Market analysis from City Index

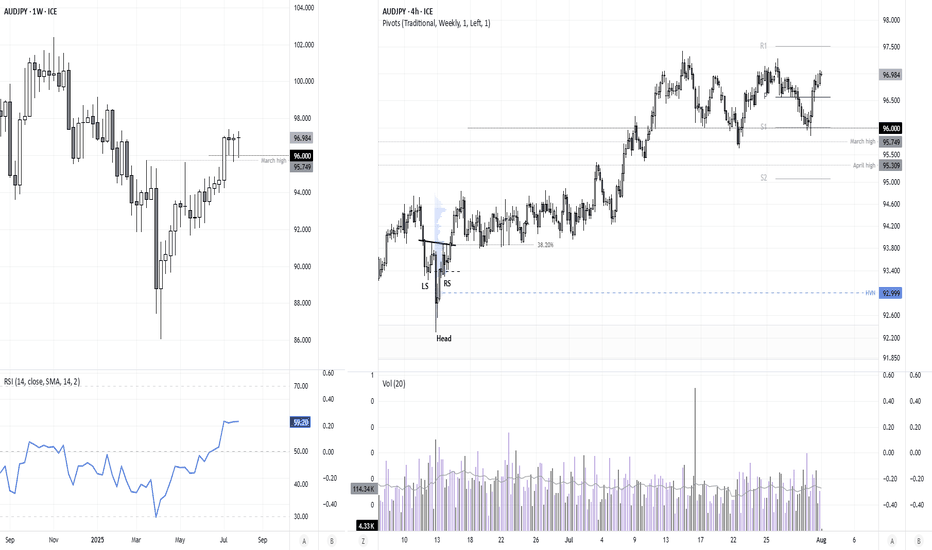

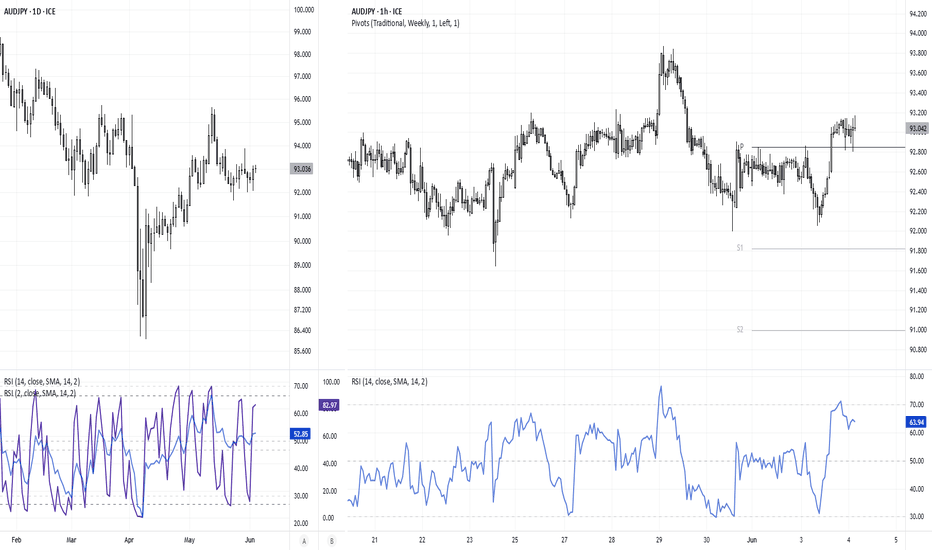

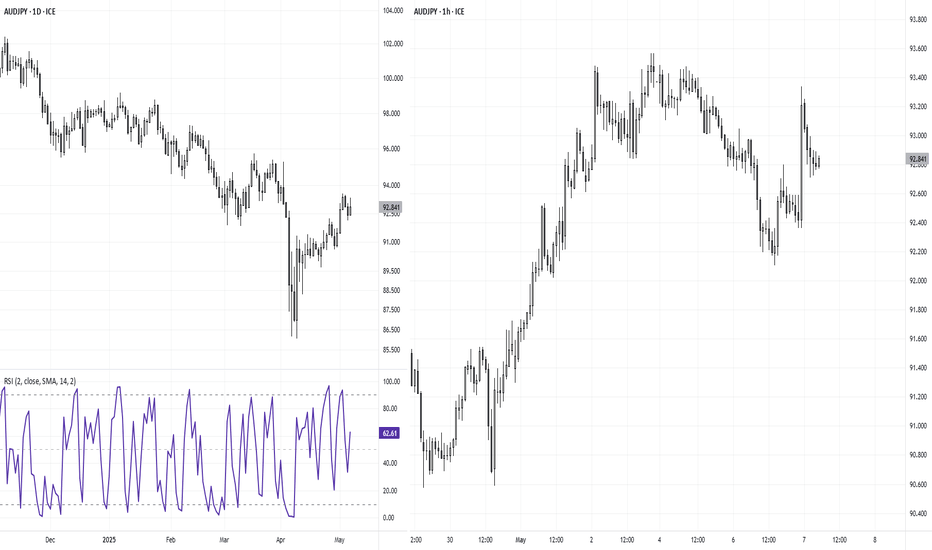

The yen is broadly weaker, which is even allowing a weaker Australian dollar to rise. And with a decent bullish trend on the daily chart, I am now seeking dips within a recent consolidation range in anticipation of a move to 99 or even 100. Matt Simpson, Market Analyst at City Index and Forex.com

