Market analysis from FOREX.com

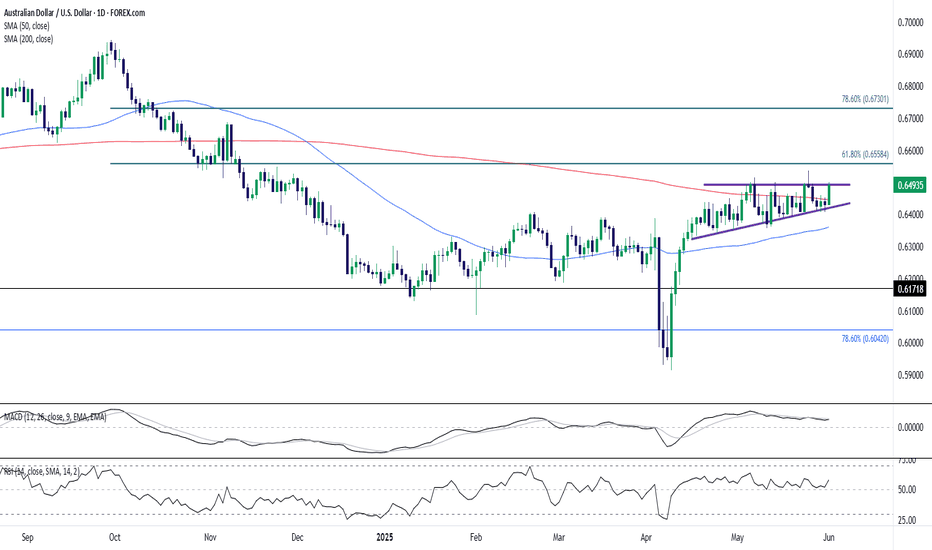

AUD/USD is threatening a breakout from a bullish ascending triangle pattern after weeks of tight consolidation: Triangle Pattern: The pair has carved out a clear ascending triangle, marked by higher lows and resistance near 0.6500. Today's breakout attempt is the most convincing yet. Key Levels in Play: 0.6500 remains the neckline to beat, while the 200-day SMA...

