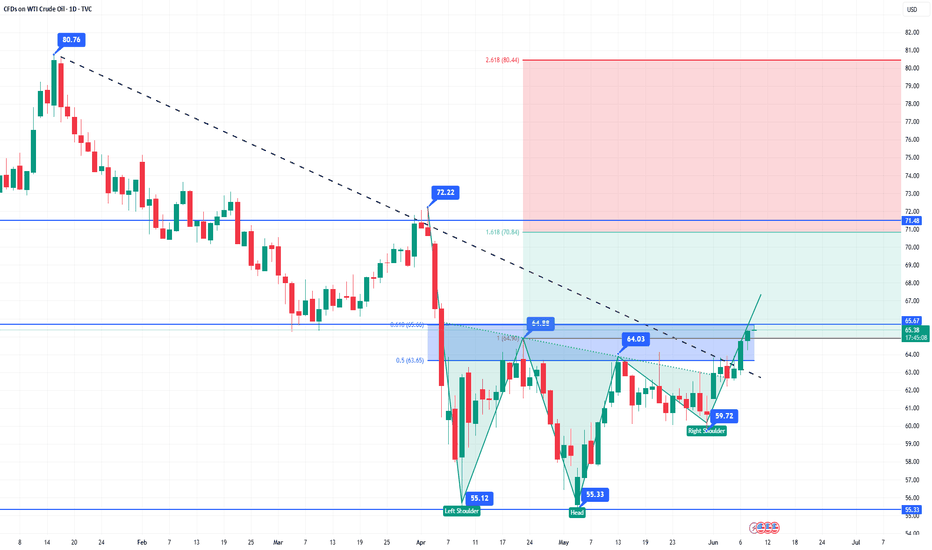

Brent Crude remains under pressure and has really caught our eye. The weakness in recent weeks is significant. The price recently failed to hold above its 200-day moving average, reinforcing downside risks. Without momentum, prices could revisit June lows unless short-term hurdles at US$69 and US$72 are decisively cleared. This weakness aligns with BP's latest...

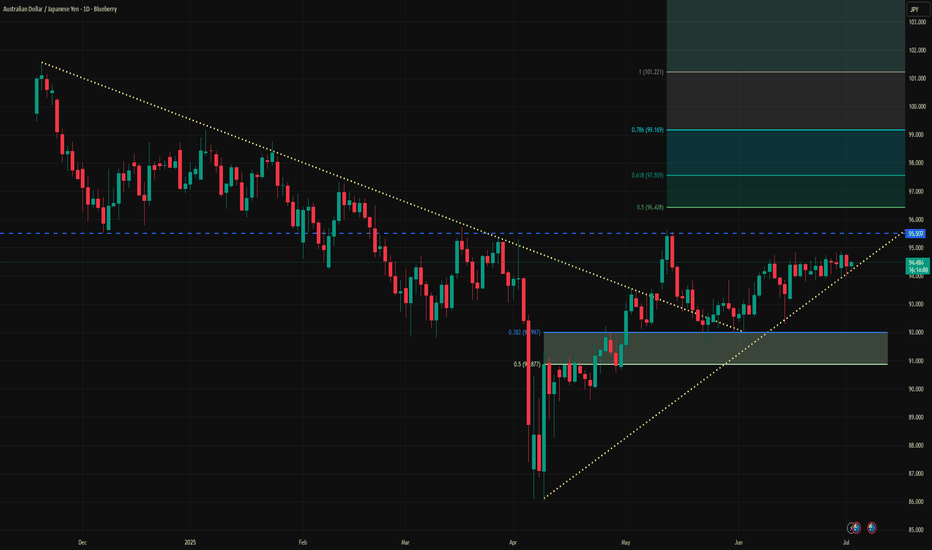

The AUD/JPY cross attracts some buyers around 94.50 during the Asian session on Wednesday. The Japanese Yen edges lower against the Aussie following domestic weaker than expected inflation data for May as the relative interest rate differentials between the two currencies will play a crucial role in determining the AUD/JPY direction. From a technical...

The Australian dollar (also known as the Aussie Battler) looks set to continue its recent bounce. Inflation is now under control and monetary easing will continue to support aggregate demand across the economy. While rate cuts are dovish, the underlying economy is still strong and, as we will explain below, the fiscal situation is shaping up better than expected....