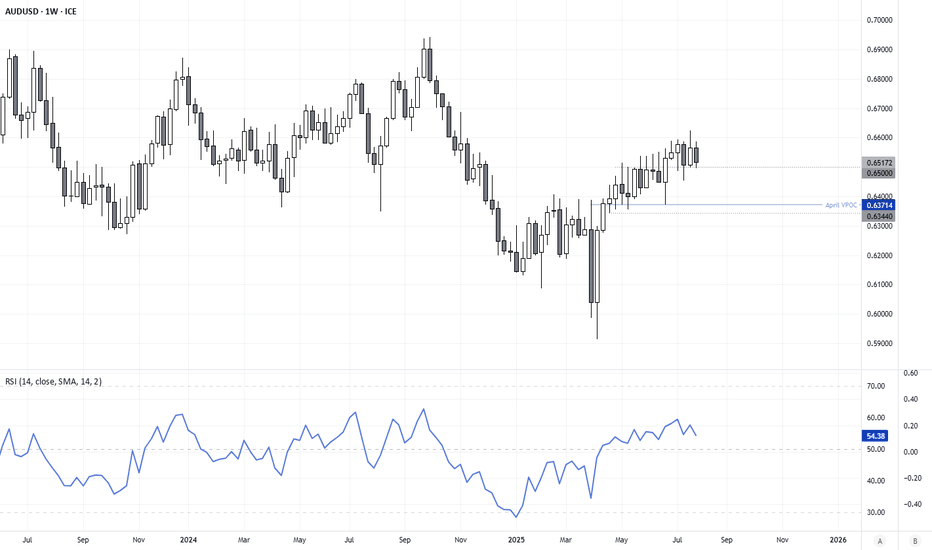

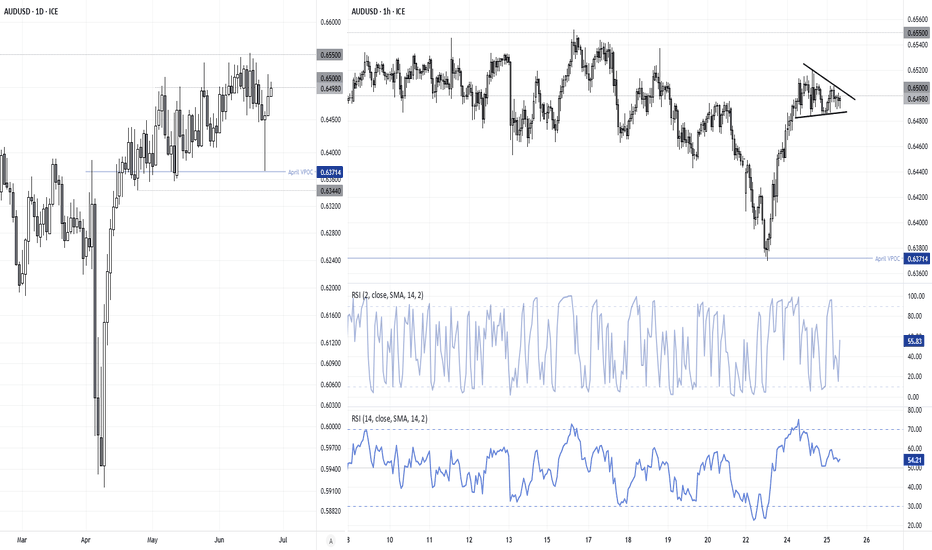

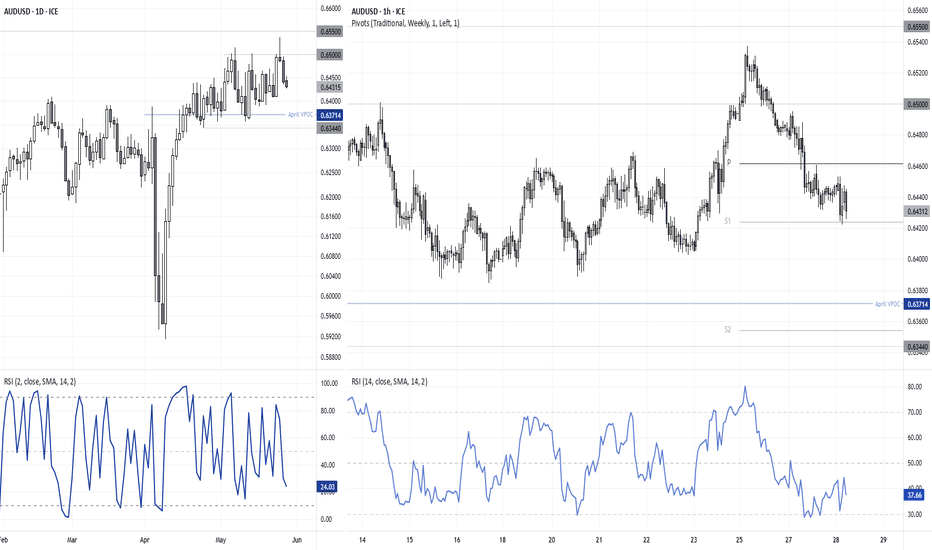

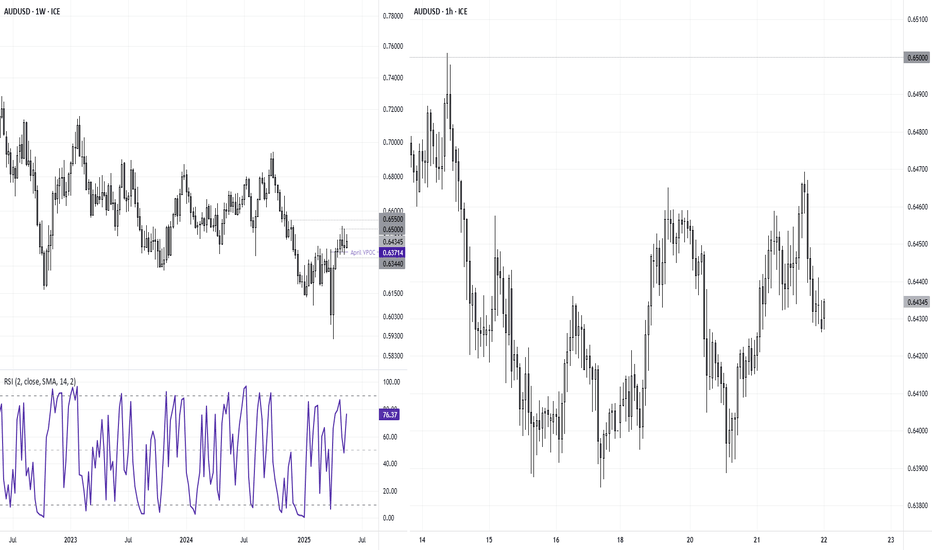

The RBA defied expectations of a cut in July, despite soft trimmed mean inflation figures in the monthly CPI report. The quarterly figures have now dropped, which I suspect leaves little wriggle room to hold at 2.85% in August. I 6ake a look at the quarterly and monthly inflation prints that matter, then wrap up on AUD/USD. Matt Simpson, Market Analyst at City...