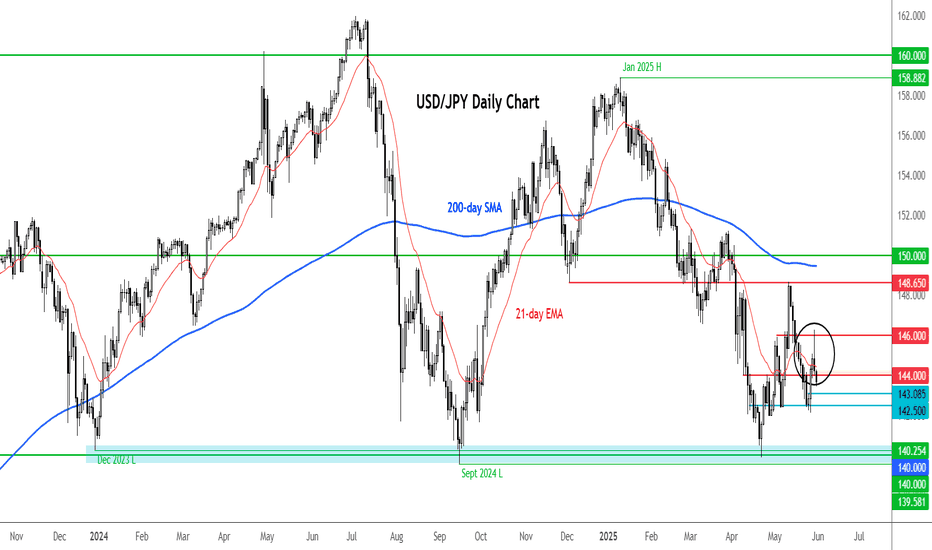

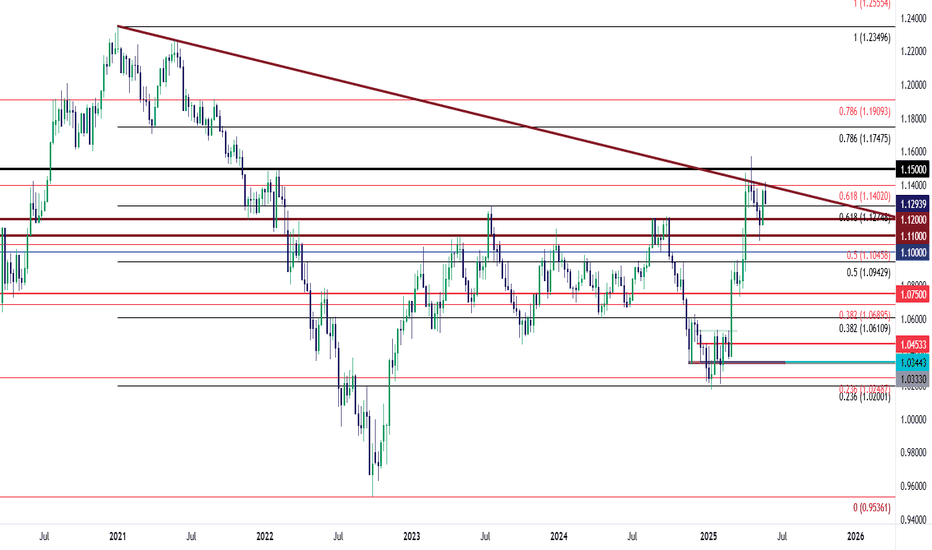

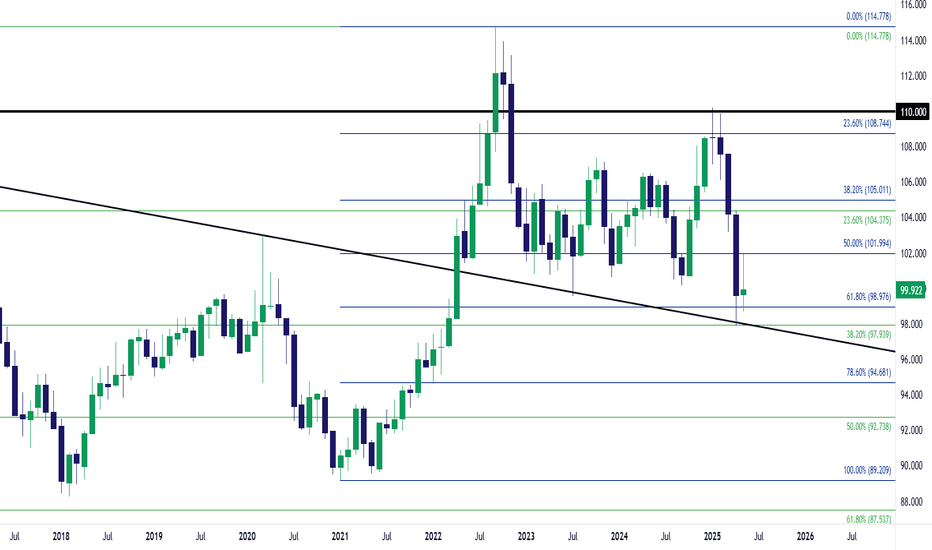

Thanks to ongoing trade uncertainty and troubles in the bond market, the USD/JPY looks like is going to end the week on a negative note, after coming down sharply in the last day and a half, which means the weekly gains have more than halved. The US dollar had actually clawed back a bit of ground in early Friday trading after taking a hit the day before. The...