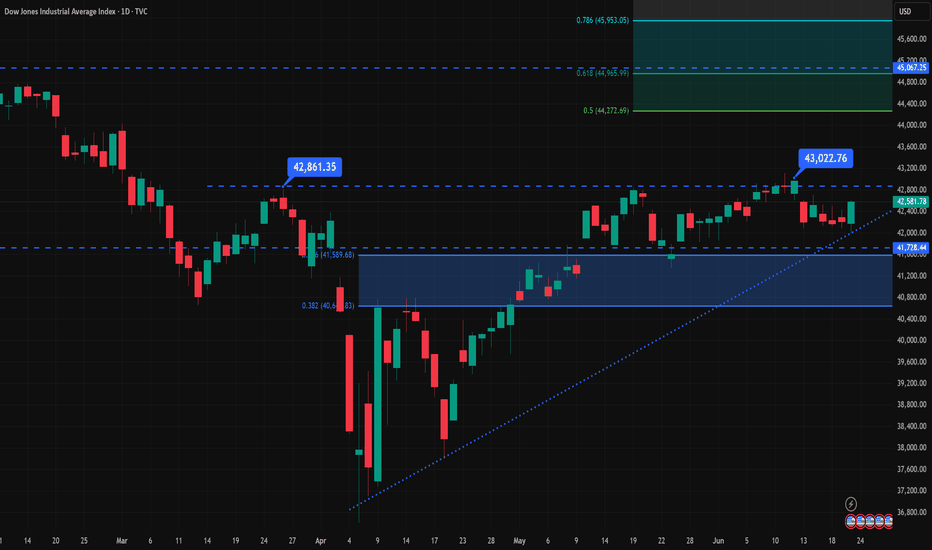

Dow Jones Industrial Average (DJIA) stands at 42,581.78 points, reflecting a 0.9% increase from the previous day. This uptick is attributed to investor optimism following a restrained retaliatory missile strike by Iran on a U.S. base in Qatar, which was perceived as non escalatory. Additionally, comments from Federal Reserve Governor Michelle Bowman suggested...

While most traders have been focused on AI's impact on Western economies, Japan has been quietly chipping away at its own AI revolution. Not by building the flashiest tools, but by embedding AI into the guts of its economy. Let's start with the obvious. Japan is an industrial giant. Toyota, Fanuc, Sony. These companies aren’t chasing fads. They’re integrating AI...

EUR/USD has been trading sideways after peaking above 1.1600 last week, as traders adopt a wait and see approach ahead of the Fed's interest rate decision due tomorrow morning (AEST). The pair is consolidating within a tight range, with the top end of the recent rally now being questioned amid growing uncertainty. While the Fed is widely expected to leave its...

Markets are on edge. The Nasdaq is hovering just above its 200-day moving average and with so much angst in the market, this line must hold. If it breaks, risk sentiment could unravel quickly, and we could see a retest of recent 2025 lows. The trigger isn’t hard to find. Rising tensions in the Middle East are putting upward pressure on oil and energy. A sustained...

Gold prices surged to nearly a two month high on Friday driven by escalating geopolitical tensions in the Middle East. Spot gold rose 1.3% to $3,427.36 per ounce. This marks a gain of over 3.5% for the week. The rally was fueled by Israel's preemptive strike on Iran's military and nuclear facilities, intensifying regional instability. The conflict has shifted...