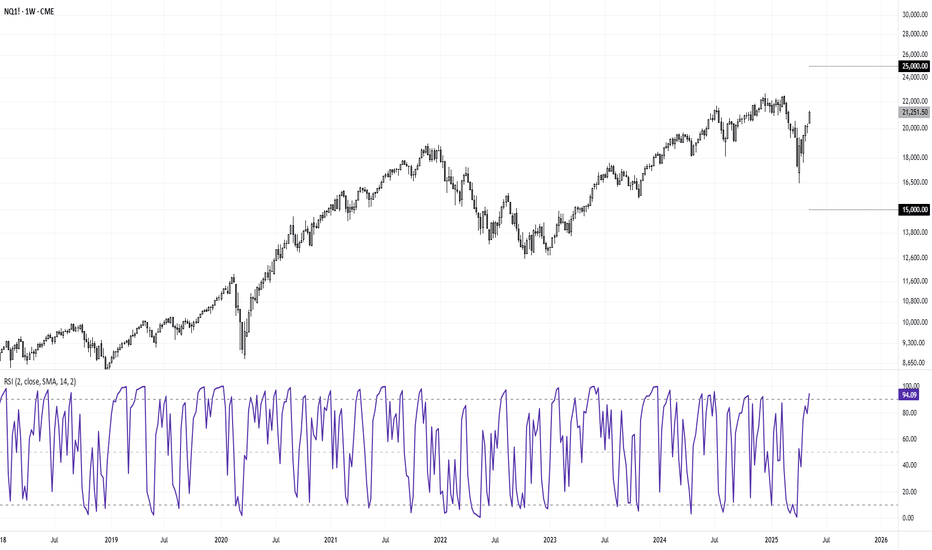

Seasonality can be a useful tool if used wisely (and in context) with current sentiment and news flows. Seasonality really is a backwards looking indicator that can easily be overpowered by key macro drivers. But its strength comes in to play when seasonality aligns with the macro landscape. With that in mind, I share my seasonality matrix for indices, metals...

I have long said that the RBA could cut in July, and today's CPI figures all but confirm one is on tap. But with AUD/USD and AUD/JPY are rising, will bears get their say? Matt Simpson, Market Analyst at City Index and Forex.com

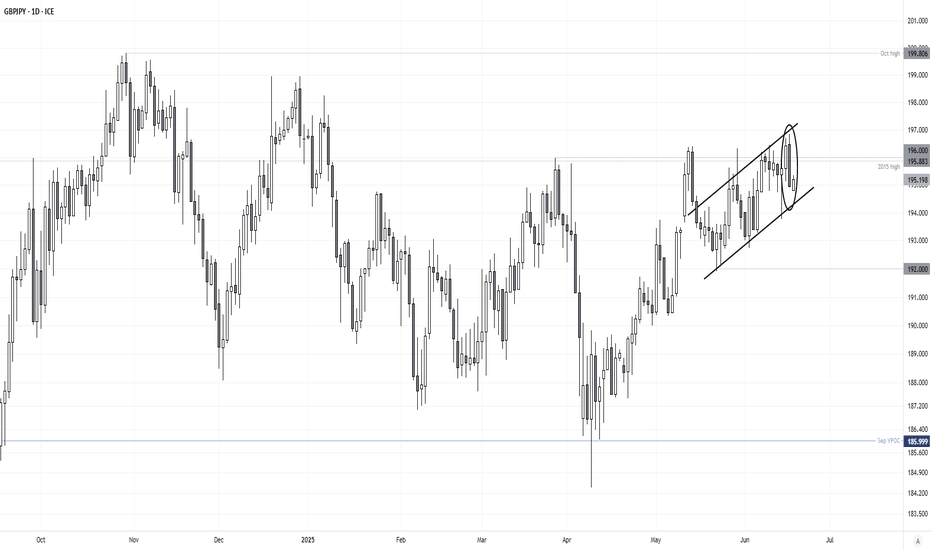

With the conclusion of the FOMC meeting just hours away, I wanted to move away from the US dollar and look at some crosses. Here are some interesting setups on yen pairs to keep in mind. Matt Simpson, Market Analyst at City Index and Forex.com