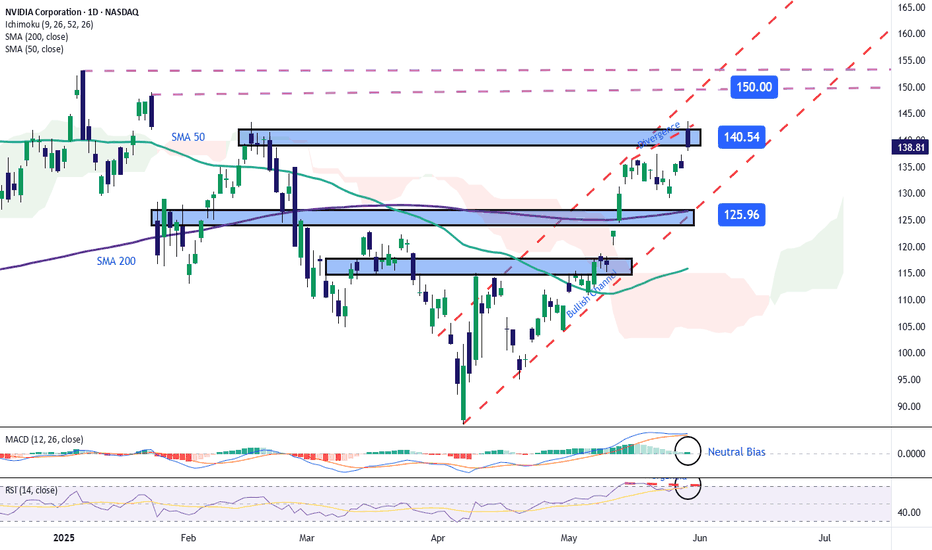

Nvidia released its quarterly earnings yesterday, and since then, market confidence triggered a significant bullish gap that pushed the stock price up by nearly 5%. However, in recent hours, a new bearish bias has started to emerge, steadily closing the gap as the market digests the company’s latest report. Nvidia reported $44 billion in revenue, slightly above...

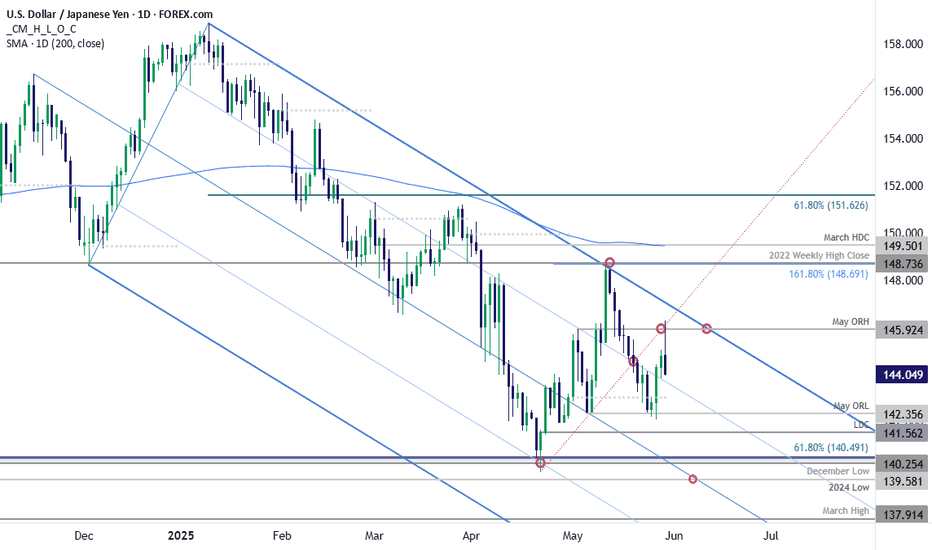

USD/JPY is poised to snap a three-day winning streak with price reversing today at the 61.8% retracement of the monthly range. A decline of more than 1.5% from the highs puts the immediate focus on the monthly range lows with a break needed to mark resumption of the broader downtrend. Monthly open support rests at 143.06 and is backed by the May opening-range...