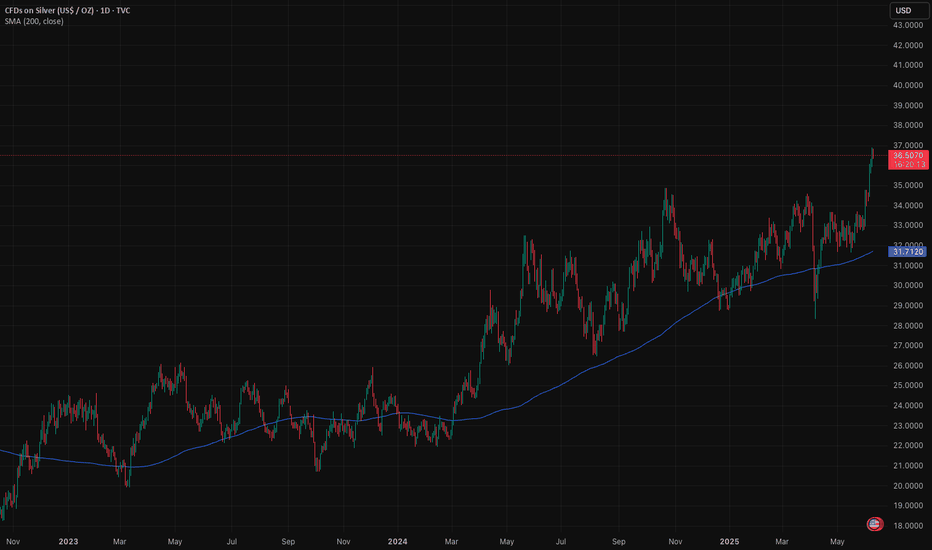

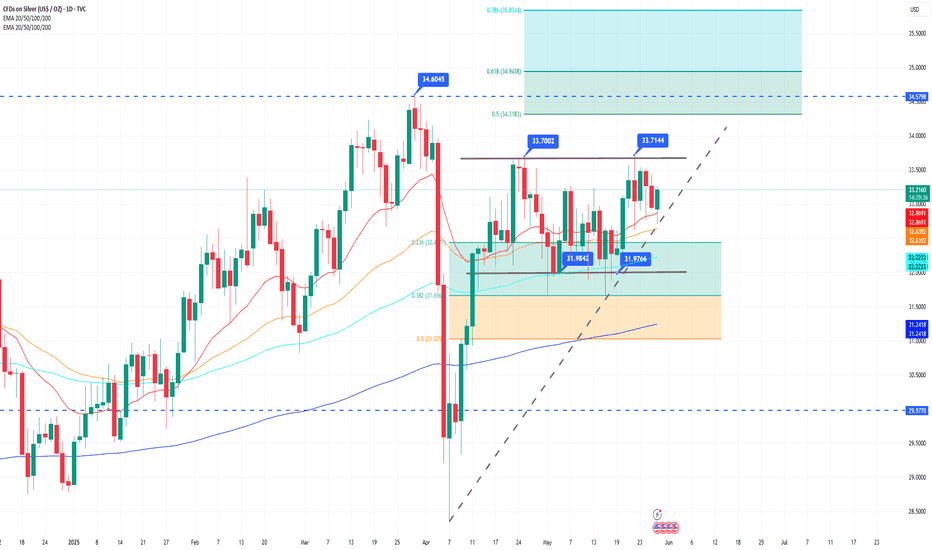

Silver is breaking out. Its strength is no accident. The US is running a structural deficit north of 6% of GDP in a full-employment economy. The bond market has absorbed the pain so far, but pressure is building. Investors are starting to look for insurance. Silver is one of the cleanest ways to play the dollar’s long-term debasement. The metal is trading well...

Crude oil prices are testing fresh 10-week highs today, with WTI futures flirting with the key resistance level at $65.50, a price not seen since the onset of trade tariff tensions in early April. Investor sentiment remains cautiously optimistic as US-China trade talks continue in London this week, raising hopes that both parties can make progress toward a...

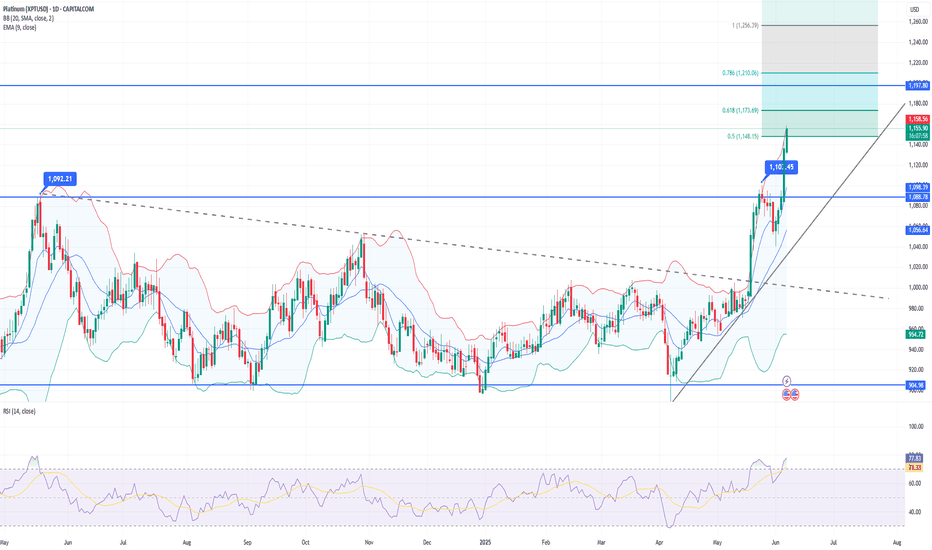

China, the world’s largest consumer of platinum, imported its highest amount in a year last month. Retail investment demand (bars and coins) in China more than doubled, overtaking North America as the top market for platinum investment. Analysts at Bloomberg Intelligence predict that global platinum demand will exceed supply for the rest of the decade. Key...

Gold prices advanced during the Asian trading hours, touching a fresh daily high around the $3,317 mark. The move comes amid a combination of factors boosting demand for the yellow metal, notably dovish signals from the Federal Reserve and escalating geopolitical tensions. The US Dollar weakened following Friday's softer-than-expected inflation data, which has...

Silver price (XAG/USD) halts its losing streak, trading around $33.20 per troy ounce during the Asian hours on Thursday. There is a good chance silver could retest the immediate support at the twenty-day EMA of $32.87. A push below this level could weaken the short and medium-term price momentum to the downside and put downward pressure on the grey metal around...