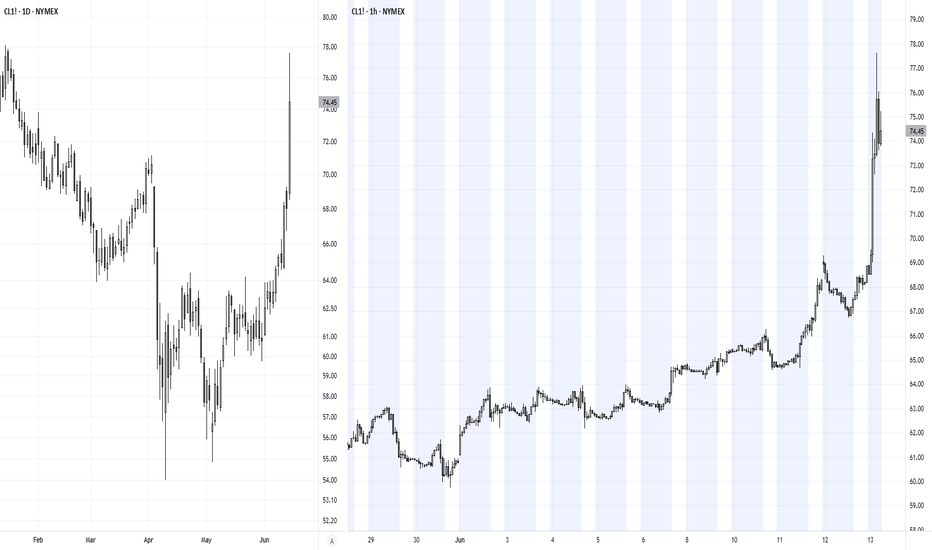

Oil prices surged over 12% in Asia on Middle East headlines, sparking a surge of volatility across safe-haven currencies and stock market futures during thin trade. It felt like a good time to provide food for thought to newer traders looking to chase these moves, highlight the mockery geopolitics can make of technical analysis with recent examples, and provide...