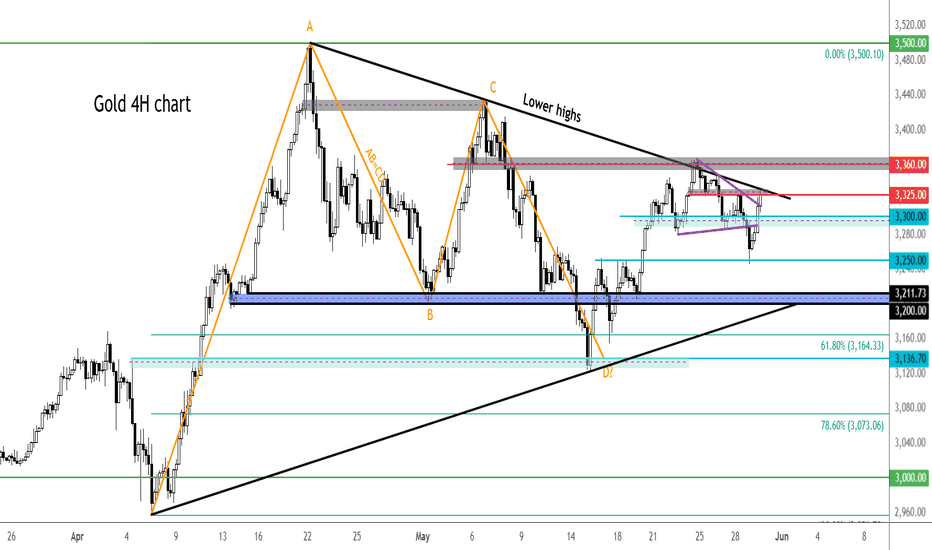

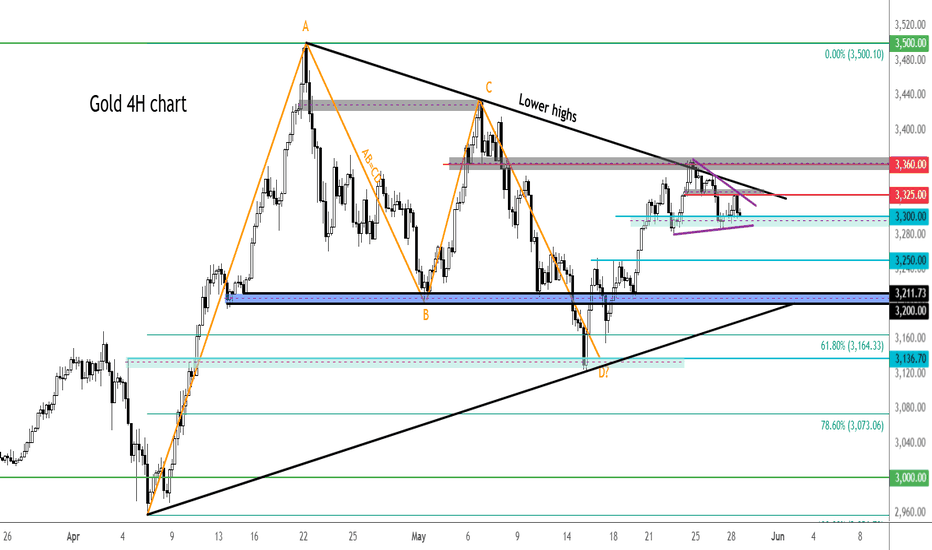

After I highlighted the potential for a short-term breakdown yesterday, the precious metal went on to break that $3,300 support and dropped a good $50 below it, before finding STRONG support at $3250 - a level that had not been re-tested yet after the upside breakout last week. Where do we go now, is the key question. Well, gold is now near the resistance trend...