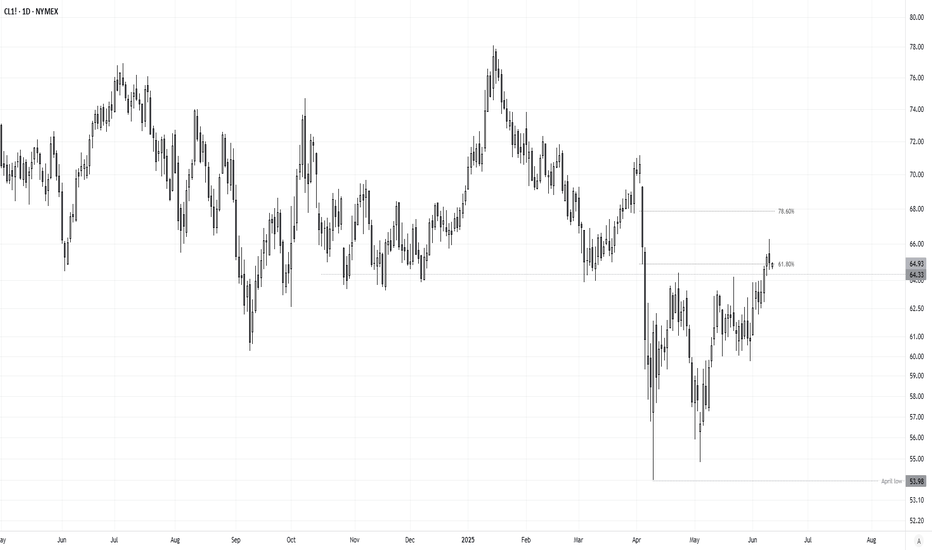

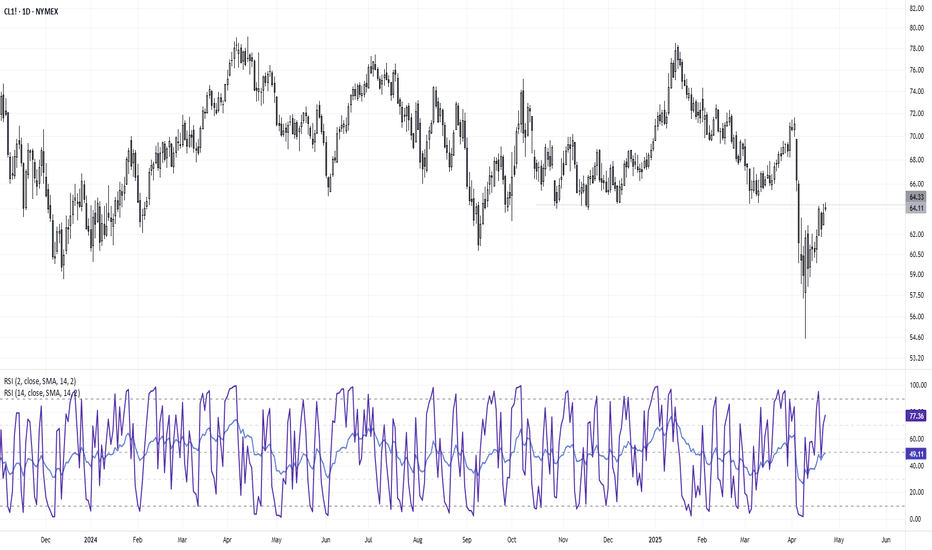

Crude oil has enjoyed a decent rally in recent weeks thanks to improved sentiment and OPEC+ scaling back production. Yet momentum turned against bulls on Tuesday, despite positive trade talks between the US and China. Today I discuss whether this could be a turning point for oil, or simply a bump in the road. Matt Simpson, Market Analyst at City Index and Forex.com

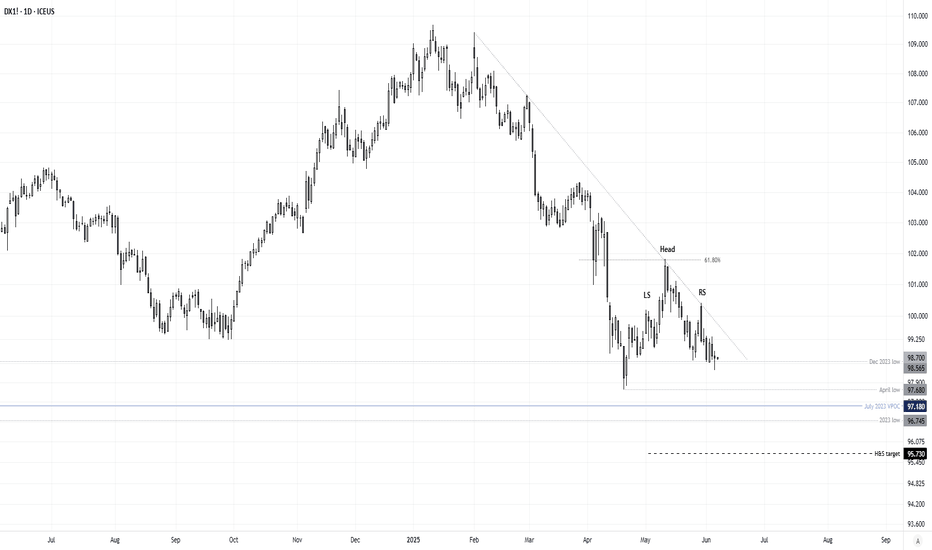

I don't recall the last bullish headline I saw for the US dollar, bearish sentiment may be stretched, and I'm seeing plenty of clues across the US dollar index and all FX majors that we could at least be looking at a minor bounce. Whether it can turn into a larger short-covering rally is likely down to Trump's trade deals. Either way, I'm, on guard for an...

An update to the prior Aussie dollar video, where I reassess the setups and decide which ones I prefer. Matt Simpson, Market Analyst at City Index and Forex.com.

Today I take a quick look at Australia's inflation figures and outline why I think the RBA could still cut in July, before moving on to charts for AUD/USD, AUD/NZD, EUR/AUD and AUD/JPY. Matt Simpson, Market Analyst at City Index and Forex.com

Asset managers increased their net-short exposure last week - and as these are 'real money' accounts, they are a group of traders worth listening to. But as always, timing as key, and there may be better setups for bears than AUD/USD over the near term. Today I pick out for AUD crosses to consider. Matt Simpson, Market Analyst at City Index and Forex.com

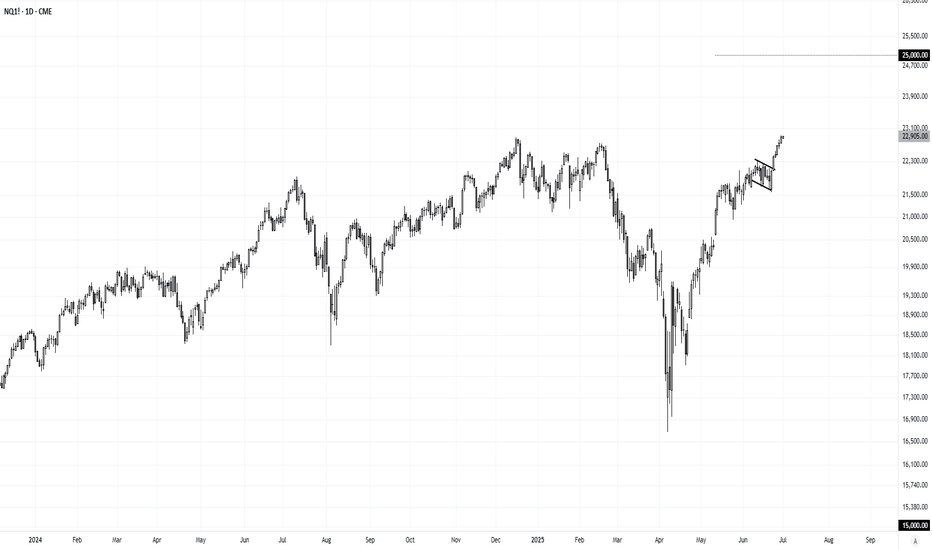

The Nasdaq 100 is in a technical bull market, having rebounded 20% from its cycle low. While the risk remains that this is simply a 'bear market bounce' that could sucker punch bulls, I believe bulls have got this and we could be headed for 25k. Matt Simpson, Market Analyst at City Index and Forex.com

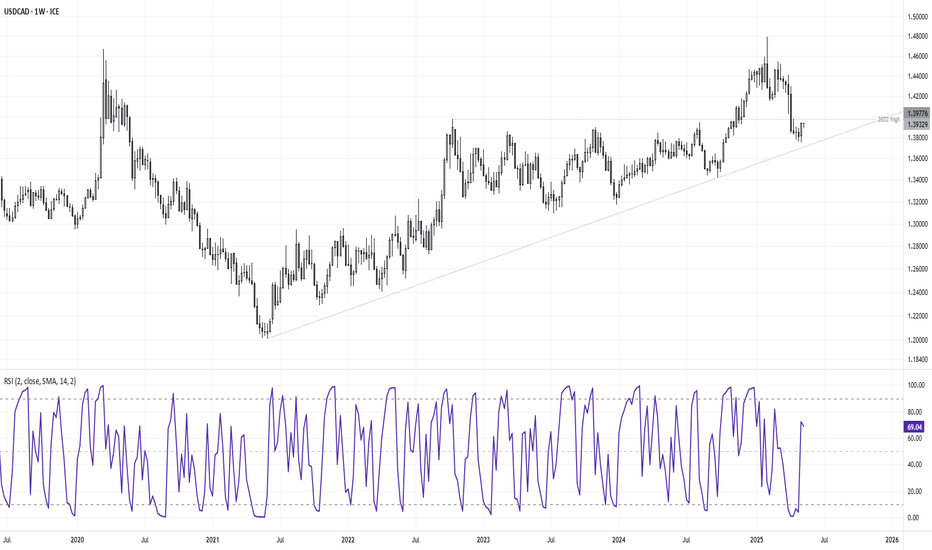

We finally saw the reversal higher on USD/CAD last week, with a notable bullish engulfing candle strongly suggesting an important swing low. I take a quick look at last week's signal, update the analysis then wrap up on Canadian dollar futures positioning. Matt Simpson, Market Analyst at City Index and Forex.com