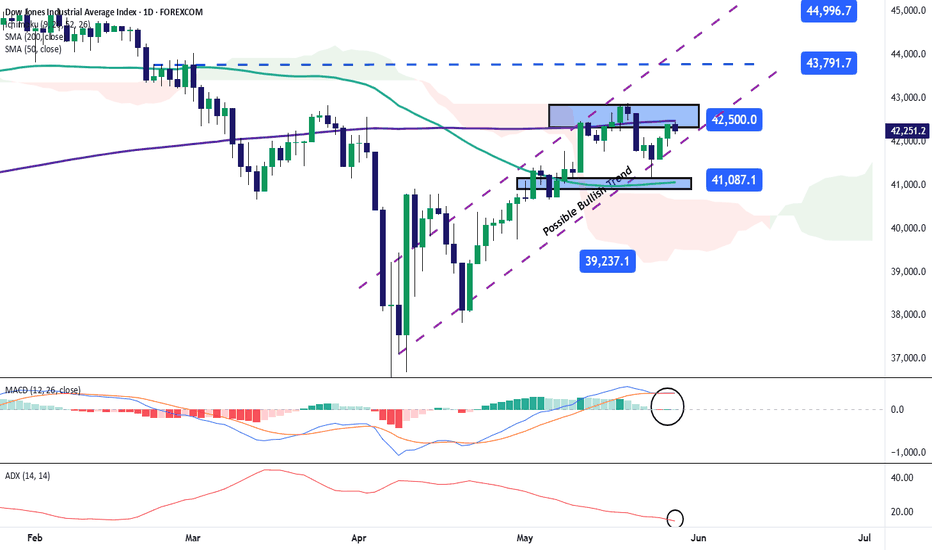

The Dow is currently holding near the neckline of a double-top formation that developed between December 2024 and February 2025, possibly buoyed by ongoing tech and Nasdaq optimism. The broader rebound from the 2025 lows is also forming a diagonal structure, setting up the following scenarios: Bullish Scenario: With weekly RSI holding above the 50 neutral zone...

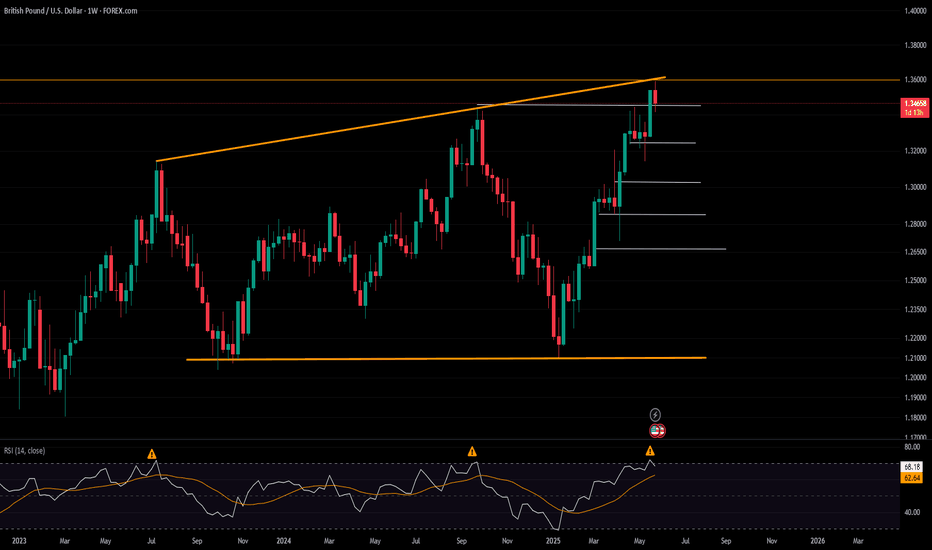

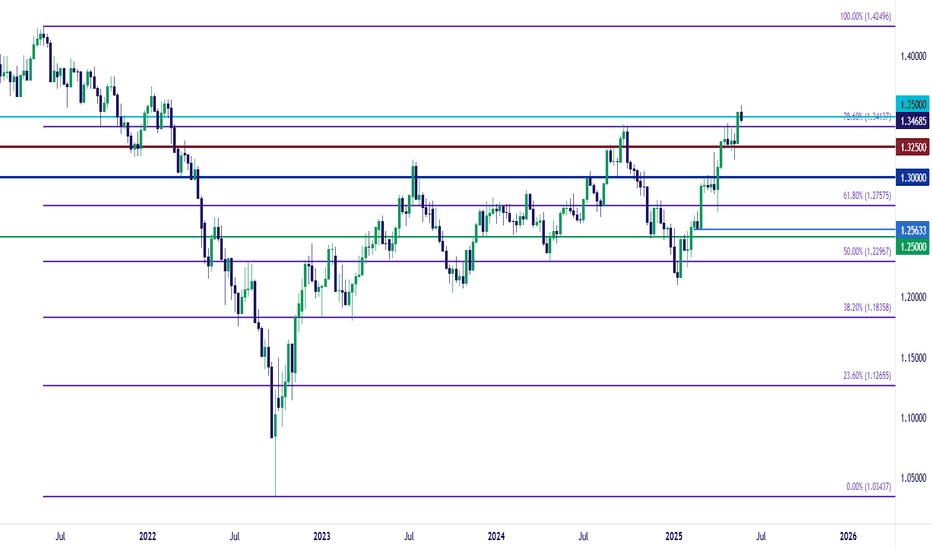

The GBP/USD pair is currently pulling back from a key resistance zone and trendline stretching from the peaks of July 2023 to September 2024. These levels coincide with previously oversold RSI readings seen during the same periods, raising the likelihood of a pullback. This resistance aligns with the 1.3590 level, which also corresponds to the 1.272 Fibonacci...

USD/JPY continues to drive impact in broader USD themes and given the fact that there's still considerable carry remaining in the pair, the consequences of a deeper sell-off could bring impact to several macro markets. USD/JPY is about 40% above the early 2021 lows when the carry trade began to build on the back of stronger US inflation, and even as US rate cuts...

GBP/USD has broken out to a fresh three-year-high, finally pushing above the Fibonacci level of 1.3414. That pushed directly into a test above the 1.3500 handle, and prices have since pulled back. Given dynamics in the USD, that bullish trend in Cable remains of attraction if we do see USD-weakness continue. But, if strength remains in DXY and USD, there's...

As looked at in the last post the US Dollar is currently working on a doji for the month of May and the weakness that was widespread through March and the first three weeks of April has dissipated over the past month and change. USD/JPY has been a big part of that, following the pair's 140.00 test last month which has so far held at a higher-low. But - if looking...

Monthly charts are often underapprecaited by many retail traders. Sure, they're not very actionable as there's only 12 per year but they can do a great job of highlighting trends and broader market themes and, of interest for this scenario, possible turns. As a case in point, back in January the US Dollar had a full head of steam, and there was nary a bear in...

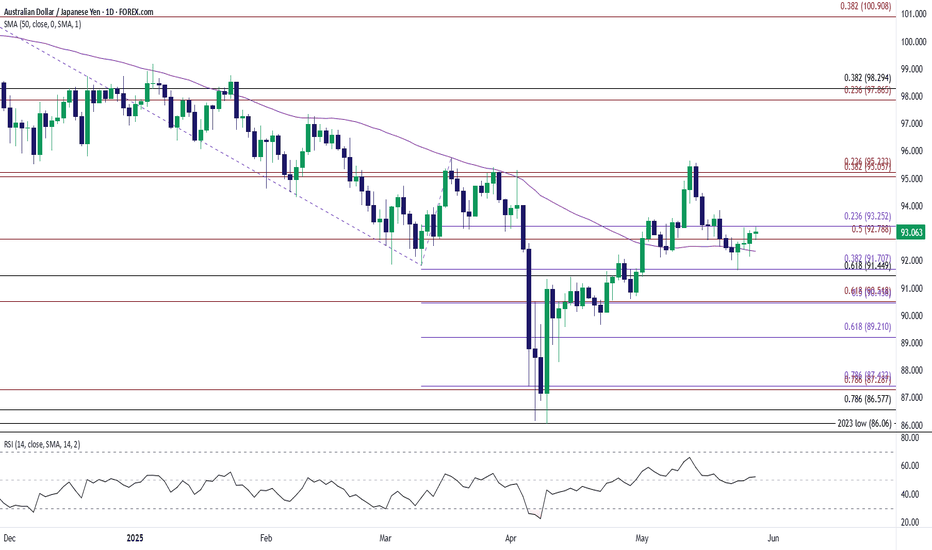

AUD/JPY continues to defend the monthly low (91.42) as it extends the rebound from last week, with a move/close above the 92.80 (50% Fibonacci extension) to 93.30 (23.6% Fibonacci extension) zone bringing the 95.10 (38.2% Fibonacci extension) to 95.20 (23.6% Fibonacci extension) region on the radar. A breach above the monthly high (95.65) may lead to a test of...