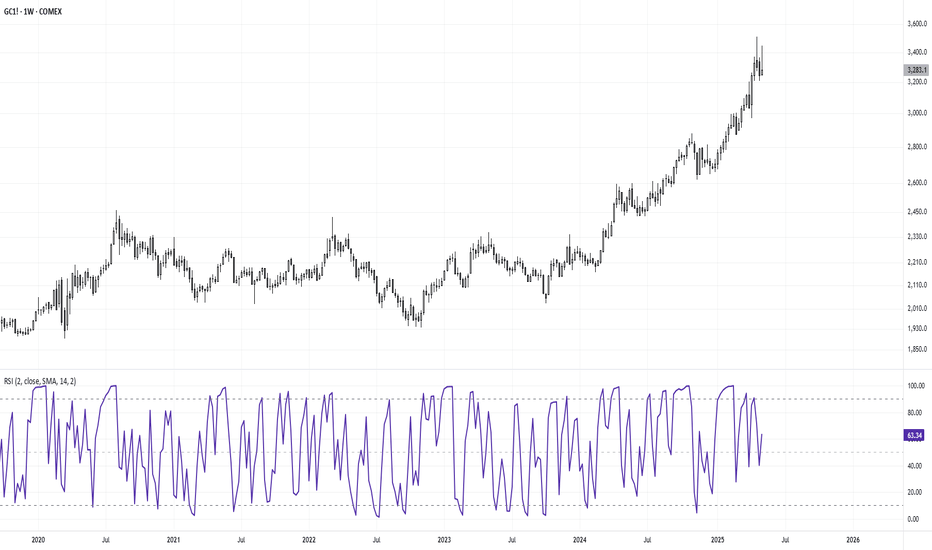

Here is my 2-minute technical take on why gold could be looking at a break below 3200 as part of a deeper correction, before it even considers resuming its almighty bullish rally. Matt Simpson, Market Analyst at City Index and Forex.com

Indicators are a popular choice among many traders, and they certainly have their place in my own toolkit. But sometimes it is best to simply look the price to gauge strength. And doing so, it can help us scenario plan for future events. After I take a quick look at Japanese yen pairs, I wrap up on my preferred setup. Matt Simpson, Market Analyst at Forex.com...

Matt Simpson breaks down the latest Australian inflation data and what it could mean for the Reserve Bank of Australia’s next move. Plus, we dive into the AUD/USD, AUD/CAD, GBP/AUD and EUR/AUD charts for key technical setups traders need to watch right now.

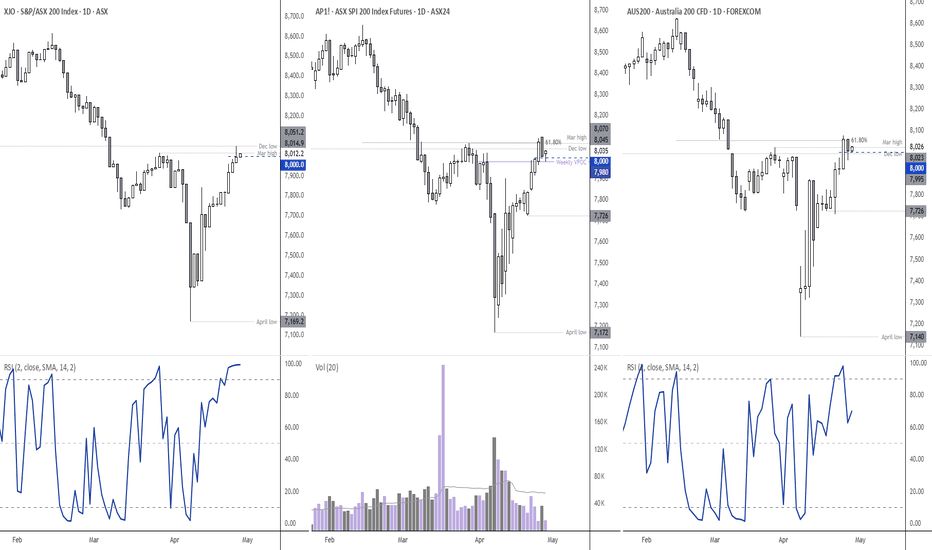

Here is my 2-minute take on the ASX 200 futures daily chart, where I discuss my hunch that a pullback could be due and how that could set us up for a better long setup further out. Matt Simpson, Market Analyst and Forex.com and City Index

Cride oil may have recovered back above $60, but it is making hard work of it. And with resistance looming and large specs increasing short bets, perhaps a pullback due. But does that mean a break below $60 is imminent? Matt Simpson, Market Analyst at Forex.com and City Index