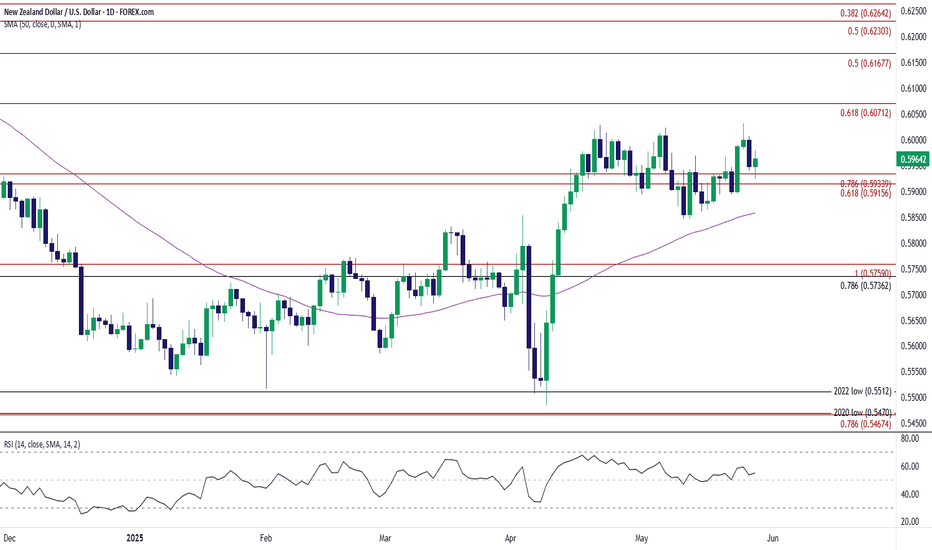

NZD/USD carves a series of lower highs and lows following the failed attempt to test the November high (0.6038), and the bearish price action may persist as it continues to fall from a fresh yearly high (0.6032). A move/close below the 0.5920 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) zone may push NZD/USD toward the monthly low (0.5847),...

The U.S. index has halted the advance of its recent bullish moves near this resistance zone, mainly because the market is awaiting the release of the Federal Reserve minutes later today, along with Nvidia’s earnings report, expected after the stock market close. For now, investor anticipation has created a neutral sentiment in the index's recent movements as it...

Last week saw gold bounce back after holding its one-year old bullish trend line and support around $3,120-$3,167 range. As well as that, this area was also the point D of an AB=CD move, sometimes called a bullish Gartley pattern. This area will be key on any future dips – bearish if we go below it. For now, gold is consolidating, but starting to look a bit...

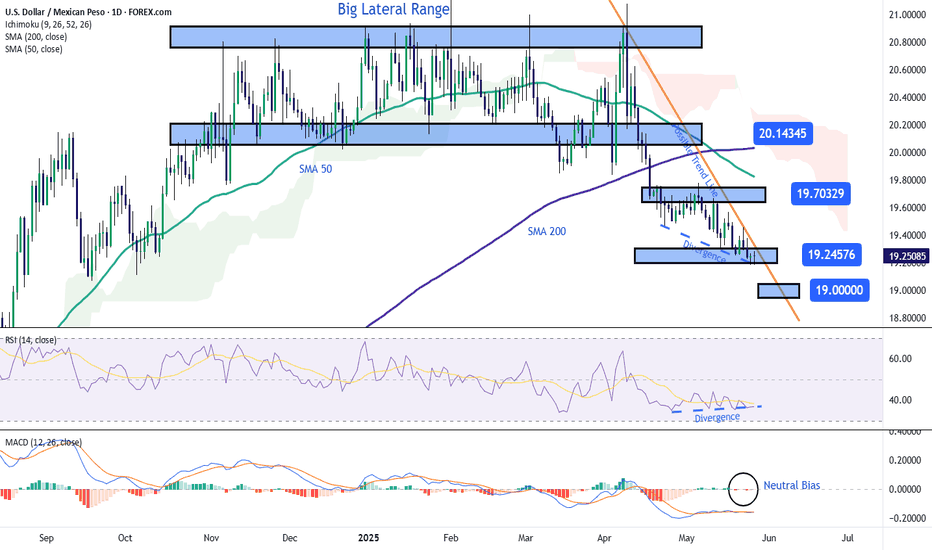

Over the last five trading sessions, USD/MXN fluctuations have shown a variation of barely 1%, indicating the emergence of sustained neutrality in the pair's recent moves. For now, the slight bearish bias in USD/MXN has managed to maintain a steady downward trend, as the Mexican peso benefits from short-term weakness in the U.S. dollar—as shown by the DXY index,...

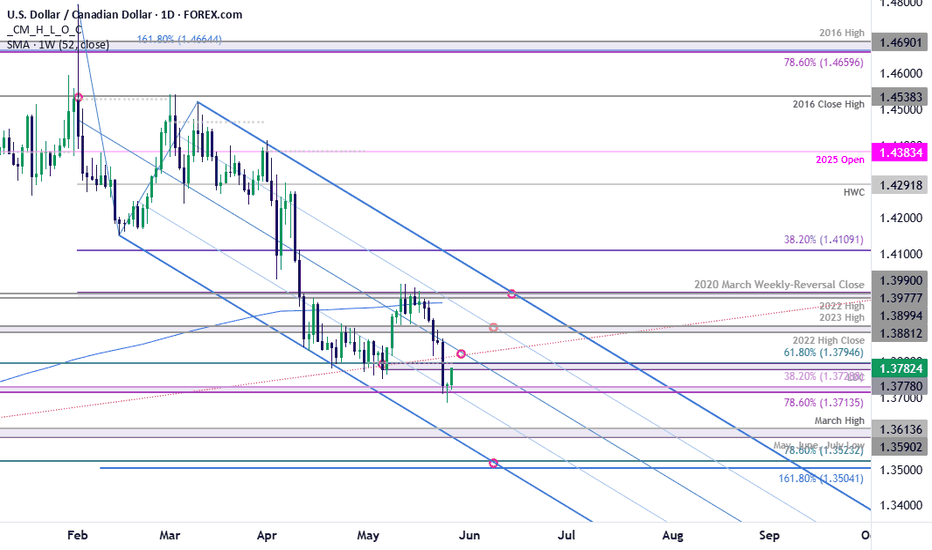

USD/CAD has responded to confluent support at 1.3714/29 - a region defined by the 78.6% retracement of the September rally and the 38.2% retracement of the 2021 advance. Note that the 25% parallel of the descending pitchfork converges on this threshold over the next few days and a break / close below is needed to fuel the next leg of the decline / mark downtrend...

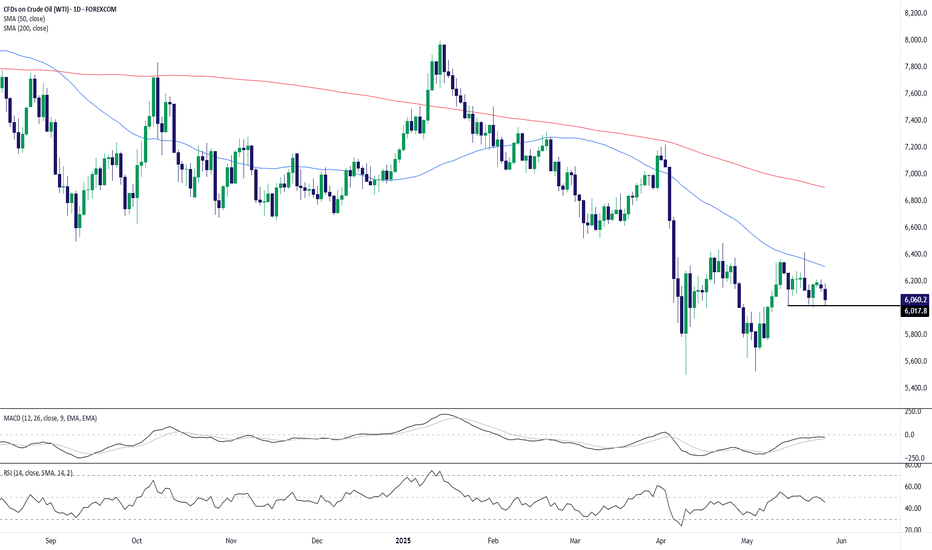

WTI crude is grinding into a pivotal horizontal support near 6,020 after another sharp rejection near the 50-day SMA: Support at Risk: Price is pressing into the horizontal support zone formed by May’s lows (~6,020). A clean break below would shift momentum back decisively to the downside. Bearish Structure: Price remains well below both the 50- and 200-day...